Chimerix (NASDAQ: CMRX), a biopharmaceutical company whose mission

it is to develop medicines that meaningfully improve and extend the

lives of patients facing deadly diseases, today reported financial

results for the first quarter ended March 31, 2024 and provided an

operational update.

“Patients, caregivers and physicians are in desperate need for

novel therapies that offer clinical benefit in H3 K27M-mutant

diffuse glioma, and we believe that dordaviprone (ONC201) has the

potential to be a major therapeutic advance in the treatment of

this disease,” said Mike Andriole, Chief Executive Officer of

Chimerix.

“We remain intensely focused on completion of the ACTION study

and will continue to be active and collaborative with regulators to

bring dordaviprone to patients in need as soon as possible. In

parallel, we are continuously evaluating options to accelerate

access to dordaviprone in select markets where accelerated

regulatory pathways exist as there are few treatment options for

this ultra-rare disease beyond radiation therapy. As an example,

our recent interaction with the Therapeutic Goods Administration

(TGA) in Australia is a positive initial step that is aligned to

this overall strategy. Having a pivotal Phase 3 study well underway

is an important consideration in global regulatory conversations

that contemplate accelerated approval, and the ongoing maturation

of the ACTION study enables these conversations,” added Mr.

Andriole.

“Furthermore, we continue to progress our second generation

imipridone, ONC206, in Phase 1 dose escalation and are enthusiastic

about the differentiated profile and activity seen with this

molecule thus far. We expect to pursue novel development

opportunities apart from dordaviprone and look forward to

describing the future development path of ONC206 by the end of the

year,” concluded Mr. Andriole.

Dordaviprone (ONC201)

Dordaviprone is an oral, first-in-class small molecule

imipridone that selectively binds to the G-protein coupled dopamine

receptor D2 (DRD2) and the mitochondrial protease ClpP.

Dordaviprone is being evaluated in the Phase 3 ACTION trial that

is currently enrolling H3 K27M-mutant glioma patients at over 135

sites in 13 countries. The trial enrolls patients shortly after

completion of front-line radiation therapy, that is the standard of

care. The study is designed to enroll 450 patients randomized 1:1:1

to receive dordaviprone at one of two dosing frequencies or

placebo. Participants are randomized to receive 625mg of

dordaviprone once per week (the Phase 2 dosing regimen), 625mg on

two consecutive days per week or placebo. The dose is scaled by

body weight for patients <52.5kg.

Chimerix expects interim overall survival (OS) data in 2025 and

final OS data in 2026. For more information, please

visit clinicaltrials.gov

Chimerix recently engaged in the process to evaluate eligibility

for dordaviprone to be considered for Provisional Registration in

Australia. The Provisional Registration process is a three-step

process which begins with a Pre-Submission Meeting evaluating

current data, as well as other program features, including the

status of pivotal studies. Chimerix recently completed the

Pre-Submission Meeting with the TGA and the TGA agreed that

dordaviprone meets the criteria to advance to the second of three

steps in the process, a Provisional Determination application. The

meeting included an assessment that preliminary data is likely to

provide a “major therapeutic advance” in H3 K27M-mutant glioma and

that the ACTION study could provide pivotal confirmatory safety and

efficacy data before the conclusion of the Provisional Registration

period. Chimerix expects to work collaboratively with TGA as

dordaviprone advances to the next step in the process over the

coming months. Once submitted, the Provisional Determination review

process is targeted for 20 working days. Should an application

for Provisional Registration be submitted the review process is 255

working days. We expect a filing could occur around year end

with possible commercial availability in 2026.

ONC206

ONC206 is a second generation ClpP agonist and DRD2 antagonist

that has demonstrated monotherapy anti-cancer activity in

pre-clinical models in primary CNS tumors and solid tumors outside

of the CNS.

Phase I dose escalation trials continue at the National

Institutes of Health (NIH) and the Pacific Pediatric Neuro-Oncology

Consortium (PNOC) in adult and pediatric CNS tumor patients,

respectively. The dose escalation trials are currently dosing at a

twice per day, three days per week schedule, which are expected to

increase the duration of therapeutic exposure. To date, ONC206 has

been generally well tolerated with no dose limiting toxicities as

is currently being dosed in the expected therapeutic range.

Chimerix expects to report preliminary safety and pharmacokinetic

(PK) data from these studies beginning in mid-2024.

Corporate

In March 2024, Chimerix announced the appointment of Marc D.

Kozin as the newest member of the Company’s Board of Directors. Mr.

Kozin brings more than 35 years of experience in corporate and

business strategy consulting and merger and acquisition advisory

services. In addition, Patrick Machado has announced

his retirement from the Chimerix Board effective at the Company’s

2024 Annual Meeting of Stockholders in June, after ten years of

service.

First Quarter 2024 Financial Results

Chimerix reported a net loss of $21.9 million, or $0.25 per

basic and diluted share, for the first quarter of 2024. During the

same period in 2023, Chimerix recorded a net loss of $21.4 million,

or $0.24 per basic and diluted share.

Research and development expenses were $18.8 million for the

first quarter of 2024 and the same period in 2023.

General and administrative expenses decreased to $5.5 million

for the first quarter of 2024, compared to $5.7 million for the

same period in 2023.

Chimerix's balance sheet at March 31, 2024 included $188.2

million of capital available to fund operations, approximately 89.6

million outstanding shares of common stock and no outstanding

debt.

Conference Call and Webcast Chimerix will host

a conference call and live audio webcast to discuss first quarter

2024 financial results and provide a business update today at

8:30 a.m. ET. To access the live conference call, please dial

646-307-1963 (domestic) or 800-715-9871 (international) at least

five minutes prior to the start time and refer to conference ID

1246220. A live audio webcast of the call will also be available on

the Investors section of Chimerix’s website, www.chimerix.com. An

archived webcast will be available on the Chimerix website

approximately two hours after the event.

About Chimerix Chimerix is a biopharmaceutical

company with a mission to develop medicines that meaningfully

improve and extend the lives of patients facing deadly diseases.

The Company’s most advanced clinical-stage development program,

ONC201, is in development for H3 K27M-mutant glioma.

Forward-Looking Statements This press release

contains forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995 that are subject

to risks and uncertainties that could cause actual results to

differ materially from those projected. Forward-looking statements

include those relating to, among other things, applications for

Provisional Determination and Provisional Determination in

Australia, plans for accelerated approval from other global

regulators, completion of the ACTION study, and the characteristics

and development of ONC206. Among the factors and risks that could

cause actual results to differ materially from those indicated in

the forward-looking statements are risks related to the ability to

obtain and maintain accelerated approval; risks related to the

timing, completion and outcome of the Phase 3 ACTION study of

ONC201; risks associated with repeating positive results obtained

in prior preclinical or clinical studies in future studies; risks

related to the clinical development of ONC206; and additional risks

set forth in the Company's filings with the Securities and Exchange

Commission. These forward-looking statements represent the

Company's judgment as of the date of this release. The Company

disclaims, however, any intent or obligation to update these

forward-looking statements.

CONTACT:

Will O’ConnorStern Investor

Relations212-362-1200will@sternir.com

|

CHIMERIX, INC. |

|

|

CONSOLIDATED BALANCE SHEETS |

|

|

(in thousands, except share and per share

data) |

|

|

(unaudited) |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

March 31, |

|

December 31, |

|

| |

|

|

|

|

2024 |

|

2023 |

|

|

ASSETS |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

| |

Cash and cash equivalents |

|

$ |

19,026 |

|

|

$ |

27,661 |

|

|

| |

Short-term investments, available-for-sale |

|

|

140,002 |

|

|

|

155,174 |

|

|

| |

Accounts receivable |

|

|

1 |

|

|

|

4 |

|

|

| |

Prepaid expenses and other current assets |

|

|

4,003 |

|

|

|

6,271 |

|

|

| |

|

Total current assets |

|

|

163,032 |

|

|

|

189,110 |

|

|

|

Long-term investments |

|

|

29,133 |

|

|

|

21,657 |

|

|

|

Property and equipment, net of accumulated depreciation |

|

|

263 |

|

|

|

224 |

|

|

|

Operating lease right-of-use assets |

|

|

1,354 |

|

|

|

1,482 |

|

|

|

Other long-term assets |

|

|

260 |

|

|

|

301 |

|

|

| |

|

|

Total assets |

|

$ |

194,042 |

|

|

$ |

212,774 |

|

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

| |

Accounts payable |

|

$ |

3,823 |

|

|

$ |

2,851 |

|

|

| |

Accrued liabilities |

|

|

15,112 |

|

|

|

15,592 |

|

|

| |

|

Total current liabilities |

|

|

18,935 |

|

|

|

18,443 |

|

|

|

Line of credit commitment fee |

|

|

- |

|

|

|

125 |

|

|

|

Lease-related obligations |

|

|

1,005 |

|

|

|

1,177 |

|

|

| |

|

|

Total liabilities |

|

|

19,940 |

|

|

|

19,745 |

|

|

| |

|

|

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

| |

Preferred stock, $0.001 par value, 10,000,000 shares authorized at

March 31, 2024 and |

|

|

|

|

|

| |

|

December 31, 2023; no shares issued and outstanding as of March 31,

2024 and |

|

|

|

|

|

| |

|

December 31, 2023; no shares issued and outstanding as of March 31,

2024 and |

|

|

- |

|

|

|

- |

|

|

| |

Common stock, $0.001 par value, 200,000,000 shares authorized at

March 31, 2024 and |

|

|

|

|

|

| |

|

December 31, 2023; 89,629,902 and 88,929,300 shares issued and

outstanding as of |

|

|

|

|

|

| |

|

March 31, 2024 and December 31, 2023, respectively |

|

|

90 |

|

|

|

89 |

|

|

| |

Additional paid-in capital |

|

|

991,583 |

|

|

|

988,457 |

|

|

| |

Accumulated other comprehensive (gain) loss, net |

|

|

(178 |

) |

|

|

7 |

|

|

| |

Accumulated deficit |

|

|

(817,393 |

) |

|

|

(795,524 |

) |

|

| |

|

Total stockholders’ equity |

|

|

174,102 |

|

|

|

193,029 |

|

|

| |

|

|

Total liabilities and stockholders’ equity |

|

$ |

194,042 |

|

|

$ |

212,774 |

|

|

| |

|

|

|

|

|

|

|

|

|

CHIMERIX, INC. |

|

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE

LOSS |

|

(in thousands, except share and per share

data) |

|

(unaudited) |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

|

|

|

|

2024 |

|

2023 |

|

Revenues: |

|

|

|

|

| |

Contract and grant revenue |

|

$ |

- |

|

|

$ |

234 |

|

|

|

Licensing revenue |

|

|

- |

|

|

|

49 |

|

| |

|

Total revenues |

|

|

- |

|

|

|

283 |

|

|

Operating expenses: |

|

|

|

|

| |

Research and development |

|

|

18,844 |

|

|

|

18,822 |

|

| |

General and administrative |

|

|

5,546 |

|

|

|

5,679 |

|

| |

|

Total operating expenses |

|

|

24,390 |

|

|

|

24,501 |

|

| |

|

|

Loss from operations |

|

|

(24,390 |

) |

|

|

(24,218 |

) |

|

Other income: |

|

|

|

|

|

|

Interest income and other, net |

|

|

2,521 |

|

|

|

2,846 |

|

|

|

|

|

|

Net loss |

|

|

(21,869 |

) |

|

|

(21,372 |

) |

|

Other comprehensive (loss) income: |

|

|

|

|

| |

Unrealized (loss) gain on debt investments, net |

|

|

(185 |

) |

|

|

106 |

|

| |

|

|

|

Comprehensive loss |

|

$ |

(22,054 |

) |

|

$ |

(21,266 |

) |

|

Per share information: |

|

|

|

|

| |

Net loss, basic and diluted |

|

$ |

(0.25 |

) |

|

$ |

(0.24 |

) |

| |

|

|

|

|

|

|

|

|

| |

Weighted-average shares outstanding, basic and diluted |

|

89,259,106 |

|

|

|

88,294,624 |

|

| |

|

|

|

|

|

|

|

|

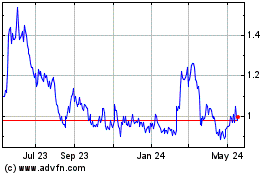

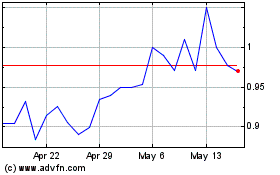

Chimerix (NASDAQ:CMRX)

Historical Stock Chart

From Nov 2024 to Dec 2024

Chimerix (NASDAQ:CMRX)

Historical Stock Chart

From Dec 2023 to Dec 2024