Akero Therapeutics Reports First Quarter 2023 Financial Results and Provides Business Update

May 15 2023 - 6:00AM

Akero Therapeutics, Inc. (Nasdaq: AKRO), a clinical-stage

company developing transformational treatments for patients with

serious metabolic diseases marked by high unmet medical need, today

reported first quarter financial results for the period ending

March 31, 2023. In addition, after close of the first quarter, the

company raised $124.2 million in net proceeds through an

At-the-Market (ATM) facility, which strengthens the company’s cash

position as it prepares to initiate the Phase 3 SYNCHRONY Histology

and SYNCHRONY Real-World studies of Efruxifermin (EFX) in NASH.

“We’re pleased to continue the strong momentum from 2022 into

the first quarter of this year, with a positive end-of-Phase 2

meeting with the FDA and additional capital from our ATM facility

that bolsters our financial position as we prepare to initiate

Phase 3 SYNCHRONY studies later this year,” said Andrew Cheng,

M.D., Ph.D., president and chief executive officer of Akero. “The

remainder of 2023 looks promising for both Akero and the NASH

community, and we look forward to reporting results from Cohort D

and the main SYMMETRY study and beginning enrollment in SYNCHRONY

Histology and SYNCHRONY Real-World.”

Phase 3 SYNCHRONY Program

- SYNCHRONY Histology

and SYNCHRONY Real-World studies remain on track to begin

enrollment in the second half of this year.

- SYNCHRONY Histology

will evaluate the efficacy of 28mg and 50mg doses of EFX in

patients with biopsy confirmed pre-cirrhotic NASH, fibrosis stage 2

or 3 (F2-F3). The primary endpoint will be ≥ 1-stage fibrosis

improvement AND resolution of NASH.

- SYNCHRONY Real-World

will assess safety and tolerability of EFX in patients with

non-invasively diagnosed NASH or NAFLD. Key secondary endpoints are

to include change in biomarkers of fibrosis and other established

non-invasive endpoints.

Phase 2b SYMMETRY Study Update

- Akero remains on

track to report Week 36 results of the Phase 2b SYMMETRY main study

in adult patients with cirrhotic NASH (F4, compensated) in the

fourth quarter of 2023.

- Akero remains on track to report results of Cohort D in the

second quarter of 2023. This is an expansion cohort of the Phase 2b

SYMMETRY evaluating safety and tolerability of EFX compared to

placebo, when dosed for 12 weeks on top of an existing GLP-1

receptor agonist in patients with pre-cirrhotic NASH (F1-F3

fibrosis) and Type 2 diabetes.

First Quarter 2023 Financial Results

- Akero's cash, cash

equivalents and short-term marketable securities for the period

ended March 31, 2023 were $343.2 million.

- Research and

development expenses for the three-month period ended March 31,

2023 were $21.8 million, compared to $20.5 million for the

comparable period in 2022. The increase is attributable to a $1.6

million increase in personnel and other R&D expenses, offset by

a $0.3 million decrease in direct EFX program costs largely related

to CRO expenses for our ongoing HARMONY and SYMMETRY studies.

- General and

administrative expenses for the three-month period ended March 31,

2023 were $7.0 million, compared to $5.5 million for the comparable

period in 2022. The increase is attributable to higher expenses for

personnel, including non-cash stock-based compensation, and

professional services and other costs associated with operating as

a public company.

- Total operating

expenses were $28.8 million for the three-month period ended March

31, 2023, compared to $26.1 million for the comparable period in

2022.

Additional Post-First Quarter Financial

Update

- From April 4 through May 11, 2023, Akero raised $124.2 million

in net proceeds through the sale of 3,006,052 shares of common

stock under its ATM facility at an average price of $42.38 per

share.

- Akero believes that

its current cash, cash equivalents and short-term marketable

securities will be sufficient to fund its current operating plan

into 2025.

About NASHNon-alcoholic steatohepatitis (NASH)

is a serious, life-threatening disease that has rapidly emerged as

a leading cause of liver failure in the world and is the leading

indication for liver transplant among women. An estimated 17.3

million Americans had NASH (fibrosis stages 1-4) in 2016, a number

that is predicted to increase to 27.0 million by 2030. NASH is a

severe form of nonalcoholic fatty liver disease (NAFLD)

characterized by hepatocyte injury, liver inflammation, and

fibrosis that can progress to scarring (cirrhosis), liver failure,

cancer and death. There are currently no approved therapies for the

disease.

About Akero TherapeuticsAkero Therapeutics is a

clinical-stage company developing transformational treatments for

patients with serious metabolic diseases marked by high unmet

medical need, including non-alcoholic steatohepatitis (NASH), a

disease without any approved therapies. Akero's lead product

candidate, efruxifermin (EFX), is a differentiated bivalent

Fc-FGF21 fusion protein that has been engineered to mimic the

balanced biological activity profile of native FGF21, an endogenous

hormone that alleviates cellular stress and regulates metabolism

throughout the body. EFX is designed to offer convenient

once-weekly subcutaneous dosing. The consistency and magnitude of

observed effects position EFX to be a potentially best-in-class

medicine, if approved, for treatment of NASH. EFX is currently

being evaluated in two Phase 2b clinical trials: the HARMONY study

in patients with pre-cirrhotic NASH (F2-F3 fibrosis), and the

SYMMETRY study in patients with cirrhotic NASH (F4 fibrosis,

compensated). EFX is also being evaluated in an expansion cohort of

the SYMMETRY study, comparing the safety and tolerability of EFX to

placebo when added to an existing GLP-1 receptor agonist in

patients with pre-cirrhotic NASH (F1-F3 fibrosis) and Type 2

diabetes. Akero is headquartered in South San Francisco.

Visit akerotx.com and follow us

on LinkedIn and Twitter for more

information.

Forward Looking StatementsStatements contained

in this press release regarding matters that are not historical

facts are "forward-looking statements" within the meaning of the

Private Securities Litigation Reform Act of 1995. Because such

statements are subject to risks and uncertainties, actual results

may differ materially from those expressed or implied by such

forward-looking statements, including, but not limited to,

statements regarding: Akero’s business plans and objectives,

including future plans or expectations for EFX; the therapeutic

effects and potential benefits of EFX, as well as the dosing,

safety and tolerability of EFX; the SYNCHRONY Phase 3 program,

including the SYNCHRONY Histology and SYNCHRONY Real-World studies

and design of trials and expected timing thereof; upcoming

milestones, including the results, and expected timing to report

such results of Cohort D and the Phase 2b SYMMETRY study; and

Akero’s growth as a company and expectations regarding its uses of

capital, expenses, usage of its ATM program and financial results,

including the expected cash runway. Any forward-looking statements

in this press release are based on management's current

expectations of future events and are subject to a number of risks

and uncertainties that could cause actual results to differ

materially and adversely from those set forth in or implied by such

forward-looking statements. Risks that contribute to the uncertain

nature of the forward-looking statements include: risks related to

the impact of COVID-19 on Akero’s ongoing and future operations,

including potential negative impacts on Akero’s employees,

third-parties, manufacturers, supply chain and production as well

as on global economies and financial markets; the success, cost,

and timing of Akero’s product candidate development activities and

planned clinical trials; Akero’s ability to execute on its

strategy; positive results from a clinical study may not

necessarily be predictive of the results of future or ongoing

clinical studies; regulatory developments in the United States and

foreign countries; Akero’s ability to fund operations; as well as

those risks and uncertainties set forth more fully under the

caption "Risk Factors" in Akero’s most recent Annual Report on Form

10-K and Quarterly Report on Form 10-Q, as filed with the

Securities and Exchange Commission (SEC) as well as discussions of

potential risks, uncertainties and other important factors in

Akero’s other filings and reports with the SEC. All forward-looking

statements contained in this press release speak only as of the

date on which they were made. Akero undertakes no obligation to

update such statements to reflect events that occur or

circumstances that exist after the date on which they were

made.

Investor Contact:Austin

Murtagh212.698.8696IR@akerotx.com

Media Contact:Sarah

O’Connell732.456.0092soconnell@vergescientific.com

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Akero Therapeutics, Inc. |

|

|

Condensed Consolidated Balance Sheets |

|

|

(Unaudited) |

|

|

(In thousands) |

|

| |

|

|

|

|

|

|

|

| |

|

March 31, 2023 |

|

December 31, 2022 |

|

|

Assets |

|

|

|

|

|

|

|

|

Cash, cash equivalents and short-term marketable securities |

|

$ |

343,222 |

|

|

$ |

351,449 |

|

|

|

Other current assets |

|

|

4,267 |

|

|

|

3,724 |

|

|

|

Non-current assets |

|

|

1,329 |

|

|

|

1,397 |

|

|

|

Total assets |

|

$ |

348,818 |

|

|

$ |

356,570 |

|

|

| |

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

Current liabilities |

|

$ |

16,678 |

|

|

$ |

19,083 |

|

|

|

Non-current liabilities |

|

|

25,795 |

|

|

|

10,925 |

|

|

|

Stockholders’ equity |

|

|

306,345 |

|

|

|

326,562 |

|

|

|

Total liabilities and stockholders’ equity |

|

$ |

348,818 |

|

|

$ |

356,570 |

|

|

| |

|

|

|

|

|

|

|

|

Akero Therapeutics, Inc. |

|

|

Condensed Consolidated Statements of Operations and Comprehensive

Loss |

|

|

(Unaudited) |

|

|

(In thousands, except share and per share amounts) |

|

| |

|

|

|

|

|

|

|

| |

|

Three Months Ended March 31, |

|

| |

|

2023 |

|

|

2022 |

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

Research and development |

|

$ |

21,787 |

|

|

$ |

20,514 |

|

|

|

General and administrative |

|

|

6,966 |

|

|

|

5,537 |

|

|

|

Total operating expenses |

|

|

28,753 |

|

|

|

26,051 |

|

|

|

Loss from operations |

|

|

(28,753 |

) |

|

|

(26,051 |

) |

|

|

Interest expense |

|

|

(457 |

) |

|

|

- |

|

|

|

Other income, net |

|

|

3,379 |

|

|

|

22 |

|

|

|

Net loss |

|

$ |

(25,831 |

) |

|

$ |

(26,029 |

) |

|

|

Comprehensive loss |

|

$ |

(25,847 |

) |

|

$ |

(26,032 |

) |

|

|

Net loss per common share, basic and diluted |

|

$ |

(0.55 |

) |

|

$ |

(0.74 |

) |

|

|

Weighted-average number of shares used in computing net loss per

common share, basic and diluted |

|

|

46,944,059 |

|

|

|

35,005,501 |

|

|

| |

|

|

|

|

|

|

|

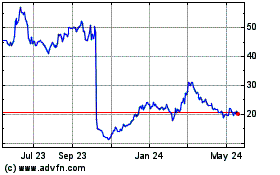

Akero Therapeutics (NASDAQ:AKRO)

Historical Stock Chart

From Oct 2024 to Nov 2024

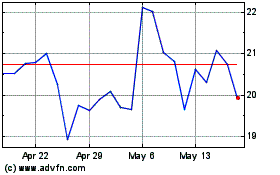

Akero Therapeutics (NASDAQ:AKRO)

Historical Stock Chart

From Nov 2023 to Nov 2024