TIDMMEGP

RNS Number : 1360V

ME Group International PLC

30 November 2023

30 November 2023

ME GROUP INTERNATIONAL PLC

("ME Group" or "the Group" or "the Company")

Year-end Trading Update

Record financial performance, with rollout of next generation

photobooths underway

ME Group International plc (LSE: MEGP), the instant-service

equipment group, announces a post-year end update in respect of the

12 months ended 31 October 2023.

Trading Update

Following a strong first-half performance, the Group continued

to see positive trading momentum throughout the second half,

particularly across its core Photobooth and Laundry operations,

reflecting continued strong consumer demand. The Group expects to

have delivered a record financial performance for the year, despite

some operational challenges within its Feed.ME division, which has

since been reorganised.

For the 12 months to 31 October 2023, the Group expects revenue

to be marginally below the lower end of the previous guidance

range(1) but to be no less than GBP298 million. Nevertheless, given

the Group's focus on profitability, EBITDA remains in line with the

previously stated guidance range(1) and the Group expects it to be

significantly above GBP100 million. Profit Before Tax is expected

to be towards the top end of the previous guided range(1) and no

less than GBP67 million.

Strategic Progress

The Group also made good progress in delivering on its five-year

growth strategy.

Through technological innovation, the Group has continued to

expand and diversify its services. The rollout of its

next-generation multi-service photobooths is well underway,

initially focused in France, with approximately 547 machines

installed to date.

This next generation photobooth was developed by the Group's

in-house R&D team and offers range of new functionalities,

focused around enhancing the user experience. These new features

include 'Mobile to Print', user personalisation services using AI

and photo filters. The Group expects other new functions will be

added over time.

The Group is currently installing approximately 180

next-generation units per month and aims to increase this to

approximately 250 new installations per month during 2024.

At the same time, the Group is modernising the hardware of its

existing photobooth estate and installing its new proprietary

software at a rate of around 200 machines per month. This

proprietary software enables the Group's engineers to quickly and

cost-effectively upgrade each machine, remotely rather than needing

to physically visit the machines.

During the period, the Group significantly extended its presence

in Japan through the acquisition of 3,548 photobooths acquired from

FUJI in September 2023, positioning the Group as the leading

operator in the Japanese photobooth market, with over 15,000

machines in operation today.

Expansion of the Group's laundry operations also remains a key

priority and continues at pace. More than 820 Revolution machines

were installed during the year across the UK & Republic of

Ireland and Continental Europe, bringing the total number of

operating Revolution units to 5,533, representing growth of 16% in

the total number of machines operated by the Group.

In line with its strategy to further diversify and expand the

breadth of products and services offered by the Group, it continues

to actively invest in R&D to drive technological innovation.

With the next generation in Photobooths, the Group expects to trial

and rollout new exciting features during 2024.

Financial Position

The Group remains well capitalised and in a strong financial

position, with net cash of approximately GBP34.3 million and GBP4.3

million in convertible bonds as at 31 October 2023.

During the year, the Group repurchased GBP1.7 million of its

ordinary shares and also paid dividends totalling GBP13.6 million

(comprising of the final dividend for 2022 of GBP11.3 million and a

special dividend for 2022 of GBP2.3 million). In November 2023, the

Company paid its announced interim dividend for 2023, totalling

GBP11.2 million.

Annual Results

The Group will publish its 2023 Annual Results in February

2024.

1. Previous FY 2023 guidance was for revenues of between GBP300

million and GBP320 million, EBITDA between GBP100 million and

GBP110 million and profit before tax between GBP64 million and

GBP67 million.

ENQUIRIES:

ME Group International plc +44 (0) 1372 453 399

Serge Crasnianski, CEO

Stéphane Gibon, CFO

Hudson Sandler +44 (0) 20 7796 4133

Wendy Baker / Nick Moore me-group@hudsonsandler.com

NOTES TO EDITORS

ME Group International plc (LSE: MEGP) operates, sells and

services a wide range of instant-service vending equipment,

primarily aimed at the consumer market.

The Group operates vending units across 19 countries and its

technological innovation is focused on four principal areas:

-- Photo.ME - Photobooths and integrated biometric identification solutions

-- Wash.ME - Unattended laundry services and launderettes

-- Print.ME - High-quality digital printing kiosks

-- Feed.ME - Vending equipment for the food service market

In addition, the Group operates other vending equipment such as

children's rides, amusement machines, and business service

equipment.

Whilst the Group both sells and services this equipment, the

majority of units are owned, operated and maintained by the Group.

The Group pays the site owner a commission based on turnover, which

varies depending on the country, location and the type of

machine.

The Group has built long-term relationships with major site

owners and its equipment is generally sited in prime locations in

areas of high footfall such as supermarkets, shopping malls

(indoors and outdoors), transport hubs, and administration

buildings (City Halls, Police etc.). Equipment is maintained and

serviced by an established network of more than 650 field

engineers.

In August 2022 the Company changed its listed entity name to ME

Group International plc (previously Photo-Me International plc) to

better reflect the Group's diversification focus and business

strategy.

The Company's shares have been listed on the London Stock

Exchange since 1962.

For further information: www.me-group.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTKZMZMGLLGFZZ

(END) Dow Jones Newswires

November 30, 2023 02:00 ET (07:00 GMT)

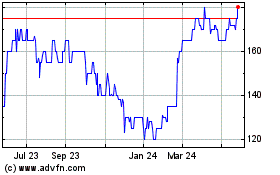

ME (AQSE:MEGP.GB)

Historical Stock Chart

From Oct 2024 to Nov 2024

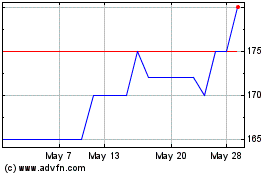

ME (AQSE:MEGP.GB)

Historical Stock Chart

From Nov 2023 to Nov 2024