Form 8-K - Current report

September 08 2023 - 3:57PM

Edgar (US Regulatory)

0000896262

false

0000896262

2023-09-08

2023-09-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section

13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 8, 2023

Commission

File Number: 0-24260

Amedisys,

Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

11-3131700 |

(State

or other jurisdiction

of incorporation) |

(IRS Employer

Identification No.) |

3854

American Way, Suite A, Baton Rouge, LA 70816

(Address and zip code

of principal executive offices)

(225)

292-2031 or (800) 467-2662

(Registrant's telephone number, including area code)

Not

Applicable

(Former name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ¨ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange

on Which Registered |

| Common Stock. $0.001 par value per share |

|

AMED |

|

The

Nasdaq Global Select Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

SECTION 5

— CORPORATE GOVERNANCE AND MANAGEMENT

| Item 5.07 | Submission of Matters to a Vote of Security Holders. |

The

Company held a special meeting of its stockholders on September 8, 2023 (the “Special Meeting”) to vote on the

proposals identified in the Company’s definitive proxy statement on Schedule 14A, filed with the U.S. Securities and Exchange Commission

on August 10, 2023 (the “Definitive Proxy Statement”), which was first mailed to the Company’s stockholders on

or about August 10, 2023. The Definitive Proxy Statement was filed in connection with the previously announced Agreement and Plan

of Merger, dated June 26, 2023 (the “Merger Agreement”), by and among UnitedHealth Group Incorporated (“Parent”),

Aurora Holdings Merger Sub Inc., a wholly owned subsidiary of Parent (“Merger Sub”), and Amedisys, Inc. (the “Company”),

pursuant to which Merger Sub will merge with and into the Company (the “Merger”) upon the terms and subject to the conditions

set forth in the Merger Agreement, with the Company surviving the Merger as a wholly owned subsidiary of Parent.

As of the close of business

on August 4, 2023, the record date for the Special Meeting, there were 32,632,961 shares of the Company’s common stock issued

and outstanding and entitled to vote at the Special Meeting. Stockholders entitled to cast 77.12% of all the votes entitled to be cast

at the Special Meeting were present in person or represented by proxy at the Special Meeting. Each of the two proposals voted on was approved

by the requisite vote of the Company’s stockholders. A brief description of and tabulation of votes for each proposal are set forth

below.

| |

1. |

The Company’s stockholders approved the adoption of the Merger Agreement. |

| Votes For | | |

Votes Against | | |

Votes Abstained | |

| 25,069,466 | | |

30,082 | | |

67,374 | |

| |

2. |

The Company’s stockholders approved, on a non-binding, advisory basis, the compensation that may be paid or become payable to the Company’s named executive officers in connection with the Merger. |

| Votes For | | |

Votes Against | | |

Votes Abstained | |

| 23,746,599 | | |

1,340,582 | | |

79,741 | |

In light of the approval of Proposal 1, Proposal

3 in the Company’s definitive proxy statement filed with the United States Securities and Exchange Commission on August 10,

2023, to adjourn the Special Meeting if necessary to solicit additional proxies, was rendered moot and was not voted on at the Special

Meeting.

Cautionary Statement Regarding Forward-Looking

Statements

This communication may

contain “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation

Reform Act of 1995. Forward-looking statements can be identified by words such as: “anticipate,” “intend,” “plan,”

“believe,” “project,” “estimate,” “expect,” “may,” “should,” “will”

and similar references to future periods. Examples of forward-looking statements include projections as to the anticipated benefits of

the proposed transaction as well as statements regarding the impact of the proposed transaction on Parent’s and the Company’s

business and future financial and operating results, the amount and timing of synergies from the proposed transaction and the closing

date for the proposed transaction.

Forward-looking statements

are neither historical facts nor assurances of future performance. Instead, they are based only on management’s current beliefs,

expectations and assumptions regarding the future of the Company’s business, future plans and strategies, projections, anticipated

events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject

to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the Company’s

control. The Company’s actual results and financial condition may differ materially from those indicated in the forward-looking

statements as a result of various factors. These factors include, among other things, (1) the termination of or occurrence of any

event, change or other circumstances that could give rise to the termination of the Merger Agreement or the inability to complete the

proposed transaction on the anticipated terms and timetable, (2) the inability to complete the proposed transaction due to the failure

to satisfy all of the conditions to closing in a timely manner or at all, or the risk that a regulatory approval that may be required

for the proposed transaction is delayed, is not obtained or is obtained subject to conditions that are not anticipated, (3) the effect

of the pendency of the proposed transaction on the Company’s ability to maintain relationships with its patients, payers and providers

and retain its management and key employees, (4) costs related to the proposed transaction, and (5) the diversion of management’s

time and attention from ordinary course business operations to completion of the proposed transaction and integration matters. The foregoing

review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements

that are included elsewhere. Additional information concerning risks, uncertainties and assumptions can be found in Parent’s and

the Company’s respective filings with the SEC, including the risk factors discussed in the Company’s most recent Annual Report

on Form 10-K, as updated by its Quarterly Reports on Form 10-Q and future filings with the SEC.

Any

forward-looking statement made in this communication is based only on information currently available to the Company and speaks only as

of the date on which it is made. The Company undertakes no obligation to publicly update any forward-looking statement, whether written

or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise. You are cautioned

not to rely on the Company’s forward-looking statements.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

AMEDISYS, INC. |

| |

|

| |

By: |

/s/ Richard Ashworth |

| |

|

Name: Richard Ashworth |

| |

|

Title: President and Chief Executive Officer |

| |

|

|

| |

|

DATE: September 8, 2023 |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

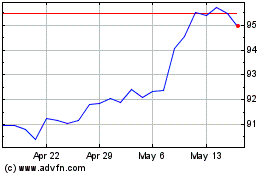

Amedisys (NASDAQ:AMED)

Historical Stock Chart

From Apr 2024 to May 2024

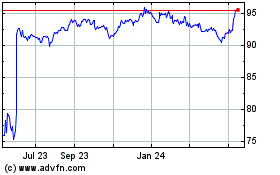

Amedisys (NASDAQ:AMED)

Historical Stock Chart

From May 2023 to May 2024