TIDMVULC

22 December 2023

Vulcan Industries plc

("Vulcan" or the "Company")

Interim Results for the 6 Months ended 30 September 2023

Vulcan Industries plc (AQSE: VULC) is pleased to announce its unaudited interim

results for the 6-month period ended 30 September 2023.

Principal activity

Vulcan seeks to acquire and consolidate industrial and renewable SMEs and

projects for value and to enhance performance in part through group synergies,

but primarily by unlocking growth which is not being achieved as a standalone

private company.

Review of business and future developments

Since admission, the focus has been to restructure the existing businesses to

recover from the financial impact of COVID-19 and lay the foundations to develop

the Group going forward. The initial step in this process was the acquisition on

24 March 2022 of the entire share capital of Aftech Limited ("Aftech"). Aftech

brings additional complementary areas of fabrication skills and product

offering. On 6 March 2023, the Company broadened its activities into the energy

sector with the acquisition of the entire share capital of Forepower Lincoln

(250) Limited ("FPL(250)"). FPL(250) is a 248 MW Battery Energy Storage System

("BESS") project, currently seeking formal planning consent.

During the period under review, early stage project planning was progressed, and

funding alternatives explored.

COVID-19 had a significant impact on the financial performance of the Group

since admission. The results for the years ended 31 March 2021 and 31 March

2022, reflected the impact of various lock downs and the subsequent challenging

market conditions. A strategic review, lead the board to conclude that, in order

to lay firm foundations for future growth, it was necessary to dispose of the

loss making businesses. M&G Olympic Products Limited was disposed of in March

2022 and both Orca Doors Limited ("Orca") and IVI Metallics Limited ("IVI") were

disposed of in July 2022. Time Rainham Limited ("TRR") was disposed of in

November 2022.

Consequently, the results for Orca, IVI and TRR are disclosed as discontinued

activities and the comparatives have been restated accordingly. The financial

results for the Group for the six months ending 30 September 2023, show a fall

in continuing revenue to £562,000 (2022: £695,000) and a fall in the continuing

loss before interest, tax, depreciation and amortisation to £178,000 (2022:

£215,000). After continuing depreciation and amortization of £19,000 (2022:

£21,000) and continuing finance costs of £178,000 (2022: £217,000), the Group is

reporting a reduced loss before taxation on continuing activities of £375,000

(2022: £453,000). The disposals of Orca, IVI and TRR generated a profit on

discontinued activities of £nil (2022: profit £1,177,000) after reporting a loss

after tax to the date of disposal of £nil (2022: £196,000). The reported loss

after tax for the Group is £375,000 (2022: Profit £724,000).

At 30 September 2023, the Group balance sheet shows net assets of £153,000

(2022: net liabilities £2,089,000).

Outlook

The disposals of the loss making legacy businesses of Orca, IVI and TRR during

the year ended 31 March 2023 added significant benefit to the Group balance

sheet and stemmed continued cash outflows. During the period, the Group has

continued to lay the foundations for its future development. The acquisition of

the FPL(250) project has broadened the sectors of Group activities. As announced

on 25 October 2023, the Company has disposed of 49.9% of its holding in FPL

(250) in order to fund the development of the project. Progress has been made in

the planning process and further announcements will be made once expected

milestones are achieved. The development phase of the project offers potential

to expand the fabrication activities of Aftech. In addition there is a strong

pipeline of further BESS and other opportunities which the Company will seek to

bring into the Group in due course.

Unaudited Consolidated

Statement of

Comprehensive Income

The comparatives have

been restated to

reflect discontinued

activities

6 Months to 6 Months to Year ended

30 September 2023 30 September 2022 31 March

2023

Note £'000 £'000 £'000

Continuing activities

Revenue 562 695 1,165

Cost of sales (308) (422) (674)

Gross profit 254 273 491

Operating expenses (415) (450) (849)

Other gains and losses (36) (59) (224)

Finance costs 3 (178) (217) (438)

Loss before tax (375) (453) (1,020)

Income tax - - 71

Loss for the period (375) (453) (949)

from continuing

activities

Discontinued

activities

Profit for the period 4 - 1,177 1,588

from discontinued

activities

(Loss) / profit for (375) 724 639

the period

attributable to the

owners of the Company

Other Comprehensive - - -

Income for the period

Total Comprehensive (375) 724 639

Income for the period

attributable to owners

of the Company

Earnings per share

- Basic and 5 (0.04p) (0.08p) (0.16p)

Diluted earnings per

share for loss from

continuing operations

attributable to the

owners of the Company

(pence)

- Basic and 5 (0.04p) 0.13p 0.11p

Diluted earnings per

share attributable to

the owners of the

Company (pence)

Unaudited

Consolidated

Statement of

Financial

Position

At At At

30 30 31

September September March

2023 2022

2023

Note £'000 £'000 £'000

Non-current

assets

Goodwill 718 945 718

Other 6 3,193 292 3,178

intangible

assets

Investments 500 500 500

Property, 127 156 131

plant and

equipment

Total non 4,538 1,893 4,527

-current

assets

Current

assets

Inventories 30 51 32

Trade and 521 731 511

other

receivables

Cash and bank 70 91 2

balances

Total current 621 873 545

assets

Total assets 5,159 2,766 5,072

Current

liabilities

Trade and (1,657) (1,451) (1,344)

other

payables

Borrowings 7 (995) (3,366) (3,187)

Total current (2,652) (4,817) (4,531)

liabilities

Non-current

liabilities

Borrowings 7 (2,329) - -

Deferred tax (25) (38) (31)

liabilities

Total non (2,354) (38) (31)

-current

liabilities

Total (5,006) (4,855) (4,562)

liabilities

Net assets / 153 (2,089) 510

(liabilities)

Equity

Share capital 8 350 234 348

Share premium 9,843 7,257 9,827

account

Shares to be - - -

issued

Retained (10,040) (9,580) (9,665)

earnings

Total equity 153 (2,089) 510

attributable

to the owners

of the

company

Unaudited Consolidated Share Shares to Share Retained Total

statement of changes in be issued Premium earnings Equity

equity Capital

£'000 £'000 £'000 £'000 £'000

At 1 April 2022 211 293 6,645 (10,304) (3,155)

Total Comprehensive income - - - 724 724

for the period

Transactions with -

shareholders

Issue of shares 23 (293) 612 - 342

Total transactions with 23 (293) 612 - 342

shareholders for the

period

At 30 September 2022 234 - 7,257 (9,580) (2,089)

Total Comprehensive income - - - (85) (85)

for the period

Transactions with

shareholders

Issue of shares 114 2,570 - 2,684

Shares to be issued - - - - -

Total transactions with 114 - 2,570 - 2,684

shareholders for the

period

At 31 March 2023 348 - 9,827 (9,665) 510

Total Comprehensive income - - - (375) (375)

for the period

Transactions with

shareholders

Issue of shares 2 - 16 - 18

Total transactions with 2 - 16 -

shareholders for the

period

At 30 September 2023 350 - 9,843 (10,040) 153

*

Unaudited Consolidated 6 Months to 30 6 Months to 30 Year Ended

Statement of Cash Flows September 2023 September 2022

31March

2023

£'000 £'000 £'000

Loss for the period from (375) (453) (949)

continuing activities

Adjustments for:

Finance costs 190 217 463

Depreciation of property, 4 11 29

plant and equipment

Depreciation of right of use - - -

assets

Amortisation of intangible 15 25 30

assets

Share based payment - 69 100

Operating cash flows before (166) (131) (327)

movements in working capital

Decrease / (increase) in 2 (34) (6)

inventories

Increase in trade and other (10) (260) (118)

receivables

Increase in trade and other 98 478 139

payables

Cash (used in) / from (76) 53 (312)

operating activities

Income tax credit received - - 28

Income tax paid - - (3)

Cash (used in) /from operating (76) 53 (287)

activities -continuing

Cash (used in) / from - 254 (278)

operating activities

-discontinued

Cash (used in) / from (76) 307 (565)

operating activities

Investing activities

Purchases of property, plant - (1) (2)

and equipment

Disposal of subsidiaries -net - - 731

debt retained

Net cash (used in) / from - (1) 729

investing activities -

continuing

Net cash (used in) / from - - -

investing activities -

discontinued

Net cash (used in) / from - (1) 729

investing activities

Financing activities

Interest paid (11) (205) (271)

Proceeds from loans and 150 - 70

borrowings

Repayment of borrowings (13) (74) (169)

Proceeds on issue of shares 18 275 258

Net cash from / (used in) 144 (4) (112)

financing activities

-continuing

Net cash used in financing - (280) (119)

activities-discontinued

Net cash from / (used in) 144 (284) (231)

financing activities

Net increase / (decrease) in 68 22 (67)

cash and cash equivalents

Cash and cash equivalents at 2 69 69

beginning of the period

Effect of foreign exchange - - -

rate changes

Cash and cash equivalents at 70 91 2

end of the period

Notes to the unaudited consolidated financial statements

for the 6-month period ended 30 September 2023

1. General information

Vulcan Industries PLC is incorporated in England and Wales as a public company

with registered number 11640409. The address of the Company's registered office

is 8th Floor, The Broadgate Tower, 20 Primrose Street, London, EC2A 2EW.

These summary financial statements are presented in Sterling and are rounded to

the nearest £'000, which is also the currency of the primary economic

environment in which the Company and Group operate (their functional currency).

Basis of accounting

The condensed consolidated financial statements of the Group for the 6 months

ended 30 September 2023, which are unaudited and have not been reviewed by the

Company's Auditor, have been prepared in accordance with the International

Financial Reporting Standards (`IFRS'), and accounting policies adopted by the

Group as set out in the annual report for the period ended 31 March 2023

(available at www.vulcanplc.com). The Group does not anticipate any significant

change in these accounting policies for the year ended 31 March 2024.

This interim report has been prepared to comply with the requirements of the

Access Rulebook of the AQSE Growth Market. In preparing this report, the Group

has adopted the guidance in the Access Rulebook for interim accounts which do

not require that the interim condensed consolidated financial statements are

prepared in accordance with IAS 34, `Interim financial reporting'. Whilst the

financial figures included in this report have been computed in accordance with

IFRSs applicable to interim periods, this report does not contain sufficient

information to constitute an interim financial report as that term is defined in

IFRSs.

The financial information contained in this report also does not constitute

statutory accounts under the Companies Act 2006, as amended. The financial

information for the period ended 31 March 2023 is based on the statutory

accounts for the year then ended. The Auditors reported on those accounts.

The auditors referred to going concern as a key audit matter. They drew

attention to note 3 in the financial statements, which shows conditions which

indicate that a material uncertainty exists that may cast significant doubt on

the company's ability to continue as a going concern. Their opinion was not

modified in respect of this matter.

The financial statements have been prepared on the historical cost basis, except

for the certain financial instruments that are measured at fair values at the

end of each reporting period, as explained in the accounting policies below.

Historical cost is generally based on the fair value of the consideration given

in exchange for goods and services.

The principal accounting policies adopted are set out below.

Significant accounting policies

Basis of consolidation

The consolidated financial statements incorporate the financial statements of

the Company and entities controlled by the Company (its subsidiaries) made up

for the period ended 30 September 2023. Control is achieved when the Company has

the power:

· over the investee;

· is exposed, or has rights, to variable returns from its involvement

with the investee; and

· has the ability to use its power to affects its returns.

The Company reassesses whether or not it controls an investee if facts and

circumstances indicate that there are changes to one or more of the three

elements of control listed above.

Consolidation of a subsidiary begins when the Company obtains control over the

subsidiary and ceases when the Company loses control of the subsidiary.

Specifically, the results of subsidiaries acquired or disposed of during the

year are included in profit or loss from the date the Company gains control

until the date when the Company ceases to control the subsidiary.

Where necessary, adjustments are made to the financial statements of

subsidiaries to bring the accounting policies used into line with the Group's

accounting policies.

All intragroup assets and liabilities, equity, income, expenses and cash flows

relating to transactions between the members of the Group are eliminated on

consolidation.

Business combinations

Acquisitions of businesses are accounted for using the acquisition method. The

consideration transferred in a business combination is measured at fair value,

which is calculated as the sum of the acquisition-date fair values of assets

transferred by the Group, liabilities incurred by the Group to the former owners

of the acquiree and the equity interest issued by the Group in exchange for

control of the acquiree. Acquisition-related costs are recognised in profit or

loss as incurred. At the acquisition date, the identifiable assets acquired and

the liabilities assumed are recognised at their fair value at the acquisition

date, except that deferred tax assets or liabilities and assets or liabilities

related to employee benefit arrangements are recognised and measured in

accordance with IAS 12 and IAS 19 respectively.

Goodwill is measured as the excess of the sum of the consideration transferred,

the amount of any non-controlling interests in the acquiree, and the fair value

of the acquirer's previously held equity interest in the acquiree (if any) over

the net of the acquisition-date amounts of the identifiable assets acquired and

the liabilities assumed.

Goodwill

Goodwill is initially recognised and measured as set out above.

Goodwill is not amortised but is reviewed for impairment at least annually. For

the purpose of impairment testing, goodwill is allocated to each of the Group's

cash-generating units (or groups of cash-generating units) expected to benefit

from the synergies of the combination. Cash-generating units to which goodwill

has been allocated are tested for impairment annually, or more frequently when

there is an indication that the unit may be impaired. If the recoverable amount

of the cash-generating unit is less than the carrying amount of the unit, the

impairment loss is allocated first to reduce the carrying amount of any goodwill

allocated to the unit and then to the other assets of the unit pro-rata on the

basis of the carrying amount of each asset in the unit. An impairment loss

recognised for goodwill is not reversed in a subsequent period.

On disposal of a cash-generating unit, the attributable amount of goodwill is

included in the determination of the profit or loss on disposal.

Revenue recognition

Revenue is measured at the fair value of the consideration received or

receivable for goods and services provided in the normal course of business, net

of discounts, value added taxes and other sales related taxes.

Performance obligations and timing of revenue recognition:

All of the Group's revenue is derived from selling goods with revenue recognised

at a point in time when control of the goods has transferred to the customer.

This is generally when the goods are collected or delivered to the customer, or

in the case of fabrication project work, when the project has been accepted by

the customer. There is limited judgement needed in identifying the point control

passes: once physical delivery of the products to the agreed location has

occurred, the Group no longer has physical possession, usually it will have a

present right to payment. Consideration is received in accordance with agreed

terms of sale.

Determining the contract price:

The Group's revenue is derived from:

a) sale of goods with fixed price lists and therefore the amount of

revenue to be earned from each transaction is determined by reference to those

fixed prices; or

b) individual identifiable contracts, where the price is defined

Allocating amounts to performance obligations:

For most sales, there is a fixed unit price for each product sold. Therefore,

there is no judgement involved in allocating the price to each unit ordered.

There are no long-term or service contracts in place. Sales commissions are

expensed as incurred. No practical expedients are used.

Current and deferred tax assets and liabilities are offset when there is a

legally enforceable right to set off.

2. Critical accounting judgements and key sources of estimation

uncertainty

In applying the Group's accounting policies, the directors are required to make

judgements (other than those involving estimations) that have a significant

impact on the amounts recognised and to make estimates and assumptions about the

carrying amounts of assets and liabilities that are not readily apparent from

other sources. The estimates and associated assumptions are based on historical

experience and other factors that are considered to be relevant. Actual results

may differ from these estimates.

The estimates and underlying assumptions are reviewed on an ongoing basis.

Revisions to accounting estimates are recognised in the period in which the

estimate is revised if the revision affects only that period, or in the period

of the revision and future periods if the revision affects both current and

future periods.

Going concern

The directors are confident that the existing financing set out in note 7 will

remain available to the Group and that additional sources of finance will be

available. The directors, with the operating initiatives already in place and

funding options available, are confident that the Group will achieve its cash

flow forecasts. Therefore, the directors have prepared the financial statements

on a going concern basis. These financial statements do not include the

adjustments that would result if the Group were unable to continue as a going

concern.

3. Finance costs

6 Months to 30 6 Months to 30 Year ended

September 2023 September 2022

31March

2023

£'000 £'000 £'000

Interest receivable

Interest on quoted 12 12 25

bond

12 12 25

Interest payable

Interest on loans, 190 247 434

bank overdrafts and

leases

Loan arrangement fees - 18 68

and other finance

costs

190 265 502

Net finance costs 178 253 477

Of which relating to: £'000 £'000 £'000

Continuing activities 178 217 438

Discontinued - 36 39

activities

178 253 477

4. Discontinued activities

6 Months to 30 6 Months to 30 Year ended

September 2023 September 2022

31March

2023

£'000 £'000 £'000

Revenue - 926 943

Cost of sales - (825) (873)

Gross margin - 101 70

Operating expenses - (270) (280)

Other Income - 9 33

Finance costs - (36) (39)

Loss before tax on - (196) (216)

discontinued

activities

Tax credit on - -

discontinued

activities

Profit on disposal of - 1,372 1,804

discontinued

activities

Profit on discontinued - 1,177 1,588

activities

The Company disposed of Orca Doors Limited on 18 July 2022, IVI Metallics

Limited on 31 July 2023 and Time Rainham Limited on 8 November 2022.

5. Earnings per share

The 6 Months to 30 6 Months to 30 September 2022 Year ended

calculation September 2023

of the basic 31March

earnings

loss per 2023

share is

based on the

following

data

£'000 £'000 £'000

Loss for the (375) (453) (949)

period from

continuing

activities

Earnings / (375) 724 639

(loss) for

the period

for the

purposes of

basic loss

per share

attributable

to equity

holders of

the Company

Weighted 872,986,621 554,051,792 595,784,173

average

number of

Ordinary

Shares for

the purposes

of basic

loss per

share

Basic loss (0.04p) (0.08p) (0.16p)

per share

(pence) from

continuing

activities

Earnings / (0.04p) 0.13p 0.11p

(loss) per

share

(pence)

attributable

to equity

holders of

the Company

The Company has issued options and warrants over ordinary shares which could

potentially dilute basic earnings per share in the future. There is no

difference between basic loss per share and diluted loss per share as the

potential ordinary shares are anti-dilutive.

6. Other intangible assets

BESS Identified Total

Project intangible

assets

Cost £'000 £'000

At 31 March 2022 - 1,200 1,200

On disposal of - (720) (720)

subsidiary

At 30 September - 480 480

2022

On acquisition of 274 - 274

subsidiary

Recognised on 2,600 - 2,600

acquisition

Additions 34 - 34

On disposal of - (180) (180)

subsidiary

At 31 March 2023 2,908 300 3,208

Additions 30 - 30

At 30 September 2,938 300 3,238

2023

Amortisation

At 31 March 2022 - 883 883

Charge for the - 25 25

period

Disposal (720) (720)

At 30 September - 188 188

2022

Charge for the - 15 15

period

Disposal - (173) (173)

At 31 March 2023 - 30 30

Charge for the - 15 15

period

At 30 September - 45 45

2023

Carrying value at 2,938 255 3,193

30 September 2023

Carrying value at 2,908 270 3,178

31 March 2023

Carrying value at - 292 292

30 September 2022

Identified intangible assets arising on acquisition comprise; marketing related

assets such as brands and domain names; customer related assets such as customer

relationships, lists and existing order books. These are amortised, depending

upon the nature of the asset and the business acquired over 1 to 10 years on a

straight-line basis.

BESS Project

£'000

Fair value on acquisition 2,874

Additions 34

At 31 March 2023 2,908

Additions 30

At 31 March 2023 2,938

Forepower Lincoln (250) Limited is a 248MW Battery Energy Storage System Project

("BESS") which was acquired on 6 March 2023. The value at 31 March 2023

represents the project costs incurred by FPL(250) together with a fair value

adjustment on acquisition of £2.6 million, being the consideration paid by the

company. The fair valuation adjustment reflects a discount from comparable

market values for similar projects to take into account the early stage of

development of the project. On 25 October 2023, the Company disposed of 49.9% of

its holding in FPL (250) in order to fund the development of the project and

value is expected to be generated as the project moves through the planning

process and obtains a firm connection date to the national grid. Further uplifts

in value are expected as project mile-stones are achieved.

7. Borrowings

At At At

30 September 2023 30 September 2022 31 March

2023

£'000 £'000 £'000

Non-current

liabilities

Secured

Convertible loan 475 - -

note

Other Loans 1,854 - -

2,329 - -

Current liabilities

Secured

Corona virus 700 703 700

business

interruption loan

Factoring facility 250 334 145

Convertible loan - 475

note

Other Loans 45 1,854 1854

Unsecured

Other Loans - 13

Convertible loan 475

note

995 3,366 3,187

Total Borrowings 3,324 3,366 3,187

The convertible loan note has a coupon of 5%. The lender has the right to

convert the outstanding principal into ordinary share of the Company at a price

of 1p per share. In the event that the lender does not exercise its conversion

rights by 30 June 2025, the loan shall become immediately repayable by the

Company.

Other loans falling due in more than one year of £1,854,000 (HY22 £1,854,000)

are secured by means of a debenture and chattels mortgage. The loans mature in

April and July 2025. The loans bear an interest rate of 18% per annum.

Following the disposal of IVI Metallics Limited and its subsequent

administration, pursuant to the cross guarantee, HSBC issued a final demand for

repayment for the outstanding principal under its CBIL. The Company is in

negotiations with the bank to reschedule the loan. Pending the outcome, the

outstanding capital is classified as falling due within one year.

The factoring facilities are secured on certain trade receivables. There is a

factoring charge of 1% of the Gross debt and a discount rate of 5% above bank

base rate on net advances. The agreement provides for 3 months' notice by either

party and certain minimum fee levels.

Other loans falling due in less than one year of £45,000 (HY22 £nil) are secured

by means of a debenture over the assets of Forepower Lincoln (250) Limited. The

Loan is interest free.

Reconciliation to cash flow statement

At 1 Drawn down Repaid At 30

April September

2023 2023

£'000 £'000 £'000 £'000

Secured borrowings

Other Loans 1,854 45 - 1,899

Convertible Loan Note 475 - - 475

CBIL 700 - - 700

Factoring facilities 145 105 - 250

3,174 150 - 3,324

Other loan 13 - (13) -

Total borrowings 3,187 150 (13) 3,324

8. Share capital

Number £'000

Issued and fully paid:

At 31 March 2022 526,334,602 218

Issued during the period 55,081,892 16

At 30 September 2022 581,416,494 234

Issued during the period 289,111,111 114

At 31 March 2023 870,527,605 348

Issued during the period 3,333,333 2

At 30 September 2023 873,860,938 350

9. Post balance sheet events

On 25 October 2023, the Company disposed of 49.9% of its holding in FPL (250) in

order to fund the development of the BESS project.

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

December 22, 2023 08:01 ET (13:01 GMT)

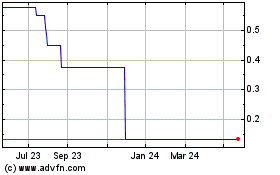

Vulcan Industries (AQSE:VULC)

Historical Stock Chart

From Jan 2025 to Feb 2025

Vulcan Industries (AQSE:VULC)

Historical Stock Chart

From Feb 2024 to Feb 2025