Creative Realities, Inc. (“Creative Realities,” “CRI,” or the

“Company”) (NASDAQ: CREX), a leading provider of digital signage

and media solutions, announced its financial results for the fiscal

first quarter ended March 31, 2024.

Highlights:

- Record first quarter revenue of $12.3

million, up 24% from $9.9 million in the prior-year period

- Gross profit of $5.8 million for the

three months ended March 31, 2024 versus $5.1 million in the first

quarter of fiscal 2023

- Adjusted EBITDA* of $0.8 million for

the first quarter of 2024 versus $1.0 million in the prior-year

period

- Annual recurring revenue (“ARR”) of

approximately $17.7 million at the end of the first quarter versus

$16.3 million at the beginning of the fiscal year; the Company

reaffirms its 2024 exit run rate guidance of $20.0 million

- Refinancing strategy is being

implemented to increase financial flexibility and lower long-term

interest expense through a new $20 million senior revolving credit

facility and $5 million accordion, with no prepayment penalties or

fixed amortization schedule

“We’re off to a great start in fiscal 2024 with

strong revenue growth and solid margins, on track to deliver record

results this year,” said Rick Mills, Chief Executive Officer.

“Revenue rose more than 20% year-over-year in the first quarter, to

$12.3 million, even as the first quarter is typically light due to

seasonality and budget cycles. While our consolidated gross margin

was lower than the 2023 first quarter, on a percentage basis, this

was primarily due to the significant 45% growth in service revenue

that included a higher percentage of installations – increasing to

18% of revenue as compared to 10% in the prior-year period. While

dampening margins in the quarter, such installs will lead to

greater subscription revenues going forward, and we ended the

quarter with a record ARR of approximately $17.7 million.

“In addition, as recently announced, on May 8,

2024, we signed a non-binding commitment letter for a

transformational refinancing agreement, expected to close next

week, that provides a $20 million revolver as well as access to a

$5 million accordion feature. Not only will this allow for greater

financial flexibility, it will enable the Company to lower its

interest rate exposure and move towards a more optimal capital

structure. By the end of the first quarter we had, once again,

reduced our outstanding debt, and we remain focused on de-levering

the balance sheet going forward. Overall, given a strong pipeline

of opportunities, increasing installations, and sound operating

execution, we are well positioned to see substantial growth in the

quarters to come and remain on track for our best year ever,

including a $20 million ARR by the end of 2024.”

*Adjusted EBITDA is a non-GAAP financial measure. A

reconciliation is provided in the tables of this press release.

2024 First Quarter Financial

ResultsSales were $12.3 million for the fiscal 2024 first

quarter, an increase of $2.4 million, or 24%, as compared to the

same period in fiscal 2023. Hardware revenue was $4.1 million,

versus $4.3 million in the prior-year period, while service revenue

rose to $8.1 million from $5.6 million in fiscal 2023, an increase

of 45%, reflecting higher installation and managed services.

Installation service revenue increased $1.2 million year-over-year

– or 128% – due to significant deployment activity during the

period.

Consolidated gross profit was $5.8 million for

the fiscal 2024 first quarter versus $5.1 million in the prior-year

period, and consolidated gross margin was 46.9% versus 51.2% in the

fiscal 2023 first quarter. Gross margin on hardware revenue was

22.9% in fiscal 2024 as compared to 25.8% in the prior-year period,

largely reflecting product mix and contract timing. Gross margin on

service amounted to 59.1%, versus 70.7% in the fiscal 2023 first

quarter, reflecting the fact that installations – historically the

Company’s lowest margin service – increased to 18% of total revenue

as compared to 10% in the prior-year period. Software subscription

run-rates continued to rise, however, and the Company ended the

quarter with record ARR of approximately $17.7 million on an

annualized run rate.

Sales and marketing expenses in the first

quarter rose to $1.5 million, versus $1.1 million in the prior-year

period, reflecting enhanced investment in business development

activities. Research and development expenses were $0.5 million

versus $0.4 million in the fiscal 2023 first quarter. First quarter

general and administrative expenses were $3.0 million, up slightly

year-over-year, primarily reflecting increases in deployment

personnel and the implementation of a new ERP system.

The Company posted an operating loss of

approximately $0.1 million in the first quarter of both fiscal 2024

and 2023. CRI reported a net loss of $0.1 million, or $(0.01) per

diluted share, in the quarter ended March 31, 2024 versus a net

loss of $1.0 million, or $(0.14) per diluted share, in the

prior-year period.

Adjusted EBITDA (defined later in this release)

was $0.8 million in the first quarter of 2024 as compared to $1.0

million in the prior-year period.

Balance SheetAs of March 31,

2024, the Company had cash on hand of approximately $2.9 million,

virtually equivalent to December 31, 2023. The Company had

outstanding principal debt of approximately $14.0 million as of

March 31, 2024 versus $15.1 million at the start of the fiscal

year. The Company’s net debt as of the date of this release is

approximately $11.7 million. CRI continues to repay approximately

$0.4 million in debt principal monthly, with a focus to reduce its

leverage ratio going forward. As of the end of the first quarter,

the trailing twelve month leverage ratio was 2.86 and 2.27 on a

gross and net basis, respectively, versus 2.97 and 2.40 at the

beginning of 2024. Net debt is equal to the Company’s cash on hand

less outstanding debt.

Conference Call DetailsThe

Company will host a conference call to review the results of the

first quarter 2024, and provide additional commentary about recent

performance, today, May 10, at 9:00 am Eastern Time, which will

include prepared remarks and materials from management, followed by

a live Q&A. The call will be hosted by Rick Mills, Chief

Executive Officer, and Will Logan, Chief Financial Officer.

Prior to the call, participants should register

at https://bit.ly/CRIearnings2024Q1. Once registered, participants

can use the weblink provided in the registration email to

participate in the live webcast. An archived edition of the

earnings conference call will also be posted on the Company’s

website later today and will remain available for one year.

About Creative Realities,

Inc.Creative Realities helps clients use place-based

digital media to achieve business objectives such as increased

revenue, enhanced customer experiences, and improved productivity.

The Company designs, develops and deploys digital signage

experiences for enterprise-level networks, and is actively

providing recurring SaaS and support services across diverse

vertical markets, including but not limited to retail, automotive,

digital-out-of-home (DOOH) advertising networks, convenience

stores, foodservice/QSR, gaming, theater, and stadium venues.

Use of Non-GAAP

MeasuresCreative Realities, Inc. prepares its consolidated

financial statements in accordance with United States generally

accepted accounting principles (“GAAP”). In addition to disclosing

financial results prepared in accordance with GAAP, the Company

discloses information regarding “EBITDA” and “Adjusted EBITDA.” CRI

defines “EBITDA” as earnings before interest, income taxes,

depreciation and amortization of intangibles. CRI defines “Adjusted

EBITDA” as EBITDA excluding stock-based compensation, fair value

adjustments and both cash and non-cash non-recurring gains and

charges. EBITDA and Adjusted EBITDA are not measures of performance

defined in accordance with GAAP. However, EBITDA and Adjusted

EBITDA are used internally in planning and evaluating the Company’s

operating performance. Accordingly, management believes that

disclosure of these metrics offers investors, bankers and other

stakeholders an additional view of the Company’s operations that,

when coupled with the GAAP results, provides a more complete

understanding of the Company’s financial results. EBITDA and

Adjusted EBITDA should not be considered as an alternative to net

income/(loss) or to net cash used in operating activities as

measures of operating results or liquidity. Our calculation of

EBITDA and Adjusted EBITDA may not be comparable to similarly

titled measures used by other companies, and the measures exclude

financial information that some may consider important in

evaluating the Company’s performance. A reconciliation of GAAP net

income/(loss) to EBITDA and Adjusted EBITDA is included in the

accompanying financial schedules. For further information, please

refer to Creative Realities, Inc.’s filings available online at

www.sec.gov, including its Annual Report on Form 10-K filed with

the Securities and Exchange Commission on March 21, 2024.

Cautionary Note on Forward-Looking

Statements This press release contains "forward-looking

statements" within the meaning of Section 27A of the Securities Act

of 1933, as amended, Section 21E of the Securities Exchange Act of

1934, as amended, and the Private Securities Litigation Reform Act

of 1995, and includes, among other things, discussions of our

business strategies, product releases, future operations and

capital resources. Words such as "estimates," "projected,"

"expects," "anticipates," "forecasts," "plans," "intends,"

"believes," "seeks," "may," "will," "should," "future," "propose"

and variations of these words or similar expressions (or the

negative versions of such words or expressions) are intended to

identify forward-looking statements. Forward-looking statements are

not guarantees of future performance, conditions or results. They

are based on the opinions, estimates and beliefs of management as

of the date such statements are made, and they are subject to known

and unknown risks, uncertainties, assumptions and other factors,

many of which are outside of our control, that may cause the actual

results, level of activity, performance or achievements to be

materially different from those expressed or implied by such

forward-looking statements. Some of these risks are discussed in

the “Risk Factors” section contained in Item 1A of our Annual

Report on Form 10-K for the year ended December 31, 2023, as

amended, and the Company’s subsequent filings with the U.S.

Securities and Exchange Commission. Important factors, among

others, that may affect actual results or outcomes include: our

ability to consummate the refinancing arrangement; our strategy for

customer retention, growth, product development, market position,

financial results and reserves, our ability to execute on our

business plan, our ability to retain key personnel, our ability to

remain listed on the Nasdaq Capital Market, our ability to realize

the revenues included in our future guidance and backlog reports,

our ability to satisfy our upcoming debt obligations, contingent

liabilities and other liabilities, the ability of the Company to

continue as a going concern, potential litigation, supply chain

shortages, and general economic and market conditions impacting

demand for our products and services. Readers should not place

undue reliance upon any forward-looking statements. We assume no

obligation to update or revise the forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by law.

ContactChristina

Daviescdavies@ideagrove.com

Investor Relations:Chris

Wittycwitty@darrowir.com

646-438-9385ir@cri.comhttps://investors.cri.com/

|

CREATIVE REALITIES, INC.CONSOLIDATED BALANCE

SHEETS(in thousands, except per share

amounts) |

| |

|

March 31, |

|

|

December 31, |

|

| |

|

2024 |

|

|

2023 |

|

| |

|

(unaudited) |

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

| Current Assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

2,899 |

|

|

$ |

2,910 |

|

|

Accounts receivable, net |

|

|

9,516 |

|

|

|

12,468 |

|

|

Inventories, net |

|

|

3,065 |

|

|

|

2,567 |

|

|

Prepaid expenses and other current assets |

|

|

837 |

|

|

|

665 |

|

| Total Current Assets |

|

$ |

16,317 |

|

|

$ |

18,610 |

|

|

Property and equipment, net |

|

|

464 |

|

|

|

499 |

|

|

Goodwill |

|

|

26,453 |

|

|

|

26,453 |

|

|

Other intangible assets, net |

|

|

23,985 |

|

|

|

24,062 |

|

|

Operating lease right-of-use assets |

|

|

875 |

|

|

|

1,041 |

|

|

Other non-current assets |

|

|

112 |

|

|

|

112 |

|

| Total Assets |

|

$ |

68,206 |

|

|

$ |

70,777 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Current Liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

4,788 |

|

|

$ |

7,876 |

|

|

Accrued expenses and other current liabilities |

|

|

3,955 |

|

|

|

3,761 |

|

|

Deferred revenues |

|

|

1,777 |

|

|

|

1,132 |

|

|

Customer deposits |

|

|

4,411 |

|

|

|

3,233 |

|

|

Current maturities of operating leases |

|

|

431 |

|

|

|

505 |

|

|

Short-term portion of related party Acquisition Term Loan, net of

$613 and $0 discount, respectively |

|

|

9,387 |

|

|

|

- |

|

|

Short-term portion of related party Consolidation Term Loan, net of

$655 and $747 discount, respectively |

|

|

3,383 |

|

|

|

3,690 |

|

|

Short-term portion of contingent consideration, at fair value |

|

|

10,603 |

|

|

|

- |

|

| Total Current Liabilities |

|

|

38,735 |

|

|

|

20,197 |

|

|

Long-term related party Acquisition Term Loan, net of $0 and $787

discount, respectively |

|

|

- |

|

|

|

9,213 |

|

|

Long-term related party Consolidation Term Loan, net of $0 and $94

discount, respectively |

|

|

- |

|

|

|

616 |

|

|

Long-term obligations under operating leases |

|

|

444 |

|

|

|

536 |

|

|

Long-term contingent consideration, at fair value |

|

|

- |

|

|

|

11,208 |

|

|

Other non-current liabilities |

|

|

178 |

|

|

|

176 |

|

| Total Liabilities |

|

|

39,357 |

|

|

|

41,946 |

|

| |

|

|

|

|

|

|

|

|

| Shareholders' Equity |

|

|

|

|

|

|

|

|

|

Common stock, $0.01 par value, 66,666 shares authorized; 10,447 and

10,409 shares issued and outstanding, respectively |

|

|

104 |

|

|

|

104 |

|

|

Additional paid-in capital |

|

|

82,200 |

|

|

|

82,073 |

|

|

Accumulated deficit |

|

|

(53,455 |

) |

|

|

(53,346 |

) |

| Total Shareholders’

Equity |

|

|

28,849 |

|

|

|

28,831 |

|

| Total Liabilities and

Shareholders' Equity |

|

$ |

68,206 |

|

|

$ |

70,777 |

|

|

CREATIVE REALITIES, INC.CONSOLIDATED STATEMENTS OF

OPERATIONS(in thousands, except per share

amounts) |

| |

|

For the Three Months Ended |

|

| |

|

March 31, |

|

| |

|

2024 |

|

|

2023 |

|

| Sales |

|

|

|

|

|

|

|

|

|

Hardware |

|

$ |

4,144 |

|

|

$ |

4,322 |

|

|

Services and other |

|

|

8,141 |

|

|

|

5,622 |

|

| Total sales |

|

|

12,285 |

|

|

|

9,944 |

|

| |

|

|

|

|

|

|

|

|

| Cost of sales |

|

|

|

|

|

|

|

|

|

Hardware |

|

|

3,193 |

|

|

|

3,206 |

|

|

Services and other |

|

|

3,328 |

|

|

|

1,649 |

|

| Total cost of sales |

|

|

6,521 |

|

|

|

4,855 |

|

| Gross profit |

|

|

5,764 |

|

|

|

5,089 |

|

| |

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

Sales and marketing expenses |

|

|

1,465 |

|

|

|

1,136 |

|

|

Research and development expenses |

|

|

508 |

|

|

|

366 |

|

|

General and administrative expenses |

|

|

3,028 |

|

|

|

2,898 |

|

|

Depreciation and amortization expense |

|

|

839 |

|

|

|

779 |

|

| Total operating expenses |

|

|

5,840 |

|

|

|

5,179 |

|

| Operating loss |

|

|

(76 |

) |

|

|

(90 |

) |

| |

|

|

|

|

|

|

|

|

| Other expenses (income): |

|

|

|

|

|

|

|

|

|

Interest expense, including amortization of debt discount |

|

|

663 |

|

|

|

803 |

|

|

Change in fair value of contingent consideration |

|

|

(604 |

) |

|

|

76 |

|

|

Other expense (income) |

|

|

(35 |

) |

|

|

(12 |

) |

| Total other expenses

(income) |

|

|

24 |

|

|

|

867 |

|

| Net loss before income

taxes |

|

|

(100 |

) |

|

|

(957 |

) |

| Benefit (provision) for income

taxes |

|

|

(9 |

) |

|

|

(43 |

) |

| Net loss |

|

$ |

(109 |

) |

|

$ |

(1,000 |

) |

| Basic loss per common

share |

|

$ |

(0.01 |

) |

|

$ |

(0.14 |

) |

| Diluted loss per common

share |

|

$ |

(0.01 |

) |

|

$ |

(0.14 |

) |

| Weighted average shares

outstanding - basic |

|

|

10,421 |

|

|

|

7,351 |

|

| Weighted average shares

outstanding - diluted |

|

|

10,421 |

|

|

|

7,351 |

|

|

CREATIVE REALITIES, INC.CONSOLIDATED STATEMENTS OF

CASH FLOWS(in thousands, except share per share

amounts) |

| |

|

Three Months Ended |

|

| |

|

March 31, |

|

| |

|

2024 |

|

|

2023 |

|

| Operating

Activities: |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(109 |

) |

|

$ |

(1,000 |

) |

| Adjustments to reconcile net

loss to net cash provided by operating activities |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

839 |

|

|

|

779 |

|

|

Amortization of debt discount |

|

|

360 |

|

|

|

356 |

|

|

Amortization of stock-based compensation |

|

|

3 |

|

|

|

298 |

|

|

Bad debt expense |

|

|

- |

|

|

|

237 |

|

|

(Gain) loss on change in fair value of contingent

consideration |

|

|

(604 |

) |

|

|

76 |

|

|

Deferred income taxes |

|

|

4 |

|

|

|

24 |

|

| Changes to operating assets

and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

2,952 |

|

|

|

1,177 |

|

|

Inventories, net |

|

|

(498 |

) |

|

|

788 |

|

|

Prepaid expenses and other current assets |

|

|

(172 |

) |

|

|

1,015 |

|

|

Accounts payable |

|

|

(2,976 |

) |

|

|

(486 |

) |

|

Accrued expenses and other current liabilities |

|

|

317 |

|

|

|

(45 |

) |

|

Deferred revenue |

|

|

645 |

|

|

|

2,382 |

|

|

Customer deposits |

|

|

1,178 |

|

|

|

(1,693 |

) |

|

Other, net |

|

|

(1 |

) |

|

|

(40 |

) |

|

Net cash provided by operating activities |

|

|

1,938 |

|

|

|

3,868 |

|

| Investing

activities |

|

|

|

|

|

|

|

|

|

Purchases of property and equipment |

|

|

(6 |

) |

|

|

(31 |

) |

|

Capitalization of labor for software development |

|

|

(824 |

) |

|

|

(1,003 |

) |

|

Net cash used in investing activities |

|

|

(830 |

) |

|

|

(1,034 |

) |

| Financing

activities |

|

|

|

|

|

|

|

|

|

Repayment of Consolidation Term Loan |

|

|

(1,109 |

) |

|

|

- |

|

|

Repayment of Secured Promissory Note |

|

|

- |

|

|

|

(310 |

) |

|

Repayment of Term Loan (2022) |

|

|

- |

|

|

|

(250 |

) |

|

Principal payments on finance leases |

|

|

(10 |

) |

|

|

(2 |

) |

|

Net cash used in financing activities |

|

|

(1,119 |

) |

|

|

(562 |

) |

| Increase (decrease) in

Cash and Cash Equivalents |

|

|

(11 |

) |

|

|

2,272 |

|

| Cash and Cash

Equivalents, beginning of period |

|

|

2,910 |

|

|

|

1,633 |

|

| Cash and Cash

Equivalents, end of period |

|

$ |

2,899 |

|

|

$ |

3,905 |

|

RECONCILIATION OF GAAP NET LOSS TO

ADJUSTED EBITDA (in thousands,

unaudited)

Creative Realities, Inc. prepares its

consolidated financial statements in accordance with United States

generally accepted accounting principles (“GAAP”). In addition to

disclosing financial results prepared in accordance with GAAP, the

Company discloses information regarding “EBITDA” and “Adjusted

EBITDA.” CRI defines “EBITDA” as earnings before interest, income

taxes, depreciation and amortization of intangibles. CRI defines

“Adjusted EBITDA” as EBITDA excluding stock-based compensation,

fair value adjustments and both cash and non-cash non-recurring

gains and charges.

EBITDA and Adjusted EBITDA are non-GAAP

financial measures and should not be considered as a substitute for

net income (loss), operating income (loss) or any other performance

measure derived in accordance with United States generally accepted

accounting principles (“GAAP”) or as an alternative to net cash

provided by operating activities as a measure of CRI’s

profitability or liquidity. CRI’s management believes EBITDA and

Adjusted EBITDA are useful financial metrics because they allow

external users of CRI’s financial statements, such as industry

analysts, investors, lenders and rating agencies, to more

effectively evaluate CRI’s operating performance, compare the

results of its operations from period to period and against CRI’s

peers without regard to CRI’s financing methods, hedging positions

or capital structure and because it highlights trends in CRI’s

business that may not otherwise be apparent when relying solely on

GAAP measures. CRI also presents EBITDA and Adjusted EBITDA because

it believes EBITDA and Adjusted EBITDA are important supplemental

measures of its performance that are frequently used by others in

evaluating companies in its industry. Because EBITDA and Adjusted

EBITDA exclude some, but not all, items that affect net income

(loss) and may vary among companies, the EBITDA and Adjusted EBITDA

CRI presents may not be comparable to similarly titled measures of

other companies.

The following table presents a reconciliation of

EBITDA and Adjusted EBITDA from net loss, CRI’s most directly

comparable financial measure calculated and presented in accordance

with GAAP.

| |

|

Quarters Ended |

|

| |

|

March 31 |

|

|

December 31 |

|

|

September 30 |

|

|

June 30 |

|

|

March 31 |

|

|

Quarters ended |

|

2024 |

|

|

2023 |

|

|

2023 |

|

|

2023 |

|

|

2023 |

|

| GAAP net (loss) income |

|

$ |

(109 |

) |

|

$ |

1,419 |

|

|

$ |

(1,931 |

) |

|

$ |

(1,425 |

) |

|

$ |

(1,000 |

) |

| Interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of debt discount |

|

|

360 |

|

|

|

366 |

|

|

|

363 |

|

|

|

358 |

|

|

|

356 |

|

|

Other interest, net |

|

|

303 |

|

|

|

302 |

|

|

|

371 |

|

|

|

429 |

|

|

|

447 |

|

|

Depreciation/amortization: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of intangible assets |

|

|

790 |

|

|

|

781 |

|

|

|

766 |

|

|

|

754 |

|

|

|

754 |

|

|

Amortization of employee share-based awards |

|

|

3 |

|

|

|

4 |

|

|

|

3 |

|

|

|

151 |

|

|

|

225 |

|

|

Depreciation of property & equipment |

|

|

49 |

|

|

|

48 |

|

|

|

50 |

|

|

|

43 |

|

|

|

25 |

|

| Income tax (benefit)

expense |

|

|

9 |

|

|

|

10 |

|

|

|

(15 |

) |

|

|

45 |

|

|

|

43 |

|

| EBITDA |

|

$ |

1,405 |

|

|

$ |

2,930 |

|

|

$ |

(393 |

) |

|

$ |

355 |

|

|

$ |

850 |

|

| Adjustments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss (Gain) on fair value of contingent consideration |

|

|

(604 |

) |

|

|

(42 |

) |

|

|

1,369 |

|

|

|

16 |

|

|

|

76 |

|

|

Stock-based compensation – Director grants |

|

|

- |

|

|

|

21 |

|

|

|

43 |

|

|

|

43 |

|

|

|

43 |

|

|

Other (income) expense |

|

|

(35 |

) |

|

|

(79 |

) |

|

|

3 |

|

|

|

(123 |

) |

|

|

(12 |

) |

| Adjusted EBITDA |

|

$ |

766 |

|

|

$ |

2,830 |

|

|

|

1,022 |

|

|

$ |

291 |

|

|

|

957 |

|

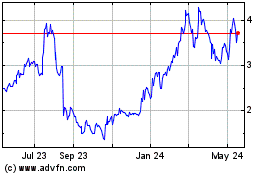

Creative Realities (NASDAQ:CREX)

Historical Stock Chart

From Dec 2024 to Jan 2025

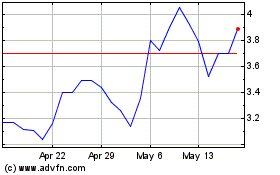

Creative Realities (NASDAQ:CREX)

Historical Stock Chart

From Jan 2024 to Jan 2025