Definitive Materials Filed by Investment Companies. (497)

August 06 2013 - 4:09PM

Edgar (US Regulatory)

BLACKROCK FUNDS II

BlackRock Strategic Income Opportunities Portfolio

(the “Fund”)

Supplement dated August 6, 2013

to the Prospectus and Statement of Additional Information, each dated April 30, 2013

Effective September 1, 2013, the following changes are

made to the Fund’s Prospectus:

Footnote 1 to the Fund’s fee table relating to “Maximum

Deferred Sales Charge (Load) Imposed on Purchases (as percentage of offering price)” for Investor A Shares in the section

of the Prospectus entitled “Fund Overview — Key Facts about BlackRock Strategic Income Opportunities Portfolio —

Fees and Expenses of the Fund” is deleted in its entirety and replaced with the following:

|

1

|

|

A contingent deferred sales charge (“CDSC”) of 0.75% is assessed on certain redemptions of Investor A Shares made within 18 months after purchase where no initial sales charge was paid at time of purchase as part of an investment of $500,000 or more.

|

The chart in the section of the Prospectus entitled “Account

Information — Details about the Share Classes — Investor A Shares - Initial Sales Charge Option” is deleted in

its entirety and replaced with the following:

|

Your Investment

|

Sales Charge

As a % of

Offering Price

|

Sales Charge

As a % of Your

Investment

1

|

Dealer

Compensation

As a % of

Offering Price

|

|

Less than $25,000

|

4.00

|

%

|

4.17

|

%

|

3.75

|

%

|

|

$25,000 but less than $100,000

|

3.75

|

%

|

3.90

|

%

|

3.50

|

%

|

|

$100,000 but less than $250,000

|

3.50

|

%

|

3.63

|

%

|

3.25

|

%

|

|

$250,000 but less than $500,000

|

2.50

|

%

|

2.56

|

%

|

2.25

|

%

|

|

$500,000 and over

2

|

0.00

|

%

|

0.00

|

%

|

—

|

2

|

|

1

|

|

Rounded to the nearest one-hundredth percent.

|

|

2

|

|

If you invest $500,000 or more in Investor A Shares, you will not pay an initial sales charge. In that case, BlackRock compensates the financial intermediary from its own resources. However, if you redeem your shares within 18 months after purchase, you may be charged a deferred sales charge of 0.75% of the lesser of the original cost of the shares being redeemed or your redemption proceeds. Such deferred sales charge may be waived in connection with certain fee-based programs.

|

The “Share Classes at a

Glance” chart in the section of the Prospectus entitled “Account Information — How to Choose the Share

Class that Best Suits Your Needs” is amended to delete the row captioned “Deferred Sales Charge?”

applicable to Investor A Shares, and to replace it with the following:

|

|

|

Investor A

|

|

Deferred Sales Charge?

|

|

No. (May be charged for purchases of $500,000 or more that are redeemed within eighteen months).

|

The first paragraph in the section of

the Prospectus entitled “Account Information — Details about the Share Classes — Investor A Shares at Net Asset

Value” is deleted in its entirety and replaced with the following:

If you invest $500,000 or more in Investor A Shares, you will not

pay any initial sales charge. However, if you redeem your Investor A Shares within 18 months after purchase, you may be charged

a deferred sales charge of 0.75% of the lesser of the original cost of the shares being redeemed or your redemption proceeds. For

a discussion on waivers see “Contingent Deferred Sales Charge Waivers.”

Effective September 1, 2013, the following changes are made

to the Fund’s Statement of Additional Information:

The section of the Statement of Additional Information entitled

“Purchase of Shares — Reduced Initial Sales Charges — Purchase Privileges of Certain Persons” as it relates

solely to the Fund is revised as follows:

BlackRock may pay placement fees to dealers on purchases of Investor

A Shares of all Funds, which may depend on the policies, procedures and trading platforms of your financial intermediary.

With respect to BlackRock Strategic Income Opportunities Portfolio

of BlackRock Funds II, the placement fees may be up to the following amounts:

|

$500,000 but less than $3 million

|

0.75%

|

|

|

|

|

$3 million but less than $15 million

|

0.50%

|

|

|

|

|

$15 million and above

|

0.25%

|

The first sentence of the second paragraph in the section of

the Statement of Additional Information entitled “Purchase of Shares — Reduced Initial Sales Charges — Other”

is deleted in its entirety and replaced with the following:

If you invest $1,000,000 ($250,000 for BlackRock Short-Term

Municipal Fund of BlackRock Municipal Bond Fund, Inc., $500,000 for BlackRock Low Duration Bond Portfolio, BlackRock Floating Rate

Income Portfolio, BlackRock Secured Credit Portfolio and BlackRock Strategic Income Opportunities Portfolio of BlackRock Funds

II) or more in Investor A or Investor A1 Shares, you may not pay an initial sales charge.

The third paragraph in the section of the Statement of Additional

Information entitled “Purchase of Shares — Reduced Initial Sales Charges — Other” is deleted in its entirety

and replaced with the following:

With respect to certain employer-sponsored retirement plans,

if a dealer waives its right to receive a placement fee, the Fund may, at its own discretion, waive the CDSC (as defined below)

related to purchases of $1,000,000 ($250,000 for BlackRock Short-Term Municipal Fund of BlackRock Municipal Bond Fund, Inc., and

$500,000 for BlackRock Low Duration Bond Portfolio, BlackRock Floating Rate Income Portfolio, BlackRock Secured Credit Portfolio

and BlackRock Strategic Income Opportunities Portfolio of BlackRock Funds II) or more of Investor A Shares. This may depend upon

the policies, procedures and trading platforms of your financial intermediary; consult your financial adviser.

Shareholders should

retain this Supplement for future reference

PR&SAI-SIO-0813SUP

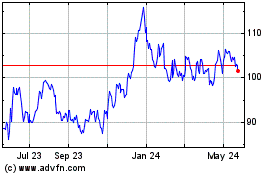

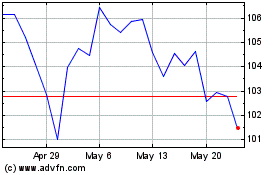

City (NASDAQ:CHCO)

Historical Stock Chart

From Jun 2024 to Jul 2024

City (NASDAQ:CHCO)

Historical Stock Chart

From Jul 2023 to Jul 2024