Coal & Allied 1st Half Profit A$227 Million, Up 41% On Year

July 27 2011 - 1:47AM

Dow Jones News

Miner Coal & Allied Industries Ltd. (CNA.AU) said Wednesday

half year profit for the period ended June 30 rose 41% on year to

A$227 million thanks to rising sales volumes and booming prices for

export coal.

But the stronger Australian dollar and rising costs cut into the

profit figure, which UBS had expected at A$273 million.

The company declared an interim dividend of 120 Australian

cents, against 150 cents predicted by UBS.

Coal & Allied, one of the largest miners of thermal and

semi-soft coking coal in the Hunter Valley region north of Sydney,

reported earlier this month that production in the first six months

of the year was 11% higher than in 2010.

Coal & Allied is 75.7% owned by Rio Tinto PLC (RIO) and

10.2% by Mitsubishi Corp. (8058.TO), with a 6.3% stake held by fund

manager Perpetual Ltd. (PPT.AU) leaving just a 7.8% free float.

-By David Fickling, Dow Jones Newswires; +61 2 8272 4689;

david.fickling@dowjones.com

Order free Annual Report for Rio Tinto PLC

Visit http://djnweurope.ar.wilink.com/?ticker=GB0007188757 or

call +44 (0)208 391 6028

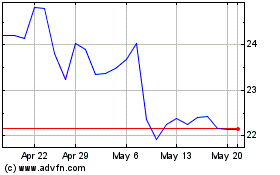

Perpetual (ASX:PPT)

Historical Stock Chart

From Jan 2025 to Feb 2025

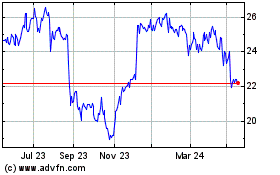

Perpetual (ASX:PPT)

Historical Stock Chart

From Feb 2024 to Feb 2025