AMP Issues Apology for Misconduct; CEO Steps Down Immediately

April 19 2018 - 7:37PM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--AMP Ltd.'s (AMP.AU) outgoing chief

executive will step down immediately, after revelations Australia's

biggest wealth manager misled customers and the corporate regulator

over fees charged for services that weren't delivered.

In a regulatory statement Friday, AMP said CEO Craig Meller

would be replaced on an acting basis by Mike Wilkins, a non

executive director and a former CEO of Insurance Australia Group

Ltd. (IAG.AU).

It comes as a Royal Commission inquiry into cases of misconduct

in the financial industry, initiated by the government, heard

evidence this week that AMP allegedly lied to the Australian

Securities and Investments Commission for years to cover a practice

of charging customers for services they didn't receive. AMP issued

an apology Friday over the misconduct and its regulatory

disclosure.

Mr. Meller said he was "personally devastated" by the actions

revealed in the inquiry.

"I do not condone them or the misleading statements made to

ASIC. However, as they occurred during my tenure as CEO, I believe

that stepping down as CEO is an appropriate measure to begin the

work that needs to be done to restore public and regulatory trust

in AMP," he said.

He had planned to retire by the end of the year.

Prime Minister Malcolm Turnbull's conservative government last

year launched a sweeping probe of the country's banks, insurers and

other financial-services providers over allegations of misdeeds

including giving misleading advice, not honoring insurance claims,

rigging rates and failing to prevent money laundering.

On Wednesday, Treasurer Scott Morrison said the admissions made

by AMP to the inquiry were "deeply disturbing" and that such

behavior could attract penalties including jail time. The

government on Friday said it was stiffening the penalties available

to regulators for individuals and financial-services firms.

AMP said Friday it would begin an immediate review of its

regulatory reporting and governance processes, and make a

submission to the inquiry responding to issues that had been

raised.

As early as 2009, AMP told the regulator that there had been

instances where it had mistakenly charged fees after customers

stopped receiving advice. Evidence presented by the inquiry

suggested the practice had been discussed by management and

approved. The inquiry heard that senior officers at AMP had

requested changes be made to a report it commissioned a law firm to

produce for the regulator on the matter of fees.

Questioned this week by a lawyer for the probe, AMP's head of

advice Anthony Regan conceded that AMP's failings were in some

cases a deliberate decision by the company rather than a failure in

process.

ASIC this week said it has been investigating AMP's conduct in

relation to "fees for no services" raised in the inquiry.

Mr. Meller, who began his career with Lloyds Banking Group PLC

in the U.K., was appointed CEO of AMP in January 2014. He joined

AMP's U.K. business in 2001 before coming to Australia the

following year.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

April 19, 2018 20:22 ET (00:22 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

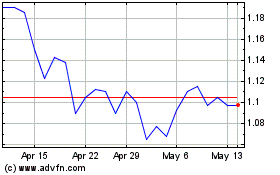

AMP (ASX:AMP)

Historical Stock Chart

From Jan 2025 to Feb 2025

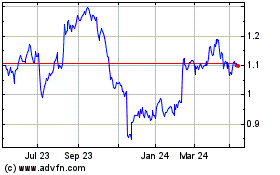

AMP (ASX:AMP)

Historical Stock Chart

From Feb 2024 to Feb 2025