SUMMARY

This

summary highlights information contained in the proxy statement. It does not include all of the information that you should consider

prior to voting, and we encourage you to read the entire document prior to voting.

Shareholders

are being asked to vote on the following matters at the 2023 Meeting:

| |

Our

Board’s Recommendation |

| ITEM

1. Election of Directors |

|

| |

|

| Our

board of directors and the Nominating and Corporate Governance Committee of the board believe that the six director nominees possess

the necessary qualifications, attributes, skills and experiences to provide quality advice and counsel to our management and effectively

oversee the business and the long-term interests of our shareholders. |

FOR

each

Director

Nominee |

| |

|

| ITEM 2. Advisory Vote

to Approve Executive Compensation |

|

| |

|

| We

seek a non-binding advisory vote to approve the compensation of our named executive officers as described in the Executive Compensation

section of the Proxy Statement beginning on page 18. The board values our shareholders’ opinions, and the Compensation Committee

of the board will take into account the outcome of the advisory vote when considering future executive compensation decisions. |

FOR |

| |

|

| ITEM

3. Ratification of the Appointment of PKF O’Connor Davies, LLP as the Company’s Independent Registered Public Accounting

Firm |

|

| |

|

| The

Audit Committee of the board believes that the retention of PKF O’Connor Davies, LLP to serve as the Company’s independent

registered public accounting firm for the fiscal year ending December 31, 2023 is in the best interest of the Company and its shareholders.

As a matter of good corporate governance, shareholders are being asked to ratify the Audit Committee’s selection of the independent

registered public accounting firm. |

FOR |

| |

|

| ITEM

4. Advisory Vote to Approve the Frequency of Voting on the Compensation Paid to the Company’s Named Executive Officers |

|

| |

|

We

seek a non-binding advisory vote to approve the frequency of voting on the compensation paid to the Company’s named executive officers

as described in the Executive Compensation section of the Proxy Statement beginning on page 18. The board values our shareholders’

opinions, and the Compensation Committee of the board will take into account the outcome of the advisory vote when considering future

executive compensation decisions. |

FOR 1 YEAR |

QUESTIONS

AND ANSWERS ABOUT THE VIRTUAL MEETING AND VOTING

How

can I participate in the Virtual Meeting?

It

is our intention that this year our Meeting will be a completely virtual meeting. There will be no physical meeting location. We believe

that a virtual meeting provides greater access to those who may want to attend, and, therefore, have chosen this method for the Meeting

over an in-person meeting.

To

participate in the Meeting, visit www.virtualshareholdermeeting.com/WTT2023 and enter the 16-digit control number included on your proxy

card, or on the instructions that accompanied your proxy materials. You may begin to log into the meeting platform beginning at 7:30

a.m., Eastern Time (“ET”), on August 25, 2023. The Meeting will begin promptly at 8:00 a.m. ET on August 25, 2023.

The

virtual meeting platform is fully supported across browsers (Internet Explorer, Firefox, Chrome and Safari) and devices (desktops, laptops,

tablets and cell phones) running the most updated version of applicable software and plug-ins. Participants should ensure that they have

a strong WiFi connection wherever they intend to participate in the Meeting. Participants should also give themselves plenty of time

to log in and ensure that they can hear streaming audio prior to the start of the meeting.

If

you wish to submit a question, during the Meeting, log into the virtual meeting platform at www.virtualshareholdermeeting.com/WTT2023,

and follow the instructions in the virtual meeting platform for submitting a question. Questions pertinent to meeting matters will be

answered during the Meeting, subject to time constraints.

If

you encounter any technical difficulties with the virtual meeting platform on the meeting day either during the check-in or meeting time,

please call the technical support number that will be posted on the virtual meeting platform log in page.

Who

is entitled to vote at the Meeting?

You

are entitled to vote at the Meeting if you owned shares of our Common Stock as of the close of business on July 13, 2023 (the “Record

Date”). Each share of our Common Stock entitles the holder of such share on the Record Date to one vote on each matter submitted

to the shareholders at the Meeting.

A

complete list of shareholders of record entitled to vote at the Meeting will be available for inspection by any shareholder for any purpose

germane to the Meeting at the Meeting.

The

presence, virtually or by proxy, of the holders of a majority of the voting power of our outstanding stock entitled to vote at the Meeting

is necessary to constitute a quorum at the Meeting. A quorum is required for the Company’s shareholders to conduct business at

the Meeting.

How

do I vote at the Virtual Meeting?

If

you own Common Stock and your shares are registered directly in your name, then you are the “record holder” of the shares,

and you may vote your shares before the Meeting by following the instructions on your proxy card, or you may vote your shares at the

Meeting by completing a ballot online during the Meeting through the virtual shareholder meeting platform at www.virtualshareholdermeeting.com/WTT2023.

If your shares are held in the name of your brokerage firm, bank or other nominee, then you are considered the “beneficial owner”

of shares held in street name, and you should receive instructions from your brokerage firm, bank or other nominee that must be followed

in order for your shares to be voted based on your instructions. Brokerage firms, banks and other nominees typically have a process for

their beneficial holders to provide voting instructions online or by telephone. If you hold your shares in street name and wish to vote

at the virtual Meeting, please obtain instructions on how to vote at the Meeting from your broker, bank or other nominee.

If

you are a shareholder of record there are four ways to vote:

Voting

by Mail. By signing the proxy card and returning it in the postage-prepaid and addressed envelope enclosed with these proxy materials,

you are authorizing the individuals named on the proxy card to vote your shares at the Meeting in the manner you indicate. We encourage

you to sign and return the proxy card even if you plan to attend the Meeting virtually so that your shares will be voted even if you

later find yourself unable to attend the Meeting. If you receive more than one proxy card, it is an indication that your shares are held

in multiple accounts. Please sign and return all proxy cards that you receive to ensure that all of your shares are voted.

Voting

at the Virtual Meeting. If you plan to attend the virtual Meeting and to vote during the Meeting, we will provide you with an

online ballot during the Meeting through the virtual shareholder meeting platform at www.virtualshareholdermeeting.com/WTT2023. To vote

at the meeting, please follow the instructions on your proxy card. We recommend you vote by proxy even if you plan to attend the Meeting.

You can always change your vote at the meeting.

Voting

by Telephone. To vote by telephone, please follow the voting instructions and use the toll-free telephone number on your proxy

card. If you are a record holder and you vote by telephone, you do not need to complete and mail a proxy card.

Voting

Online. If you wish to vote your shares online, please follow the instructions included on your proxy card. If you are

a record holder and you vote online, you do not need to complete and mail a proxy card.

How

to vote if you are a “beneficial owner” of shares held in street name:

Shares

that are held in a brokerage account in the name of the broker or by a bank or other nominee are held in “street name.” If

your shares are held in street name, you should follow the voting instructions provided by your broker, bank, or other nominee. If you

hold your shares in street name and wish to vote at the Meeting, please obtain instructions on how to vote at the meeting from your broker,

bank, or other nominee.

Can

I change my vote?

Any

shareholder of record delivering a proxy has the power to change or revoke it at any time before it is voted by: (i) filing written notice

of such revocation with the Secretary of the Company, (ii) submitting a duly executed proxy bearing a later date, or (iii) voting at

the Meeting. Please note, however, that any beneficial owner of our Common Stock whose shares are held in street name may (a) revoke

his or her proxy and (b) attend and vote his or her shares at the virtual Meeting only in accordance with applicable rules and procedures

that may then be employed by such beneficial owner’s brokerage firm or bank.

What

Proposals am I being asked to vote on at the Virtual Annual Meeting and what is required to approve each proposal?

You

are being asked to vote on three proposals:

| |

● |

Proposal 1 – Election of six

proposed nominees as directors; |

| |

● |

Proposal 2 – Approval, in a non-binding advisory

vote, of the Company’s executive compensation; |

| |

● |

Proposal 3 – Ratification of the appointment

of our independent registered public accounting firm; and |

| |

● |

Proposal 4 – Approval, in a non-binding advisory

vote, of the frequency of voting on the compensation paid to the Company’s named executive officers. |

In

voting with regard to Proposal 1, you may vote in favor of each nominee, withhold authority to vote in favor of one or more nominees,

or abstain from voting. Directors will be elected by a plurality of the votes cast by holders of our shares present virtually or represented

by proxy at the Meeting and entitled to vote on Proposal 1, provided a quorum is present.

In

voting with regard to Proposal 2, you may vote in favor of the proposal, against the proposal, or abstain from voting. The vote required

to approve Proposal 2 is a majority of the voting power of our shares present virtually or represented by proxy at the Meeting and entitled

to vote on Proposal 2, provided a quorum is present.

In

voting with regard to Proposal 3, you may vote in favor of the proposal, against the proposal, or abstain from voting. The vote required

to approve Proposal 3 is a majority of the voting power of our shares present virtually or represented by proxy at the Meeting and entitled

to vote on Proposal 3, provided a quorum is present.

In

voting with regard to Proposal 4, you may vote for 1, 2 or 3 years, or may abstain. The advisory vote on frequency will be determined

based on the number of years which receives the most votes cast by holders of our shares present virtually or represented by proxy at

the Meeting and entitled to vote on Proposal 4, provided a quorum is present.

Effect

of Abstentions. If a shareholder abstains from voting, those shares will be counted only for purposes of determining whether

a quorum is present. Abstentions will not be considered in determining the number of votes cast on a particular matter and will have

no effect on the outcome of the vote.

The

Company is not aware, as of the date hereof, of any matters to be voted upon at the Meeting other than those stated in this proxy statement.

If any other matters are properly brought before the Meeting, your proxy gives discretionary authority to the persons named as proxies

to vote the shares represented thereby in their discretion.

What

happens if I don’t return my proxy card or vote my shares?

If

you hold your shares directly, your shares will not be voted if you do not return your proxy card, vote online or by telephone prior

to the Meeting, or vote online at the virtual Meeting. If your shares are held in the name of a bank or brokerage firm (i.e., in “street

name”) and you do not vote your shares, your bank or brokerage firm can only vote your shares in their discretion for proposals

which are considered “routine” proposals. Proposal 3, the ratification of the appointment of our independent registered public

accounting firm, is considered a routine proposal, and therefore we do not expect any “broker non-votes” (as defined below)

on Proposal 3.

Brokers

are prohibited from exercising discretionary authority for beneficial owners who have not provided voting instructions to the broker

for “non-routine” proposals which are considered “non-discretionary” (i.e., a “broker non-vote”).

Proposals 1, 2 and 4 are non-routine and non-discretionary proposals. Broker non-votes will be counted for the purpose of determining

if a quorum is present but will not be considered as shares entitled to vote on Proposals 1, 2 and 4. Broker non-votes will have no effect

on the outcome of those proposals.

What

happens if I sign, date and return my proxy card but do not specify how to vote my shares?

If

a signed proxy card is received which does not specify a vote or an abstention, then the shares represented by that proxy card will be

voted FOR the election of all six director nominees, FOR the approval of the Company’s executive compensation, FOR

the ratification of the appointment of PKF O’Connor Davies, LLP as our independent registered public accounting firm for the

year ending December 31, 2023, and FOR a frequency of every year for voting on the compensation paid to the Company’s named

executive officers.

Who

pays for the cost of this proxy solicitation?

We

will bear the cost of preparing, printing and filing the proxy statement and related proxy materials. In addition to soliciting proxies

through the mail, we may solicit proxies through our directors, officers and employees, in person and/or by telephone, email and facsimile.

Our directors, officers and other employees will not receive compensation for such services other than regular director or employee compensation.

Brokerage firms, nominees, custodians and fiduciaries also may be requested to forward proxy materials to the beneficial owners of shares

held of record by them. We will pay all expenses incurred in connection with the solicitation of proxies.

PROPOSAL

1

ELECTION

OF DIRECTORS

General

The

Company’s By-laws provide that the Company’s board of directors shall consist of up to nine members. The number of directors

constituting the Company’s board of directors, as determined by the Company’s board of directors, is currently fixed at six.

At the meeting, the Company’s shareholders will be asked to vote for the election of six nominees to serve on the Company’s

board of directors for a one year term and until their respective successors are elected and qualified. Shareholders may not vote for

a greater number of persons than the number of nominees named.

If

a proxy is properly executed but does not contain voting instructions, it will be voted “FOR” the election of each of the

nominees named below as a director of the Company. Proxies can be voted only for persons who are nominated in accordance with applicable

law and the procedures set forth in the Company’s By-laws. Management has no reason to believe that any of the nominees named below

will be unable to serve as a director. However, in the event that any of the nominees should become unable or unwilling to serve as a

director, the proxies may be voted for such substitute nominees as the Company’s board of directors may designate.

Director

Nominees and Executive Officers of the Company

Set

forth below is information with respect to each of the current directors and executive officers of the Company. All directors are currently

serving one year terms and were previously elected by the shareholders. Mr. Gibson will continue to serve as Chairman of the Board.

| Name |

|

Age |

|

Position(s) |

| C. Scott Gibson |

|

70 |

|

Chairman of the Board |

| Alan L. Bazaar |

|

53 |

|

Director |

Jennifer

Fritzsche |

|

52 |

|

Director |

| Michael

Millegan |

|

64 |

|

Director |

| Allan D.L. Weinstein |

|

52 |

|

Director |

| Timothy Whelan |

|

57 |

|

Director, Chief Executive Officer |

| Michael Kandell |

|

47 |

|

Chief Financial Officer and Secretary |

Alfred

Rodriguez |

|

47 |

|

SVP,

GM of RBS Segment* |

| Daniel

Monopoli |

|

43 |

|

SVP,

GM of T&M Segment |

*

The Company entered into a separation agreement with Mr. Rodriguez on March 20, 2023 and he left the Company effective April 1, 2023.

C.

Scott Gibson became a director and Vice Chairman of the board of directors of the Company on April 1, 2021. Mr. Gibson became Chairman

of the board of directors on July 29, 2022 and continues to serve as Chairman of the board of directors. For more than the last five

years, Mr. Gibson has served on public company boards as his full-time profession. From January 1983 through February 1992, Mr. Gibson

co-founded and served as President, and Co-CEO of Sequent Computer Systems, Inc. (“Sequent”), a computer systems company.

Prior to co-founding Sequent, Mr. Gibson served as General Manager, Memory Components Operation, at Intel Corporation. Beginning in March

1992, Mr. Gibson served as a director for several public and private high technology companies, and has been an independent member of

the board of directors of Pixelworks, Inc (a public company), a provider of video and pixel processing semiconductors and software, since

May 2002. Mr. Gibson announced his retirement from the board of directors of Northwest Natural Holding Company (a public company), a

provider of water and wastewater distribution and natural gas distribution services in five western states, in August 2021, effective

December 31, 2021, after twenty years of board service. Also within the past five years, Mr. Gibson also served on the board of directors

of RadiSys Corporation (a public company), and TriQuint Semiconductor, Inc. (a public company), which subsequently merged with RF Micro

Devices, Inc., and became Qorvo, Inc. in January 2015. Mr. Gibson served on the board of directors of Qorvo, Inc., a public company,

until October 2019. Radisys, TriQuint, and Qorvo were all highly focused on RF/4G/5G semiconductors, and software. Mr. Gibson serves

as trustee of St. John’s Health in Jackson, WY, where he resides. Mr. Gibson holds a Bachelor of Science in electrical engineering

and Master of Business administration degrees from the University of Illinois. Mr. Gibson was awarded the NACD Board Fellow credential

in January 2017. Mr. Gibson’s semiconductor expertise, experience with telecommunications software and systems and overall experience

in the high-technology industry provide him with a deep understanding of our business. Mr. Gibson’s significant experience as a

director of other public companies provides him with a current working knowledge of business and economic trends that affect our industry.

Alan

L. Bazaar became a director of the Company in June 2013 and served as Chairman of the board of directors from April 2014 until July

2022. Mr. Bazaar is currently the Chief Executive Officer of Hollow Brook Wealth Management LLC, a position he has held since November

2013, where he is responsible for firm-wide operations, investment research, and portfolio management. Mr. Bazaar served as a director

of PDL BioPharma Inc., a public company engaged in development of innovative therapeutics and healthcare technologies from February 2020

until March 2021. Mr. Bazaar served as a director of Hudson Global Inc. from June 2015 to May 2019 and a director of Sparton Corp. from

May 2016 until the completion of its sale in March 2019. Mr. Bazaar served as a director of LoJack Corporation from March 2015 until

the completion of its sale in March 2016. Mr. Bazaar was formerly a director of NTS and served from December 2012 until the completion

of its sale in June 2014. From 2004 until April 2008, Mr. Bazaar served as a director of Media Sciences International, Inc., which manufactured

and distributed business color printer supplies and industrial ink applications in the United States. From July 1999 until December 2009,

Mr. Bazaar was a Managing Director and Portfolio Manager at Richard L. Scott Investments, LLC where he co-managed the public equity portfolio

and was responsible for all elements of due diligence. Previously, Mr. Bazaar served as a director of Airco Industries, Inc., a privately

held manufacturer of aerospace products, and was employed by Arthur Andersen LLP in the Assurance and Financial Buyer’s Practices

group and in the Business Fraud and Investigation Services Unit. Mr. Bazaar received an undergraduate degree in History from Bucknell

University and a Master of Business Administration from the Stern School of Business at New York University. Mr. Bazaar is also a Certified

Public Accountant (“CPA”). Mr. Bazaar’s successful track record as an accomplished business leader with significant

experience as Chief Executive Officer and service on public company boards qualifies him to serve on the Company’s board of directors.

Jennifer

Fritzsche became a director of the Company on December 18, 2020. Ms. Fritzsche has served as a managing director of Greenhill &

Co., a leading independent investment bank focused on providing financial advice globally on significant mergers, acquisitions, restructurings,

financings and capital raisings to leading corporations, partnerships, institutions and governments across a number of industries, since

April 2021. In this capacity she Co-Leads the North American Communication Services and Digital infrastructure practice. Ms. Fritzsche

previously served as Chief Financial Officer and director of Canopy Spectrum, LLC, a company focused on the wireless spectrum space,

from July 2020 until April 2021. Prior to July 2020, Ms. Fritzsche served as Managing Director and Senior Equity Analyst at Wells Fargo

Securities for 25 years where she focused on the telecommunications services, cable, data center and tower sectors. While at Wells Fargo,

Ms. Fritzsche received top rankings from Institutional Investor in the communications infrastructure space every year from 2017 through

2020. Mr. Fritzsche has made numerous media appearances and has often been a guest on Bloomberg and CNBC and speaks at many telecommunications

regulatory seminars and industry and trade conferences. On October 28, 2020, Ms. Fritzsche joined the board of directors of Dycom Industries,

Inc., a publicly held leading provider of specialty contracting services throughout the U.S. Additionally, Ms. Fritzsche is a Senior

Fellow at Georgetown University’s McDonough School of Business. Ms. Fritzsche holds a Bachelor’s degree in History from the

College of Holy Cross and a Master of Business Administration from the D’Amore-McKim School of Business at Northeastern University.

Ms. Fritzsche’s experience as a senior equity analyst in the telecommunications sector qualifies her to serve on the Company’s

board of directors.

Michael

Millegan became a director of the Company on November 13, 2016. Since 2018, Mr. Millegan has served as the Founder and CEO of Millegan

Advisory Group 3 LLC which advises early-stage companies on strategy that drives technology innovation and shareholder value. Previously,

he held a variety of executive leadership and management positions within Verizon, where he led large-scale and scope business units.

As president of Verizon Global Wholesale Group, he was responsible for $11 billion in sales revenue, 13,000 employees and $1 billion

in annual capital spending. Mr. Millegan served on the advisory board of FINSPHERE, a leader in mobile identity authentication enabling

financial institutions and mobile network operators to protect against credit card fraud. In addition, Mr. Millegan is a member of the

board of directors of Portland General Electric, one of the largest public utilities in the pacific northwest. Mr. Millegan also serves

on board of directors of Axis Capital Holdings Limited (a public company), the Virginia Mason Foundation, a division of the Virginia

Mason Health System, Network Wireless Solutions and was a member of the board of directors of Coresite Realty Corporation until its acquisition

by American Tower in December 2021. Mr. Millegan is a strategic advisor to Windpact, Inc., a private innovative sports technology company

developing protective gear to minimize sports related concussive head trauma and Vettd, Inc. a private company that develops AI-based

software solutions for the human resource industry. Mr. Millegan holds a Bachelor’s and Master’s degree in Business Administration

from Angelo State University. Mr. Millegan’s experience as an executive at Verizon and advisor to multiple technology companies

qualifies him to serve on the Company’s board of directors.

Allan

D.L. Weinstein became a director of the Company on November 9, 2016. Mr. Weinstein is the co-founder and Managing Partner of Gainline

Capital Partners LP., a private equity firm. Prior to co-founding Gainline in 2015, he was a Managing Partner of CAI Private Equity,

a private equity firm, which he joined in 2012. While at CAI, Mr. Weinstein served on the firm’s Investment Committee and was a

partner in CAI’s management company. Before joining CAI, Mr. Weinstein was a Managing Director at New York-based private equity

firm Lincolnshire Management, Inc., where he was employed for nearly 18 years. Among other responsibilities at Lincolnshire, he served

as interim Chief Financial Officer of a portfolio company and led a transaction that in 2007 won Private Equity Deal of the Year from

the Los Angeles Venture Association. Mr. Weinstein began his career with Fleet Bank, and he has served as a director or officer of numerous

privately held companies, including SourceHOV tax LLC dba Source Advisors, CSAT Solutions, Prince Sports, Bankruptcy Management Solutions

and Shred-Tech Corporation, Inc. He is currently on the board of directors of iES-Mach, a privately held company providing grid relationship

management software and demand response services to large commercial energy consumers, Southern Motion, Inc. a privately held leader

in design and innovation in motion furniture, Core Health & Fitness LLC, a privately held vertically integrated global manufacturer

of commercial fitness equipment, Galaxy Universal, LLC, a privately held company leading vertically integrated brand owner, brand manager

and sourcing in the global outdoor and athletic industry and Atlantic Energy Group, LLC, a privately held company providing electricity

and natural gas through environmentally-conscious value added bundles that leverage technology to help customers reduce consumption and

align with broader emissions reduction efforts and clean energy goals. Mr. Weinstein has a Bachelor’s degree in History and Economics

from Vassar College. Mr. Weinstein’s experience in private equity and service on boards of multiple companies qualifies him to

serve on the Company’s board of directors.

Timothy

Whelan was appointed Chief Executive Officer of the Company effective June 30, 2016, and has served as a director of the Company

since March 2015. Before assuming the role of the Company’s CEO, Mr. Whelan was Managing Director of Echo Financial Business Consulting

Group, a privately held financial and operational consulting firm he co-founded in February 2014. Mr. Whelan served as President and

Chief Operating Officer of IPC Systems, Inc., a company that provides and services voice communication systems for the financial services

industry, from 2009 to 2013. Mr. Whelan served as Executive Vice President and Chief Financial Officer of IPC Acquisition Corp./IPC Systems

Holdings Corp. from 2001 to 2009 and also served as its Principal Accounting Officer from 2001 to 2009. From July 2000 to December 2001,

Mr. Whelan served as Divisional Chief Financial Officer of Global Crossing’s Financial Markets division. From May 1999 to June

2000, Mr. Whelan served as Vice President of Finance at IPC Information Systems, Inc. and IXnet. Mr. Whelan is a Certified Public Accountant

and previously worked for Ernst & Young from 1992 to 1999. He previously spent four years as a U.S. Naval Officer. Mr. Whelan has

previously served as a member of the board of directors of Edgewater Technologies from 2015 to 2018 and has served on the board of directors

of the New York Metropolitan chapter of the USO from 2019 to 2020. He has a Bachelor of Science degree in Accounting from Villanova University.

Mr. Whelan’s significant tenure as a chief financial officer and chief operating officer, his experience managing all aspects of

the financial management of a company, as well as his experience in IT services, technology and telecommunications industries, qualify

him to serve on the Company’s board of directors.

Michael

Kandell was appointed to serve as Chief Financial Officer effective January 2, 2017. Prior to joining the Company and beginning in

2010, Mr. Kandell worked at Avaya, Inc., a multinational technology company specializing primarily in unified communication and contact

center products and services, where he most recently served as Senior Director of Accounting. Prior to Avaya, Mr. Kandell worked at Precision

Partners, Inc., an advanced manufacturing and engineering services company, from 2006 to 2010 as assistant corporate controller and,

prior to that, from 1997 to 2004 at Ernst & Young LLP in various roles in the audit and assurance practice. He received his Bachelor

of Science degree in accounting from College of New Jersey. Mr. Kandell is a Certified Public Accountant.

Daniel

Monopoli was appointed to serve as Senior Vice President, General Manager of the Test and Measurement Segment effective January 6,

2022. Prior to that Mr. Monopoli served as the Company’s Chief Technology Officer since June 30, 2017. Mr. Monopoli joined the

Company in September 2015 as the General Manager of the Test and Measurement Segment. Prior to joining the Company Mr. Monopoli held

various positions of increasing responsibility at Teledyne LeCroy, a leading provider of test and measurement solutions in the telecommunications

industry, from July 2002 to April 2015. Mr. Monopoli holds a Master of Business Administration from Columbia University, Master of Engineering

in Electrical Engineering degree from Stevens Institute of Technology and a Bachelor of Science in Electrical Engineering from Binghamton

University.

Alfred

Rodriguez was appointed to serve as Senior Vice President, General Manager of the Radio, Baseband and Software Segment effective

January 6, 2022. The Company entered into a separation agreement with Mr. Rodriguez on March 20, 2023, and he left the Company effective

April 1, 2023. Prior to that Mr. Rodriguez served as the Company’s Chief Revenue Officer effective from his date of hire on August

4, 2020. Prior to joining the Company, Mr. Rodriguez spent 17 years at Xilinx, serving as a designer and developer of programmable devices

and associated technologies, in a variety of sales, business development and engineering roles. He also worked in sales roles at ST Microelectronics

and Cavium, Inc. Mr. Rodriguez holds a Bachelor of Science degree in Electrical Engineering and a Master of Business Administration from

the University of California, Davis.

There

are no family relationships among any of the directors or executive officers of the Company.

Independence

of Directors

We

apply the standards of the NYSE American exchange (the “NYSE American” or the “New York Stock Exchange”), the

stock exchange upon which our Common Stock is listed, and, where applicable, SEC rules, for determining the independence of the members

of our board of directors and board committees. The Company’s board of directors has determined that all of the Company’s

directors, except Mr. Whelan, are currently “independent” in accordance with the applicable listing standards of the New

York Stock Exchange and, where applicable, SEC rules, as currently in effect. Under applicable New York Stock Exchange rules, Mr. Whelan

is not considered independent because he presently serves as the Company’s CEO. The board of directors considered the relationship

of Alan Bazaar to Hollow Brook Wealth Management LLC, an 8.7% shareholder of the Company, as well as Mr. Bazaar’s beneficial ownership

of the Company’s shares. As of April 25, 2023, Mr. Bazaar may be deemed to beneficially own 10.5% of the Company’s outstanding

Common Stock, which includes the shares held by Hollow Brook Wealth Management LLC. The board concluded, consistent with the guidance

of the New York Stock Exchange, that this significant stock ownership did not adversely affect Mr. Bazaar’s independence from management.

The board also determined that, notwithstanding his significant beneficial ownership, Mr. Bazaar meets the additional independence requirements

for members of the Audit Committee under applicable SEC rules. There were no other relationships between the Company and any of the other

directors to be considered by the board in its independence determinations.

Meetings

of the Board of Directors and its Committees

During

the fiscal year ended December 31, 2022, the Company’s board of directors held fifteen meetings. The board of directors has an

Audit Committee, a Compensation Committee, a Nominating and Corporate Governance Committee and a Strategy Oversight Committee. During

the fiscal year ended December 31, 2022, the Audit Committee held five meetings, the Compensation Committee held five meetings, the Nominating

and Corporate Governance Committee held two meetings and the Strategy Oversight Committee held two meetings. During the fiscal year ended

December 31, 2022, no director attended fewer than 75% of the aggregate of the total number of meetings of the Company’s board

of directors (held during the period for which he or she was a director) and the total number of meetings held by all committees of the

Company’s board of directors on which he or she served (held during the period that person served).

Corporate

Governance Guidelines and Committees of the Board of Directors

Our

board of directors maintains a formal statement of its responsibilities and corporate governance guidelines to ensure effective governance

in all areas of its responsibilities.

The

Company’s board of directors has also adopted a written charter for each of the Audit Committee, the Compensation Committee, the

Nominating and Corporate Governance Committee and the Strategy Oversight Committee. Each charter is available on the Company’s

website at www.wirelesstelecomgroup.com by first clicking on the tab “Investor Relations” then clicking on the tab “Corporate

Governance” and then the appropriate link for each committee charter. Except to the extent expressly stated otherwise, information

contained on or accessible from our website or any other website is not incorporated by reference into and should not be considered part

of this proxy statement.

The

Audit Committee oversees the accounting and financial reporting processes of the Company and audits of the financial statements of the

Company. The Audit Committee provides assistance to the board of directors with respect to its oversight of the integrity of the Company’s

financial statements, compliance with legal and regulatory requirements, independent auditor’s qualifications and independence

and performance.

The

Audit Committee approves all engagements of any independent public accounting firm by the Company to render audit or non-audit services.

Our Audit Committee has the sole authority to approve the scope of the audit and any audit-related services as well as all audit fees

and terms. Our Audit Committee must pre-approve any audit and non-audit related services by our independent registered public accounting

firm. During our fiscal year ended December 31, 2022, no services were provided to us by our independent registered public accounting

firm other than in accordance with the pre-approval procedures described herein.

During

the fiscal year ended December 31, 2022, the members of the Audit Committee were Messrs. Alan L. Bazaar , Allan D.L. Weinstein and C.

Scott Gibson.

The

Company’s board of directors determined that each of Messrs. Bazaar, Weinstein and Gibson met the independence criteria set forth

in the applicable rules of the New York Stock Exchange and the Securities and Exchange Commission (“SEC”), for audit committee

membership. The board of directors has also determined that all current members of the Audit Committee possess the level of financial

literacy required by applicable rules of the New York Stock Exchange and the SEC. The Company’s board of directors has determined

that Mr. Bazaar is qualified as an “audit committee financial expert” as such term is defined in Item 407(d) of Regulation

S-K.

The

purpose of the Compensation Committee is to carry out the overall responsibility of the board of directors relating to the compensation

of the Company’s officers and directors and compensation policies, plans and programs. The members of the Compensation Committee

during the fiscal year ended December 31, 2022 were Mr. Millegan (Chair), Ms. Fritzsche and Mr. Weinstein. The board of directors has

determined that each of Mr. Millegan (Chair), Ms. Fritzsche and Mr. Weinstein is currently independent for purposes of the applicable

New York Stock Exchange rules.

The

Nominating and Corporate Governance Committee is responsible for establishing criteria for the selection of directors, identifying qualified

candidates, recommending the slate of nominees for election to the board and overseeing matters of general corporate governance, including

evaluation of the performance and practices of the Company’s board of directors. It is also within the charter of the Nominating

and Corporate Governance Committee to review the Company’s management succession plans and executive resources. The members of

the Nominating and Corporate Governance Committee during the fiscal year ended December 31, 2022 were Messrs. Bazaar (Chair), Millegan

and Ms. Fritzsche. The board of directors has determined that each of Messrs. Bazaar, Millegan and Ms. Fritzsche are currently independent

for purposes of the applicable New York Stock Exchange rules.

The

Strategy Oversight Committee assists management and the board in overseeing the development and implementation of the Company’s

overall strategies, activities and initiatives relating to research and development, product development and the technology roadmaps

of the Company’s products and services and make related recommendations to the board. The members of the Strategy Oversight Committee

are Messrs. Gibson (Chair), Millegan and Ms. Fritzsche.

Delinquent

Section 16(a) Reports

Section

16(a) of the Exchange Act requires that our executive officers and directors, and persons who own more than 10% of a registered class

of our equity securities, file reports of ownership and changes in ownership on Forms 3, 4 and 5 with the SEC and the NYSE. Executive

officers, directors and greater than 10% stockholders are required by the SEC to furnish us with copies of all Forms 3, 4 and 5 that

they file. Based solely on our review of copies of such reports, we believe that all Section 16(a) filing requirements applicable to

our directors, officers and 10% stockholders were complied with during 2022.

Code

of Business Conduct and Ethics

The

Company’s board of directors has adopted a Code of Business Conduct and Ethics (the “Code”) that outlines the principles

of legal and ethical business conduct under which the Company does business. The Code, which is applicable to all directors, employees

and officers of the Company, is available at the Company’s website at www.wirelesstelecomgroup.com. Any substantive amendment or

waiver of the Code may be made only by the Company’s board of directors or a committee of the board of directors and will be promptly

disclosed to the Company’s shareholders on its website. In addition, disclosure of any waiver of the Code will also be made by

the filing of a Current Report on Form 8-K with the SEC in accordance with the requirements thereof.

Director

Nominations

The

Nominating and Corporate Governance Committee is responsible for, among other things, the selection, or the recommendation to the Company’s

board of directors for selection, of nominees for election as directors. The Company’s board of directors determines whether the

Nominating and Corporate Governance Committee shall make director nominations as a committee or make recommendations to the board of

directors with respect to director nominations. In selecting candidates for appointment, election or re-election to the board of directors,

the Nominating and Corporate Governance Committee considers the following criteria:

| |

● |

Personal and professional

ethics and integrity, including a reputation for integrity and honesty in the business community. |

| |

|

|

| |

● |

Experience as an executive

officer of companies or as a senior leader of complex organizations, including scientific, government, educational, or large not-for-profit

organizations. The committee may also seek directors who are widely recognized as leaders in the fields of technology, wireless systems,

or business generally, including those who have received awards and honors in their field. |

| |

|

|

| |

● |

Financial knowledge, including

an understanding of finance, accounting, the financial reporting process, and company measures for operating and strategic performance.

|

| |

|

|

| |

● |

Fundamental qualities of intelligence, perceptiveness,

fairness, and responsibility. |

| |

|

|

| |

● |

Ability to critically and

independently evaluate business issues, contributing diverse perspectives or viewpoints, and making practical and mature judgments.

|

| |

|

|

| |

● |

A genuine interest in the

Company, and the ability to spend the time required to make substantial contributions as a director. |

| |

|

|

| |

● |

No conflict of interest

or legal impediment that would interfere with the duty of loyalty to the Company and its shareholders. |

Directors

should have varied educational and professional experiences and backgrounds that, collectively, provide meaningful guidance and counsel

to management. Diversity of background, including gender, race, ethnic or national origin, age, and experience in business, government,

education, international experience and other areas relevant to the Company’s business are factors in the selection process. As

a company, we are committed to creating and sustaining a culture of inclusion and fairness. In addition, the Nominating and Corporate

Governance Committee reviews the qualifications of the directors to be appointed to serve as members of the committees of the board,

including the Audit Committee to ensure that they meet the financial literacy and sophistication requirements under New York Stock Exchange

rules and that at least one of them qualifies as an “audit committee financial expert” under the rules of the SEC.

If

the Nominating and Corporate Governance Committee believes that the Company’s board of directors requires additional candidates

for nomination, the Committee may engage, as appropriate, a third party search firm to assist in identifying qualified candidates and

will consider recommendations from the Company’s directors and officers.

Shareholder

Nominations of Directors

Shareholders

may nominate persons for election to our board of directors at a meeting of shareholders in the manner provided in our By-laws, which

include a requirement to comply with certain notice procedures. Nominations shall be made pursuant to written notice addressed to our

principal executive offices set forth on page 1 of this proxy statement, and for the Annual Meeting of Shareholders in 2024, must be

received not less than ninety (90) days nor more than one hundred twenty (120) days prior to the anniversary date of the 2023 Annual

Meeting of Shareholders, or no later than May 27, 2024 and no earlier than April 26, 2024. The board of directors will consider candidates

nominated by shareholders using the same procedures describe above for consideration of candidates identified by the board of directors.

Board

Leadership Structure and Role in Risk Oversight

The

board of directors oversees an enterprise-wide approach to risk management, designed to support the achievement of organizational objectives,

including strategic objectives, to improve long-term organizational performance and enhance shareholder value. Risk management includes

not only understanding company specific risks and the steps management implements to manage those risks, but also what level is acceptable

and appropriate for the Company. Management is responsible for establishing our business strategy, identifying and assessing the related

risks and implementing the appropriate level of risk for the Company. The board of directors meets with management at least quarterly

to review, advise and direct management with respect to strategic business risks, operational risks and financial risks, among others.

The board of directors also delegates oversight to board committees to oversee selected elements of risk.

The

Audit Committee oversees financial risk exposures, including monitoring the integrity of the Company’s financial statements, internal

control over financial reporting, and the independence of the Company’s independent registered public accounting firm. The Audit

Committee receives periodic internal controls and related assessments from the Company’s finance department. The Audit Committee

also assists the board of directors in fulfilling its oversight responsibility with respect to compliance matters and meets at least

quarterly with our finance department and independent registered public accounting firm to discuss risks related to our financial reporting

function. In addition, the Audit Committee ensures that the Company’s business is conducted with the highest standards of ethical

conduct in compliance with applicable laws and regulations by monitoring our Code of Conduct and by directly monitoring the Company’s

whistleblower hotline.

The

Compensation Committee participates in the design of compensation structures that create incentives that encourage a level of risk-taking

behavior consistent with the Company’s business strategy as is further described in the Executive Compensation section below. The

Company believes its compensation policies and practices for all employees do not create risks that are reasonably likely to have a material

adverse effect on the Company.

The

Nominating and Corporate Governance Committee oversees governance-related risks by working with management to establish corporate governance

guidelines applicable to the Company, and making recommendations regarding director nominees, the determination of director independence,

leadership structure and membership on the committees of the board of directors.

The

Company separates the roles of CEO and Chairman of the board of directors in recognition of the differences between the two roles. Additionally,

having an independent director serve as the Chairman of the board of directors is an important aspect of the Company’s corporate

governance policies. All of the members of the board of directors are “independent” within the standards of the New York

Stock Exchange, except Mr. Whelan, our CEO. Our board of directors receives periodic presentations from our executive officers regarding

our compliance with our corporate governance practices. While our board of directors maintains oversight responsibility, management is

responsible for our day-to-day risk management processes. Our board of directors believes this division of responsibility is an effective

approach for addressing the risks we face. The independent members of our board of directors, as defined by SEC rules and New York Stock

Exchange listing standards, meet in executive sessions in conjunction with regularly scheduled quarterly board meetings. Mr. Scott Gibson

presided over the executive sessions in 2022.

Communications

by Shareholders and Interested Parties with Directors

The

Company encourages communications to the Company’s board of directors and/or individual directors. Shareholders and interested

parties who wish to communicate with the Company’s board of directors or an individual director should send their communications

to the director(s) care of Timothy Whelan, Chief Executive Officer, Wireless Telecom Group, Inc., 25 Eastmans Road, Parsippany, New Jersey

07054; or Fax: (973) 386-9191. Communications regarding financial or accounting policies should be sent to the attention of the Chairman

of the Audit Committee. All other communications should be sent to the attention of the Chairman of the Nominating and Corporate Governance

Committee. Mr. Whelan will maintain a log of such communications and will transmit as soon as practicable such communications to either

the Chairman of the Audit Committee or the Chairman of the Nominating and Corporate Governance Committee, as applicable, or to the identified

individual director(s), although communications that are abusive, in bad taste or that present safety or security concerns may be handled

differently, as determined by Mr. Whelan.

Director

Attendance at Annual Meetings

The

Company will make every effort to schedule its annual meeting of shareholders at a time and date to accommodate attendance by directors

taking into account the directors’ schedules. All of our directors attended the Company’s 2022 annual meeting of shareholders.

All directors are expected to attend the Meeting.

Vote

Required and Recommendation of the Company’s Board of Directors

If

a quorum is present at the Meeting, the six nominees for director receiving the highest number of votes cast “FOR” will be

elected as directors of the Company, each to serve a one-year term and until their respective successors are elected and qualified.

The

Company’s board of directors unanimously recommends that you vote “FOR” the election of each of the nominees named

above to the Company’s board of directors. PROXIES SOLICITED BY THE BOARD WILL BE VOTED “FOR” EACH NOMINEE UNLESS SHAREHOLDERS

SPECIFY A CONTRARY VOTE.

AUDIT

COMMITTEE REPORT

The

Audit Committee is composed of independent directors, as defined in the listing standards of the NYSE American and the rules of the SEC,

and operates under a written charter adopted by the board of directors. The current members of the Company’s Audit Committee are

Alan L. Bazaar, Allan D.L. Weinstein and C. Scott Gibson.

The

following is the report of the Audit Committee with respect to the Company’s audited financial statements for the fiscal year ended

December 31, 2022. The information contained in this report shall not be deemed to be soliciting material or to be filed with the SEC,

nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933, as amended, or the Exchange

Act, except to the extent that the Company specifically incorporates it by reference in such filing.

In

connection with the preparation and filing of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022:

| |

1. |

The Audit Committee reviewed and discussed the audited

financial statements with management; |

| |

|

|

| |

2. |

The Audit Committee discussed

with PKF O’Connor Davies, LLP (“PKF”), the Company’s independent registered public accounting firm, the matters

required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and

the SEC; and |

| |

|

|

| |

3. |

The Audit Committee received

and reviewed the written disclosures and the letter from PKF required by applicable requirements of the PCAOB regarding the independent

auditors’ communications with the Audit Committee concerning independence, and discussed with the auditors their independence

and satisfied itself as to the auditor’s independence. |

Based

on the review and discussion referred to above, the Audit Committee recommended to the Company’s board of directors that the Company’s

audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022,

for filing with the SEC.

| |

AUDIT COMMITTEE |

| |

|

| |

Alan L. Bazaar |

| |

Allan

D.L. Weinstein

C.

Scott Gibson |

Dated:

May 1, 2023

EXECUTIVE

COMPENSATION

Overview

The

goal of our executive compensation program is the same as our goal for operating the Company: to create long-term value for our shareholders.

Toward this goal, we have designed and implemented our compensation programs for our named executive officers to reward them for sustained

financial and operating performance and leadership excellence, to align their interests with those of our shareholders and to encourage

them to remain with the Company for long and productive careers. Most of our compensation elements simultaneously fulfill one or more

of our performance, alignment and retention objectives. These elements consist of salary and bonuses, equity incentive compensation,

retirement and other benefits. In deciding on the type and amount of compensation for each executive, we focus on both current pay and

the opportunity for future compensation. We combine the compensation elements for each executive in a manner we believe optimizes the

executive’s contribution to the Company. Our named executive officers for 2022 were Mr. Whelan, Mr. Kandell, Mr. Monopoli and Mr.

Rodriquez.

Compensation

Objectives

Performance.

Key elements of compensation that depend on the named executive officer’s performance include:

| |

● |

a discretionary cash bonus

that is based on an assessment of his performance against pre-determined quantitative and qualitative measures within the context

of the Company’s overall performance; and |

| |

|

|

| |

● |

equity incentive compensation

in the form of stock options and restricted stock, which may be subject to performance objectives and continued service by the executive

with the Company. |

Base

salary and bonus are designed to reward annual achievements and be commensurate with the executive’s scope of responsibilities,

demonstrated leadership abilities, and management experience and effectiveness. Our equity incentive compensation is focused on motivating

and challenging each named executive officer to achieve superior, longer-term, sustained results.

Alignment.

We seek to align the interests of the named executive officers with those of our investors by evaluating executive performance

on the basis of key financial measurements which we believe closely correlate to long-term shareholder value. These may include revenue,

operating profit, earnings per share, operating margins, return on total equity or total capital, cash flow from operating activities,

total shareholder return and adjusted earnings before interest, taxes, depreciation expense, amortization expense and other non-recurring

expenses (“Adjusted EBITDA”). We believe that our equity incentive compensation awards align the interests of the named executive

officers with the interests of our shareholders because we have structured the vesting of the awards to vest over time or based on achievement

of key financial measurements and the total realized value of the awards are designed to correspond to stock price appreciation.

Retention.

We attempt to retain our executives by using continued service as part of the vesting terms of our equity compensation awards.

Implementing

Our Objectives

Determining

Compensation. Our Compensation Committee relies upon its judgment in making compensation decisions, after reviewing the performance

of the Company and carefully evaluating an executive’s performance during the year against predetermined established goals, relating

to leadership qualities, operational performance, business responsibilities, career with the Company, current compensation arrangements

and long-term potential to enhance shareholder value. Specific factors affecting compensation decisions for the named executive officers

include:

| |

● |

key financial measurements

such as revenue, operating profit, earnings per share, operating margins, return on total equity or total capital, cash flow from

operating activities, total shareholder return and Adjusted EBITDA; |

| |

● |

strategic objectives such

as acquisitions, dispositions or joint ventures, technological innovation and globalization; |

| |

|

|

| |

● |

promoting commercial excellence

by launching new or continuously improving products or services, being a leading market player and attracting and retaining customers; |

| |

|

|

| |

● |

achieving specific operational

goals for the Company, including improved productivity, simplification and risk management; |

| |

|

|

| |

● |

achieving excellence in

their organizational structure and among their employees; and |

| |

|

|

| |

● |

supporting our values by

promoting a culture of unyielding integrity through compliance with law and our ethics policies, as well as commitment to community

leadership and diversity. |

We

generally do not adhere to rigid formulas or react to short-term changes in business performance in determining the amount and mix of

compensation elements. We consider competitive market compensation paid by other companies, but we do not attempt to maintain a certain

target percentile within a peer group or otherwise rely on those data to determine executive compensation.

We

strive to achieve an appropriate mix between equity incentive awards and cash payments in order to meet our objectives. Any apportionment

goal is not applied rigidly and does not control our compensation decisions; we use it as another tool to assess an executive’s

total pay opportunities and whether we have provided the appropriate incentives to accomplish our compensation objectives. Our mix of

compensation elements is designed to reward recent results and motivate long-term performance through a combination of cash and equity

incentive awards. We also seek to balance compensation elements that are based on financial, operational and strategic metrics, including

elements intended to reflect the performance of our shares. We believe the most important indicator of whether our compensation objectives

are being met is our ability to motivate our named executive officers to deliver superior performance and retain them to continue their

careers with us on a cost-effective basis.

Role

of Compensation Committee and CEO. The Compensation Committee of our board has primary responsibility for overseeing the design,

development and implementation of the compensation program for the CEO and the other named executive officers. The Compensation Committee

evaluates the performance of the CEO and recommends to all independent directors the CEO compensation in light of the goals and objectives

of the compensation program. The CEO and the Compensation Committee together assess the performance of the other named executive officers

and the Compensation Committee determines their compensation, based on initial recommendations from the CEO. The other named executive

officers do not play a role in their own compensation determination, other than discussing individual performance objectives with the

CEO.

Role

of Compensation Consultants. We did not use the services of any compensation consultant in matters affecting senior executive

or director compensation in 2022 or 2021. However, we have engaged with compensation consultants in the past and either the Company or

the Compensation Committee may engage or seek the advice of compensation consultants in the future.

Equity

Grant Practices. The exercise price of each stock option awarded to our named executive officers under our current long-term

equity incentive plan is at or above the closing price of our stock on the date of grant. Scheduling decisions are made without regard

to anticipated earnings or other major announcements by the Company. We prohibit the re-pricing of stock options. Restricted stock awards

for our named executive officers and our stock option awards typically provide for vesting over a requisite service period or when performance

targets, pre-determined by our board are achieved. The vesting structure of our equity grants is intended to further our goal of executive

retention by providing an incentive to our senior executives to remain in our employ during the vesting period.

Potential

Impact on Compensation from Executive Misconduct. If the board determines that an executive officer has engaged in fraudulent

or intentional misconduct, the board would take action to remedy the misconduct, prevent its recurrence, and impose such discipline on

the wrongdoers as it deems appropriate and permissible in accordance with applicable law. Discipline would vary depending on the facts

and circumstances, and may include, without limitation, (1) termination of employment, (2) initiating an action for breach of fiduciary

duty, and (3) if the misconduct resulted in a significant restatement of the Company’s financial results, seeking reimbursement

of any portion of performance-based or incentive compensation paid or awarded to the executive that is greater than would have been paid

or awarded if calculated based on the restated financial results. These remedies would be in addition to, and not in lieu of, any actions

imposed by law enforcement agencies, regulators or other authorities.

Measures

Used to Achieve Compensation Objectives

Annual

Cash Compensation

Base

salary. Base salaries for our named executive officers depend on the scope of their responsibilities, their performance, and

the period over which they have performed those responsibilities. Decisions regarding salary increases take into account the executive’s

current salary and the amounts paid to the executive’s peers within and outside the Company. Base salaries are reviewed approximately

every 12 months but are not automatically increased if the Compensation Committee believes that other elements of compensation are more

appropriate in light of the Company’s stated objectives. This strategy is consistent with the Company’s primary intent of

offering compensation that, in significant part, is contingent on the achievement of performance objectives.

Bonus.

In April 2015, the Compensation Committee adopted an Officer Incentive Compensation Plan, or the Bonus Plan. The Bonus Plan is

an incentive program designed to (i) attract, retain and motivate the executives required to manage the Company, (ii) promote the achievement

of rigorous but realistic annual financial goals and (iii) encourage intensive fact-based business planning. The Compensation Committee

is authorized to interpret the Bonus Plan, establish, amend or rescind any rules and regulations relating to the Bonus Plan and to make

any other determinations that it deems necessary or desirable for the administration of the Plan.

Pursuant

to the terms of the Bonus Plan, the Compensation Committee has the authority to select the Company’s employees that are eligible

to participate in the Bonus Plan, who are referred to as participants. Each participant will be assigned a target award that is expressed

(i) as a specified maximum bonus amount of cash, (ii) as a percentage of base salary as in effect on the first day of the applicable

fiscal year or (iii) in such other manner as determined by the Compensation Committee. The Bonus Plan affords the Compensation Committee

the full power and authority to establish the terms and conditions of any award and to waive any such terms or conditions at any time.

The

payment of a target award is conditioned on the achievement of certain performance goals established by the Compensation Committee with

respect to a participant. Bonuses paid under the Bonus Plan, if any, are based upon an annual performance period, corresponding to each

fiscal year. For each performance period, participants are eligible to receive a potential bonus payment based on the participant’s

and the Company’s achievement, respectively, of individual management objectives and corporate financial performance elements.

Under certain circumstances, the Compensation Committee is authorized to adjust or modify the calculation of any performance goal set

for a participant. Furthermore, the Compensation Committee determines the amount of the award for the applicable performance period for

each participant. Under the terms of the Bonus Plan, the Compensation Committee also retains the right to reduce the amount of or totally

eliminate an award to a participant if it determines that such a reduction or elimination is appropriate.

Awards

under the Bonus Plan, if any, will be distributed in lump sum cash payments following the Compensation Committee’s determination

of such award. All payments under the Bonus Plan are contingent on satisfactory service through the last date of any applicable performance

period, except as described in the Bonus Plan in the event of termination due to death, disability or retirement.

The

base salaries paid, and the annual bonuses awarded, to the named executive officers in 2022 and 2021 are show in the Summary Compensation

Table below and are discussed in the footnotes.

Equity

Awards

The

Company’s equity incentive compensation program is designed to recognize scope of responsibilities, reward demonstrated performance

and leadership, motivate future superior performance, align the interests of the executive with our shareholders’ and retain the

executives through the term of the awards. We consider the grant size and the appropriate combination of stock options or restricted

stock when making award decisions. Equity-based awards are made pursuant to the Company’s equity incentive plan. Our current equity-based

employee compensation plan, the 2021 Long-Term Incentive Plan, which we refer to as the 2021 Plan, was approved by our shareholders in

June 2021. We regard the 2021 Plan as a key retention tool. Retention serves as a very important factor in our determination of the type

of award to grant and the number of underlying shares that are granted in connection with an award.

The

Compensation Committee considers cost to the Company in determining the form of award and, as a result, typically grants stock options

and restricted shares. In determining the size of an option or restricted stock grant to a named executive officer, both upon initial

hire and on an ongoing basis, our Compensation Committee considers competitive market factors, the size of the equity incentive plan

pool, cost to the Company, the level of equity held by other officers and individual contribution to corporate performance. Although

there is no set target ownership level for options or stock, the Compensation Committee recognizes that the equity based component ensures

additional focus by the named executive officers on stock price performance and enhances executive retention. The exercise price of stock

options is typically tied to the fair market value of our Common Stock on the date of grant, but could be set at a higher price if deemed

appropriate, and such options typically vest either when performance targets, pre-determined by our Compensation Committee, are achieved,

or over a requisite service period.

There

is no set formula for the granting of awards to individual executives or employees. The number of options and shares of restricted stock

awarded may vary up or down from year-to-year.

Equity

incentive compensation is based upon the strategic, operational and financial performance of the Company overall and reflects the executives’

expected contributions to the Company’s future success. Existing ownership levels are not a factor in award determination, as we

do not want to discourage executives from holding significant amounts of our stock.

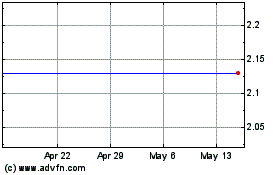

On

January 6, 2022, the Compensation Committee approved the grant of restricted common stock awards to named executive officers Tim Whelan,

Mike Kandell, Dan Monopoli and Alfred Rodriguez of 125,000, 75,000, 50,000 and 50,000 shares respectively. The awards vest equally over

two years. If a named executive officer’s service with the Company terminates before the restricted awards are fully vested, then

the unvested shares are forfeited and immediately returned to the Company. The grant date value per share was $2.11.

Employment

Agreement with CEO

In

connection with our retention of Timothy Whelan as Chief Executive Officer on June 30, 2016, the Company entered into an Employment Agreement

with Mr. Whelan. The Employment Agreement had a term of one year with automatic renewals for successive one-year periods, unless either

the Company or Mr. Whelan gives notice that such party elected not to extend the term. Under the Employment Agreement, Mr. Whelan was

originally entitled to an initial base salary of $275,000 per annum for his services as Chief Executive Officer, which is to be reviewed

annually and may be adjusted by the Compensation Committee or the Board in their sole discretion. On June 5, 2017, the Compensation Committee

recommended, and the Board approved, an extension of Mr. Whelan’s Employment Agreement for an additional four year term at a base

annual salary of $325,000 and Mr. Whelan is eligible to receive an annual cash incentive award as determined by the Compensation Committee.

Under

the Employment Agreement, Mr. Whelan is entitled to at least four weeks of paid vacation per annum and general expense reimbursement

for business and travel related expenses incurred in the performance of his duties. The Agreement provides that Mr. Whelan also is entitled

to participate in such health, group insurance, welfare, pension, and other employee benefit plans, programs and arrangements as are

made generally available from time to time to senior executives of the Company.

If

Mr. Whelan’s employment is terminated by the Company without cause, upon a change of control or by Mr. Whelan for good reason (as

such terms are defined in the Employment Agreement), in each case, subject to Mr. Whelan’s compliance with certain conditions,

the Employment Agreement provided that Mr. Whelan is entitled to: (i) severance in an amount equal to the sum of one year of his salary

as in effect immediately prior to the date of termination, which is payable in equal installments over a period of one-year, (ii) the

cash amount Mr. Whelan has earned as of the date of termination as determined by the Compensation Committee in good faith, taking into

account Mr. Whelan’s annual cash incentive award opportunity for the applicable year (the “Cash Bonus”), (iii)

extension of the post-termination exercise period for all outstanding stock options of the Company’s common stock held by Mr. Whelan

as of the date of his termination to the earlier of (a) the first anniversary of the date of termination, and (b) the date of expiration

of the respective option, during which post-termination period such options shall continue to vest in accordance with their respective

terms (to the extent not already fully vested) (the “Option Termination Benefits”), and (iv) his accrued salary and

benefits as of the date of termination.

In

the event that Mr. Whelan’s employment terminates due to his death or disability, he and/or his estate or beneficiaries (as the

case may be) shall be entitled to (a) a single sum cash amount, payable on the 60th day following the date of termination,

in an amount equal to the Cash Bonus, (b) the Option Termination Benefits and (c) his accrued salary and benefits as of the date of termination.

If

Mr. Whelan’s employment is terminated by the Company for cause, by Mr. Whelan without good reason or upon expiration of the term

of the Employment Agreement, he is entitled only to his accrued salary and benefits as of the date of termination.

On

January 6, 2022, the Compensation Committee approved certain amendments to that certain Employment Agreement between the Company and

Mr. Whelan. The Compensation Committee extended the term of the Employment Agreement through December 31, 2023 and increased Mr. Whelan’s

bonus target from $200,000 in 2021 to $250,000 for 2022 and future years.

The

Employment Agreement amendment increased Mr. Whelan’s severance benefits from twelve (12) months to fifteen (15) months and provided

for a fixed, rather than discretionary severance bonus. As a result, if Mr. Whelan’s employment is terminated by the Company without

cause, upon a change of control or by Mr. Whelan for good reason (as such terms are defined in the Employment Agreement), in each case,

subject to Mr. Whelan’s compliance with certain conditions, the Employment Agreement amendment provides that Mr. Whelan is entitled

to: (i) severance in an amount equal to the sum of fifteen (15) months of his salary as in effect immediately prior to the date of termination,

which is payable in equal installments over a period of fifteen (15) months, and (ii) cash in an amount equal to Mr. Whelan’s annual

cash incentive award opportunity for the applicable year, among other things set forth in the Employment Agreement.

Employment

Arrangements with Other Named Executive Officers

Amendment

of Kandell Employment Arrangement and Termination Agreement

On

January 6, 2022, the Compensation Committee also approved certain amendments to the terms of its employment arrangement and termination

agreement with Michael Kandell, the Company’s Chief Financial Officer. The Compensation Committee increased Mr. Kandell’s

base salary from $242,500 in 2021 to $260,000 for 2022 and also increased Mr. Kandell’s bonus target from $100,000 in 2021 to $150,000

for 2022 and future years. The Compensation Committee also granted Mr. Kandell 75,000 shares of restricted stock which vest annually

over two years under the Company’s 2021 Long-Term Incentive Plan.

The

employment arrangement amendment increased Mr. Kandell’s severance benefits from nine (9) months to twelve (12) months and provided

for a fixed, rather than discretionary severance bonus. As a result, if Mr. Kandell’s employment is terminated by the Company for