UPDATE: BAM Earnings Beat Expectations; CEO To Retire

May 20 2010 - 6:03AM

Dow Jones News

Dutch construction company Royal BAM Group NV (BAMNB.AE)

reported a 19% rise in first-quarter net profit as profitability at

most of its units improved, but revenue dropped 13% as market

prospects remain uncertain.

The company also announced that Chief Executive Joop van Oosten

will retire next year. "My departure is due to the fact that I'm

now 62 and will be 63 when I retire," Van Oosten told

reporters.

The Bunnik-based company said net profit for the first three

months of 2010 rose to EUR9.9 million from EUR8.3 million in the

same period a year ago.

Revenue fell to EUR1.54 billion from EUR1.77 billion a year ago

due to poor winter weather and lackluster volumes in the

residential and commercial property markets.

Analysts were caught off guard by the results. They had expected

a EUR1 million net loss and revenue of EUR1.63 billion.

"BAM reported results that were ahead of our--and far ahead of

consensus--estimates in operational results and somewhat light on

revenues," said Edwin de Jong, analyst at SNS Securities. He rates

BAM at hold.

Investors cheered the results. At 1021 GMT, BAM shares traded up

EUR0.31, or 6.2%, at EUR5.32 while the benchmark AEX index traded

up 0.1%. Over the past 12 months, BAM shares have lost almost 30%

of their value, while the AEX has gained over 20%.

The company reiterated it's expectation of EUR8 billion in

revenue for 2010, but said it is impossible to predict

profitability due to uncertainty in all its markets.

BAM earns almost 50% of its revenue in the Netherlands, which

has endured a severe slump in the construction sector. The country

faces parliamentary elections June 9 and it remains uncertain what

will happen to government spending on infrastructure and other

public construction projects after the poll. The company earns most

of its money doing construction work for third parties, but also

develops its own commercial and residential property.

It's real-estate unit was its only loss-making business during

the first quarter, mostly due to underutilization.

In 2009, BAM booked EUR266 million in losses on its real-estate

business and announced a EUR250 million rights issue in its

full-year results in March. Thursday, it said it expects to

conclude the rights issue in the middle of this year.

If the rights issue is successful, the company's loan covenants

will be loosened, while interest payments will rise. However, it

agreed to use part of the proceeds it may fetch from selling its

21.5% stake in Dutch dredging company Van Oord to pay down its

debt.

Talks about a possible sale of the Van Oord stake are expected

to take place this summer. "But it won't be easy to reach an

agreement this year," Van Oosten said.

Van Oosten will be replaced by Nico de Vries, who has been an

executive board member at BAM since 1998. De Vries will become

chairman on Oct. 1, 2010, while Van Oosten will leave the company

March 31, 2011, after a 35-year career at BAM.

"Van Oosten's departure comes as a surprise, but I'm positive

about his successor," De Jong at SNS said.

"The contribution of the first quarter of a year is always so

small in this business, that we don't believe (the

better-than-expected results) will lead to significant upgrades in

consensus expectations," said analyst Michael Roeg at KBC

Securities. He rates BAM at accumulate.

-By Robin van Daalen and Eelco Hiltermann, Dow Jones Newswires;

+31 20 571 52 01; robin.vandaalen@dowjones.com

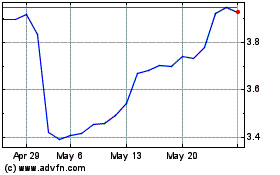

Royal BAM Group NV (EU:BAMNB)

Historical Stock Chart

From Oct 2024 to Nov 2024

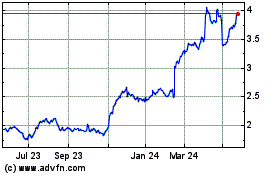

Royal BAM Group NV (EU:BAMNB)

Historical Stock Chart

From Nov 2023 to Nov 2024