false

0001083446

0001083446

2024-01-31

2024-01-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): January 31, 2024

APOLLO MEDICAL HOLDINGS, INC.

(Exact Name of Registrant as Specified in its

Charter)

| Delaware |

001-37392 |

95-4472349 |

| (State or Other Jurisdiction |

(Commission |

(I.R.S. Employer |

| of Incorporation) |

File Number) |

Identification No.) |

1668 S. Garfield Avenue, 2nd Floor, Alhambra, California 91801

(Address of Principal Executive Offices) (Zip Code)

(626) 282-0288

Registrant’s Telephone Number, Including

Area Code

__________________________________

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock |

AMEH |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 3.02 | Unregistered Sales of Equity Securities. |

On January 31, 2024, Apollo Medical Holdings, Inc. (the “Company”)

issued 631,712 shares of common stock pursuant to the transactions described under Item 8.01 of this Current Report on Form 8-K (this

“Report”). The issuance of shares of common stock was deemed to be exempt from registration pursuant to Section 4(a)(2) of

the Securities Act of 1933, as amended, as a transaction not involving a public offering.

On November

7, 2023, the Company filed a Current Report on Form 8-K reporting that it entered into an Asset and Equity Purchase Agreement (the

“Purchase Agreement”) to acquire (i) all of the outstanding general and limited partnership interests of Advanced Health Management

Systems, L.P. (“AHMS”) and (ii) substantially all the assets of Community Family Care Medical Group IPA, Inc. (“CFC”),

and that the Company anticipated such acquisitions would occur in two separate closings. On November 7, 2023, Network

Medical Management, Inc., a wholly-owned subsidiary of the Company, also entered into a Stock Purchase Agreement (the “I Health

Purchase Agreement”) to purchase 25% of the outstanding shares of common stock of I Health, Inc. (“I Health”). Under

such terms, the purchase price of approximately $202 million is comprised of approximately $152 million in cash on hand, subject to customary

adjustments, approximately $20 million in equity (which equals 631,712 shares of common stock of the Company), and up to approximately

$30 million in performance-based milestone payments.

On January 31, 2024, the parties to the Purchase Agreement entered

into Amendment No. 1 to the Purchase Agreement (the “Amendment”). The Amendment amends the Purchase Agreement by, among other things, modifying certain

defined terms, covenants and schedules and the effective time of the Initial Closing (as defined in the Purchase Agreement). The foregoing description of the

Amendment does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Amendment, a copy

of which is filed as Exhibit 10.1 to this Report and is incorporated herein by reference.

Also on January

31, 2024, the first closing under the Purchase Agreement occurred, and the Company completed its acquisition of CFC’s assets pursuant

to the terms of the Purchase Agreement, as amended by the Amendment. The Company expects to complete the second closing under the Purchase

Agreement and acquire the outstanding general and limited partnership interests of AHMS during the first quarter of 2024, subject to obtaining

required regulatory approvals. It is currently expected that the I Health Purchase Agreement

closing will occur during the first quarter of 2024.

Forward-Looking Statements

This Report contains forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements

include words such as “forecast,” “guidance,” “projects,” “estimates,” “anticipates,”

“believes,” “expects,” “intends,” “may,” “plans,” “seeks,” “should,”

or “will,” or the negative of these words or similar words. Forward-looking statements involve certain risks and uncertainties,

and actual results may differ materially from those discussed in each such statement. A number of important factors could cause actual

results to differ materially from those included within or contemplated by the forward-looking statements, including, but not limited

to, risks arising from the diversion of management’s attention from the Company’s ongoing business operations, an increase

in the amount of costs, fees and expenses and other charges related to the acquisitions described in this Report, outcome of any litigation

that the Company or the sellers may become subject to relating to such acquisitions, the extent of, and the time necessary to obtain,

any regulatory approvals required for completion of the acquisitions, the occurrence of any event, change or other circumstance that could

give rise to the termination of the agreements relating to the acquisitions, an inability to complete the acquisitions in a timely manner

or at all, including due to a failure of any condition to the closing of the acquisitions to be satisfied or waived by the applicable

party, the occurrence of any event, change or other circumstance that could give rise to the termination of any of the agreements to the

acquisitions, a decline in the market price for the Company’s common stock if the acquisitions are not completed, risks that the

acquisitions disrupt current plans and operations of the Company or sellers and potential difficulties in sellers’ employee retention

as a result of the acquisitions, and the ability to implement business plans, forecasts and other expectations after the completion of

the acquisitions, realize the intended benefits of the acquisitions, and identify and realize additional opportunities following the acquisitions,

as well as the other risks and uncertainties identified in filings by the Company with the Securities and Exchange Commission, including

the Company’s Annual Report on Form 10-K/A for the year ended December 31, 2022 and subsequent quarterly reports on Form 10-Q. The

Company does not undertake any responsibility to update any of these factors or to announce publicly any revisions to any of the forward-looking

statements contained in this or any other document, whether as a result of new information, future events, or otherwise, except as may

be required by any applicable securities laws.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| Exhibit No. |

|

Description |

| 10.1* |

|

Amendment No. 1 to Asset and Equity Purchase Agreement, dated as of January 31, 2024, by and among Metropolitan IPA, a California professional corporation, ApolloCare Enablement of CA, LLC, Network Medical Management, Inc., Apollo Medical Holdings, Inc., Community Family Care Medical Group IPA, Inc., Advanced Health Management Systems, L.P., Accie M. Mitchell and Gloria C. Mitchell, as Co-Trustees of the Mitchell Family Trust dated July 2, 2003, CFC Management, LLC, the other parties thereto and Marc Mitchell, as the Equityholder Representative. |

| 104 |

|

Cover Page Interactive Data File (the cover page XBRL tags are embedded within the inline XBRL document). |

* Certain of the exhibits and schedules to

this exhibit have been omitted in accordance with Item 601(a)(5) of Regulation S-K. The Company agrees to furnish a copy of all omitted

exhibits and schedules to the Securities and Exchange Commission upon its request.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

APOLLO MEDICAL HOLDINGS, INC. |

| |

|

| Date: February 2, 2024 |

By: |

/s/ Brandon Sim |

| |

Name:

Title: |

Brandon Sim

Chief Executive Officer and President |

Exhibit 10.1

AMENDMENT NO. 1

to

ASSET AND EQUITY PURCHASE AGREEMENT

THIS

AMENDMENT (this “Amendment”), is entered into as of January 31, 2024, by and among METROPOLITAN IPA,

a California professional corporation (“PC Buyer”); APOLLOCARE ENABLEMENT OF CA, LLC, a California limited liability

company (“MSO GP Buyer”); NETWORK MEDICAL MANAGEMENT, INC., a California corporation (“MSO LP Buyer”

and, together with MSO GP Buyer, the “MSO Buyers” and together with PC Buyer, the “Buyers” and

each a, “Buyer”); APOLLO MEDICAL HOLDINGS, INC., a Delaware corporation the stock of which is publicly traded

on the Nasdaq (“Buyer Parent” and together with Buyers, “Buyer Parties” and each, a “Buyer

Party”); COMMUNITY FAMILY CARE MEDICAL GROUP IPA, INC., a California professional corporation (“CFC IPA”);

ADVANCED HEALTH MANAGEMENT SYSTEMS, L.P., a California limited partnership (“AHMS” and together with the CFC IPA,

the “Companies” and each, a “Company”); ACCIE M. MITCHELL AND GLORIA C. MITCHELL, AS CO-TRUSTEES

OF THE MITCHELL FAMILY TRUST DATED JULY 2, 2003 ( “IPA Equityholder”); ACCIE M. MITCHELL, M.D. (“IPA Beneficial

Owner”); CFC MANAGEMENT, LLC, a California limited liability company and the general partner of AHMS (“AHMS General

Partner”); the other limited partners of AHMS set forth in the signature page hereto (collectively, the “AHMS

Limited Partners” and each, an “AHMS Limited Partner”) (AHMS General Partner and the AHMS Limited Partners

are referred to collectively herein as the “AHMS Equityholders” and together with the IPA Equityholder, the “Equityholders”,

and together with CFC IPA, the “Sellers”); and MARC MITCHELL, as an authorized representative of the Sellers (“Equityholder

Representative”); and solely for purposes of Section 6.9, I Health, Inc., a California corporation (“I

Health”). The Buyer Parties, the Companies, the Equityholders, and the Equityholder Representative are referred to collectively

herein as the “Parties” and, each individually, as a “Party”). Capitalized terms used and not defined

elsewhere in this Amendment shall have the meanings given them in the Agreement.

WHEREAS,

Buyer Parties, the Companies, the Equityholders, IPA Beneficial Owner, the Equityholder Representative and I Health are parties

to that certain Asset and Equity Purchase Agreement (the “Agreement”), dated as of November 7, 2023; and

WHEREAS,

pursuant to Section 12.7 of the Agreement, the Agreement may only be amended, modified or supplemented by an agreement in writing

signed by each Party hereto.

NOW,

THEREFORE, in consideration of the premises, the mutual agreements hereinafter set forth, and other good and valuable consideration,

the receipt and adequacy of which are hereby acknowledged, the parties hereto agree as follows:

Section 1. Section 1.1(c)(13)

(Excluded Liabilities) shall be deleted in its entirety and replaced with the following:

“(13) reserved;”

Section 2. Schedule

1.3(c) (Deferred Payments Covenants) to the Agreement is hereby amended as set forth on Schedule A to this Amendment.

Section 3. With

respect to Section 1.3(c) of the Agreement, the term “Buyer Party” shall be deemed to include Allied Physicians

of California, a California professional corporation doing business as Allied (“Allied”).

Section 4. Section 1.6(a) of

the Agreement shall be deleted in its entirety and replaced with the following:

“The consummation of the sale

of the Acquired Assets and the assumption of the Assumed Liabilities (the “Initial Closing”) shall take place electronically

via mutual exchange of facsimile or portable document format (.PDF) signatures on the last day of the month following the date on which

all of the conditions set forth in Section 8.1, Section 8.2 and Section 8.3 have been satisfied or

waived (other than conditions which, by their nature, are to be satisfied on the Initial Closing Date), or at such other time as shall

be agreed upon in writing by the Buyer Parties and CFC IPA (the “Initial Closing Date”). Unless otherwise agreed in

writing by the Parties, the Initial Closing shall be effective as of 11:59 P.M., Pacific Standard Time on the Initial Closing Date (the

“Initial Effective Time”).”

Section 5. Section 1.8

of the Agreement shall be deleted in its entirety and replaced with the following:

“Non-Assignable Contracts.

Notwithstanding anything to the contrary in this Agreement, to the extent that the assignment hereunder by CFC IPA to PC Buyer of any

Assumed Contract or Permit is not permitted or is not permitted without the consent of any other party to such Assumed Contract or any

Governmental Authority, neither this Agreement nor the Bill of Sale shall be deemed to constitute an assignment of any such Assumed Contract

or Permit if such consent is not given or if such assignment otherwise would constitute a breach of, violation of or cause a loss of

benefits under, any such Assumed Contract or Permit, and except as otherwise provided in this Agreement, PC Buyer shall not assume any

obligations or liabilities under any such Assumed Contract or Permit. CFC IPA shall use Commercially Reasonable Efforts to obtain all

consents and waivers necessary for the sale, transfer, assignment, conveyance and delivery of the Assumed Contracts, Permits and the

Acquired Assets to PC Buyer hereunder and, if any such consent is not obtained or if such assignment is not permitted irrespective of

such consent, CFC IPA shall, for a period of twelve (12) months following the Initial Closing Date, cooperate with PC Buyer following

the Initial Closing Date in any reasonable and lawful arrangement designed to provide PC Buyer or its Affiliates with the rights and

benefits under any such Assumed Contract or Permit, including enforcement for the benefit of PC Buyer, at the request of PC Buyer, of

any and all rights of CFC IPA thereunder (including rights against any other party thereto arising out of any breach or cancellation

of any such Assumed Contract by such other party) and, if requested by PC Buyer, to the extent legally permitted, acting as an agent

on behalf of PC Buyer or as PC Buyer shall otherwise reasonably require; provided, that, if PC Buyer is provided the benefits

of any Assumed Contracts or Permits, then PC Buyer shall assume the Liabilities of CFC IPA under such Assumed Contract or Permits, as

applicable, but only to the extent the Liabilities thereunder arise after the Initial Closing Date.”

Section 6. The

Disclosure Schedule is hereby amended as set forth on Schedule B to this Amendment.

Section 7. A

new Section 5.11 is hereby added to Article 5 of the Agreement, as follows:

“5.11 Organization and Authority

of Allied. Allied is a medical professional corporation duly organized, validly existing and in good standing under the laws of the

state of California. Allied has full power and authority to enter into each document contemplated by this Agreement to which Allied is

a party (an “Allied Document”), and to carry out its obligations thereunder. The execution and delivery by Allied

of any Allied Document, and the performance by Allied of its obligations thereunder have been duly authorized by all requisite corporate

action on the part of Allied. Each Allied Document has been duly executed and delivered by Allied, and (assuming due authorization, execution

and delivery by the counterparty or counterparties) each such document constitutes a legal, valid and binding obligation of Allied enforceable

against it in accordance with its terms; subject to bankruptcy, insolvency, reorganization, moratorium and similar Applicable Laws of

general application relating to or affecting creditors’ rights and to general equity principles.”

Section 8. Section 6.26

of the Agreement shall be deleted in its entirety and replaced with the following:

“Letter of Credit Requirements.

Prior to the date hereof, CFC IPA had obtained the letters of credit, security agreement and other Indebtedness identified on Schedule

6.26 (the “CFC LOC Obligations”) for the benefit of the applicable Plan as required under the applicable Contract.

On or after to the Initial Closing Date, (i) the applicable Buyer Party shall seek agreement with the Plans under any Contract with

such Plans that is an Assumed Contract as to what credit support arrangements (e.g. notes, letters of credit, capitation withhold reserves, etc.)

are required to be in place on and after the Initial Closing Date (“LOC Requirement”); and (ii) the applicable

Buyer Party shall satisfy any such LOC Requirements so as to enable the assignment of such Assumed Contracts and to enable CFC IPA to

be released from the CFC LOC Obligations.” The following shall be added as a new Section 6.29 of the Agreement:

“Within sixty (60) days following

the Initial Closing Date, MSO LP Buyer shall have engaged Recovery Audit Solutions, Inc. (“RASI”), at CFC IPA’s

sole cost and expense, to provide to, and for the benefit of, the Group Companies certain payment integrity auditing services, which

include investigation and review of the appropriateness of payments made by MSO LP Buyer on behalf of CFC IPA and/or CFCHP during the

period beginning on January 1, 2023 through December 31, 2023, to certain payees, including without limitations investigations

of overpayments, duplicate checks and payments, and incorrect payments made prior to the applicable Closing Date (collectively, the “Payment

Integrity Auditing Services”). MSO LP Buyer shall cause RASI to provide the Payment Integrity Auditing Services to the Group

Companies for the period beginning sixty (60) days after the Initial Closing Date through one hundred and eighty days (180) days thereafter

(the “Applicable Period”). MSO LP Buyer, on the one hand, and CFC IPA and the Equityholder Representative, on the

other, shall jointly provide instructions to RASI to ensure that the Payment Integrity Auditing Services are adequately provided to enable

accurate financial reporting of the Group Companies’ financial statements. The Buyer Parties shall, during the Applicable Period,

use commercially reasonable efforts to (i) cooperate and collaborate with RASI and the Group Companies, including without limitation

promptly providing RASI with the necessary information and records, in order to enable RASI to adequately provide the Payment Integrity

Auditing Services in a timely manner, and (ii) collect any amounts incorrectly paid or otherwise due as a result of or arising from

RASI’s findings (“Auditing Services Recovered Amount”). Any and all Auditing Services Recovered Amount with

respect to the Applicable Period shall be promptly paid over to CFC IPA or CFCHP during the Applicable Period, as applicable, based on

the findings of RASI; provided that, after the Second Closing Date, any Auditing Services Recovered Amount relating to CFCHP shall be

paid to the Equityholder Representative on behalf of the AHMS Equityholders.”

Section 10. A

new Section 7.11 is added to the Agreement as follows:

“Stale Checks. On the

Initial Closing Date, PC Buyer shall set aside One Million Five Hundred Ninety Thousand Nine Hundred Seventy-Two Dollars ($1,590,972)

(the “Stale Check Escrow Amount”) from the CFC IPA Cash Purchase Price, which amount shall be deposited by PC Buyer

into an account (the “Stale Check Escrow Account”), funded by CFC IPA at its sole cost and expense, within thirty

(30) days of the Initial Closing Date, and subject to release each month to either CFC IPA and/or PC Buyer pursuant to the terms of this

Section 7.11. The Stale Check Escrow Amount (or any portion thereof) shall survive until such amounts are released pursuant

to this Section 7.11.

(a) Within

thirty (30) days of the Initial Closing, CFC IPA shall engage a mutually agreeable third-party consultant (the “Stale Check

Consultant”), at CFC IPA’s sole cost and expense, to review the checks in the CFC IPA AHMS Check Register and the CFC

IPA NMM Check Register that were issued prior to January 1, 2023 and which have not yet been presented for payment (collectively,

the “Stale Checks”), in order to determine which checks reflect obligations still owing to the payee (“Valid

Checks”) and which are no longer owing (such as on account of having been reissued, representing duplicate payments, etc.)

(“Invalid Checks”).

(b) The

Stale Check Consultant shall review the Stale Checks pursuant to this Section 7.11, and report its findings and analysis

to PC Buyer and CFC IPA on a quarterly basis. PC Buyer and CFC IPA shall reasonably cooperate in good faith to promptly come to an agreement

on which Stale Checks are Valid Checks, the amount of which shall be paid from the Stale Check Escrow Account and released to PC Buyer

for reissuance to the applicable payees or, as required by Applicable Law, escheatment, and which Stale Checks represent Invalid Checks,

in which case, the amount of such Invalid Checks shall be released to CFC IPA from the Stale Check Escrow Account. Buyer Parties shall

indemnify CFC IPA for Damages incurred or sustained by CFC IPA to the extent Buyer Parties breach the obligations under this Section 7.11

to make payments to the applicable payees or, as required by Applicable Law, escheat to the State, such Valid Checks; provided,

however, that the aggregate amount of all Damages arising under this Section 7.11 for which the Buyer Parties may

be liable to CFC IPA shall not exceed the extent of the Stale Check Escrow Amount, less any fees payable to the Escrow Agent.

(c) The

remainder of the Stale Check Escrow Amount, less any fees payable to the Escrow Agent, shall be released to CFC IPA on December 31,

2024.

Section 11. Schedule

8.2(g) (Initial Closing Related Party Contract Terminations) to the Agreement is hereby amended as set forth on Schedule C

to this Amendment.

Section 12. A

new Clause (f) is hereby added to Section 10.3 of the Agreement, as follows:

“any breach or inaccuracy of

any of the representations or warranties made with respect to Allied in this Agreement or any agreements with third-parties entered into

in connection with obtaining the Initial Closing Required Consents.”

Section 13. Section 11.1

of the Agreement is hereby amended as follows:

| a. | The definition of “Actual Member Month” is amended and

restated in its entirety to read as follows: |

“Actual Member Month Amount”

means the total number of Member Months, which service is attributed to or related to PC Buyer and CFCHP, measured as of the last day

of each month of each Measurement Period as evidenced by membership eligibility reports (inclusive of subsequent corrections made within

six (6) months following the date of such report) received by CFCHP and PC Buyer, as applicable, from the Plans, divided by twelve

(12); provided, that the Actual Member Month Amount shall be increased by the subsequent addition of Members to PC Buyer or CFCHP,

as applicable, from other Plans managed by MSO LP Buyer during the first month in which such Members join PC Buyer or CFCHP and are managed

by MSO LP Buyer. For the avoidance of doubt, any eligible individual who is enrolled in a Plan that contracts with CFCHP or PC Buyer

at any point during a given month shall be considered a Member for such month. For the purposes of this definition, PC Buyer shall be

deemed to include Metropolitan IPA and Allied physicians along with all primary care physicians that have provider agreements with CFC

IPA as of the Initial Closing Date, and are in the zip codes where CFC IPA primary care physicians are located as of the Initial Closing

Date, including but not limited to Antelope Valley, San Fernando Valley and the metropolitan areas of Los Angeles. A hypothetical example

of calculating the Target Member Month Amount and Actual Member Month Amount is attached hereto as Schedule 1.3(a).

| b. | The definition of “CFCHP TNE” is amended and restated

in its entirety to read as follows: |

“CFCHP TNE” means,

with respect to CFCHP only, the “Tangible Net Equity” (as such term is defined in Section 1300.76(c) of Title 28

of the California Code of Regulations) calculated as of a specific point in time, as applicable, and using the accounting practices,

assumptions, policies and methodologies as set forth on, and used in the calculation of CFCHP’s related risk-bearing organization

filings on the unaudited balance sheet of CFCHP attached to Section 4.5 of the Disclosure Schedule, and shall consist of

the line items set forth on Exhibit B-2 attached hereto, which is consistent with the requirements of the DMHC, determined

as of the Second Effective Time. Notwithstanding the foregoing, for purposes of calculating the CFCHP TNE, the CFCHP TNE shall exclude

(a) Funded Indebtedness, (b) Company Transaction Expenses, (c) any current or deferred Tax assets or liabilities (including

any Tax assets or Tax receivables), and (d) the impact of purchase price adjustments related to cash. For the avoidance of doubt,

for the purposes of calculating the CFCHP TNE, CFCHP TNE shall be reduced by the deferred revenue balance as of the Second Closing; provided,

that reported deferred revenue balances will not be excluded.

| c. | The definition of “CFC IPA TNE” is amended and restated

in its entirety to read as follows: |

“CFC IPA TNE” means,

with respect to CFC IPA only (and not any other Group Company, including CFCHP) the “Tangible Net Equity” (as such term is

defined in Section 1300.76(c) of Title 28 of the California Code of Regulations) calculated as of a specific point in time,

as applicable, and using the accounting practices, assumptions, policies and methodologies as set forth on, and used in the calculation

of CFC IPA’s related risk-bearing organization filings on the unaudited balance sheet of CFC IPA attached to Section 4.5

of the Disclosure Schedule, and shall consist of the line items set forth on Exhibit B-1 attached hereto, which is consistent

with the requirements of the DMHC, determined as of the Initial Effective Time. Notwithstanding the foregoing, for purposes of calculating

the CFC IPA TNE, the CFC IPA TNE shall exclude (a) Funded Indebtedness, (b) Company Transaction Expenses, (c) intercompany

balances, (d) any current or deferred Tax assets or liabilities (including any Tax assets or Tax receivables), and (e) the

impact of purchase price adjustments related to cash. For the avoidance of doubt, for the purposes of calculating the CFC IPA TNE, CFC

IPA TNE shall be reduced by the deferred revenue balance that is not an Excluded Asset as of the Initial Closing; provided, that

reported deferred revenue balances will not be excluded.

| d. | The

definition of “Closing Cash” is amended and restated in its entirety to read as follows: |

“Closing Cash” means

the aggregate amount of the following as of the Effective Time (without duplication), but without giving effect to any changes thereto

(at the direction of Buyer or any Affiliate thereof, purchase accounting adjustments or other changes) arising from or resulting as a

consequence of the transactions contemplated hereby: (i) all cash, commercial paper, certificates of deposit and other bank deposits,

treasury bills, short term investments and all other cash equivalents in the accounts of CFC IPA, set forth in clause (n) of the

definition of Enumerated Assets, and the applicable Plan Companies (in each case, including security deposits held by third parties),

plus (ii) third-party checks deposited or held in the accounts of the applicable Group Companies that have not yet cleared (but

only to the extent not counted as a current asset), plus (iii) any and all credit card receivables and credit card deposits in transit

of the applicable Group Companies, plus (iv) all security or rent or other similar deposits held for the applicable Group Companies’

account, minus (v) issued but uncleared checks, drafts and wire transfers of the applicable Group Companies.

| e. | The definition of “Enumerated Assets” is amended and

restated in its entirety to read as follows: |

“Enumerated Assets”

means all of the following assets of CFC IPA, in each case, other than the Excluded Assets: (a) the Assumed Contracts; (b) all

Assumed Intellectual Property and all income, royalties, damages and payments accrued, due or payable as of the Initial Effective Time

or thereafter (including damages and payments for past, present or future infringement, misappropriation or dilution thereof or other

conflict therewith, the right to sue and recover for past, present or future infringement, misappropriation or dilution thereof or other

conflict therewith, and any and all corresponding rights that, now or hereafter may be secured throughout the world), and all trademarks,

service marks, trade dress, trade names, logos, dba’s, fictitious names, and corporate names and registrations and applications

(including intents to use) for registration thereof, together with all of the goodwill associated therewith used by CFC; (c) all

claims, refunds, credits, causes of action, rights of recovery and rights of set-off; (d) all documents, books, ledgers, files and

records (excluding Personnel Records); (e) all advertising, marketing and promotional materials and the right to receive mail and

other communications of the IPA Business; (f) all Permits; (g) all goodwill (including goodwill related to the Assumed Intellectual

Property); (h) all proceeds under warranty, indemnity and similar rights against third parties, rights of recovery relating to any

Insurance Claims (except those relating to the Excluded Assets and Excluded Liabilities); (i) all equipment used in the IPA Business

that is owed or leased by CFC IPA; (j) all tangible assets used in the IPA Business, including, without limitation, all inventory,

furniture, furnishings, fixtures and supplies, (k) the right to receive all payments in respect of accounts and notes receivable

outstanding as of the Initial Effective Time; (l) all prepayments and prepaid expenses, advance payments, employee advances, surety

accounts, bonds and deposits and similar assets; (m) the right to bill and receive payment for products or materials shipped or

delivered or services performed but unbilled or unpaid as of the Initial Effective Time; (n) all bank accounts of CFC IPA except

for the following accounts: (i) Certificate of Deposit account at City National Bank (Account Number [*]); (ii) Money

Market Account at City National Bank (Account Number [*]); (iii) Investment Account at City National Bank (Account Number

[*]); (iv) Investment Account at City National Bank (Account Number [*]); (v) Investment Account at City National

Bank (Account Number [*]); and (vi) Operating Account at City National Bank (Account Number [*]); and (o) all other

properties, assets and rights owned by CFC IPA as of the Initial Closing Date, or in which CFC IPA has an interest.

| f. | The definition of “Member” is amended and restated in

its entirety to read as follows: |

“Member” means eligible

individuals who are enrolled in a Plan that contracts with CFC IPA (if before the Initial Closing) or PC Buyer (if after the Initial

Closing), with respect to whom CFCHP (whether before or after the Second Closing) or CFC IPA (if before the Initial Closing) or PC Buyer

(if after the Initial Closing) assumes financial risk or is entitled to receive payment (whether on a capitated, percentage of premium,

or other basis) from, as evidenced by membership eligibility files received by CFCHP and PC Buyer from the Plans. For the avoidance of

doubt, any eligible individual who is enrolled in a Plan that contracts with CFCHP or PC Buyer at any point during a given month shall

be considered a Member for such month. For the purposes of this definition, PC Buyer shall be deemed to include Metropolitan IPA and

Allied physicians along with all primary care physicians that have provider agreements with CFC IPA as of the Initial Closing Date, and

are in the zip codes where CFC IPA primary care physicians are located as of the Initial Closing Date, including but not limited to Antelope

Valley, San Fernando Valley and the metropolitan areas of Los Angeles.

| g. | The definition of “Member Month” is amended and restated

in its entirety to read as follows: |

“Member Month” means

the quotient of the (i) total number of Members per month during a Measurement Period, divided by (ii) twelve (12), as evidenced

by membership eligibility files received by CFCHP and PC Buyer from the Plans. By way of example only, a Member who is a Member for each

month of a twelve (12) month Measurement Period will be counted twelve (12) times; a Member who is a Member for only six (6) of

the twelve (12) months will be counted six (6) times. For the purposes of this definition, PC Buyer shall be deemed to include Metropolitan

IPA and Allied physicians along with all primary care physicians that have provider agreements with CFC IPA as of the Initial Closing

Date, and are in the zip codes where CFC IPA primary care physicians are located as of the Initial Closing Date, including but not limited

to Antelope Valley, San Fernando Valley and the metropolitan areas of Los Angeles.

| h. | The definition of “Target Member

Month Amount” is amended and restated in its entirety to read as follows: |

“Target Member Month Amount”

means eighty-seven and fifty hundredths percent (87.5%) of the Member Months as December 31, 2023 as evidenced by membership eligibility

reports received by CFCHP and CFC IPA from the Plans; provided, that the Target Member Month Amount shall be increased by the

subsequent addition of Members to PC Buyer or CFCHP from other Plans managed by MSO LP Buyer during the first month in which such Members

(other than Members who were formerly Members of CFC IPA) join PC Buyer or CFCHP and are managed by MSO LP Buyer. For the avoidance of

doubt, any eligible individual who is enrolled in a Plan that contracts with CFCHP or PC Buyer at any point during a given month shall

be considered a Member for such month. By way of example only, if the Initial Closing is January 15, 2023, and there are 100 Members

as of January 31, 2023, and on April 15, 2023, 100 Members are added, then (i) for the First Measurement Period, the Target

Member Month Amount would be 87.5% of 175 Member Months, and (ii) for the Second Measurement Period, the Target Member Month Amount

would be 87.5% of 200 Member Months. A hypothetical example of calculating the Target Member Month Amount and Actual Member Month Amount

is attached hereto as Schedule 1.3(a). For the purposes of this definition, PC Buyer shall be deemed to include Metropolitan IPA

and Allied physicians along with all primary care physicians that have provider agreements with CFC IPA as of the Initial Closing Date,

and are in the zip codes where CFC IPA primary care physicians are located as of the Initial Closing Date, including but not limited

to Antelope Valley, San Fernando Valley and the metropolitan areas of Los Angeles. A hypothetical example of calculating the Target Member

Month Amount and Actual Member Month Amount is attached hereto as Schedule 1.3(a).

Section 14. Continuation

of Agreement. As of and after the date hereof, each reference in the Agreement to “this Agreement”, “hereunder”,

“hereof”, “herein”, “hereby” or words of like import referring to the Agreement shall mean and be

a reference to the Agreement as amended by this Amendment. The Agreement, as amended hereby, shall continue in full force and effect.

Except as expressly amended by this Amendment, the Agreement is hereby ratified and confirmed in all respects.

Section 15. Governing

Law. This Amendment shall be governed in all respects in accordance with the provisions of Section 12.9 of the Agreement.

Section 16. Counterparts.

This Amendment may be executed in any number of counterparts, each of which when executed, shall be deemed to be an original and all

of which together will be deemed to be one and the same instrument binding upon all of the parties hereto notwithstanding the fact that

all parties are not signatory to the original or the same counterpart. For purposes of this Amendment, facsimile signatures and electronically

delivered signatures shall be deemed originals.

[Remainder of page intentionally left

blank.]

IN WITNESS WHEREOF, the parties have executed

this Amendment as of the date first above written.

| |

BUYER PARTIES: |

| |

|

| |

“PC Buyer” |

| |

|

| |

METROPOLITAN IPA |

| |

|

| |

|

| |

By: |

/s/ Thomas S. Lam |

| |

Name: Thomas S. Lam |

| |

Title: Chief Executive Officer |

| |

|

| |

|

| |

“MSO LP Buyer” |

| |

|

| |

NETWORK MEDICAL MANAGEMENT, INC. |

| |

|

| |

|

| |

By: |

/s/ Thomas S. Lam |

| |

Name: Thomas S. Lam |

| |

Title: Chief Executive Officer |

| |

|

| |

|

| |

“MSO GP Buyer” |

| |

|

| |

APOLLOCARE ENABLEMENT OF CA, LLC |

| |

|

| |

|

| |

By: |

/s/ Brandon Sim |

| |

Name: Brandon Sim |

| |

Title: Manager |

| |

|

| |

|

| |

“Buyer Parent” |

| |

|

| |

APOLLO MEDICAL HOLDINGS, INC. |

| |

|

| |

|

| |

By: |

/s/ Brandon Sim |

| |

Name: Brandon Sim |

| |

Title: Co-Chief Executive Officer |

[Signature Page to Amendment No. 1

to Asset and Equity Purchase Agreement]

IN WITNESS WHEREOF, each Party has duly executed

and delivered this Amendment as of the date first above written.

| |

COMPANIES: |

| |

|

| |

“CFC IPA” |

| |

|

| |

Community Family Care Medical Group IPA, Inc. |

| |

|

| |

|

| |

By: |

/s/ Accie Mitchell, M.D. |

| |

Name: Accie Mitchell, M.D. |

| |

Title: Chief Executive Officer |

| |

|

| |

|

| |

“AHMS” |

| |

|

| |

Advanced Health Management Systems, L.P. |

| |

|

| |

By: CFC Management, LLC |

| |

Its: General Partner |

| |

|

| |

|

| |

By: |

/s/ Marc L. Mitchell |

| |

Name: Marc L. Mitchell |

| |

Title: Manager |

[Signature Page to Amendment No. 1

to Asset and Equity Purchase Agreement]

IN WITNESS WHEREOF, each Party has duly executed

and delivered this Amendment as of the date first above written.

| |

EQUITYHOLDERS: |

| |

|

| |

“IPA Equityholder” |

| |

|

| |

Accie M. Mitchell and Gloria C. Mitchell,

as co-trustees of the Mitchell Family Trust dated July 2, 2003 |

| |

|

| |

|

| |

/s/ Accie Mitchell, M.D. |

| |

Accie Mitchell, M.D. |

| |

Co-Trustee |

| |

|

| |

|

| |

/s/ Gloria Mitchell |

| |

Gloria Mitchell |

| |

Co-Trustee |

| |

|

| |

|

| |

“IPA Beneficial Owner” |

| |

|

| |

|

| |

/s/ Accie Mitchell, M.D. |

| |

Accie Mitchell, M.D. |

| |

|

| |

|

| |

“AHMS General Partner” |

| |

|

| |

By: CFC Management, LLC |

| |

Its: Manager |

| |

|

| |

|

| |

By: |

/s/ Marc L. Mitchell |

| |

|

Name: Marc L. Mitchell |

| |

|

Title: Manager |

[Signature Page to Amendment No. 1

to Asset and Equity Purchase Agreement]

| |

“AHMS Limited Partners” |

| |

|

| |

Mitchell Family Trust |

| |

|

| |

|

| |

/s/ Accie Mitchell, M.D. |

| |

Accie M. Mitchell, M.D. |

| |

Co-Trustee |

| |

|

| |

|

| |

/s/ Gloria C. Mitchell |

| |

Gloria C. Mitchell |

| |

Co-Trustee |

| |

|

| |

|

| |

Mitchell Children’s Trust |

| |

|

| |

|

| |

/s/ Marc L. Mitchell |

| |

Marc L. Mitchell |

| |

Co-Trustee |

| |

|

| |

|

| |

/s/ Alex M. Mitchell |

| |

Alex M. Mitchell |

| |

Co-Trustee |

| |

|

| |

|

| |

Marc Mitchell Irrevocable Trust |

| |

|

| |

|

| |

/s/ Marc L. Mitchell |

| |

Marc L. Mitchell |

| |

Trustee |

| |

|

| |

|

| |

Alex Mitchell Irrevocable Trust |

| |

|

| |

|

| |

/s/ Alex M. Mitchell |

| |

Alex M. Mitchell |

| |

Trustee |

[Signature Page to Amendment No. 1

to Asset and Equity Purchase Agreement]

| |

Cynthia Heard Irrevocable Trust |

| |

|

| |

|

| |

/s/ Marc L. Mitchell |

| |

Marc L. Mitchell |

| |

Co-Trustee |

| |

|

| |

|

| |

/s/ Alex M. Mitchell |

| |

Alex M. Mitchell |

| |

Co-Trustee |

| |

|

| |

|

| |

Tracy Mitchell Irrevocable Trust |

| |

|

| |

|

| |

/s/ Marc L. Mitchell |

| |

Marc L. Mitchell |

| |

Co-Trustee |

| |

|

| |

|

| |

/s/ Alex M. Mitchell |

| |

Alex M. Mitchell |

| |

Co-Trustee |

| |

|

| |

|

| |

Lori Konsker Irrevocable Trust |

| |

|

| |

|

| |

/s/ Marc L. Mitchell |

| |

Marc L. Mitchell |

| |

Co-Trustee |

| |

|

| |

|

| |

/s/ Alex M. Mitchell |

| |

Alex M. Mitchell |

| |

Co-Trustee |

| |

|

| |

|

| |

Jason Heard Irrevocable Trust |

| |

|

| |

|

| |

/s/ Marc L. Mitchell |

| |

Marc L. Mitchell |

| |

Co-Trustee |

| |

|

| |

|

| |

/s/ Alex M. Mitchell |

| |

Alex M. Mitchell |

| |

Co-Trustee |

[Signature Page to Amendment No. 1

to Asset and Equity Purchase Agreement]

| |

Briella Konsker Irrevocable Trust |

| |

|

| |

|

| |

/s/ Marc L. Mitchell |

| |

Marc L. Mitchell |

| |

Co-Trustee |

| |

|

| |

|

| |

/s/ Alex M. Mitchell |

| |

Alex M. Mitchell |

| |

Co-Trustee |

| |

|

| |

|

| |

Eliana Konsker Irrevocable Trust |

| |

|

| |

|

| |

/s/ Marc L. Mitchell |

| |

Marc L. Mitchell |

| |

Co-Trustee |

| |

|

| |

|

| |

/s/ Alex M. Mitchell |

| |

Alex M. Mitchell |

| |

Co-Trustee |

| |

|

| |

|

| |

Harrison Konsker Irrevocable Trust |

| |

|

| |

|

| |

/s/ Marc L. Mitchell |

| |

Marc L. Mitchell |

| |

Co-Trustee |

| |

|

| |

|

| |

/s/ Alex M. Mitchell |

| |

Alex M. Mitchell |

| |

Co-Trustee |

| |

|

| |

|

| |

Bennet Mitchell Irrevocable Trust |

| |

|

| |

|

| |

/s/ Marc L. Mitchell |

| |

Marc L. Mitchell |

| |

Co-Trustee |

| |

|

| |

|

| |

/s/ Alex M. Mitchell |

| |

Alex M. Mitchell |

| |

Co-Trustee |

[Signature Page to Amendment No. 1

to Asset and Equity Purchase Agreement]

| |

August Mitchell Irrevocable

Trust |

| |

|

| |

|

| |

/s/ Marc L. Mitchell |

| |

Marc L. Mitchell |

| |

Co-Trustee |

| |

|

| |

|

| |

/s/ Alex M. Mitchell |

| |

Alex M. Mitchell |

| |

Co-Trustee |

| |

|

| |

|

| |

Langston Mitchell Irrevocable Trust |

| |

|

| |

|

| |

/s/ Marc L. Mitchell |

| |

Marc L. Mitchell |

| |

Co-Trustee |

| |

|

| |

|

| |

/s/ Alex M. Mitchell |

| |

Alex M. Mitchell |

| |

Co-Trustee |

| |

|

| |

|

| |

Josephine Mitchell Irrevocable Trust |

| |

|

| |

|

| |

/s/ Marc L. Mitchell |

| |

Marc L. Mitchell |

| |

Trustee |

| |

|

| |

|

| |

William Calder Mitchell Irrevocable Trust |

| |

|

| |

|

| |

/s/ Alex M. Mitchell |

| |

Alex M. Mitchell |

| |

Trustee |

[Signature Page to Amendment No. 1

to Asset and Equity Purchase Agreement]

| |

AHMS Trust |

| |

|

| |

|

| |

/s/ Desiree Ryan |

| |

Premier Trust |

| |

Trust Officer: Desiree Ryan |

| |

|

| |

|

| |

/s/ Ronald L. Brandt |

| |

Name: Ronald L. Brandt |

[Signature Page to Amendment No. 1

to Asset and Equity Purchase Agreement]

IN WITNESS WHEREOF, each Party has duly executed

and delivered this Amendment as of the date first above written.

| |

I HEALTH: |

| |

|

| |

I Health Inc. |

| |

|

| |

|

| |

/s/ Ronald L. Brandt |

| |

Name: Ronald L. Brandt |

| |

Title: President |

[Signature Page to Amendment No. 1

to Asset and Equity Purchase Agreement]

IN WITNESS WHEREOF, each Party has duly executed

and delivered this Amendment as of the date first above written.

| |

EQUITYHOLDER REPRESENTATIVE: |

| |

|

| |

|

| |

/s/ Marc L. Mitchell |

| |

Name: Marc L. Mitchell |

[Signature Page to Amendment No. 1

to Asset and Equity Purchase Agreement]

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

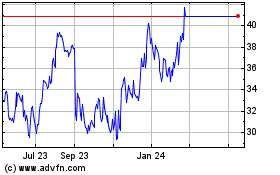

Apollo Medical (NASDAQ:AMEH)

Historical Stock Chart

From Jan 2025 to Feb 2025

Apollo Medical (NASDAQ:AMEH)

Historical Stock Chart

From Feb 2024 to Feb 2025