TIDMPRES

RNS Number : 9583D

Pressure Technologies PLC

27 June 2023

The information contained within this announcement is deemed by

the Group to constitute inside information as stipulated under the

UK version of the EU Market Abuse Regulation (2014/596) which is

part of UK law by virtue of the European Union (Withdrawal) Act

2018, ("MAR"), and is disclosed in accordance with the Group's

obligations under Article 17 of MAR. Upon the publication of this

announcement via a Regulatory Information Service, this inside

information will be considered to be in the public domain.

27 June 2023

Pressure Technologies plc

("Pressure Technologies", the "Company" or the "Group")

2023 Interim Results

Pressure Technologies (AIM: PRES), the specialist engineering

group, is pleased to announce its unaudited interim results for the

26 weeks to 1 April 2023.

Financial Highlights

-- Group revenue increased 45% to GBP13.8 million (2022:

GBP9.5 million)

-- Gross profit up 76% to GBP3.7 million at 27% margin

(2022: GBP2.1 million at 22% margin)

-- Adjusted EBITDA(1) profit of GBP0.3 million (2022:

EBITDA loss of GBP1.2 million)

-- Adjusted operating loss(2) of GBP0.5 million (2022:

loss of GBP2.1 million)

-- Reported loss before tax of GBP1.4 million (2022: loss

of GBP2.3 million)

-- Reported basic loss per share of 3.9p (2022: loss per

share of 6.0p) and Adjusted basic loss per share(3)

of 2.3p (2022: loss per share of 5.7p)

-- Net debt(4) of GBP3.7 million (2022: GBP5.4 million;

1 October 2022: GBP3.5 million); Net bank borrowings,

excluding asset finance lease liabilities and right

of use asset lease liabilities, of GBP0.9 million (2022:

GBP2.7 million; 1 October 2022: GBP0.6 million)

1 Adjusted EBITDA is earnings before interest, tax,

depreciation, amortisation and other exceptional costs

2 Adjusted operating loss is operating loss before amortisation

and other exceptional costs

3 Adjusted basic loss per share is reported earnings per share

before amortisation and other exceptional costs

4 Net debt comprises cash and cash equivalents, bank borrowings,

asset finance lease liabilities and right of use asset lease

liabilities

Group Highlights

-- Improving trading conditions during the first half of FY23

driven by major defence contract placement and continued

recovery in the oil and gas market against the backdrop of

more resilient economic conditions.

-- Group revenue in the first half of FY23 of GBP13.8 million

(2022: GBP9.5 million), representing like-for-like growth

of 45% and underpinning a return to Adjusted EBITDA profitability

of GBP0.3m (2022: loss of GBP1.2 million).

-- Order intake of GBP34.3 million for the eight months ended

May 2023 (eight months ended May 2022: GBP17.4 million) was

97% higher than the corresponding period last year and supports

a current order book of GBP28.1 million at May 2023 (May

2022: GBP16.6 million), the highest level for more than five

years.

-- Fundraising of GBP2.1 million (net of expenses) in December

2022 used to support the Group's short-term working capital

requirements and provide a bridge to profitable, cash-generative

trading following placement of a major defence contract in

February 2023.

-- Bank borrowings were reduced by GBP0.5 million in the period

to GBP1.9 million (1 October 2022: GBP2.4 million).

-- The refinancing of the debt facilities of the Group has not

progressed as quickly as originally expected. The Board continues

to explore refinancing options for the Group and is engaged

in constructive discussions with potential lenders. Based

on these discussions, the Board has a reasonable expectation

that the refinancing can be completed in the remainder of

calendar year 2023.

-- Following a marketing process, the Board has decided not

to divest Precision Machined Components at this time due

to improving conditions in the oil and gas market and will

revisit strategic options for the division later in the year.

Chesterfield Special Cylinders ("CSC")

-- CSC revenue in the first half of FY23 of GBP8.8 million (2022:

GBP6.3 million), driven by defence work in the second quarter

and progress in hydrogen markets, underpinning improved EBITDA

profitability.

-- Defence revenue of GBP7.0 million (2022: GBP5.0 million),

reflecting strong order book and new contract placements

for submarine and surface ship projects for UK and overseas

navies.

-- Largest ever contract award of GBP18.2 million announced

in February 2023 to supply safety-critical pressure vessels

for major UK naval new construction programme over three

years to 2025.

-- Hydrogen revenue increased to GBP1.3 million (2022: GBP0.5

million), driven equally by sales of new refuelling station

storage and periodic inspection, testing and recertification

services for hydrogen road trailers.

-- Enquiry levels for Integrity Management services increased

sharply during the first half of FY23, driven by growing

activity in the offshore and hydrogen energy markets.

-- CSC order intake of GBP22.3 million in the eight months ended

May 2023 (eight months ended May 2022: GBP12.4 million) supports

a current order book of GBP19.2m million at the end of May

2023 (May 2022: GBP14.2 million), the highest order book

level seen in the last five years, providing strong revenue

cover for the remainder of FY23 and good visibility into

FY24.

-- Operational improvements in the Sheffield facility are delivering

increased capacity and efficiency for hydrogen cylinder and

road trailer new build, inspection and testing services.

Precision Machined Components ("PMC")

-- PMC revenue in the first half of FY23 of GBP4.9 million (2022:

GBP3.2 million), reflecting recovery in the oil and gas market

and underpinning a return to EBITDA profitability.

-- PMC order intake strengthened significantly in the first

half of FY23 and reached GBP12.0 million in the 8 months

ended May 2023 (8 months ended May 2022: GBP5.0 million),

supporting a current order book of GBP8.9 million at the

end of May 2023 (May 2022: GBP2.4 million), the highest order

book level seen in the last five years, providing strong

revenue cover for the remainder of FY23.

Outlook

-- Improved second-half performance expected for CSC, driven

by high-value defence contract milestones, Integrity Management

deployments and hydrogen energy projects.

-- Despite delays in the broader hydrogen supply chain, opportunities

continue to be developed for the supply of new hydrogen storage

and transportation systems for refuelling and decarbonisation

applications.

-- Demand for in-situ and factory-based inspection, testing

and recertification services for hydrogen storage and road

trailers presents an exciting growth opportunity across an

expanding customer base.

-- Recovery of financial performance in PMC expected to strengthen

in second half driven by increasing order intake as OEM customers

report a stronger oil and gas market outlook, supporting

improving profitability.

-- The order book of the Group is robust, underpinning a stronger

performance in the second half of FY23. However, this will

require further strong improvements in operational and supply

chain performance and confirmation of the expected increase

in Integrity Management activity, all of which represent

material uncertainties.

-- Accordingly, the Board therefore believes that full-year

FY23 Adjusted EBITDA is more likely to be in the range GBP2.2

million to GBP2.5 million, which would represent significant

progress as compared to FY22 (Adjusted EBITDA Loss of GBP0.9

million).

Chris Walters, Chief Executive of Pressure Technologies plc,

commented:

"Significantly improved performance in the first half of FY23

reflects the strong defence order book in Chesterfield Special

Cylinders and the continued recovery of oil and gas market trading

conditions in Precision Machined Components.

In Chesterfield Special Cylinders, the order book reached the

highest level on record following an GBP18.2 million contract award

to supply air pressure vessels for a major UK naval new

construction programme. This order was the largest ever for the

division, providing good visibility of high-value work through the

remainder of FY23 and into FY24.

Despite delays in the hydrogen energy supply chain over the past

year, we remain well positioned in this emerging market to supply

static and mobile hydrogen storage solutions, and to provide the

through-life inspection, testing and recertification services for

these safety-critical systems over the medium and longer term.

In Precision Machined Components, the recovery of order intake

levels during the first half of the year is expected to continue

throughout the second half, as OEM customers report an increasingly

positive oil and gas market outlook. In light of these improving

conditions, the Board has decided not to divest PMC at this time

and will revisit strategic options for the business later in the

year.

Both of our divisions have strong and growing order books, our

executive team, including Chief Financial Officer and Chief

Operating Officer, is complete and we see the opportunity for

revenue growth and margin improvement across the Group."

Additional Information

The person responsible for arranging release of this

announcement on behalf of the Company is Steve Hammell, Chief

Financial Officer.

For further information, please contact:

Pressure Technologies plc Tel: 0333 015 0710

Chris Walters, Chief Executive

Steve Hammell, Chief Financial

Officer

Singer Capital Markets (Nomad Tel: 0207 496 3000

and Broker)

Rick Thompson / Asha Chotai

Houston (Financial PR and Investor Tel: 0204 529 0549

Relations) pressuretechnologies@houston.co.uk

Kay Larsen /Ben Robinson

COMPANY DESCRIPTION

www.pressuretechnologies.com

With its head office in Sheffield, the Pressure Technologies

Group was founded on its leading market position as a designer and

manufacturer of high-integrity, safety-critical components and

systems serving global supply chains in oil and gas, defence,

industrial and hydrogen energy markets.

The Group has two divisions:

-- Chesterfield Special Cylinders (CSC) - www.chesterfieldcylinders.com

-- Precision Machined Components (PMC) - www.pt-pmc.com

o Includes the Al-Met, Roota Engineering and Martract sites.

Business Review

Pressure Technologies has made significant progress in the first

half of FY23 as reflected in these interim results. Revenue has

increased significantly in the period alongside an increase in new

orders, driven by a major new UK defence contract and recovery in

the oil and gas market.

Chesterfield Special Cylinders

Chesterfield Special Cylinders ("CSC") has built momentum in the

period following receipt of its largest ever contract award of

GBP18.2 million to supply safety-critical pressure vessels for a

major UK naval new construction programme, with a three-year

manufacturing programme to 2025. Operational performance on this

contract was strong in the second quarter driving revenue

recognition.

CSC remains well positioned in the emerging market for hydrogen

storage and transportation. Order placement from established and

new customers was slower than expected during the first half of

FY23, influenced by constraints and delays in the broader supply

chain for components required in the generation and compression of

hydrogen for refuelling and decarbonisation projects. Despite these

delays, CSC delivered hydrogen revenues of GBP1.3 million (2022:

GBP0.5 million) from several refuelling station projects and from

periodic inspection, testing and recertification services carried

out on existing hydrogen storage systems and road trailers.

CSC order intake in the eight months ended May 2023 was GBP22.3

million (eight months ended May 2022: GBP12.4 million) supporting a

current order book of GBP19.2 million at the end of May 2023 (May

2022: GBP14.2 million), the highest order book level seen in the

last five years. The order book provides strong revenue cover for

the remainder of FY23 and good visibility into FY24.

CSC has made strong progress on its operational excellence

improvements in the period. Organisational changes have been made

to strengthen the operations team, with new appointments and

governance to improve multi-functional working through a focussed

project management approach. A continuous improvement roadmap has

been developed and deployment is on-track through a dedicated

team.

Furthermore, equipment maintenance processes have been

strengthened with the appointment of new technicians and the

roll-out of software to track equipment reliability and enable the

development of focussed improvements. Further system developments

are in the implementation stage which will drive productivity and

margins. Solid progress has been made in CSC to improve reliability

and repeatability to customers, which in-turn delivers improved

forecast accuracy so that forward efforts and plans can focus on

cost control and margin enhancement.

Precision Machined Components

Since 2020, our Precision Machined Components ("PMC") division

has felt the significant impact of the Covid-19 pandemic. However,

we are now seeing the early stages of recovery in oil and gas

markets and are encouraged by the steady growth in order intake for

the division, which has traded in-line with expectations throughout

the first half of FY23 and returned to EBITDA profitability.

The demand for subsea well intervention tools, valve assemblies

and control module components has continued to grow during the

first half of the year with a sharp improvement noted in April and

May 2023. Roota Engineering OEM customers, including Aker, Expro,

Halliburton and Schlumberger, continue to report a stronger oil and

gas market outlook for the second half of 2023 and are investing

heavily in their global manufacturing capacity to support growth in

oil and gas production, principally from Middle East, South

America, North Sea, US Gulf of Mexico and Australasia regions.

There is also growing demand for well de-commissioning projects in

the North Sea.

Business Review (continued)

Roota Engineering order intake in the eight months ended May

2023 was GBP4.2 million (eight months ended May 2022: GBP2.9

million) supporting a current order book of GBP2.7 million at May

2023 (May 2022: GBP1.3 million).

Demand for production drilling and flow control components,

supported by a strong and sustained recovery in subsea tree new

build capex, is also expected to grow across 2023 and beyond for

major subsea and

surface production projects. Al-Met OEM customers, including

Schlumberger and Baker Hughes, report increasing investment to

support oil and gas production in Middle East, South America, North

Sea, US Gulf of Mexico, Canada and South-East Asia regions.

The recovery of order intake at Al-Met was particularly strong

in the first half of the year. Order intake in the eight months

ended May 2023 was GBP7.8 million (eight months ended May 2022:

GBP2.1 million) supporting a current order book of GBP6.2 million

at May 2023 (May 2022: GBP1.1 million), which includes over GBP3.0

million already secured for delivery in the first half of FY24.

Overall PMC order intake in the eight months ended May 2023 was

GBP12.0 million (eight months ended May 2022: GBP5.0 million)

supporting a current order book of GBP8.9 million at the end of May

2023 (May 2022: GBP2.4 million), the highest order book level seen

in the last five years. The order book provides strong revenue

cover for the remainder of FY23.

In November 2022, the Board announced that an improved trading

environment and outlook created the potential opportunity to divest

PMC in order to raise funds to progress strategic priorities in

CSC. As part of this process, a number of offers to acquire PMC

were received but none were at a level that the Board felt

appropriately reflected the value of the business, particularly in

light of the improved outlook for the oil and gas market and the

recent strong order intake of PMC. As a result, the Board has

decided not to divest PMC at this time and will revisit strategic

options for the business later in the year.

Equity Raising

On 6 December 2022, the Group completed a GBP2.1 million equity

fundraise with support from institutional and retail shareholders.

The funds raised provided important flexibility and liquidity

during the first half of FY23 and a bridge to profitable,

cash-generative trading driven by the commencement of major defence

contracts in CSC and recovering order intake in PMC.

Outlook

The Group is well positioned in the defence and emerging

hydrogen energy sectors and expects to benefit from recovery in the

oil and gas market. Based on the strong current order book, the

Group is well placed to drive revenue growth in the second half of

FY23 and beyond although this will be critically dependent on the

rate at which improved production and supply chain performance can

be delivered. Given the supply chain challenges experienced in the

period, the Board recognises that this remains a risk to the

delivery of the expected stronger performance in the second half of

FY23 as delivery milestones, and hence revenue, could be deferred

into FY24.

The Board therefore believes that full-year FY23 Adjusted EBITDA

is more likely to be in the range GBP2.2 million to GBP2.5 million,

which would represent significant progress as compared to FY22

(Adjusted EBITDA Loss of GBP0.9 million).

Chris Walters

Chief Executive

27 June 2023

Financial Review

Revenue & Profitability

Improving market conditions in the oil and gas market and strong

new defence orders have underpinned a significant improvement in

performance in the first half of FY23. Revenue of GBP13.8 million

was 45% higher than the corresponding period last year (2022:

GBP9.5 million) and has helped drive gross profit to GBP3.7 million

at 27% margin (2022: GBP2.1m at 22% margin).

The gross margin improvement has been driven by the higher level

of activity and throughput in both CSC and PMC, improving asset

utilisation, and a benefit of GBP0.4 million in the period in

relation to the adoption of the amended IFRS 15 treatment for

certain long-term contracts disclosed in the FY22 Annual

Report.

Overhead costs increased slightly in the period to GBP4.2

million (2022: GBP4.1 million) with a strict focus on cost control

largely offsetting inflationary pressures.

The Group reported an operating loss of GBP0.5 million (2022:

loss of GBP2.0 million) in the period. Allowing for depreciation

charges of GBP0.8 million (2022: GBP0.8 million), the Group

returned to an Adjusted EBITDA profit of GBP0.3 million in the

period (2022: loss of GBP1.2 million), demonstrating a strong

turnaround in underlying financial performance.

Exceptional costs of GBP0.7 million were incurred in the period

(2022: GBP0.1 million) in relation to reorganisation costs, the

extension of its banking facilities with Lloyds Bank in October

2022 and the strategic review of PMC.

Cashflow

The Group reported a net cash outflow of GBP0.8 million in the

period (2022: outflow of GBP1.9 million). This was driven by

reported EBITDA of GBP0.3 million, exceptional costs of GBP0.7

million, working capital outflows (GBP1.1 million), capital

expenditure (GBP0.6 million), interest costs (GBP0.2 million) and

debt repayments (GBP0.6 million), partially offset by the net

proceeds of the equity raising (GBP2.1 million) in December

2022.

The equity raising involved the issue of 7,600,000 new ordinary

shares at an issue price of 30 pence per share and has provided

essential financial flexibility in the period. These funds also

supported the purchase of a new milling machine at PMC for GBP0.5

million in the period.

The cash balance at the end of the period was GBP1.0 million (1

October 2022: GBP1.8 million). Net debt, which comprises cash, bank

borrowings, finance lease liabilities and right of use asset lease

liabilities, at the end of the period was GBP3.7 million (1 October

2022: GBP3.5 million). Net bank borrowings, which comprises cash

and bank borrowings only, at the end of the period was GBP0.9

million (1 October 2022: GBP0.6 million).

Prior Year Adjustment

During the preparation of the Annual Report & Accounts for

the year ended 1 October 2022, the Group reviewed its accounting

policy and past accounting treatment in respect of a small number

of long-term defence contracts within CSC and it was identified

that this accounting treatment was not in compliance with IFRS

15.

As a result, the comparative period financial statements have

been restated. As at 2 October 2021 and 2 April 2022, the impact of

the restatement was to reduce total equity by GBP1,054,000. The

restatement had no impact on profit recognition in the 26 weeks

ended 1 April 2023 or the 26 weeks ended 2 April 2022.

These accounting adjustments only impact the timing of profit

recognition under these specific contracts.

They do not impact the total profitability of the contracts, the

net debt position of the Group at any date,

Financial Review (continued)

the future cash generation profile of the Group, nor the

underlying trading or operations of the business.

Refinancing of Debt Facilities and Amendment of Lloyds Bank

Facilities

The Board has been engaged in discussions with a number of

prospective lenders to provide asset-backed lending facilities and

alternative financing to enable the full repayment of the existing

facilities of Lloyds Bank and provide working capital headroom to

support the strategic development of the Group. These discussions

have progressed more slowly than expected and have not concluded at

this time. The Board continues to explore options for refinancing

and is engaged in constructive discussions with potential lenders

which will require more time to conclude.

The current debt facilities provided by Lloyds Bank have been

amended this month such that the final maturity date of the

facilities has been brought forward from 31 March 2024 to 31

December 2023, with Lloyds having agreed to waive the financial

covenant tests due on 30 June 2023 under the facilities. The Lloyds

facility is expected to support the financing requirements of the

Group over the period to 31 December 2023 although the liquidity

and covenant headroom during this period remains limited.

After December 2023 the Group is likely to require additional

working capital facilities, depending on operational and financial

performance, to ensure it meets its financial obligations as they

fall due. Given the on-going constructive discussions with

potential lenders, the Board has a reasonable expectation that

adequate financing can be secured during the remainder of the

calendar year 2023.

Auditor

Grant Thornton resigned as auditors to the Group on 23 May 2023

following the signing of the FY22 Annual Report and Accounts. They

confirmed that there were no matters connected with their ceasing

to hold office which they considered should be brought to the

attention of the shareholders or creditors of the Group. The Board

has commenced the process to appoint new auditors and will update

in due course.

Steve Hammell

Chief Financial Officer

27 June 2023

Condensed Consolidated Statement of Comprehensive Income

For the 26 weeks ended 1 April 2023

Unaudited Unaudited Audited

26 weeks 26 weeks 52 weeks

ended ended ended

1 April 2 April 1 October

2023 2022 2022

Notes GBP'000 GBP'000 GBP'000

Revenue 4 13,765 9,492 24,939

Cost of sales (10,051) (7,437) (19,680)

Gross profit 3,714 2,055 5,259

Administration expenses (4,230) (4,110) (7,883)

Operating loss before amortisation,

impairments and other exceptional

costs (516) (2,055) (2,624)

Separately disclosed items of administrative

expenses:

Amortisation - (64) (101)

Other exceptional costs 6 (704) (41) (968)

Operating loss (1,220) (2,160) (3,693)

Finance costs (180) (140) (292)

Loss before taxation (1,400) (2,300) (3,985)

Taxation 7 - 437 (52)

Loss for the period attributable

to owners of the parent (1,400) (1,863) (4,037)

Other comprehensive income/(expense)

to be reclassified to profit or

loss in subsequent periods

Currency exchange differences on

translation of foreign operations 6 42 (5)

Total comprehensive expense for

the period attributable to the owners

of the parent (1,394) (1,821) (4,042)

Loss per share - basic and diluted

From loss for the period 8 (3.9)p (6.0)p (13.0)p

Condensed Consolidated Statement of Financial Position

As at 1 April 2023

Restated*

Unaudited Unaudited Audited

26 weeks 26 weeks 52 weeks

ended ended ended

1 April 2 April 1 October

2023 2022 2022

Notes GBP'000 GBP'000 GBP'000

Non-current assets

Intangible assets - 152 -

Property, plant and equipment and

right of use assets 10,961 12,477 11,197

Deferred tax asset 663 1,138 663

11,624 13,767 11,860

Current assets

Inventories 4,765 4,578 4,566

Trade and other receivables 8,137 12,487 9,331

Cash and cash equivalents 9 1,039 1,326 1,783

Current tax asset 58 435 58

13,999 18,826 15,738

Total assets 25,623 32,593 27,598

Current liabilities

Trade and other payables (7,342) (10,452) (9,477)

Borrowings - revolving credit facility 9 (1,907) - (2,407)

Lease liabilities 9 (526) (1,028) (839)

(9,775) (11,480) (12,723)

Non-current liabilities

Other payables (22) (62) (32)

Borrowings - revolving credit facility 9 - (4,000) -

Lease liabilities 9 (2,293) (1,732) (2,037)

Deferred tax liabilities (703) (1,066) (703)

(3,018) (6,860) (2,772)

Total liabilities (12,793) (18,340) (15,495)

Net assets 12,830 14,253 12,103

Equity

Share capital 10 1,933 1,553 1,553

Share premium account 10 1,699 - -

Translation reserve (259) (218) (265)

Retained earnings 9,457 12,918 10,815

Total equity 12,830 14,253 12,103

*A restatement of the Condensed Consolidated Statement of

Financial Position as at 2 April 2022 has been undertaken to

correct an error which related to the incorrect treatment of

certain contract accounting transactions (see Note 13).

Condensed Consolidated Statement of Changes in Equity

For the 26 weeks ended 1 April 2023

Share

Share premium Translation Retained Total

capital account reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 October 2022 (audited) 1,553 - (265) 10,815 12,103

Shares issued 380 1,699 - - 2,079

Share based payments - - - 42 42

Transactions with owners 380 1,699 - 42 2,121

Loss for the period - - - (1,400) (1,400)

Exchange differences arising on

retranslation of foreign operations - - 6 - 6

Total comprehensive income/(expense) - - 6 (1,400) (1,394)

Balance at 1 April 2023 (unaudited) 1,933 1,699 (259) 9,457 12,830

For the 26 weeks ended 2 April 2022

Share

Share premium Translation Retained Total

capital account reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 2 October 2021 (audited) 1,553 - (260) 15,784 17,077

Prior period adjustment - - - (1,054) (1,054)

Restated* balance at 2 October

2021 (audited) 1,553 - (260) 14,730 16,023

Share based payments - - - 51 51

Transactions with owners - - - 51 51

Loss for the period - - - (1,863) (1,863)

Exchange differences arising on

retranslation of foreign operations - - 42 - 42

Total comprehensive income/(expense) - - 42 (1,863) (1,821)

Restated* balance at 2 April 2022

(unaudited) 1,553 - (218) 12,918 14,253

Condensed Consolidated Statement of Changes in Equity

(continued)

For the 52 weeks ended 1 October 2022

Share

Share premium Translation Retained Total

capital account reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 2 October 2021 (audited) 1,553 - (260) 15,784 17,077

Prior period adjustment - - - (1,054) (1,054)

Restated* balance at 2 October 2021

(audited) 1,553 - (260) 14,730 16,023

Share based payments - - - 122 122

Transactions with owners - - - 122 122

Loss for the period - - - (4,037) (4,037)

Exchange differences arising on translating

foreign operations - - (5) - (5)

Total comprehensive expense - - (5) (4,037) (4,042)

Balance at 1 October 2022 (audited) 1,553 - (265) 10,815 12,103

*A restatement of the Condensed Consolidated Statement of

Changes in Equity as at 2 October 2021 and 2 April 2022 has been

undertaken to correct an error which related to the incorrect

treatment of certain contract accounting transactions (see Note

13).

Condensed Consolidated Cash Flow Statement

For the 26 weeks ended 1 April 2023

Unaudited Unaudited Audited

26 weeks 26 weeks 52 weeks

ended ended ended

1 April 2 April 1 October

2023 2022 2022

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Loss after tax (1,400) (1,863) (4,037)

Adjustments for:

Depreciation of property, plant and

equipment 778 849 1,678

Finance costs - net 180 140 292

Amortisation of intangible assets - 64 101

Exchange differences 6 42 -

Profit on disposal of property, plant

and equipment - - (327)

Share option costs 42 51 122

Income tax (credit)/charge - (437) 52

Release of grants - - (66)

Changes in working capital:

Increase in inventories (199) (870) (859)

(Increase)/decrease in trade and other

receivables 1,194 (3,425) (269)

Increase/(decrease) in trade and other

payables (2,145) 4,799 4,132

Cash flows from operating activities (1,544) (650) 819

Finance costs paid net of interest income

received (180) (140) (292)

Corporation tax refunded - 414 138

Net cash (outflow)/inflow from operating

activities (1,724) (376) 665

Cash flows from investing activities

Purchase of property, plant and equipment (542) (364) (536)

Proceeds from disposal of fixed assets

and assets held for sale - 217 2,063

Net cash (outflow)/inflow from investing

activities (542) (147) 1,527

Financing activities

Repayment of lease liabilities (411) (595) (1,260)

New finance leases 354 - -

Repayment of borrowings (500) (773) (2,366)

Shares issued 2,079 - -

Net cash inflow/(outflow) from financing

activities 1,522 (1,368) (3,626)

Net decrease in cash and cash equivalents (744) (1,891) (1,434)

Cash and cash equivalents at beginning

of period 1,783 3,217 3,217

Cash and cash equivalents at end of

period 1,039 1,326 1,783

Notes to the Condensed Consolidated Interim Financial

Statements

1. General information

Pressure Technologies plc is incorporated in England and Wales

and is quoted on AIM, a market operated by the London Stock

Exchange.

These unaudited interim condensed consolidated financial

statements for the 26 weeks ended 1 April 2023 and were approved by

the Board of Directors on 26 June 2023.

These financial statements may contain certain statements about

the future outlook of Pressure Technologies plc. Although the

Directors believe their expectations are based on reasonable

assumptions, any statements about future outlook may be influenced

by factors that could cause actual outcomes and results to be

materially different.

2. Basis of preparation

The Group's unaudited interim results for the 26 weeks ended 1

April 2023 ("Interim Results") are prepared in accordance with the

Group's accounting policies which are based on the recognition and

measurement principles of the UK-adopted International Accounting

Standards in conformity with the requirements of the Companies Act

2006. As permitted, the Interim Results has been prepared in

accordance with the AIM rules and not in accordance with IAS 34

"Interim financial reporting" and therefore the interim information

is not in full compliance with International Accounting

Standards.

The interim condensed consolidated financial statements are

prepared under the historical cost convention as modified to

include the revaluation of certain financial instruments. The

accounting policies adopted in the preparation of the interim

condensed consolidated financial statements are consistent with

those followed in the preparation of the Group's annual

consolidated financial statements for the year ended 1 October

2022. The principal accounting policies of the Group have remained

unchanged from those set out in the Group's 2022 annual report and

financial statements. The Principal Risks and Uncertainties of the

Group are also set out in the Group's 2022 annual report and

financial statements and are unchanged in the period.

The financial information for the 26 weeks ended 1 April 2023

and 2 April 2022 has not been audited and does not constitute full

financial statements within the meaning of Section 434 of the

Companies Act 2006.

The Group's 2022 financial statements for the 52 weeks ended 1

October 2022 were prepared under UK-adopted International

Accounting Standards. The auditor's report on these financial

statements was unqualified and did not contain statements under

Sections 498(2) or (3) of the Companies Act 2006 and they have been

filed with the Registrar of Companies.

3. Going concern

The Directors have considered whether the Group will be able to

meet its obligations as they fall due for the period of at least 12

months from the date of these Interim Results. These interim

condensed financial statements have been prepared on a going

concern basis.

The Group's current revolving credit facility (RCF) with Lloyds

Bank was amended in June 2023. The facility reduces from GBP1.9

million to GBP0.9 million on 30 September 2023 and now expires on

31 December 2023. The covenant test on 30 June 2023 has been waived

and the final testing date is 30 September 2023. The Board is

currently engaged in constructive discussions with potential

lenders in order to refinance the Lloyds Bank facilities and has a

reasonable expectation that new financing arrangements can be

secured before the expiry of the Lloyds Bank facility on 31

December 2023.

Management have produced forecasts for the period up to

September 2024 for all business units, taking account of reasonably

plausible changes in trading performance and market conditions,

which have been reviewed by the Directors. In particular, the

forecasts reflect both (i) the award of a major, multi-year

contract for the Chesterfield Special Cylinders division to supply

air pressure vessels for a major UK naval new construction program,

which was announced on 6 February 2023, and also (ii) the recent

significantly improved trading in the Precision Machined Components

division as oil and gas markets recover, following unprecedented

order intake levels which have resulted in an order book of GBP8.9

million at the end of May 2023, the highest order book level seen

in the last five years for the division. The base case forecast

demonstrates that the Group is projected to:

-- generate profits and cash in the current financial year and beyond;

-- has headroom in financial covenants over the period up to the

expiry of the Lloyds RCF on 31 December 2023; and

-- generates sufficient cash to repay the tranche of the RCF on

30 September 2023 and the final repayment of the facility on 31

December 2023 and has sufficient cash reserves beyond 31 December

2023 to manage without the RCF or an alternative financing

facility. While the level of cash reserves is low for the first

quarter of calendar year 2024, the level is forecast to improve

substantially for the remainder of the forecast period.

The Group has also developed downside scenarios, which include

consideration of the recent track record of not always achieving

budgets. The downside scenario demonstrates the Group's dependence

on the performance of large contracts (including the large

3. Going concern (continued)

naval contract) noted above due to their materiality to the

Group's overall results. Management have modelled the downside

scenario based on reasonably possible delays in the large naval

contract. By their nature, the achievement of performance

milestones under these types of contract can be subject to

uncertainties and delays have occurred on similar contracts in the

past. These uncertainties include in-house operational delays and

inefficiencies, delays in the supply of material and components by

suppliers and delays in the performance of work by subcontractors.

The Group often has limited control of the latter two factors. The

achievement of performance milestones enables the Group to

recognise revenue and profits under the contract and typically

initiates invoicing to, and subsequent cash collection from, the

customer.

As a result, these delays, whilst typically not impacting the

financial performance of the contract over its entire duration, can

lead to material delays in the timing of profit recognition and

cash receipts between periods. Given the size of the recent naval

contract, any delays and unforeseen events could have a material

impact on the Group's cash reserves and covenant compliance.

In the event of delays in the contract, the Group would look to

mitigate the impact, partially or fully, by pulling forward

contracted work from other customers and through normal working

capital management and other cash preservation initiatives. Work on

this contract has already commenced and, to date, whilst the

contract is progressing in line with our contractual commitments,

some minor delays have arisen, principally due to supply issues

with components from third parties and the work of

subcontractors.

Given the expiry of the RCF on 31 December 2023 and the step

down in its quantum in September 2023, the Group is currently

exploring several actions to strengthen the Group's financial

position. In particular, the Group is currently working with an

advisor to support the Group's review of funding options, including

asset-backed and alternative financing lenders, in order to replace

the Lloyds Bank RCF with new arrangements that will provide the

Group with increased facility headroom and flexibility. These

discussions are taking longer than was originally anticipated but

management expect these discussions to be completed by the time of

the expiry of the Lloyds Bank RCF on 31 December 2023. In addition

to pursuing these refinancing opportunities, the Group is also

currently exploring the refinancing of the Group's freehold

property at Meadowhall Road, Sheffield.

Other factors which could negatively impact the forecasts

include:

-- Failure to win additional contracts in the Chesterfield

Special Cylinders division for hydrogen energy projects due to

market factors outside the control of the Group;

-- Weaker revenue from Integrity Management deployments due to customer delays; and

-- The recent improvement in the Precision Machined Components

divisional revenue and order book not continuing going forward due

to weaker than expected oil and gas market conditions.

The Group believes that these factors are individually less

likely to be material to the achievement of the forecasts than

potential delays in the large naval contract, but in the event that

they occur, together with large naval contract delays, they may

have a negative impact on covenant compliance and cash flow at

certain test dates in the forecast period.

The possibility of material delays to the performance of

contracts (naval contract in particular) and a replacement

financing facility not yet being in place gives rise to material

uncertainties, as defined in accounting standards, relating to

events and circumstances which may cast significant doubt about the

Group's ability to continue as a going concern and to realise its

assets and discharge its liabilities in the normal course of

business.

Reflecting management's confidence in delivering large contracts

and successfully replacing their financing facility, the Group

continue to adopt the going concern basis in preparing these

interim condensed financial statements. Management have concluded

that the Group will be able to continue in operation and meet their

liabilities as they fall due over the period to September 2024.

Consequently, these financial statements do not include any

adjustments that would be required if the going concern basis of

preparation were to be inappropriate.

4. Segmental analysis of Revenue and Operating Loss

Revenue by destination Unaudited Unaudited Audited

26 weeks 26 weeks 52 weeks

ended ended ended

1 April 2 April 1 October

2023 2022 2022

GBP'000 GBP'000 GBP'000

United Kingdom 9,441 6,482 16,126

Europe 2,779 1,462 6,715

Rest of the World 1,545 1,548 2,098

13,765 9,492 24,939

Revenue by sector

Unaudited Unaudited Audited

26 weeks 26 weeks 52 weeks

ended ended ended

1 April 2 April 1 October

2023 2022 2022

GBP'000 GBP'000 GBP'000

Oil and Gas 4,938 3,105 7,953

Defence 7,211 5,047 13,483

Industrial 322 785 1,099

Hydrogen Energy 1,294 555 2,404

13,765 9,492 24,939

Revenue by activity

Unaudited Unaudited Audited

26 weeks 26 weeks 52 weeks

ended ended ended

1 April 2 April 1 October

2023 2022 2022

GBP'000 GBP'000 GBP'000

Cylinders 8,835 6,247 17,583

Precision Machined Components 4,930 3,245 7,356

13,765 9,492 24,939

4. Segmental analysis of Revenue and Operating Loss

(continued)

Revenue recognition

The Group's pattern of revenue recognition is as follows:

Unaudited Unaudited Audited

26 weeks 26 weeks 52 weeks

ended ended ended

1 April 2 April 1 October

2023 2022 2022

GBP'000 GBP'000 GBP'000

Sale of goods transferred at a point

in time 6,559 5,513 10,357

Sale of goods transferred over time 6,350 2,696 12,584

Rendering of services 856 1,283 1,998

13,765 9,492 24,939

Operating loss by activity

Unaudited Unaudited Audited

26 weeks 26 weeks 52 weeks

ended ended ended

1 April 2 April 1 October

2023 2022 2022

GBP'000 GBP'000 GBP'000

Cylinders 768 (250) 409

Precision Machined Components (181) (825) (1,100)

Manufacturing subtotal 587 (1,075) (691)

Unallocated central costs (1,103) (980) (1,933)

Operating loss before amortisation,

impairment and other exceptional costs (516) (2,055) (2,624)

Amortisation and impairment - (64) (101)

Other exceptional costs (note 6) (704) (41) (968)

Operating loss (1,220) (2,160) (3,693)

Finance costs (180) (140) (292)

Loss before taxation (1,400) (2,300) (3,985)

The Operating (loss)/profit by activity is stated before the

allocation of Group management charges, which are included within

'Unallocated central costs'.

5. Earnings before Interest, Taxation, Depreciation and

Amortisation (EBITDA)

Earnings before interest, taxation, depreciation, and

amortisation (EBITDA) is as follows:

Unaudited Unaudited Audited

26 weeks 26 weeks 52 weeks

ended ended ended

1 April 2 April 1 October

2023 2022 2022

GBP'000 GBP'000 GBP'000

Adjusted EBITDA (pre-exceptionals) 262 (1,206) (946)

Other exceptional costs (note 6) (704) (41) (968)

EBITDA (442) (1,247) (1,914)

Depreciation (778) (849) (1,678)

Amortisation and impairments - (64) (101)

Finance costs (180) (140) (292)

Loss before taxation (1,400) (2,300) (3,985)

6. Other exceptional costs

Items that are incurred outside the normal course of business

and/or that are non-recurring are considered as exceptional costs

and are disclosed separately on the face of the Condensed

Consolidated Statement of Comprehensive Income.

An analysis of the amounts presented as exceptional costs is as

follows:

Unaudited Unaudited Audited

26 weeks 26 weeks 52 weeks

ended ended ended

1 April 2 April 1 October

2023 2022 2022

GBP'000 GBP'000 GBP'000

Reorganisation and redundancy (201) (65) -

Refinancing of Group banking facilities (176) (344)

Professional fees in relation to banking

facilities (98) - -

Professional fees in relation to strategic

review of PMC (229) - -

Reversal of impairment/(impairment)

of inventory and work in progress - 89 (121)

Property costs - - (280)

Reversal of inventory provision - - 91

Final settlement for ERP system costs - - (193)

Historical contract settlement - - (88)

Other plc costs - (65) (33)

(704) (41) (968)

7. Taxation

Unaudited Unaudited Audited

26 weeks 26 weeks 52 weeks

ended ended ended

1 April 2 April 1 October

2023 2022 2022

GBP'000 GBP'000 GBP'000

Current tax credit - 435 58

Deferred taxation credit/(charge) - 2 (110)

Taxation credit/(charge) to the income

statement - 437 (52)

8. Loss per ordinary share

The calculation of basic loss per share is based on the loss

attributable to ordinary shareholders divided by the weighted

average number of shares in issue during the period.

The calculation of diluted loss per share is based on basic loss

per share, adjusted to allow for the issue of shares on the assumed

conversion of all dilutive share options.

Adjusted loss per share shows loss per share after adjusting for

the impact of amortisation charges, impairment charges and any

other exceptional items, and for the estimated tax impact, if any,

of those costs. Adjusted loss per share is based on the loss as

adjusted divided by the weighted average number of shares in

issue.

For the 26 week period ended 1 April 2023

GBP'000

Loss after tax (1,400)

Number of Shares

('000).

Weighted average number of shares - basic 36,134

Dilutive effect of share options 528

Weighted average number of shares - diluted 36,662

Loss per share - basic and diluted (3.9)p

The effect of anti-dilutive potential shares is not disclosed in

accordance with IAS 33.

The Group adjusted loss per share is calculated as follows:

Loss after tax (1,400)

Other exceptional items (note 5) 704

Theoretical tax effect of above adjustments (134)

Adjusted loss (830)

Adjusted basic loss per share (2.3)p

8. Loss per ordinary share (continued)

For the 26 week period ended 2 April 2022

GBP'000

Loss after tax (1,863)

Number of Shares

('000)

Weighted average number of shares - basic 31,067

Dilutive effect of share options 702

Weighted average number of shares - diluted 31,769

Loss per share - basic and diluted (6.0)p

The effect of anti-dilutive potential shares is not disclosed in

accordance with IAS 33.

The Group adjusted loss per share is calculated as follows:

Loss after tax (1,863)

Amortisation and impairments 64

Other exceptional items (note 5) 41

Theoretical tax effect of above adjustments (19)

Adjusted loss (1,777)

Adjusted basic loss per share (5.7)p

For the 52 week period ended 1 October 2022

GBP'000

Loss after tax (4,037)

Number of Shares

('000)

Weighted average number of shares - basic 31,067

Dilutive effect of share options 661

Weighted average number of shares - diluted 31,728

Loss per share - basic and diluted (13.0)p

The effect of anti-dilutive potential shares is not

disclosed in accordance with IAS 33.

8. Loss per ordinary share (continued)

The Group adjusted loss per share is calculated as follows:

For the 52 week period ended 1 October 2022

GBP'000

Loss after tax (4,037)

Amortisation 101

Other exceptional items (note 5) 968

Theoretical tax effect of above adjustments (203)

Adjusted loss (3,171)

Adjusted basic loss per share (10.2)p

9. Reconciliation of net debt

Unaudited Unaudited Audited

1 April 2 April 1 October

2023 2022 2022

GBP'000 GBP'000 GBP'000

Cash and cash equivalents 1,039 1,326 1,783

Bank borrowings (1,907) (4,000) (2,407)

Net bank borrowings excluding lease

liabilities (868) (2,674) (624)

Asset finance lease liabilities (1,386) (1,886) (1,364)

Right of use asset lease liabilities (1,433) (874) (1,512)

Net debt (3,687) (5,434) (3,500)

As at 1 April 2023, the Group's bank borrowings was a revolving

credit facility provided by Lloyds Bank with a drawn balance of

GBP1.9 million (1 October 2022: GBP2.4 million drawn) and an expiry

date of 31 March 2024. The revolving credit facility was amended in

June 2023 and now has an expiry date of 31 December 2023.

10. Called up share capital and share premium

Unaudited Audited Unaudited Audited

1 April 1 October 1 April 1 October

2023 2022 2023 2022

Share Share

Shares Shares Capital Capital

No. No. GBP'000 GBP'000

Allotted, issued and fully paid

Ordinary shares of 5p each 38,667,163 31,067,163 1,933 1,553

Share

Premium

GBP'000

Share Premium account

At 2 April 2022 and 1 October 2022 -

Shares issued 1,699

At 1 April 2023 1,699

On 6 December 2022, the Group issued 7,600,000 new ordinary

shares with a nominal value of 5p each, raising GBP2.1 million net

of expenses. Of this total, GBP1.7 million was allocated to the

share premium account.

11. Dividends

No final or interim dividend was paid for the 52-week period

ended 1 October 2022. No interim dividend is declared for the

26-week period ended 1 April 2023.

12. Related party transactions

There were no related party transactions in the 26 week periods

to 1 April 2023 and 2 April 2022.

13. Prior year adjustment - Restatement in respect of IFRS 15

"Revenue from Contracts with Customers"

During the preparation of the Annual Report & Accounts for

the year ended 1 October 2022, the Group reviewed its accounting

policy and past accounting treatment in respect of a small number

of long-term defence contracts within CSC.

Since FY19, the Group has consistently applied an accounting

treatment whereby revenue for these specific defence contracts was

recognised using an 'Output' methodology under IFRS 15, 'Revenue

from Contracts with Customers' ("IFRS 15"), with costs being

accrued to achieve a uniform profit margin throughout the

multi-year life of the contracts, resulting in cost deferrals at

financial period ends. Whilst this cost treatment impacted the

timing of profit recognition between financial periods, it had no

impact on either the total profitability of the contracts over

their entire lives, nor the quantum or timing of cash flows.

During the preparation of the Annual Report & Accounts for

the year ended 1 October 2022, it was noted that this accounting

treatment is not in compliance with IFRS 15, which requires that

all costs incurred in the period relating to the contract should be

immediately expensed. This means that cost deferral to achieve a

uniform contract profit margin, as historically adopted by the

Group, is not permitted.

13. Prior year adjustment - Restatement in respect of IFRS 15

"Revenue from Contracts with Customers" (continued)

As a result, the comparative period financial statements have

been restated. As at 2 October 2021 and 2 April 2022, the impact of

the restatement was to reduce total equity by GBP1,054,000. The

restatement had no impact on profit recognition in the 26 weeks

ended 1 April 2023 or the 26 weeks ended 2 April 2022.

These accounting adjustments only impact the timing of profit

recognition under these specific contracts. They do not impact the

net debt position of the Group at any date, the future cash

generation profile of the Group, nor the underlying trading or

operations of the business.

A copy of the Interim Report will be sent to shareholders

shortly and will be available on the Company's website:

www.pressuretechnologies.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FFMRTMTMTBBJ

(END) Dow Jones Newswires

June 27, 2023 02:00 ET (06:00 GMT)

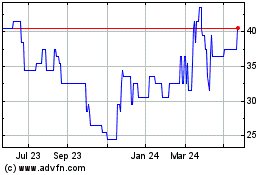

Pressure Technologies (AQSE:PRES.GB)

Historical Stock Chart

From Oct 2024 to Nov 2024

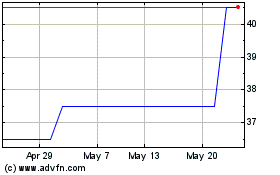

Pressure Technologies (AQSE:PRES.GB)

Historical Stock Chart

From Nov 2023 to Nov 2024