TIDMVIS

RNS Number : 9366I

Visum Technologies PLC

07 December 2022

7 December 2022

VISUM TECHNOLOGIES PLC

("VISUM" or the "Company")

Financial Results for the year ended 30 June 2022

Visum Technologies Plc ("the Company"), a video technology

company focussed on the global leisure market, announces its Annual

Financial Results for the period ended 30 June 2022.

A copy of the Annual Report is available on the Company's

website at https://visumtechnologies.net/annual-interim-reports/

.

Highlights

-- Successfully acquired Ridercam Systems assets, contracts, IP

and listed on the Aquis Growth Market, raising over GBP600k.

Financial Highlights

-- Revenue during the 16-month period was minimal (GBP28,455) due to the impact of COVID-19.

-- The cost of Sales was GBP28,960 but we expect this to trend

towards 25-30% as the business ramps up.

Post period end events

-- Signed a Framework Services Agreement with Digiphoto

Entertainment Imaging LLC on 26 July 2022 to supply a custom video

system at TILT, Chicago's Highest Thrill Ride at the 360 Chicago

Observation Deck at the former John Hancock Center.

-- Resignation of Chief Finance Officer, Michael James Stilwell on 31 October 2022.

-- Signed a Collaboration Agreement with Kool Replay on 8 November 2022.

-- Appointment of Peter van Bilsen as a Non-Executive Director on 15 November 2022.

-- Embedding corporate governance framework.

The Directors of the Company accept responsibility for the

contents of this announcement.

For further information, please contact:

Visum Technologies PLC

Marc Dixon, Chief Executive Officer marc.dixon@visumtechnologies.net

First Sentinel Corporate Finance

Limited (AQSE Corporate Adviser)

Brian Stockbridge Brian@first-sentinel.com

+44 (0) 203 989 2222

CHAIRMAN'S REPORT

Dear shareholders,

The process of listing Visum Technologies PLC took longer than

expected. However, it was a key milestone and hugely rewarding to

list the business on the Aquis Stock Exchange in June 2022 with a

raise of just over GBP600k.

Over the last 12 months, the focus of the board has been to

service our customer base, despite obvious challenges posed by

Covid, establish the required governance frameworks required for a

PLC organisation and look to the future by building an installation

sales pipeline. Under the leadership of the Chief Executive Officer

("CEO"), Marc Dixon, and the financial stewardship of Mike

Stillwell, the team has remained stable, motivated, and with a

strong sense of the "art of the possible" going forward.

Our customer base of installs has remained stable, and we have

been ensuring that, as a team, we maintain our high service

standards despite travel challenges. By working with our current

partners on consumer participation rates and video capture

reliability, we are hopeful that we can build relationships and a

reputation that will allow us to grow ride penetration within our

current theme park operators into 2023/24.

A lot of time has been spent training the board in preparation

for listing as well as establishing robust governance structures

with the support of our company secretariat, Computershare. I am

confident that we have both the right governance frameworks and

also knowledge base to support the growth of the business over the

coming years.

Our CEO has done a great job of attending both live events, such

as International Association of Amusement Parks and Attractions

("IAAPA"), as well as using his vast experience in this industry to

re-establish historical connections as well as create new ones to

help build a strong install pipeline into 2023. The Chicago 360

installation was a recent, high-profile win for Visum Technologies

PLC. There is a very strong sense, based on feedback from a variety

of industry operators that the "future is video" as consumers look

to capture dynamic content of their experiences that they can then

share with friends and on social media. Visum Technologies PLC is

in a strong position to capitalise on the movement from still

images to video capture over the coming years.

The business has stable technology, an experienced management

team, and a PLC status that will allow for future expansion.

Despite some macroeconomic challenges the world is facing in 2022,

the future looks positive, and the business is ready to seize the

opportunities that lie ahead.

Andrew Edge

Chairman

CHIEF EXECUTIVE OFFICER'S REPORT

Dear fellow shareholders,

It is my pleasure to provide you with our first annual report

for the sixteen-month period ending June 30, 2022. The period was a

challenging one. On May 26, 2021, we acquired the Ridercam

business, assets, IP, and contracts for GBP3.75 million. After

which, we spent most of the year working through the IPO process to

list on either the London Stock Exchange or on the Aquis Stock

Exchange (AQSE). After careful consideration of the support and

flexibility that AQSE can offer to high growth companies, and

reaching a critical point in funding because of delays, we elected

to put in an application with AQSE. On June 30, 2022, Visum

Technologies Plc reached a significant milestone and successfully

listed on the Aquis Growth Market, raising just over GBP600k.

In addition to the challenges with the delay in the listing,

Visum Technologies Plc operated on a limited budget and staffing

model for the 2021 summer season and the first half of the 2022

season. Covid-19 restrictions on capacity also limited our revenue

potential at our two operating locations during the 2021 season and

caused us to postpone our growth plans for Asia. The war in Ukraine

also derailed our contract with a future installation in Russia,

which has now been on permanent hold. The timing of the IPO also

proved challenging, as our potential clients were in the middle of

their summer season and not ready to engage in discussions for

future opportunities. However, we took this time to update our

branding, website, and other marketing materials for the

future.

Despite all the challenges we faced in 2021, the team remained

steadfast and dedicated to Visum Technologies Plc, our products,

our vision, and the future of video capture in the travel and

leisure market.

Growth Strategy

Since listing, we have focused on filling our future sales

pipeline and ensuring that we keep servicing our current customer

base. The growth strategy we put in place for Visum Technologies

Plc in the period under review has four distinct strands: product

innovation; direct sales to leisure venues; sales to leisure venues

via industry partners; and where we see the accretive benefit,

strategic acquisition. The benefits of this blended approach have

resulted in the uplift in momentum we are experiencing post-period

end and are covered in Current Trading and Outlook below.

Operational KPI's

During the 18-month period, we have also given considerable

thought to the operational KPIs we believe our most relevant to

help monitor the uptake and usage of our technology. These are:

-- Number of ride installations

-- Number of cameras installed

-- Number of passenger rides recorded

-- Number of purchases

Current Trading and Outlook

We continue to see strong interest in our video products as the

theme park photo providers adopt a model around creating social

memories and currency beyond what a typical photo can provide and

the strength and social sharing of a video.

In September 2022, we attended the IAAPA Expo Show in London. In

November 2022, we attended the IAAPA show in Orlando, with both

shows being heavily attended, seeing record numbers at the Orlando

show. The response continues to be very strong, with several

opportunities for the 2023 summer season.

Additionally, amusement and theme parks saw double-digit growth

during the 2022 season, with pent-up demand for entertainment

post-Covid. We expect this to strengthen our growth potential as

the attractions industry continues to look for new ways to engage

and capture their guest experiences.

Our 2023 outlook is already off to a positive start, with three

new contracts in place. The first is a new location at Europa Park

(the second largest theme park in Europe) to provide a system for

their Silver Star roller coaster in Spring 2023 reflecting our

direct sales to venues strands. The second agreement is with DEI to

provide a video system at TILT within the 360 Chicago Observatory,

which is currently operational, demonstrating the importance of

working with industry partners in our sector. The third agreement

is a strategic partnership with Kool Replay, a Canadian company, to

provide other capture options for Visum and Kool Replay.

In terms of our in-house product development strategy, we are

currently working on two new capture products we previewed at the

IAAPA Orlando Show and have already seen strong client interest. We

anticipate our first location by Q2 of 2023.

Despite the current financial climate, Visum Technologies Plc

has a robust pipeline of opportunities to deliver creative content

and memories to our clients and their consumers. We remain

confident in our future plans for growth. To that end, post-period

we were delighted to welcome Shahyan Khan to the management team as

Director of Finance and industry veteran, Peter Van Bilsen to the

Board as a non-executive director. The Board would also like to

thank Mike Stilwell, our former CFO who was working on a part-time

basis, who resigned in October due to other commitments, for his

unfailing support during the listing process. We wish him well.

Marc Dixon

Chief Executive Officer

FINANCIAL KEY POINTS

Revenue

As covered in the Chief Executive Officer's Report, revenues for

the sixteen month period end 30 June 2022 were minimal (GBP28,455)

reflecting the historic R&D focus of the Ridercam business and

the impact of COVID-19 in the 2021 season at its first

installation.

Cost of Sales

Costs of Sales were GBP28,960. As the business develops, we

would expect Costs of Sales to trend towards the 25-30% of revenue

range.

OPEX

Administrative expenses for the period was GBP848,057.

Significant elements of this amount were the one-off costs relating

to the acquisition of Ridercam and the listing process, totaling

GBP234,366. Moving forward, the goal of the business will be for

OPEX to be in the 45-55% of revenue range given the underlying

scaleability of the business model. We are also grateful to certain

advisers in relation to the admission process who have been fully

understanding of the business's current revenue status and are

providing extended credit terms.

EBITDA

Earnings before interest, taxation, depreciation, and

amortization was GBP790,489 for the period.

Balance sheet

At the time of listing, the business successfully raised

approximately GBP600,000 via the issue of 4,294,197 ordinary shares

at 14 pence. Prior to the listing, the business had also raised

GBP200,000 via a convertible loan note which was interest free and

fully converted into shares on 24 August 2022. At 30 June 2022, the

Company's cash and cash equivalents stood at GBP222,386.

As of 2 December 2022, cash and cash equivalents were

GBP158,194. As a result, the business continues to streamline its

operating expenses and review its funding options whilst the

business continues to grow its sales pipeline.

STRATEGIC REPORT

The directors present their strategic report on Visum

Technologies Plc (the "Company") for the period ended 30 June

2022.

Principal activity

The principal business activity is the development and

installation of high-quality photo and video-capture technologies

for roller coasters and attractions around the world.

Review of business, future outlook and key performance

indicators

The Company listed on the Aquis Stock Exchange during the period

and also acquired the business and assets of Ridercam Systems

Limited. A review of the business of the company, together with

comments on future developments is given in the Chairman's

Statement and Chief Executive's Statement.

The board monitors the Company's performance in delivery of

strategy by measuring progress against Key Performance Indicators

("KPIs"). These KPIs comprise a number of operational and financial

metrics.

Period ending

30 June 2022

GBP

Operating metrics

Revenue from continuing activities 28,445

Gross loss for the period (515)

Net loss for the period (858,776)

Financial metrics

Net Assets / (liabilities) 2,998,214

Cash 222,386

Further KPIs may be introduced as the Company evolves.

Principal Risks and Uncertainties

Global Pandemics, War, Terrorism & Other Events out of the

Company's Control

The Company's stated business strategy may be adversely affected

if the above events impact the leisure sector and specifically

influence the opening and operation of Customers' theme parks.

Those of any other adverse events may cause negative impacts on the

Company's operations in these areas through the closure of leisure

activities and theme parks which could result in reduced income

levels for the Company and reduced growth of a new business. This

risk materialised regarding COVID-19 as a global pandemic, which

has impacted and could continue to impact the ability of the

business to operate at its full capacity due to the closure of

theme parks or reduction and restrictions on travel.

Furthermore, the Company's product offering depends on the

performance of particular hardware and software systems that could

be affected by outages, downtime, or poor performance both in and

out of the Company's control. This could result in negative impacts

on the Company through increased costs of rectifying issues, loss

of contracts, or reduction in brand value over time. The Company

systems are vulnerable to impact, or interruption from events such

as (but not limited to) (i) natural disasters, (ii) power loss,

(iii) third-party supplier failure (including telecommunications),

(iv) viruses, or other similar third-party software negatively

introduced to the system, (v) computer hacking or other similar

activity and (vi) acts of war, terrorism or pandemics. No material

outages have occurred as of the date of this report.

The supply chain could be an issue as the company orders

hardware and equipment to fulfill orders for the 2023 season. The

company is looking at alternative camera designs to mitigate risks

related to certain components and availability.

The current macroeconomic situation continues to be a key risk

and concern for the company and could impact the ability for future

growth and expansion globally.

Technological Development

In order for the Company to remain competitive, technological

developments must be followed especially in the event of any

technology changes. The Company must continue to increase and

improve the functionality, properties and the quality of existing

products. Such adaptation is associated with costs that can be

significant and are affected by factors that are wholly or partly

outside the control of the Company. This means that the level and

timing of future operating costs and capital requirements to follow

in this development may deviate significantly from current

estimates. A lack of ability to follow technological developments,

or the costs attributable to any future developments can have a

material adverse effect on the Company's operations, financial

position, and results.

Financial and Capital Risk Management

The directors constantly monitor the financial risks and

uncertainties facing the group with particular reference to the

exposure of credit risk and liquidity risk. They are confident that

suitable policies are in place and that all material financial

risks have been considered. The major balances and financial risks

to which the company is exposed to and the controls in place to

minimise those risks are disclosed. The financial risk management

objectives and policies can be found within note 22 of the

financial statements. The Board considers and reviews these risks

on a strategic and day to day basis in order to minimise any

potential exposure.

The Board's objective is to maintain a balance sheet that is

both efficient and delivers long term shareholder value. The Board

continues to monitor the balance sheet to ensure it has an adequate

capital structure.

Going Concern

The Board monitors the Company's ability to continue as a going

concern. The following is a summary of the Directors' assessment of

the going concern status of the Company.

With the company's current cash position, moderate monthly burn

rate, upcoming installments for current clients and a strong

pipeline of clients for 2023, the company is in good standing for

the upcoming year.

Based on this information, the Board has made its assessment and

remains satisfied that there are no material uncertainties

affecting the Company's ability to continue in business for the

foreseeable future, being at least 12 months from the date of

approval of the financial statements. Accordingly, the Company has

adopted the going concern basis in preparing these financial

statements.

FINANCIAL STATEMENTS

Income Statement for the period from 18 February 2021 to 30 June

2022

2022

Notes GBP

Turnover 5 28,445

Cost of sales (28,960)

----------

Gross loss (515)

Administrative expenses (848,057)

Operating loss 6 (848,572)

Interest payable (10,204)

----------

Loss on ordinary activities before taxation (858,776)

Tax on loss on ordinary activities 8 -

Loss for the period (858,776)

==========

Loss per share:

Basic and diluted loss per share - pence 24 2.22

==========

All amounts relate to continuing operations.

The notes below form part of these financial statements.

Statement of Comprehensive Income for the period from 18

February 2021 to 30 June 2022

Notes 2022

GBP

Loss for the period (858,776)

Other comprehensive income -

Total comprehensive income for the period (858,776)

--------------------

The notes below form part of these financial statements.

Statement of Financial Position as at 30 June 2022

2022

Notes GBP GBP

Fixed assets

Intangible assets 9 3,661,917

Current assets

Debtors 10 449,546

Cash at bank and in hand 222,386

-------------------

671,932

Creditors: amounts falling due

within one year

Trade and other creditors 11 (762,584)

Net Current liabilities (90,652)

-------------------

Total assets less current

liabilities 3,571,265

Creditors: amounts falling due after more

than one year

Other creditors 12 (573,051)

Net assets 2,998,214

-------------------

Capital and reserves

Share Capital 13 507,213

Share Premium 14 3,349,777

Profit and loss account 15 (858,776)

Total Equity 2,998,214

-------------------

Statement of Changes in Equity for the period from 18 February

2021 to 30 June 2022

Profit

Share Share Other and Loss

Capital Premium reserves Account Total

GBP GBP GBP GBP GBP

At 18 February 2021 - - - - -

Loss for the financial

year - - - (858,776) (858,776)

Total comprehensive

income for the financial

year - - - (858,776) (858,776)

Shares issued 507,213 3,349,777 - - 3,856,990

At 30 June 2022 507,213 3,349,777 - (858,776) 2,998,214

--------- ---------- ------------------- ---------- ----------

The following describes the nature and purpose of each reserve

within owners' equity.

Reserve Description and purpose

Share Capital This represents the nominal value of shares

issued.

Share Premium Amount subscribed for share capital in excess of

nominal value.

Profit & Loss Account Cumulative net gains and losses

recognized in the statement of comprehensive income.

The notes below form part of these financial statements.

Statement of Cash Flows for the period from 18 February 2021 to

30 June 2022

2022

Notes GBP

Cash flows from operating activities

Operating loss for the period (848,572)

Adjustments for:

Amortisation of goodwill 58,083

Changes in:

Trade and other debtors (99,546)

Trade and other creditors 473,032

Cash generated from operations (417,003)

Interest paid -

Net cash used in operating activities (417,003)

----------------------------------------------------------- -------------------

Cash flows from investing activities

- -

Net cash generated from investing activities -

----------------------------------------------------------- -------------------

Cash flows from financing activities

Share issue 439,389

Issue of Convertible Loan Note 200,000

Net cash used in financing activities 639,389

----------------------------------------------------------- -------------------

Increase/(Decrease- in cash and cash equivalents 222,386

Cash and cash equivalents at beginning

of year -

Cash and cash equivalents at the end

of the year 222,386

----------------------------------------------------------- -------------------

Non-cash transactions

The acquisition of the business and certain assets of Ridercam

Systems Limited for GBP3.75m was a non-cash transaction during the

period with shares issued to settle the majority of the

consideration payable, with some consideration being deferred.

Refer to Note 9 for further details.

The notes below form part of these financial statements.

Notes to the accounts for the period from 18 February 2021 to 30

June 2022

1 General Information

The company is a public company limited by shares, registered in

England and Wales. The address of the registered office is

Bragborough Hall Business Centre, Welton Lane, Braunston,

Northamptonshire, NN11 7JG, United Kingdom.

2 Statement of compliance

These financial statements have been prepared in compliance with

FRS 102, 'The Financial Reporting Standard applicable in the UK and

the Republic of Ireland'

3 Summary of significant accounting policies

Turnover

Turnover is measured at the fair value of the consideration

received or receivable, net of discounts and value added taxes.

Turnover includes revenue earned from the sale of goods and from

the rendering of services. Turnover from the sale of goods is

recognised when the significant risks and rewards of ownership of

the goods have transferred to the buyer. Turnover from the

rendering of services is recognised by reference to the stage of

completion of the contract. The stage of completion of a contract

is measured by comparing the costs incurred for work performed to

date to the total estimated contract costs.

Research and development

Expenditure on research activities is recognised as an expense

in the period in which it is incurred. An internally generated

intangible asset arising from the company's development activity is

recognised only if all the following conditions are met:

-- an asset is created that can be identified;

-- it is probable that the asset created will generate future economic benefits: and,

-- the development cost of the asset can be measured reliably.

Internally-generated intangible assets are amortised on a

straight-line basis over their useful lives. Where no

internally-generated intangible asset can be recognised,

development expenditure is recognised as an expense in the period

in which it is incurred.

Intangible assets

Externally acquired intangible assets are initially recognised

at cost and subsequently amortised on a straight-line basis over

their estimated useful economic lives. The amortisation expense is

included within the other administrative expenses line of the

statement of comprehensive income.

Intangible assets are recognised on business combinations if

they are separable from the acquired entity or give rise to other

contractual/legal rights.

Business combinations and goodwill

The consideration transferred in a business combination is

measured at fair value, which is calculated as the sum of the

acquisition-date fair values of the assets transferred by the

company, liabilities incurred by the company to the former owners

of the acquiree and the equity interests issued by the company in

exchange for the business and assets of the acquiree.

Acquisition-related costs are recognised in the profit and loss as

incurred. Any goodwill that arises is amortised over its estimated

useful economic life.

Going Concern

In preparing the financial statements, the directors are

required to make an assessment of the ability of the company to

continue as a going concern. The directors have prepared a cash

flow forecast which covers the period to June. A "reverse stress"

test has been applied to the forecasts, seeking to establish the

level of liquidity headroom the company is expected to have during

this forecast period to June 2024. The directors' assessment has

taken into account current macroeconomic factors.

On the basis of these forecasts, the directors are confident

that the company has adequate resources to continue in operational

existence and to meet their liabilities as they fall due for the

foreseeable future. As a result of the above, the directors have

concluded that it remains appropriate to adopt a going concern

basis of preparation in these financial statements.

Taxation

A current tax liability is recognised for the tax payable on the

taxable profit of the current and past periods. A current tax asset

is recognised in respect of a tax loss that can be carried back to

recover tax paid in a previous period.

Deferred tax is recognised in respect of all timing differences

between the recognition of income and expenses in the financial

statements and their inclusion in tax assessments.

Unrelieved tax losses and other deferred tax assets are

recognised only to the extent that it is probable that they will be

recovered against the reversal of deferred tax liabilities or other

future taxable profits. Deferred tax is measured using the tax

rates and laws that have been enacted or substantively enacted by

the reporting date and that are expected to apply to the reversal

of the timing difference, except for revalued land and investment

property where the tax rate that applies to the sale of the asset

is used. Current and deferred tax assets and liabilities are not

discounted.

Provisions

Provisions (ie liabilities of uncertain timing or amount) are

recognised when there is an obligation at the reporting date as a

result of a past event, it is probable that economic benefit will

be transferred to settle the obligation and the amount of the

obligation can be estimated reliably.

Foreign currency translation

Transactions in foreign currencies are initially recognised at

the rate of exchange ruling at the date of the transaction.

At the end of each reporting period foreign currency monetary

items are translated at the closing rate of exchange. Non- monetary

items that are measured at historical cost are translated at the

rate ruling at the date of the transaction. All differences are

charged to profit or loss.

Share-based compensation

The fair value of the employee and suppliers services received

in exchange for the grant of the options and warrants is recognized

as an expense. The total amount to be expensed over the vesting

year is determined by reference to the fair value of the options

and warrants granted, excluding the impact of any non-market

vesting conditions (for example, profitability and sales growth

targets). Non-market vesting conditions are included in assumptions

about the number of options and warrants that are expected to vest.

At each statement of financial position date, the entity revises

its estimates of the number of options and warrants that are

expected to vest. It recognises the impact of the revision to

original estimates, if any, in the income statement, with a

corresponding adjustment to equity.

The proceeds received net of any directly attributable

transaction costs are credited to share capital (nominal value) and

share premium when the options are exercised.

The fair value of share-based payments recognised in the income

statement is measured by use of the Black Scholes model, which

takes into account conditions attached to the vesting and exercise

of the equity instruments. The expected life used in the model is

adjusted; based on management's best estimate, for the effects of

non-transferability, exercise restrictions and behavioural

considerations. The share price volatility percentage factor used

in the calculation is based on management's best estimate of future

share price behaviour and is selected based on past experience,

future expectations and benchmarked against peer companies in the

industry.

Financial assets

Basic financial assets, including trade and other receivables

and cash or bank balances, excluding any financing transactions,

are initially recognised at transaction price and are subsequently

measured at amortised cost determined using the effective interest

method, less any impairment losses for bad and doubtful debts.

Investments in equity instruments (other than the company's own

equity or any subsidiaries, associates and joint ventures) and

other financial assets are initially recognised at their

transaction price and are subsequently measured at fair value at

each period end. Changes in fair value are recognised in the profit

or loss. Fair value is measured with reference to the net asset

value per share at the period end.

Financial assets are derecognised when (a) the contractual

rights to the cash flows from the asset expire or are settled, or

(b) substantially all the risks and rewards of the ownership of the

asset are transferred to another party or (c) despite having

retained some significant risks and rewards of ownership, control

of the asset has been transferred to another party who has the

practical ability to unilaterally sell the asset to an unrelated

third party without imposing additional restrictions.

Financial liabilities

Basic financial liabilities, including trade and other payables

and bank loans, excluding any financing transactions, are initially

recognised at transaction price and are subsequently measured at

amortised cost determined using the effective interest method.

Financial liabilities are derecognised when the liability is

extinguished, that is when the contractual obligation is

discharged, cancelled or expires.

3 Critical accounting estimates and judgements

The preparation of financial statements in accordance with FRS

102, the Financial Reporting Standard applicable in the United

Kingdom and the Republic of Ireland, requires the use of certain

critical accounting estimates and judgements. Estimates and

judgements are continually evaluated and are based on historical

experience and other factors, including expectations of future

events that are believed to be reasonable under circumstances.

Although these estimates are based on directors' best knowledge of

the amount, event or actions, actual results may differ from those

estimates. The following is intended to provide an understanding of

the policies that the directors consider critical because of the

level of complexity, judgment or estimation involved in their

application and their impact on the financial statements.

Share based payments

The fair value of share based payments recognized in the income

statement is measured by use of the Black Scholes model, which

takes into account conditions attached to the vesting and exercise

of the equity instruments. The expected life used in the model is

adjusted; based on management's best estimate, for the effects of

non-transferability, exercise restrictions and behavioural

considerations. The share price volatility percentage factor used

in the calculation is based on management's best estimate of future

share price behaviour and is selected based on past experience,

future expectations and benchmarked against peer companies in the

industry. Refer to Note 22 for further details.

Intangible assets

It is the company's policy to amortise intangible assets over

the period during which the company is expected to benefit.

Amortisation only commences once the asset is fully ready for use

as intended by management. During the period the company acquired

an intangible asset from Ridercam Systems Limited but judged that

further development work would be required on the asset. Therefore,

the company has judged that the intangible asset shouldn't be

amortised during the period. With regards to goodwill the company

has estimated that they will receive future economic benefits for

at least 10 years, so have used the maximum life permitted. The

carrying amounts of intangible assets are disclosed in Note 9.

Going concern

Management have considered that the company remains a going

concern. The going concern assumption is discussed further in note

1.

5 Analysis of turnover 2022

GBP

Sale of goods 26,827

Services rendered 1,618

28,445

----------------------------

By geographical market:

UK -

Europe 26,827

North America 1,618

28,445

----------------------------

2022

6 Operating Loss GBP

This is stated after charging:

Auditors remuneration for

audit services 10,000

Amortisation of goodwill 58,083

Foreign exchange differences 1,250

============================

The interest payable in the income statement relates to deferred

consideration included within creditors due after 1 year.

2022

7 Directors' emoluments GBP

Emoluments 265,162

Highest paid director 169,225

Number of directors to whom accrued/paid

fees during year 6

There were no employees, the directors were paid via service

agreements and further details are

provided on in the Corporate Governance Statement.

8 Taxation 2022

GBP

Analysis of charge in

period

Current tax:

UK corporation tax on profits

for the period -

Adjustments in respect

of previous periods -

============================

Reconciliation of tax

expense

The tax assessed on the profit on ordinary activities

of the year is the standard rate of corporation tax

in the UK of 19%

2022

GBP

Loss on ordinary activities

before taxation (858,776)

Loss on ordinary activities

by rate of tax (163,167)

Effect of expenses not deductible

for tax purposes 37,246

Unutilised / (Utilised) losses

carried forward 125,922

Tax on loss -

============================

9 Intangible fixed assets

Identified

intangible

Goodwill assets Total

GBP GBP GBP

Cost

At 18 February 2021 - - -

Additions through business

combinations 536,154 3,183,846 3,720,000

--------- ------------

At 30 June 2022 536,154 3,183,846 3,720,000

--------- ------------ -------------------------

Amortisation

At 18 February 2021 - - -

Provided during period 58,083 - 58,083

--------- ------------

At 30 June 2022 58,083 - 58,083

--------- ------------ -------------------------

Carrying amount

At 30 June 2022 478,071 3,183,846 3,661,917

========= ============ =========================

At 17 February 2021 - - -

========= ============ =========================

Acquisition

On 26 May 2021 the company acquired the business and certain

assets of Ridercam Systems Limited ("Ridercam") for total

consideration of GBP3.75m. The consideration payable was as

follows:

-- GBP682,400 of deferred consideration

-- GBP739,098 by way of the issue of 7,390,982 Ordinary Shares

which were issued on 26 May 2021; and

-- GBP2,328,502 by way of the settlement of all outstanding debt

liabilities due from Ridercam to the

company as a result of the acquisition of the debt from the

original creditors of Ridercam as part of the restructure of their

business. Following such acquisition of the debt by the company,

the company then settled such debts due from Ridercam as part of

the consideration for the acquisition.

The deferred consideration was later reduced by GBP30,000 on 12

April 2022.

Identified intangible assets

Prior to the acquisition, Ridercam had been focused on its

research and development program,

which provided for the development of the Visum 4.0 camera

system. During this period, Ridercam had many ride installations,

but these were operated as part of the research & development

program rather than on a fully commercialised basis. The main

expenditure incurred by Ridercam prior to its acquisition related

to the development of the technology, intellectual property, and

camera system with total aggregate expenditure reaching

GBP3,183,846.

The company has allocated this cost as the fair value at

acquisition date of the identified intangible assets.

The company intends to continue its research and development

program to continue developing its products and features offered to

customers. The asset is not yet fully ready for use as intended by

management and therefore, it has not yet been amortised.

Goodwill

The goodwill relates to the excess of the cost of acquiring

Ridercam over the identified intangible assets, as there were no

other significant identifiable assets, liabilities or contingent

liabilities acquired. The goodwill includes other intangible assets

that cannot be recognised separately as intangible assets. The

goodwill is to be written off in equal annual instalments over its

estimated economic life of 10 years.

Revenue and profit and loss

The revenue in the period relating to the business acquired from

Ridercam is GBP28,445.

The loss in the period relating to the business acquired from

Ridercam is GBP515.

10 Debtors 2022

GBP

Other debtors 436,207

Accrued Income 3,339

Prepayments 10,000

449,546

=========================

Creditors: amounts falling due

11 within one year 2022

GBP

Trade Creditors 354,761

Other creditors 289,091

Accruals and deferred income 118,732

762,584

=======================

Included within other creditors is a GBP200,000 convertible loan

which was converted into equity on 24 August 2022.

Creditors: amounts falling due after more

12 than one year

Deferred Consideration 573,051

=======================

13 Share capital Nominal 2022

Value Number GBP

Allotted and called up:

Ordinary shares 0.01 50,721,287 507,213

=======================

Shares issued during period:

Ordinary shares 0.01 50,721,287 507,213

=======================

2,500,000 ordinary shares have been issued but not fully paid.

The remaining ordinary shares are fully paid. The consideration

receivable for the ordinary shares issued in the year is

GBP3,856,990.

Each ordinary share has full rights in the company with respects

to voting, dividends and distributions.

14 Share premium 2022

GBP

At 18 February 1

Shares issued 3,349,776

-----------------------------

At 30 June 2022 3,349,777

=============================

15 Profit and loss account 2022

GBP

At 18 February -

Profit for the period (858,776)

Dividends -

At 30 June 2022 (858,776)

=============================

Events after the reporting

16 date

On 24 August 2022 the Company issued 1,428,571 ordinary shares

of GBP0.01 each at GBP0.14 per share upon the conversion of a

GBP200,000 convertible loan.

17 Related party transactions

Included within trade creditors and accruals are balances of

GBP63,031 and GBP93,000 respectively which are due to the directors

in relation to their fees. The directors fees are disclosed in the

Corporate Governance Statement.

18 Presentation currency

The financial statements are presented

in Sterling.

Legal form of entity and country

19 of incorporation

Visum Technologies PLC is a public company limited by

shares and incorporated in England.

20 Principal place of business

Bragborough Hall Business

Centre

Welton Road

Braunston

Daventry

Northamptonshire

NN11 7JG

21 Warrants and share based payments

On 29 June 2022, 1,014,426 warrants were granted to the

company's corporate adviser and were exercisable at 14p each over a

term of 5 years.

The fair value of the warrants issued in the period was derived

using the Black Scholes model and the share based expense was

approximately GBP30,000 but has not been deemed to be material and

so has not been recognised. The net charge recognized in the income

statement and statement of comprehensive income for share warrants

was GBPnil.

The following assumptions were used in the calculations for

director warrants issued in the period, depending on the warrants

and date of share issue:

Exercise price 14p

Share price at grant

date 14p

Risk-free rate 2.1%

Volatility 25%

Expected life 5 years

Fair value 2.93p

Expected volatility is based on a conservative estimate for a

AQSE listed entity. The expected life used in the model has been

adjusted, based on management's best estimate, for the effects of

non-transferability, exercise restrictions and behavioural

considerations.

Conversion of warrants

Each warrant converts into one ordinary share of the company on

exercise. No amounts are paid or payable by the recipient on

receipt of the warrant and the company has no legal obligation to

repurchase or settle the warrant in cash. The warrants carry

neither rights to dividends nor voting rights prior to the date on

which the warrants are exercised. Warrants may be exercised at any

time from the date of vesting to the date of expiry.

Movements in the number of warrants outstanding and their

related weighted average exercise prices are as follows:

Number of warrants Average exercise

price

2022 2022

No. GBP

Outstanding at the beginning - -

of the period

* Granted during the year 1,014,426 0.14

- -------------- ------------

Outstanding at the end

of the period 1,014,426 0.14

-------------- ------------

The warrants outstanding at the period end were all exercisable

and had a weighted average remaining contractual life of 5 years

and the maximum term is 5 years. The exercise price range is

14p.

22 Financial Risk Management Objectives and Policies

The Company's financial instruments comprise cash balances and

receivables and payables that arise directly from its

operations.

The main risks the Company faces are foreign currency risk,

interest risk, liquidity risk and capital risk.

The board regularly reviews and agrees policies for managing

each of these risks. The Company's policies for managing these

risks are summarised below and have been applied throughout the

period. The numerical disclosures exclude short-term debtors and

their carrying amount is considered to be a reasonable

approximation of their fair value.

Foreign currency risk

The Company is exposed to movement in foreign currency exchange

rates arising from normal trading transactions that are denominated

in currencies other than the respective functional currencies of

the Company entities, primarily with respect to United States

dollars and Australian dollars. The Company does not currently have

a policy to hedge its exposure to foreign currency exchange risk.

The gains or losses disclosed in Note 6 are equivalent to a

sensitivity analysis and indicate how the profit or loss is

affected by changes in foreign currency exchange rates.

Interest risk

The Company is not exposed to significant interest rate risk as

it has fixed rates of interest bearing liabilities at the period

end.

Credit risk

The Company is exposed to significant credit risk from its loans

and receivables if underlying borrowers fail to make repayments or

default.

The Board of Directors manages credit risk by using secured Debt

instruments with collateral where possible and by reviewing the

credit worthiness of counterparties prior to making loans and

credit sales. The carrying amounts of trade and other receivables,

secured loan notes and cash and bank balances represent the

Company's maximum exposure to credit risk in relation to financial

assets.

Cash and bank balances, including fixed deposits are placed with

reputable financial institutions.

Liquidity risk

Liquidity risk is the risk that Company will encounter

difficulty in meeting these obligations associated with financial

liabilities.

The responsibility for liquidity risks management rest with the

Board of Directors, which has established appropriate liquidity

risk management framework for the management of the Company's short

term and long-term funding risks management requirements.

During the period under review, the Company has utilised various

borrowing facilities and their carrying amount is a reasonable

approximation of their fair value.

The Company manages liquidity risks by maintaining adequate

reserves and reserve borrowing facilities by continuously

monitoring forecast and actual cash flows, and by matching the

maturity profiles of financial assets and liabilities.

Capital risk

The Company's objectives when managing capital are to safeguard

the ability to continue as a going concern in order to provide

returns for shareholders and benefits to other stakeholders and to

maintain an optimal capital structure to reduce the cost of

capital.

23 Financial Instruments

Financial instruments represent any contractual agreement that

creates a financial asset, financial liability

or an equity instrument. Financial assets comprise cash and bank

balances, trade and other receivables. Financial liabilities

comprise trade and other payables, loans and borrowings.

Fair value measurements

Management consider that the carrying amounts of financial

assets and financial liabilities recognised in the

Company's financial statements approximate their fair

values.

2022

GBP

Financial assets

at amortised cost

Trade and other

receivables 398,982

Cash and cash equivalents 222,386

----------

621,368

==========

Financial liabilities

at amortised cost

Trade payables 354,761

Other creditors 867,604

----------

1,222,365

==========

The fair value of the financial assets and liabilities are

included at the amount at which the instrument could be exchanged

in a current transaction between willing parties, other than in a

forced or liquidation sale .

Cash and cash equivalents, trade and other receivables, trade

and other payables and loans and borrowings approximate their

carrying amounts largely due to the short-term maturities of these

instruments.

24. Earnings per share

Basic earnings per share is calculated by dividing the earnings

attributable shareholders by the weighted average number of

ordinary shares outstanding during the period.

Reconciliations are set out below:

Earnings Weighted average Loss per-share

GBP Number of shares Pence

2022

Basic and diluted earnings

per share:

Earnings attributable

to ordinary shareholders (858,776) 38,603,674 2.22

Basic and diluted earnings per share are considered to be the

same, since where a loss is incurred the effect of outstanding

share options and warrants is considered anti-dilutive and is

ignored for the purpose of the loss per share calculation. As at 30

June 2022 there were 1,014,426 outstanding share warrants, which

are potentially dilutive.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXGZMGZZNGGZZM

(END) Dow Jones Newswires

December 07, 2022 07:03 ET (12:03 GMT)

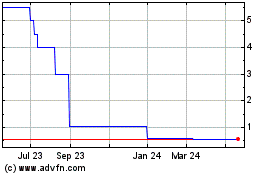

VISUM Technologies (AQSE:VIS)

Historical Stock Chart

From Oct 2024 to Nov 2024

VISUM Technologies (AQSE:VIS)

Historical Stock Chart

From Nov 2023 to Nov 2024