Acer Therapeutics Inc. (Nasdaq: ACER), a pharmaceutical company

focused on the acquisition, development and commercialization of

therapies for serious, rare and life-threatening diseases with

significant unmet medical needs, today announced that Institutional

Shareholder Services Inc. (ISS) and Glass, Lewis & Co. LLC

(Glass Lewis) recommended that Acer shareholders vote "FOR" the

proposed merger with Zevra Therapeutics, Inc. and the related

proposals in the Company's proxy statement and prospectus for the

special meeting of its shareholders to be held on November 8, 2023

at 11:00 a.m. Eastern Time.

ISS and Glass Lewis are widely recognized as the leading

independent voting and corporate governance advisory firms. Their

analysis and recommendations are relied on by many major

institutional investment firms, mutual funds and fiduciaries

throughout North America.

In its report, ISS stated, among other things, that “The

transaction warrants support in light of the reasonably thorough

review of alternatives, the positive market reaction, the upside

potential provided by the stock and CVR forms of consideration, and

the downside risk of non-approval.”

Glass Lewis concluded that the transaction would allow Acer

shareholders to participate in a larger and better capitalized

pharmaceutical company, while also retaining significant upside

potential through the CVR consideration, at a time when Acer

appears to have few, if any, viable alternatives. Glass Lewis also

noted that the total implied value of the proposed consideration

represents a substantial premium to the unaffected trading price of

Acer shares and the merger consideration compares favorably with

the expected outcome in a liquidation scenario, in which Acer

shareholders were not expected to receive any proceeds.

Commenting on the proxy advisors’ reports, Chris Schelling, CEO

and Founder of Acer, said: "The ISS and Glass Lewis recommendations

are consistent with our view that the merger with Zevra is in the

best interest of Acer shareholders."

The merger and related agreements have been unanimously approved

by the boards of directors of both companies. The merger and

related proposals have been unanimously approved by Acer’s board of

directors.

Failure to vote or an abstention from voting will have the same

effect as a vote "AGAINST" the merger proposal. All shareholders

are asked to vote "FOR" all proposals as soon as possible.

THE MERGER WILL NOT GO FORWARD UNLESS THE

MERGER AND RELATED PROPOSALS ARE APPROVED.

ACER SHAREHOLDERS – PLEASE VOTE

TODAY!

If the merger is not approved on November 8, ACER will begin

trading on OTC Pink Market starting on November 9 because of the

failure by the Company to regain compliance, during the previously

granted 180 calendar day grace period, with Nasdaq’s requirement of

having at least $35 million in market value of listed securities,

resulting in the trading suspension of ACER on Nasdaq.

If the merger is not subsequently consummated, Acer will not be

able to fund its business operations and will likely be forced to

terminate operations, liquidate or file for bankruptcy.

If you are an Acer shareholder and you have questions or require

assistance in submitting your proxy or voting your shares, please

contact Acer’s proxy solicitor:

ADVANTAGE PROXY, INC.Toll Free: 1-877-870-8565Collect:

1-206-870-8565Email: ksmith@advantageproxy.com

Additional Information about the Proposed Merger between

Acer and Zevra, the Special Meeting and Where to Find ItIn

connection with the proposed merger, Zevra has filed a registration

statement on Form S-4 with the Securities and Exchange Commission

(the "SEC"), including a proxy statement / prospectus. The

registration statement was declared effective on October 10, 2023.

Additionally, Acer’s proxy statement was filed on October 10, 2023.

Acer shareholders are urged to read these materials because they

contain important information about Acer, Zevra and the proposed

merger. The proxy statement / prospectus and other relevant

materials, and any other documents filed by Zevra and Acer with the

SEC, may be obtained free of charge at the SEC website at

www.sec.gov. In addition, Acer shareholders will be able to attend

the Acer special meeting via the Internet at

https://www.cstproxy.com/acertx/sm2023 and view the Acer 2023

Special Meeting Proxy Statement and the Zevra Therapeutics, Inc.

Forms 10-K, 10-Qs and 8-Ks. Acer shareholders are urged to read the

proxy statement / prospectus and the other relevant materials

before making any voting or investment decision with respect to the

proposed merger.

No Offer or SolicitationThis communication is

for informational purposes only and not intended to and does not

constitute an offer to subscribe for, buy or sell, the solicitation

of an offer to subscribe for, buy or sell or an invitation to

subscribe for, buy or sell any securities or the solicitation of

any vote or approval in any jurisdiction pursuant to or in

connection with the proposed transaction or otherwise, nor shall

there be any sale, issuance or transfer of securities in any

jurisdiction in contravention of applicable law. No offer of

securities shall be made except by means of a prospectus meeting

the requirements of Section 10 of the Securities Act of 1933, as

amended (the “Securities Act”), and otherwise in accordance with

applicable law.

Participants in the SolicitationAcer, Zevra and

their respective directors and executive officers may be considered

participants in the solicitation of proxies in connection with the

proposed transaction. Information about the directors and executive

officers of Acer is set forth in its Annual Report on

Form 10-K for the year ended December 31, 2022, which was

filed with the SEC on March 27, 2023, and its proxy statement for

its 2023 annual meeting of shareholders, which was filed with the

SEC on April 14, 2023. Information about the directors and

executive officers of Zevra is set forth in its Annual Report on

Form 10-K for the year ended December 31, 2022, which was

filed with the SEC on March 7, 2023, and its proxy statement for

its 2023 annual meeting of stockholders, which was filed with the

SEC on March 15, 2023, the definitive proxy statement filed by

Daniel J. Mangless, together with the other participants named

therein, which was filed with the SEC on March 17, 2023, and

Zevra’s Current Reports on Form 8-K, filed with the SEC on March

30, 2023, May 8, 2023, May 15, 2023, and August 7, 2023. Other

information regarding the participants in the proxy solicitations

and a description of their direct and indirect interests, by

security holdings or otherwise, is set forth in the proxy

statement/prospectus and other relevant materials filed with the

SEC and may be obtained free of charge from the sources indicated

above.

About Acer TherapeuticsAcer is a pharmaceutical

company focused on the acquisition, development and

commercialization of therapies for serious rare and

life-threatening diseases with significant unmet medical needs. In

the U.S., OLPRUVA® (sodium phenylbutyrate) is approved for the

treatment of UCDs involving deficiencies of CPS, OTC, or AS. Acer

is also advancing a pipeline of investigational product candidates

for rare and life-threatening diseases, including: OLPRUVA® (sodium

phenylbutyrate) for treatment of various disorders, including Maple

Syrup Urine Disease (MSUD); and EDSIVO™ (celiprolol) for treatment

of vascular Ehlers-Danlos syndrome (vEDS) in patients with a

confirmed type III collagen (COL3A1) mutation. For more

information, visit www.acertx.com.

Forward-Looking StatementsDISCLOSURE NOTICE:

This press release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act and Section 21E of the

Securities Exchange Act of 1934, as amended, related to Acer, Zevra

and the proposed acquisition of Acer by Zevra. All statements other

than statements of historical fact are forward-looking statements

for purposes of federal and state securities laws. These

forward-looking statements involve uncertainties that could

significantly affect the financial or operating results of Acer,

Zevra or the combined company. These forward-looking statements may

be identified by terms such as anticipate, believe, foresee,

expect, intend, plan, may, will, could, should and would and the

negative of these terms or other similar expressions.

Forward-looking statements in this document include, among other

things, statements about the potential benefits of the proposed

acquisition; statements about contingent cash consideration and

related milestones as contemplated by the CVR Agreement; the

anticipated timing of closing of the acquisition; the delisting of

Acer’s stock from Nasdaq and resulting move to OTC Pink Market; and

that, if the merger is not subsequently consummated, Acer will not

be able to fund its business operations and will likely be forced

to terminate operations, liquidate or file for bankruptcy. These

forward-looking statements involve substantial risks and

uncertainties that could cause actual results to differ materially

from those expressed or implied by such statements. Risks and

uncertainties include, among other things, risks related to the

satisfaction of the conditions to closing the acquisition

(including the failure to obtain necessary stockholder approval) in

the anticipated timeframe or at all; risks related to the ability

to realize the anticipated benefits of the acquisition, including

the possibility that the expected benefits from the proposed

acquisition will not be realized or will not be realized within the

expected time period; risks related to the contingent cash

consideration and related milestones as contemplated by the CVR

Agreement, including that such milestone may not be achieved and

thus the related cash consideration would not become payable; the

risk that the businesses will not be integrated successfully;

disruption from the transaction making it more difficult to

maintain business, contractual and operational relationships; the

unfavorable outcome of the legal proceedings that have been or may

be instituted against Acer, Zevra or the combined company; the

ability to retain key personnel; negative effects of this

announcement or the consummation of the proposed acquisition on the

market price of the capital stock of Acer and Zevra and on Acer’s

and Zevra’s operating results; risks relating to the value of

Zevra’s shares to be issued in the transaction; significant

transaction costs, fees, expenses and charges; unknown liabilities;

the risk of litigation and/or regulatory actions related to the

proposed acquisition; the financing of the transaction and Acer’s

interim operations; the occurrence of any event, change or other

circumstances that could give rise to the termination of the merger

agreement; other business effects, including the effects of

industry, market, economic, political or regulatory conditions;

future exchange and interest rates; changes in tax and other laws,

regulations, rates and policies; future business combinations or

disposals; and competitive developments.

A further description of risks and uncertainties relating to

Acer and Zevra can be found in their respective most recent Annual

Reports on Form 10-K, Quarterly Reports on

Form 10-Q and Current Reports on Form 8-K, all

of which are filed with the SEC and available at www.sec.gov.

Neither Acer nor Zevra intends to update the forward-looking

statements contained in this document as the result of new

information or future events or developments, except as required by

law.

Corporate ContactHarry PalminChief Financial

OfficerAcer Therapeutics

Inc.investors@acertx.com+1-844-902-6100

Acer Therapeutics (NASDAQ:ACER)

Historical Stock Chart

From Jan 2025 to Feb 2025

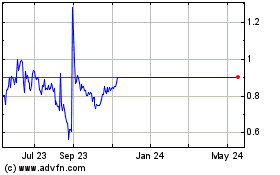

Acer Therapeutics (NASDAQ:ACER)

Historical Stock Chart

From Feb 2024 to Feb 2025