Bitcoin’s Price Momentum Shifts As Spot Market Outpaces Futures – Here’s What It Means

December 17 2024 - 10:30PM

NEWSBTC

Bitcoin has continued its upward trajectory as recent market trends

highlight a shift in investor behaviour. According to data shared

by CryptoQuant analyst Avocado Onchain, spot market demand has

emerged as a significant driving force behind Bitcoin’s ongoing

price increases. This trend indicates growing buying pressure from

long-term investors, as speculative activity in the futures market

appears to be cooling. Related Reading: Bitcoin’s Next Big Move?

Key Metric Reveals When to Cash In Profits Bitcoin Spot Market

Demand Gains Strength The analyst’s observations provide insights

into Bitcoin’s ongoing bull cycle, which began in the first half of

2023. According to Avocado, initially, the futures market led the

charge in pushing Bitcoin’s price upward, signalling a speculative

phase fuelled by short-term traders. However, this momentum was

interrupted earlier this year when both the futures and spot

markets experienced reduced trading activity starting in March.

Since October, market activity has returned, with trading volumes

rising across both futures and spot markets, providing fresh

support for Bitcoin’s rally. In his analysis, Avocado Onchain noted

a key trend: while futures market activity has recently declined,

demand in the spot market has been steadily increasing. Spot market

activity refers to the actual purchase of Bitcoin on exchanges for

immediate delivery, typically driven by investors with a long-term

perspective. This stands in contrast to futures markets, where

traders speculate on price movements using contracts that do not

require immediate ownership of the asset. Spot Market Demand Takes

the Lead as Bitcoin Continues Its Upward Momentum “While futures

market activity has declined, spot market demand continues to

increase. This suggests that speculative excess in the futures

market is cooling, while buying pressure in the spot market is…

pic.twitter.com/M4o4TsG02V — CryptoQuant.com (@cryptoquant_com)

December 17, 2024 What This Means For BTC The analyst suggests that

this shift indicates speculative excess in the futures market may

be stabilizing. Historically, overheated futures markets have led

to volatility, often triggering liquidations. However, the cooling

of futures market activity, coupled with rising spot market demand,

reflects a more sustainable form of buying pressure that can

underpin Bitcoin’s long-term growth. The CryptoQuant analyst noted:

Looking ahead, the futures market is likely to undergo cycles of

overheating and liquidations, which will contribute to Bitcoin’s

price growth. This price movement will, in turn, encourage further

capital inflows into the spot market. Additionally, Avocado Onchain

pointed to the 30-day exponential moving average (EMA) of Bitcoin’s

funding rate, which shows “no signs of late-cycle overheating.”

Related Reading: Bitcoin To Hit $180,000 If These Cycle Top

Indicators Are Absent, Says VanEck’s Sigel The funding rate

measures the cost of holding futures contracts and is often used as

an indicator of market sentiment. Avocado mentioned that as BTC

funding rate remains balanced, it suggests that BTC’s price

movements are not being driven solely by leveraged positions,

reducing the risk of sudden price reversals. Featured image created

with DALL-E, Chart from TradingView

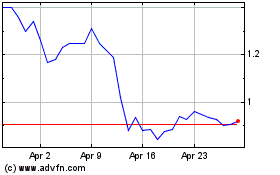

Flow (COIN:FLOWUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Flow (COIN:FLOWUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024