Current Report Filing (8-k)

December 07 2022 - 5:02AM

Edgar (US Regulatory)

FALSE000091577900009157792022-12-052022-12-050000915779us-gaap:CommonStockMember2022-12-052022-12-050000915779us-gaap:PreferredStockMember2022-12-052022-12-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 5, 2022

Daktronics, Inc.

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | |

South Dakota | 0-23246 | 46-0306862 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

201 Daktronics Drive

Brookings, SD 57006

(Address of Principal Executive Offices, and Zip Code)

(605) 692-0200

(Registrant's Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, No Par Value | DAKT | Nasdaq Global Select Market |

| Preferred Stock Purchase Rights | DAKT | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 2 - Other Events

Item 8.01 Other Events.

On December 5, 2022, management of Daktronics, Inc. (the “Company”) determined to delay the release of its scheduled earnings press release and conference call and the filing of the Company’s Quarterly Report on Form 10-Q for the quarter ended October 29, 2022 (the “Form 10-Q”) in order to address the determination that there is substantial doubt about the Company’s ability to continue as a going concern and the discovery of a material weakness relating to the lack of adequate and appropriate financial reporting and disclosure related to such determination and the resultant accounting for income taxes. To permit additional time to properly complete the Company’s analysis, the Company will file a Form 12b-25 to extend the filing deadline for its Form 10‑Q to December 13, 2022. In addition, the Company has postponed the release of its second fiscal quarter 2023 financial results and its conference call and webcast previously scheduled for Wednesday, December 7, 2022, at 10:00 a.m. Central Time. The Company will now release its second quarter fiscal 2023 financial results on Monday, December 12, 2022, before the market opens and will host a conference call and webcast for all interested parties at 10:00 AM Central Time that day.

Ongoing supply chain disruptions and inflationary challenges in materials, freight and personnel related costs have and will continue to cause volatility in our cash flow, pricing, order volumes, lead-times, competitiveness, revenue cycles, and production costs. Our ability to fund inventory levels, operations and capital expenditures in the future will be dependent on our ability to generate cash flow from operations in these conditions, to maintain or improve margins, to use funds from our credit facility, and to find other sources of liquidity.

Although supply chain disruptions have started to ease, and we expect our inventory levels to decline, we cannot be certain we will not experience future disruptions or need additional liquidity to fund inventory levels, operations, and capital expenditures. We will need additional liquidity to meet our obligations as they come due in the 12 months following the date of this Form 12b-25, and we cannot be assured that such liquidity will be available or the form of such liquidity, such as equity raises or debt financing. These conditions raise substantial doubt about our ability to continue as a going concern.

In response to these conditions, we are pursuing additional liquidity through various means, including but not limited to obtaining financing secured by a mortgage on our facilities, a sales-leaseback transaction, leasing property and equipment, and continued focus on reducing working capital. Since these plans are not finalized and are subject to market conditions that are not within our control, they cannot be deemed probable. As a result, we have concluded that our plans do not alleviate substantial doubt about our ability to continue as a going concern.

Section 9 – Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits:

(d)Exhibits. The following exhibit is furnished as part of this Report:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | |

| DAKTRONICS, INC. |

| | |

| By: /s/ Sheila M. Anderson |

| | Sheila M. Anderson, Chief Financial Officer |

Date: December 6, 2022 | | |

EXHIBIT INDEX

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 104 | | Cover page Interactive Data File (embedded within the Inline XBRL document) |

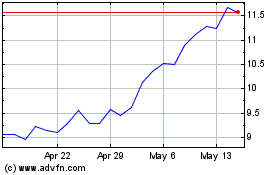

Daktronics (NASDAQ:DAKT)

Historical Stock Chart

From Jun 2024 to Jul 2024

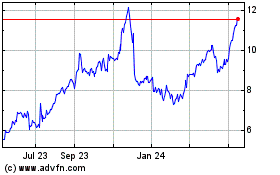

Daktronics (NASDAQ:DAKT)

Historical Stock Chart

From Jul 2023 to Jul 2024