Trendy Outerwear Maker Canada Goose Preparing for IPO

October 07 2016 - 3:20PM

Dow Jones News

Canada Goose, the maker of trendy down-filled parkas that cost

$1,000 apiece, is preparing for an initial public offering, in a

sign that an uptick in the new-issue market could continue.

The Canadian company is interviewing potential underwriters for

an offering that could value it at around $2 billion, according to

people familiar with the matter. That would put it on track for a

debut early next year. There is no guarantee an offering will take

place as any number of factors, like a renewed bout of stock-market

volatility, could get in the way.

Should Canada Goose pull off the share sale, it would give it

broader access to capital for growth and provide a path for

private-equity firm Bain Capital to begin exiting its investment in

the apparel company.

Founded in 1957 as Metro Sportswear Ltd., Canada Goose got its

start making woolen vests and snowmobile suits from a small

warehouse in Toronto. Over the years, it found a niche following

among film crews shooting in frigid climes. Lately, it has

attracted fashion-savvy consumers looking for winter-weather gear

and willing to pay a hefty price for it. In May, the company

announced its first stand-alone retail stores, in Toronto and in

New York's tony Soho neighborhood.

Canada Goose sold a majority stake to Bain in 2013 for an

undisclosed sum. Dani Reiss, the company's chief executive and

grandson of its founder, Sam Tick, retained a significant minority

stake.

Trendy apparel brands have benefited from robust investor demand

lately. Lululemon Athletica Inc.'s stock is up 11% this year, while

shares of Moncler SpA, a clothing maker that has large network of

retail stores, are up 17%. Under Armour Inc. has risen more than

twentyfold since its 2005 IPO, though the stock is down from its

September 2015 high.

The IPO market is starting to show signs of life after suffering

through a sluggish year, with 17 companies selling shares on U.S.

exchanges in September, according to Dealogic. That makes it one of

the busiest months this year. Yet despite the pickup, U.S.-listed

IPO activity is still on pace for its slowest year since 2009.

Should the recent upturn be sustained, it would be good news for

firms like Bain that depend on the IPO market to exit investments

and return cash to their own investors.

One of the most highly anticipated debuts this year is that of

another hot consumer brand, Yeti Holdings Inc., which makes

high-end coolers.

Write to Matt Jarzemsky at matthew.jarzemsky@wsj.com and Maureen

Farrell at maureen.farrell@wsj.com

(END) Dow Jones Newswires

October 07, 2016 16:05 ET (20:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

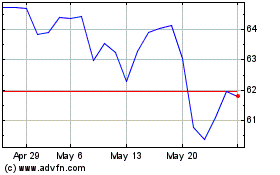

Moncler (BIT:MONC)

Historical Stock Chart

From Feb 2025 to Mar 2025

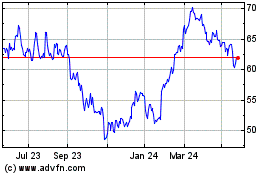

Moncler (BIT:MONC)

Historical Stock Chart

From Mar 2024 to Mar 2025