falseUSD0001546417iso4217:USDxbrli:shares00015464172024-12-302024-12-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) December 30, 2024

BLOOMIN’ BRANDS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-35625 | 20-8023465 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer

Identification No.) |

2202 North West Shore Boulevard, Suite 500, Tampa, FL 33607

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (813) 282-1225

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

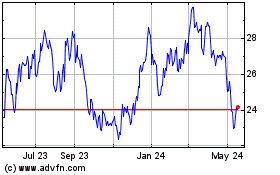

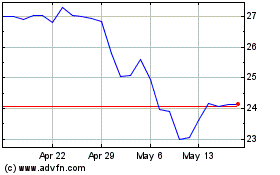

| Common Stock | $0.01 par value

| | BLMN | | The Nasdaq Stock Market LLC (Nasdaq Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

The information set forth below under Item 2.01 is incorporated by reference into this Item 1.01.

Item 2.01 Completion of Acquisition or Disposition of Assets

As previously disclosed in the Current Report on Form 8-K filed by Bloomin’ Brands, Inc., a Delaware corporation (the “Company”), with the Securities and Exchange Commission (the “SEC”) on November 8, 2024, Bloom Group Holdings, B.V., a limited liability company organized under the laws of the Netherlands (the “Seller”) and an indirect wholly owned subsidiary of the Company, entered into a Quota Purchase Agreement and Other Covenants dated November 6, 2024 (the “Purchase Agreement”), by and among Seller, Bloom Participações Ltda., a limited liability company organized under the laws of the Federative Republic of Brazil (“BPar”), Outback Steakhouse Restaurantes Brasil S.A., a corporation organized under the laws of the Federative Republic of Brazil (“OSRB” and, together with BPar, the “Target Entities”), and Osaka Participações Societárias S.A., a corporation organized under the laws of the Federative Republic of Brazil (“Buyer”). Buyer is owned by a fund managed by an affiliate of Vinci Partners Investments Ltd.

The transaction contemplated by the Purchase Agreement (the “Transaction”), closed on December 30, 2024 (the “Closing Date”). On the Closing Date, Buyer acquired 67% of the capital stock of BPar from the Seller for a purchase price of R$1.4 billion Reais (approximately $225.3 million in U.S. Dollars based on the current exchange rate), subject to customary post-closing adjustments (the “Purchase Price”). An installment payment in the amount of $117.2 million before tax comprising 52% of the Purchase Price was paid to the Seller on the Closing Date. The remaining 48% of the Purchase Price will be paid on the first anniversary of the Closing Date. The Company has entered into foreign exchange forward contracts to mitigate most of the exchange rate risk associated with the remaining Purchase Price installment payment.

In connection with and as a condition to closing the Transaction, on the Closing Date, Buyer, Seller and the Target Entities entered into a Shareholders Agreement (the “Shareholders Agreement”), pursuant to which Buyer and Seller have representation on the boards of directors and in executive management of the Target Entities based on their respective interests in BPar. The Shareholders Agreement contains customary corporate governance provisions, customary restrictions on transfer of shares and customary shareholders’ rights. The Shareholders Agreement also sets forth a put-call mechanism pursuant to which (1) Buyer may cause Seller to sell the totality of its interest in the Target Entities for a period between October 1, 2028 and December 31, 2028 (the “Option Exercise Period”), and (2) the Seller may cause Buyer to purchase the totality of Seller’s interest in the Target Entities during the Option Exercise Period.

Pierre Berenstein, who has served as the Company’s Executive Vice President, Chief Customer Officer since August 2023 and served as President of Bloomin’ Brands Brazil from May 2017 through October 2023, will leave his role with the Company and is expected to become the Chief Executive Officer of OSRB. In consideration for this appointment, among other things, Mr. Berenstein is expected to receive equity interests in the Target Entities, with a grant date value of $2 million in U.S. Dollars. These interests will be funded 50% by the Company and 50% by OSRB.

The Purchase Agreement and Shareholders Agreement are included as Exhibits 10.1 and 10.2 to this Current Report on Form 8-K and are incorporated by reference herein. The description of the terms of the Purchase Agreement and the Shareholders Agreement set forth above is qualified in its entirety by reference to such exhibits.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

| | | | | | | | | | | |

| | Exhibit Number | | Description |

| 10.1* | | |

| 10.2* | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

* Portions of this exhibit (indicated by asterisks) have been redacted in compliance with Regulation S-K Item 601(b)(2)(ii).

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | BLOOMIN’ BRANDS, INC. |

| | | (Registrant) |

| | | |

| Date: | December 31, 2024 | By: | /s/ Kelly Lefferts |

| | | Kelly Lefferts |

| | | Executive Vice President and Chief Legal Officer |

Exhibit 10.2

CERTAIN INFORMATION INDICATED BY [***] HAS BEEN OMITTED AS NOT MATERIAL AND PRIVATE OR CONFIDENTIAL

| | |

Dated December 30, 2024 |

SHAREHOLDERS AGREEMENT OF BOLD HOSPITALITY COMPANY S.A.

entered into by and among, on one side, OSAKA PARTICIPAÇÕES SOCIETÁRIAS S.A., and, on the other side, BLOOM GROUP HOLDINGS, B.V., and, as assenting parties, BOLD HOSPITALITY COMPANY S.A., and OUTBACK STEAKHOUSE RESTAURANTES BRASIL S.A. |

SHAREHOLDERS AGREEMENT OF BOLD HOSPITALITY COMPANY S.A.

This Shareholders Agreement of Bold Hospitality Company S.A. is entered into as of December 30, 2024 (“Execution Date”), by and between:

(1)OSAKA PARTICIPAÇÕES SOCIETÁRIAS S.A., a joint-stock company (sociedade por ações) duly organized and validly existing in accordance with the Laws of the Federative Republic of Brazil, enrolled with the CNPJ under the No. 53.262367/0001-40, with its headquarters at 1,293, Alameda Santos, 4th floor, suite 42, Cerqueira Cesar, City and State of São Paulo, Postal 01419-904 (“Majority Shareholder”).

(2)BLOOM GROUP HOLDINGS, B.V., a limited liability company organized under the laws of the Netherlands, enrolled with the CNPJ under the No. 18.962.020/0001-09, with registered office at 2202 N. West Shore Blvd. 5th floor, Tampa, FL 33607 (“Minority Shareholder” referred to jointly and severally with the Majority Shareholder as a “Party” or “Shareholder” and collectively as the “Parties” or “Shareholders”);

and as assenting parties:

(3)BOLD HOSPITALITY COMPANY S.A., a joint-stock company duly organized and validly existing in accordance with the Laws of the Federative Republic of Brazil, enrolled with the CNPJ under No. 18.598.507/0001-54, headquartered in the City of São Paulo, State of São Paulo, at Avenida das Nações Unidas, 12,901, 4th floor, Block C, unit 401, part., West Tower, Brooklin Paulista, Postal Code 04.578-000, with its corporate acts duly registered and filed with JUCESP under NIRE 35227765167 (“Company”); and

(4)OUTBACK STEAKHOUSE RESTAURANTES BRASIL S.A., a corporation duly organized and validly existing in accordance with the Laws of the Federative Republic of Brazil, enrolled with the CNPJ under the No. 17.261.661/0001-73, with registered office in the City of São Paulo, State of São Paulo, at Avenida das Nações Unidas, 12,901, 4th floor, Block C, unit 401, Brooklin, Postal Code 04.578-000, with its corporate acts duly registered and filed with JUCESP under NIRE 35300463412 (“OSRB”).

R E C I T A L S:

WHEREAS:

(A)On the date hereof, the Company, OSRB and Outback Steakhouse International, L.P. entered into certain Amended and Restated Multi-Restaurant Franchise Agreements (“Franchise Agreements”) governing the terms and conditions of the development and operation of restaurants in Brazil under the “Outback Steakhouse®”, “Abbraccio” and “Ausie Grill” trademarks;

(B)On November 6th, 2024, the Parties entered into that certain Quota Purchase Agreement and Other Covenants (“QPA”) governing the terms and conditions for, inter alia, (i) the acquisition, by the Majority Shareholder from the Minority Shareholder, of shares representing sixty-seven percent (67%) of the total and voting capital stock of the Company, on a fully diluted basis; (ii) the entering into the Franchise Agreements (“Transaction”);

(C)On the date hereof, the Parties implemented the Closing (as defined in the QPA) of the transaction comprised in the QPA, including the transformation of the company into a corporation (sociedade por ações), subscription and transfer of the Company’s shares

indicated in the Whereas (B) above, being the capital stock of the Company currently held as follows:

| | | | | | | | |

| Shareholder | Number of Common Shares | % of Common Shares |

| Osaka Participações Societárias S.A. | [***] | 67% |

| Bloom Group Holdings, B.V. | [***] | 33% |

| Total | [***] | 100% |

(D)The Shareholders wish to set forth the principles and rules which shall govern their relationship as shareholders of the Company, and as indirect shareholders of OSRB and any other Subsidiary that the Company may have in the future.

NOW, THEREFORE, in consideration of the mutual promises and covenants set forth below and for other good and valuable consideration, the Parties wish to enter into this Agreement to set forth their rights and obligations as shareholders of the Company, and indirect shareholders of the Subsidiaries (present and future), pursuant to and for the purposes of article 118 of Law No. 6,404, of December 15th, 1976, as amended from time to time (“Brazilian Corporations Law”).

1Rules of interpretation

1.1Definitions of Certain Terms

Unless expressly indicated otherwise or if the context is incompatible with any meaning indicated herein, the words, expressions and abbreviations initiated with capital letters and not defined elsewhere in this Agreement shall have the meaning assigned to them below:

| | |

“Accounting Principles” means the accounting methods, practices, procedures and policies used in the preparation of the financial statements of the Company and OSRB. |

“Acquisition Debt” means [***]. |

“Affected Shareholder” has the meaning given in Section 10.10.1. |

“Affiliate” means, as to any Person, any other Person that, directly or indirectly, Controls, is Controlled by, or is under Common control with such Person. |

“Agreement” means this Shareholders Agreement of Bold Hospitality Company S.A., including the Schedules and Exhibits hereto, as may be amended from time to time. |

“Appointed Expert” means PriceWaterhouseCoopers, Deloitte Touche Tohmatsu, Ernst & Young, KPMG Auditores Independentes, Grant Thornton, and BDO Auditores Independentes, or any internationally recognized independent auditor chosen by consensus among the Parties, which shall not have been an auditor of either the Majority Shareholder or the Minority Shareholder within the last twelve (12)-month period. |

“Arbitral Tribunal” has the meaning given in Section 13.19.3. |

“Arbitration Chamber” means the International Court of Arbitration of the International Chamber of Commerce. |

“Audit Committee” has the meaning given in Section 6.4.2. |

| | |

“Audit Firm” means an independent auditing firm registered with the CVM and appointed at a General Shareholders’ Meeting of the Company. |

“B3” means B3 S.A. – Brasil, Bolsa e Balcão. |

“Binding Offer” has the meaning given in Section 10.7.1. |

“Board of Directors Meetings” has the meaning given in Section 6.3.6. |

“Board of Directors” means the Company’s board of Directors (Conselho de Administração). |

“Board Reserved Matters” has the meaning given in Section 6.3.8. |

“Brazilian Corporations Law” has the meaning given in the recitals to this Agreement. |

“Business” means the business of the Company as currently conducted on the date hereof, comprising the operation of restaurants under the trademarks “Outback”, “Aussie Grill”, “Aussie Chicken & More” and “Abbraccio”. “Business Day” means a day other than a Saturday, Sunday or other day on which commercial banks in São Paulo, State of São Paulo, Brazil or in Tampa, State of Florida, United States are authorized or required by Law to close. |

“Bylaws” means the Company’s bylaws, as amended from time to time. |

“Cash” means all cash, cash equivalents (to the extent convertible to cash within ninety (90) days), bank deposits, deposits in transit and freely marketable funds on securities of or held by the Company and its Subsidiaries, as determined in accordance with the Accounting Principles, as such cash and cash equivalents may be reduced by outstanding checks and drafts or pending electronic debits. |

“CDI” means one hundred percent (100%) of the variation of the daily average rates of one-day interbank deposits, over extra group, denominated “DI” rates, expressed as a percentage per year, based on two hundred and fifty-two (252) Business Days, calculated and disclosed by the CETIP S.A. – Mercados Organizados, on a daily basis calculated pro rata per day. |

“CEO” has the meaning given in Section 6.5.1. |

“CFC” means a “controlled foreign corporation” within the meaning of Section 957(a) of the U.S. Internal Revenue Code. |

“CFO” has the meaning given in Section 6.5.1. |

“Chairperson” has the meaning given in Section 6.3.3. |

“CNPJ” means the National Register of Legal Entities of the Brazilian Ministry of Finance. |

“Commercial Notes” has the meaning given in Section 1.1. |

“Committees” has the meaning given in Section 6.4. |

“Common Shares” has the meaning given in Section 4.2.1. |

“Company” has the meaning given in the preamble of this Agreement. |

| | |

“Compelled Party” has the meaning given in Section 2.1.2. |

“Competitor” means a Person that is considered a “Competitor” according to the definition set forth in the Franchise Agreements, i.e., all fine dining, casual dining, fast casual or quick service segment restaurants whose primary menu item is steak and/or ribs or Italian food; provided that [***]. |

“Confidential Arbitration Information” has the meaning given in Section 13.19.4. |

“Confidential Information” has the meaning given in Section 2.1. |

“Contract” means any contract, agreement, arrangement, warranty, purchase order, note, mortgage, bond, indenture, loan, license, lease, sublease, commitment or other written instrument or understanding. |

“Control” (including the terms “Controlled by” and “under common Control with”) means the possession, directly or indirectly, and effective use of the power to direct or cause the direction of the management policies of a Person, whether through the ownership of voting securities, by contract or credit arrangement, as trustee or executor, or otherwise. |

“COO” has the meaning given in Section 6.5.1. |

“Counter Notice” has the meaning given in Section 10.6.2. |

“CVM” means Securities and Exchange Commission (Comissão de Valores Mobiliários). |

“Debt Pushdown” has the meaning given in Section 11.5. |

“Default Call Exercise Period” has the meaning given in Section 11.4.1. |

“Default Call Option Notice” has the meaning given in Section 11.4.2. |

“Default Call Option” has the meaning given in Section 11.4. |

“Default Event” means the default by the Minority Shareholder to pay to the Majority Shareholder (or their Indemnifiable Parties, as defined in the QPA) an indemnification payment that has become due (líquida, certa e exigivel) but not paid for more than twelve (12)-months from the expiration of the term set forth in Section 8.7.3 of the QPA, provided, however, that the offset mechanisms set for in item (i), (ii), and (iii) of Section 8.8.1 of the QPA have not been sufficient to cover the payment as indemnification under the QPA up to the end of the twelve (12)-month period set forth above. |

“Distribution Policy” has the meaning given in Section 8.1. |

“EBITDA” means, with respect to a Person, the Earnings Before Interest, Taxes, Depreciation, and Amortization of the Company (on a consolidated basis) calculated pursuant to the Accounting Principles and under the same criteria for determination of adjustments set out in Exhibit 11.3.1. “EBITDA LTM” means, with respect to a Person, its EBITDA of the twelve (12) months before an event of calculation, considering only full months. “EBITDA LTM Negotiation Period” has the meaning given in Section 11.3.2. |

“Encumbered Shares” has the meaning given in Section 10.10.1. |

| | |

“Entity” means a partnership, limited partnership, corporation, limited liability company, business trust, joint stock company, trust, foundation, unincorporated association, Brazilian investment fund, joint venture, Governmental Authority or other entity or organization. |

“Execution Date” has the meaning defined in the preamble of this Agreement. |

“Exit Call Option” has the meaning given in Section 11.1. “Exit Call Option Notice” has the meaning given in Section 11.1.2. “Exit Options” has the meaning given in Section 11.2. “Exit Option Exercise Period” has the meaning given in Section 11.1.1. “Exit Option Shares” has the meaning given in Section 11.1. “Exit Put Option” has the meaning given in Section 11.2. “Exit Put Option Notice” has the meaning given in Section 11.2.2. |

“Financial Distress” has the meaning given in Section 9.3.2. |

“FIP” means the Vinci Capital Partners IV C FI em Participações Multiestrategia Responsabilidade Limitada, enrolled in the CNPJ under No. 57.215.699/0001-24, under the discretionary management of Vinci. |

“Franchise Agreement” has the meaning given in the recitals to this Agreement. |

“Funding Call” has the meaning given in Section 9.3. |

“General Shareholders’ Meetings” has the meaning given in Section 5.1. |

“Governmental Authority” means any state, provincial, local or other political subdivision thereof, any entity, authority or body exercising executive, legislative, judicial, regulatory or administrative functions or pertaining to of government, including any government authority, agency, department, board, commission or instrumentality of Brazil or any other country under which the Parties are incorporated, as well as any political subdivision of any thereof and any court, tribunal or arbitration panel or any self-regulatory organization. |

“Holdback” has the meaning given in Section 11.3.5. |

“Holdback Amount” has the meaning given in Section 11.3.5(ii)(b). |

“ICP-Brasil” means the Infraestrutura de Chaves Públicas Brasileira. |

“Indebtedness” means [***]. |

“Indemnification Report Counter-Notice” has the meaning given in Section 11.3.5(ii). “Indemnification Report Notice” has the meaning given in Section 11.3.5(i). “Indemnified Claims” has the meaning given in Section 11.3.5(i). |

“Intermediary Stake” has the meaning given in Section 5.6.1. |

“IPCA” means [***]. |

| | |

“Law” means any federal, state, local, foreign, international or supranational law (including common law), statute, treaty, ordinance, rule (including accounting rules), regulation, Order, code, governmental restriction or other legally binding requirement. |

“Leverage Cap” means [***]. “Leverage Policy” means the leverage policy by which the Company and its Subsidiaries, as applicable, may take Indebtedness pursuant to Section 9. “Leverage Ratio” has the meaning given in Section 9.2.1. |

“Lien” means any mortgage (including caução or penhor), pledge, hypothecation, assignment, right of others, claim, charge, security interest, encumbrance, adverse claim or interest, easement, covenant, encroachment, servitude, option, lien, preemptive or similar right, any financing lease involving substantially the same economic effect as any of the foregoing or any restriction on sale, transfer, assignment, disposition or other alienation, proxy, voting trust or agreement (including any right of first refusal or first offer), or other security interest of any kind having similar effect or any restriction or documentation of the foregoing or decisions rendered by a Governmental Authority. |

“Litigation” means any action, allegation, demand, suit, hearing, litigation, dispute, proceeding, arbitration, investigation or audit, whether civil, criminal, administrative, regulatory, judicial, investigative or otherwise, whether formal or informal, whether public or private. |

“Losses” means any and all losses, damages, liabilities, costs or expenses, including reasonable attorneys’ fees, court deposits and court guarantees (to the extent borne by the indemnified party), provided that (except to the extent payable to a third party in connection with a third-party claim) in no event shall any Person be entitled to recover or make a claim for any amounts in respect of consequential, indirect or punitive damages (and, in particular, no loss of future income, revenue, or profits, business interruption, loss of business reputation or opportunity, diminution in value, “multiple of profits”, “multiple of cash flow” or similar valuation methodology shall be used or taken into account in calculating the amount of any Losses), in each case, regardless of whether or not the possibility of such damages has been disclosed to the other party in advance, in written. |

“M&A Transactions” means any investment in equity, equity-like securities and/or convertible debt of any Person (including unincorporated entities), acquisition, disposal or combination of businesses, equity or equity-like joint ventures, profit/revenue sharing arrangements or other arrangements which result in the establishing of partner-like or governance rights in any Person (including unincorporated entities). |

“Majority Shareholder” has the meaning given in the preamble of this Agreement. |

“Managing Shareholders” means OSRB’s minority shareholders, holders of non-voting preferred shares issued by OSRB, responsible for the management, coordination, operation and functioning of the OSRB branches who are parties to certain managing shareholders’ agreements. |

“Minimum Stake” has the meaning given in Section 5.6.3. |

“Minority Shareholder” has the meaning given in the preamble of this Agreement. |

| | |

“Net Indebtedness” means the amount of Indebtedness of the Company minus Cash. |

“Normal Working Hours” means the period between 9:00 a.m. and 5:00 p.m. (time of the location in which the relevant action is to take place) of any Business Day. |

“Notice of Encumbered Shares” has the meaning given in Section 10.10.1(ii). |

“Offer Conditions” has the meaning given in Section 10.6.1. |

“Offer Notice” has the meaning given in Section 10.6. |

“Offered Shareholder” has the meaning given in Section 10.6. |

“Offered Shares” has the meaning given in Section 10.6. |

“Offering Shareholder” has the meaning given in Section 10.6. |

“Officers” has the meaning given in Section 6.5.1. |

“Option Price” has the meaning given in Section 11.3.1. “Option SPA” has the meaning given in Section 11.3.6. |

“OSRB” has the meaning given in the preamble of this Agreement. |

“Parties” has the meaning given in the preamble of this Agreement. |

“Permitted Transferees” has the meaning given in Section 10.3. |

“Permitted Transfers” has the meaning given in Section 10.3. |

“Person” means any natural person, firm, limited liability company, general or limited partnership, fund, unincorporated organization, association, corporation, company, joint venture, trust, Governmental Authority or other entity. |

“PFIC” means a “passive foreign investment company” within the meaning of the Section 1297(a) of U.S. Internal Revenue Code. |

“Potential Buyer” has the meaning given in Section 10.6. |

“Preemptive Right” has the meaning given in Section 9.4. |

“Prohibited Transferee” means [***]. |

“QPA” has the meaning given in the recitals to this Agreement. |

“Qualified IPO” means an initial public offering of Shares of the Company, OSRB or any new direct or indirect holding company (in which the Shareholders shall hold the same equity stake that they held before the reorganization in preparation to the Qualified IPO) that fulfills the following conditions, cumulatively: [***]. For the purposes of the foregoing, the Qualified IPO process shall be deemed initiated if the Company has issued a formal notice to the Shareholders confirming the engagement of the lead underwriter and the holding of the kick-off meeting of the offering with the lead underwriter of the Qualified IPO. |

“Reais” or “R$” means the lawful currency of Brazil. |

| | |

“Related Party” means, with respect to any Person, (i) the spouse, ascendants, descendants, or relatives up to the third degree of such Persons; (ii) any Affiliate of such Persons or their spouses, ascendants, descendants, or relatives up to the third degree. |

“Relevant Meeting” has the meaning given in Section 6.7. |

“Remaining Shareholders” has the meaning given in Section 10.10.1(ii). |

“Reserved Matters” has the meaning given in Section 6.3.8. |

“Right of First Offer Period” has the meaning given in Section 10.6.2. |

“Right of First Offer” has the meaning given in Section 10.6. |

“Rules of Arbitration” means the Rules of Arbitration of the Arbitration Chambers then in effect. |

“Shareholder Reserved Matters” has the meaning given in Section 5.6. |

“Shareholders” has the meaning given in the preamble of this Agreement. |

“Shares” has the meaning given in Section 4.1(iii). |

“Signing” has the meaning given in Section 10.6.3. |

“Substitute Instrument” has the meaning given in Section 11.6.1(i). |

“Subsidiary” means OSRB and any other entity Controlled by the Company, in the present or future. |

“Tag Offer Notice” has the meaning given in Section 10.7.1. |

“Tag Offered Shares” has the meaning given in Section 10.7.1. |

“Tag-Along Right” has the meaning given in Section 10.7.1. |

“Tax” or “Taxes” means any federal, state, local or foreign income or gross receipts tax, value added, sales and use tax, customs duty, social security contributions (payable to any Governmental or Taxing Authority or any other Entity) and any other tax, charge, fee, levy or other assessment including property, transfer, occupation, service, license, payroll, franchise, excise, withholding, ad valorem, severance, stamp, premium, profit, windfall profit, employment, rent or other tax, governmental fee or like assessment or charge of any kind whatsoever, together with any interest, fine or penalty thereon, addition to tax, additional amount, deficiency, assessment or governmental charge imposed by any Taxing Authority. |

“Taxing Authority” means any Governmental Authority having jurisdiction over the assessment, determination, collection or other imposition of Taxes. |

“Third Party” means any Person that is not a Party to this Agreement or an Affiliate of a Party to this Agreement. |

“Transaction” has the meaning given in the recitals to this Agreement. |

| | |

“Transfer” means (which includes the expressions “to Transfer”, “Transferred”, “Transferor” and “Transferee”) means, whether directly or indirectly, voluntarily or involuntarily, the transfer, sale, assignment (including the assignment of the right of first refusal), transfer, exchange, donation, payment in kind or other type of disposal resulting from the foreclosure of any mortgage, pledge, security interest or other retention right or further, relating to any succession, legal determination, merger, amalgamation, spin-off, reorganization, consolidation, issuance of Shares or other transactions with similar effects, making any voting trust or other arrangement or agreement with respect to the transfer of any voting and/or economic rights or interests (including any proxy or otherwise - whether or not revocable) or of any other beneficial interest. |

“U.S. GAAP” means the generally accepted accounting principles and standards for U.S. companies adopted by the U.S. Securities and Exchange Commission. |

“U.S. Internal Revenue Code” means of the Internal Revenue Code of 1986, as amended. |

“United States” or “U.S.” means the United States of America. |

“Vinci” means Vinci Capital Gestora de Recursos Ltda., a limited liability company (sociedade empresária limitada) enrolled with the CNPJ under No. 11.079.478/0001-75, with its registered office at Avenida Bartolomeu Mitre, 336, sala 701, Leblon, Rio de Janeiro/RJ, Postal Code 22.431-002. |

“Working Capital” means, without duplication with the determination of Indebtedness, (i) the current assets of the Company and its Subsidiaries, but excluding Cash, minus (ii) the current Liabilities of the Company and its Subsidiaries that have not been included as Indebtedness. For the avoidance doubt, the determination of the Working Capital shall follow the same guidelines and criteria set out in the QPA. |

1.2Construction and application of defined terms

The meaning assigned to each term defined in Section 1.1 shall be equally applicable to all grammatical variations thereof.

1.3Headings; Table of Contents

Headings and table of contents are inserted for convenience and reference purposes only and are in no way intended to describe, interpret, define, or limit the scope, extent, or intent of this Agreement or any provision of this Agreement.

1.4References and construction

For purposes of this Agreement, unless the context otherwise requires:

(i)the words “include,” “includes” and “including” and similar expressions shall be construed as illustrative only and without limitation. Therefore, any such expressions shall be deemed to be followed by the words “without limitation” or “by way of example only;”

(ii)the word “or” is not exclusive;

(iii)the words “herein,” “hereof,” “hereby,” “hereto” and “hereunder” refer to this Agreement as a whole;

(iv)an accounting term not otherwise defined has the meaning assigned to it in accordance with the Accounting Principles;

(v)references to Preamble, Articles, Sections, Schedules and Exhibits, if applicable, refer to the Preamble, Articles, Sections, Schedules and Exhibits to this Agreement;

(vi)references to an agreement, instrument or other document means such agreement, instrument or other document as amended, supplemented and modified from time to time;

(vii)references to any agreement, Law or to any provision of any agreement or Law shall include any amendment thereto, and any modification or re-enactment thereof, any Law substituted therefor, and all rules and regulations issued thereunder or pursuant thereto;

(viii)the word “Person” includes individuals, firms, companies, their successors, Permitted Transferees and vice-versa;

(ix)references to a Party include such Party’s permitted successor in accordance with this Agreement; and

(x)the information contained in this Agreement, the Exhibits and the Schedules hereto is disclosed solely for purposes of this Agreement; no information contained herein or therein will be deemed to be an admission by any Party hereto to any third party of any matter whatsoever (including any violation of Law or breach of contract).

1.5Information

References to books, records or other information mean books, records or other information in any form, including paper, electronically stored data, magnetic media, film and microfilm.

1.6Periods

References to any period will be deemed references to the number of calendar days in such period (unless Business Days are specified); provided, however, that unless otherwise expressly stated herein, all terms or periods set forth in this Agreement will be counted by excluding the date of the event that caused the commencement of such term or period and including the last day of such period, as set forth in Article 132 of the Brazilian Civil Code.

All periods provided for in this Agreement ending on Saturdays, Sundays or holidays in the City of São Paulo, State of São Paulo, Brazil or the City of Tampa, Florida, United States of America, shall be automatically extended to the first subsequent Business Day.

1.7Execution

This Agreement shall be deemed executed as of the Execution Date, even if the collection of signatures is concluded on a different date. As such, any refences to “date of this Agreement”, ‘date hereof”, “execution date” and similar expressions shall be construed as references to the Execution Date only.

1.8Drafting

The Parties have jointly drafted this Agreement with the assistance of their respective advisors. Pursuant to Articles 113, § 2º and 421-A, inc. I of the Brazilian Civil Code, the

Parties expressly reject the application of Article 113, § 1º, IV of the Brazilian Civil Code, so that this Agreement shall be construed without regard to any presumption or rule requiring construction or interpretation against the party drafting an instrument (or causing any instrument to be drafted) in the event of a Dispute on the intent of the Parties or ambiguity in the interpretation of the terms hereof.

2Confidentiality

2.1Confidentiality undertaking

Each of the Shareholders, their Affiliates, and their respective directors, officers, employees, service providers, representatives and agents shall maintain the confidential nature of any information exchanged under and/or related to this Agreement, including, without limitation, all data and information obtained by any of the Shareholders prior to the execution and for the enforcement of this Agreement, during the negotiation of this Agreement, including, without limitation, information on the Company and its Subsidiaries of a legal, financial, accounting, commercial and operational nature, among others (“Confidential Information”).

2.1.1Exceptions. Notwithstanding the foregoing, nothing in this Agreement shall prohibit disclosure or use of any non-public information if and to the extent:

(i)the disclosure is permitted under this Agreement (including in the context of a Qualified IPO);

(ii)the disclosure is required by applicable Law or by the rules and regulations of any securities exchange or national market system upon which the securities of the Parties or their Affiliates are listed (at the moment of the disclosure), in which case the relevant Party or its Affiliates shall use its commercially reasonable efforts to provide the other Party with sufficient time, consistent with such requirements, to review the nature of such requirements and to comment upon such disclosure prior to publication;

(iii)the disclosure or use is required by judicial or administrative process or by other requirements of applicable Law or the rules of any Governmental Authority or is requested by a Governmental Authority having regulatory oversight over such Person (including, for the avoidance of doubt, as a result of a regulatory audit or requests or requirements from a bank examiner, regulatory authority or self-regulatory authority in the ordinary course of broad based examination or inspection not specific to the transaction contemplated by this Agreement);

(iv)the disclosure or use is required or is deemed reasonably required for the purpose of any potential or actual judicial or arbitration proceedings, including any such proceedings arising out of this Agreement;

(v)such information is or becomes publicly available (other than by breach of this Agreement or any other obligation of confidence by the Party seeking to disclose such information);

(vi)Disclosures to a Shareholder's investors, quotaholders, shareholders, directors, officers, employees, agents, attorneys, Affiliates and financial and professional advisors (in each case, to the extent such disclosure

reasonably relates to the administration of the investment in the Company) who agree to hold confidential and refrain from using the Confidential Information substantially in accordance with the terms of this Section 2.1. For the avoidance of doubt, the exception hereunder shall cover disclosures by (a) the Majority Shareholder to the manager (gestor), administrator (administrador), custodian (custodiante) or quotaholders of the FIP; and (b) the Minority Shareholder to the shareholders of Bloomin Brands, Inc. and securities market;

(vii)the other Party has given prior written approval to the disclosure or use; or

2.1.2Compelled disclosures. If any Person restricted by this Section 2 is required by Law to disclose any Confidential Information (a “Compelled Party”), then such Person shall, to the extent permitted by Law, provide the Party owning the relevant Confidential Information with prompt written notice of such requirement so that such Party, Company or its Subsidiaries may seek (at the Compelled Party´s sole expense) an appropriate protective order or other remedy protecting the Confidential Information from such disclosure.

(i)notwithstanding anything herein to the contrary, if, failing the entry of a protective order or obtainment of such other remedy, such Compelled Party is advised by its counsel that such Compelled Party is compelled to disclose Confidential Information, such Compelled Party may disclose that portion of the Confidential Information that its counsel advises that such Compelled Party is strictly compelled to disclose.

(ii)in no event shall either of the Parties oppose Litigation to obtain an appropriate protective order or other remedy or reliable assurance that confidential treatment will be accorded to the Confidential Information.

2.1.3Confidentiality Term. The confidentiality obligations set forth in this Section 2 and its subsections shall survive for a term of three (3) years after: (i) the termination of this Agreement; or (ii) the date on which a Shareholder and/or its Affiliates (or any Person that becomes a shareholder of the Company in the future, subject to Section 10.3) ceases being a shareholder of the Company or is no longer a party to this Agreement, exclusively in relation to such Shareholder, whichever occurs latter.

3Scope of the Agreement

3.1Purpose

The purpose of this Agreement is to establish the general framework governing the relationship between the Parties as shareholders of the Company, and the principles set forth herein are the intent of the Parties and shall, at all times during the term of this Agreement, be complied with by the Parties. The Shareholders hereby agree to:

(i)exercise their respective votes at the General Shareholders’ Meetings of the Company;

(ii)cause the Company to exercise its vote at the General Shareholders’ Meetings of its Subsidiaries, if any; and

(iii)instruct their respective representatives in the management bodies of the Company and its Subsidiaries (if any), to the extent legally possible, to act in accordance with the provisions of this Agreement and in a manner that assures the ability to timely and adequately conduct the decision-making process in connection with the development of the Company’s Business in the best interest of the Company and pursuant to the terms hereof.

4Shares Subject to this Agreement; General Provisions

4.1Shares Subject to this Agreement

The following securities are subject to this Agreement:

(i)all shares representing the Company’s capital stock, owned by the Shareholders as of the date hereof, which includes all common shares, nominative and without par value of the Company;

(ii)all shares that may be owned by the Shareholders in the future, including upon subscription, option, purchase, bonus, split, reverse split and/or otherwise; and

(iii)securities, debentures and/or subscription warrants, debt instruments, founders’ shares (partes beneficiárias), or any other instruments that grant their holders, governance or economic rights on the Company, the right to subscribe for and/or to vote for, or consent to, resolutions pertaining to the Company and its Subsidiaries or which are subject to conversion into shares, subscribed or acquired by any of the Shareholders during the term of effectiveness of this Agreement, as well as all rights and prerogatives related thereto, including options, warrants, preemptive or other rights or agreements, commitments or understandings of any kind, including rights of first refusal or first offer, to acquire or subscribe shares or other equity interests in or securities convertible into or exercisable or exchangeable for shares of or other equity interests or equity interest equivalent in the Company (“Shares”, or, individually, “Share”). For the avoidance of doubt, the shares issued by OSRB held by the Managing Shareholders or held by executives under any incentive plans referred to OSRB and/or any other Subsidiaries shall be considered Shares but shall not be bound to this Agreement.

4.2Capital Stock Ownership; No Liens

4.2.1Types of Shares. The Company’s capital stock is currently composed only by common voting shares with no par value with a single vote assigned to each share (“Common Shares”).

4.2.2Capital stock as of the Execution Date. As of the date hereof, the capital stock of the Company is represented by [***] Common Shares that are issued, fully subscribed and partially paid up, of which [***] are held by the Majority Shareholder and [***] are held by the Minority Shareholder.

4.2.3Ownership of the Shares. Each of the Shareholders hereby represents and warrants to the other Shareholder that, on the date hereof: (i) it has valid and good title to the Shares listed opposite to its name in the table in Whereas (C) above; and (ii) its Shares are free and clear of any and all Liens (whether judicial or extrajudicial), except as provided under this Agreement.

4.2.4Liens on the Shares. The Majority Shareholder shall be free to create Liens on the totality of its Shares for the specific purposes of using such Shares as collateral in favor of creditors in the context of the Acquisition Debt.

4.3Validity and Enforceability

The Shareholders further represent and warrant that this Agreement has been freely and lawfully executed by such Shareholder and is a lawful and binding obligation undertaken by such Shareholder, enforceable in accordance with its terms, and that there is no existing, threatened or pending lawsuit, arbitration or administrative proceedings that may, in any way, whether directly or indirectly, affect and/or restrict the free exercise of the rights and prerogatives related to such Shareholders’ Shares.

4.4No Other Shareholders Agreement

This Agreement constitutes the entire and exclusive agreement currently existing between the Shareholders ruling their relationship as shareholders of the Company and, indirectly, of the Subsidiaries (existing or future), replacing all and any other understandings or agreements, written or verbal, in regard to the subject matter hereof and thereof.

The Shareholders hereby covenant not to enter into any other shareholders’ agreement with regard to their respective equity interests held directly in the Company and/or indirectly in the Subsidiaries (existing or future) and the Company hereby covenants not to register any such additional shareholder agreement, provided, however, that the Company and its Subsidiaries shall be authorized to enter into new shareholders’ agreements (as well as to amend or terminate any shareholders’ agreements) as set forth in Section 4.6.3.

4.5Survival

If due to corporate restructurings or any other reason: (i) the Company’s Business ends up being carried out by an Entity other than the Company; or (ii) the Shareholders decide to Transfer their title to the Shares to another Entity or fund or otherwise end up holding the Shares indirectly, the provisions of this Agreement shall apply, mutatis mutandis, to such new Entity or fund. In any such event, the Shareholders and the Company undertake to enter into additional shareholders’ agreements and to amend and restate any organizational documents of the relevant legal entities or funds to ensure that the terms and provisions hereunder shall apply to the furthest extent possible.

4.6Subsidiaries

4.6.1Applicability of this Agreement. All provisions of this Agreement applying to the Company shall equally be applicable to its Subsidiaries to the furthest extent possible. In view of the foregoing, to ensure to the greatest extent that the provisions of this Agreement shall be applicable to the Subsidiaries, the Company shall cause each of the Subsidiaries to amend its respective articles of incorporation, articles of association, bylaws, or any other similar documents governing a Subsidiary that is in force, as the case may be and except for the Managing Shareholder Agreements, in order to incorporate the provisions contained herein, especially governance provisions regarding the need of prior approval by the Company and/or any of its other Subsidiaries for certain matters, so as to ensure that the provisions of this Agreement shall be duly reflected, to the greatest extent possible, in all Subsidiaries’ governing documents. The Shareholders agree to take any and all measures necessary to ensure the

applicability of such provisions to the Subsidiaries, including, without limitation, the filing of a copy hereof at their respective main offices, as provided under Section 13.6.

4.6.2Voting Rights. The Shareholders shall cause the Company to exercise its voting rights in its Subsidiaries always in accordance with this Agreement. Therefore, any matter that would be deemed to be a matter subject to approval by the Shareholders, Board of Directors or Committee, as the case may be, when it relates to a Subsidiary, shall be treated as a matter subject to the approvals required under this Agreement, and, therefore, before the Company exercises its voting rights in the Subsidiary, the matter shall be voted at the Board of Directors of the Company and receive the necessary approval.

4.6.3Shareholders Agreements. The Company and its Subsidiaries may execute new shareholders’ agreements (as well as amend or terminate any shareholders agreements) with Managing Shareholders or executives under incentive plans, or similar plans, regulating their relationship as holders of preferred non-voting shares issued by OSRB.

5General Shareholders’ Meetings

5.1General Shareholders’ Meetings

The general shareholders meetings of the Company (“General Shareholders’ Meetings”) shall be: (i) ordinary, within [***] after the end of each fiscal year of the Company, to deliberate on matters set forth in article 132 of Brazilian Corporations Law; or (ii) extraordinary, whenever required by the business and pursuant to the Brazilian Corporations Law, the Bylaws and this Agreement. Each Share shall represent one (1) vote at a General Shareholders’ Meeting of the Company.

5.2Call Procedures

Notwithstanding the hypotheses provided in the Brazilian Corporations Law, the General Shareholders’ Meetings shall be called by means of notices issued by any Shareholder or Director at least, with [***] in advance on first call, and with [***] in advance on second call, of the scheduled date of the General Shareholder Meeting. Call notices shall be published as set forth by the applicable Law, the Bylaws and this Agreement and delivered by notices under Section 13.4.

5.2.1Call notice requirements. Call notices shall contain at least: (i) information on the place, date and time the relevant General Shareholders’ Meeting shall be held and the detailed agenda (the inclusion of generic items, such as, "general matters of interest to the Company and its Subsidiaries" or "others", are expressly forbidden); and (ii) as applicable, be accompanied by any document and/or information reasonably required for the Shareholders to evaluate the proposed resolutions and any materials prepared by the management in advance of such meeting. In the event that there is not a quorum in attendance at the first call of a General Shareholders’ Meeting, a new call notice shall be issued for the second call.

5.2.2Dismissal. Notwithstanding the formalities provided herein for convening General Shareholders’ Meetings, such meetings shall be considered duly called and

convened if all Shareholders are present, pursuant to article 124, §4º, of Brazilian Corporations Law.

5.3Quorum

The General Shareholders’ Meetings will be installed, on first call, with the presence of the Majority Shareholder and the Minority Shareholder, and, on second call, with the presence of Shareholders holding any number of Shares of the Company’s capital stock.

5.4Chair and secretary

The General Shareholders’ Meetings shall be presided by the Chairperson of the Board of Directors or, in his/her absence, by any member of the Board of Directors or the Board of Officers (or, if no such members attend the meeting, any person among the present). The president of the meeting shall appoint the secretary of the General Shareholders’ Meeting.

5.5Attendance

The Shareholders may take part in any General Shareholders’ Meeting by videoconference or phone conference (in accordance with the applicable Law), provided, however, that all individuals participating in it can be clearly identified. Participation in a meeting by videoconference or phone conference shall be deemed as a valid attendance at the respective meeting.

In case of meeting by videoconference or teleconference, as a condition to the validity of the meeting and the resolutions, the Shareholder shall, based on the matters to be discussed (and to the extent the meeting is not being recorded), provide an executed copy of its vote, by letter or e-mail, to the Chairperson, on the date of the meeting, or even, by e-mail, with receipt of written evidence of delivery by the Chairperson.

5.6Majority

The resolutions of the General Shareholders’ Meeting shall depend on the affirmative vote of Shareholders representing simple majority (i.e., 50%+1 of the Company’s total and voting capital stock present on the General Shareholders’ Meeting) except for the matters subject to a more restrictive quorum under the Brazilian Corporations Law, the Bylaws and/or this Agreement (in particular the matters subject to the Minority Shareholder’s affirmative vote under Sections 5.6.1, 5.6.2, 5.6.3 and 5.6.4 – the “Shareholder Reserved Matters”).

5.6.1Qualified Matters - Intermediary Stake. As long as Minority Shareholder holds Shares representing at least [***] stock (“Intermediary Stake”), the following matters shall be subject to Minority Shareholder’s affirmative vote:

(i)capital increases, implementation of any capital increase or injection of funds related to a Funding Call, issuance of any Shares or securities convertible into Shares, except if the Company or its Subsidiaries are in a situation of Financial Distress, provided that Section 9.3 is complied with;

(ii)changes to the Company’s Business outside the business of full-service restaurant(s) that are focused on steakhouses, ribs and/or Italian restaurants or other concepts franchised from Affiliates of Bloomin, Inc., or to carry out any other business in addition to the Company’s Business that is not related or complementary to the business of full-service restaurant(s) that are focused on the foregoing;

(iii)corporate restructuring transactions involving the Company and Subsidiaries (i.e., merger of entities or merger of shares, spin-off, business combinations), except for the corporate restructurings involving only the Company and wholly owned Subsidiaries that do not admit any Third Party as shareholder, do not dilute the Minority Shareholder, and cumulatively do not involve or create tax liabilities to the Minority Shareholder, either under Brazilian or U.S. Laws. [***]; and

(iv)creation or termination of statutory Committees and the creation, amendment or termination of statutory Committees’ internal policies.

5.6.2Qualified Matters – 20% Stake. As long as the Minority Shareholder holds Shares representing at least [***] stock, the entering into, terminating or otherwise materially amending the terms of an M&A Transaction shall be subject to Minority Shareholder’s affirmative vote.

5.6.3Qualified Matters - Minimum Stake. As long as the Minority Shareholder holds shares representing at least [***] stock (“Minimum Stake”), the following matters shall be subject to Minority Shareholder’s affirmative vote:

(i)execution, amendment or termination of a joint venture agreement, investment agreement, partnership agreement, shareholders´ or quotaholders’ Agreement and limited liability company agreement or similar type of agreement (however named) involving a sharing of profits, losses, costs or liabilities, except for: (a) shareholders’ agreements with the Managing Shareholders; and (b) transactions that qualify as an M&A Transaction, which shall be subject to Section 5.6.2;

(ii)corporate restructuring transactions involving the Company and Subsidiaries (i.e., merger of entities or merger of shares, spin-off, business combinations), except for the corporate restructurings involving only the Company and wholly owned Subsidiaries that either admit any Third Party as shareholder or otherwise dilute the Minority Shareholder. [***];

(iii)change of powers, structure or number of members of the Board of Directors, the Board of officers or the corporate structure of the Company and its Subsidiaries (including the preferred shares owned by the Managing Shareholders);

(iv)changes to the annual global compensation of the members of the Board of Directors and Board of Officers that represents an increase that is at least [***] higher than the annual global compensation of the members of the Board of Directors and Board of Officers in the immediately preceding fiscal year (duly adjusted by the variation of the IPC-A);

(v)capital reductions (except for purposes of offsetting accumulated losses), issuance of preferred shares containing different economic or political rights, priority over shares or debt securities convertible into shares, acquisition or sale of securities held by the Company in treasury, or the grant of options, Liens and/or encumbrances over them, or other changes in the capital structure of the Company (except for purposes of transferring shares to beneficiaries of incentive plans approved by the Company);

(vi)amendments to by-laws or the organizational documents of the Company that conflicts with this Agreement or adversely affects Minority Shareholder’s rights hereunder;

(vii)appointment of Audit Firms other than [***];

(viii)initiation of a process to carry out an IPO other than a Qualified IPO in accordance with Section 10.11; and

(ix)license of Intellectual Property (not related to the brands set forth in the Franchise Agreement) owned or licensed to the Company or its Subsidiaries to a Third Party, which grants such Third Party the right to conduct the Business or any material part thereof, or assigning or transferring any material right to all or any of the revenue therefrom, it being understood that the foregoing will not supersede the restrictions set forth in the Franchise Agreement.

5.6.4Qualified Matters – Shareholder Matters. As long as the Minority Shareholder holds Shares, the following matters shall be subject to [***]:

(i)creation of shares with different voting or economic rights, securities or rights to acquire any securities of any type creation of new classes of shares of the Company or its Subsidiaries or conversion of an existing class of shares other than Common Shares compliant with Section 4.2.1 or, with regard to OSRB, the Preferred Shares issued or Transferred to Managing Shareholders;

(ii)corporate restructuring transactions involving the Company and Subsidiaries (i.e., merger of entities or merger of shares, spin-off, business combinations) that involve or create tax liabilities to the Minority Shareholder, either under Brazilian or U.S. Laws;

(iii)changes to the Distribution Policy and any distributions to the Shareholders other than pro-rata to their shareholding participation in the Company other than in accordance with the Distribution Policy;

(iv)changes to the Company’s Business outside the food services business or ancillary activities directly related to the food services business.

(v)requests of bankruptcy, judicial or extrajudicial recovery of the Company or any Subsidiary; and

(vi)liquidation, dissolution (formal or silent) or interruption of the Company’s Business.

5.6.5Subsidiaries. For the purpose of clarity, in line with Section 5.6 above, the Shareholders Reserved Matters with regard to the Company shall also be extended to its Subsidiaries, as applicable.

5.6.6Conflict of Interest. In any case, a Shareholder with conflict of interest, as provided for in article 115 of the Brazilian Corporation Law, shall not participate, and shall abstain from voting, in the approval of the respective resolution. The non-conflicted Shareholder(s) shall make its decision in the best interest of the Company, provided, however, that the following has been observed:

(i)In case of a potential conflict of interest of any Shareholder, the senior executives of the Shareholders shall enter into good faith negotiations to try to reach a mutually satisfactory resolution involving the relevant matter. For the avoidance of doubt, any Shareholder may make such referral of conflict to the other Shareholders.

(ii)If the negotiation among senior executives of the Shareholders results in an agreement of the Shareholders as to the conflicted matter, such agreement shall be binding on the Company.

(iii)If the senior executives of both Shareholders are unable to reach a mutually satisfactory resolution of the relevant conflict of interest within [***], then the conflicted matter shall be resolved by the General Shareholders’ Meeting pursuant to this Agreement and organizational documents of the Company without participation of the conflicted Shareholder.

6Management of the Company

6.1Management

The Company shall be managed by a Board of Directors (Conselho de Administração) and a Board of Officers (Diretoria), whose members shall be elected and appointed pursuant to this Agreement, each with the duties and responsibilities as set forth by the Bylaws, this Agreement and the Brazilian Corporations Law.

6.2Management Compensation

6.2.1Compensation. The overall compensation of the members of the Board of Officers shall be split among its members as approved by the Board of Directors.

6.2.2Reimbursement of Expenses. The members of the Board of Directors shall not be entitled to receive compensation, but their documented reasonable hotel and travel expenses shall be borne or otherwise reimbursed by the Company, provided, however, that such hotel and travel expenses shall be subject to the provisions of the Annual Budget. Any amounts related to hotel and travel expenses which exceeds the ones established in the Annual Budget shall be subject to the Shareholder’s prior approval.

6.3Board of Directors

6.3.1Composition. The Board of Directors shall be composed of, at least, [***] members and, at most, [***] members with a unified [***] term in office, reelection being permitted. Shareholders may elect alternate members at their sole discretion and observed the appointment provisions set forth in Section 6.3 below. The number of members of the Company’s Board of Directors shall be defined yearly by the Shareholders when electing its members, always being an odd number.

6.3.2Appointment. The Shareholders shall have a pro rata right (considering that decimals will be disregarded), pursuant to their equity holding on the Company, to appoint and elect Directors, provided that the Minority Shareholder shall be entitled to appoint and remove at least one (1) Director while holder of at least the Minimum Stake.

6.3.3Chairperson. The chairperson of the Board of Directors (“Chairperson”) shall be elected by the Majority Shareholder and the Vice-Chairperson shall be elected by the Minority Shareholder (as long as the Minority Shareholder holds at least the Minimum Stake). The Chairperson and Vice-Chairperson shall have no right to decide in the event of a tie with regard to any matter subject to the Board of Directors (voto de minerva).

6.3.4Appointment by multiple vote system (voto múltiplo). It is hereby agreed that no Shareholder holding more than the Minimum Stake shall request the adoption by the Company of the multiple vote system (voto múltiplo) set forth in article 141 of the Brazilian Corporations Law for election of the members of the Board of Directors.

6.3.5Permanent Vacancy. Any permanent vacancy of any position of the Board of Directors shall be filled by the respective alternate or, in the absence of a pre-elected alternate, by an individual to be indicated by the same Shareholder that has previously appointed the vacant Director(s). The appointment of the substitute shall be made no later than thirty (30) days following the respective vacancy by the Board of Directors. The appointed substitute shall hold office during the remaining term of the replaced Director, observed the provisions of Section 6.6 below.

6.3.6Board of Directors Meetings. The Board of Directors shall hold a number of general meetings (“Board of Directors Meetings”) throughout the year to be agreed in the first meeting to occur each year, and extraordinary meetings at any time as deemed necessary. The Chairperson may dismiss, up to [***] before a Board of Directors Meeting, such meeting if there are no resolution to be taken or approved by the Board of Directors, except if any Director requests the maintenance of such Board of Directors Meetings to the Chairperson within [***] of the notice of dismissal.

(i)Authority to call. The Board of Directors Meetings may be called by the Chairperson or by any other member of the Board of Directors, by written call notice sent to the other Directors, issued as per Sections 6.3.6(ii) and 13.4 below.

(ii)Call notices. Except in the event of dismissal set forth in Section 6.3.6 above, the Board of Directors Meetings shall be called, on first call, at least [***] in advance of such meeting. In the event a duly called meeting of the Board of Directors is not installed on first (1st) call, a second (2nd) call shall be made [***] in advance of such meeting. Call notices shall contain at least: (a) information on the place, date and time the relevant meeting shall be held and the detailed agenda (the inclusion of generic items, such as, "general matters of interest to the Company and its Subsidiaries" or "others", are expressly forbidden); and (b) as applicable, be accompanied by any document reasonably required for the Directors to evaluate the proposed resolutions and any materials prepared by the executive officers in advance of such meeting. In the event that there is not a quorum in attendance at a first call of a Board of Directors’ Meeting, a new call notice shall be issued for the second call.

(iii)Dismissal. Notwithstanding the formalities provided herein for convening Board of Directors’ Meetings, such meetings shall be considered duly called and convened if all Directors are present.

(iv)Quorum. The meetings of the Board of Directors shall only be installed, on (a) first (1st) call, with the presence of at least [***] appointed by the Majority Shareholder and at least [***] appointed by the Minority Shareholder (as long as such appointment has been made under the terms of this Agreement) and, on a (b) second (2nd) call, with the presence of any number of its members.

(v)Resolutions. A Board of Directors Meeting may be dismissed in the event all Directors agree, by unanimous decision, on the matter, by execution of a signed written resolution.

(vi)Support by the Officers. At any Board of Directors Meeting, whether ordinary or extraordinary, the Directors shall be free to question the Board of Officers on any matter relating to the Company, its Subsidiaries and their activities, and the Officers are required to adequately answer and to present, if applicable, the supporting documentation.

(vii)Venue. Subject to the provisions of Section 6.3.6(viii) below, the meetings of the Board of Directors shall be held at the Company’s principal place of business, or at any other place deemed appropriate and mutually agreed in writing by the totality of the members of the Board of Directors.

(viii)Attendance. The members of the Board of Directors may take part in any Board of Directors Meeting by videoconference or phone conference, provided, however, all Persons participating in it can be clearly identified. Participation in a meeting by videoconference or phone conference shall be deemed as a valid attendance at the respective meeting. In this case, the meeting shall be deemed taken place where the Chairperson of the Board of Directors is. In case of meeting by videoconference or teleconference, as a condition to the validity of the meeting and the resolutions, the member of the Board of Directors shall, based on the matters to be discussed (and to the extent the meeting is not being recorded), provide an executed copy of their vote, by letter or e-mail, to the Chairperson of the Board of the Directors, on the date of the meeting, or even, by e-mail, with receipt of written evidence of delivery by the Chairperson.

6.3.7Attributions of the Board of Directors. The Board of Directors' primary duty is to oversee, control and supervise the business of the Company and its Subsidiaries, as well as the performance of the Board of Officers.

6.3.8Majority. Resolutions passed at any Board of Directors’ meeting shall require the affirmative vote of Directors representing [***], except for the matters subject to a more restrictive quorum under the Brazilian Corporations Law, the Bylaws and/or this Agreement (in particular the matters subject to the affirmative vote of the Director appointed by the Minority Shareholder under Sections 6.3.9 and 6.3.10 – the “Board Reserved Matters” and, collectively with the Shareholder Reserved Matters, the “Reserved Matters”).

6.3.9Qualified Matters - Intermediary Stake. [***]:

(i)capital increases within the limits of the authorized capital, except: (a) for a capital increase required to be implemented in the context of implementation of a Qualified IPO in accordance with Section 10.11; or (b) if the Company or its Subsidiaries are in a situation of Financial Distress, provided that Section 9.3 is complied with;

(ii)approval or amendment to the Annual Budget and/or the Business Plan;

(iii)execution, amendment or termination of agreements related to suppliers outside the ordinary course of business or otherwise involving an amount in excess of [***] in a consecutive twelve (12)-month period, in a sole transaction or in several related transactions;

(iv)transactions or agreements for the disposal, sale, lease or other disposition or creation of Liens over material business or asset(s) involving an amount in excess of [***] (in a sole transaction or in several related transactions);

(v)creation, amendment and/or termination of incentive plans to the Target Entities’ staffing and grants thereunder, excluding (a) spot bonuses or one-time extraordinary premiums (premiações extraordinárias) awarded to employees that are not Directors, Officers and/or Managing Shareholders; or (b) profit sharing - participação nos lucros e resultados - PLR;

(vi)execution, amendment or termination of agreements that purports to, directly or indirectly, (a) restrict the Company from engaging in any business or activity anywhere in the territory of the Federative Republic of Brazil, and (b) to restrict the Company from competing with any other Person, or which contains any non-compete, exclusivity and/or non-solicitation obligations, including by limiting individuals who may be solicited for employment or employed by the Company;

(vii)execution, amendment or termination of agreement that is in the nature of structured financings or other types of agreements providing off-balance sheet financing;

(viii)amendment or termination of transactions with Related Parties of the Shareholders or their respective Affiliates, subject to Section 6.3.13 below, and except for the intercompany loans to Buyer pursuant to Section 11.7;

(ix)assumption of Indebtedness while the Leverage Ratio is above the Leverage Cap, pursuant to Section 9.2 or assumption of Indebtedness outside the parameters authorized by the Leverage Policy set out in Section 9;

(x)creation or termination of non-statutory Committees and the creation, amendment or termination of non-statutory Committees’ internal policies; and

(xi)opening of new restaurants under different brands than those developed by the Company or its Subsidiaries as of the date hereof (including through M&A Transactions or franchise agreements), other than as set forth in the Business Plan or in the Annual Budget.

6.3.10Qualified Matters - Minimum Stake. [***]:

(i)commencement of any litigation or arbitration proceedings instituting claims against any Third Party where such claim could reasonably be expected to exceed an amount of [***] or entering into of any settlement in connection with a or settlement of a litigation or arbitration involving an amount [***];

(ii)execution, amendment or termination of agreement that is a warranty, guarantee or similar undertaking to the benefit of any Person other than the Company and its Subsidiaries with respect to the payment or performance;

(iii)execution, amendment or termination of agreement with Managing Shareholders or otherwise changing the structure used to engage the individuals responsible for the management, coordination, operation and functioning of the restaurant operated by the Company and its Subsidiaries (it being understood the entering into, termination or amendment of Managing Shareholders’ Agreements consistent with past practice and the Ordinary Course of Business will not be subject to the affirmative vote hereunder); and

(iv)execution, amendment or termination of a license of Intellectual Property owned by a Third Party concerning the Business or any material part thereof and/or a franchise agreement having the Company or Subsidiaries as franchisees (or master franchisee) (other than the Franchise Agreements).

6.3.11IPCA Adjustment. The thresholds expressed in Reais above shall be updated at the end of each fiscal year by the positive variation of the IPCA in the entire fiscal year in question, or another index with similar base that may replace it.

6.3.12Subsidiaries. For the purpose of clarity, in line with Section 4.6 above, the Board Reserved Matters with regard to the Company shall also be extended to its Subsidiaries, as applicable.

6.3.13Conflict of Interest. The provisions of Section 5.6.6 of this Agreement shall apply, mutatis mutandis, to the Directors.

6.3.14M&A Transactions. In case an M&A Transaction is proposed and the Minority Shareholder holds one or more affirmative voting rights in connection with such transaction, the Company (via its Officers) shall present to the Board of Directors the proposed M&A Transaction with a reasonable level of detail regarding its main terms and conditions, such as the price to be paid, payment structures, representation and warranties and indemnification structures, collaterals, ancillary agreements, restrictive covenants (including the application of non-compete, non-solicit or similar provisions) and other material items. In case the proposed M&A Transaction is duly approved by the Minority Shareholder, the transaction as a whole will be considered approved, so that the affirmative vote from the Minority Shareholder will not be required multiple times with respect to each aspect of the M&A Transaction that fulfills one or more of the Reserved Matters, as long as the main terms and conditions presented to the Board of Directors have not changed.

6.4Committees

The Board of Directors may, at its sole discretion, create, designate and terminate any consulting committees, with or without deliberative powers, to assist the Board of Directors (“Committees”) and to determine their duties, responsibilities, activities and composition, provided, that the Committees, their resolutions and their members shall be subject to the same rules and procedures applicable to the Board of Directors.

6.4.1Appointment of members. The Board of Directors shall elect the members of the Committees pursuant to the provisions of Section 6.3.2, provided, however, that, in case of the Audit Committee, its members shall be appointed pursuant to the provisions of Section 6.4.2. The members of the Committees may or may not be members of the Board of Directors (but shall be bound to the same fiduciary duties applicable to board members), and said members will be responsible for implementing, monitoring, assisting, controlling and supervising the policies and procedures of the Company in respect of the matters determined by the Board of Directors, as well as for assisting the Board of Directors with the preparation of analysis and suggestions concerning the matters requested by any of the its members, as per the internal charter (regimento interno) of each Committee approved by the Board of Directors (which approval and amendments shall be subject to the affirmative vote of the Director appointed by the Minority Shareholder) together with the creation of the Committee and election of its members.

6.4.2Audit Committee. The Company shall have an audit committee that shall be implemented by the date that is [***] from the execution date of this Agreement (“Audit Committee”).

(i)Responsibilities. The Audit Committee shall be responsible for assisting the Board of Directors in overseeing (a) the integrity of the Company’s financial statements; (b) the effectiveness of the Company’s internal control over financial reporting; (c) the Company’s compliance with legal and regulatory requirements; and (d) the Audit Firm’s qualifications and independence. The Audit Committee shall have advisory functions only and not be vested with any decision-making authority.

(ii)Composition. The Audit Committee shall be composed of [***] members able to read and understand fundamental financial statements, including the Company’s balance sheet, income statement and cash flow, of which: (a) [***] shall be appointed by the Shareholders by mutual consent (as long as the Minority Shareholder holds at least the Minimum Stake), being such members not entitled to any compensation; and (b) the [***] shall be independent, with expertise on audit/accounting matters, and appointed by the decision of the majority of the Board of Directors. If the Minority Shareholder ceases to hold the Minimum Stake, then [***] of the Audit Committee shall be appointed by the Board of Directors, and the [***] shall be independent. The Board of Directors shall designate one member of the Audit Committee as chairman.

(iii)Meetings. The Audit Committee shall meet at least quarterly or more frequently as circumstances require. Following each meeting, the Audit

Committee shall report on the meeting to the Board of Directors, including a description of all actions taken by the Committee at the meeting. The Audit Committee shall keep written minutes of its meetings. The Audit Committee may request that any directors, officers or employees of the Company, or other persons whose advice and counsel are sought by the Audit Committee, attend any meeting of the Committee to provide such information or meet with any members of, or consultants to, the Audit Committee.

6.5Board of Officers

6.5.1Composition. The Board of Officers shall be a non-deliberative and non-collegiate body, composed of at least [***] officers (“Officers”), being [***], if any, with no specific designation or the designation the Board of Directors may attribute to them at the relevant appointment, each with a one (1) year term in office, reelection being permitted. All Officers shall have the functions assigned to them in the Bylaws.