TIDMORCP

RNS Number : 6506O

Oracle Power PLC

04 October 2023

4 October 2023

Oracle Power PLC

("Oracle", the "Company" or the "Group")

Conditional Placing to Raise GBP 350,000

Capital Reorganisation

Notice of General Meeting

Oracle Power PLC (AIM:ORCP), the international natural resources

project developer, is pleased to announce that it has entered into

a placing agreement, conditional on the passing of certain

resolutions to be proposed at a general meeting of the Company, to

raise gross proceeds of GBP 350,000 by way of a placing of

1,000,000,000 new ordinary shares in the capital of the Company

(the " Placing Shares ") at a price of 0 .035 pence per share (the

" Placing Price ") (the " Placing "). Pursuant to the Placing,

placees will receive one warrant for every two Placing Shares

subscribed for, exercisiable at a price of 0.07 pence per ordinary

share, for a period of two years from the date of the Placing.

Use of Proceeds

The net proceeds of the Placing will be primarily used to

support the advancement of the Company's green hydrogen project

(the " Project ") through the joint venture with His Highness

Sheikh Ahmed Dalmook Al Maktoum (through his wholly owned company,

Kaheel Energy Limited). The Company recently announced the

completion of the technical and commercial Feasibility Study

relating to the Green Hydrogen Project. The study, undertaken by

thyssenkrupp Uhde, supports the development of a 400MW capacity

green hydrogen production facility. The results of the study were

noted to be very encouraging and on a par with industry

expectations as observed in other green hydrogen projects announced

worldwide, providing significant confidence in the development

route towards commercialisation. The Company is now moving into a

highly active period as it works towards completing other studies

in collaboration with State Grid Corporation of China, leading into

the FEED stage, and formulation of the investment and lender

consortium.

Capital Reorganisation

The Placing Price is less than the current nominal value of 0.1

pence per ordinary share. The Companies Act 2006 (as amended)

prohibits the Company from issuing new shares at a price below

nominal value. Accordingly, the Company is seeking shareholder

approval to carry out the capital reorganisation through which it

is proposed that each existing ordinary share will be subdivided

into one new ordinary share of 0.00 1 pence (the " New Ordinary

Shares ") and one deferred share of 0.099 pence (the " Deferred

Shares ") (the " Capital Reorganisation ") . The Deferred Shares

will have very limited rights and the Company will not issue any

share certificates or credit CREST accounts in respect of them. The

Deferred Shares will not be admitted to trading on AIM or any other

exchange.

The number of ordinary shares in issue, and held by each

Shareholder, as a result of the passing of the Resolutions will not

change. It is simply the nominal value of the existing ordinary

shares which will change. The New Ordinary Shares will continue to

carry the same rights as those attached to the existing ordinary

shares, save for the change in nominal value.

The Placing

The Placing has been carried out by CMC Capital Markets (" CMC

") and the Company has entered into a placing agreement with CMC

dated 3 October 2023 (the " Placing Agreement ") pursuant to which

CMC, as agent to the Company, has procured placees for the Placing

Shares at the Placing Price. CMC will receive 80 million warrants

over New Ordinary Shares, exercisable at the Placing Price for a

period of two years from the date of the Placing.

General Meeting

The Company will shortly be posting a circular (the " Circular

") to its shareholders which will include, inter alia , details of

a general meeting (the " General Meeting ") at which shareholders

will vote on the following resolutions (the " Resolutions "):

- Resolution 1: Capital Reorganisation

A resolution to approve the Capital Reorganisation, which is

necessary to issue the Placing Shares at the Placing Price, which

is below the current nominal value.

- Resolution 2: Amendment to Articles of Association of the Company

A special resolution to approve the amendment of the Company's

Articles of Association containing, inter alia , the rights and

restrictions attaching to the Deferred Shares, necessary to effect

the Capital Reorganisation.

The Placing is conditional on the Capital Reorganisation being

approved by Shareholders and admission of the New Ordinary Shares

and the Placing Shares to trading on AIM.

The Circular to shareholders will be made available on the

Company ' s website at www.oraclepower.co.uk when posted to

shareholders.

Recommendation

In the event that the resolutions are not passed, the Company

will be unable to complete the Placing or raise equity capital

unless any placing price is above the current nominal value.

The directors of Oracle consider that the resolutions to be

proposed at the General Meeting are in the best interests of the

Company and its shareholders as a whole and unanimously recommend

that shareholders vote in favour of the resolutions at the General

Meeting to be convened.

Admission to Trading, Total Voting Rights, ISIN and SEDOL

Application will be made for the New Ordinary Shares and the

Placing Shares to be admitted to trading on AIM ( " Admission " ).

It is expected that Admission will become effective at 8:00 a.m. on

or around 2 7 October 2023. The Placing Shares and the New Ordinary

Shares will have the same ISIN number and SEDOL code as each

existing ordinary share. The Placing Shares will rank pari passu

with the New Ordinary Shares.

Following shareholder approval and Admission, the total issued

share capital of the Company will be 4,735,415,387 New Ordinary

Shares, with no shares held in Treasury. Therefore, the total

current voting rights in the Company following Admission will be

4,735,415,387 and this figure may be used by shareholders in the

Company as the denominator for the calculations by which they will

determine if they are required to notify their interest in, or a

change in their interest in, the share capital of the Company under

the FCA's Disclosure Guidance and Transparency Rules.

Naheed Memon, CEO of Oracle, commented:

" We continue to advance our green hydrogen strategy in Pakistan

and today ' s conditional fundraise will enable us to continue on

this upward trajectory. The majority of the funds raised will be

used to support the green hydrogen initiative, whilst also

providing us with sufficient working capital to develop the other

projects in Oracle ' s portfolio.

" We are now looking toward the next stage in the Project ' s

development as we move forward with detailed technical and

financial feasibilities. With the recent completion of the

feasibility study and support from His Highness Shaikh Ahmed

Dalmook Al Maktoum, I am confident we will be able to rapidly

progress the development of this ground-breaking and globally

significant project. "

*ENDS*

For further information:

Oracle Power PLC +44 (0) 203 580

Naheed Memon - CEO 4314

Strand Hanson Limited (Nominated Adviser

and Broker) +44 (0) 20 7409

Rory Murphy, Matthew Chandler, Rob Patrick 3494

Global Investment Strategy UK Limited (Joint

Broker) +44 (0) 20 7048

Samantha Esqulant 9432

St Brides Partners Limited (Financial PR) +44 (0) 20 7236

Susie Geliher, Isabel de Salis 1177

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

United Kingdom domestic law by virtue of the European Union

(Withdrawal) Act 2018, as amended by virtue of the Market Abuse

(Amendment) (EU Exit) Regulations 2019.

About Oracle Power PLC:

Oracle Power PLC is an international natural resource and power

project developer quoted on London's AIM market. The Company

currently has two areas of focus: Western Australia and Pakistan.

The Company is active in the energy industry in Pakistan and is

working to establish one of the largest green hydrogen production

facilities in the region.

About Northern Zone Project:

The Northern Zone Project is comprised of one granted

prospecting licence (P25/2651) which covers an area of 82 hectares.

The Project is located in an area highly prospective for gold and

is approximately 25km east of Kalgoorlie, the home of the 'Super

Pit' mine, the second largest gold mine in Australia.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEZLBBXBLZFBK

(END) Dow Jones Newswires

October 04, 2023 02:00 ET (06:00 GMT)

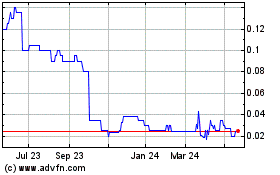

Oracle Power (AQSE:ORCP.GB)

Historical Stock Chart

From Oct 2024 to Nov 2024

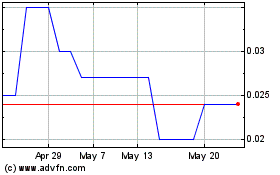

Oracle Power (AQSE:ORCP.GB)

Historical Stock Chart

From Nov 2023 to Nov 2024