TIDMPREM

RNS Number : 8452X

Premier African Minerals Limited

28 April 2023

28 April 2023

Premier African Minerals Limited

Exercise of Options

Director / PDMR shareholding

Premier African Minerals Limited ("Premier" or the "Company"),

announces that on 27 April 2023, Mr George Roach, Chief Executive

Officer and Mr. Wolfgang Hampel, Non-Executive Director, exercised

options over in aggregate 24,500,000 new ordinary shares in the

capital of the Company as set out in the table below pursuant to

the terms of the 2017 Share Option Plan:

Director Existing Exercise Resultant holding % of enlarged

options exercised price of Ordinary Shares issued share capital

George Roach 9,500,000 0.28p 1,616,514,207 7.1%

9,500,000 0.40p

Wolfgang Hampel 2,750,000 0.28p 101,834,781 0.45%

2,750,000 0.40p

In addition, the Company advises that on 27 April 2023, previous

board members, current and former employees also exercised a

further 70,688,565 options at a price of 0.28p per ordinary share

and 70,688,565 options at a price of 0.40 pence per ordinary

share.

In aggregate therefore, a total of 165,877,130 new ordinary

shares have been issued by Company pursuant to the exercise of the

options ("New Ordinary Shares") as set out above. The total

proceeds of the exercise amounts to GBP563,982.24 which will be

used by the Company for general working capital purposes.

Application is being made to the London Stock Exchange for

165,877,130 New Ordinary Shares to be admitted to trading on AIM

and it is expected that Admission will become effective, and

dealings will commence in the New Ordinary Shares at 8.00 a.m. on

or around 5 May 2023. The New Ordinary Shares shall rank pari passu

in all respects with all other Ordinary Shares then in issue.

Total Voting Rights

Following the issue of the New Ordinary Shares, the Company's

issued share capital consists of 22,583,886,961 Ordinary Shares,

with voting rights. This figure may be used by shareholders in the

Company as the denominator for the calculation by which they will

determine if they are required to notify their interest in, or a

change to their interest in, the share capital of the Company under

the Financial Conduct Authority's Disclosure and Transparency

Rules.

Enquiries:

George Roach Premier African Minerals Tel: +27 (0) 100

Limited 201 281

Michael Cornish Beaumont Cornish Limited Tel: +44 (0) 20

/ Roland Cornish (Nominated Adviser) 7628 3396

--------------------------- -----------------

John More/Toby Shore Capital Stockbrokers Tel: +44 (0) 20

Gibbs Limited 7408 4090

--------------------------- -----------------

Forward Looking Statements:

Certain statements in this announcement are or may be deemed to

be forward looking statements. Forward looking statements are

identi ed by their use of terms and phrases such as "believe"

"could" "should" "envisage" "estimate" "intend" "may" "plan" "will"

or the negative of those variations or comparable expressions

including references to assumptions. These forward-looking

statements are not based on historical facts but rather on the

Directors' current expectations and assumptions regarding the

Company's future growth results of operations performance future

capital and other expenditures (including the amount. Nature and

sources of funding thereof) competitive advantages business

prospects and opportunities. Such forward looking statements re ect

the Directors' current beliefs and assumptions and are based on

information currently available to the Directors. A number of

factors could cause actual results to differ materially from the

results discussed in the forward-looking statements including risks

associated with vulnerability to general economic and business

conditions competition environmental and other regulatory changes

actions by governmental authorities the availability of capital

markets reliance on key personnel uninsured and underinsured losses

and other factors many of which are beyond the control of the

Company. Although any forward-looking statements contained in this

announcement are based upon what the Directors believe to be

reasonable assumptions. The Company cannot assure investors that

actual results will be consistent with such forward looking

statements.

Notes to Editors:

Premier African Minerals Limited (AIM: PREM) is a

multi-commodity mining and natural resource development company

focused on Southern Africa with its RHA Tungsten and Zulu Lithium

projects in Zimbabwe.

The Company has a diverse portfolio of projects, which include

tungsten, rare earth elements, lithium and tantalum in Zimbabwe and

lithium and gold in Mozambique, encompassing brownfield projects

with near-term production potential to grass-roots exploration. The

Company has a ccepted a share offer by Vortex Limited ("Vortex")

for the exchange of Premier's entire 4.8% interest in Circum

Minerals Limited ("Circum"), the owners of the Danakil Potash

Project in Ethiopia, for a 13.1% interest in the enlarged share

capital of Vortex. Vortex has an interest of 36.7% in Circum.

In addition, the Company holds a 19% interest in MN Holdings

Limited, the operator of the Otjozondu Manganese Mining Project in

Namibia.

Details of the person discharging managerial responsibilities

1 / person closely associated

a) Name George Roach

--------------------------- -----------------------------------------------

Reason for the notification

2

----------------------------------------------------------------------------

a) Position/status Chief Executive

--------------------------- -----------------------------------------------

b) Initial notification Initial Notification

/Amendment

--------------------------- -----------------------------------------------

Details of the issuer, emission allowance market participant,

3 auction platform, auctioneer or auction monitor

----------------------------------------------------------------------------

a) Name Premier African Minerals Limited

--------------------------- -----------------------------------------------

b) LEI 213800WDKYXYJZE5DZ61

--------------------------- -----------------------------------------------

Details of the transaction(s): section to be repeated for

4 (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have

been conducted

----------------------------------------------------------------------------

a) Description of the Ordinary shares of no-par value in Premier

financial instrument, African Minerals Limited

type of instrument

Identification code ISIN: VGG7223M1005

b) Nature of the transaction Issue of Ordinary Shares

--------------------------- -----------------------------------------------

c) Price(s) and volume(s) Director Price Volume(s)

------------- ------ ---------

George Roach 0.28p 9,500,000

0.40p 9,500,000

-------------------------------------------

d) Aggregated information

- Aggregated volume 19,000,000 Ordinary Shares

- Price 0.28p and 0.40p

e) Date of the transaction 27 April 2023

--------------------------- -----------------------------------------------

f) Place of the transaction Outside a trading venue

--------------------------- -----------------------------------------------

Details of the person discharging managerial responsibilities

1 / person closely associated

a) Name Wolfgang Hampel

-------------------------- -----------------------------------------------

Reason for the notification

2

---------------------------------------------------------------------------

a) Position/status Non-executive Director

-------------------------- -----------------------------------------------

b) Initial notification Initial Notification

/Amendment

-------------------------- -----------------------------------------------

Details of the issuer, emission allowance market participant,

3 auction platform, auctioneer or auction monitor

---------------------------------------------------------------------------

a) Name Premier African Minerals Limited

-------------------------- -----------------------------------------------

b) LEI 213800WDKYXYJZE5DZ61

-------------------------- -----------------------------------------------

Details of the transaction(s): section to be repeated for

4 (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have

been conducted

---------------------------------------------------------------------------

a) Description of the Ordinary shares of no-par value in Premier

financial instrument, African Minerals Limited

type of instrument

Identification code ISIN: VGG7223M1005

b) Nature of the transaction Issue of Ordinary Shares

-------------------------- -----------------------------------------------

c) Price(s) and volume(s) Director Price Volume(s)

---------------- ------- ---------

Wolfgang Hempel 0.28 p 2,750,000

0.40 p 2,750,000

-------------------------------------------

d) Aggregated information

- Aggregated volume 5,500,000 Ordinary Shares

- Price 0.28p and 0.40p

e) Date of the transaction 27 April 2023

-------------------------- -----------------------------------------------

f) Place of the transaction Outside a trading venue

-------------------------- -----------------------------------------------

Ends

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DSHPPUWWCUPWUCR

(END) Dow Jones Newswires

April 28, 2023 02:00 ET (06:00 GMT)

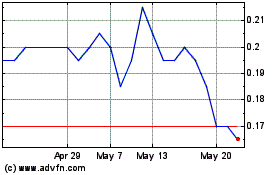

Premier African Minerals (AQSE:PREM.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

Premier African Minerals (AQSE:PREM.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025