Why Closing Out The Year Below $50,000 Could Be Bad For Bitcoin

December 09 2021 - 2:30PM

NEWSBTC

A lot of predictions had put the price of bitcoin at $100,000 by

the end of the year and although there are still some weeks left to

go, it does not look like these predictions will come to pass.

Bitcoin has however maintained a bullish trend despite price

crashes and massive liquidations rocking the digital asset in

recent times. Since analysts, and the crypto market in general, has

been so focused on the bullish future of the asset, there has not

been much attention paid to a low for the year. As the end of 2021

rolls around, it is important to not only look at the bullish

end-of-year predictions but also how the cryptocurrency might be

affected depending on the price bitcoin closes at. Related Reading

| Bitcoin Open Interest Takes Second Largest Dump Of 2021

Crypto analyst Justin Bennett addresses this in his latest issue of

the weekly newsletter. Bennett maps out the outlook for the digital

asset, as well as the implications of bitcoin closing out the year

below $50,000. Options Contracts Becoming Worthless Some of the

bitcoin options contracts are set to expire at the end of the year

and the profitability of these options contracts depend greatly on

what price BTC is when they expire. Since the crash, bitcoin has

struggled to maintain its value above $50,000 and this has not been

good for the options contracts. Bennett notes that a close below

$50,000 would see all of these contracts expire worthless, playing

into what he called the “max pain theory”. The crypto analyst is

not particularly confident in the digital asset’s ability to finish

the year above $50,000. He expressed that he expects the

consolidation in larger cap cryptocurrencies to continue through

the last month of the year. Bennett however notes that there is a

wide range for bitcoin due to the December 4th candle. This means

that anywhere between $42,000 and $53,000 is possible going

forward, providing a massive margin for the digital asset. BTC

price continues downtrend | Source: BTCUSD on TradingView.com

Bitcoin Volume Is Concerning Bennett also points to the lack of

volume in the cryptocurrency. One thing is to start a rally or a

breakout, but the other thing is to get enough volume to match that

breakout. Otherwise, a rally would not be successful. Related

Reading | Number Of Bitcoin Lightning Network Nodes Jumps 23%

In Three Months “If we’re to see Bitcoin and the rest of the crypto

market breakout later this month or even January, we need to see

volume to match the price increase,” said Bennett. “Without volume,

any rally or even breakout is more likely to fail.” As bitcoin

continues to consolidate following a $53,000 test, the market is

quietly waiting for more institutional money to pump into the

market. Currently, Bennett has put the bitcoin key support at

$49,000. “Below that is the April trend line near $46,000,” Bennett

notes. Featured image from Bitcoin News, chart from TradingView.com

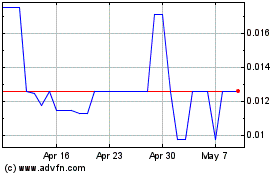

Rally (COIN:RLYUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

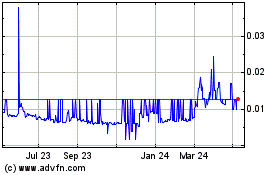

Rally (COIN:RLYUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024

Real-Time news about Rally (Cryptocurrency): 0 recent articles

More Rally News Articles