Janus Henderson to Offer Five Actively Managed Sustainable Exchange Traded Funds

June 28 2021 - 7:30AM

Business Wire

Janus Henderson Group plc (NYSE/ASX: JHG) today announced the

filing of a preliminary registration statement with the Securities

and Exchange Commission for five sustainable exchange-traded funds

(ETFs) for investors in the U.S.

Janus Henderson plans to offer three equity and two fixed income

ETFs, including U.S. Sustainable Equity ETF (SSPX), International

Sustainable Equity ETF (SXUS), Net Zero Transition Resources ETF

(JZRO), Sustainable Corporate Bond ETF (SCRD), and Impact Bond ETF

(JIB).

The new ETFs will be actively managed by four investment teams

across three continents, including Portfolio Managers Hamish

Chamberlayne, CFA; Aaron Scully, CFA; Daniel Sullivan, Darko

Kuzmanovic, Tal Lomnitzer, CFA; Tim Gerrard, Brad Smith; Michael

Keough; Nick Childs, CFA; and Greg Wilensky, CFA.

Consumer demand for ETFs and Environmental, Social and

Governance (ESG) investment opportunities is growing rapidly.

Through its new ETFs, Janus Henderson hopes to offer investors

additional options to build portfolios around sustainable

investments in a cost-effective and flexible way.

“Janus Henderson has a 30-year track record of sustainable

investing and we are committed to expanding and extending our

product offering to meet the needs of our clients. These new ETFs

will allow us to build on a strong tradition of sustainable

investing and meet the growing demand for ESG investing

opportunities,” said Dick Weil, Chief Executive Officer of Janus

Henderson.

If all approvals are granted, the funds are expected to launch

on or around September 9, 2021.

Notes to editors

About Janus Henderson

Janus Henderson Group (JHG) is a leading global active asset

manager dedicated to helping investors achieve long-term financial

goals through a broad range of investment solutions, including

equities, fixed income, quantitative equities, multi-asset and

alternative asset class strategies.

At 31 March 2021, Janus Henderson had approximately US$405

billion in assets under management, more than 2,000 employees, and

offices in 25 cities worldwide. Headquartered in London, the

company is listed on the New York Stock Exchange (NYSE) and the

Australian Securities Exchange (ASX).

Investing involves risk, including the possible loss of

principal and fluctuation of value. Past performance is no

guarantee of future results. There is no assurance the stated

objective(s) will be met.

The information in each prospectus is not complete and may be

changed. The securities may not be sold until the registration

statement filed with the Securities Exchange Commission is

effective. Each prospectus is not an offer to sell these securities

and is not soliciting an offer to buy these securities in any state

where the offer is not permitted.

Please consider the charges, risks, expenses and investment

objectives carefully before investing. A prospectus or, if

available, a summary prospectus will contain this and other

information for each fund. You can obtain a copy of the prospectus

by calling Janus Henderson at 800.668.0434. The final prospectus

should be read carefully before investing.

Equity and fixed income securities are subject to various

risks including, but not limited to, market risk, credit risk and

interest rate risk.

Securitized products, such as mortgage- and asset-backed

securities, are subject to prepayment and liquidity risk.

Commodities and commodity-linked securities may be affected

by overall market movements, changes in interest rates, and other

factors such as weather, disease, embargoes, and international

economic and political developments, as well as the trading

activity of speculators and arbitrageurs in the underlying

commodities.

Environmental, Social and Governance (ESG) or sustainable

investing considers factors beyond traditional financial analysis.

This may limit available investments and cause performance and

exposures to differ from, and potentially be more concentrated in

certain areas than, the broader market.

Actively managed portfolios may fail to produce the intended

results. No investment strategy can ensure a profit or eliminate

the risk of loss.

Not all products or services are available in all

jurisdictions.

Janus Capital Management LLC is the investment adviser and ALPS

Distributors, Inc. is the distributor. ALPS is not affiliated with

Janus Henderson or any of its subsidiaries.

Janus Henderson is a trademark of Janus Henderson Group plc or

one of its subsidiaries. © Janus Henderson Group plc.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210628005099/en/

Media Contact: Sarah Johnson, +1 720-364-0708

sarah.johnson@janushenderson.com Investor Relations Contact: Jim

Kurtz, 303-336-4529 Jim.Kurtz@janushenderson.com

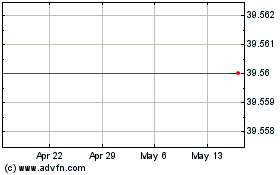

Janus Henderson (ASX:JHG)

Historical Stock Chart

From Jan 2025 to Feb 2025

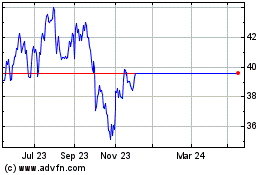

Janus Henderson (ASX:JHG)

Historical Stock Chart

From Feb 2024 to Feb 2025