0001376227

false

0001376227

2023-08-08

2023-08-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of

Report (Date of earliest event reported): August 8, 2023

UNITED

STATES NATURAL GAS FUND, LP

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-33096 |

|

20-5576760 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification No.) |

| |

|

|

|

|

1850

Mt. Diablo Boulevard, Suite 640

Walnut

Creek, California 94596

(Address

of principal executive offices) (Zip Code)

(510)

522-9600

Registrant’s

telephone number, including area code

Not

Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| o |

Written communication pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| o |

Soliciting material pursuant to Rule 14a-12

under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| o |

Pre-commencement communications pursuant

to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| o |

Pre-commencement communications pursuant

to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| |

|

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company o

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Securities registered pursuant

to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered: |

| Shares of United States Natural Gas Fund, LP |

|

UNG |

|

NYSE

Arca, Inc. |

Item 1.01

Entry into a Material Definitive Agreement.

On August 8, 2023, United States Natural Gas Fund, LP (the “Registrant”) entered into a Customer Account Agreement (the “Agreement”) with ADM Investor Services, Inc. (“ADMIS”) to serve as an additional futures commission merchant (“FCM”) for the Registrant. The Agreement requires ADMIS to provide services to the Registrant in connection with the purchase and sale of futures that may be purchased or sold by or through ADMIS for the Registrant’s account. Under the Agreement, the Registrant has agreed to pay ADMIS commissions for executing and clearing trades on behalf of the Registrant.

The foregoing description of the Agreement is not complete and is qualified in its entirety by reference to the full text of the Agreement, a form of which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Item 8.01 Other Material Events.

Marex

North America, LLC (“MNA”) and Marex Capital Markets, Inc. (formerly ED&F Man Capital Markets Inc.) (“MCM”),

which are affiliated entities, serve as futures commission merchants for the Registrant. On July 28, 2023, MNA and MCM formally

advised the Registrant that (1) on or about July 14, 2023 MNA transferred its futures clearing business to MCM as part of an internal

reorganization (the “Transfer”), and (2) in connection with the Transfer and to avoid confusion as to which futures

customer agreement governs, the MCM futures customer agreement will be terminated. The Registrant’s futures trading account

with MNA has been consolidated with the Registrant’s futures trading account with MCM and the MCM futures trading account

is governed by the Registrant’s futures customer agreement between the Registrant and MNA. MCM has agreed to assume the

rights and obligations of the futures customer agreement in place between the Registrant and MNA from and after the date of the

Transfer and, therefore, no material impact on the Registrant’s operations is anticipated.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| |

UNITED

STATES NATURAL GAS FUND, LP |

| |

By: |

United States

Commodity Funds LLC, its general partner |

| |

|

|

| Date:

August 8, 2023 |

By: |

/s/ John P. Love |

| |

Name: |

John

P. Love |

| |

Title: |

President

and Chief Executive Officer, and

Management

Director |

| |

|

|

|

CUSTOMER

ACCOUNT AGREEMENT

In

consideration of ADM Investor Services, Inc. (“ADMIS”) opening and carrying one or more accounts (collectively, “Account”)

for the undersigned person(s) (individually or collectively, as applicable, “Customer”), and ADMIS acting as futures

commission merchant (“FCM”) for Customer in the execution and clearing of orders for the purchase or sale of commodity

futures, commodity options, forward contracts, foreign exchange, physical or cash commodities, and exchange for physical (“EFP”)

or exchange for risk (“EFR”) transactions (collectively “Commodity Contracts”), Customer enters into this

Customer Account Agreement (“Agreement”) with ADMIS as of the date executed by Customer below.

1. Relationship and Acknowledgments. Customer understands, acknowledges and confirms the following:

(a) The purchase or sale of Commodity Contracts is speculative, involves a high degree of risk and is suitable only for persons who

can assume the risk of loss in excess of their margin deposits or of their entire option premium. Customer understands that price

changes in Commodity Contracts may result in significant losses, which losses, whether realized or unrealized, Customer would

be responsible for and which may substantially exceed Customer’s margin deposits and any other deposits Customer may make.

Customer also acknowledges that Customer has received, has read and understands this Agreement and the accompanying risk disclosures.

(b) ADMIS is authorized to execute and clear orders and transactions and carry positions for the Account, including orders, transactions

and positions executed by or on behalf of third- party brokers, to act as counterparty to Commodity Contracts and to exercise

commodity options for the Account in accordance with Customer’s oral or written instructions. ADMIS shall have the right

to refuse to accept any of Customer’s orders in accordance with Section 1(f) of this Agreement or if such orders would result

in a debit equity balance. ADMIS shall also have the right to tape record all telephone conversations with Customer.

(c) ADMIS or its affiliates may at times be the counterparty and act as principal in regard to any cash, forward, or foreign exchange

transactions. Customer further understands and acknowledges that ADMIS may be the counterparty and receive revenue regarding such

transactions through the difference between the bid and offer prices quoted or provided to Customer and through markups or markdowns

on positions that ADMIS enters into with Customer or with other parties in connection with such positions. Furthermore, Customer

acknowledges that ADMIS is not obligated to quote a price for any principal transaction.

(d) ADMIS shall not be responsible to Customer for any third-party brokers’ inability to execute orders, or for error or negligence

or misconduct on the part of any third-party brokers who are not employees of ADMIS.

(e) Execution of an order for a futures contract contemplates making or accepting delivery, and Customer agrees to notify ADMIS promptly

if Customer intends to make or take delivery. Customer authorizes ADMIS to take any action deemed necessary or appropriate by

ADMIS in the event ADMIS takes physical delivery for Customer and Customer hereby agrees to indemnify ADMIS from all costs in

connection therewith. ADMIS may, in its sole discretion, liquidate any short position in Customer’s account if Customer

has not delivered to ADMIS certificates, receipts or other appropriate instruments of delivery at least five (5) days prior to

the last trading day of the applicable futures contract.

Classification:

Internal

(f) Upon entry into this Agreement, ADMIS will notify Customer of the exchanges, products, size and number of open Commodity Contracts

(net or gross) that ADMIS will at any time execute, clear and/or carry for Customer (such size and number limitation, the “Trading

Limits”). ADMIS has the right in ADMIS’ sole and absolute discretion to revise the Trading Limits with no less than

one (1) business day’s prior written notice unless otherwise required by the exchange or regulatory body, and provided that,

if any revision of the Trading Limits requires Customer to close out open, existing Commodity Contract positions, Customer shall

be afforded no less than thirty (30) calendar days to do so (i) unless otherwise prohibited by regulatory body or exchange (which

ADMIS will notify Customer of, if practicable), (ii) unless any such positions are open at least seven days prior to the last

trading day of the applicable futures contract and are subject to delivery; and (iii) provided Customer’s Account is margined

as required by Section 2 of this Agreement, as ADMIS determines in its reasonable discretion. For the avoidance of doubt, ADMIS

is under no obligation to accept, and may refuse, orders to establish Commodity Contract positions that do not conform to the

Trading Limits.

(g) Reserved.

(h) ADMIS: (i) is not a bank, savings and loan association or trust company under federal or state law or regulation; (ii) does not

offer check writing services or any similar or comparable service or services; and (iii) is not engaged in the business of banking

under Article 4A of the Uniform Commercial Code, as amended, or otherwise under Applicable Law (as defined below).

(i) Any market recommendation or information communicated to Customer by ADMIS does not constitute an offer to sell, or the solicitation

of an offer to buy, any commodity, or any commodity futures contract.

(j) Such

recommendation or information may be incomplete and may not be verified.

(k) ADMIS does not operate or maintain a research department or division as defined under or within the scope of CFTC rules or regulations

and ADMIS makes no representation, warranty or guarantee as to, and shall not be responsible for, the accuracy or completeness

of any information or recommendation furnished to Customer.

(l) ADMIS and/or its officers, directors, affiliates, stockholders or representatives may have a position or positions in or may intend

to buy or sell commodities or commodity futures contracts which are the subject of recommendations that may be furnished to Customer,

and the position or positions of ADMIS or any such officer, director, affiliate, stockholder, or representative may or may not

be consistent with any recommendation or information furnished to Customer by ADMIS.

2. Margin. Customer agrees to maintain collateral and/or margin in the Account in an amount that is the greater of (i) the amount

required by the relevant clearing house (“AL Margin”) and (ii) an amount in excess of AL Margin as required in ADMIS’

sole discretion (“Required Additional Margin”) and, together with AL Margin, “Margin”), provided that

in no event will the amount of Required Additional Margin be more than two times (2x) the AL Margin and, provided further, that

the amount of Required Additional Margin will in no event exceed the notional value of the particular Commodity Contract position

to which it relates. Customer agrees to wire transfer funds to ADMIS upon verbal or written request or otherwise make payment

in immediately available funds and to furnish ADMIS with names of bank officers for immediate verification of such transfers or

payments.

Classification:

Internal

3. Customer

Funds and ACH Transfers. Customer shall deposit with ADMIS (1) immediately available funds

to meet all initial and maintenance margin requirements established by ADMIS as referenced in Section 2 above, pay interest, commission,

brokerage, exchange and regulatory fees and charges that have been agreed to with ADMIS and memorialized in a written schedule

of fees (such schedule, a “Fees Schedule”), which Fees Schedule may be revised with no less than thirty (30) business

days’ prior written notice; however, Customer understands and agrees that fees or charges of third parties (i.e.,

exchanges, regulators or other providers) within the Fee Schedule are not under the control of ADMIS and that ADMIS may not be

able to provide 30 business days’ prior notice of changes in such fees. Fees not included in the Fees schedule, but which

apply to transactions conducted for or on behalf of Customer, (such as, currency conversions, deliveries, transfer of accounts,

interbank fees and charges, contract market or other self-regulatory organization charges) shall be the responsibility of, and

satisfied from the accounts of Customer. Commissions and brokerage may be shared by ADMIS with more

than one of Customer’s representatives; (2) deposit amount(s) to pay any deficit or debit balance in the Account; and (3)

pay interest and service charges on any Customer deficit or debit balances at the rates customarily charged by ADMIS together

with ADMIS’ costs and attorneys’ fees incurred in collecting any such deficit or debit or defending claims brought

by Customer in which ADMIS is the prevailing party. If Customer elects to have access to or use Automatic Clearing House funds

transfers with respect to the Account, Customer agrees to execute and deliver to ADMIS such additional documents, agreements or

information as ADMIS may request or require.

4. If

at any time the Account does not contain at least the amount of funds required by ADMIS, any exchange, clearing house or other

regulatory authority, ADMIS may in its commercially reasonable discretion, at any time or from time to time, close out Customer’s

open positions in whole or in part or take any other action ADMIS deems necessary to satisfy such requirements, including, but

not limited to, transferring funds from other accounts of Customer, including transfers between accounts designated as segregated,

secured, cleared swaps or non-regulated. Failure of ADMIS to act in such circumstances in whole or in part, shall not constitute

a waiver of ADMIS’ rights to do so any time or from time to time thereafter, nor shall ADMIS be subject to any liability

to Customer for ADMIS’ failure to so act. In addition, ADMIS has the right, but not the obligation, to close the Account

and liquidate or offset any open position(s) upon receipt of notice of Customer’s death, if applicable. Transfers among

accounts for the purpose of margin or collateral or the reduction or satisfaction of any deficit balance or other payment obligation

of Customer shall be conducted among accounts of the same beneficial ownership in accordance with CFTC Reg. 1.56.

5. No Guarantee. Customer understands that there are no guarantees of profit or guarantees against loss in Commodity Contract

trading. Customer has received no such guarantees from ADMIS or from any of ADMIS’ representatives. Customer acknowledges

that Customer is aware of the risks inherent in Commodity Contract trading and is financially able to bear such risks and withstand

any losses incurred in the Account or otherwise by Customer.

6. Applicable Law. For purposes of and provisions under this Agreement, the Commodity Exchange Act, as amended (“CEA”),

rules and regulations of the Commodity Futures Trading Commission (“CFTC”) or National Futures Association (“NFA”),

and any other applicable federal or state law, statute, rule, regulation or administrative requirement or condition to which ADMIS

is subject shall collectively be defined and referred to as “Applicable Law.”

7. Foreign Exchange. Unless Customer provides ADMIS with written or oral instructions to liquidate an open foreign exchange position

in the Account, any such position in ADMIS sole and absolute discretion will either be: (a) rolled over as an open position to

the next successive business day; or

(b)

liquidated in accordance with the provisions of this Agreement and Applicable Law. Alternatively, in order to liquidate an open

foreign exchange position in the Account by means of delivering, or taking delivery, of the underlying currency, written or oral

instructions to this effect must be given to ADMIS, together with sufficient funds to cover such delivery and all documents required

by ADMIS to effectuate this mode of settlement, in accordance with ADMIS’ instructions.

8. Security Interest and Pledge. All monies, securities, negotiable instruments, forward contracts, foreign exchange contracts,

physical or cash contracts, commodity options, open positions in futures contracts and commodities, or other property now or at

any future time deposited or maintained in or transferred to the Account, or held by ADMIS or its affiliates for Customer in connection

with this Agreement, are hereby pledged with ADMIS, and shall be subject to a senior security interest in ADMIS’ favor to

secure any indebtedness, at any time, owing by Customer to ADMIS or its affiliates under this Agreement, without regard to whether

ADMIS or its affiliates has made demand or advances with respect to any such property. Such security interest shall include a

general right of offset, and Customer waives to the fullest extent possible under Applicable Law any claim or defense that ADMIS’

exercise of any right or action under Applicable Law regarding such security interest violates any privacy or data protection

law, rule or regulation to which ADMIS or its affiliates is subject. Customer will not cause or allow any property held in the

Account to be subject to any other liens, security interests, mortgages or other encumbrances without the express prior written

approval of ADMIS.

Classification:

Internal

9. Foreign

Currency. If Customer requests that ADMIS enter into, or if Customer places an order for, any Commodity Contracts denominated

in a foreign currency: (a) any profit or loss arising from a fluctuation in the exchange rate affecting such currency will be

entirely for the Account and Customer’s risk; (b) all initial and subsequent deposits for margin purposes shall be made

in U.S. dollars, in such amounts as ADMIS may in its sole and absolute discretion request; and (c) ADMIS is authorized to convert

funds in the Account for margin into and from such foreign currency at a rate of exchange determined by ADMIS in its sole and

absolute discretion on the basis of then prevailing market rates. Customer acknowledges and agrees that ADMIS may receive revenue

in connection with any such currency conversion by collecting a fee and/or all or a portion of the difference between the bid

and offer prices quoted or provided to Customer for such foreign currency conversion.

10. Compliance with Applicable Law. All transactions by ADMIS on Customer’s behalf shall be subject to Applicable Law and

the constitution, rules, regulations, customs, usages, rulings, and interpretations of the exchanges or markets on which such

transactions are executed by ADMIS or its agents for the Account (such as the Chicago Mercantile Exchange and its affiliated clearing

house). ADMIS shall not be liable to Customer as a result of any action taken by ADMIS, or its agents, to comply with Applicable

Law or any such constitution, rule, regulation, custom, usage, ruling or interpretation. If Customer is subject to regulation

by any regulatory agency or organization, Customer agrees that ADMIS has no duty to ascertain, confirm or ensure that Customer

is in compliance with the requirements of such agency or organization.

11. Losses. For purposes of and provisions under this Agreement, any and all liabilities, claims, losses, damages, costs and expenses,

including incidental or consequential costs, losses, and damages and reasonable attorneys’ fees and expenses incurred with

collecting a deficit or debit balance in the Account , shall collectively be defined and referred to as “Losses.”

12. Delivery Efforts. If at any time Customer shall be unable to deliver to ADMIS any security, commodity or other property previously

bought or sold by ADMIS on Customer’s behalf, Customer authorizes ADMIS, in its sole and absolute discretion, to borrow

or to buy any security, commodity, or other property necessary to make delivery thereof, and Customer shall pay and indemnify

ADMIS for any Losses which ADMIS or its affiliates may sustain thereby and any premiums which ADMIS or its affiliates may be required

to pay thereon, and for any Losses which ADMIS or its affiliates may sustain from its inability to borrow or buy any such security,

commodity or other property.

13. Account Controllers. Customer acknowledges and agrees that ADMIS shall not be responsible to Customer for any Losses resulting

from conduct or advice (including but not limited to errors or negligence) on the part of any third-party person or entity introducing

Customer to ADMIS or having trading authority over the Account, including but not limited to any broker/dealer, FCM, independent

introducing broker, commodity trading advisor or commodity pool operator. Customer specifically agrees that ADMIS shall have no

obligation to supervise the activities of any such person or entity and Customer will indemnify ADMIS and its affiliates and hold

ADMIS and its affiliates harmless from and against all Losses incurred by ADMIS or its affiliates as a result of any actions taken

or not taken by such person or entity.

Classification:

Internal

14. Verification of Information. Customer authorizes ADMIS to

contact such banks, financial institutions, credit agencies, and other references as ADMIS shall deem appropriate or advisable

in ADMIS’ sole and absolute discretion from time to time to verify any information regarding Customer which may be provided

by Customer. Customer understands that an investigation may be made pertaining to Customer’s personal and business credit

standing and that Customer may make a written request within a reasonable period of time for disclosure of the nature and scope

of any such investigation.

15. Transmission or Communication Delays. ADMIS shall not be responsible for delays in the execution of orders due to breakdown

or failure of transmission, or communication facilities, or to any other cause beyond ADMIS’ control. ADMIS shall not be

liable for any Losses caused, directly or indirectly, by a break-down or failure of any transmission or communication system or

computer facility or trading software, whether belonging to ADMIS, Customer, any market, or any settlement or clearing system

when Customer trades on-line (via internet or electronically).

16. Customer

Communication(s) and Errors. Confirmation of trades, contracts, statements of account, margin calls, and any other notices

transmitted by ADMIS to Customer shall be transmitted to either the email address or the physical address and attention of the

person(s) named in the “Customer Account Documentation” and such address(es) shall be conclusively deemed accurate

and complete. The price at which an order is executed shall be binding notwithstanding the fact that an erroneous report is made.

An order which was executed but reported in error as not having been executed shall nevertheless be conclusive and binding except

as provided in the following sentence. Customer must notify ADMIS in writing of any objection to, or regarding, an order or discrepancy

or disagreement with any confirmation, report or statement forwarded by ADMIS to Customer prior to the opening of trading in the

applicable futures contract on the first business day following the day ADMIS sent such confirmation, report or statement, as

applicable, to Customer. Such objection shall be delivered to ADM Investor Services, Inc., 141 West Jackson Boulevard, Suite #2100A,

Chicago, Illinois 60604, (312) 242-7000, email: custserv@admis.com. If Customer does not timely object in accordance with the

previous sentence, such confirmation, report or statement, as applicable, shall be deemed and considered ratified and confirmed

as correct by Customer, and ADMIS shall have no responsibility or liability whatever regarding or in connection with transactions

shown, included or reported on such confirmation, report or statement, as applicable.

17. Consent to Electronic Delivery. Customer specifically consents to receive trade confirmations, daily and monthly account activity

statements, margin calls and any other notices sent by ADMIS to Customer electronically via email transmission. Such consent shall

be effective until revoked by Customer in writing and received by ADMIS. Customer is responsible for providing immediate notification

to ADMIS of any change in its email address. Physical copies of Customer’s statements are available upon request but may

incur additional charges. ADMIS will provide Customer with password- protected access to on-line reports. Customer will be able

to generate daily, monthly and annual account statements which provide transaction activity, profit and loss statements, open

positions and margin balances. Statements are deemed received when made available to Customer by ADMIS, regardless of whether

or when Customer actually accesses such statements.

18. Option

Exercise. Customer acknowledges and agrees that Customer is solely and exclusively responsible for taking action to

exercise any Commodity Contracts that are an option or option contract. ADMIS shall not be required to take any action with

respect to an option or option contract, including but not limited to any action to exercise an option prior to its

expiration date, except upon express instructions from Customer. Customer acknowledges and understands that exchanges have

established certain exercise cut-off times for the tender of exercise instructions, and that any options in the Account may

become or expire worthless if Customer does not provide instructions promptly. Customer also acknowledges and understands

that certain exchanges may automatically exercise long in-the-money options pursuant to the regulations of such exchange.

Customer acknowledges and understands that ADMIS’ cut-off times may differ from corresponding times established by

exchanges, and Customer waives any and all claims for Losses in connection with or which might arise out of an option not

being exercised. ADMIS will not be responsible for information regarding option expiration dates and assignment notification

or for any errors or omissions regarding such information. Customer acknowledges and understands that short option positions

are subject to assignment by an exchange or clearing house at any time, including positions established on the same day that

exercises are assigned. Notices of assignment are allocated on a random basis by an exchange or clearing house among all

short option positions which are subject to exercise.

Classification:

Internal

19. Single

Account. All Commodity Contract transactions executed by ADMIS for or on Customer’s behalf shall be deemed to be included

in and part of the Account as a single account regardless of whether such transactions are segregated on ADMIS’ records

into separate accounts, either severally or jointly with others, for regulatory purposes or otherwise, including the reporting

of Customer’s positions as required by Applicable Law or regulatory authorities Anything contained in this Agreement to

the contrary notwithstanding, and for the avoidance of doubt, ADMIS and its affiliates shall have a general right of offset and

authorization to transfer balances or amounts between or among any separate accounts within the Account, regardless of how such

separate accounts may be segregated or maintained, severally or jointly with others, on ADMIS’ records. Transfers

among accounts for the purpose of margin or collateral or the reduction or satisfaction of any deficit balance or other payment

obligation of Customer shall be conducted among accounts of the same beneficial ownership in accordance with CFTC Reg. 1.56.

20. Non-U.S. Customers. A Customer not residing in the United States may be requested to provide special or additional information

by ADMIS as required by any governmental or regulatory agency. This includes, but is not limited to, special or additional calls

for information, including but not limited to information concerning trading positions, ownership and authorization to trade.

In the event of a special or additional call for information, ADMIS shall endeavor to obtain and provide such information to the

requesting agency. Customer’s failure to respond to a special or additional call for information may cause prospective transactions

to be prohibited (other than offsetting or closing trades) for Customer.

21. Remedies Cumulative. The rights and remedies conferred upon the parties hereto shall be cumulative, and the exercise or waiver

of any thereof shall not preclude or inhibit the exercise of additional rights or remedies.

22. Account Subject to Agreement. Customer agrees that ADMIS may, from time to time, change the account number assigned to the

Account, and that this Agreement shall remain in full force and effect. Customer agrees further that the Account, as well as all

additional accounts opened by Customer at ADMIS, shall be covered by this same Agreement with the exception of any account for

which a new Customer Agreement is signed.

23. Venue and Waiver of Jury Trial. Subject to any Arbitration Agreement between ADMIS and Customer, each of ADMIS and Customer

agrees that any civil action or other legal proceeding between ADMIS or its employees, agents, representatives, affiliated brokers

and/or associated persons, on the one hand, and Customer, on the other hand, arising out of or relating to this Agreement, transactions

hereunder, or Customer’s account shall be brought, heard and resolved in the federal or state courts located in Chicago, Cook

County, Illinois, and each party waives any right to have such proceeding transferred to any other court, dispute resolution forum

or location. In addition, Customer waives the right to trial by jury in any such action or proceeding.

24. Statute of Limitations. No claim, including arbitration, and regardless of forum, arising out of or relating to this Agreement,

transactions hereunder, or the Account, may be brought by Customer more than ( two years after the alleged cause of action giving

rise to such claim arose (regardless of the date of discovery of the alleged injury), including claims alleging violations of

Section 14 of the CEA. Customer understands and acknowledges that the foregoing time limitation is a material inducement for ADMIS

to enter into this Agreement, and Customer accepts and agrees to be bound by such limitation to the fullest extent possible under

Applicable Law.

Classification:

Internal

25. Governing Law. This Agreement, including any action or proceeding in connection with or related to this Agreement, shall be

governed by the internal laws of the State of Illinois without regard to such State’s conflict of law provisions.

26. Legal Capacity. Customer represents that: (a) Customer is (or, if Customer is an entity, that each person acting for or on

behalf of Customer is) an adult of sound mind and is under no legal disability which would prevent Customer from trading in commodities,

commodity futures contracts, options contracts, forward contracts, foreign exchange or other physical or cash contracts therein

or entering into this Agreement; and (b) Customer is (or each person acting for or on behalf of Customer is) authorized to enter

into this Agreement.

27. Receipt

of Privacy Policy; Accuracy of Information. Customer acknowledges receipt of the ADMIS Privacy Policy, which is incorporated

into this Agreement by reference. Customer warrants the accuracy of all information contained in the account application to be

complete, true and correct and agrees that Customer will promptly notify ADMIS of any material change in such information. Customer

acknowledges and agrees that ADMIS will use and rely on such information in preparing any income tax or related disclosure, form,

notice or report that ADMIS provides to Customer; provided, however, that ADMIS will not undertake and is not responsible for

preparing or filing any income tax or related disclosure, form, notice or report for or on behalf of Customer. Customer further

warrants that no one except Customer has an interest in the Account and that Customer has full power and authority to enter into

this Agreement and to engage in the transactions of the kind contemplated herein.

28. Fees and Charges. Customer agrees to pay to ADMIS the commissions, fees and other charges as set forth in the Fees Schedule

and as described in Section 3 above Customer hereby authorizes ADMIS to withdraw the amount of any such commissions, fees and

charges from the Account as such commissions, fees and charges are incurred. In accordance with Section 3 above, ADMIS may provide

notice electronically or otherwise of any changes in the amount and type of commissions, fees and other charges, and the effective

date of such changes. If Customer is introduced to ADMIS by another party, such other party may receive a portion of any commission

paid to ADMIS by Customer.

29. Amendment. Any waiver, amendment or modification of this Agreement must be in writing, signed by the party against whom it

is to be enforced, except as otherwise provided herein. Notwithstanding the foregoing, ADMIS may amend this Agreement upon written

notice to Customer of such amendment, as follows: (i) with respect to an amendment to the material terms of this Agreement, such

amendment shall become effective upon mutual agreement of the parties; and. (ii) other non-material amendments to this Agreement

or amendments implemented to comply with Applicable Law, industry rules, regulations or by a regulatory body shall be effective

if Customer fails to object within ten (10) business days of ADMIS providing written notice to Customer of such amendment. The

rights and remedies of each party under this Agreement are cumulative, and no waiver, amendment or modification of this Agreement

or of any such right or remedy may be inferred from a failure by any party to exercise any right or remedy under this Agreement.

Classification:

Internal

30. Actions

by ADMIS. This Agreement shall inure to the benefit of ADMIS, its successors and assigns and shall be binding upon

Customer and Customer’s personal representatives, executors, trustees, administrators, agents, successors, and assigns. Further,

ADMIS may assign this Agreement and transfer Customer’s Account(s) to another duly registered futures commission

merchant, subject to applicable provisions of CFTC and NFA rules and regulations. In

the event of (a) the death or judicial declaration of incompetence of Customer; (b) the filing of a petition in bankruptcy,

or a petition for the appointment of a receiver, or the institution of any insolvency or similar proceeding by or against

Customer; the filing of an attachment against any of Customer’s accounts carried by ADMIS; or (d)

Customer’s failure to pay or deliver margin, provided however, such failure shall be deemed not to have occurred if

Customer shall demonstrate to the reasonable satisfaction of ADMIS that: i) such failure is caused by an error or omission of

an administrative or operational nature; and ii), the funds were available to Customer to enable it to satisfy the relevant

margin requirement when due; and, iii) such margin requirement is satisfied within one (1) business day; (e) Customer’s

failure to provide ADMIS any information requested pursuant to this Agreement within a reasonable time of such or request, or

within the time period specified if such request is made pursuant to rule, or by a regulatory body or exchange; or (f) any

other circumstances or developments that ADMIS deems appropriate for its protections in ADMIS’ commercially reasonable

discretion, ADMIS may take one or more of, or any portion of, the following actions: (1) satisfy any obligation Customer may

have to ADMIS under this Agreement, either directly or by way of guaranty or suretyship, out of any Customer’s funds or

property in ADMIS’ possession, custody or control, in each case in connection with this Agreement; (2) sell any or

purchase any or all Commodity Contracts, securities or other property held or carried for Customer; and (3) cancel any or all

outstanding orders or Commodity Contracts, or any other commitments made with Customer. Any of the above actions may be taken

without demand for margin or additional margin, without prior notice of sale or purchase or other notice to Customer,

Customer’s personal representatives, heirs, executors, administrators, trustees, legatees or assigns and regardless of

whether the ownership interest shall be solely that of Customer or held in any form or maintained in any type or kind of

joint or co- or common ownership with other persons.

31. Indemnification. Customer

shall indemnify and hold ADMIS, its affiliates, directors, officers, stockholders, employees, agents, successors and assigns

(individually and collectively, “ADMIS Indemnitees”) harmless from and against any and all Losses incurred by any

ADMIS Indemnitees, arising from or in connection with: (a) Customer’s failure to fully and timely perform its

obligations hereunder; (b) deficit or debt balances in the Account; or (c) any of

Customer’s representations and warranties made in this Agreement being untrue or incorrect when made or given or (d)

any claim allegation or cause of action alleging or related to ADMIS being a bank, savings and loan association or trust

company or engaging in the business of banking under Article 4A of the Uniform Commercial Code, as amended, or otherwise

under Applicable Law Customer also agrees to pay promptly to ADMIS any and all Losses incurred by any ADMIS Indemnitees in

enforcement of any of the provisions of this Agreement and any of the transactions contemplated hereunder, efforts or

attempts to collect any amounts due hereunder and the defense of any action or proceeding, including an arbitration

proceeding brought by Customer against any ADMIS Indemnitees in which ADMIS Indemnitees are the substantially prevailing

party.

32. Waiver

of UCC Article 4A. In consideration of and as a condition of ADMIS opening and carrying

the Account for Customer, Customer agrees and covenants to waive and not to claim, assert, raise or allege, in any pleading or

proceeding, whether in an action brought against ADMIS or as a defense or affirmative defense or counterclaim in any action brought

by ADMIS, that ADMIS is operating or at any time has operated as a bank, savings and loan association or trust company or engaged

in the business of banking under Article 4A of the Illinois Uniform Commercial Code, as amended (“Art. 4A”) or any

similar or comparable federal law or state law in any other jurisdiction.

33. Limitation

of Liability. IN NO EVENT SHALL ADMIS BE LIABLE TO CUSTOMER OR ANY PERSON FOR INDIRECT,

INCIDENTAL, SPECIAL, PUNITIVE OR CONSEQUENTIAL DAMAGES OF ANY KIND OR NATURE WHATSOEVER, WHETHER ARISING UNDER CONTRACT, WARRANTY,

OR TORT (INCLUDING NEGLIGENCE OR STRICT LIABILITY) OR ANY OTHER THEORY OF LIABILITY EVEN IF THE POSSIBILITY OF SUCH DAMAGES WERE

DISCLOSED TO ADMIS OR COULD HAVE BEEN REASONABLY FORESEEN BY ADMIS. The limitations of liability reflect the allocation of risk

between the parties. The limitations specified in this Section 33 will survive and remain in effect even if or to the extent that

any limited remedy specified in this Agreement is found to have failed of its essential purpose.

Classification:

Internal

34. Electronic

Records and Signatures. Customer agrees that any records stored by a printed media storage

method shall be deemed complete, true and genuine record of Account documents and signatures. If Customer elects to open an account

through use of an electronic signature under the Electronic Signatures in Global and National Commerce Act, as amended, such electronic

signature will meet the requirements of an original signature. However, at the sole discretion of ADMIS, documents signed and

transmitted by facsimile machine or electronic mail may be accepted as original documents. The signature of any person or entity

thereon, will be considered as an original signature, and the document transmitted will be considered to have the same binding

effect as an original signature on an original document. No party hereto may raise the use of a facsimile or telecopier machine

as a defense to the enforcement of this Agreement or any amendment or other document executed in compliance with this section.

Customer consents and agrees that Customer’s use of a key pad, mouse or other device to select an item, button, icon or

similar act/action while using any electronic service ADMIS offers, or in accessing or making any transactions regarding any agreement,

acknowledgment, consent, terms, disclosures or conditions constitutes Customer’s signature, acceptance and agreement as

if actually signed by Customer in writing. Further, Customer agrees that no certification authority or other third-party verification

is necessary to the enforceability of Customer’s signature or any resulting contract between Customer and ADMIS.

35. Severability

and Headings. If any provision of this Agreement shall be prohibited by or invalid under applicable law, such provision shall

be ineffective only to the extent of such prohibition or invalidity without invalidating the remaining provisions of this Agreement.

Headings of each provision are for descriptive purposes only

and shall not be deemed to modify or qualify any of the rights or obligations set forth in each provision.

36. Termination. Termination of this Agreement may be commenced by either party upon written notice to the other party, provided

that if ADMIS terminates this Agreement, Customer shall be afforded no less than thirty (30) calendar days to liquidate Customer’s

open, existing Commodity Contract positions as long as Customer’s Account is adequately funded under Section 2 of this Agreement

during such period; and, provided account is adequately funded, to transfer them to an alternate futures commission merchant,

it being understood that, upon expiry of the thirty-day period, ADMIS shall have the right to liquidate any remaining open Commodity

Contract positions. The termination of this Agreement shall not take effect until Customer no longer has funds or Commodity Contracts

with ADMIS and has fully satisfied any and all obligations under this Agreement that are due and owing to ADMIS. Until such time

of termination as previously stated, the obligations the parties arising from Commodity Contract transactions shall remain in

effect.

BY

SIGNING THIS AGREEMENT, CUSTOMER ACKNOWLEDGES, AGREES AND CONFIRMS THAT:

| (a) | Customer

has received, read carefully and understands this Agreement; |

| (b) | This

Agreement has been negotiated between Customer and ADMIS and shall not be construed against

the party that drafted all or any portion of this Agreement; and |

| (c) | Without

limiting any acknowledgment, agreement, representation or warranty otherwise contained

in this Agreement, Customer accepts and agrees to: (i) the venue provisions set forth

in Section 23 above; (ii) the time limitations set forth in Section 24 above; and (iii)

the waiver and covenants set forth in Section 32 above not to claim, assert or allege

that ADMIS is operating or at any time has operated as a bank, savings and loan association

or trust company or engaged in the business of banking under Art. 4A. |

CUSTOMER:

| X |

SIGNATURE |

|

X |

SIGNATURE |

|

| NAME,

TITLE |

|

NAME,

TITLE |

|

| DATE |

|

DATE |

|

Classification:

Internal

v3.23.2

Cover

|

Aug. 08, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 08, 2023

|

| Entity File Number |

001-33096

|

| Entity Registrant Name |

UNITED

STATES NATURAL GAS FUND, LP

|

| Entity Central Index Key |

0001376227

|

| Entity Tax Identification Number |

20-5576760

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1850

Mt. Diablo Boulevard

|

| Entity Address, Address Line Two |

Suite 640

|

| Entity Address, City or Town |

Walnut

Creek

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94596

|

| City Area Code |

(510)

|

| Local Phone Number |

522-9600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Shares of United States Natural Gas Fund, LP

|

| Trading Symbol |

UNG

|

| Security Exchange Name |

NYSEArca

|

| Entity Emerging Growth Company |

false

|

| Entity Information, Former Legal or Registered Name |

Not

Applicable

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

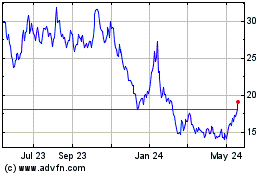

United States Natural Gas (AMEX:UNG)

Historical Stock Chart

From Nov 2024 to Dec 2024

United States Natural Gas (AMEX:UNG)

Historical Stock Chart

From Dec 2023 to Dec 2024