false

0001083446

0001083446

2023-11-06

2023-11-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington,

DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

November 6, 2023

APOLLO

MEDICAL HOLDINGS, INC.

(Exact Name of Registrant as Specified in its

Charter)

| Delaware |

001-37392 |

95-4472349 |

| (State or Other Jurisdiction |

(Commission |

(I.R.S. Employer |

| of Incorporation) |

File Number) |

Identification No.) |

1668

S. Garfield Avenue, 2nd

Floor, Alhambra,

California

91801

(Address of Principal Executive Offices) (Zip

Code)

(626)

282-0288

Registrant’s Telephone Number, Including

Area Code

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

¨ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common

Stock |

AMEH |

The

Nasdaq

Stock Market LLC |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 | Entry into a Material Definitive Agreement. |

On November

6, 2023, Apollo Medical Holdings, Inc. (the “Company”) entered into a stock repurchase agreement with Allied Physicians of

California, a Professional Medical Corporation (“APC”), pursuant to which the Company agreed to repurchase approximately

$100 million of the Company’s common stock from APC. APC is

a consolidated affiliate of the Company of which Dr. Thomas Lam, the Company’s Co-Chief Executive Officer and President and a director,

is the Chief Executive Officer and Chief Financial Officer and a director and stockholder; Dr. Kenneth Sim, the Company’s Executive

Chairman, is Chairman and a director and stockholder; and Dr. Albert Young, the Company’s Chief Administrative Officer, is Senor

Executive Vice President and a stockholder. The Company’s Board of Directors and the Audit Committee of the Board of Directors

approved the proposed repurchase.

The above description of the stock repurchase agreement does not purport

to be complete and is subject to, and qualified in its entirety by, the full text of such agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

* Certain of the exhibits and schedules to this exhibit have been

omitted in accordance with Item 601(a)(5) of Regulation S-K. The Company agrees to furnish a copy of all omitted exhibits and schedules

to the Securities and Exchange Commission upon its request.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

APOLLO

MEDICAL HOLDINGS, INC. |

| |

|

| Date:

November 7, 2023 |

By:

|

/s/

Thomas S. Lam |

| |

Name: |

Thomas S. Lam, M.D., M.P.H.

|

| |

Title: |

Co-Chief Executive Officer and President |

Exhibit 10.1

STOCK REPURCHASE AGREEMENT

This STOCK REPURCHASE

AGREEMENT (this “Agreement’) is made and entered into as of November 6, 2023 (the “Effective

Date”), by and between APOLLO MEDICAL HOLDINGS, INC., a Delaware corporation (the “Company”),

and ALLIED PHYSICIANS OF CALIFORNIA, A PROFESSIONAL MEDICAL CORPORATION, a California professional medical corporation (the “Selling

Stockholder” and together with the Company, the “Parties” and each a “Party”).

RECITALS

The Selling Stockholder desires

to sell to the Company, and the Company desires to purchase from the Selling Stockholder on the terms set forth herein (the “Transaction”),

shares of the Company’s Common Stock (NASDAQ: AMEH), $0.001 par value per share (the “Common Stock”)

as set forth below. It is the intention of the parties to this Agreement that the Transaction contemplated by this Agreement be a private

sale of securities that is exempt from the registration and prospectus delivery requirements of the Securities Act of 1933, as amended

(the “Securities Act”), pursuant to the satisfaction of the conditions for the so-called “Section 4(a)(1½

)” private resale exemption.

NOW, THEREFORE, in consideration

of the foregoing and the mutual promises and agreements of the parties made in this Agreement, and for other good and valuable consideration,

the parties hereby agree as follows:

AGREEMENT

1. STOCK

REPURCHASE.

1.1.

The Selling Stockholder hereby sells, transfers, assigns and delivers to the Company, and the Company purchases from the Selling Stockholder,

an aggregate number of shares of the Company’s Common Stock (the “Shares”) determined by dividing the “Purchase

Price” by the “Per Share Purchase Price” (as defined below). The Shares shall be free and clear of all liens, encumbrances,

security interests, equities, claims, preemptive rights, rights of first offer, rights of first refusal, options, licenses, charges and

assessments and without any restrictive legend. The aggregate purchase price for all of the Shares shall be Ninety-Nine Million Nine

Hundred Ninety-Nine Thousand Nine Hundred Ninety-Six Dollars and Thirty-Eight Cents ($99,999,996.38) (the “Purchase Price”),

and the “Per Share Purchase Price” shall be determined in accordance with the methodology set forth in Exhibit A

hereto.

1.2. The consummation of

the actions provided for in this Section 1.2 shall be referred to as the “Closing”, which shall take place at

10:00AM Central Standard Time on the day the following conditions are satisfied in full: (i) the Selling Stockholder shall

deliver or cause to be delivered to the Company (x) the Shares via DTC electronic transfer (or equivalent) or via account

transfer (where the Shares are held in Selling Stockholder’s account at the same financial institution or brokerage as the

Company’s account) to the Company’s account as designated by the Company, and (y) evidence of the transfer of the

Shares in electronic form, and in any event, in form and substance reasonably acceptable to the Company; and (ii) the Company

shall deliver the Purchase Price to the Selling Stockholder’s account as shown on Exhibit B hereto by wire

transfer of immediately available funds. Except for the payment of the Purchase Price in accordance with the terms hereof, the

Selling Stockholder acknowledges and agrees that it is not owed or entitled to any additional compensation or consideration from the

Company or its directors, officers, employees, agents, representatives, partners, members or Affiliates (as defined below) with

respect to the purchase and sale of the Shares. Notwithstanding anything to the contrary contained herein, if the Closing has not

occurred by the date that is twenty (20) business days following the Effective Date, either party shall be able to terminate this

Agreement upon written notice to the other party; provided, that a Party that is in material breach of its obligations under this

Agreement shall not be able to terminate this Agreement.

1.3. The Parties hereto agree

to (i) execute and deliver such other documents, instruments, waivers and certificates and (ii) do or perform such other actions

as may be necessary to give effect to the sale of the Shares.

2.

REPRESENTATIONS AND WARRANTIES

OF THE SELLING STOCKHOLDER. The Selling Stockholder hereby represents and warrants to the Company, as of the date hereof and

as of the Closing, as follows:

2.1. The Selling Stockholder

is duly organized, validly existing and in good standing under the laws of the jurisdiction of its organization.

2.2. As of the Closing, the

Selling Stockholder is the sole beneficial owner of, and has good and marketable title to the Shares. As of the Closing, the Selling Stockholder

is not a party to any stockholder agreements, proxies, or other contracts in effect with respect to the voting or transfer of any of the

Shares. As of the Closing, such Shares are owned by the Selling Stockholder free and clear of all liens, encumbrances, security interests,

equities, claims, preemptive rights, rights of first offer, rights of first refusal, options, licenses, charges and assessments and are

subject to no restrictions with respect to transferability of such Shares to the Company.

2.3. The Selling Stockholder

has the requisite power and authority to enter into and perform this Agreement and has taken all action required for the authorization,

execution, delivery of and performance of all of its obligations under this Agreement. The Selling Stockholder represents that this Agreement

is a legal, valid and binding obligation of the Selling Stockholder enforceable in accordance with its terms, except as may be limited

by (i) applicable bankruptcy, insolvency, reorganization or other laws of general application relating to or affecting the enforcement

of creditors’ rights generally and (ii) the effect of rules of law governing the availability of equitable remedies. The

execution and delivery of, and the performance of the obligations under, this Agreement by the Selling Stockholder do not and will not

contravene or result in any breach of any law or of any regulation, order, writ, injunction or decree of any court, tribunal, governmental

body, authority, agency or instrumentality applicable to the Selling Stockholder or the Shares, nor do or will such execution, delivery

or performance violate, conflict with or result in (with notice or lapse of time or both result in) a breach of or default under any term

or provision of any agreement or contract, oral or written, or organizational document to which the Selling Stockholder or any of its

Affiliates is a party or is bound or to which the Shares are subject.

2.4.

The Selling Stockholder is not and will not become a party to any agreement, arrangement or understanding with any Person that could

result in the Company having any obligation or liability for any brokerage fees, commissions, underwriting discounts or other similar

fees or expenses relating to the transactions contemplated by this Agreement. For purposes of this Agreement, “Person”

means any individual, corporation, company, association, partnership, limited liability company, joint venture, trust or unincorporated

organization, or a government or any agency or political subdivision thereof.

2.5. The Selling Stockholder

(i) has such knowledge and experience in business, financial and investment matters as to be capable of evaluating the merits, risks

and suitability of the Transaction, (ii) has considered the suitability of the Transaction in light of its own circumstances and

financial condition, and (iii) is consummating the Transaction with a full understanding of all of the terms, conditions and risks

and willingly assumes those terms, conditions and risks.

2.6. The Selling Stockholder

has had access to all information that it and its advisers deem appropriate and necessary to make an informed decision to enter into the

Transaction and has reviewed all such information.

2.7. The Selling Stockholder

has evaluated the merits, risks and consequences of consummating the Transaction based exclusively on its own independent review and consultations

with such investment, legal, tax, accounting and other advisers as it deemed appropriate and has made its own decision concerning the

Transaction, without reliance on any representation or warranty of, information provided by, or advice from, the Company.

2.8. The Selling Stockholder

represents that it is not relying on (and will not at any time rely on) any communication (written or oral) of the Company, or omission

on the part of the Company to communicate any particular piece of information, as investment advice or as a recommendation to sell the

Shares.

2.9. The Selling Stockholder

confirms that the Company has not (i) given any guarantee or representation as to the potential success, return, effect or benefit

(either legal, regulatory, tax, financial, accounting or otherwise) of the Transaction or (ii) made any representation to the Selling

Stockholder regarding the legality of the Transaction under applicable legal investment or similar laws or regulations except as set forth

in Section 3.2.

2.10. The

Selling Stockholder acknowledges and understands that should the Company possess material nonpublic information relating to the Company

not known to the Selling Stockholder that may impact the value of the Shares (collectively, the “Information”),

including, without limitation, information received from others on a confidential basis, that the Company may be unable to disclose any

such Information to the Selling Stockholder and that, notwithstanding the foregoing in this Section 2.10, the Company shall not

have any liability to the Selling Stockholder due to or in connection with the Company’s use or non-disclosure of the Information

or otherwise as a result of the Transaction, and the Selling Stockholder hereby irrevocably waives any claim that the Selling Stockholder

might have based on the failure of the Company to disclose the Information. The Selling Stockholder expressly acknowledges that the Selling

Stockholder is not entering into the transactions contemplated hereby in reliance on the assumption or perception that the Company does

not have such Information.

2.11. The Selling Stockholder

acknowledges that the Company is relying on the Selling Stockholder’s representations, warranties, acknowledgments and agreements

in this Agreement in connection with the Transaction.

2.12. The Selling Stockholder

acknowledges and warrants that it has been represented, or has had the opportunity to be represented, by counsel of its own choice throughout

all negotiations which preceded the execution of this Agreement.

3.

REPRESENTATIONS AND WARRANTIES OF THE COMPANY. The Company hereby represents and warrants to each of the Selling

Stockholder, as of the date hereof and as of the Closing, as follows:

3.1. The Company is duly organized,

validly existing and in good standing under the laws of the jurisdiction of its organization.

3.2.

The Company has the requisite power and authority to enter into and perform this Agreement

and to assume and perform its obligations hereunder. This Agreement, when executed and delivered by the Company, will constitute a

legal, valid and binding obligation of the Company enforceable in accordance with its terms, except as may be limited by

(i) applicable bankruptcy, insolvency, reorganization or other laws of general application relating to or affecting the

enforcement of creditors’ rights generally and (ii) the effect of rules of law governing the availability of

equitable remedies. The execution and delivery of, and the performance of the obligations under, this Agreement by the Company do

not and will not contravene or result in any breach of any law or of any regulation, order, writ, injunction or decree of any court,

tribunal, governmental body, authority, agency or instrumentality applicable to the Company, nor do or will such execution, delivery

or performance violate, conflict with or result in (or with notice or lapse of time or both result in) a breach of or default under

any term or provision of any agreement or contract, oral or written, to which Company or any of its Affiliates, other than any

portfolio company (as such term is customarily used among institutional investors, and including any holding company of a portfolio

company or any person controlled by a portfolio company), is a party or is bound.

3.3. The Company is not and

will not become a party to any agreement, arrangement or understanding with any Person that could result in the Selling Stockholder having

any obligation or liability for any brokerage fees, commissions, underwriting discounts or other similar fees or expenses relating to

the transactions contemplated by this Agreement.

3.4. The Company (i) has

such knowledge and experience in business, financial and investment matters as to be capable of evaluating the merits, risks and suitability

of the Transaction, (ii) has considered the suitability of the Transaction in light of its own circumstances and financial condition,

and (iii) is consummating the Transaction with a full understanding of all of the terms, conditions and risks and willingly assumes

those terms, conditions and risks.

3.5. The Company has had access

to all information that it and its advisers deem appropriate and necessary to make an informed decision to enter into the Transaction

and has reviewed all such information.

3.6. The Company has evaluated

the merits, risks and consequences of consummating the Transaction based exclusively on its own independent review and consultations with

such investment, legal, tax, accounting and other advisers as it deemed appropriate and has made its own decision concerning the Transaction,

without reliance on any representation or warranty of, information provided by, or advice from, the Selling Stockholder.

3.7. The Company represents

that it is not relying on (and will not at any time rely on) any communication (written or oral) of the Selling Stockholder, or omission

on the part of the Selling Stockholder to communicate any particular piece of information, as investment advice or as a recommendation

to purchase the Shares.

3.8. The Company confirms that

the Selling Stockholder has not (i) given any guarantee or representation as to the potential success, return, effect or benefit

(either legal, regulatory, tax, financial, accounting or otherwise) of the Transaction or (ii) made any representation to the Company

regarding the legality of the Transaction under applicable legal investment or similar laws or regulations except as set forth in Section 2.3.

3.9.

The Company acknowledges and understands that should the Selling Stockholder possess material nonpublic information relating to the

Company not known to the Company that may impact the value of the Shares (collectively, the “Information”), including,

without limitation, information received from others on a confidential basis, that the Selling Stockholder may be unable to disclose

any such Information to Company and that, notwithstanding the foregoing in this Section 3.9, the Selling Stockholder shall not

have any liability to the Company due to or in connection with the Selling Stockholder’s use or non-disclosure of the

Information or otherwise as a result of the Transaction, and the Company hereby irrevocably waives any claim that it might have

based on the failure of the Selling Stockholder to disclose the Information. The Company expressly acknowledges that it is not

entering into the transactions contemplated hereby in reliance on the assumption or perception that the Selling Stockholder does not

have such Information.

3.10. Company is acquiring the

Shares for Company’s own account, for investment and not with a view to the distribution or resale thereof, except in compliance

with the Securities Act and applicable state securities laws. Company has evaluated the merits and risks of purchasing the Shares on the

terms set forth in this Agreement on its own and without reliance upon Selling Stockholder, and has such knowledge and experience in financial

and business matters and in making investments of this type that it is capable of evaluating the merits and risks of such purchase, is

aware of and has considered the financial risks and financial hazards of purchasing the Shares on the terms set forth in this Agreement

and is able to bear the economic risks of purchasing the Shares, including the possibility of complete loss with respect thereto. Company

has had access to such information regarding the business and finances of the Company and such other matters with respect to the Shares

as a reasonable person would consider in evaluating the Transaction, including, in particular, all information necessary to determine

the fair market value of the Shares, but this sentence shall in no way prejudice any liability that the Selling Stockholder may have as

a result of a breach of the representations and warranties set forth in Section 2. Company is an “accredited investor,”

as that term is defined in Rule 501(a) of Regulation D under the Act. Company is not a “party-in-interest” of Selling

Stockholder within the meaning of Section 3(14) of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”),

or a “disqualified person,” with respect to Selling Stockholder within the meaning of Section 4975(e) of the Code

(as hereinafter defined) and the consummation of the transactions contemplated by this Purchase Agreement will not be a “prohibited

transaction” (within the meaning of Section 406 of ERISA or Section 4975 of the Code). The Company is not, and is not

acting on behalf of, an employee benefit plan subject to Title I of ERISA or Section 4975 of the Code.

3.11. The Company acknowledges

that the Selling Stockholder is relying on the Company’s representations, warranties, acknowledgments and agreements in this Agreement

in connection with the Transaction.

3.12. The Company acknowledges

and warrants that it has been represented, or has had the opportunity to be represented, by counsel of its own choice throughout all negotiations

which preceded the execution of this Agreement.

4. PUBLICITY;

CONFIDENTIALITY.

4.1. Each Party agrees that

neither it nor any of its Affiliates or representatives will issue any press release or public announcement or comment concerning this

Agreement or the transactions contemplated hereby without obtaining the prior written approval of the other Party, except:

(i) and

only to the extent, upon the advice of outside counsel, disclosure is required by applicable law (except as may be addressed elsewhere

within this Section 4.1) and only to the extent required by such law (provided, that in the case of this clause (i), the party

intending to make such release shall use its commercially reasonable efforts consistent with applicable law to consult with the other

party in advance of such release with respect to the text thereof, only disclose the minimum amount required by law to be so disclosed,

and request “confidential treatment” or similar treatment thereof);

(ii) the

parties may make any disclosure (w) required to be included in its or its Affiliates’ financial statements or tax audits

or other filings with Governmental Authorities, (x) required by periodic reporting requirements under

the Exchange Act or continuous disclosure obligations under other applicable securities laws or under the rules of any

securities exchange on which the securities of either party or an Affiliate of either party, as applicable, are or will be listed, (y) to

its Affiliates or its or their direct or indirect, current or prospective, investors or limited partners and/or (z) by way of

any communication by either party or its Affiliates to its employees, (provided that, in the case of the foregoing clauses

(y) and (z), such recipients are obligated to keep such information confidential); and

(iii) disclosures

made by way of any statements that are substantially similar to previous press releases, public disclosures or public statements made

by the parties in compliance with this Section 4.1.

4.2. Each party agrees that

neither it nor any of its Affiliates or representatives will disclose, directly or indirectly, to any other person (except as required

by applicable law, rule or regulation, including the United States federal securities laws or any rules and regulations of any

applicable national securities exchange), any nonpublic information furnished to it by or on behalf of the other party in connection with

the transactions contemplated hereby or any of the terms, communications, conditions or facts with respect to the transactions contemplated

hereby, including, without limitation, the disclosure of this Agreement, the identity of the parties hereto or the terms hereof. Notwithstanding

the foregoing, the parties hereto agree that this Agreement and the transactions contemplated hereby shall not be deemed to create any

duty on the part of any party hereto (or any of its Affiliates) to any other party hereto not to purchase or sell, or otherwise transact

in, any securities on the basis of any such information.

5. MISCELLANEOUS.

5.1. Fees and Expenses.

Except as expressly set forth in this Agreement, all fees and expenses incurred by each party hereto in connection with the matters contemplated

by this Agreement shall be borne by the party incurring such fees or expenses, including the fees and expenses of any investment banks,

attorneys, accountants or other experts or advisors retained by such party; provided, that the Selling Stockholder shall be solely

responsible for any transfer, documentary, sales, use, stamp, registration or other similar charges, duties or taxes and any fees of the

depository or registrar of the Shares payable in connection with the sale of the Shares hereunder.

5.2. Entire Agreement; Absence

of Presumption. This Agreement, including all exhibits attached hereto, constitutes a single integrated contract expressing the entire

agreement of the parties with respect to the subject matter hereof and supersedes all prior and contemporaneous oral and written agreements

and discussions with respect to the subject matter hereof. Each party has participated in the drafting and preparation of this Agreement,

and accordingly, in any construction or interpretation of this Agreement, the same shall not be construed against any party by reason

of the source of drafting. Each party represents that it is entering into this Agreement voluntarily, that it understands its final and

binding effect.

5.3.

Governing Law; Specific Performance. This Agreement shall be governed and construed in accordance with the internal laws of the

State of Delaware, without regard to its choice-of-law provisions. The parties hereto recognize and agree that if for any reason any

of the provisions of this Agreement are not performed by any party hereto in accordance with their terms or are otherwise breached, then

the other parties hereto will suffer immediate and irreparable harm or injury for which money damages will not be an adequate remedy.

Accordingly, the parties hereto each agree with the other that, in addition to any other remedies, each party hereto shall be entitled

to seek an injunction restraining any violation or threatened violation by any other party hereto of the provisions of this Agreement.

5.4.

Successors and Assigns; Amendments; No Third Party Beneficiaries. The terms and conditions of this Agreement shall inure to the

benefit of and be binding upon the respective successors and assigns of the parties. No party may assign its respective rights or delegate

its respective obligations under this Agreement, whether by operation of law or otherwise, and any assignment by the Company or the Selling

Stockholder in contravention hereof shall be null and void; provided, that the Company may assign all or any portion of its rights

and obligations under this Agreement to one or more Affiliates; provided, however, that no such assignment will relieve

the Company of its obligations hereunder. For purposes of this Agreement, (i) “Affiliate” means, with

respect to any Person, any other Person which directly or indirectly controls or is controlled by or is under common control with such

Person and (ii) “control” (including its correlative meanings, “controlled by”

and “under common control with”) means possession, directly or indirectly, of power to direct or cause the

direction of management or policies (whether through ownership of securities or partnership or other ownership interests, by contract

or otherwise). This Agreement and each provision hereof may be amended, modified, supplemented or waived only by a written document duly

executed by each party. This Agreement is solely for the benefit of the parties hereto and is not enforceable by any other persons.

5.5. COUNSEL. BY SIGNING

THIS AGREEMENT, EACH PARTY HERETO EXPRESSLY AGREES AND ACKNOWLEDGES THAT IT (A) HAS READ THIS AGREEMENT CAREFULLY, (B) IS SIGNING

THIS AGREEMENT KNOWINGLY AND VOLUNTARILY, (C) HAS BEEN, OR HAS HAD THE OPPORTUNITY TO BE, REPRESENTED BY INDEPENDENT LEGAL COUNSEL

OF ITS OWN CHOOSING REGARDING THE NEGOTIATION AND EXECUTION OF THIS AGREEMENT AND ITS RIGHTS AND OBLIGATIONS HEREUNDER, AND (D) FULLY

UNDERSTANDS THE TERMS AND CONDITIONS CONTAINED HEREIN. FURTHERMORE, SELLING STOCKHOLDER EXPRESSLY AGREES AND ACKNOWLEDGES THAT, IN

CONNECTION WITH THIS AGREEMENT, TIN KIN LEE LAW OFFICE, A PROFESSIONAL CORPORATION (“TKL”) IS COUNSEL FOR THE COMPANY AND

NOT FOR SELLING STOCKHOLDER. IN ADDITION, EACH OF THE PARTIES HEREBY ACKNOWLEDGES THAT (i) TKL CURRENTLY REPRESENTS SELLING STOCKHOLDER

IN CONNECTION WITH OTHER MATTERS UNRELATED TO THE TRANSACTIONS CONTEMPLATED IN THIS AGREEMENT, BUT DOES NOT CURRENTLY REPRESENT SELLING

STOCKHOLDER IN ANY MATTER RELATED TO THIS AGREEMENT, AND (ii) FOLLOWING THE MERGER OF THE COMPANY WITH NETWORK MEDICAL MANAGEMENT, INC.

(“NMM”) IN DECEMBER 2017, TKL HAS PROVIDED AND IS CURRENTLY PROVIDING REPRESENTATION TO THE COMPANY ON A WIDE VARIETY OF MATTERS, INCLUDING

IN CONNECTION WITH THIS AGREEMENT. BASED ON THE FOREGOING, A POTENTIAL OR ACTUAL CONFLICT OF INTEREST SHOULD NOT EXIST WITH RESPECT TO

TKL’S REPRESENTATION OF THE COMPANY (AND NOT SELLING STOCKHOLDER) IN CONNECTION WITH THIS AGREEMENT. HOWEVER, BECAUSE THE CALIFORNIA

RULES OF PROFESSIONAL CONDUCT REQUIRE FULL DISCLOSURE AND INFORMED WRITTEN CONSENT IN CASES OF A POTENTIAL OR ACTUAL CONFLICT OF INTEREST,

EACH OF THE COMPANY AND SELLING STOCKHOLDER EXPRESSLY AGREES AND ACKNOWLEDGES THAT TKL MAY REPRESENT THE COMPANY IN CONNECTION WITH

THE TRANSACTIONS CONTEMPLATED BY THIS AGREEMENT, AND IRREVOCABLY WAIVES (AND WILL NOT ASSERT) ANY CONFLICT OF INTEREST OR ANY OBJECTION

ARISING THEREFROM OR RELATING THERETO.

5.6. Severability. If

one or more provisions of this Agreement are held to be unenforceable under applicable law, such provision(s) shall be excluded from

this Agreement and the balance of the Agreement shall be interpreted as if such provision(s) were so excluded and shall be enforceable

in accordance with its terms.

5.7. Counterparts. This

Agreement may be executed in any number of counterparts and by different parties hereto in separate counterparts (including by means of

electronic delivery or facsimile (including pdf or any electronic signature complying with the U.S. federal ESIGN Act of 2000, e.g., www.docusign.com

or www.echosign.com) or other transmission method), each of which when so executed and delivered shall be deemed an original and all of

which when taken together shall constitute but one and the same instrument

5.8. Survival. Each of

the representations, warranties, covenants, and agreements in this Agreement or pursuant hereto shall survive the closing of the transactions

contemplated by this Agreement.

IN WITNESS WHEREOF the undersigned have

executed this Agreement as of the date set forth above.

| “Company”: |

|

“Selling Stockholder”: |

| |

|

|

| APOLLO MEDICAL HOLDINGS, INC. |

|

ALLIED PHYSICIANS OF CALIFORNIA, A PROFESSIONAL MEDICAL CORPORATION |

| |

|

|

| By: |

/s/ Chandan Basho |

|

By: |

/s / Paul Liu |

| |

Chandan Basho, |

|

|

Paul Liu, M.D. |

| |

Chief Strategy Officer and Chief Financial Officer |

|

|

Secretary |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

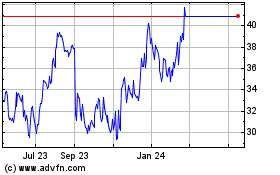

Apollo Medical (NASDAQ:AMEH)

Historical Stock Chart

From Feb 2025 to Mar 2025

Apollo Medical (NASDAQ:AMEH)

Historical Stock Chart

From Mar 2024 to Mar 2025