Manitowoc Shares Up on Earnings Beat - Analyst Blog

October 28 2013 - 8:00AM

Zacks

Shares of Manitowoc

Company, Inc. (MTW) gained 4% a day after reporting upbeat

third-quarter 2013 results on Oct 24. Adjusted earnings from

continuing operations catapulted an impressive 129% year over year

to 39 cents per share helped by sound performance in the Crane

segment, successful introduction of new products, as well as

Manitowoc’s strategic initiatives. The results beat the Zacks

Consensus Estimate of 32 cents.

Operational Update

Total revenue was $1014 million in the reported quarter, up 7% year

over year driven by increased Crane segment sales. However, the

revenues fell short of the Zacks Consensus Estimate of $1034

million.

Cost of sales increased 6% to $754 million in the second quarter

from $713 million in the year-ago quarter. Gross profit improved

11% year over year to $260 million. Consequently, gross margin

expanded 90 basis points (bps) to 25.6% in the quarter.

Engineering, selling and administrative expenses slipped 1% year

over year to $151 million. Adjusted operating income was $109

million, up 34% year over year, leading to 220 bps expansion in

operating margin to 10.8%.

Segmental Performance

Revenues from the Crane and Related Products segment increased 10%

year over year to $612 million in the reported quarter, driven by

continued growth in the American region due to increased crawler

crane activity, as well as strong results from the crane care. The

segment’s operating income rose 103% year over year to $55.7

million on higher sales volume as well as improved operational

efficiency.

Foodservice Equipment segment revenues were $401.9 million in the

quarter compared with $392.4 million in the prior-year quarter. The

improvement was mainly backed by sales of new products and growth

in the Americas and increasing demand in Europe from the successful

roll-out of Manitowoc’s blended beverage technology. However, the

segment’s operating income dropped 3% year over year to $69

million. Ongoing investments in key brand manufacturing strategies,

as well as new product development costs affected profitability

during the quarter.

Backlog

Backlog in the Crane segment stood at $568 million at the end of

the third quarter of 2013, down $158 million sequentially. Total

orders were $450 million, a 23% decline from the prior-year

quarter, reflecting conservative spending actions of customers.

Financial Update

As of Sept 30, 2013, cash and temporary investments amounted to

$87.2 million versus $76.1 million as of Dec 31, 2012. Long-term

debt was $1.71 billion as of Sep 30, 2013, compared with $1.73

billion as of Dec 31, 2012. Debt-to-capitalization ratio remained

high at 72% as of Sep 30, 2013, though it improved from 76% as of

Dec 31, 2012.

Cash flow from operating activities improved substantially to $114

million in third quarter from $49.7 million in the prior-year

quarter driven by cash from profitability, partially offset by

seasonal working capital requirements in both segments. Capital

expenditure was $26.4 million in the quarter compared with $15.5

million in the year-ago quarter.

Outlook

For full-year 2013, Manitowoc lowered its revenue guidance for the

Crane segment from high single-digit to mid single-digit growth.

Foodservice revenues are expected to rise in modest single- digits

compared with the mid single-digit growth expected earlier.

The company however reiterated its forecast of high single-digit

improvement in operating margins in the Crane segment and mid-teens

gains in the Foodservice segment.

Capital expenditure is expected to be $100 million for the year.

Manitowoc also reaffirmed the outlook for depreciation and

amortization, which will be $115 million for 2013. Interest

expenses are expected at $125 million, while debt reduction is

targeted to exceed $200 million.

Our View

Crane demand is expected to increase significantly, aided by the

new highway bill and a turnaround in the construction sector. The

segment will also be benefited by innovation of new products and

services. Growing global energy and power generation investment

will drive segment growth. The Foodservice segment will be assisted

by new manufacturing facilities and new products. Margins for both

the Crane and Foodservice segments are expected to improve in

fiscal 2013. However, high debt levels will continue to be a

headwind.

Wis.-based Manitowoc is one of the world's leading innovators

and manufacturers of commercial foodservice equipment. The company

is one of the premier innovators and providers of crawler cranes,

tower cranes, and mobile cranes for the heavy construction

industry. These are complemented by industry-leading product

support services. Manitowoc currently retains a Zacks Rank #4

(Sell).

Peer Performance

Among Manitowoc’s peers, Caterpillar Inc.'s (CAT)

third quarter earnings dropped 43% year over year to $1.45 per

share, well short of the Zacks Consensus Estimate of $1.68.

Earnings of Astec Industries, Inc. (ASTE) also

dipped 3.4% to 28 cents per share, short of the Zacks Consensus

Estimate of 37 cents.

On the other hand, Terex Corp. (TEX) fared much

better, delivering a 24% increase in its third-quarter 2013

adjusted earnings to 77 cents per share, outperforming the Zacks

Consensus Estimate of 58 cents.

ASTEC INDS INC (ASTE): Free Stock Analysis Report

CATERPILLAR INC (CAT): Free Stock Analysis Report

MANITOWOC INC (MTW): Free Stock Analysis Report

TEREX CORP (TEX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

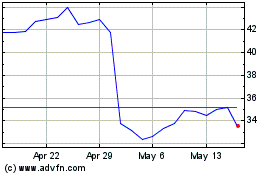

Astec Industries (NASDAQ:ASTE)

Historical Stock Chart

From Oct 2024 to Nov 2024

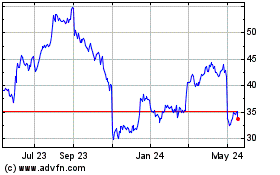

Astec Industries (NASDAQ:ASTE)

Historical Stock Chart

From Nov 2023 to Nov 2024