Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

November 01 2022 - 3:31PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of November 2022

Commission File Number 001-35715

JX Luxventure Limited

(Translation of registrant’s name into English)

Bin Hai Da Dao No. 270

Lang Qin Wan Guo Ji Du Jia Cun Zong He Lou

Xiu Ying District

Haikou City, Hainan Province 570100

People’s Republic of China

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: Form 20-F

☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Note:

Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached

annual report to security holders.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Note:

Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that

the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated,

domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on

which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to

be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the

subject of a Form 6-K submission or other Commission filing on EDGAR.

On October 26, 2022, the board of directors (the

“Board”) of JX Luxventure Limited, a Republic of the Marshall Islands corporation (the “Company”), acting by unanimous

consent, in accordance with applicable provisions of the Marshall Island Business Corporations Act (“BCA”) and the Company’s

Bylaws, authorized the termination of the Company’s existing 2022 equity incentive plan (the “Existing 2022 Plan”) and

adopted a new 2022 Equity Incentive Plan (the “New 2022 EIP”), replacing the Existing 2022 Plan, effective immediately. On

the same date, October 26, 2022, the holders of 15,528,520 shares of common stock, $0.0001 par value per share (the “Common Stock”)

of the Company, representing approximately 75% of the total issued and outstanding capital stock of the Company entitled to vote therein,

acting by written consent, approved and authorized the terms and provisions of the New 2022 EIP, in accordance with the applicable provisions

of the BCA and the Company’s Bylaws.

The maximum aggregate

number of shares of Common Stock, issuable under the New 2022 EIP shall be forty million (40,000,000) shares, subject to adjustments in

the event of certain reorganizations, mergers, combinations, recapitalizations, share splits, share dividends, or other similar events

which change the number or kind of shares outstanding.

Pursuant to the terms

of the New 2022 EIP, the Board shall serve as the “Administrator” as defined in the New 2022 EIP and shall have the authority

and responsibilities to grant, from time to time, equity awards in the form of incentive share options, non-statutory options, restricted

shares, restricted share units, share appreciation rights, performance units and performance shares (collectively, the “Awards”)

to directors, officers, key employees, and consultants of the Company or any affiliates of the Company, provided that the incentive share

options may be granted only to employees of the Company or its subsidiaries. The Administrator shall have the discretion to make all other

determinations necessary or advisable for the administration of the New 2022 EIP, including, without limitation, the number of shares

of Common Stock subject to each Award, the price to be paid for the shares and the applicable vesting criteria.

The foregoing description

is subject to, and qualified in its entirety by the New 2022 EIP, filed as Exhibit 10.1 hereto and incorporated herein by reference.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: November 1, 2022 |

JX Luxventure Limited |

| |

|

|

| |

By: |

/s/ Sun Lei |

| |

Sun Lei

Chief Executive Officer |

EXHIBIT INDEX

3

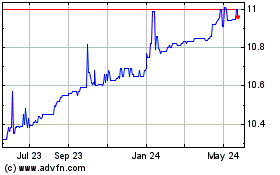

Aquaron Acquisition (NASDAQ:AQU)

Historical Stock Chart

From Dec 2024 to Jan 2025

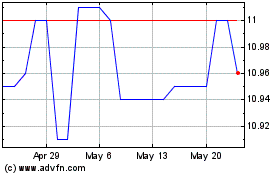

Aquaron Acquisition (NASDAQ:AQU)

Historical Stock Chart

From Jan 2024 to Jan 2025