Comera Life Sciences Announces the Completion of $4.1 Million Private Placement

September 12 2023 - 7:00AM

Comera Life Sciences Holdings, Inc. (Nasdaq: CMRA), a life sciences

company developing a new generation of biologic medicines to

improve patient access, safety, and convenience, today announced

that it has completed its previously announced $4.1 million private

placement of shares of its common stock, and accompanying warrants

to purchase shares of its common stock, to existing stockholders at

a purchase price of $0.51125 per share. The shares are accompanied

by five-year warrants to purchase shares of common stock at an

exercise price of $0.6135 per share. On July 31, 2023, Comera sold

and issued a total of 4,399,016 shares of its common stock and

warrants to purchase an aggregate of 10,997,550 shares of its

common stock in a first closing, resulting in gross proceeds of

$2.25 million to Comera. On September 11, 2023, following receipt

of stockholder approval on August 31, 2023, Comera sold and issued

an additional 3,561,851 shares of its common stock and warrants to

purchase an aggregate of 8,904,641 shares of its common stock in a

second closing, resulting in additional gross proceeds of $1.82

million. Warrants issued in connection with the initial closing are

exercisable beginning six months and one day after issuance and

warrants issued in connection with the second closing are

immediately exercisable. Proceeds from the private placement are

expected to be used for working capital and general corporate

purposes.

The securities sold in the private placement,

including the shares of common stock underlying the warrants, were

sold in a transaction not involving a public offering, have not

been registered under the Securities Act of 1933, as amended, and

may not be offered or sold in the United States except pursuant to

an effective registration statement or an applicable exemption from

the registration requirements. Concurrently with the initial

closing, Comera and the investors entered into a registration

rights agreement pursuant to which the Company has filed a

registration statement with the Securities and Exchange Commission

registering the resale of the securities sold in the private

placement.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

About Comera Life Sciences

Leading a compassionate new era in medicine,

Comera Life Sciences is applying a deep knowledge of formulation

science and technology to transform essential biologic medicines

from intravenous (IV) to subcutaneous (SQ) forms. The goal of this

approach is to provide patients with the freedom of self-injectable

care, reduce institutional dependency and to put patients at the

center of their treatment regimen.

To learn more about the Comera Life Sciences

mission, as well as the proprietary SQore™ platform, visit

https://comeralifesciences.com/.

Forward-Looking Statements

This press release includes “forward-looking

statements” within the meaning of the federal securities laws.

These forward-looking statements generally are identified by the

words “believe,” “project,” “expect,” “anticipate,” “estimate,”

“intend,” “strategy,” “future,” “opportunity,” “plan,” “may,”

“should,” “will,” “would,” “will be,” “will continue,” “will likely

result,” and similar expressions. Forward-looking statements are

predictions, projections and other statements about future events

(including statements related to the expected use of proceeds from

the private placement) that are based on current expectations and

assumptions and, as a result, are subject to risks and

uncertainties. Many factors could cause actual future events to

differ materially from the forward-looking statements in this

document, including, but not limited to: the Company’s ability to

maintain the listing of its securities on the Nasdaq Capital

Market; the Company’s ability to obtain stockholder approval for

the second closing of the private placement; the price of the

Company’s securities may be volatile due to a variety of factors,

including changes in the competitive and highly regulated

industries in which the Company plans to operate, variations in

performance across competitors, changes in laws and regulations

affecting the Company’s business and changes in the capital

structure; the Company’s ability to execute on its business plans,

forecasts, and other expectations and identify and realize

additional opportunities; the risk of economic downturns and the

possibility of rapid change in the highly competitive industry in

which the Company operates; the risk that the Company and its

current and future collaborators are unable to successfully develop

and commercialize the Company’s products or services, or experience

significant delays in doing so; the risk that we will be unable to

continue to attract and retain third-party collaborators, including

collaboration partners and licensors; the risk that the Company may

never achieve or sustain profitability; the risk that the Company

will need to raise additional capital to execute its business plan,

which may not be available on acceptable terms or at all; the risk

that the Company experiences difficulties in managing its growth

and expanding operations; the risk that third-party suppliers and

manufacturers are not able to fully and timely meet their

obligations; the risk that the Company is unable to secure or

protect its intellectual property; the risk that the Company is

unable to secure regulatory approval for its product candidates;

the effect of any resurgence of the COVID-19 pandemic or other

public health emergencies on the Company’s business; general

economic conditions; and other risks and uncertainties described in

Item 1A of Part I of the Company’s Annual Report on Form 10-K filed

with the Securities and Exchange Commission (SEC) on March 17, 2023

under “Risk Factors” and in other filings that have been made or

will be made with the SEC. The foregoing list of factors is not

exhaustive. Forward-looking statements speak only as of the date

they are made. Readers are cautioned not to put undue reliance on

forward-looking statements, and Comera assumes no obligation and

does not intend to update or revise these forward-looking

statements, whether as a result of new information, future events,

or otherwise. Comera can give no assurance that it will achieve its

expectations.

Contacts

Comera Investor

John Woolford ICR Westwicke John.Woolford@westwicke.com

Comera Press

Jon Yu ICR WestwickeComeraPR@westwicke.com

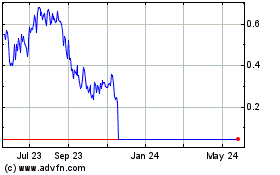

Comera Life Sciences (NASDAQ:CMRA)

Historical Stock Chart

From Nov 2024 to Dec 2024

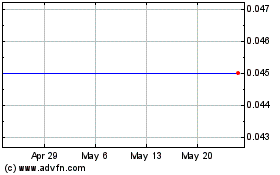

Comera Life Sciences (NASDAQ:CMRA)

Historical Stock Chart

From Dec 2023 to Dec 2024