TIDMJE. TIDM0A28 TIDMTTM

RNS Number : 6569X

JUST EAT plc

20 December 2019

Just Eat plc

20 December 2019

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY (IN WHOLE OR IN PART) IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF

SUCH JURISDICTION. IN PARTICULAR, THIS ANNOUNCEMENT SHOULD NOT BE

RELEASED, PUBLISHED, DISTRIBUTED, FORWARDED OR TRANSMITTED, IN

WHOLE OR IN PART, IN, INTO OR FROM ANY RESTRICTED JURISDICTION,

INCLUDING THE UNITED STATES.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

FOR IMMEDIATE RELEASE

Just Eat plc ("Just Eat")

Recommendation of final offer by Takeaway.com N.V. and rejection

of final offer by Prosus N.V.

On 19 December 2019, Takeaway.com N.V. ("Takeaway.com") and

Prosus N.V. ("Prosus") announced their final offers to acquire the

entire issued and to be issued share capital of Just Eat.

The final offer by Takeaway.com (the "Final Takeaway.com

Offer")

Under the Final Takeaway.com Offer, Just Eat shareholders will

receive 0.12111 Takeaway.com shares for each Just Eat share and

will own approximately 57.5 per cent. of the share capital of the

combined group with Takeaway.com shareholders owning approximately

42.5 per cent. of the share capital of the combined group. This

offer is final and cannot be increased.

The Final Takeaway.com Offer represents:

-- an implied value for Just Eat of 916 pence per Just Eat share

based on Takeaway.com's closing share price of EUR88.90 on 18

December 2019, the last day prior to the announcement of the Final

Takeaway.com Offer;

-- based on this implied value, a premium of 44 per cent. to

Just Eat's closing share price on 26 July 2019 (being the last

business day before 26 July 2019, the date on which Takeaway.com

and Just Eat announced a possible all-share combination); and

-- an improvement of 25 per cent. over the value implied by the

terms of the all-share combination of Takeaway.com and Just Eat

announced on 5 August 2019.

The Board of Just Eat notes that Takeaway.com has announced that

it has now received valid acceptances of and further commitments to

accept the Final Takeaway.com Offer in respect of 314.641,871 Just

Eat shares, representing approximately 46.07 per cent. of the

existing issued and to be issued share capital of Just Eat.

Takeaway.com has also announced that it has reduced the level of

acceptances required to satisfy the Final Takeaway.com Offer to 50

per cent. plus one share of Just Eat shares.

The Final Takeaway.com Offer remains subject to the approval of

Takeaway.com shareholders. Takeaway.com has confirmed that the

required approval of Takeaway.com shareholders will be sought at

the extraordinary general meeting convened for Thursday, 9 January

2020. Just Eat has received irrevocable undertakings from

Takeaway.com Managing Directors and Gribhold, the personal holding

company of Jitse Groen, to vote in favour of all the relevant

resolutions in respect of 15,893,252 Takeaway.com shares,

representing approximately 25.97 per cent. of the ordinary issued

share capital of Takeaway.com.

The final offer by Prosus (the "Final Prosus Offer")

Under the Final Prosus Offer Just Eat shareholders will receive

800 pence per share in cash. This value represents:

-- a premium of 26 per cent. to Just Eat's closing share price

on 26 July 2019 (being the last business day before the date on

which Takeaway.com and Just Eat announced a possible all-share

combination); and

-- an increase of approximately 19 per cent. to the value of the

initial offer made by Prosus to the Board of Just Eat of 670 pence

per share.

The Prosus Final Offer is final and cannot be increased.

Recommendation of the Board of Just Eat

Just Eat is a leading, strategic asset in the food delivery

sector with attractive assets and prospects. As set out in its

circular to Just Eat shareholders on 25 November 2019, the Board of

Just Eat believes that Just Eat has:

-- leading market positions in a rapidly expanding sector with massive headroom;

-- built a unique hybrid model with world-class capabilities

which has delivered proven result; and

-- a clear winning strategy which it can accelerate through increased investment.

The Board of Just Eat continues to believe that the combination

of Just Eat with Takeaway.com:

-- represents an opportunity to create one of the leading online

food delivery companies in the world with scale, strategic vision,

industry-leading capabilities, leading positions in attractive

markets and a diversified geographic presence;

-- creates the second largest food delivery player globally and

the largest outside China and will be the market leader in 15 of

the 23 countries where it operates;

-- gives Just Eat Shareholders exposure to the Netherlands and

Germany, two high-quality markets which will further drive

profitability and financial strength;

-- provides access to a proven founder-led management team, led

by Jitse Groen, which has achieved significant success in our

sector; and

-- enhances the Just Eat business and provides Just Eat

shareholders with the opportunity to remain invested and benefit

from the future upside.

The Board of Just Eat recognises that the Prosus Final Offer

would provide immediate cash value to Just Eat shareholders.

Given the terms of the Final Takeaway.com Offer and the Final

Prosus Offer (together the "Final Offers"), the Board of Just Eat,

which has been so advised by Goldman Sachs, Oakley Advisory and UBS

as to the financial terms of the Final Offers, considers the terms

of the Final Offers to be fair and reasonable relative to the

standalone value of Just Eat. In providing their financial advice

to the Directors, Goldman Sachs, Oakley Advisory and UBS have taken

into account the Directors' commercial assessments.

Taking into account all of the above, the Board of Just Eat

continues to believe that the combination with Takeaway.com is

based on a compelling strategic rationale that allows shareholders

to participate in the upside potential of the enlarged group and,

based on the Board of Just Eat's own analysis, that the Final

Takeaway.com Offer will deliver greater value to Just Eat

shareholders than the Final Prosus Offer.

Accordingly, the Board of Just Eat unanimously believes that

Just Eat shareholders should accept the Final Takeaway.com Offer

and reject the Final Prosus Offer.

The Board of Just Eat unanimously recommends that Just Eat

shareholders take no action in relation to the Final Prosus Offer

and neither accept through CREST nor return any Prosus Form of

Acceptance.

Instead, the Board of Just Eat unanimously recommends that Just

Eat shareholders accept the Final Takeaway.com Offer, either

through CREST or by completing and returning your Takeaway.com Form

of Acceptance for the Takeaway.com Combination. The closing date

for the Final Takeaway.com Offer has been extended to 1.00 p.m. on

Friday, 10 January 2020.

The Directors who have beneficial holdings of Just Eat shares

have irrevocably undertaken to accept or procure acceptance of the

Takeaway.com Offer in respect of their beneficial holdings

totalling 660,486 Just Eat shares and share options (representing

approximately 0.10 per cent. of Just Eat's issued share capital on

18 December 2019).

If any Just Eat shareholder has accepted the Final Prosus Offer,

they should be aware that if the Final Prosus Offer has not become

or been declared unconditional as to acceptances by 1.00 p.m. on 1

January 2020 they can withdraw their acceptance of the Final Prosus

Offer.

Enquiries

Just Eat +44 (0) 20 3667 6948

Chris Dyett, Natalia Dyett, Investor Relations

Jo de Koning, Ellen Freeth, Corporate Communications

press@just-eat.com

Goldman Sachs International (Financial adviser and corporate

broker to Just Eat)

Anthony Gutman +44 (0) 20 7774 1000

Nick Harper

Clif Marriott

Duncan Stewart

Oakley Advisory (Financial adviser to Just Eat) +44 (0) 20 7766 6900

Christian Maher

Marc Jones

Max Gilbert

UBS (Financial adviser and corporate broker to Just Eat) +44 (0) 20 7567 8000

Rahul Luthra

Craig Calvert

Sandip Dhillon

Christian Lesueur

Brunswick Group LLP +44 (0) 20 7404 5959

Sarah West

David Litterick

James Baker

Linklaters are retained as legal advisers to Just Eat.

Further Information

Goldman Sachs International, which is authorised by the

Prudential Regulation Authority and regulated by the Financial

Conduct Authority and the Prudential Regulation Authority in the

United Kingdom, is acting exclusively for Just Eat and no one else

in connection with the matters referred to in this announcement and

will not be responsible to anyone other than Just Eat for providing

the protections afforded to clients of Goldman Sachs International,

or for providing advice in connection with the matters referred to

in this announcement.

Oakley Advisory, which is authorised and regulated by the

Financial Conduct Authority in the United Kingdom, is acting

exclusively for Just Eat and no one else in connection with the

matters referred to in this announcement and will not be

responsible to anyone other than Just Eat for providing the

protections afforded to clients of Oakley Advisory, or for

providing advice in connection with the matters referred to in this

announcement.

UBS AG London Branch ("UBS") is authorised and regulated by the

Financial Market Supervisory Authority in Switzerland. It is

authorised by the Prudential Regulation Authority and subject to

regulation by the Financial Conduct Authority and limited

regulation by the Prudential Regulation Authority in the United

Kingdom. UBS is acting as financial adviser to Just Eat and no one

else in connection with the matters set out in this Announcement.

In connection with such matters, UBS, its affiliates, and its or

their respective directors, officers, employees and agents will not

regard any person other than Just Eat as their client, nor will

they be responsible to any other person for providing the

protections afforded to their clients or for providing advice in

relation to the contents of this Announcement or any other matter

referred to herein.

Publication of this announcement

A copy of this announcement and the Response Circular will be

available, subject to certain restrictions relating to persons

located or resident in the Restricted Jurisdictions, on Just Eat's

website at www.justeatplc.com, by no later than 12 noon (London

time) on the business day following the date of this announcement.

The content of the websites referred to in this announcement is not

incorporated into and does not form part of this announcement.

Important notice

This announcement is not intended to, and does not, constitute,

represent or form part of any offer, invitation or solicitation of

an offer to purchase, otherwise acquire, subscribe for, sell or

otherwise dispose of, any securities whether pursuant to this

announcement or otherwise.

Overseas Shareholders

The release, publication or distribution of this announcement in

certain jurisdictions, including the United States, may be

restricted by law ("Restricted Jurisdictions"). Persons who are not

located or resident in the United Kingdom or who are subject to the

laws of other jurisdictions should inform themselves of, and

observe, any applicable requirements.

Unless otherwise determined by Takeaway.com or required by the

City Code, and permitted by applicable law and regulation, the

Takeaway.com Offer will not be made, directly or indirectly, in,

into or from the United States or any other Restricted Jurisdiction

where to do so would violate the laws of that jurisdiction, and the

Takeaway.com Offer will not be capable of acceptance from or within

the United States or any other Restricted Jurisdiction where to do

so would violate the laws of that jurisdiction. Accordingly, copies

of this announcement and all documents relating to the Takeaway.com

Offer are not being, and must not be, directly or indirectly,

mailed or otherwise forwarded, distributed or sent in, into or from

the United States or any other Restricted Jurisdiction where to do

so would violate the laws in that jurisdiction, and persons

receiving this announcement and all documents relating to the

Takeaway.com Offer (including custodians, nominees and trustees)

must not mail or otherwise distribute or send them in, into or from

such jurisdictions as doing so may invalidate any purported

acceptance of the Takeaway.com Offer.

The availability of the Takeaway.com Offer and the Prosus Offer

to Just Eat Shareholders who are not resident in the United Kingdom

may be affected by the laws of the relevant jurisdictions in which

they are resident. Persons who are not resident in the United

Kingdom should inform themselves of, and observe, any applicable

requirements.

This announcement is not an offer of securities for sale in the

United States. Securities may not be offered or sold in the United

States absent registration with the United States Securities and

Exchange Commission or an exemption from registration. There will

be no public offering of these securities in the United States.

Securities to be issued pursuant to the Takeaway.com Offer have

not been, and will not be, registered under the US Securities Act

of 1933, as amended (the "US Securities Act") and may not be

offered, sold or resold except in transactions exempt from, or not

subject to, the registration requirements of the US Securities Act.

Such securities will only be made available in the United States to

qualified institutional buyers (as defined in Rule 144A under the

US Securities Act) or accredited investors (as defined in Rule

501(a) under the US Securities Act) in transactions that are exempt

from the registration requirements of the US Securities Act. Such

shareholders will be required to make such acknowledgements and

representations to, and agreements with, Takeaway.com as

Takeaway.com may require to establish that they are entitled to

receive such securities. A person who receives securities pursuant

to the Takeaway.com Offer may not resell such securities without

registration under the US Securities Act or without an applicable

exemption from registration or in a transaction not subject to

registration (including a transaction that satisfies the applicable

requirements of Regulation S under the US Securities Act).

Securities to be issued pursuant to the Takeaway.com Offer have

not been, and will not be, registered or qualified under the

securities laws of any state or jurisdiction in the United States

and, accordingly, will only be issued to the extent that exemptions

from the registration or qualification requirements of state "blue

sky" securities laws are available or such registration or

qualification requirements have been complied with.

For purposes of the US Securities Exchange Act of 1934, as

amended (the "US Exchange Act"), it is intended that the

Takeaway.com Offer will be made pursuant to Section 14(e) and

Regulation 14E under the US Exchange Act benefitting from

exemptions available to "Tier II" tender offers. Accordingly, the

Takeaway.com Offer will be subject to disclosure and other

procedural requirements, including with respect to withdrawal

rights, offer timetable, settlement procedures and timing of

payments that may be different from those applicable under US

domestic tender offer procedures and law, and certain rules

applicable to tender offers made into the United States, including

rules promulgated under Section 14(d) of the US Exchange Act, do

not apply. In accordance with normal UK market practice and Rule

14e-5 under the US Exchange Act, Takeaway.com, certain affiliated

companies and its nominees, or its brokers (acting as agents) may

from time to time make certain purchases of, or arrangements to

purchase, Just Eat Shares, other than pursuant to the Takeaway.com

Offer, before or during the period in which the Takeaway.com Offer

remains open for acceptance. If such purchases or arrangements were

to be made they would be made outside the United States either in

the open market at prevailing prices or in private transactions at

negotiated prices and would comply with applicable law, including

the US Exchange Act. Any information about such purchases will be

disclosed as required in the United Kingdom.

The receipt of consideration by a US holder for the transfer of

its Just Eat Shares pursuant to the Takeaway.com Offer or the

Prosus Offer may be a taxable transaction for United States federal

income tax purposes and under applicable United States state and

local, as well as non-US and other, tax laws. Each Just Eat

Shareholder is urged to consult their independent professional

adviser immediately regarding the tax consequences of the

Takeaway.com Offer and Prosus Offer applicable to them, including

under applicable United States federal, state and local, as well as

non-US and other, tax laws.

Dealing Disclosure Requirements

Under Rule 8.3(a) of the Code, any person who is interested in

1% or more of any class of relevant securities of an offeree

company or of any securities exchange offeror (being any offeror

other than an offeror in respect of which it has been announced

that its offer is, or is likely to be, solely in cash) must make an

Opening Position Disclosure following the commencement of the offer

period and, if later, following the announcement in which any

securities exchange offeror is first identified. An Opening

Position Disclosure must contain details of the person's interests

and short positions in, and rights to subscribe for, any relevant

securities of each of (i) the offeree company and (ii) any

securities exchange offeror(s). An Opening Position Disclosure by a

person to whom Rule 8.3(a) applies must be made by no later than

3.30 pm (London time) on the 10th business day following the

commencement of the offer period and, if appropriate, by no later

than 3.30 pm (London time) on the 10th business day following the

announcement in which any securities exchange offeror is first

identified. Relevant persons who deal in the relevant securities of

the offeree company or of a securities exchange offeror prior to

the deadline for making an Opening Position Disclosure must instead

make a Dealing Disclosure.

Under Rule 8.3(b) of the Code, any person who is, or becomes,

interested in 1% or more of any class of relevant securities of the

offeree company or of any securities exchange offeror must make a

Dealing Disclosure if the person deals in any relevant securities

of the offeree company or of any securities exchange offeror. A

Dealing Disclosure must contain details of the dealing concerned

and of the person's interests and short positions in, and rights to

subscribe for, any relevant securities of each of (i) the offeree

company and (ii) any securities exchange offeror, save to the

extent that these details have previously been disclosed under Rule

8. A Dealing Disclosure by a person to whom Rule 8.3(b) applies

must be made by no later than 3.30 pm (London time) on the business

day following the date of the relevant dealing.

If two or more persons act together pursuant to an agreement or

understanding, whether formal or informal, to acquire or control an

interest in relevant securities of an offeree company or a

securities exchange offeror, they will be deemed to be a single

person for the purpose of Rule 8.3.

Opening Position Disclosures must also be made by the offeree

company and by any offeror and Dealing Disclosures must also be

made by the offeree company, by any offeror and by any persons

acting in concert with any of them (see Rules 8.1, 8.2 and

8.4).

Details of the offeree and offeror companies in respect of whose

relevant securities Opening Position Disclosures and Dealing

Disclosures must be made can be found in the Disclosure Table on

the Takeover Panel's website at www.thetakeoverpanel.org.uk,

including details of the number of relevant securities in issue,

when the offer period commenced and when any offeror was first

identified. You should contact the Takeover Panel's Market

Surveillance Unit on +44 (0)20 7638 0129 if you are in any doubt as

to whether you are required to make an Opening Position Disclosure

or a Dealing Disclosure.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

OUPLLFSIFALIFIA

(END) Dow Jones Newswires

December 20, 2019 06:10 ET (11:10 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

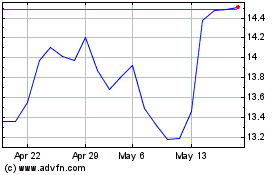

Just Eat Takeaway.com N.V (EU:TKWY)

Historical Stock Chart

From Nov 2024 to Dec 2024

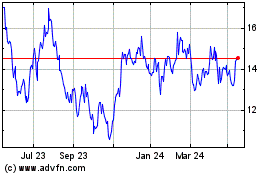

Just Eat Takeaway.com N.V (EU:TKWY)

Historical Stock Chart

From Dec 2023 to Dec 2024