TIDMECP

RNS Number : 6704J

Eight Capital Partners PLC

25 August 2021

25 August 2021

Eight Capital Partners plc

("ECP", "Eight Capital" or "the Company")

Purchase of EUR40million 2.5% Fixed Rate Secured Bonds from IWEP

Limited at par value

Significant increase in ECP's gross asset base

Eight Capital Partners plc (AQSE: ECP), the investing company

whose investment strategy focuses on technology, media, telecoms

and financial services businesses including listed investing

companies, is pleased to announce that, following shareholder

approval pursuant to Section 190 of the Companies Act 2006 at the

Company's recent AGM, it has acquired EUR40million 2.5% fixed rate

secured bonds ("Bonds") from IWEP Limited ("IWEP"), a company

controlled by ECP's Chairman, Mr Dominic White.

Eight Capital intends to scale-up its business significantly in

the coming months starting with this acquisition and it is expected

that it may include the conversion of a number of existing loans

into equity and a share placing. The objective is to grow the

equity value of the Company such that it establishes a strong

equity base from which to grow its operations, and, subsequently,

becomes increasingly attractive to investors.

The Bonds were issued to IWEP by 1AF2 Limited, a private company

registered in England which is a wholly owned subsidiary of The

Avantgarde Group S.p.A. ("TAG"), an Italian private holding company

invested in the fintech sector, in settlement of the acquisition of

assets by TAG from IWEP.

The Bonds have been purchased at par value plus accrued but

unpaid interest from the date of issue of the Bonds to the date of

their acquisition in the sum of EUR150,684. The Bonds carry a fixed

rate coupon of 2.5% per annum plus a potential equity linked

payment at redemption which gives bondholders the opportunity to

participate in the performance of the underlying security package.

The Bonds have a maturity date of 30 June 2024. Interest due on the

Bonds can be paid in cash or listed securities, to an equivalent

value, and is payable on the date falling four calendar months

after the 1 July 2021, each date falling four calendar months

thereafter and the first business day following the third

anniversary of the issue of the Bonds. They are secured by a

security package held by The Bank of New York Mellon, acting as

custodian, which may be called upon by a trustee (a company

controlled by Dominic White) who represents the bondholders in the

event of default. The terms of the agreement for the issue of the

Bonds require periodic review and revaluation of the security

package, and provide mechanisms for its modification if required,

and additionally include a parent company guarantee by TAG which

may be exchanged for a specific asset pledge in the future, subject

to the trustee accepting this change on behalf of bondholders. The

Company understands that it is the intention of TAG to list the

Bonds on a European stock exchange in due course.

Consideration for the acquisition of the Bonds, including the

accrued, unpaid interest, has been settled by a one year vendor

loan ("Vendor Loan"), as described in the AGM notice and approved

by shareholders on 6 August 2021, for the full par value of the

Bonds and bearing interest at a fixed rate of 1.5% per annum due on

repayment. The Vendor Loan may be repaid in full at any time and

ECP can make partial repayments from time to time. In the event of

a default on the repayment of the Vendor Loan, interest will accrue

at a rate of 2 per cent. above the Bank of England Base Rate per

annum. The transaction is, therefore, expected to provide ECP with

a 1% per annum net interest income from the Bonds in the first year

which is expected to be EUR400,000.

The Vendor Loan is intended to be repaid by the raising of new

equity capital and the issue of other securities by the Company in

stages, in the short-term. This may include an equity placing via

an open offer to all shareholders. Warrants and/or other securities

may also be included in the capital raise.

The ECP Board believes that the significant increase in size of

the gross assets of the Company following the Bonds purchase,

combined with an intended open offer to all shareholders to

subscribe for new securities as well as the confidence demonstrated

by the Board in completing the transaction, may enable it to

significantly strengthen its balance sheet and further increase the

equity value of ECP.

ECP Chairman, Dominic White commented:

"This transaction affords a much stronger base from which ECP

can further develop as a technology-led growth company focussed on

financial services, fintech, decentralised finance and banking

technology. It also increases shareholder value by significantly

enhancing gross asset value together with the potential for an

equity performance linked payment at bond redemption.

"We have been developing a deep-value investment model over

several years that involves using securities and transaction

structure to deliver attractive business acquisitions and

combinations, that target asymmetrical returns for shareholders.

Together with enhancing the team quality and operations of acquired

companies, this can result in outsized investment returns to

shareholders.

"We expect that ECP will begin to take shape and grow more

rapidly following this first step. We will be nurturing earnings

potential and structuring for further growth in our operating

subsidiaries, and upcoming investments. We believe that our ability

to invest in private and public debt and equity, as well as own

operating companies and passive investments, gives us a competitive

advantage and high levels of structuring flexibility that can help

to maximise returns. We have a great pipeline of opportunities that

we intend to deliver through this business model in the coming 24

months."

Dominic White, a director of the Company, is also a director and

the beneficial owner of IWEP. Pursuant to AQSE Rule 4.6, the

purchase of the Bonds from IWEP by the Company therefore

constitutes a related party transaction. Pursuant to Section 190 of

the Companies Act 2006, the transaction was presented to

shareholders who approved it at the Company's recent AGM. Mr White

has not taken part in any deliberations by the Board in respect of

the acquisition of the Bonds.

This announcement contains inside information for the purposes

of the UK Market Abuse Regulation and the Directors of the Company

are responsible for the release of this announcement.

Eight Capital Partners plc +44 20 3808 0029

Dominic White info@eight.capital

Cairn Financial Advisers LLP

AQSE Corporate Adviser

Jo Turner / James Lewis +44 20 7213 0880

Walbrook PR Limited +44 20 7933 8780

Paul Vann/Nicholas Johnson Paul.vann@walbrookpr.com

About Eight Capital Partners:

Eight Capital Partners plc is an international investing company

whose investment strategy focuses on technology, media, telecoms

and financial services businesses, including both privately-owned

and listed entities. It has recently refined its strategy to focus

increasingly upon investing in those businesses engaged in

"Fintech" operations, from the digitisation of banking services,

through to blockchain-backed decentralised finance companies and

"crypto banks".

ECP provides equity, debt, and equity-related investment capital

to companies seeking capital for growth and development,

consolidation or acquisition, or pre-IPO financing. The Company

seeks to generate an attractive rate of return for shareholders,

predominantly through capital appreciation, by taking advantage of

the increasing number of investment opportunities within the

continuously developing global technology, media, telecoms and

financial services sectors.

About Eight Capital Partner's wholly-owned subsidiaries

Epsion Capital:

Epsion Capital is an independent corporate advisory firm based

in London with an extensive experience in UK and European capital

markets. The team of senior and experienced ECM and M&A

professionals is specialised across multiple markets, sectors and

geographies and it prides itself on a commercial approach that

allows the clients to achieve their growth ambitions.

www.epsioncapital.com/

Innovative Finance:

Innovative Finance is a corporate finance advisory business that

develops mergers and acquisitions and financing solutions across

multiple sectors, primarily in Europe, with access to international

transactions. It is currently working on transactions in the USA

and Europe which are linked to technological developments in the

financial services industry, AI, Cybersecurity, Ecommerce and

Cannabis.

www.eight.capital

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXPPUPPRUPGPPC

(END) Dow Jones Newswires

August 25, 2021 02:01 ET (06:01 GMT)

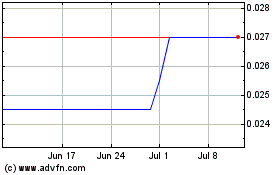

Eight Capital Partners (AQSE:ECP)

Historical Stock Chart

From Nov 2024 to Dec 2024

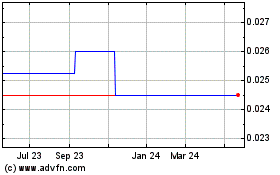

Eight Capital Partners (AQSE:ECP)

Historical Stock Chart

From Dec 2023 to Dec 2024