TIDMNTQ

RNS Number : 4602T

Enteq Technologies PLC

15 November 2023

Enteq Technologies plc

("Enteq", the "Company" or the "Group")

Interim results for the six months ended 30 September 2023

Enteq Technologies plc (AIM: NTQ.L) is pleased to announce its

interim results for the six months ended 30 September 2023.

Key Highlights (FY24 year to date)

Enteq Technologies is a specialist energy services engineering

and technology company with the flagship product being the SABER

Tool (Steer-At-Bit Enteq Rotary Tool) for directional drilling

technology.

-- The SABER project, a novel and disruptive method of drilling

boreholes, has progressed well with the technology operating as

expected during successful field-testing in Oklahoma. SABER tools

are currently in manufacture for commercial deployment.

-- Investment in the SABER engineering has continued using

existing balance sheet resources, with a closing cash position of

$5.1m at the end of the period ($5.4m at end of March 2023)

following realisation of capital from the sale of XXT IP and

assets.

-- Appointment of David MacNeill as an independent non-executive

director, based in Dubai, UAE and bringing over 30 years' extensive

experience across drilling businesses, notably having direct

exposure to rotary steerable system development and operations.

Financial metrics

Six months ended

30 September:

2023 2022

US$m US$m

* Revenue* 0.0 4.9

* Adjusted EBITDA** (1.6) 0.1

* Post tax loss for the period 0.6 0.8

* Loss per share (cents) 1.0 1.1

* Cash balance 5.1 1.8

Andrew Law, CEO of Enteq Technologies plc, commented:

"Enteq continues to focus on the global Rotary Steerable market

with a value of $3.6bn annually***, where SABER has the potential

to deliver value to customers through a differentiated, high

quality and lower operating cost alternative to the incumbent,

limited, competition. A fleet of the first generation of commercial

SABER tools is currently being manufactured to support a customer

contract which includes a first phase of customer testing, as well

as other potential opportunities. The team and resources, from the

existing balance sheet, are in place for this pending

commercialisation phase."

For further information, please contact:

Enteq Technologies plc +44 (0)20 8087 2202

www.enteq.com

Andrew Law, Chief Executive Officer

Mark Ritchie, Chief Financial Officer

Cavendish Capital Markets Limited (NOMAD and Broker) +44 (0)20 7220 0500

Ed Frisby, Fergus Sullivan (Corporate Finance)

Andrew Burdis, Barney Hayward (ECM)

(*) Revenue from continued operations only. Revenue reported in

financial section relates to the recently disposed of XXT

business.

(**) Adjusted EBITDA is reported (loss)/profit before tax

adjusted for interest, depreciation, amortisation, foreign exchange

movements, performance share plan charges and exceptional items -

see note 5

***Source: Spears & Associates Directional Drilling Report

(2023).

Interim Report

CHAIRMAN & CHIEF EXECUTIVE OFFICER'S REPORT

Overview

Enteq Technologies is a specialist energy services engineering

and technology company with the flagship product being the

revolutionary, field-test proven SABER Tool (Steer-At-Bit Enteq

Rotary Tool) directional drilling technology.

The SABER Tool is based on a concept originally developed by

Shell, where rather than using pads or pistons to create steering

forces, the SABER Tool uses an internally directed fluid pressure

differential system. By removing these external contact points, the

SABER Tool achieves true at-bit steering for the first time and the

mechanically simple design gives the potential to improve

reliability and project uptime versus conventional RSS (rotary

steerable system) solutions.

Enteq has the exclusive license for this novel rotary steerable

technology and IP from Shell. Enteq has developed and refined the

concept, generating additional protected IP. The SABER Tool is

field-test proven from downhole drilling and is being readied for

commercial deployment.

The global RSS market is worth approximately $3.6 billion

annually according to a recent (2023) report from Spears. The SABER

Tool has the potential to drive operational efficiency across the

world's directional drilling applications, including hydrocarbon

production, geothermal energy, methane capture and CCS (carbon

capture and storage). Enteq will provide the SABER Tool to

customers through rental or purchase, enabling independent and

regional directional drilling companies to compete with major

integrated service companies which have to date dominated this

segment.

Financial performance

There has been a strong and ongoing focus on managing the

Company's cash position to underpin investment in product line

development, primarily the deployment of SABER. In April 2023,

following the previous financial year end, Enteq divested of the

assets and IP related to the XXT product line, for up to $3.2m,

$0.9m of which has been received in cash during this period.

$0.8m has been invested in SABER between 1 April 2023 and 30

September 2023, and the first generation of commercial tools is

currently being manufactured. A contract is in place to progress

from customer-testing in the new calendar year, on to commercial

operations.

The cash position at the end on the period was $5.1m

Cash balance and cashflow

On 30 September 2023, the Group had a cash balance of US$5.1m

down US$0.2m on the US$5.4m reported as at 31 March 2023. As at the

date of this announcement the cash balance is US$4.6m.

The half year cash movement can be analysed as follows:

US$m

Adjusted loss (0.6)

Change in trade and other receivables 1.1

Change in trade and other payables (1.0)

Change in inventory 0.0

Operational cashflow (0.5)

Sale of tangible fixed assets 1.0

R&D expenditure (0.8)

Net cash movement (0.3)

Cash balances as at 1 April 2023 5.4

-------

Cash balances as at 30 September 2023 5.1

=======

The cash inflow on trade receivables relates to ongoing deferred

proceeds from the sale of the XXT business, as announced at the

time of the XXT disposal. The R&D expenditure was primarily

relating to the SABER Rotary Steerable System development program.

Management expects that the future cash balances are sufficient to

complete SABER's field-testing phase and to bring it to a

successful commercial launch.

Operations

Enteq has a rented operations facility in Houston (having sold a

freehold property in the year ending March 2023), a technology

centre in Cheltenham, UK and a support office in Aberdeen, UK. The

Houston, Texas and Cheltenham, UK, facilities are all close to the

main global centres of expertise for Rotary Steerable Systems, with

access to highly specialised engineering and machining firms.

Organisation

The in-house product development team leads project engineering

and works closely with a number of specialist contractors in

Houston and in the UK as necessary. The product development team in

Houston has been strengthened, with the recent addition of an

Engineering Director (non-Board).

The in-house operations team (supporting field-testing and

customer operations) is based in Houston and the team has been

recently strengthened with the addition of a RSS reliability

engineer.

International business is led by the in-house team and is

supported through a network of international sales agents.

There were a total of 11 employees at the end of September

2023.

Outlook

The SABER project has been substantially de-risked after the

recent successful field-testing, with a fleet of the first

generation of commercial tools currently being manufactured for

deployment, to a customer contract which includes a first phase of

customer testing, in addition to other potential opportunities.

The global RSS sector is estimated at $3.6bn annually and needs

additional competition. Extensive and continued industry

engagement, including recent attendance at the ADIPEC global trade

show, has confirmed a high level of potential demand for SABER

across the key regions, including applications to support energy

transition.

Andrew Law Martin Perry

Chief Executive Chairman

Enteq Technologies plc

15 November 2023

Enteq Technologies plc

Condensed Consolidated Income

Statement

Six months Six months Year to

to 30 to 30 31 March

September September 2023

2023 2022

Unaudited Unaudited Audited

Notes US$ 000's US$ 000's US$ 000's

Revenue 774 4,912 6,245

Cost of Sales (1,326) (3,518) (4,777)

Gross Profit (552) 1,394 1,467

Administrative expenses before

amortisation (1,056) (1,866) (3,489)

Amortisation of acquired

intangibles 10 - (241) (408)

Other exceptional items 6 988 (25) (696)

Foreign exchange (loss)/gain

on operating activities (11) (34) 5

------------------------- ----------- ----------

Total Administrative expenses (79) (2,166) (4,588)

Operating loss (631) (772) (3,121)

Finance income 37 6 37

Loss before tax (594) (766) (3,084)

Tax expense 9 - - 280

Loss for the period 5 (594) (766) (2,804)

========================= =========== ==========

Loss attributable to:

Owners of the parent (594) (766) (2,804)

========================= =========== ==========

Earnings/loss per share

(in US cents): 8

Basic (1.0) (1.1) (2.0)

Diluted (1.0) (1.1) (2.0)

Enteq Technologies plc

Condensed Statement of Financial Position

30 September 30 September 31 March

2023 2022 2023

Unaudited Unaudited Audited

Notes US$ 000's US$ 000's US$ 000's

Non-current assets

Intangible assets 10 7,316 5,051 6,484

Property, plant and equipment 57 2,142 63

Rental fleet - 98 -

Trade and other receivables - 54 -

greater than one year

------------------------------- ----------

Non-current assets 7,374 7,345 6,547

------------------------------- ------------- ----------

Current assets

Trade and other receivables 517 5,342 237

Inventories - 2,006 -

Cash and cash equivalents 5,037 319 5,351

Assets held for sale 1,229 - 2,184

Bank deposits - 1,500 -

------------------------------- ------------- ----------

Current assets 6,784 9,167 7,772

------------------------------- ------------- ----------

Total assets 14,158 16,512 14,319

=============================== ============= ==========

Equity and liabilities

Equity

Share capital 11 1,080 1,081 1,080

Share premium 92,037 92,038 92,037

Share based payment reserve 686 410 448

Retained earnings (80,045) (78,660) (80,489)

----------

Total equity 13,757 14,869 13,076

------------------------------- ------------- ----------

Current Liabilities

Trade and other payables 400 1,643 1,243

------------------------------- ------------- ----------

Total equity and liabilities 14,158 16,512 14,319

=============================== ============= ==========

Enteq Technologies

plc

Condensed Consolidated Statement of Changes

in Equity

Six months to 30 September 2023

Share

Called

up Profit based

share and loss Share payment Total

capital account premium reserve Equity

US$ 000's US$ 000's US$ 000's US$ 000's US$ 000's

Issue of share capital - - - - -

Share based payment

charge - - - 238 238

---------- ----------

Transactions with owners - - - 238 238

---------- ---------- ---------- ---------- ----------

Loss for the period - 444 - - 444

Total comprehensive

income - 444 - - 444

---------- ---------- ---------- ---------- ----------

Movement in period: - 444 - 238 682

As at 1 April 2023 (audited) 1,080 (80,489) 92,037 448 13,076

---------- ---------- ---------- ---------- ----------

As at 30 September

2023 (unaudited) 1,080 (80,045) 92,037 686 13,757

========== ========== ========== ========== ==========

Six months to 30 September 2022

Share

Called

up Profit based

share and loss Share payment Total

capital account premium reserve Equity

US$ 000's US$ 000's US$ 000's US$ 000's US$ 000's

Issue of share capital 9 - 119 - 128

Share based payment

charge - - - (22) (22)

Transactions with owners 9 - 119 (22) 106

---------- ----------

Loss for the period - (766) - - (766)

Total comprehensive

income (766) - - (766)

Movement in period: 9 (766) 119 (22) (660)

As at 1 April 2022 (audited) 1,072 (77,894) 91,919 432 15,529

As at 30 September

2022 (unaudited) 1,081 (78,660) 92,038 410 14,869

---------- ---------- ---------- ---------- ----------

Enteq Technologies plc

Condensed Consolidated Statement

of Cash Flows

Six months Six Year

to months to

30 September to 31 March

2023 30 September 2023

2022

Unaudited Unaudited Audited

US$

US$ 000's 000's US$ 000's

Cash flows from operating

activities:

Loss for the period (594) (766) (3,084)

Gain on disposal of fixed

assets 1,000 - (292)

Net finance income 37 (6) (37)

Share-based payment non-cash

charges - (22) 225

Impact of foreign exchange

movement (11) (34) 5

Depreciation, amortisation

and exceptional charges (13) 784 1,162

419 (44) (2,021)

(Increase)/decrease in

inventory - 404 1,681

Tax received from continuing

operations - - 280

Decrease/(increase) in

trade and other receivables 734 (1,859) 1,853

(Decrease)/increase in

trade and other payables (663) (219) (617)

Increase in rental fleet

assets - (256) (255)

Net cash from operating

activities 490 (1,974) 921

---------------- -------------- ----------

Investing activities

Purchase of tangible fixed

assets - (22) (25)

Disposal proceeds of tangible

fixed assets - - 2,266

Purchase of intangible

fixed assets (832) (1,148) (2,639)

Funds placed on interest

bearing deposit - - 1,500

Interest received 37 6 37

---------------- --------------

Net cash from investing

activities (305) (1,164) 1,139

---------------- -------------- ----------

Financing activities

Share issue - 127 -

---------------- --------------

Net cash from financing

activities - 127 -

---------------- -------------- ----------

Increase/(decrease) in

cash and cash equivalents (305) (3,011) 2,060

Non-cash movements - foreign

exchange (8) 34 (5)

Cash and cash equivalents

at beginning of period 5,351 3,296 3,296

Cash and cash equivalents

at end of period 5,038 319 5,351

================ ============== ==========

Cash and cash equivalents

at end of period 5,038 319 5,351

Funds placed on interest

bearing deposit - 1,500 -

---------------- -------------- ----------

5,038 1,819 5,351

================ ============== ==========

ENTEQ TECHNOLOGIES PLC

NOTES TO THE FINANCIAL STATEMENTS

For the six months to 30 September 2023

1. Reporting entity

The Company is a public limited company incorporated and

domiciled in England and Wales (registration number 07590845). The

Company's registered address is The Courtyard, High Street, Ascot,

Berkshire, SL5 7HP.

The Company's ordinary shares are traded on the AIM market of

The London Stock Exchange.

Both the Company and its subsidiaries (together referred to as

the "Group") provides equipment to energy service companies for use

in the hydrocarbon and geothermal extraction sectors.

2. General information and basis of preparation

The information for the period ended 30 September 2023 does not

constitute statutory accounts as defined in section 434 of the

Companies Act 2006. A copy of the statutory accounts for the period

ended 31 March 2023 has been delivered to the Registrar of

Companies

The annual financial statements of the Group are prepared in

accordance with IFRS as adopted by the European Union. The

condensed set of financial statements included in this half-yearly

financial report has been prepared in accordance with International

Accounting Standard 34 'Interim Financial Reporting', as adopted by

the European Union.

The Group's consolidated interim financial statements are

presented in US Dollars (US$), which is also the functional

currency of the parent company. These condensed consolidated

interim financial statements (the interim financial statements)

have been approved for issue by the Board of directors on 15

November 2023

This half-yearly financial report has not been audited and has

not been formally reviewed by auditors under the Auditing Practices

Board guidance in ISRE 2410.

3. Accounting policies

The interim financial statements have been prepared on the basis

of the accounting policies and methods of computation applicable

for the period ending 31 March 2024. These accounting policies are

consistent with those applied in the preparation of the accounts

for the period ended 31 March 2023.

4. Estimates

When preparing the interim financial statements, management

undertakes a number of judgements, estimates and assumptions about

recognition and measurement of assets, liabilities, income and

expenses. The actual results may differ from the judgements,

estimates and assumptions made by management, and will seldom equal

the estimated results. The judgements, estimates and assumptions

applied in the interim financial statements, including the key

sources of estimation uncertainty were the same as those applied in

the Group's last annual financial statements for the year ended 31

March 2023.

5. Adjusted earnings and adjusted EBITDA

The following analysis illustrates the performance of the

Group's activities, and reconciles the Group's loss, as shown in

the condensed consolidated interim income statement, to adjusted

earnings. Adjusted earnings are presented to provide a better

indication of overall financial performance and to reflect how the

business is managed and measured on a day-today basis. Adjusted

earnings before interest, taxation, depreciation and amortisation

("adjusted EBITDA") is also presented as it is a key performance

indicator used by management.

Six months Six months Year to

to 30 September to 30 September 31 March

2023 2022 2023

US$ 000's US$ 000's US$ 000's

Unaudited Unaudited Audited

Loss attributable to ordinary

shareholders (594) (766) (787)

Exceptional items (988) 25 7

Amortisation of acquired intangible

assets 0 240 199

Foreign exchange movements 11 34 40

----------------- ----------------- --------------

Adjusted loss (1,571) (467) (541)

Depreciation charge 6 543 643

Finance income (37) (6) (16)

PSP credit/(charge) - (49) 220

Other - 34 -

Adjusted EBITDA (1,601) 55 306

================= ================= ==============

6. Exceptional items

The exceptional items can be analysed as follows:

Six months Six months Year to

to 30 September to 30 September 31 March

2023 2022 2023

US$ 000's US$ 000's US$ 000's

Unaudited Unaudited Audited

Severance payments 25 20 37

Loss/(gain) on sale of fixed

assets (1,000) 5 (30)

Other (13) - -

----------------- ----------------- --------------

Exceptional items (988) 25 7

================= ================= ==============

7. Segmental Reporting

For management purposes, the Group is currently organised into a

single business unit which is based, operationally, primarily in

the USA but with a support centre based in the UK.

At present, there is only one operating segment and the

information presented to the Board is consistent with the

consolidated income statement and the consolidated statement of

financial position.

The net assets of the Group by geographic location

(post-consolidation adjustments) are as follows:

Net Assets 30 September 30 September 31 March

2023 2022 2023

US$ 000's US$ 000's US$ 000's

Unaudited Unaudited Audited

Europe (UK) 4,519 1,282 3,649

United States 9,238 13,587 11,880

------------- ------------- -------------

Total Net Assets 13,757 14,869 15,529

============= ============= =============

The net assets in Europe (UK) are represented, primarily, by

cash balances denominated in US$.

8. Earnings Per Share

Basic earnings per share

Basic earnings per share is calculated by dividing the loss

attributable to ordinary shareholders for the six months of

US$594,000 (September 2022: loss of US$766,000) by the weighted

average number of ordinary shares in issue during the period of

69,724,006 (September 2022: 69,247,129).

9. Income Tax

No tax liability arose on ordinary activities for the six months

under review.

10. Intangible Fixed Assets

Other Intangible Fixed Assets

Developed IPR&D Brand

technology technology names Total

US$ 000's US$ 000's US$ 000's US$ 000's

Cost:

As at 1 April 2023 13,339 17,804 1,240 32,383

Capitalised in period - 832 - 1,149

------------ ------------ ---------- ----------

As at 30 September

2023 13,339 18,636 1,240 33,215

------------ ------------ ---------- ----------

Amortisation:

As at 1 April 2023 13,339 11,320 1,240 25,899

Charge for the period - - - -

As at 30 September

2023 13,339 11,320 1,240 25,899

------------ ------------ ---------- ----------

Net Book Value:

------------ ------------ ---------- ----------

As at 1 April 2023 - 6,484 - 6,484

============ ============ ========== ==========

As at 30 September

2023 - 7,316 - 7,316

============ ============ ========== ==========

The main categories of Intangible Fixed Assets are as

follows:

Developed technology:

This is technology which is currently commercialised and

embedded within the current product offering.

IPR&D technology:

This is technology, which is in the final stages of field

testing, has demonstrable commercial value and is expected to be

launched in the foreseeable future.

Brand names:

The value associated with various trading names used within the

Group.

11. Share capital

Share capital as at 30 September 2023 amounted to US$1,081,000

(31 March 2023: US$1,080,000 and 30 September 2022:

US$1,080,000).

12. Going concern

The Directors have carried out a review of the Group's financial

position and cash flow forecasts for the next 12 months by way of a

review of whether the Group satisfies the going concern tests.

These have been based on a comprehensive review of revenue,

expenditure and cash flows, taking into account specific business

risks and the current economic environment. With regards to the

Group's financial position, it had cash and cash equivalents at 30

September 2023 of US$5.1 million.

Having taken the above into consideration the Directors have

reached a conclusion that the Group is well placed to manage its

business risks in the current economic environment. Accordingly,

they continue to adopt the going concern basis in preparing the

Interim Condensed Financial Statements.

13. Principal risks and uncertainties

Further detail concerning the principal risks affecting the

business activities of the Group is detailed on pages 11 to 13 of

the Annual Report and Accounts for the period ended 31 March 2023.

Consideration has been given to whether there have been any changes

to the risks and uncertainties previously reported. None have been

identified.

14. Events after the balance sheet date

There have been no material events subsequent to the end of the

interim reporting period ended 30 September 2023.

15. Copies of the interim results

Copies of the interim results are available from the Group's

website at www.enteq.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FFFFILDLSLIV

(END) Dow Jones Newswires

November 15, 2023 02:00 ET (07:00 GMT)

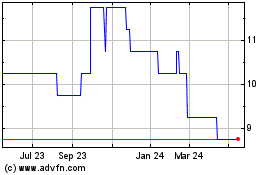

Enteq Technologies (AQSE:NTQ.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Enteq Technologies (AQSE:NTQ.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024