Robust first-quarter organic growth, as expected

Regulatory News:

Elior Group (Paris:ELIOR) (Euronext Paris – ISIN: FR

0011950732), one of the world’s leading operators in catering and

support services, announces its revenues for the first quarter of

fiscal 2022-2023, ended December 31, 2022.

First-quarter 2022-2023 revenue

- Q1 revenue came to €1.225 billion, an 11.7% organic increase

compared with Q1 2021-2022, as the Group continues to recover from

the Covid pandemic (Omicron)

- Business development momentum remains strong, contributing 10

points out of 11.7

- The retention rate at December 31, 2022, came to 92.6%

excluding voluntary contract exits (91.5% including them), compared

with 91.3% at December 31, 2021

- As of December 31, 2022, 73% of our contracts were successfully

renegotiated, representing €234 million in price increases over a

rolling 12-month period

- Available liquidity was €307 million at end-December 2022,

compared with €399 million at end-September 2022, in line with our

expectations

- Outlook for fiscal 2022-2023 confirmed, along with ambitions

for 2024

Elior Group Chairman and CEO Bernard Gault commented:

“Organic growth achieved by the Group in the first quarter of

2022-2023 remains strong. Elior continues to benefit from a Covid

catch-up effect, as our volumes rebound was hindered by the first

Omicron wave in the first half of the previous fiscal year. Revenue

growth should continue in the months ahead with business

development momentum and price increases agreed with our clients.

Inflationary pressures, notably on food costs, remain strong and

require maintaining renegotiation efforts, particularly with public

sector clients. In parallel, in France, we started implementing

measures to streamline our organization and boost operating

efficiency, as introduced with our full-year 2021-2022 results.

Lastly, the planned acquisition of Derichebourg Multiservices,

which aims to accelerate Elior’s turnaround, is on track and

proceeding on schedule.”

Business development

Elior signed or renewed several significant contracts in

catering and services in the first quarter, including:

- In France, Nexans, the Périgueux National Police Academy, AS

Monaco football club, schools in Champigny-sur-Marne, La Ciotat, Le

Plessis-Robinson and Schiltigheim, the Ange Gardien Clinic in

Chamigny, and Uneos Group hospital facilities in Metz; and for

Elior Services, RATP (public transport group) and Cofidis

- In the UK, Kennedys Law LLP, Linklaters, Nike, Kerry Foods, SS

Great Britain Trust, Ofcom (telecoms regulator), Spinnaker View

retirement homes in Gosport, and St Luke's Hospital in Oxford

- In the USA, Boston Dynamics, Savannah State University in

Georgia and Colorado State University Pueblo, schools in Loving,

New Mexico, Northwest New Mexico Correctional Center, Nutrition

& Services For Seniors in Texas, Lifespark in Minnesota, Meals

on Wheels for Contra Costa County in California, and the Minnesota

Department of Human Services

- In Italy, Trenitalia, Generali, Technip, Gruppo Hera, Dallara

Automobili, the EDUCatt academic financial assistance organization,

and the city of Pisa

- In Spain, the EU intellectual property office in Alicante,

public school administrations in the provinces of León, Zamora and

the Basque Country, Vigil de Quiñones Hospital in Seville, and the

Zorroaga Foundation in Donastia

Revenues

Consolidated revenue from continuing operations totaled

€1.225 billion for the first quarter of 2022-2023, compared

with €1.116 billion a year earlier. The 9.8% increase includes

organic growth of 11.7%, a favorable currency impact of 3% (US

dollar gains against the euro), and a negative scope effect of

4.9%, mainly linked to exiting Preferred Meals in the USA.

On a like-for-like basis, revenues rose 10.2%, compared with

16.2% a year earlier, reflecting price increases of 3.8%.

Furthermore, business development boosted revenues by 10.0%

compared with 9.2% in Q1 2021-2022.

Lastly, lost contracts caused an 8.5% drop in revenues. The

retention rate was therefore 91.5% at December 31, 2022, a marginal

increase relative to 91.3% at December 31, 2021, despite deliberate

contract terminations which had a -1.1pp impact.

Revenue by geography

The proportion of revenue generated by international operations

was 56% in the first quarter of 2022-2023, on par with the previous

fiscal year.

Revenue generated in France totaled €533 million in the

first quarter of 2022-2023, compared with €489 million for the same

period a year ago, an increase of 9.0% as reported and 8.9% in

organic terms (no material scope effects). Group business is still

benefiting from a Covid catch-up effect, as the rebound in first

quarter 2021-2022 fiscal year was slowed by the first Omicron

wave.

International revenue totaled €688 million in the first

quarter of 2022-2023, up 10.4% compared with €623 million a year

earlier. The gain reflects a 13.9% organic increase, a favorable

currency contribution of 5.2% (US dollar gains vs the euro), and a

negative scope effect of 8.7%. Most of the scope effect (€56

million) is attributable to exiting Preferred Meals in the USA.

That impact was partly offset by converting some former contracts

into new, on-site catering contracts.

The Corporate & Other segment, which includes the

Group’s remaining concession catering activities not sold with

Areas, generated revenue of €4 million in the first three months of

2022-23, on par with the previous year.

Revenue by market:

The Business & Industry market generated revenues of

€527 million, up 19% on Q1 2021-2022, or an organic increase of

16.2%. This is a strong rebound after a period that was impacted by

the onset and spread of the Omicron variant. It also reflects more

satisfactory price increases than in the Education and Health &

Welfare markets.

Education generated revenues of €368 million—down 3.2% on

Q1 2021-2022 due to the closure of Preferred Meals in the USA—with

organic growth of 8.5%.

Health & Welfare revenues totaled €330 million, up

12.6% year on year, including 9% organic growth.

Liquidity

At December 31, 2022, liquidity amounted to €307 million,

compared with €399 million at September 30, 2022, in line with our

expectations due to seasonal working capital requirements amid

strong organic growth. It includes €59 million in cash and €189

million from the €350 million renewable revolving credit facility.

Remaining available credit lines amount to €59 million.

Outlook

The Covid catch-up effect observed until now should persist in

the second quarter before leveling out mechanically in the second

half. Higher prices negotiated with our clients and robust business

development should help to support organic growth.

As of December 31, 2022, 73% of the contracts were successfully

renegotiated, compared with 67% at September 30, 2022. These

renegotiations represent €234 million in price increases for Elior

Group over a rolling 12-month period, compared to €139 million at

September 30, 2022.

Inflationary pressures, especially regarding food prices, remain

strong. This requires maintaining contract renegotiation efforts,

particularly with public sector clients.

Given these factors, and assuming a stable public health

situation, we maintain our outlook for fiscal 2022-2023:

– At least 8% organic revenue growth

– Adjusted EBITA margin of 1.5-2.0%

– Capex between 1.5% and 1.7% of revenues

Our ambitions for 2024 remain as follows:

– Average annual organic revenue growth of at least 7% over the

next two years

– Adjusted EBITA margin of around 4.0% in 2023-2024

– Organic revenue growth / Capex as a percentage of revenues

between 2x and 3x

– Resumption of dividend payments in respect of fiscal year

2023-2024

Furthermore, Elior remains particularly attentive to the health

and well-being of its guests, the satisfaction of its clients,

development and engagement of all its employees, and its

activities’ environmental impact. Elior therefore reaffirms its CSR

commitments:

– Cut our greenhouse gas emissions per meal by 12% by 2025

compared with 2020 (Scopes 1,2, and 3)

– Reduce food waste per meal by 30% by 2025 compared with

2020

– Lower our energy consumption and ensure that 80% of our

electricity use comes from renewables by 2025

Planned acquisition of Derichebourg Multiservices

The project to acquire Derichebourg Multiservices, which aims to

accelerate Elior’s turnaround, is proceeding according to the

initial schedule. Arrangements to inform and consult employee

representatives have been made and are going ahead as planned.

Elior Group will host a conference call on Thursday, January 26

at 3:00 pm, Paris time (CET).

The conference call will be accessible by webcast on the Elior

Group website and by telephone by dialing one of the following

numbers:

France: +33 (0) 1 7037 7166 UK: +44 (0) 33

0551 0200 USA: +1 786 697 3501 Access code: Elior

Financial calendar:

- Thursday, February 23, 2023: Annual shareholders’ meeting

- Wednesday, May 17, 2023: First half 2022-2023 results —

Pre-opening press release and conference call

- Thursday, July 27, 2023: Revenue for the first nine months of

fiscal 2022-2023 —Pre-opening press release and conference

call

- Wednesday, November 22, 2023: Annual results for fiscal

2022-2023 — Pre-opening press release and conference call

Appendix 1: Revenue by geographic

segment

Appendix 2: Revenue by market

Appendix 3: Definition of alternative

performance indicators

About Elior Group

Founded in 1991, Elior Group has grown into one of the world's

leading operators in contract catering and support services and has

become a benchmark player in the Business & Industry,

Education, Health & Welfare and Leisure markets. With strong

positions in five countries, the Group generated €4.45 billion in

revenue in fiscal 2022.

Our 97,000 employees feed over 3 million people on a daily basis

in 20,250 restaurants on three continents and offer services on

2,400 sites in France.

Innovation and social responsibility are at the core of our

business model. Elior Group has been a member of the United Nations

Global Compact since 2004, reaching the GC Advanced Level in

2015.

For further information please visit our website at

http://www.eliorgroup.com or follow us on Twitter

(@Elior_Group)

Appendix 1: Revenue by

geographic segment

Q1

Q1

Organic

Change

Currency

Total

(in € millions)

2022-2023

2021-2022

growth

in scope

effect

change

France

533

489

8.9%

0.1%

-

9.0%

International

688

623

13.9%

-8.7%

5.2%

10.4%

Contract Catering & Services

1,221

1,112

11.7%

-4.9%

3.0%

9.8%

Corporate & Other

4

4

n.m.

n.m.

n.m.

n.m.

GROUP TOTAL

1,225

1,116

11.7%

-4.9%

3.0%

9.8%

n.m.: not meaningful

Appendix 2: Revenue by

market

Q1

Q1

Organic

Change

Currency

Total

(in € millions)

2022-2023

2021-2022

growth

in scope

effect

change

Business & Industry

527

443

16.2%

-

2.8%

19.0%

Education

368

380

8.5%

-14.3%

2.6%

-3.2%

Health & Welfare

330

293

9.0%

-

3.6%

12.6%

GROUP TOTAL

1,225

1,116

11.7%

-4.9%

3.0%

9.8%

Appendix 3: Definition of alternative

performance indicators

Organic growth in consolidated revenue: as described in

Chapter 4, Section 4.2 of the Universal Registration Document,

growth in consolidated revenue expressed as a percentage and

adjusted for the impact of (i) changes in exchange rates, (ii)

changes in accounting policies and (iii) changes in scope of

consolidation.

Retention rate: percentage of revenues retained from the

previous year, adjusted for the cumulative year-on-year change in

revenues attributable to contracts or sites lost since the

beginning of the previous year.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230125005783/en/

Press Antonia Krpina – antonia.krpina@eliorgroup.com /

+33 (0)6 21 47 88 69

Investor relations Kimberly Stewart –

kimberly.stewart@eliorgroup.com / +33 (0)1 71 06 70 13

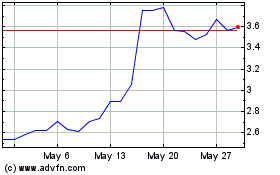

Elior (EU:ELIOR)

Historical Stock Chart

From Oct 2024 to Nov 2024

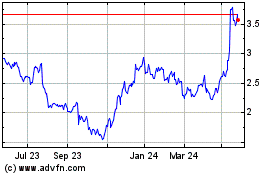

Elior (EU:ELIOR)

Historical Stock Chart

From Nov 2023 to Nov 2024