Williams Industrial Services Group Inc. (NYSE American: WLMS)

(“Williams” or the “Company”), an infrastructure services company,

today announced that, on February 24, 2023, it entered into a

fourth amendment to its existing senior secured term loan and

revolving credit facilities to provide more liquidity to fund the

Company’s operations; additional details about the amendments and a

liquidity update are provided in a Form 8-K filed with the

Securities and Exchange Commission. Williams continues to work with

Greenhill & Company on strategic alternatives designed to

strengthen the business and enhance shareholder value.

“While our engagement with Greenhill is well underway, we found

it necessary to once again amend our credit agreements to support

the working capital needs of the Company over the coming months,

driven in part by more scope on a major customer contract,” said

Tracy Pagliara, President and CEO of Williams. “We are encouraged

by our performance thus far in 2023, with favorable execution on a

key client project and revenue trending higher versus last year’s

first quarter as well as, sequentially, versus the fourth quarter

of 2022. We continue to cut costs and address underperforming

operations while evaluating additional streamlining activities, and

we remain committed to taking all appropriate measures to advance

the best interests of our shareholders.”

The Company has not set a timetable for the conclusion of the

previously announced review of strategic alternatives, nor has it

made any decisions related to any further actions or possible

strategic alternatives at this time. There can be no assurance that

the review will result in any transaction or other strategic change

or outcome. The Company does not intend to comment further until it

determines that further disclosure is appropriate or necessary.

About Williams Industrial Services Group

Williams Industrial Services Group Inc. has been safely helping

plant owners and operators enhance asset value for more than 50

years. The Company provides a broad range of building, maintenance

and support services to infrastructure customers in the energy,

power and industrial end markets. Williams’ mission is to be the

preferred provider of construction, maintenance, and specialty

services through commitment to superior safety performance, focus

on innovation, and dedication to delivering unsurpassed value to

its customers. Additional information can be found at

www.wisgrp.com.

Forward-looking Statement Disclaimer

This press release contains "forward-looking statements" within

the meaning of the term set forth in the Private Securities

Litigation Reform Act of 1995. The forward-looking statements

include statements or expectations regarding the Company’s 2023

performance, the Company’s liquidity situation and the outcome of

the Company’s review of strategic alternatives, including engaging

in a potential sale, restructuring or refinancing its debt, seeking

additional debt or equity capital, reducing or delaying its

business activities and strategic initiatives, or selling assets,

other strategic transactions and/or other measures, including

obtaining relief under the U.S. Bankruptcy Code, the Company’s

ability to successfully implement its liquidity improvement plan

and, if necessary, to obtain additional funding on reasonable

terms, or at all, the Company’s ability to obtain support from

customers in dealing with its liquidity challenges, future demand

for the Company’s services, the Company’s funding levels and

ability to continue operations, and expectations regarding future

revenues, cash flow, and other related matters. These statements

reflect the Company’s current views of future events and financial

performance and are subject to a number of risks and uncertainties,

including the Company’s ability to continue to implement its

liquidity improvement plan and to continue as a going concern; the

Company’s level of indebtedness and ability to make payments on,

and satisfy the financial and other covenants contained in, its

amended debt facilities, as well as its ability to engage in

certain transactions and activities due to limitations and

covenants contained in such facilities; its ability to generate

sufficient cash resources to continue funding operations, including

investments in working capital required to support growth-related

commitments that it makes to customers, and the possibility that it

may be unable to obtain any additional funding as needed or incur

losses from operations in the future; exposure to market risks from

changes in interest rates; the Company’s ability to obtain adequate

surety bonding and letters of credit; the Company’s ability to

maintain effective internal control over financial reporting and

disclosure controls and procedures; the Company’s ability to

attract and retain qualified personnel, skilled workers, and key

officers; failure to successfully implement or realize its business

strategies, plans and objectives of management, and liquidity,

operating and growth initiatives and opportunities, including any

expansion into new markets and its ability to identify potential

candidates for, and consummate, acquisition, disposition, or

investment transactions (including any that may result from the

Company’s review of strategic alternatives); the loss of one or

more of its significant customers; its competitive position; market

outlook and trends in the Company’s industry, including the

possibility of reduced investment in, or increased regulation of,

nuclear power plants, declines in public infrastructure

construction, and reductions in government funding; costs exceeding

estimates the Company uses to set fixed-price contracts; harm to

the Company’s reputation or profitability due to, among other

things, internal operational issues, poor subcontractor performance

or subcontractor insolvency; potential insolvency or financial

distress of third parties, including customers and suppliers; the

Company’s contract backlog and related amounts to be recognized as

revenue; its ability to maintain its safety record, the risks of

potential liability and adequacy of insurance; adverse changes in

the Company’s relationships with suppliers, vendors, and

subcontractors, including increases in cost, disruption of supply

or shortage of labor, freight, equipment or supplies, including as

a result of the COVID-19 pandemic; compliance with environmental,

health, safety and other related laws and regulations, including

those related to climate change; limitations or modifications to

indemnification regulations of the U.S.; the Company’s expected

financial condition, future cash flows, results of operations and

future capital and other expenditures; the impact of unstable

market and economic conditions on our business, financial condition

and stock price, including inflationary cost pressures, supply

chain disruptions and constraints, labor shortages, the effects of

the Ukraine-Russia conflict and ongoing impact of COVID-19, and a

possible recession; our ability to meet expectations about our

business, key metrics and future operating results; the impact of

the COVID-19 pandemic on the Company’s business, results of

operations, financial condition, and cash flows, including global

supply chain disruptions and the potential for additional COVID-19

cases to occur at the Company’s active or future job sites, which

potentially could impact cost and labor availability; information

technology vulnerabilities and cyberattacks on the Company’s

networks; the Company’s failure to comply with applicable laws and

regulations, including, but not limited to, those relating to

privacy and anti-bribery; the Company’s ability to successfully

implement its new enterprise resource planning (ERP) system; the

Company’s participation in multiemployer pension plans; the impact

of any disruptions resulting from the expiration of collective

bargaining agreements; the impact of natural disasters, which may

worsen or increase due to the effects of climate change, and other

severe catastrophic events (such as the ongoing COVID-19 pandemic);

the impact of corporate citizenship and environmental, social and

governance matters; the impact of changes in tax regulations and

laws, including future income tax payments and utilization of net

operating loss and foreign tax credit carryforwards; volatility of

the market price for the Company’s common stock; the Company’s

ability to maintain its stock exchange listing; the effects of

anti-takeover provisions in the Company’s organizational documents

and Delaware law; the impact of future offerings or sales of the

Company’s common stock on the market price of such stock; expected

outcomes of legal or regulatory proceedings and their anticipated

effects on the Company’s results of operations; and any other

statements regarding future growth, future cash needs, future

operations, business plans and future financial results.

Other important factors that may cause actual results to differ

materially from those expressed in the forward-looking statements

are discussed in the Company’s filings with the U.S. Securities and

Exchange Commission, including the "Risk Factors" section of the

Annual Report on Form 10-K for its 2021 fiscal year and its

Quarterly Report on Form 10-Q for the quarter ended September 30,

2022. Any forward-looking statement speaks only as of the date of

this press release. Except as may be required by applicable law,

the Company undertakes no obligation to publicly update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise, and you are cautioned not

to rely upon them unduly.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230302005295/en/

Investor Contact: Chris Witty Darrow Associates

646-345-0998 cwitty@darrowir.com

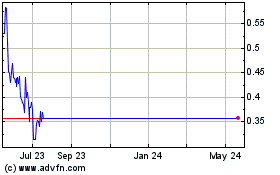

Williams Industrial Serv... (AMEX:WLMS)

Historical Stock Chart

From Dec 2024 to Jan 2025

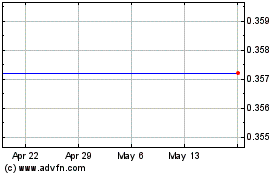

Williams Industrial Serv... (AMEX:WLMS)

Historical Stock Chart

From Jan 2024 to Jan 2025