As filed with the Securities and Exchange Commission

on November 17, 2023.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CHECKPOINT THERAPEUTICS, INC.

(Exact Name of Registrant as Specified in Its

Charter)

| Delaware |

47-2568632 |

(State or Other Jurisdiction of

Incorporation

or Organization) |

(I.R.S. Employer

Identification Number) |

95 Sawyer Road, Suite 110

Waltham, Massachusetts 02453

(781) 652-4500

(Address, Including Zip Code, and Telephone

Number, Including Area Code, of Registrant’s Principal Executive Offices)

James F. Oliviero III

President & Chief Executive Officer

95 Sawyer Road, Suite 110

Waltham, Massachusetts 02453

(781) 652-4500

(Name, Address, Including Zip Code, and Telephone

Number, Including Area Code, of Agent For Service)

Copies to:

Matthew W. Mamak, Esq.

Alston & Bird LLP

90 Park Avenue

New York, NY 10016

(212) 210-9400

Approximate date of commencement

of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If the only securities being

registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ¨

If any of the securities being

registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other

than securities offered only in connection with dividend or interest reinvestment plans, check the following box. x

If this form is filed to register

additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective

amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration

statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the

Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is a post-effective

amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional

classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging

growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ |

Accelerated filer ¨ |

| Non-accelerated filer x |

Smaller reporting company x |

| |

Emerging growth company x |

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. x

The Registrant hereby amends

this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further

amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a)

of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission,

acting pursuant to said Section 8(a), may determine.

The information in this prospectus

is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange

Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities

in any jurisdiction where the offer or sale is not permitted.

Subject To Completion, Dated November

17, 2023

PROSPECTUS

13,030,229 Shares of Common Stock underlying

certain Series A Warrants, Series B Warrants and Placement Agent Warrants

This prospectus relates to

the resale from time to time by certain selling stockholders identified herein of up to 6,325,354 shares of common stock, $0.0001 par

value, underlying those certain Series A warrants (the “Series A Warrants”), 6,325,354 shares of common stock, $0.0001 par

value, underlying those certain Series B warrants (the “Series B Warrants”), and 379,521 shares of common stock, $0.0001

par value, underlying those certain Placement Agent Warrants (the “Placement Agent Warrants,” and together with the Series

A Warrants and Series B Warrants, the “Warrants”). We refer to the 13,030,229 shares of common stock underlying the Warrants

being registered herein as the “Registered Securities.”

The selling stockholders

may offer, sell or distribute all or a portion of the Registered Securities publicly or through private transactions at prevailing market

prices or at negotiated prices. The selling stockholders may retain underwriters, dealers or agents from time to time. See “Plan

of Distribution” for more information about how the selling stockholders may sell the Registered Securities.

We will not receive any proceeds

from the sale of the Registered Securities but we agreed to bear the expenses relating to the registration of the Registered Securities.

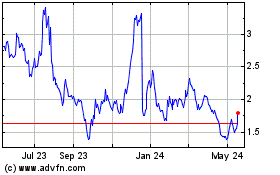

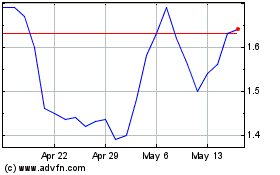

Our common stock is listed

for trading on the Nasdaq Capital Market under the symbol “CKPT.” On November 16, 2023, the last reported sale price of our

common stock on the Nasdaq Capital Market was $1.81 per share.

We are an “emerging

growth company” as defined in the Jumpstart Our Business Startups Act and will therefore be subject to reduced reporting requirements.

Investing in our securities

involves risks. See “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022, which has

been filed with the SEC and are incorporated by reference into this prospectus. You should read this entire prospectus carefully before

you make your investment decision.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy

or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is ,

2023.

TABLE OF CONTENTS

IMPORTANT INFORMATION ABOUT

THIS PROSPECTUS

This prospectus is part of

a registration statement that we have filed with the SEC pursuant to which the selling stockholders named herein may, from time to time,

offer and sell or otherwise dispose of the shares of our common stock, $0.0001 par value (“common stock”) covered by this

prospectus. You should not assume that the information contained in this prospectus is accurate on any date subsequent to the date set

forth on the front cover of this prospectus or that any information we have incorporated by reference is correct on any date subsequent

to the date of the document incorporated by reference, even though this prospectus is delivered or shares of common stock are sold or

otherwise disposed of on a later date. It is important for you to read and consider all information contained in this prospectus, including

the documents incorporated by reference therein, in making your investment decision. You should also read and consider the information

in the documents to which we have referred you under “Where You Can Find More Information” and “Incorporation of Certain

Documents by Reference” in this prospectus.

We have not authorized anyone

to give any information or to make any representation to you other than those contained or incorporated by reference in this prospectus.

You must not rely upon any information or representation not contained or incorporated by reference in this prospectus. This prospectus

does not constitute an offer to sell or the solicitation of an offer to buy any of our shares of common stock other than the shares of

our common stock covered hereby, nor does this prospectus constitute an offer to sell or the solicitation of an offer to buy any securities

in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. Persons who come into

possession of this prospectus in jurisdictions outside the United States are required to inform themselves about, and to observe, any

restrictions as to the offering and the distribution of this prospectus applicable to those jurisdictions.

Unless we have indicated otherwise, or the context

otherwise requires, references in this prospectus to “Checkpoint,” the “Company,” “we,” “us”

and “our” refer to Checkpoint Therapeutics, Inc.

| |

| SUMMARY |

| |

| Our

Business |

| |

| We

are a clinical-stage immunotherapy and targeted oncology company focused on the acquisition, development and commercialization of

novel treatments for patients with solid tumor cancers. We are evaluating our lead antibody product candidate, cosibelimab, an anti-programmed

death-ligand 1 antibody licensed from the Dana-Farber Cancer Institute, in an ongoing multi-regional, open-label, multicohort Phase

1 clinical trial in checkpoint therapy-naïve patients with selected recurrent or metastatic cancers, including ongoing cohorts

in locally advanced and metastatic cutaneous squamous cell carcinoma (“CSCC”) intended to support one or more applications

for marketing approval. Based on top-line and interim results in metastatic and locally advanced CSCC, respectively, Checkpoint submitted

a Biologics License Application to the U.S. Food and Drug Administration (“FDA”) for these indications in January 2023,

which application is filed and under review with a Prescription Drug User Fee Act goal date of January 3, 2024. In addition, we are

evaluating our lead small-molecule, targeted anti-cancer agent, olafertinib (formerly CK-101), a third-generation epidermal growth

factor receptor (“EGFR”) inhibitor, as a potential new treatment for patients with EGFR mutation-positive non-small cell

lung cancer. |

| |

| In

July 2023, we announced longer-term results for cosibelimab from its pivotal studies in locally advanced and metastatic CSCC. These

results demonstrated a deepening of response over time, resulting in complete response rates of 23% and 13% in locally advanced and

metastatic CSCC, respectively. Additionally, the confirmed objective response rate (“ORR”) in metastatic CSCC increased

to 50.0% based on independent central review using Response Evaluation Criteria in Solid Tumors version 1.1 (“RECIST 1.1”).

Furthermore, responses continue to remain durable over time with the median duration of response not yet reached in either group.

Updated safety data across 247 patients enrolled and treated with cosibelimab in all cohorts of the ongoing study remain consistent

with those previously reported. |

| |

| In

June 2022, we announced interim results from a registration-enabling cohort of our multi-regional, Phase 1 clinical trial of cosibelimab

in patients with locally advanced CSCC that are not candidates for curative surgery or radiation. Cosibelimab demonstrated a confirmed

ORR of 54.8% (95% CI: 36.0, 72.7) based on independent central review of 31 patients enrolled in the cohort. |

| |

| In

January 2022, we announced top-line results from a registration-enabling cohort of our multi-regional, Phase 1 clinical trial of

cosibelimab in patients with metastatic CSCC. The cohort met its primary endpoint, with cosibelimab demonstrating a confirmed ORR

of 47.4% (95% CI: 36.0, 59.1) based on independent central review of 78 patients enrolled in the metastatic CSCC cohort using RECIST

1.1. |

| |

| To

date, we have not received approval for the sale of any product candidate in any market and, therefore, have not generated any product

sales from any product candidates. In addition, we have incurred substantial operating losses since our inception, and expect to

continue to incur significant operating losses for the foreseeable future and may never become profitable. As of September 30, 2023,

we have an accumulated deficit of $295.2 million. |

| |

| We

are a majority-controlled subsidiary of Fortress Biotech, Inc (“Fortress”). |

| |

| |

| About

this Offering |

| |

| On

October 2, 2023, we entered into an inducement offer letter agreement (the “Inducement Letter”) with a certain holder

(the “Holder”) of certain of our existing warrants to purchase up to 6,325,354 shares (the “Shares”) of our

common stock, $0.0001 par value (the “Common Stock”), issued to the Holder on December 16, 2022 at an exercise price

of $4.075 per share (the “December Warrants”), and issued to the Holder on February 22, 2023 at an exercise price of

$5.00 per share (the “February Warrants” and together with the December Warrants, the “Existing Warrants”). |

| |

| Pursuant

to the Inducement Letter, the Holder agreed to exercise for cash its Existing Warrants to purchase an aggregate of 6,325,354 shares

of our Common Stock at a reduced exercise price of $1.76 per share in consideration of the Company’s agreement to issue new

unregistered Series A Warrants (the “Series A Warrants”) to purchase up to 6,325,354 shares of Common Stock and new unregistered

Series B Warrants (the “Series B Warrants”) to purchase up to 6,325,354 shares of Common Stock (collectively, the “New

Warrant Shares”). The Series A Warrants have an exercise price of $1.51 per share, were immediately exercisable upon issuance

and have a term equal to five years from the date of issuance. The Series B Warrants have an exercise price of $1.51 per share, were

immediately exercisable upon issuance and have a term equal to 24 months from the date of issuance. |

| |

| On

September 29, 2023, we entered into an engagement letter with H.C. Wainwright & Co., LLC (“Wainwright”), pursuant

to which Wainwright agreed to serve as our exclusive placement agent, on a reasonable best-efforts basis, in connection with the

transactions contemplated by the Inducement Letter. We also agreed to issue to Wainwright or its designees as compensation warrants

to purchase up to 379,521 shares of Common Stock, equal to 6.0% of the aggregate number of Existing Warrants exercised in the offering

(the “Placement Agent Warrants”). The Placement Agent Warrants have an exercise price of $2.20 per share of Common Stock

(equal to 125% of the exercise price per Existing Warrant) and a term equal to five years from the closing of the offering. |

| |

| We

agreed to register the Registered Securities. |

| |

| Company

Information |

| |

| Checkpoint

Therapeutics, Inc. was incorporated in Delaware on November 10, 2014, and commenced principal operations in March 2015. Our principal

executive offices are located at 95 Sawyer Road, Suite 110, Waltham, MA 02453, and our telephone number is (781) 652-4500. We maintain

a website on the Internet at www.checkpointtx.com and our e-mail address is ir@checkpointtx.com. Our internet website, and the information

contained on it, are not to be considered part of this prospectus. For further information regarding us and our financial information,

you should refer to our recent filings with the SEC. See “Where You Can Find More Information” and “Incorporation

of Certain Information by Reference.” |

| |

| A

certificate of amendment of Checkpoint’s certificate of incorporation for a 1-for-10 reverse split of Checkpoint’s issued

and outstanding Common Stock was effective as of December 6, 2022. Unless otherwise indicated, all share numbers herein, including

Common Stock and all securities convertible into Common Stock, give effect to the Reverse Stock Split. However, documents incorporated

by reference into this prospectus that were filed prior to December 6, 2022, do not give effect to the Reverse Stock Split. |

| |

| Our

Common Stock is listed on the Nasdaq Capital Market under the symbol “CKPT”. |

| |

SPECIAL NOTE REGARDING FORWARD-LOOKING

STATEMENTS

Certain matters discussed

in this prospectus may constitute forward-looking statements for purposes of the Securities Act of 1933, as amended, or the Securities

Act, and the Securities Exchange Act of 1934, as amended, or the Exchange Act, and involve known and unknown risks, uncertainties and

other factors that may cause our actual results, performance or achievements to be materially different from the future results, performance

or achievements expressed or implied by such forward-looking statements. The words “anticipate,” “believe,” “estimate,”

“may,” “expect,” “will,” “could,” “project,” “intend” and similar

expressions are generally intended to identify forward-looking statements. Our actual results may differ materially from the results

anticipated in these forward-looking statements due to a variety of factors, including, without limitation, those discussed under the

caption “Risk Factors” contained in this prospectus, any prospectus supplement, any applicable free writing prospectus, or

under similar heading in the other documents that are incorporated by reference into this prospectus. All written or oral forward-looking

statements attributable to us are expressly qualified in their entirety by these cautionary statements. Such forward-looking statements

include, but are not limited to, statements about our:

| |

· |

expectations for increases or decreases in expenses; |

| |

|

|

| |

· |

expectations for the clinical and pre-clinical development, manufacturing,

regulatory approval, and commercialization of our pharmaceutical product candidates or any other products we may acquire or in-license; |

| |

|

|

| |

· |

use of clinical research centers and other contractors; |

| |

|

|

| |

· |

expectations as to the timing of commencing or completing pre-clinical

and clinical trials and the expected outcomes of those trials, including the novel coronavirus (COVID-19) pandemics or other crises’

potentials to negatively affect the hospitals and clinical sites in which we may conduct any of our clinical trials, and patients’

willingness to access those sites to continue the trials; |

| |

|

|

| |

· |

intention to use data from our ongoing Phase 1 clinical trial of cosibelimab

to support the submissions of one or more U.S. Biologics License Applications and relatedly, our assumption that exclusively foreign

clinical data may be acceptable to support marketing approval under Food and Drug Administration regulations; |

| |

|

|

| |

· |

expectations regarding the potential differentiation of cosibelimab,

including a potentially favorable study profile as compared to the currently available anti-PD-1 therapies, the two-fold mechanism

of action of cosibelimab translating into potential enhanced efficacy, and the projections of publication and regulatory submission

timelines; |

| |

|

|

| |

· |

expectations for incurring capital expenditures to expand our research

and development and manufacturing capabilities; |

| |

|

|

| |

· |

expectations for generating revenue or becoming profitable on a sustained

basis; |

| |

|

|

| |

· |

expectations or ability to enter into marketing and other partnership

agreements; |

| |

|

|

| |

· |

expectations or ability to enter into product acquisition and in-licensing

transactions; |

| |

|

|

| |

· |

expectations or ability to build a commercial infrastructure to manufacture,

market and sell our product candidates; |

| |

|

|

| |

· |

expectations for the acceptance of our products by doctors, patients

or payors; |

| |

|

|

| |

· |

ability to compete against other companies and research institutions; |

| |

|

|

| |

· |

ability to secure adequate protection for our intellectual property; |

| |

|

|

| |

· |

ability to attract and retain key personnel; |

| |

· |

ability to obtain reimbursement for our products; |

| |

|

|

| |

· |

estimates of the sufficiency of our existing cash and cash equivalents

and investments to finance our operating requirements, including expectations regarding the value and liquidity of our investments; |

| |

|

|

| |

· |

stock price and the volatility of the equity markets; |

| |

|

|

| |

· |

expected losses; and |

| |

|

|

| |

· |

expectations for future capital requirements. |

The forward-looking statements

contained in this prospectus reflect our views and assumptions only as of the date of this prospectus. Except as required by law, we

assume no responsibility for updating any forward-looking statements. We qualify all of our forward-looking statements by these cautionary

statements. New risks and uncertainties arise from time to time, and it is impossible for us to predict these events or how they may

affect us. In addition, with respect to all of our forward-looking statements, we claim the protection of the safe harbor for forward-looking

statements contained in the Private Securities Litigation Reform Act of 1995.

RISK FACTORS

Investment in our

securities involves risks. Before deciding whether to invest in our securities, you should consider carefully the risk factors

discussed below and those contained in the section entitled “Risk Factors” contained in our Annual Report on Form 10-K for the year ended December 31, 2022, as filed with the SEC on March 31, 2023, which is incorporated herein by reference in its

entirety, as well as any amendment or update to our risk factors reflected in subsequent filings with the SEC. If any of the risks

or uncertainties described in our SEC filings actually occurs, our business, financial condition, results of operations or cash flow

could be materially and adversely affected. This could cause the trading price of our common stock to decline, resulting in a loss

of all or part of your investment. The risks and uncertainties we have described are not the only ones facing our company.

Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business

operations.

Risks Related to Our Common Stock and This

Offering

The resale of our Common Stock by the selling

stockholders could adversely affect the prevailing market price of our common stock and may cause substantial dilution to our existing

stockholders.

We are registering for resale

by the selling stockholders 6,325,354 shares of common stock, $0.0001 par value, underlying those certain Series A warrants (the “Series

A Warrants”), 6,325,354 shares of common stock, $0.0001 par value, underlying those certain Series B warrants (the “Series

B Warrants”), and 379,521 shares of common stock, $0.0001 par value, underlying those certain Placement Agent Warrants (the “Placement

Agent Warrants,” and together with the Series A Warrants and Series B Warrants, the ”Warrants”). We refer to the 13,030,229

shares of common stock underlying the Warrants being registered herein as the “Registered Securities.”

The number of shares of common

stock ultimately offered for sale by the selling stockholders under this prospectus is dependent upon the number of shares of common

stock the selling stockholders elects to sell from time to time. Depending upon market liquidity at the time, sales of shares of our

common stock upon the exercise of the Warrants, may cause the trading price of our common stock to decline.

The selling stockholders

may sell all, some or none of the shares that they hold or come to hold upon the exercise of the Warrants. Sales by the selling stockholders

of the shares acquired upon such exercise and sold under the registration statement of which this prospectus is a part, may result in

dilution to the interests of other holders of our common stock. The sale of a substantial number of shares of our common stock by the

selling stockholders in this offering, or anticipation of such sales, could make it more difficult for us to sell equity or equity-related

securities in the future at a time and at a price that we might otherwise wish to effect sales.

Holders of Warrants will have no rights

as a common stockholder until they acquire our common stock.

The Warrants do not confer

any rights of common stock ownership on their holders but rather merely represent the right to acquire shares of our common stock at

a fixed price for a limited period of time. Only upon exercise of the Warrants will a holder be entitled to exercise the rights of a

holder of our common stock.

The trading price of our Common Stock could be highly volatile,

which could result in substantial losses for holders of our Common Stock.

Our stock price is volatile.

The stock market in general and the market for pharmaceutical and biotechnology companies in particular have experienced extreme volatility

that has often been unrelated to the operating performance of particular companies. As a result of this volatility, you may lose some

or all of your investment. The market price for our Common Stock may be influenced by many factors, including:

| |

· |

announcements relating to the clinical development of our product candidates; |

| |

|

|

| |

· |

announcements concerning the progress of our efforts to obtain regulatory

approval for and commercialize our product candidates or any future product candidate, including any requests we receive from the

FDA, or comparable regulatory authorities outside the United States, for additional studies or data that result in delays or additional

costs in obtaining regulatory approval or launching these product candidates, if approved; |

| |

· |

the depth and liquidity of the market for our common stock; |

| |

|

|

| |

· |

investor perceptions about us and our business; |

| |

|

|

| |

· |

market conditions in the pharmaceutical

and biotechnology sectors or the economy as a whole, which may be impacted by economic or other crises or external factors, including

the effects of the COVID-19 pandemic on the global economy; |

| |

|

|

| |

· |

price and volume fluctuations in the overall

stock market; |

| |

|

|

| |

· |

the failure of one or more of our product

candidates or any future product candidate, if approved, to achieve commercial success; |

| |

|

|

| |

· |

announcements of the introduction of new products

by us or our competitors; |

| |

|

|

| |

· |

developments concerning product development

results or intellectual property rights of others; |

| |

|

|

| |

· |

litigation or public concern about the safety

of our potential products; |

| |

|

|

| |

· |

actual fluctuations in our quarterly operating

results, and concerns by investors that such fluctuations may occur in the future; |

| |

|

|

| |

· |

deviations in our operating results from the

estimates of securities analysts or other analyst comments; |

| |

|

|

| |

· |

additions or departures of key personnel; |

| |

|

|

| |

· |

health care reform legislation, including

measures directed at controlling the pricing of pharmaceutical products, and third-party coverage and reimbursement policies; |

| |

|

|

| |

· |

developments concerning current or future

strategic collaborations; and |

| |

|

|

| |

· |

discussion of us or our stock price by the

financial and scientific press and in online investor communities. |

In the past, securities class

action litigation has often been brought against a company following a decline in the market price of its securities. This risk is especially

relevant for pharmaceutical and biotechnology companies, which have experienced significant stock price volatility in recent years.

You may experience future dilution as a result of future equity

offerings.

In order to raise additional

capital, we may in the future offer additional shares of our common stock or other securities convertible into or exchangeable for our

common stock at prices different from the price you paid. We may sell shares or other securities in any other offering at a price per

share that is less than the price per share paid by investors in this offering, and investors purchasing shares or other securities in

the future could have rights superior to existing stockholders. If we sell Common Stock, convertible securities, or other equity securities,

investors may be materially diluted by subsequent sales.

USE OF PROCEEDS

We will not receive any proceeds

from the sale of the Registered Securities by the selling stockholders. We will bear all other costs, fees and expenses incurred

by us, or by the selling stockholders, in effecting the registration of the Registered Securities. The selling stockholders, however,

will pay any other expenses incurred in selling their Registered Securities, including any brokerage commissions or costs of sale.

SELLING

STOCKHOLDERS

The common stock being offered

by the selling stockholders are those previously issued to the selling stockholders in the Offerings, and those issuable to the selling

stockholders upon exercise of the Warrants. For additional information regarding the Offerings, see “Summary – About this

Offering.” We are registering the Registered Securities in order to permit the selling stockholders to offer such securities for

sale from time to time. Except for the ownership of the Registered Securities issued in the Offerings, the selling stockholders have

not had any material relationship with us within the past three years.

The table below lists the

selling stockholders and other information regarding the beneficial ownership of our common stock of each of the selling stockholders.

The second column lists the number of shares of common stock beneficially owned by each selling stockholder, based on its ownership of

the Warrants and our common stock, as of October 4, 2023, assuming exercise of all Warrants held by such selling stockholder on that

date, without regard to any limitations on exercise.

This prospectus generally

covers the resale of the maximum number of shares of common stock issuable upon exercise of the Warrants, determined as if the outstanding

Warrants were exercised in full as of the trading day immediately preceding the date the registration statement of which this prospectus

forms a part was initially filed with the SEC, each as of the trading day immediately preceding the applicable date of determination

and all subject to adjustment as provided in the registration right agreement, without regard to any limitations on the exercise of the

Warrants. The third column assumes the sale of all of the shares of common stock offered by the selling securityholders pursuant to this

prospectus.

Under the terms of the Warrants,

a selling securityholder may not exercise the Warrants to the extent such exercise would cause such selling securityholder, together

with its affiliates and attribution parties, to beneficially own a number of shares of common stock which would exceed 4.99% (or, at

the direction of the selling securityholder, 9.99%), of our then outstanding shares of common stock following such exercise, excluding

for purposes of such determination of the shares of common stock issuable upon exercise of such Warrants which have not been exercised.

The number of shares of common stock in the columns below do not reflect this limitation. The selling securityholders may sell all, some

or none of their shares of common stock in this offering. See “Plan of Distribution.”

| Name of Selling Shareholder | |

Number of

shares of

Common Stock

Owned Prior

to Offering (1) | | |

Maximum

Number of

shares of

Common Stock

to be Sold

Pursuant to this

Prospectus (2) | | |

Number of

shares of

Common Stock

Owned

After Offering (3) | | |

Percentage of

Beneficial

Ownership

After Offering (3) | |

| Armistice Capital Master Fund Ltd. (4) | |

| 1,996,000 | (5) | |

| 12,650,708 | | |

| 1,996,000 | | |

| 8.74 | % |

| Michael Vasinkevich (6)(7)(8) | |

| 631,967 | | |

| 243,368 | | |

| 388,599 | | |

| 1.70 | % |

| John Chambers (6)(7)(8) | |

| 110,663 | | |

| 36,054 | | |

| 74,609 | | |

| 0.33 | % |

| Noam Rubinstein (6)(7)(8) | |

| 223,499 | | |

| 83,495 | | |

| 140,004 | | |

| 0.61 | % |

| Craig Schwabe (6)(7)(8) | |

| 35,803 | | |

| 12,809 | | |

| 22,994 | | |

| 0.10 | % |

| Charles Worthman (6)(7)(8) | |

| 10,608 | | |

| 3,795 | | |

| 6,813 | | |

| 0.03 | % |

| (1) | All of the shares of common stock that are exercisable for the

shares underlying the Warrants offered hereby contain certain beneficial ownership limitations, which provide that a holder of the securities

will not have the right to exercise any portion of its Warrants if such holder, together with its affiliates and attribution parties,

would beneficially own in excess of 4.99% or 9.99%, as applicable, of the number of shares of common stock outstanding immediately after

giving effect to such exercise, provided that upon at least 61 days’ prior notice to us, a holder may increase or decrease such

limitation up to a maximum of 9.99% of the number of shares of common stock outstanding. Additionally, stockholders may have acquired

shares on the open market without the Company’s knowledge that may not be reflected. |

| (2) | Represents shares of common stock underlying the Warrants issued

to the selling stockholders in the private placement and offered hereby. |

| | |

| (3) | We do not know when or in what amounts a selling stockholder

may offer shares for sale. The selling stockholders might not sell any or might sell all of the shares offered by this prospectus. Because

the selling stockholders may offer all or some of the shares pursuant to this offering, and because there are currently no agreements,

arrangements or understandings with respect to the sale of any of the shares, we cannot estimate the number of the shares that will be

held by the selling stockholders after completion of the offering. However, for purposes of this table, we have assumed that, after completion

of the offering, none of the shares covered by this prospectus will be held by the selling stockholders, including common stock issuable

upon exercise of the Warrants issued in the Offering. |

| | |

| (4) | These securities are directly held by Armistice Capital Master

Fund, Ltd. (the “Master Fund”), a Cayman Islands exempted company, and may be deemed to be indirectly beneficially owned

by Armistice Capital, LLC (“Armistice”), as the investment manager of the Master Fund; and Steven Boyd, as the Managing Member

of Armistice. Armistice and Steven Boyd disclaim beneficial ownership of the reported securities except to the extent of their respective

pecuniary interest therein. The Warrants are subject to a 4.99% beneficial ownership limitation that precludes the Master Fund from exercising

any portion of the Warrants to the extent that, following such exercise, the Master Fund’s beneficial ownership of our then outstanding

Common Stock would exceed 4.99%. The number of shares set forth in the above table do not reflect the application of this limitation,

but the percentages in the table do give effect to such beneficial ownership limitation. The address of the Master Fund is c/o Armistice

Capital, LLC, 510 Madison Avenue, 7th Floor, New York, NY 10022. |

| | |

| (5) | The beneficial ownership “Prior to Offering” excludes

(i) an aggregate of 9,080,662 shares of common stock issuable upon the exercise of certain warrants due to a 4.99% beneficial ownership

blocker and (ii) 5,360,000 shares of common stock held in abeyance. |

| | |

| (6) | The selling stockholder purchased or received the Warrants in

the ordinary course of business and, at the time of purchase of the securities that are registered for resale, the selling stockholders

had no agreements or understanding, directly or indirectly with any person to distribute securities. |

| | |

| (7) | Each of the selling stockholders is affiliated with H.C. Wainwright

& Co., LLC, a registered broker dealer and has a registered address of c/o H.C. Wainwright & Co., LLC, 430 Park Ave, 3rd Floor,

New York, NY 10022, and has sole voting and dispositive power over the securities held. H.C. Wainwright & Co., LLC acted as our exclusive

placement agent in connection with our financings consummated in December 2022, February 2023, April 2023, May 2023, and July 2023. |

| | |

| (8) | Consists of warrants to purchase shares of our common stock. |

PLAN OF DISTRIBUTION

We are registering the Registered

Securities on behalf of the selling stockholders. The selling stockholders and any of their pledgees, assignees, distributees, and successors-in-interest in the

Registered Securities received after the date of this prospectus from the selling stockholders as a partnership distribution, gift, pledge,

or other transfer, may, from time to time, sell, transfer, or otherwise dispose of any or all of the shares of our common stock covered

hereby on the Nasdaq Capital Market or any other stock exchange, market or trading facility on which the common stock is traded or in

private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of the sale, at varying prices

determined at the time of sale, or at negotiated prices. The selling stockholders may use any one or more of the following methods when

selling common stock:

| |

· |

ordinary brokerage transactions and transactions in which the broker-dealer

solicits purchasers; |

| |

|

|

| |

· |

block trades in which the broker-dealer will attempt to sell the common

stock as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| |

|

|

| |

· |

purchases by a broker-dealer as principal and resale by the broker-dealer

for its account; |

| |

|

|

| |

· |

exchange distributions in accordance with the rules of the applicable

exchange; |

| |

|

|

| |

· |

privately negotiated transactions; |

| |

|

|

| |

· |

settlement of short sales; |

| |

|

|

| |

· |

transactions through broker-dealers that agree with the selling stockholders

to sell a specified number of such common stock at a stipulated price per security; |

| |

|

|

| |

· |

through the writing or settlement of options or other hedging transactions,

whether through an options exchange or otherwise; |

| |

|

|

| |

· |

a combination of any such methods of sale; or |

| |

|

|

| |

· |

any other method permitted pursuant to applicable law. |

The selling stockholders

may, from time to time, pledge or grant a security interest in some or all of the Registered Securities owned by them and, if they default

in the performance of their secured obligations, the pledgees or secured parties may offer and sell the Registered Securities, from time

to time, under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities

Act amending the list of selling stockholders to include the pledgee, transferee or other successors in interest as selling stockholders

under this prospectus. The selling stockholders also may transfer the Registered Securities in other circumstances, in which case the

transferees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

In connection with

the sale of the Registered Securities, the selling stockholders may enter into hedging transactions with broker-dealers or other financial

institutions, which may in turn engage in short sales of the Registered Securities in the course of hedging the positions they assume.

To the extent permitted by applicable securities laws, the selling stockholders may also sell the Registered Securities short and deliver

these securities to close out their short positions, or loan or pledge the Registered Securities to broker-dealers that in turn may sell

these securities. The selling stockholders may also enter into option or other transactions with broker-dealers or other financial institutions

or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution

of the Registered Securities offered by this prospectus, which Registered Securities such broker-dealer or other financial institution

may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The aggregate proceeds to

the selling stockholders from the sale of the Registered Securities offered by them will be the purchase price of the Registered Securities

less discounts or commissions, if any. Each of the selling stockholders reserves the right to accept and, together with their agents

from time to time, to reject, in whole or in part, any proposed purchase of the Registered Securities to be made directly or through

agents. We will not receive any of the proceeds from this offering.

The selling stockholders

also may resell all or a portion of the Registered Securities in open market transactions in reliance upon Rule 144 under the Securities

Act, provided that they meet the criteria and conform to the requirements of that rule.

The selling stockholders

and any underwriters, broker-dealers or agents that participate in the sale of the Registered Securities or interests therein may be

“underwriters” within the meaning of Section 2(11) of the Securities Act. Any discounts, commissions, concessions or

profit they earn on any resale of the Registered Securities covered by this prospectus may be underwriting discounts and commissions

under the Securities Act. Selling stockholders who are “underwriters” within the meaning of Section 2(11) of the Securities

Act will be subject to the prospectus delivery requirements of the Securities Act.

To the extent required, the

Registered Securities to be sold, the names of the selling stockholders, the respective purchase prices and public offering prices, the

names of any agents, dealer or underwriter, any applicable commissions or discounts with respect to a particular offer will be set forth

in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement that includes this

prospectus.

In order to comply with the

securities laws of some states, if applicable, the Registered Securities may be sold in these jurisdictions only through registered or

licensed brokers or dealers. In addition, in some states the Registered Securities may not be sold unless it has been registered or qualified

for sale or an exemption from registration or qualification requirements is available and is complied with.

Description

of Securities

Description of Capital Stock

The following description

summarizes the material terms of Checkpoint capital stock. Because it is only a summary, it does not contain all the information that

may be important to you. For a complete description of our capital stock, you should refer to our certificate of incorporation, our bylaws

and to the provisions of applicable Delaware law.

Common Stock

Our common stock is traded

on The Nasdaq Capital Market, or the Exchange, under the symbol “CKPT”.

The authorized capital stock

of Checkpoint consists of 80,000,000 shares of common stock, of which 700,000 shares have been designated as Class A common stock. The

description of our Class A common stock in this item is for information purposes only. All of the Class A common stock has been issued

to Fortress. Class A common stock is identical to common stock other than as to voting rights, the election of directors for a definite

period, and conversion rights. On any matter presented to our stockholders for their action or consideration at any meeting of our stockholders

(or by written consent of stockholders in lieu of meeting), each holder of outstanding shares of Class A common stock will be entitled

to cast for each share of Class A common stock held by such holder as of the record date for determining stockholders entitled to vote

on such matter, the number of votes that is equal to one and one-tenth (1.1) times a fraction, the numerator of which is the sum of the

shares of outstanding common stock and the denominator of which is the number of shares of outstanding Class A common stock. Thus, the

Class A common stock will at all times constitute a voting majority. For a period of ten (10) years from the date of the first issuance

of shares of Class A common stock expiring in 2025 (the “Class A Director Period”), the holders of record of the shares of

Class A common stock (or other capital stock or securities issued upon conversion of or in exchange for the Class A common stock), exclusively

and as a separate class, will be entitled to appoint or elect the majority of the directors of Checkpoint (the “Class A Directors”).

Finally, each share of Class A common stock is convertible, at the option of the holder, into one fully paid and nonassessable share

of common stock (the “Conversion Ratio”), subject to certain adjustments.

If Checkpoint at any

time effects a subdivision of the outstanding common stock (or other capital stock or securities at the time issuable upon

conversion of the Class A common stock) by any stock split, stock dividend, recapitalization or otherwise, the applicable Conversion

Ratio in effect immediately before that subdivision will be proportionately decreased so that the number of shares of common stock

(or other capital stock or securities at the time issuable upon conversion of the Class A common stock) issuable on conversion of

each share of Class A common stock will be increased in proportion to such increase in the aggregate number of shares of common

stock (or other capital stock or securities at the time issuable upon conversion of the Class A common stock) outstanding. If

Checkpoint at any time combines the outstanding shares of common stock, the applicable Conversion Ratio in effect immediately before

the combination will be proportionately increased so that the number of shares of common stock (or other capital stock or securities

at the time issuable upon conversion of the Class A common stock) issuable on conversion of each share of Class A common stock will

be decreased in proportion to such decrease in the aggregate number of shares of common stock (or other capital stock or securities

at the time issuable upon conversion of the Class A common stock) outstanding. Additionally, if any reorganization,

recapitalization, reclassification, consolidation or merger involving Checkpoint occurs in which the common stock (but not the Class

A common stock) is converted into or exchanged for securities, cash or other property (other than a transaction involving the

subdivision or combination of the common stock), then, following any such reorganization, recapitalization, reclassification,

consolidation or merger, each share of Class A common stock becomes convertible into the kind and amount of securities, cash or

other property which such Class A Stockholder would have been entitled to receive had he or she converted the Class A Shares

immediately before said transaction. In such case, appropriate adjustment (as determined in good faith by the Board of Directors of

Checkpoint) will be made in the application of the provisions of Checkpoint’s Amended and Restated Certificate of

Incorporation relating the subdivision or combination of the common stock with respect to the rights and interests thereafter of the

holders of the Class A common stock, such that the provisions set forth in of Checkpoint’s Amended and Restated Certificate of

Incorporation relating to the subdivision or combination of the common stock (including the provisions with respect to changes in

and other adjustments of the applicable Conversion Ratio) will thereafter be applicable, as nearly as reasonably may be, in relation

to any securities or other property thereafter deliverable upon the conversion of the Class A common stock. Checkpoint is not

authorized to issue preferred stock.

Dividends

The holders of outstanding

shares of our common stock, including Class A Common Stock, are entitled to receive dividends out of funds legally available at the times

and in the amounts that our board of directors may determine. All dividends are non-cumulative.

Voting Rights

The holders of our common

stock are entitled to one vote for each share of common stock held on all matters submitted to a vote of the stockholders, including

the election of directors, except as to the Class A Directors during the Class A Director Period. Our certificate of incorporation and

bylaws do not provide for cumulative voting rights.

Liquidation and Dissolution

Upon our liquidation, dissolution,

or winding-up, the assets legally available for distribution to our stockholders would be distributable ratably among the holders of

our common stock, including Class A Common Stock, outstanding at that time after payment of other claims of creditors, if any.

Other

The holders of our common

stock have no preemptive, conversion, or subscription rights, and there are no redemption or sinking fund provisions applicable to our

common stock.

All of the outstanding shares

of our common stock, including Class A common stock, are duly issued, fully paid and non-assessable.

DIVIDEND POLICY

We have never declared or

paid any dividends. We currently intend to retain earnings, if any, for use in our business. We do not anticipate paying dividends in

the foreseeable future. Any future determination to declare dividends will be made at the discretion of our board of directors and will

depend on our financial condition, operating results, capital requirements, general business conditions, and other factors that our board

of directors may deem relevant.

LEGAL MATTERS

The validity of the securities

offered hereby will be passed upon for us by Alston & Bird LLP, New York, New York. Additional legal matters may be passed upon for

us or any underwriters, dealers or agents, by counsel that we will name in any applicable prospectus supplement.

EXPERTS

The financial statements as

of December 31, 2021 and for the year then ended incorporated by reference in this prospectus and in the Registration Statement have been

so incorporated in reliance on the report of BDO USA, LLP (n/k/a BDO USA, P.C.), an independent registered public accounting firm, incorporated

herein by reference, given on the authority of said firm as experts in auditing and accounting.

The financial statements

of Checkpoint Therapeutics, Inc. as of December 31, 2022 and for the year then ended, have been incorporated by reference herein in reliance

upon the report of KPMG LLP, independent registered public accounting firm, incorporated by reference herein, and upon the authority

of said firm as experts in accounting and auditing.

The audit report covering

the December 31, 2022 financial statements contains an explanatory paragraph that states that the Company’s recurring losses from

operations and net capital deficiency raise substantial doubt about the entity’s ability to continue as a going concern. The financial

statements do not include any adjustments that might result from the outcome of that uncertainty.

As of July 15, 2022, KPMG

LLP was engaged as our registered independent public accounting firm.

WHERE YOU CAN FIND MORE INFORMATION

We file reports with the

SEC on an annual basis using Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. The SEC maintains a website that

contains annual, quarterly, and current reports, proxy statements, and other information that issuers (including us) file electronically

with the SEC. The SEC’s website address is www.sec.gov. You can also obtain copies of materials we file with the SEC from our internet

website found at www.checkpointtx.com. Our stock is quoted on the Nasdaq Capital Market under the symbol “CKPT”.

This prospectus is only part

of a registration statement on Form S-3 that we have filed with the SEC under the Securities Act and therefore omits certain information

contained in the registration statement. We have also filed exhibits and schedules with the registration statement that are excluded

from this prospectus, and you should refer to the applicable exhibit or schedule for a complete description of any statement referring

to any contract or other document. You may inspect a copy of the registration statement, including the exhibits and schedules, without

charge, at the SEC’s website.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The SEC allows us to “incorporate

by reference” the information we file with them, which means that we can disclose important information to you by referring you

to those documents instead of having to repeat the information in this prospectus and any prospectus supplement. The information incorporated

by reference is considered to be part of this prospectus, and later information that we file with the SEC will automatically update and

supersede this information. This prospectus incorporates by reference the documents listed below (other than, unless otherwise specifically

indicated, current reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on such form that are related to such

items):

| |

a) |

Our Annual Report on Form 10-K for the year ended December 31, 2022,

filed with the SEC on March 31, 2023; |

| |

|

|

| |

b) |

Our Quarterly Reports on Form 10-Q for the

quarters ended March 31, 2023, June 30, 2023, and September 30, 2023 filed with the SEC on May 15, 2023, August 14, 2023, and November 13, 2023 respectively; |

| |

|

|

| |

c) |

Our Current Reports on Form 8-K filed with

the SEC on January 4, 2023, February 22, 2023, March 2, 2023, April 4, 2023, May 24, 2023, June 13, 2023, July 27, 2023, July 31, 2023, and October 3, 2023; and |

| |

|

|

| |

d) |

Description of our common stock, which is contained in the Registration

Statement on Form 10-12G/A, as filed with the SEC on August 19, 2016, as supplemented by the description of common stock found on

page 13 of this prospectus. |

All reports and other documents

we subsequently file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the termination of this offering, including

all such documents we may file with the SEC after the date of the initial registration statement and prior to the effectiveness of the

registration statement, but excluding any information furnished to, rather than filed with, the SEC, will also be incorporated by reference

into this prospectus and deemed to be part of this prospectus from the date of the filing of such reports and documents.

We will provide to each person,

including any beneficial owner, to whom a copy of this prospectus is delivered, a copy of any or all of the information that we have

incorporated by reference into this prospectus and any related prospectus, but not delivered with this prospectus and any related prospectus.

We will provide this information upon written or oral request at no cost to the requester. You may request this information by contacting

our corporate headquarters at the following address: 95 Sawyer Road, Suite 110, Waltham, Massachusetts 02453, Attn: Chief Financial Officer,

or by calling (781) 652-4500.

Checkpoint Therapeutics, Inc.

13,030,229 Shares of Common Stock underlying

certain Series A Warrants, Series B Warrants and Placement Agent Warrants

PROSPECTUS

, 2023

PART

II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

| | |

Amount to

Be Paid | |

| U.S. Securities and Exchange Commission registration fee | |

$ | 3,423.41 | |

| Legal fees and expenses | |

| * | |

| Accounting fees and expenses | |

| * | |

| Miscellaneous | |

| * | |

| Total | |

| * | |

* These fees and expenses are calculated based

on the number of issuances and amount of securities offered and accordingly cannot be estimated at this time. An estimate of the aggregate

amount of these expenses will be reflected in the applicable prospectus supplement.

Item 15. Indemnification of Directors and Officers

Under the General Corporation

Law of the State of Delaware (“DGCL”), a corporation may include provisions in its certificate of incorporation that will

relieve its directors of monetary liability for breaches of their fiduciary duty to the corporation, except under certain circumstances,

including a breach of the director’s duty of loyalty, acts or omissions of the director not in good faith or which involve intentional

misconduct or a knowing violation of law, the approval of an improper payment of a dividend or an improper purchase by the corporation

of stock or any transaction from which the director derived an improper personal benefit. The Company’s Amended and Restated Certificate

of Incorporation eliminates the personal liability of directors to the Company or its stockholders for monetary damages for breach of

fiduciary duty as a director with certain limited exceptions set forth in the DGCL.

Section 145 of the DGCL grants

to corporations the power to indemnify each officer and director against liabilities and expenses incurred by reason of the fact that

he or she is or was an officer or director of the corporation if he or she acted in good faith and in a manner he or she reasonably believed

to be in or not opposed to the best interests of the corporation and, with respect to any criminal action or proceeding, had no reasonable

cause to believe his or her conduct was unlawful. The Company’s Amended and Restated Certificate of Incorporation and Bylaws provide

for indemnification of each officer and director of the Company to the fullest extent permitted by the DGCL. Section 145 of the DGCL

also empowers corporations to purchase and maintain insurance on behalf of any person who is or was an officer or director of the corporation

against liability asserted against or incurred by him in any such capacity, whether or not the corporation would have the power to indemnify

such officer or director against such liability under the provisions of Section 145 of the DGCL.

Item 16. Exhibits and Financial Statement Schedules

The exhibits to the Registration

Statement are listed in the Exhibit Index attached hereto and incorporated by reference herein.

Item 17. Undertakings

| (a) |

The undersigned registrant hereby undertakes: |

| 1. |

To file, during any period in which offers or sales are being made,

a post-effective amendment to this registration statement: |

(i) To

include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) To

reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective

amendment thereof) which individually or in the aggregate, represent a fundamental change in the information set forth in the registration

statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities

offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range

may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes

in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of

Registration Fee” table in the effective registration statement;

(iii) To

include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any

material change to such information in the registration statement;

provided, however, that paragraphs

(1)(i), (1)(ii) and (1)(iii) of this section do not apply if the information required to be included in a post-effective amendment

by those paragraphs is contained in reports filed with or furnished to the SEC by the registrant pursuant to Section 13 or Section 15(d) of

the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus

filed pursuant to Rule 424(b) that is part of the registration statement.

| 2. |

That, for the purpose of determining any liability under the Securities

Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered

therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| |

|

| 3. |

To remove from registration by means of a post-effective amendment

any of the securities being registered which remain unsold at the termination of the offering. |

| |

|

| 4. |

That, for the purpose of determining liability under the Securities

Act of 1933 to any purchaser: |

(i) Each

prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date

the filed prospectus was deemed part of and included in the registration statement; and

(ii) Each

prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule

430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required

by Section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier

of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the

offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date

an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the

registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial

bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration

statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is

part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or

modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in

any such document immediately prior to such effective date.

| 5. |

That, for the purpose of determining liability of the registrant under

the Securities Act of 1933 to any purchaser in the initial distribution of the securities, the undersigned registrant undertakes

that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the

underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means

of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer

or sell such securities to such purchaser: |

(i) Any

preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any

free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the

undersigned registrant;

(iii) The

portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant

or its securities provided by or on behalf of the undersigned registrant; and

(iv) Any

other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

| (b) |

The undersigned registrant hereby undertakes that, for purposes of

determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section

13(a) or 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefits plan’s annual

report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement

shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities

at that time shall be deemed to be the initial bona fide offering thereof. |

| |

|

| (c) |

The undersigned registrant hereby undertakes to supplement the prospectus,

after the expiration of the subscription period, to set forth the results of the subscription offer, the transactions by the underwriters

during the subscription period, the amount of unsubscribed securities to be purchased by the underwriters, and the terms of any subsequent

reoffering thereof. If any public offering by the underwriters is to be made on terms differing from those set forth on the cover

page of the prospectus, a post-effective amendment will be filed to set forth the terms of such offering. |

| |

|

| (d) |

Insofar as indemnification for liabilities arising under the Securities

Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions,

or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification

is against public policy as expressed in the Securities Act of 1933, as amended, and is, therefore, unenforceable. In the event that

a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a

director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted

by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in

the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the

question of whether such indemnification by it is against public policy as expressed in the Securities Act of 1933, as amended, and

will be governed by the final adjudication of such issue. |

SIGNATURES

Pursuant to the requirements

of the Securities Act of 1933, the registrant has duly caused this registration statement to be signed on its behalf by the undersigned,

thereunto duly authorized.

| |

CHECKPOINT THERAPEUTICS, INC. |

| |

|

| Date: November 17, 2023 |

By: |

/s/ James F. Oliviero |

| |

Name: |

James F. Oliviero |

| |

Title: |

President and Chief Executive Officer |

POWER OF ATTORNEY

We, the undersigned directors

and/or executive officers of Checkpoint Therapeutics, Inc., hereby severally constitute and appoint James F. Oliviero, acting singly,

his or her true and lawful attorney-in-fact and agent, with full power of substitution and resubstitution, for him or her in any and

all capacities, to sign this registration statement and to file the same, with all exhibits thereto and other documents in connection

therewith, with the Securities and Exchange Commission, granting unto said attorney-in-fact and agent full power and authority to do

and perform each and every act and thing necessary or appropriate to be done in connection therewith, as fully for all intents and purposes

as he or she might or could do in person, hereby approving, ratifying and confirming all that said attorney-in-fact and agent, or his

substitute, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements

of the Securities Act of 1933, this registration statement has been signed below by the following persons on behalf of the registrant

and in the capacities and on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/ James F. Oliviero |

|

Chief Executive Officer and President |

|

November 17, 2023 |

| James F. Oliviero |

|

(Principal Executive Officer) |

|

|

| |

|

|

|

|

| /s/ Garrett Gray |

|

Chief Financial Officer |

|

November 17, 2023 |

| Garrett Gray |

|

(Principal Financial Officer) |

|

|

| |

|

|

|

|

| /s/ Michael S. Weiss |

|

Chairman of the Board |

|

November 17, 2023 |

| Michael S. Weiss |

|

|

|

|

| |

|

|

|

|

| /s/ Lindsay A. Rosenwald, M.D. |

|

Director |

|

November 17, 2023 |

| Lindsay A. Rosenwald, M.D. |

|

|

|

|

| |

|

|

|

|

| /s/ Scott Boilen |

|

Director |

|

November 17, 2023 |

| Scott Boilen |

|

|

|

|

| |

|

|

|

|

| /s/ Neil Herskowitz |

|

Director |

|

November 17, 2023 |

| Neil Herskowitz |

|

|

|

|

| |

|

|

|

|

| /s/ Barry Salzman |

|

Director |

|

November 17, 2023 |

| Barry Salzman |

|

|

|

|

| |

|

|

|

|

| /s/ Christian Béchon |

|

Director |

|

November 17, 2023 |

| Christian Béchon |

|

|

|

|

EXHIBIT

INDEX

Exhibit 5.1

90 Park Avenue

New York, NY 10016

212-210-9400 | Fax: 212-210-9444

| Matthew W. Mamak |

Direct Dial: 212-210-1256 |

Email: matthew.mamak@alston.com |

November 17, 2023

Checkpoint Therapeutics, Inc.

95 Sawyer Road, Suite 110,

Waltham, MA 02453

| |

Re: |

Registration Statement on Form S-3 |

Ladies and Gentlemen:

We are acting as counsel to

Checkpoint Therapeutics, Inc., a Delaware corporation (the “Company”) in connection with the registration statement

(the “Registration Statement”) on Form S-3 filed today by the Company with the Securities and Exchange Commission (the

“Commission”) to register under the Securities Act of 1933, as amended (the “Securities Act”), 13,030,229

shares of the Company’s common stock, $0.0001 par value per share (the “Shares”). The Shares being registered

are shares of the Company’s common stock underlying certain warrants follows: 6,325,354 Shares underlying certain Series A Warrants,

6,325,354 Shares underlying certain Series B Warrants, and 379,521 Shares underlying certain Placement Agent Warrants (the "Warrants,"

and the agreements under which they are governed, the “Warrant Agreements”).

This opinion is furnished to you at your request in accordance with the requirements of Item 601(b)(5) of Regulation S-K promulgated under

the Securities Act.

We have examined the Warrant

Agreements, the Amended and Restated Certificate of Incorporation of the Company, as amended, the Bylaws of the Company, records of proceedings

of the Board of Directors of the Company (the “Board of Directors”), or committees thereof, and records of proceedings

of the stockholders, deemed by us to be relevant to this opinion letter and the Registration Statement. We also have made such further

legal and factual examinations and investigations as we deemed necessary for purposes of expressing the opinion set forth herein. In our

examination, we have assumed the genuineness of all signatures, the legal capacity of all natural persons, the authenticity of all documents

submitted to us as original documents and the conformity to original documents of all documents submitted to us as certified, conformed,

facsimile, electronic or photostatic copies.

As to certain factual matters

relevant to this opinion letter, we have relied conclusively upon originals or copies, certified or otherwise identified to our satisfaction,

of such records, agreements, documents and instruments, including certificates or comparable documents of officers of the Company and

of public officials, as we have deemed appropriate as a basis for the opinion hereinafter set forth. Except to the extent expressly set

forth herein, we have made no independent investigations with regard to matters of fact, and, accordingly, we do not express any opinion

as to matters that might have been disclosed by independent verification.

Our opinion set forth below

is limited to the General Corporation Law of the State of Delaware, applicable provisions of the Constitution of the State of Delaware

and reported judicial decisions interpreting such General Corporation Law and Constitution that, in our professional judgment, are normally

applicable to transactions of the type contemplated by the Plan, the laws of the State of New York, and the federal law of the United

States, and we do not express any opinion herein concerning any other laws.

| Alston & Bird LLP |

www.alston.com |