Adamis Pharmaceuticals Corporation (NASDAQ: ADMP), a

commercial-stage biopharmaceutical company, today announced the

closing of its merger with DMK Pharmaceuticals Corporation.

The combined, publicly traded company will focus its efforts on

increasing sales of Adamis’ commercial products and advancing DMK’s

lead clinical stage compound, DPI-125, which is being studied as a

potential novel treatment for opioid use disorder (OUD). The common

stock of Adamis will continue to trade on the Nasdaq Capital Market

under the ticker symbol “ADMP”.

At the close of the merger, Ebrahim Versi, CEO of DMK, was named

CEO of Adamis and Chairman of the Board of Directors. Dr. Versi

stated, “We are very excited about this merger, as I believe that

the combined company will make a significant contribution to saving

and improving the lives of people suffering from opioid use

disorder. Too many lives are cut far too short and families are

devastated by this disease and we need to act urgently to reverse

this epidemic. ZIMHI, I believe, is the most effective naloxone

medicine to reverse fentanyl overdoses and my goal will be to make

this our flagship product and to build on that with our novel

first-in-class compound, DPI-125. Not only does it have the

potential to treat patients with opioid use disorder but also, I

believe, to prevent it when used as a potent analgesic, thus

obviating the need for use of opiates. The global opioid market in

2021 was reported as being greater than $22 billion. Given the

differentiated profiles of these agents, along with our large

portfolio of novel compounds, I see a bright future for the

company.”

Preceding the closing of the merger, on May 22, 2023, Adamis

effected a 1-for-70 reverse stock split of all of its issued and

outstanding shares of common stock. All outstanding options,

restricted stock unit awards, and warrants were proportionately

adjusted, pursuant to their respective terms. Pursuant to the terms

of the merger transaction, Adamis issued shares of common stock and

Series E Convertible Preferred Stock to the former shareholders of

DMK. Upon completion of the merger, taking into consideration the

reverse stock split, Adamis has approximately 2,662,632 shares of

common stock outstanding, excluding options, RSUs, warrants and

convertible securities.

Management and Organization

In connection with the merger, Dr. Versi assumed the role of CEO

and Chairman of the Board, and David J. Marguglio, previously Chief

Executive Officer of Adamis, will assume the role of President and

Chief Operating Officer of the combined company. Dr. Versi and DMK

board member Jannine Versi, have been appointed to the Board and

join the pre-merger Adamis directors Howard C. Birndorf, Meera J.

Desai, PhD, and Vickie Reed as the new Board of the combined

company. Adamis Chairman, Richard C. Williams, and Mr. Marguglio

resigned their prior director roles in connection with the closing

of the merger.

About Adamis Pharmaceuticals

Prior to the merger, Adamis Pharmaceuticals Corporation was a

specialty biopharmaceutical company primarily focused on developing

and commercializing products in various therapeutic areas,

including opioid overdose and allergy. Adamis’ products approved by

the FDA include ZIMHI® (naloxone) Injection for the treatment

of opioid overdose, and SYMJEPI® (epinephrine) Injection for

use in the emergency treatment of acute allergic reactions,

including anaphylaxis. As a result of the merger with DMK

Pharmaceuticals, the Company is now also focused on developing

novel therapies for opioid use disorder (OUD) and other important

neuro-based conditions where patients are currently underserved.

The Company believes that DMK’s technology is at the forefront of

endorphin-inspired drug design with its mono, bi- and

tri-functional small molecules that simultaneously modulate

critical networks in the nervous system. DMK has a library of

approximately 750 small molecule neuropeptide analogues and a

differentiated pipeline that could address unmet medical needs by

taking the novel approach to integrate with the body’s own efforts

to regain balance of disrupted physiology. DMK’s lead clinical

stage product candidate, DPI-125, is being studied as a potential

novel treatment for OUD. The Company also plans to develop the

compound for the treatment of moderate to severe pain. DMK’s other

development stage product candidates include DPI-221 for bladder

control problems and DPI-289 for severe end stage Parkinson’s

disease. For additional information about Adamis Pharmaceuticals,

please visit our website and follow us on Twitter and

LinkedIn.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Forward-looking statements are identified by terminology such

as “may,” “should,” “expects,” “plans,” “anticipates,” “could,”

“intends,” “target,” “projects,” “contemplates,” “believes,”

“estimates,” “predicts,” “potential” or “continue” or the negative

of these terms or other similar words. Such forward-looking

statements include those that express plans, anticipation, intent,

contingencies, goals, targets or future development and/or

otherwise are not statements of historical fact. These statements

relate to future events or future results of operations, including,

but not limited to statements concerning the following matters: (i)

the outcome of any current legal proceedings or future legal

proceedings that may be instituted against the parties or others,

including proceedings related to the merger transaction with DMK;

(ii) whether the combined business of DMK and Adamis will be

successful; (iii) whether any DMK product candidates will be

successfully developed or commercialized; (iv) the Company’s

ability to raise capital to continue as a going concern; and (v)

those risks detailed in Adamis’ most recent Annual Report on Form

10-K and subsequent reports filed with the Securities and Exchange

Commission (“SEC”), as well as other documents that may be filed by

Adamis from time to time with the SEC. These statements are only

predictions and involve known and unknown risks, uncertainties, and

other factors, which may cause Adamis’ actual results to be

materially different from the results anticipated by such

forward-looking statements. Accordingly, you should not rely upon

forward-looking statements as predictions of future events. Adamis

cannot assure you that the events and circumstances reflected in

the forward-looking statements will be achieved or occur, and

actual results could differ materially from those projected in the

forward-looking statements. Factors that could cause actual results

to differ materially from management’s current expectations include

those risks and uncertainties relating to: our ability to maintain

the continued listing of the common stock on the Nasdaq Capital

Market, including without limitation regaining compliance with the

Nasdaq $1.00 minimum bid price requirements and the $35 million

market value of listed securities requirement; our cash flow, cash

burn, expenses, obligations and liabilities; the outcomes of any

litigation, regulatory proceedings, inquiries or investigations

that we are or may become subject to; and other important factors

discussed in the Company’s filings with the SEC. If we do not

obtain required additional equity or debt funding in the near term,

our cash resources will be depleted and we could be required to

materially reduce or suspend operations, which would likely have a

material adverse effect on our business, stock price and our

relationships with third parties with whom we have business

relationships, at least until additional funding is obtained. If we

do not have sufficient funds to continue operations or satisfy out

liabilities, we could be required to seek bankruptcy protection or

other alternatives to attempt to resolve our obligations and

liabilities that could result in our stockholders losing most or

all of their investment in us. You should not place undue reliance

on any forward-looking statements. Further, any forward-looking

statement speaks only as of the date on which it is made, and

except as may be required by applicable law, we undertake no

obligation to update or release publicly the results of any

revisions to these forward-looking statements or to reflect events

or circumstances arising after the date of this press release.

Certain of these risks and additional risks, uncertainties, and

other factors are described in greater detail in Adamis’ filings

from time to time with the SEC, including its annual report on Form

10-K for the year ended December 31, 2022, and subsequent filings

with the SEC, which Adamis strongly urges you to read and consider,

all of which are available free of charge on the SEC’s website at

http://www.sec.gov.

Contact:Adamis Investor RelationsRobert UhlManaging DirectorICR

Westwicke619.228.5886

Adamis Pharmaceuticals (NASDAQ:ADMP)

Historical Stock Chart

From Dec 2024 to Jan 2025

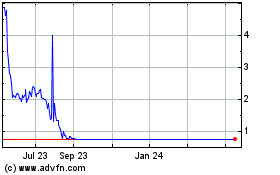

Adamis Pharmaceuticals (NASDAQ:ADMP)

Historical Stock Chart

From Jan 2024 to Jan 2025