Splitit Partners with UnionPay, the World’s Largest Card Network of 9 Billion Cardholders

April 12 2021 - 6:30PM

Business Wire

- Enables UnionPay credit card holders to use Splitit’s

installment solution for the first time wherever Splitit is offered

globally

- Marks significant expansion into a large Asia Pacific shopper

base, aligning with Splitit’s growth strategy for the region

Splitit, a global payment technology company (ASX:SPT),

announces a new global partnership with UnionPay International,

part of China UnionPay, the provider of bank card services and a

major card scheme in mainland China.

UnionPay International will be integrating Splitit to make it

available to its network. This will give UnionPay card holders and

those accepting UnionPay the opportunity to utilize Splitit’s

installment payments product.

The UnionPay global acceptance network has expanded to 180

countries and regions, covering over 55 million merchants. Outside

the Chinese Mainland, UnionPay is accepted at over 32 million

merchants. To date, over 9 billion UnionPay cards (debit and

credit) are issued in 68 countries and regions, among which over

150 million are issued outside mainland China. All UnionPay credit

cardholders will be able to use Splitit’s interest- and fee-free

installment payment option at any merchant offering Splitit from

June FY21.

“The cooperation with Splitit is a remarkable milestone for

UnionPay to further deepen its cooperation with partners in the

South Pacific region,” said Jiangtao Jian, General Manager,

UnionPay International South Pacific branch. “We’re excited to

bring this partnership with Splitit to UPI customers globally so

they can benefit from increased flexibility in how they pay.”

“Partnering with UnionPay opens up our solution to UnionPay

credit card holders, building on our existing card partner

networks. It combines our unique installment solution and global

reach, with UnionPay’s powerful card holder base to allow countless

more shoppers to better use their existing credit,” commented Brad

Paterson, CEO of Splitit.

“The partnership is another significant milestone in Splitit’s

Asia Pacific expansion strategy to boost consumer adoption and

merchant acceptance. This increased relevance to more cardholders

and merchants will, in turn, accelerate our merchant sales volume,”

he concluded.

The economic materiality of the agreement with UnionPay

International is unknown due to the contingent nature of results

that may be generated. At this point in time, Splitit considers the

UnionPay partnership is unlikely to yield a short-term economic

benefit for Splitit, however, Splitit considers that the UnionPay

partnership supports Splitit’s strategic growth plans.

About UnionPay International

UPI Company Profile: UnionPay International (UPI) is a

subsidiary of China UnionPay focused on the growth and support of

UnionPay’s global business. In partnership with more than 2400

institutions worldwide, UnionPay International has enabled card

acceptance in 180 countries and regions with issuance in 68

countries and regions. UnionPay International provides high

quality, cost effective and secure cross-border payment services to

the world’s largest cardholder base and ensures convenient local

services to a growing number of global UnionPay cardholders and

merchants.

Global Acceptance and Issuance So far, the UnionPay

global acceptance network has expanded to 180 countries and

regions, covering over 55 million merchants and about 2.9 million

ATMs. Outside the Chinese Mainland, UnionPay is accepted at over 32

million merchants and 1.7 million ATMs.

To date, over 9 billion UnionPay cards are issued in 68

countries and regions, among which over 150 million are issued

outside mainland China.

Global Acceptance of UnionPay mobile payment service To

date, UnionPay mobile payment services, UnionPay mobile QuickPass

and UnionPay QR code payment, are accepted in 94 countries and

regions (60 outside mainland China).

UnionPay QR code payment is accepted at 30 million merchants in

45 countries and regions.

UnionPay mobile QuickPass (UnionPay contactless payment

solution) is accepted at 25 million POS terminals, including over 7

million POS terminals in 82 countries and regions outside mainland

China.

About Splitit

Splitit is a global payment solution provider that enables

shoppers to use the credit they’ve earned by breaking up purchases

into monthly interest-free installments, using their existing

credit card. Splitit enables merchants to improve conversion rates

and increase average order value by giving customers an easy and

fast way to pay for purchases over time without requiring

additional approvals. Serving many of Internet Retailer’s top 500

merchants, Splitit’s global footprint extends to thousands of

merchants in countries around the world. Headquartered in New York,

Splitit has an R&D center in Israel and offices in London and

Australia. The company is listed on the Australian Securities

Exchange (ASX) under ticker code SPT.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210412005991/en/

Australian Media & Investor Enquiries Catherine

Strong Citadel-MAGNUS cstrong@citadelmagnus.com +61 2 8234 0111

US Media Inquiries Cari Sommer Raise Communications

info@raisecg.com +1 646 480 7683

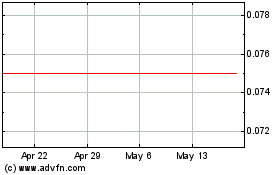

Splitit Payments (ASX:SPT)

Historical Stock Chart

From Oct 2024 to Nov 2024

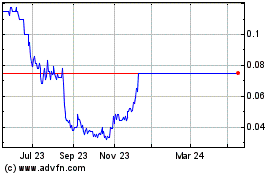

Splitit Payments (ASX:SPT)

Historical Stock Chart

From Nov 2023 to Nov 2024