HAL's Safilo Bond Offer Wins 40% Acceptance So Far-Source

November 17 2009 - 11:27AM

Dow Jones News

HAL Holding NV's offer to Safilo SpA (SFL.MI) bondholders ending

Nov. 18 has been taken up by holders of around 40% of bonds so far,

a person familiar with the situation told Dow Jones Newswires

Tuesday.

HAL's offer to acquire Safilo is conditional upon HAL buying at

least 60% of EUR195 million of high-yield 2013 Safilo bonds by Nov.

18.

HAL was not immediately available for comment. Safilo declined

to comment. HAL will announce the results of the offer on

Wednesday, said other people familiar with the situation.

If HAL withdraws its offer, Safilo "would again be in a highly

leveraged situation and will, in all likelihood, default under its

banking facilities by year-end," Safilo said last week.

At the end of September, Safilo's net debt was EUR586.3 million.

Its main creditors are Italy's two biggest banks, Intesa Sanpaolo

SpA (ISP.MI) and UniCredit SpA (UCG.MI).

Were Safilo forced to seek bankruptcy protection, it would leave

the much larger Luxottica SpA (LUX.MI) as the only major player in

the high-end eyewear industry. That could give Luxottica huge

negotiating power with the luxury goods companies for which it

manufactures eyewear under license.

Based in Padua, Italy, Safilo is the world's second-largest

maker of eyewear after Luxottica. Safilo manufactures eyewear under

license for brands including Gucci, Giorgio Armani, Valentino, Max

Mara and Marc Jacobs.

-By Chiara Vasarri and Jennifer Clark, Dow Jones Newswires; 39

02 58 21 9904; djitaly@dowjones.com

(With additional reporting by Sabrina Cohen.)

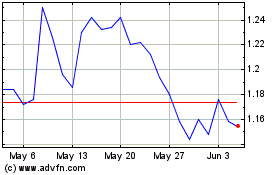

Safilo (BIT:SFL)

Historical Stock Chart

From Nov 2024 to Dec 2024

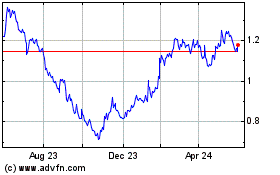

Safilo (BIT:SFL)

Historical Stock Chart

From Dec 2023 to Dec 2024

Real-Time news about Safilo Group SpA (Italian Stock Exchange): 0 recent articles

More Safilo News Articles