Current Report Filing (8-k)

May 01 2023 - 5:25AM

Edgar (US Regulatory)

0001614067

false

0001614067

2023-04-26

2023-04-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported)

April

26, 2023

Aridis

Pharmaceuticals, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-38630 |

|

47-2641188 |

(State

or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(I.

R. S. Employer

Identification

No.) |

983

University Avenue, Bldg. B

Los

Gatos, California 95032

(Address

of principal executive offices, including ZIP code)

(408)

385-1742

(Registrant’s

telephone number, including area code)

(Former

name or former address, if changed since last report)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class: |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered: |

| Common Stock |

|

ARDS |

|

Nasdaq Capital Market |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 1.01 | Entry

into a Material Definitive Agreement. |

On

April 26, 2023, Aridis Pharmaceuticals, Inc. (the “Company”) entered into a Note Purchase and Loan Restructuring Agreement

(the “Agreement”) with Streeterville Capital, LLC (the “Investor”). We had previously issued to the Investor

in February 2021, a secured promissory note in the original principal amount of $5,250,000. Pursuant to the Agreement, the Investor agreed

to invest an additional investment amount of up to $2,500,000, $1,000,000 of which will delivered to the Company at closing and the remaining

$1,500,000 of which will be placed into escrow under a secured line of credit facility with the total original principal amount of the

secured promissory note being up to $9,286,770.80 (the “Secured Note”). Closing occurred on April 26, 2023 (the “Issuance

Date”). The Note carries an original issue discount of $606,564.45. The Note bears interest at the rate of 8% per annum and matures

on April 26, 2024. Beginning on October 26, 2023, on the same day of each month for the following five (5) calendar months thereafter,

the Company will be obligated to reduce the Outstanding Balance of the Secured Note by sixteen and two-thirds percent (16.6667%) of the

Outstanding Balance of the Secured Note per month. The Company can prepay all or any portion of the Outstanding Amount at a rate of 110%

of the portion of the Outstanding Balance.

Of

the $1,500,000 placed into escrow, $750,000.00 of the escrowed amount will be released upon (a) satisfaction of all of the Draw Conditions

as set forth in the Secured Note; (b) all of Investor’s security interests granted have been perfected to Investor’s reasonable

satisfaction; and (c) the Company has filed a preliminary Form S-1 with the SEC (the “First Draw Conditions”) and the balance

of the escrowed amount will be released upon (a) satisfaction of all of the Draw Conditions; (b) all of the First Draw Conditions shall

have been satisfied; and (c) either (1) the Company has raised $750,000.00 in new funding through the sale of shares of its common stock

through its Form S-1, or (2) ninety-one (91) days have passed since the Effective Date.

Pursuant

to the Note Purchase Agreement, we are subject to certain covenants, including the obligations to: (i) timely file all reports required

to be filed under Sections 13 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and not terminate

its status as an issuer required to file reports under the Exchange Act; (ii) maintain listing of our common stock on a securities exchange;

and (iii) avoid trading in our common stock from being suspended, halted, chilled, frozen or otherwise ceased.

In

addition, pursuant to the Security Agreement dated April 26, 2023 between the Company and the Investor, the Note is secured by all of

the Company’s assets.

The

foregoing descriptions of the Agreement, the Security Agreement and the Note do not purport to be complete and are qualified in their

entirety by reference to the full text of the Agreement, the Security Agreement and the Note, forms of which are attached as Exhibit

10.1, 10.2 and 4.1, respectively, to this Current Report on Form 8-K, and are incorporated herein by reference.

| Item

2.03 |

Creation

of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The

information included in Item 1.01 of this Form 8-K is hereby incorporated by reference into this Item 2.03.

| Item 9.01. | Financial

Statements and Exhibits |

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

May 1, 2023 |

ARIDIS

PHARMACEUTICALS, INC. |

| |

|

| |

/s/

Vu Truong |

| |

Vu

Truong |

| |

Chief

Executive Officer |

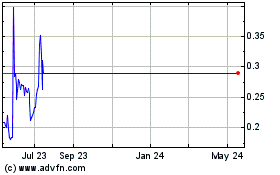

Aridis Pharmaceuticals (NASDAQ:ARDS)

Historical Stock Chart

From Jan 2025 to Feb 2025

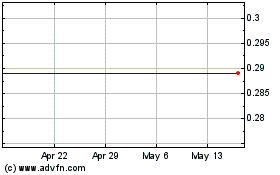

Aridis Pharmaceuticals (NASDAQ:ARDS)

Historical Stock Chart

From Feb 2024 to Feb 2025