- Continued unfavorable market context in the “Construction

& Materials” and “Hygiene & Protection” business areas and

delays in marketing approvals for new products

- Slight increase in revenue in the “Health, Beauty &

Nutrition” business area

- Good momentum in “Industry” business area sales, thanks to

investments made by the Group

- Revision of the Group's financial targets following the

review of its business plan within the framework of Kenerzeo1's

tender offer project

Regulatory News:

Groupe Berkem, a leading player in bio-based chemistry

(ISIN code: FR00140069V2 – Ticker: ALKEM), announces its 2024

first-year revenue and provides an update on its recent

activity.

Olivier FAHY, Chairman and CEO of Groupe Berkem, stated:

“As expected, revenue for the first half of 2024 are in line with

our previous publications. Our Group continues to be impacted by

the tensions observed for over a year in the “Construction &

Materials” and “Hygiene & Protection” business areas, coupled

with delays in obtaining marketing authorizations for the new

bio-based products we launched in recent months. At the same time,

and despite the decline in sales of nutritional supplements, we

were able to achieve a slight improvement on last year's

performance in the “Health, Beauty & Nutrition” business area,

demonstrating the quality of our solutions and our expertise in

these markets showing strong demand for naturalness. Finally, our

proactive investment policy is bearing fruit in the “Industry”

business area, which is increasingly emerging as a genuine growth

driver for the years ahead. Faced with the major challenges

affecting our industry and to pursue our development strategy,

which proved its worth in a highly complex market context, we have

decided to join forces with Eurazeo to write a new chapter for our

Group. This decision is reflected in a simplified tender offer

project that has been favorably received by the Board of Directors,

and which should be filed during the 4th quarter of 2024.”

2024 FIRST-HALF REVENUE

As at June 30, 2024, Groupe Berkem's revenue reached €27.3

million, compared with €28.0 million in the first-half of 2023,

i.e. a slight decrease of -2.2%.

Breakdown of revenue by business area

for the first half of 2024

In € thousands

30/06/2024

30/06/2023

Change

Construction & Materials

11,609

12,459

(6.8%)

Hygiene & Protection

5,768

6,479

(11.0%)

Health, Beauty & Nutrition

8,704

8,556

+1.7%

Industry

1,247

377

+231.0%

Central /Shared

-

86

(100.0%)

TOTAL

27,328

27,956

(2.2%)

The persistent difficulties affecting the “Construction &

Materials” and “Hygiene & Protection” business areas

resulted in a drop in revenue of -6.8% and -11.0% respectively

compared with the first half of 2023, coupled with significant

delays in marketing approvals for the Group's new products. The

“Health, Beauty & Nutrition” business area saw a slight

improvement in sales of 1.7% compared with the performance achieved

in the first half of 2023. In line with previously published

figures, the “Industry” business area continues its strong

growth momentum, rising from €0.3 million in the first half of 2023

to €1.2 million in the first half of 2024, while remaining marginal

in the Group's business mix.

2024 FIRST HALF AND POST-CLOSING HIGHLIGHTS

External growth operations

February 2024: Acquisition of

Naturex Iberian Partners, Givaudan's industrial site in

Valencia (Spain) specialized in plant and marine extraction

activities, for players in the food, nutrition (nutraceuticals) and

cosmetics markets. With this acquisition, Groupe Berkem

significantly increases its production capacity for plant extracts

destined for the “Health, Beauty & Nutrition” business

area.

Activity

January 2024: Extension of the

H2OLIXIR range of 100% natural floral waters, with the launch

of lavender water and thyme water, two new 97.5% organic floral

waters for the cosmetics industry.

May 2024: Presentation of

BiombalanceTM and Pineol® Premium, two active ingredients from

the Group's new range for the Nutraceuticals market.

Signature of a contribution agreement and conclusion of an

investment agreement between Kenercy2 and Eurazeo in view of a

simplified tender offer project

As announced in the press release issued on July 18, 2024,

Kenercy and Kenerzeo, a newly simplified joint-stock company (RCS

928 791 813) incorporated under French law, 100% owned by Kenercy

(RCS 804 788 503), itself managed by Olivier Fahy, signed a

contribution agreement on July 17, 2024, under which Kenercy will

transfer to Kenerzeo 100% of the Groupe Berkem shares it holds,

i.e. 12,069,833 shares representing 67.93% of Groupe Berkem's share

capital to date. Under the terms of the contribution agreement,

Groupe Berkem shares were valued at €3.10 each.

Kenerzeo and Danske Bank Asset Management (shareholder of Groupe

Berkem) today signed reciprocal commitments for the acquisition and

sale concerning the acquisition by Kenerzeo, and the sale by Danske

Bank Asset Management, of 1,322,931 Groupe Berkem shares. Under the

terms of these commitments, Kenerzeo irrevocably agreed to acquire,

and Danske Bank Asset Management irrevocably agreed to sell,

1,322,931 Groupe Berkem shares, representing 7.5% of Groupe

Berkem's share capital, at a price of €3.10 per share. Completion

of these commitments and the transfer of ownership of the shares

are expected to take place on July 31, 2024.

After the final completion of the contribution and commitments

described above, scheduled for July 31, 2024, Kenerzeo will hold

75.43% of Groupe Berkem's share capital.

At the same time, Kenercy and Eurazeo concluded an investment

agreement concerning the financing, by funds managed by Eurazeo, of

Kenerzeo up to a maximum amount of €23.5 million through the issue

of convertible bonds and the subscription of Kenerzeo shares.

This release is the first step in a simplified tender offer to

be initiated by Kenerzeo for all the Groupe Berkem shares it will

not hold. Completion of the tender offer is subject to the AMF's

declaration of conformity and could take place during the fourth

quarter of 2024.

At its meeting on July 17, 2024, the Group's Board of Directors

supported the proposed transaction and decided to enable Kenerzeo

to file a tender offer during the 4th quarter of 2024. Groupe

Berkem and Eurazeo will keep the market informed of any significant

developments in the planned transaction.

No change in the governance of Groupe Berkem is planned until

completion of the tender offer project. In the event that Groupe

Berkem remains a listed company following the proposed tender

offer, Eurazeo's appointment as a director of Groupe Berkem will be

put to a vote at the General Meeting.

An independent expert whose mission is to prepare a report on

the financial terms of the tender offer in accordance with the

provisions of article 261-1 of the AMF's general regulations will

be appointed shortly. The Group will keep the market informed of

the terms and conditions of the independent expert's appointment,

as well as the terms and conditions of his mission.

Outlook

Within the framework of the transaction announced today, Groupe

Berkem has reconsidered its business plan and financial

projections. This revision takes into account the persistent

difficulties affecting the “Construction & Materials” business

area since the Ukrainian crisis, as well as delays in obtaining

marketing authorizations for its bio-based products, both in France

and internationally. Lastly, in view of the numerous investments to

be made at its new production site in Valencia, Spain, and the

ever-changing economic and geopolitical context, Groupe Berkem has

no immediate plans to make any new acquisitions in the short to

medium term.

In view of the above, Groupe Berkem now expects to achieve

revenue of at least €70 million by 2025, and an EBITDA3 margin of

at least 16% by 2027.

Next financial report:

- 2024 First-Half Results: September 26, 2024 (after

market close)

ABOUT GROUPE BERKEM

Founded in 1993 by Olivier Fahy, Chairman and Chief Executive

Officer, Groupe Berkem is a leading force in the bio-based

chemicals market. Its mission is to advance the environmental

transition of companies producing the chemicals used in everyday

life (Construction & Materials, Health, Beauty & Nutrition,

Hygiene & Protection, and Industry). By harnessing its

expertise in both plant extraction and innovative formulations,

Groupe Berkem has developed bio-based boosters—unique high-quality

bio-based solutions augmenting the performance of synthetic

molecules. Groupe Berkem achieved revenue of €51.9 million in 2023.

The Group has almost 250 employees working at its head office

(Blanquefort, Gironde) and 5 production facilities in Gardonne

(Dordogne), La Teste-de-Buch (Gironde), Chartres (Eure-et-Loir),

Tonneins (Lot-et-Garonne) and Valence (Spain).

Groupe Berkem has been listed on Euronext Growth Paris since

December 2021 (ISIN code: FR00140069V2 - ALKEM).

www.groupeberkem.com

1 Simplified joint-stock company (RCS 928 791 813) with Kenercy

as Chairman. 2 Limited liability company (RCS 804 788 503) with

Olivier FAHY as manager. 3 Earnings Before Interest, Taxes,

Depreciation and Amortization (EBITDA), corresponds to the

operating cash flow generated by the Group, taking into account

other operating income and other operating expenses, but excluding

depreciation and amortization and the Group's financing policy.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240725017939/en/

Groupe Berkem Olivier Fahy,

Chairman and CEO Anthony Labrugnas, Chief Financial Officer Phone:

+33 (0)5 64 31 06 60 investisseurs@berkem.com

NewCap Investor Relations

Mathilde Bohin / Nicolas Fossiez Phone: +33 (0)1 44 71 94 94

berkem@newcap.eu

NewCap Media Relations

Nicolas Merigeau / Antoine Pacquier Phone: +33 (0)1 44 71 94 94

berkem@newcap.eu

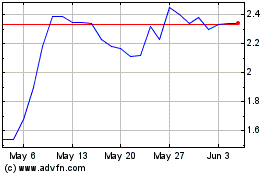

Groupe Berkem (EU:ALKEM)

Historical Stock Chart

From Oct 2024 to Nov 2024

Groupe Berkem (EU:ALKEM)

Historical Stock Chart

From Nov 2023 to Nov 2024