Red Rock Resources plc Asset review - current developments (4303T)

November 14 2023 - 9:03AM

UK Regulatory

TIDMRRR

RNS Number : 4303T

Red Rock Resources plc

14 November 2023

Red Rock Resources PLC

("Red Rock" or the "Company")

Asset Review - Current Developments

14 November 2023

Red Rock Resources Plc, ("Red Rock" or "the Company"), is a

natural resource development company with interests in gold and

base metals, principally in Africa and Australia.

The following is an update of key points only in relation to the

Company's assets and current developments. For a more comprehensive

summary of the Company's assets, the announcement of 8 March 2023

may be referred to.

Highlights :

o RRR expects the most important near-term developments to

be:

o Announcement of first shipments of Lithium Ore

o Release of arbitration result in the DRC

o An update on how to progress New Ballarat Gold Corporation

o RRR expects to initiate activity this month on its lead

Burkina Faso project with a view to possible short term production

of alluvial Gold

PROJECT 2023 UPDATE

Lithium Project, Zimbabwe RRR has been in a continuing process

with a local partner of assembling

a lithium portfolio by purchase

of old mining areas and by pegging

of prospective areas with evidence

of good grade lithium mineralisation.

Sampling has been carried out over

the areas of interest.

An Environmental Impact Assessment

("EIA") has been obtained over

the first production area.

Beaconing and environmental work

on other areas is in progress.

The Company has the first 200t

of spodumene lithium ore available

for shipping and expects to make

a further announcement shortly.

---------------------------------------------

Former Copper-Cobalt Joint Venture, The Company's 100% owned subsidiary

DRC obtained in 2022 an executory judgment

for $2.5m (being 50.1% of $5m paid

to local partner VUP by a buyer).

A further claim by the Company's

subsidiary for $2m costs and damages

is under appeal.

The buyer retains a further $15m

unpaid consideration pending determination

of an arbitration where RRR claims

$7.5m gross.

The release of the arbitration

result is now anticipated.

---------------------------------------------

New Ballarat Gold Corporation Plc 15 principal granted licences targeting

gold and 1 purchased licence, together

Gold: Victoria, Australia totalling 2,517 sq km, are held

around the historic mining centre

50.1% interest of Ballarat.

A further copper-prospective licence

of 500 sq km is now also held in

South Australia.

In 2022 NBGC obtained grant of

the historic Ajax Mine with recorded

production of 312,789 oz at 14.8

g/t, and purchased the historic

Berringa Mines, with recorded production

of just under 300,000 oz at 8.3

g/t.

The acquisition of these two significant

assets, among the largest producing

hard rock mines in the history

of the Victoria gold fields, and

with significant associated exploration

targets, is an important milestone

for NBGC.

Three drill programmes have been

carried out over target areas,

and the results at the old Berringa

Mine were particularly promising.

We consider that our JV in the

Victoria Goldfields is adding value

with each stage of exploration

work, and as the drilling confirms

the initial model.

---------------------------------------------

Faso Minerals Ltd Faso Minerals Ltd (FML) through

its subsidiary Faso Greenstone

Gold: Boromo and Banfora greenstone Resources SARL holds 348 sq km

belts, SW Burkina Faso of highly prospective ground acquired

from local holders in the SW of

Subsidiary Burkina Faso at Bilbale and Boulon.

Applications for other areas have

been prepared.

This initial scout drilling programme

(later extended to 778m) of seven

holes across two locations in the

extremely promising Bilbale licence

produced, in the first phase at

the Djikologo target, gold intersections

in three of the four holes drilled,

with three relatively high-grade

intersections in the BilR22-03

drillhole including 20m at 3.19

g/t gold from 22m depth.

The Company is preparing a new

exploration programme and has a

team scheduled to visit in the

next weeks to investigate the possibility

of fast-tracking into production

of the alluvial material.

---------------------------------------------

Mikei Gold Project Results of drilling of 20 Reverse

Circulation (RC) holes totalling

Western Kenya 2,093m were announced in August

2022.

Gold: 723,000 oz Mineral Resource

Estimate at 1.49 g/t (JORC 2012) Drilling was over the Central KKM

project area within and just outside

100% economic interest the Resource envelope showing continuity

along strike and down dip.

16 of 20 holes intercepted gold

mineralisation, in 15 holes at

or above cut-off grade.

An EIA has been obtained for drilling

four of the remaining prospects.

The next stage diamond drilling

programme has begun the planning

process, with consultant input,

the ultimate intention being a

JORC Resource revision.

However the licences are due for

renewal this year, in the course

of which some ground has to be

dropped, and pending completion

of this process the only activity

being carried out is work on additional

EIAs, opening up new areas for

drilling.

---------------------------------------------

LacGold Minerals Ltd LacGold Minerals Ltd (LGM) through

its 100% subsidiary LacGold Resources

Gold: greenstone belts in Côte SARLU made initial applications

d'Ivoire for seven prospective areas, screened

from a long list, for gold exploration.

Subsidiary The first 344.5 sq km licence at

Djekanou has been granted, and

a further three in the same area

totalling 1,060 sq km are awaited.

---------------------------------------------

Elephant Oil Corporation RRR has 397,873 shares in Elephant

Oil Corporation, where a Form S-1/A

and a presentation have been filed

and are kept updated on the EDGAR

website of the Securities and Exchange

Commission under the stock code

ELEP. The intention of Elephant

is to list on a North American

Exchange. It had been expected

that this would have taken place

early in 2023, but the process

is taking longer than expected

and the Company awaits definitive

news. RRR has a strongly positive

view of the assets.

---------------------------------------------

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

For further information, please contact:

Andrew Bell 0207 747 9990 Chairman Red Rock Resources Plc

Roland Cornish/ Rosalind Hill Abrahams 0207 628 3396 NOMAD Beaumont Cornish Limited

Jason Robertson 0207 374 2212 Broker First Equity Limited

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFFUFLLEDSEIF

(END) Dow Jones Newswires

November 14, 2023 10:03 ET (15:03 GMT)

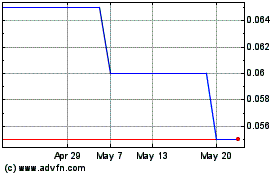

Red Rock Resources (AQSE:RRR.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

Red Rock Resources (AQSE:RRR.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025