TIDMZPHR

RNS Number : 4919Z

Zephyr Energy PLC

16 May 2023

Prior to publication, the information contained within this

announcement was deemed by the Company to constitute inside

information as stipulated under the UK Market Abuse Regulation.

With the publication of this announcement, this information is now

considered to be in the public domain.

16 May 2023

Zephyr Energy plc

("Zephyr" or the "Company")

First Quarter 2023 results from Williston Basin portfolio;

State 36-2 LNW-CC well update

Zephyr Energy plc (AIM: ZPHR) (OTCQB: ZPHRF), the Rocky Mountain

oil and gas company focused on responsible resource development

from carbon-neutral operations, is pleased to provide initial first

quarter 2023 ("Q1") results related to hydrocarbon production and

cashflows from its non-operated asset portfolio in the Williston

Basin, North Dakota, U.S (the "Williston project"), as well as an

update on the State 36-2 LNW-CC well

Q1 Williston Basin Highlights

-- Quarterly revenues totaled US$6.3 million, net to Zephyr,

compared to fourth quarter 2022 ("Q4") revenues of US$7.4 million

(subject to audit). Q1 revenues reflect the standard decline

expected from the portfolio and the lower commodity price

environment during the quarter.

-- Q1 operating income was US$5.7 million (after taxes, lease

operating expenses, realised hedging impacts, and gathering and

marketing fees), compared to Q4 operating income of US$6.3

million.

-- Q1 sales volumes averaged 1,093 barrels of oil equivalent per

day ("boepd") compared to Q4 sales volumes average of 1,192 boepd.

Q1 sales volumes were in line with management expectations.

-- The Company hedged 36,000 barrels of oil in Q1 at a

weighted-average price of US$90.05 per barrel of oil ("bbl").

-- At 31 March 2023, 223 wells in the portfolio were available

for production, including one well which came online during Q1.

o Net working interests across the Williston Basin portfolio now

average 6.4% per well, equivalent to 15.1 gross wells in total, all

of which utilised horizontal drilling and modern, hydraulically

stimulated completions.

-- The recently acquired Slawson Exploration ("Slawson")

operated wellbore interests (as announced to the market on 21

December 2022) are now fully drilled and completed. Production from

these working interests had been forecast to be online by July

2023, and are now forecast to be online by October 2023 due to

minor delays related to the completion of surface facilities on the

well pad. The Company will provide an update in relation to FY 2023

production guidance when those wells are brought online.

Paradox Basin - State 36-2 LNW-CC well update

Following the well control incident announced on April 11, 2023,

the Company reports that the State 36-2 LNW-CC well remains stable

and under control while additional well repair work is ongoing.

Zephyr plans to commence a production test of the well as soon as

all necessary well work has been completed. This work includes a

cement squeeze and the perforation of the well in the Cane Creek

reservoir. Given the high pressures and significant hydrocarbon

volumes witnessed to date, the continued safety of all personnel on

site and the mitigation of any environmental impact are the top

priorities of the Company.

The Zephyr team is working methodically and carefully to ensure

both goals are met, at which point the Company will announce and

commence the production test.

Colin Harrington, Chief Executive of Zephyr, said : "Over the

last two years, Zephyr has built a successful and profitable

non-operated asset base comprised of a diverse mix of

working-interests in 223 low-risk, high-margin producing wells.

This production is well-hedged at above current market prices, and

delivers rapid payback and solid cash flows to fund future growth

within both our operated and non-operated portfolios.

"Near term growth includes our investment in the newly drilled

and completed Slawson-operated wells, wells which are expected to

significantly boost non-operated production rates when brought

online this Autumn.

"On our operated Paradox project, our near-term priority is to

deliver a safe and successful production test of the State 36-2

LNW-CC well, and we look forward to updating Shareholders when we

commence that test."

Q1 Sales Detail

Zephyr's net sales for Q1 were approximately 98,401 boe.

Q1 product mix was 88% crude oil, 5% natural gas, and 7% natural

gas liquids. The table below provides sales volumes, product mix,

and average sales prices for the quarter:

Oil: 70,464 bbls at an average sales price of US$77.98/bbl*

Natural Gas: 89,675 thousand cubic feet ("mcf") at an average sales price

of US$3.22 /mcf

Natural Gas Liquids: 12,991 bbls at an average sales price of US$37.28 per bbl

*not including hedges

(Note: Q1 volumes and average sales prices figures include field

estimates in respect of March 2023 natural gas and natural gas

liquids sales volumes and are subject to future revision.)

During Q1, more of Zephyr's existing production wells were

changed from temporarily shut-in to producing status. As new infill

wells are drilled, existing offset wells may be temporarily shut in

to optimise the nearby completion and mitigate offset well

production losses. The Company is now seeing those offset wells

being re-instated for production when the new infill wells are

started up for production.

In the Williston Basin, cashflow from non-operated interests in

newly drilled wells may lag actual production by up to five months.

Such payments from the operator accrue on a monthly basis and are

paid in full prior to the sixth month of production, which may

result in impacts to quarterly sales volumes and revenues during

times of significant completion activity. Zephyr expects additional

accrued payments from operators during the remainder of 2023 given

the Company's interests in 25 newly drilled wells which came online

over the last two quarters.

The Company has hedged 164,000 barrels of oil over the next 12

months (starting 1 April 2023) at a weighted-average price of

US$84.34 per barrel. The Company is expecting significant

additional production volumes by the end of October 2023 from new

wells coming online and will continue to evaluate its commodity

price risk management strategy on a regular basis.

Contacts

Zephyr Energy plc Tel: +44 (0)20 7225 4590

Colin Harrington (CEO)

Chris Eadie (CFO)

Allenby Capital Limited - AIM Nominated Tel: +44 (0)20 3328 5656

Adviser

Jeremy Porter / Vivek Bhardwaj

Turner Pope Investments - Joint-Broker Tel: +44 (0)20 3657 0050

James Pope / Andy Thacker

Panmure Gordon (UK) Limited - Joint-Broker Tel: +44 (0) 20 7886 2500

John Prior / Hugh Rich / James Sinclair-Ford

Celicourt Communications - PR

Mark Antelme / Felicity Winkles Tel: +44 (0) 20 8434 2643

Qualified Person

Dr Gregor Maxwell, BSc Hons. Geology and Petroleum Geology, PhD,

Technical Adviser to the Board of Zephyr Energy plc, who meets the

criteria of a qualified person under the AIM Note for Mining and

Oil & Gas Companies - June 2009, has reviewed and approved the

technical information contained within this announcement.

Notes to Editors

Zephyr Energy plc (AIM: ZPHR) (OTCQB: ZPHRF) is a technology-led

oil and gas company focused on responsible resource development

from carbon-neutral operations in the Rocky Mountain region of the

United States. The Company's mission is rooted in two core values:

to be responsible stewards of its investors' capital, and to be

responsible stewards of the environment in which it works.

Zephyr's flagship asset is an operated 45,000-acre leaseholding

located in the Paradox Basin, Utah, 25,000 acres of which has been

assessed to hold, net to Zephyr, 2P reserves of 2.6 million barrels

of oil equivalent ("mmboe"), 2C resources of 34 mmboe and 2U

resources 240 mmboe.

In addition to its operated assets, the Company owns working

interests in a broad portfolio of non-operated producing wells

across the Williston Basin in North Dakota and Montana. Cash flow

from the Williston production will be used to fund the planned

Paradox Basin development. In addition, the Board will consider

further opportunistic value-accretive acquisitions.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDNKPBNDBKBPPD

(END) Dow Jones Newswires

May 16, 2023 02:00 ET (06:00 GMT)

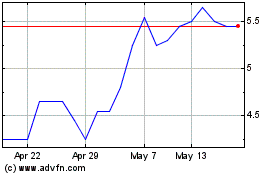

Zephyr Energy (AQSE:ZPHR.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Zephyr Energy (AQSE:ZPHR.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024