UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE 14A

(Rule

14a-101)

INFORMATION

REQUIRED IN PROXY STATEMENT

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of The Securities Exchange Act of 1934

Filed

by the Registrant ☐

Filed

by a Party other than the Registrant ☒

Check

the appropriate box:

| |

☒ |

Preliminary Proxy Statement |

| |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

☐ |

Definitive Proxy Statement |

| |

☐ |

Definitive Additional Materials |

| |

☐ |

Soliciting Material Under Rule 14a-12 |

DAKTRONICS, INC.

(Name of Registrant

as Specified in Its Charter)

ALTA FOX OPPORTUNITIES

FUND, LP

ALTA FOX GENPAR, LP

ALTA FOX EQUITY, LLC

ALTA FOX CAPITAL MANAGEMENT, LLC

P. CONNOR HALEY

(Name of Person(s) Filing

Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

| |

☒ |

No fee required. |

| |

☐ |

Fee paid previously with preliminary materials. |

| |

☐ |

Fee computed in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

PRELIMINARY PROXY MATERIALS - SUBJECT

TO COMPLETION

ALTA FOX OPPORTUNITIES FUND, LP

[●], 2025

Dear Fellow Daktronics Shareholders:

The attached proxy statement

and enclosed BLUE proxy card are being furnished to you, as a shareholder of Daktronics, Inc., a South Dakota corporation (“Daktronics”

or the “Company”), in connection with the solicitation of proxies by Alta Fox Opportunities Fund, LP, a Delaware limited

partnership, together with the other participants in this solicitation (collectively, “Alta Fox”, “our”,

“us” or “we”) to vote “AGAINST” the Company’s proposals related

to the reincorporation of the Company from the State of South Dakota to the State of Delaware (the “Reincorporation”)

at a special meeting of shareholders to be held at Daktronics, Inc., 201 Daktronics Drive, Brookings, South Dakota 57006 on _______, 2025,

at 4:30 p.m., Central Daylight Time (including any adjournments or postponements thereof, the “Special Meeting”).

As

discussed in detail in the proxy statement, Alta Fox is the Company’s largest shareholder, beneficially owning approximately 11.7%

of the outstanding shares of Common Stock, no par value (the “Common Stock”). We are opposed to the Reincorporation

and believe that that the Company should remain incorporated in South Dakota. In our view, the sole purpose of the Reincorporation is

to reduce the rights not just of Alta Fox, but all shareholders. The minor governance improvements included in the Special Meeting agenda

(proxy access and majority voting) can both be implemented without the Reincorporation. Meanwhile, the Company is proposing to eliminate

cumulative voting, a bedrock of South Dakota corporate law that protects minority shareholders. As the Company has all but admitted, it

is proposing to depart from the state where it has been incorporated for almost six decades primarily to evade such shareholder protections.

We also note that the Company had the opportunity to put forth a proposal to declassify its Board of Directors, but chose not to. Accordingly,

our view is that the Special Meeting is held primarily to curtail rights that Daktronics’ shareholders have enjoyed for many years.

We urge you to carefully

consider the information contained in the attached Proxy Statement and then support our efforts by voting using the instructions on the

enclosed BLUE proxy card today.

If you have already voted

for Daktronics’ proposals relating to the Reincorporation, you have every right to change your vote by signing, dating and returning

a later dated BLUE proxy card or by voting at the Special Meeting.

If you have any questions

or require any assistance with your vote, please contact Okapi Partners LLC, which is assisting us, at its address and toll-free number

listed on the following page.

| |

Thank you for your support, |

| |

Alta Fox Opportunities Fund, LP |

If

you have any questions, require assistance in voting your BLUE proxy card, or need

additional copies of Alta Fox’s proxy materials, please contact Okapi Partners at the phone numbers or email address listed below:

Okapi Partners

LLC

1212 Avenue of the Americas, 24th Floor

New York, New York 10036

Shareholders may call toll-free: (877) 629-6356

Banks and

brokers call: (212) 297-0720

E-mail: info@okapipartners.com

SPECIAL MEETING OF SHAREHOLDERS

OF

DAKTRONICS, INC.

PROXY STATEMENT

OF

ALTA FOX OPPORTUNITIES FUND, LP

PLEASE SIGN, DATE AND

MAIL THE ENCLOSED BLUE PROXY CARD TODAY

Alta

Fox Opportunities Fund, LP, a Delaware limited partnership (“Alta Fox Opportunities”), and the other participants in

this solicitation (collectively, “Alta Fox”, “we”, “us” or “our”)

beneficially own an aggregate of 5,933,019 shares, or approximately 11.7% of the outstanding shares of Common Stock, no par value

(the “Common Stock”), of Daktronics, Inc., a South Dakota corporation (“Daktronics” or the “Company”),

making us the largest shareholder of the Company.

We are writing to you in

connection with the Company’s proposed reincorporation from the State of South Dakota to the State of Delaware (the “Reincorporation”).

The Company’s Board of Directors (the “Board”) has scheduled a special meeting for the purposes of considering

certain proposals relating to the Reincorporation (including any and all adjournments, postponements, continuations or reschedulings thereof,

or any other meeting of shareholders held in lieu thereof, the “Special Meeting”). The Special Meeting is scheduled

to be held at Daktronics, Inc., 201 Daktronics Drive, Brookings, South Dakota 57006 on _______, 2025, at 4:30 p.m. This Proxy Statement

and BLUE proxy card are first being mailed to the Company’s shareholders on or about ____________, 2025.

As set forth fully in this

Proxy Statement, we are soliciting proxies from Daktronics’ shareholders in respect of the following proposal to be considered at

the Special Meeting, each as described in greater detail in the proxy statement filed by Daktronics (the “Company Proxy Statement”)

with the U.S. Securities and Exchange Commission (the “SEC”):

| 1. | The Company’s proposal to approve the reincorporation of the Company from the State of South Dakota

to the State of Delaware pursuant to a plan of conversion (the “Reincorporation Proposal”); and |

| 2. | The Company’s proposal to approve an adjournment of the meeting, if necessary, to solicit additional

proxies if there are not sufficient votes of the Reincorporation Proposal (the “Adjournment Proposal”). |

We refer to the Reincorporation

Proposal and the Adjournment Proposal each as a “Proposal” and collectively as the “Proposals.”

We oppose the Reincorporation

and urge Daktronics’ shareholders to vote “AGAINST” the Reincorporation Proposal and “AGAINST”

the Adjournment Proposal because we believe that the Proposals are not in the best interests of shareholders. Please refer to the information

set forth under the heading “Reasons for the Solicitation” for a more detailed explanation of our rationale for opposing the

Reincorporation.

The Company has set the

close of business on _____________, 2025 as the record date for determining the shareholders entitled to vote at the Special Meeting (the

“Record Date”). The principal executive offices of the Company are located at 201 Daktronics Drive, Brookings, South

Dakota 57006. Shareholders of record at

the close of business on the Record Date will

be entitled to vote at the Special Meeting. According to the Company Proxy Statement, as of the close of business on the Record Date,

there were ____________ shares of Common Stock issued and outstanding.

As

of the close of business on the Record Date, Alta Fox beneficially owned [●] shares of Common Stock. We intend to vote our shares

of Common Stock “AGAINST” the Proposals. ALTA FOX URGES YOU TO SIGN, DATE AND RETURN THE BLUE

PROXY CARD VOTING “AGAINST” THE PROPOSALS.

THIS

SOLICITATION IS BEING MADE BY ALTA FOX AND NOT ON BEHALF OF THE BOARD OR MANAGEMENT OF THE COMPANY. WE ARE NOT AWARE OF ANY OTHER MATTERS

TO BE BROUGHT BEFORE THE SPECIAL MEETING OTHER THAN AS SET FORTH IN THIS PROXY STATEMENT. SHOULD OTHER MATTERS, WHICH ALTA FOX IS NOT

AWARE OF A REASONABLE TIME BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE SPECIAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED BLUE PROXY

CARD WILL VOTE ON SUCH MATTERS IN THEIR DISCRETION.

IF

YOU HAVE ALREADY SENT A PROXY CARD FURNISHED BY COMPANY MANAGEMENT OR THE BOARD, YOU MAY REVOKE THAT PROXY AND VOTE ON EACH OF THE PROPOSALS

DESCRIBED IN THIS PROXY STATEMENT BY VOTING THE ENCLOSED BLUE PROXY CARD. THE LATEST

DATED PROXY IS THE ONLY ONE THAT COUNTS. ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE SPECIAL MEETING BY DELIVERING A WRITTEN NOTICE

OF REVOCATION OR A LATER DATED PROXY FOR THE SPECIAL MEETING OR BY VOTING IN PERSON AT THE SPECIAL MEETING.

Important Notice Regarding the Availability

of Proxy Materials for the Special Meeting:

This Proxy Statement and our BLUE proxy

card are available at:

FixDaktronics.com

IMPORTANT

Your

vote is important, no matter how many or how few shares of Common Stock you own. Alta Fox urges you to vote “AGAINST”

each of the Proposals by following the instructions on the enclosed BLUE proxy card.

| ● | If your shares of Common Stock are registered in your own name, please vote (i) through the Internet at

any time prior to __________ on __________, 2025 by following the instructions on the enclosed BLUE proxy card; (ii) by telephone

from the United States, by calling (877) 629-6356 at any time prior to __________ on __________, 2025; or (iii) by signing and dating

the enclosed BLUE proxy card and returning it to Alta Fox, c/o Okapi Partners LLC (“Okapi”), in the enclosed

postage-paid envelope today. |

| ● | If your shares of Common Stock are held in a brokerage account or bank, you are considered the beneficial

owner of the shares of Common Stock, and these proxy materials, together with a voting form, are being forwarded to you by your broker

or bank. As a beneficial owner, you must instruct your broker, trustee or other representative how to vote. Your broker cannot vote your

shares of Common Stock on your behalf without your instructions. |

| ● | Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the

internet. Please refer to the enclosed voting form for instructions on how to vote electronically. You may also vote by signing, dating

and returning the enclosed voting form. |

| ● | You may vote Common Stock at the Special Meeting. However, even if you plan to attend the Special Meeting,

we recommend that you submit your BLUE proxy card by the applicable deadline so that your vote will be counted if you later decide

not to attend the Special Meeting |

If

you have any questions, require assistance in voting your BLUE proxy card, or need

additional copies of Alta Fox’s proxy materials, please contact Okapi Partners at the phone numbers or email address listed below:

Okapi Partners

LLC

1212 Avenue of the Americas, 24th Floor

New York, New York 10036

Shareholders may call toll-free: (877) 629-6356

Banks and

brokers call: (212) 297-0720

E-mail: info@okapipartners.com

BACKGROUND OF THE SOLICITATION

The following is a chronology

of relevant events leading up to this proxy solicitation:

| ● | Alta Fox has been an investor in the Company since July 2022. |

| ● | On September 26, 2024, Mr. Haley flew to the Company’s headquarters to meet with Chief Executive

Officer, Mr. Reece Kurtenbach and Chief Financial Officer, Ms. Sheila Anderson, to discuss operational improvements and financial discipline

required for Daktronics’ growth. Mr. Haley also offered to increase its investment in the Company should it need additional capital. |

| ● | On December 7, 2022, Daktronics filed a Current Report on Form 8-K with the SEC, disclosing that their

auditors issued “doubt about their ability to operate as a going concern” (the “Going Concern Notice”). |

| ● | On January 26, 2023, Alta Fox filed its Schedule 13D with the SEC disclosing an ownership position of

5.9%, making Alta Fox the company’s largest individual shareholder. |

| ● | On March 21, 2023, Alta Fox filed Amendment No. 1 to the Schedule 13D with the SEC disclosing a 6.0% ownership

position. Pursuant to Amendment No. 1 to the Schedule 13D, Alta Fox disclosed that on March 19, 2023, Alta Fox and the Company entered

into a Standstill and Voting Agreement, in connection with ongoing negotiations between the Company and Alta Fox regarding a potential

financing transaction. |

| ● | On May 11, 2023, Alta Fox Opportunities and the Company entered into a Securities Purchase Agreement (the

“Securities Purchase Agreement”) under which the Company agreed to sell and issue to Alta Fox its senior secured convertible

notes (the “Convertible Notes”) in exchange for the payment by Alta Fox to the Company of $25 million. On May 11, 2023

(the “Issuance Date”), the Company issued the Convertible Notes to Alta Fox Opportunities in the total original principal

amount of $25 million. The Convertible Notes are convertible into shares of Common Stock, subject to certain conditions and limitations.

The Convertible Notes provide a conversion right which allows Alta Fox Opportunities, at any time after the Issuance Date, to convert

all or any portion of the principal amount of the Convertible Notes, together with any accrued and unpaid interest and any other unpaid

amounts, including late charges, if any (together, the “Conversion Amount”), into shares at an initial conversion price

of $6.31 per share, subject to adjustment in accordance with the terms of the Convertible Notes (the “Conversion Price”).

The Company also has a forced conversion right, which is exercisable on the occurrence of certain conditions set out in the Convertible

Notes, pursuant to which it can cause all or any portion of the outstanding and unpaid Conversion Amount to be converted into shares at

the Conversion Price. The Company shall not issue any shares pursuant to the terms of the Convertible Notes, and the holders of the Convertible

Notes shall not have the right to any shares otherwise issuable under their respective Convertible Notes to the extent that, after giving

effect to such issuance, a holder together with certain “Attribution Parties” (as defined in the Convertible Notes),

collectively would beneficially own in excess of 9.99% (which percentage can be increased or decreased from time to time to a percentage

not in excess of 19.99%, effective as of the sixty-first (61st) day after delivery of written notice of such increase or decrease to the

Company) of the number of Shares outstanding immediately after giving effect to such issuance (the “Beneficial Ownership Limitation”). |

| ● | Also on May 11, 2023, Daktronics’ Chief Executive Officer commented on the new capital provided

by Alta Fox, stating, “[w]e . . . appreciate that Alta Fox has demonstrated its confidence in Daktronics’ path |

forward by committing additional capital

to the Company. Alta Fox has been a collaborative partner and we thank them for their support.”

| ● | On May 15, 2023, Alta Fox filed Amendment No. 2 to the Schedule 13D with the SEC, disclosing a 9.99% ownership

position and that they had entered into the Securities Purchase Agreement and the Convertible Notes described above. |

| ● | On June 9, 2023, Alta Fox filed Amendment No. 3 to the Schedule 13D with the SEC, disclosing a 4.99% ownership

position and that in accordance with the Convertible Notes, Alta Fox elected to decrease the Beneficial Ownership Limitation to 4.99%. |

| ● | On June 5, 2024, Alta Fox sent a private letter to the Board’s Lead Independent Director, outlining

governance concerns with the Company, the need for a new Chief Financial Officer and the need for shareholder-appointed Board members.

The Board failed to respond. |

| ● | On September 5, 2024, Alta Fox again sent a private letter – this time to the entire Board –

outlining governance and managerial concerns with the Company. The Board did not provide any substantive feedback but agreed that Board

members Mr. Kurtenbach and Mr. Siegel would meet with representatives of Alta Fox. |

| ● | On September 26, 2024, counsel for Alta Fox discussed with counsel for Daktronics various ideas for promptly

resolving the parties’ disagreements. Topics included governance improvements, capital allocation commitments, share buybacks and

Board refreshment. |

| ● | On October 21, 2024, Alta Fox Opportunities delivered a notice to the Company decreasing the Beneficial

Ownership Limitation to 3.0%. |

| ● | On November 8, 2024, Daktronics issued a press release announcing a plan to begin forcibly converting

the Convertible Note as of November 11, 2024. |

| ● | On November 11, 2024, counsel for Alta Fox requested a written questionnaire required for valid shareholder

nominations at a special meeting in order to prepare a potential request for a special meeting of shareholders. |

| ● | Also on November 11, 2024, Daktronics delivered a purported notice of forced conversion to Alta Fox Opportunities

(the “Purported Conversion Notice”). The Purported Conversion Notice stated that the Conversion Amount was $7 million,

to purportedly be converted into 1,109,350 shares, with a purported conversion date of December 3, 2024. Alta Fox disputed the effectiveness

of the Purported Conversion Notice and reserves all rights regarding the same. Daktronics informed Alta Fox Opportunities that its purported

forced conversion of the Convertible Note will not result in the issuance of common shares to Alta Fox Opportunities until after Alta

Fox Opportunities certifies it owns less than the Beneficial Ownership Limitation. |

| ● | On November 20, 2024, the Company filed a Current Report on Form 8-K with the SEC that the Board approved

the Second Amendment to Rights Agreement, dated as of November 19, 2024, by and between |

the Company and Equiniti Trust Company,

LLC, (the “Poison Pill Renewal”). In connection with the Poison Pill Renewal, the Company specifically named Alta Fox

in its Press Release as a reason why the Poison Pill Renewal was entered into, “the Board considered the risk that Alta Fox, by

virtue of its significant ownership position,” which the Company indicated was feasible given the important shareholder right of

cumulative voting under South Dakota Law, “Because Daktronics’ Articles of Incorporation and South Dakota law mandate cumulative

voting in the election of directors, a shareholder who also owns debt, like Alta Fox… may be able to make Board composition changes

even without broad shareholder support.”

| ● | Also on November 20, 2024, upon filing the Poison Pill Renewal, the Company’s Common Stock price

fell by over 5%. |

| ● | On November 22, 2024, Alta Fox submitted a demand to inspect the Company’s Books and Records pursuant

to South Dakota Business Corporation Act § 47-1A-1602, the purpose of which was to gather information regarding misjudgment and/or

malfeasance by the Board and potential breaches of fiduciary duties by certain members of the Board in connection with the Going Concern

Notice and the Poison Pill Renewal, as well as other concerning actions taken by the Company, its executive officers and the Board. |

| ● | On November 25, 2024, Alta Fox Opportunities delivered a notice to Daktronics

increasing the Beneficial Ownership Limitation to 14.99%, which increase will not be effective until the sixty-first (61st) day after

the delivery of the notice on November 25, 2024. Thereafter, on December 11, 2024 and January 10, 2025, Daktronics delivered additional

purposed notices of forced conversion to Alta Fox Opportunities, each of which stated that the Conversion Amount was $7 million, to purportedly

be converted into 1,109,350 shares, with conversion dates of January 3, 2025 and February 3, 2025, respectively. |

| ● | On December 2, 2024, Alta Fox filed a Schedule 13D with the SEC disclosing an ownership position of 11.7%.

Pursuant to the Schedule 13D, Alta Fox disclosed the Purported Conversion Notice. |

| ● | On December 10, 2024, Alta Fox released an investor presentation (the “Investor Presentation”)

at the Bloomberg Activism Forum, highlighting measures that Alta Fox believes are necessary to unlock shareholder value and renew accountability

to the Company’s shareholders. In conjunction with the Investor Presentation, Alta Fox also issued a press release announcing the

Investor Presentation. The Investor Presentation recommended several proposals to fix the Board and management including proposals: (1)

nominate independent Board members; (2) declassify the Board; (3) split the CEO and Chairman roles and (4) remove the “poison pill” Rights Agreement. |

| ● | Also on December 10, 2024, on information and belief, the Company interpreted the Investor Presentation

as a threat to the Board – rather than constructive proposals to improve the Company – Daktronics issued a press release characterizing

the Investor Presentation as an intimidation tactic. |

| ● | On December 11, 2024, Alta Fox filed a press release correcting the record on what it believed were misleading

statements made by the Company, explaining that “[a]s a shareholder, [Alta Fox] ha[s] an unassailable right to put up directors

for election at an annual meeting and to call a special meeting of shareholders. The Company’s claim in its December 11th press

release that [Alta Fox] tried to ‘intimidate’ the Board by stating [its] intention to nominate highly qualified, independent

director candidates is not only |

delusional, but also speaks to the Board’s

extreme level of entrenchment and the insular culture it has perpetuated.”

| ● | Also on December 11, 2024, Alta Fox filed Amendment No. 1 to the Schedule 13D disclosing the Investor

Presentation and related press release. |

| ● | On December 17, 2024, Breach Inlet Capital, LP, urged Daktronics to “immediately stop fighting

with DAKT’s shareholders,” and to stop “wasting shareholder capital in a public feud with its largest

investor,” Alta Fox, whom Breach Inlet Capital, LP characterized as “the firm that potentially saved [Daktronics] from

bankruptcy.” |

| ● | On January 12, 2025, advisors to the Company reached out to advisors to Alta Fox and threatened that if a negotiated resolution could not be reached promptly, the Company would remove cumulative voting. |

| ● | On January 16, 2025, counsel for Alta Fox and Daktronics discussed the non-binding term sheet, pursuant

to which, counsel for Daktronics sent a revised term sheet reflecting discussions. |

| ● | Also on January 16, 2025, the Board approved the Reincorporation. |

| ● | On January 18, 2025, counsel for Alta Fox sent Daktronics’ counsel a revised non-binding term

sheet. |

| ● | On January 21, 2025, the Company filed its preliminary proxy statement with the SEC. |

| ● | On January 22, 2025, counsel for Alta Fox sent a revised non-binding term sheet to Daktronics’ counsel

for review. |

| ● | On January 24 2025, counsel for Daktronics’ sent Alta Fox’s counsel a revised non-binding

term sheet, which was unacceptable to Alta Fox. |

| ● | On January 27, 2025, Anchor Capital Advisors,

LLC filed a press release, indicating that they are in favor of governance reforms and against the Reincorporation. |

| ● | On January 31, 2025, Alta Fox filed this preliminary proxy statement with the SEC. |

REASONS

FOR THE SOLICITATION

We believe the Reincorporation

is NOT in the best interests of shareholders

Alta Fox is Daktronics’

largest shareholder, with beneficial ownership of approximately 11.7% of the Company’s outstanding Common Stock and an unwavering

commitment to creating long-term value for all fellow stakeholders. We are urging all shareholders to vote “AGAINST” the

Proposals at the Special Meeting. Our interests are fully aligned with all independent shareholders.

Alta Fox believes that

cumulative voting is an important shareholder right that protects the voice of independent minority shareholders. Cumulative voting in

director elections is available in a majority of U.S. states and mandated by the South Dakota Constitution and the South Dakota Business

Corporation Act (the “SDBCA”). Under cumulative voting, shareholders can allocate their votes for particular candidates

in director elections. As investors in a South Dakota company, Daktronics shareholders have enjoyed the right to cumulate their votes

in director elections for decades.

Alta Fox believes that

the Reincorporation reflects the Board’s intent to entrench itself and limit the influence of minority shareholders, specifically

through the elimination of cumulative voting. It was only after Alta Fox’s advocacy for director refreshment, Board declassification

and other governance improvements that the Board voted for the proposed Reincorporation. Indeed, shortly before the Reincorporation proposal,

the Company, through its advisors, privately threatened that if Alta Fox did not back off its demands for governance reforms, the Company

would remove cumulative voting. In light of this, it is not surprising that the first and principal reason offered in the Company Proxy

Statement in favor of the Reincorporation is in fact to escape the cumulative voting provisions of the SDBCA. Alta Fox believes that enacting

the Reincorporation will a) weaken the ability of the Company’s shareholders to nominate and elect well-qualified, truly independent

Board members, and b) slow or prevent the adoption of other critical governance reforms that Daktronics desperately needs by reducing

the Board’s accountability to shareholders.

Alta Fox also believes

that the “Majority Voting for Uncontested Elections” and “Adoption of Proxy Access” provisions of the proposed

Delaware Bylaws described in the Company Proxy Statement are not a sufficient basis to vote for the Reincorporation. The Board can adopt

both provisions while remaining a South Dakota corporation, but has not done so. The timing of the Board’s approval of the Reincorporation,

coming only after Alta Fox advocated for governance reforms and new Board members, also suggests that the other reasons for the Reincorporation

stated in the Company Proxy Statement are only a pretext for the Board’s actual potential motivation for Reincorporation, entrenchment

and a rejection of strong Board members.

For these reasons, Alta

Fox opposes and will vote “AGAINST” the Reincorporation Proposal at the Special Meeting.

PROPOSAL NO. 1

THE REINCORPORATION PROPOSAL

In connection with the Reincorporation,

you are being asked by the Company to approve the Reincorporation Proposal. According to the Company Proxy Statement, the Reincorporation

Proposal requires, among other things, the affirmative vote of the holders of at least a majority of the voting power of shares present

or represented by proxy and entitled to vote at the Special Meeting, assuming a quorum is present. For purposes of this vote, abstentions

will have the same effect as a vote “AGAINST” the Reincorporation Proposal, and shares represented by executed

proxies that fail to instruct their broker, bank or other nominee to vote will have the same effect as a vote “FOR” the Reincorporation

Proposal. Broker non-votes will have no effect on the outcome of the proposal.

As discussed further in the “Reasons

for the Solicitation” section of this Proxy Statement, we oppose the Reincorporation and are soliciting your proxy to vote “AGAINST”

the Reincorporation Proposal at the Special Meeting.

ALTA FOX URGES YOU TO VOTE “AGAINST”

THE REINCORPORATION PROPOSAL ON

THE ENCLOSED BLUE PROXY CARD.

PROPOSAL

NO. 2

THE

Adjournment PROPOSAL

You are

being asked by the Company to approve a proposal that will give the Board authority to adjourn the Special Meeting from time to time,

if necessary or appropriate, including to solicit additional proxies in favor of the Reincorporation Proposal if there are insufficient

votes at the time of such adjournment to approve such proposal.

Approval of the Adjournment

Proposal requires the affirmative vote of at least a majority of the voting power of shares present or represented by proxy and entitled

to vote at the Special Meeting, assuming a quorum is present. For purposes of this vote, an abstention will have the same effect as a

vote “AGAINST” the Adjournment Proposal, and shares represented by executed proxies that fail to instruct their

broker, bank or other nominee to vote will have the same effect as a vote “FOR” the Adjournment Proposal. Broker non-votes

will have no effect on the outcome of the proposal.

ALTA

FOX URGES YOU TO VOTE “AGAINST” THE ADJOURNMENT PROPOSAL ON THE

ENCLOSED BLUE PROXY CARD.

CONSEQUENCES OF DEFEATING THE REINCORPORATION PROPOSAL

According to the Company

Proxy Statement, the Reincorporation Proposal requires a majority of the voting power of shares present or represented by proxy and entitled

to vote at a meeting at which a quorum is present.

If the Company fails

to obtain the requisite vote of shareholders to approve the Reincorporation, the Reincorporation will not be consummated, and

Daktronics will continue to be incorporated under the laws of the State of South Dakota and governed by the SDBCA, the

company’s existing Amended and Restated Articles of Incorporation (the “Charter”) and Amended and Restated Bylaws

(the “Bylaws”).

Please see the Company

Proxy Statement for further information and details regarding the Reincorporation and the Reincorporation Proposal. The Reincorporation

and the Reincorporation Proposal are described in further detail in the Company Proxy Statement which is available at www.sec.gov.

VOTING

AND PROXY PROCEDURES

Only

shareholders of record on the Record Date will be entitled to notice of and to vote at the Special Meeting. Shareholders who sell their

Common Stock before the Record Date (or acquire them without voting rights after the Record Date) may not vote such shares. Shareholders

of record on the Record Date will retain their voting rights in connection with the Special Meeting even if they sell such shares after

the Record Date. Based on publicly available information, Alta Fox believes that the only outstanding class of securities of the Company

entitled to vote at the Special Meeting is the Common Stock.

Common

Stock represented by properly executed BLUE proxy cards will be voted at the Special Meeting

as marked and, in the absence of specific instructions, will be voted “AGAINST”

the Reincorporation Proposal, “AGAINST” the Adjournment Proposal and in the

discretion of the persons named as proxies on all other matters as may properly come before the Special Meeting, as described herein.

QUORUM; BROKER NON-VOTES; DISCRETIONARY

VOTING

A

quorum is the minimum number of shares of Common Stock that must be represented at a duly called meeting in person or by proxy in order

to legally conduct business at the meeting. For the Special Meeting, Daktronics’ shareholders entitled to cast a majority of all

the votes entitled to be cast at the Special Meeting must be present or represented by proxy to constitute a quorum. Abstentions and broker

non-votes will be included in determining whether a quorum is present at the Special Meeting.

If

you hold your shares in street name and do not provide voting instructions to your broker, bank or other nominee your shares will not

be voted on any proposal on which your broker, bank or other nominee does not have discretionary authority to vote (a “broker non-vote”).

As noted above, while broker non-votes are considered entitled to vote for purposes of determining a quorum, they are excluded from the

tally of votes cast. Therefore, for each of the Proposals in this Proxy Statement, abstentions will have the same effect as a vote “AGAINST”

such proposal, while broker non-votes will have no effect on the outcome of the Proposals.

VOTES REQUIRED FOR APPROVAL

Reincorporation

Proposal – According to the Company Proxy Statement, the Reincorporation Proposal will

be approved if a majority of the voting power of shares present or represented by proxy and entitled to vote at a meeting at which a quorum

is present votes in favor of the Reincorporation Proposal. Accordingly, abstentions will have the effect as a vote “AGAINST”

the Reincorporation Proposal.

Adjournment

Proposal – According to the Company Proxy Statement, the Adjournment Proposal will

be approved if a majority of the voting power of shares present or represented by proxy and entitled to vote at a meeting at which a quorum

is present votes in favor of the Adjournment Proposal. Accordingly, abstentions will have the effect as a vote “AGAINST”

the Adjournment Proposal.

REVOCATION OF PROXIES

Shareholders of the Company may

revoke their proxies at any time before their proxies are voted at the Special Meeting by (i) delivering a written notice of revocation

to the Secretary of the Company; (ii) submitting another proxy bearing a later date; (iii) voting by telephone or via the Internet after

a prior telephone or Internet vote; or (iv) attending the Special Meeting and voting in person (although attendance at the Special Meeting

alone will not itself revoke a proxy). If your shares of Common Stock are held by a broker, bank or other nominee, you must follow the

instructions provided by the broker, bank or other nominee on how to change your instructions or change your vote.

The delivery of a subsequently

dated proxy, as set out above, which is properly completed will constitute a revocation of any earlier delivered proxy. The revocation

may be delivered either to Alta Fox in care of Okapi at the address set forth on the back cover of this Proxy Statement or to the Secretary

of the Company at the Company’s principal executive offices located at 201 Daktronics Drive, Brookings South Dakota 57006. Although

a revocation is effective if delivered to the Company, we request that either the original or photostatic copies of all revocations be

mailed to Alta Fox in care of Okapi at the address set forth on the back cover of this Proxy Statement so that we will be aware of all

revocations and can more accurately determine if and when proxies have been received from the requisite Daktronics’ shareholders

on the Record Date. Additionally, Okapi may use this information to contact shareholders who have revoked their proxies in order to solicit

later dated proxies against the Proposals.

IF YOU WISH TO VOTE “AGAINST”

THE PROPOSALS, PLEASE SIGN, DATE AND RETURN

PROMPTLY THE ENCLOSED BLUE PROXY CARD IN THE POSTAGE-PAID ENVELOPE

PROVIDED.

QUESTIONS AND ANSWERS ABOUT

THE PROXY MATERIALS AND THE SPECIAL MEETING

The following questions and

answers are intended to address some commonly asked questions regarding the Reincorporation, Proposals and Special Meeting. These questions

and answers may not address all questions that may be important to you as a Daktronics’ shareholder. You are encouraged to carefully

read the detailed information contained elsewhere in this Proxy Statement and the documents publicly filed by the Company referenced in

this Proxy Statement, including the Company Proxy Statement.

| |

Q: |

When and where is the Special Meeting? |

| |

A: |

The Special Meeting will be

held in person at Daktronics, Inc., 201 Daktronics Drive, Brookings, South Dakota 57006, at 4:30 p.m. (Central Daylight Time), on _______,

2025. |

| |

Q: |

Who is entitled to vote at the Special Meeting? |

| |

A: |

Only holders of record of Common

Stock at the close of business on _______, 2025 will be entitled to receive notice of the Special Meeting and to vote on the Reincorporation

Proposal at the Special Meeting. If you hold shares of Common Stock in “street name” at a broker, bank or nominee, please

follow the voting instructions provided by your broker, bank or nominee to ensure that your shares of Common Stock are represented at

the Special Meeting. |

| |

Q: |

What am I being asked to vote on at the Special Meeting? |

| |

A: |

Daktronics’ shareholders are being asked to vote to approve the Reincorporation Proposal and the Adjournment Proposal. The Reincorporation cannot be completed without the approval of a majority of Daktronics’ shareholders. The approval of the Adjournment Proposal is not a condition to the completion of the Reincorporation.

Please see the sections titled “Proposal No. 1–Reincorporation Proposal” and “Proposal No. 2–Adjournment Proposal” for more information about each of these proposals. |

| |

Q: |

How should I vote on the Proposals? |

| |

A: |

We recommend that you vote “AGAINST” the Reincorporation Proposal and “AGAINST” the Adjournment Proposal on the enclosed BLUE proxy card. You may also vote “AGAINST” the Proposals using the Company’s proxy card. |

| |

Q: |

What vote is required to approve the Proposals? |

| |

A: |

According to the Company Proxy Statement, (a) the Reincorporation Proposal requires the affirmative vote of holders of at least a majority of the voting power of shares present or represented by proxy and entitled to vote at the Special Meeting on the Reincorporation Proposal and (b) the Adjournment Proposal requires the affirmative vote of holders of at least a majority of the voting power of shares present or represented by proxy and entitled to vote at the Special Meeting on the Adjournment Proposal. |

| |

A: |

If you were a holder

of record of Common Stock as of the close of business on the Record Date, you may vote on the applicable proposal by: |

| |

|

●

accessing the Internet website specified on your proxy card;

●

calling the toll-free number specified on your proxy card;

●

signing and returning the enclosed proxy card in the postage-paid envelope provided; or

●

attending the Special Meeting and voting.

If you hold Common Stock in

the name of a broker, bank or other nominee, please follow the voting instructions provided by your broker, bank or other nominee to

ensure that your shares are represented at the Special Meeting. |

| |

Q: |

How important is my vote? |

| |

A: |

Your vote “AGAINST” each of the Reincorporation Proposal and the Adjournment Proposal is very important, and you are encouraged to submit a BLUE proxy card as soon as possible. |

|

|

We

urge you to demonstrate your opposition to the Reincorporation and send a message to the Board that the Reincorporation is not in the

best interests of the Company and its shareholders by signing, dating and returning the enclosed BLUE proxy card

as soon as possible. |

| |

Q: |

What happens if the Reincorporation Proposal does not obtain the vote required for approval? |

| |

A: |

If the Reincorporation Proposal does not obtain the requisite vote required for shareholder approval, Daktronics will continue to be incorporated under the laws of South Dakota and governed by the SDBCA, Charter and Bylaws. Please refer to the information under the heading “Consequences of Defeating the Reincorporation Proposal” for more information. |

| |

Q: |

How can I receive more information? |

| |

A: |

If you have any questions about giving your proxy to cast your vote or about our solicitation, or if you require assistance, please call Okapi toll-free at + 1 (877) 629-6356, (212) 297-0720 or by email at info@okapipartners.com. |

| |

Q: |

Where can I find additional information concerning the Company and the Proposals? |

| |

A: |

Pursuant to Rule 14a-5(c)

promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), we have omitted from this Proxy Statement

certain disclosure required by applicable law to be included in the Company Proxy Statement in connection with the Special Meeting, including:

●

a summary term sheet of the Reincorporation;

●

the terms of the Reincorporation;

●

any reports, opinions and/or appraisals received by the Company in connection with the Reincorporation;

●

past contacts, transactions and negotiations regarding the Reincorporation and the Company’s

respective affiliates and advisors;

|

| |

|

●

U.S. federal and state regulatory requirements that must be complied with and approvals that must

be obtained in connection with the Reincorporation;

●

security ownership of certain beneficial owners and management of the Company, including 5% owners;

●

the trading prices of Common Stock over time;

●

the compensation paid and payable to the Company’s directors and executive officers; and

●

appraisal rights and dissenters’ rights.

We take no responsibility for the

accuracy or completeness of information contained in the Company Proxy Statement. Except as otherwise noted herein, the information in

this Proxy Statement concerning the Company has been taken from or is based upon documents and records on file with the SEC and other

publicly available information. |

|

Q: |

What do I need to do now? |

| |

A: |

Even if you plan to attend the Special Meeting, after carefully reading and considering the information contained in this Proxy Statement, please submit your BLUE proxy card promptly to ensure that your shares of Common Stock are represented at the Special Meeting. If you hold shares of Common Stock in your own name as the holder of record, please submit your proxy for your Common Stock by completing, signing, dating and returning the enclosed BLUE proxy card in the accompanying pre-paid reply envelope. If you decide to attend the Special Meeting in person and vote your shares of Common Stock at the Special Meeting, your vote by ballot at the Special Meeting will revoke any proxy previously submitted. If you are a beneficial owner of Common Stock, please refer to the instructions provided by your bank, brokerage firm or other nominee to see which of the above choices are available to you. |

SOLICITATION OF PROXIES

The solicitation of proxies pursuant

to this Proxy Statement is being made by Alta Fox. Proxies may be solicited by mail, facsimile, telephone, electronic mail, in person

and by advertisements. Solicitations may also be made by certain of the respective directors, officers, members and employees of Alta

Fox, none of whom will, except as described elsewhere in this Proxy Statement, receive additional compensation for such solicitation.

We have retained Okapi

for solicitation and advisory services in connection with solicitations relating to the Special Meeting. Okapi will receive up to $[_____],

applicable toward the final fee to be mutually agreed upon by Alta Fox and Okapi and reimbursement of reasonable out-of-pocket expenses

for its services to Alta Fox in connection with the Solicitation. Arrangements will also be made with custodians, nominees and fiduciaries

for forwarding proxy solicitation materials to beneficial owners of Common Stock held as of the Record Date for the Special Meeting. Alta

Fox will reimburse such custodians, nominees and fiduciaries for reasonable expenses incurred in connection therewith. In addition, directors,

officers, members and certain other employees of Alta Fox and its affiliates may solicit proxies as part of their duties in the normal

course of their employment without any additional compensation. It is anticipated that Okapi will employ approximately [●] persons

to solicit shareholders for the Special Meeting.

Alta Fox will pay all costs

of the Solicitation. Alta Fox Opportunities may seek reimbursement from the Company of all expenses Alta Fox incurs in connection with

the Solicitation but does not intend to submit the question of such reimbursement to a vote of shareholders of the Company. The expenses

incurred by Alta Fox to date in furtherance of, or in connection with, the Solicitation is approximately $[____]. Alta Fox anticipates

that its total expenses will be approximately $[_____]. The actual amount could be higher or lower depending on the facts and circumstances

arising in connection with this solicitation.

ADDITIONAL PARTICIPANT INFORMATION

The participants in the

solicitation are anticipated to be Alta Fox Opportunities, a Delaware limited partnership, Alta Fox GenPar, LP (“Alta Fox GP”),

a Delaware limited partnership, Alta Fox Equity, LLC (“Alta Fox LLC”), a Delaware limited liability company, Alta Fox

Capital Management, LLC (“Alta Fox Capital”), a Texas limited liability company, and P. Connor Haley, a citizen of

the United States of America (each a “Participant” and, collectively, the “Participants”).

The principal business

of Alta Fox Opportunities is investing in securities and engaging in all related activities and transactions. The principal business of

Alta Fox GP is serving as the general partner of Alta Fox Opportunities. The principal business of Alta Fox LLC is serving as the general

partner of Alta Fox GP. The principal business of Alta Fox Capital is serving as the investment manager to, and managing investment and

trading accounts of, Alta Fox Opportunities. The principal occupation of Mr. Haley is serving as the sole owner, member and manager of

each of Alta Fox Capital and Alta Fox LLC.

The address of the principal

office of each of the members of Alta Fox is 640 Taylor Street, Suite 2522, Fort Worth, Texas 76102.

As of the date hereof, Alta Fox

Opportunities directly beneficially owns 5,933,019 shares of Common Stock. Alta Fox Capital, as the investment manager of Alta Fox Opportunities,

may be deemed to beneficially own the 5,933,019 shares of Common Stock beneficially owned by Alta Fox Opportunities. Alta Fox GP, as the

general partner of each of Alta Fox Opportunities, may be deemed to beneficially own the 5,933,019 shares of Common Stock beneficially

owned by Alta Fox Opportunities. Alta Fox LLC, as the general partner of Alta Fox GP, may be deemed to beneficially own the 5,933,019

shares of Common Stock beneficially owned by Alta Fox Opportunities. Mr. Haley, as the sole owner, member and manager of each of Alta

Fox Capital and

Alta Fox LLC, may be deemed to beneficially own the

5,933,019 shares of Common Stock owned beneficially by Alta Fox Opportunities.

For information regarding

purchases and sales of securities of the Company during the past two (2) years by Alta Fox Opportunities, see Schedule I.

The shares of Common Stock owned

directly by Alta Fox Opportunities were purchased with working capital (which may, at any given time, include margin loans made by brokerage

firms in the ordinary course of business).

Except as set forth in this Proxy

Statement (including the Schedules hereto), (i) during the past ten (10) years, no Participant has been convicted in a criminal proceeding

(excluding traffic violations or similar misdemeanors); (ii) no Participant directly or indirectly beneficially owns any securities of

the Company; (iii) no Participant owns any securities of the Company which are owned of record but not beneficially; (iv) no Participant

has purchased or sold any securities of the Company during the past two years; (v) no part of the purchase price or market value of the

securities of the Company owned by any Participant is represented by funds borrowed or otherwise obtained for the purpose of acquiring

or holding such securities; (vi) no Participant is, or within the past year was, a party to any contract, arrangements or understandings

with any person with respect to any securities of the Company, including, but not limited to, joint ventures, loan or option arrangements,

puts or calls, guarantees against loss or guarantees of profit, division of losses or profits, or the giving or withholding of proxies;

(vii) no associate of any Participant owns beneficially, directly or indirectly, any securities of the Company; (viii) no Participant

owns beneficially, directly or indirectly, any securities of any parent or subsidiary of the Company; (ix) no Participant or any of his,

her or its associates was a party to any transaction, or series of similar transactions, since the beginning of the Company’s last

fiscal year, or is a party to any currently proposed transaction, or series of similar transactions, to which the Company or any of its

subsidiaries was or is to be a party, in which the amount involved exceeds $120,000; (x) no Participant or any of his, her or its associates

has any arrangement or understanding with any person with respect to any future employment by the Company or its affiliates, or with respect

to any future transactions to which the Company or any of its affiliates will or may be a party; (xi) no Participant has a substantial

interest, direct or indirect, by securities holdings or otherwise, in any matter to be acted on at the Special Meeting; (xii) no Participant

holds any positions or offices with the Company; (xiii) no Participant has a family relationship with any director, executive officer,

or person nominated or chosen by the Company to become a director or executive officer; and (xiv) no companies or organizations, with

which any of the Participants has been employed in the past five years, is a parent, subsidiary or other affiliate of the Company.

There are no material proceedings

to which any Participant in this solicitation or any of his or its associates is a party adverse to the Company or any of its subsidiaries

or has a material interest adverse to the Company or any of its subsidiaries.

OTHER MATTERS AND ADDITIONAL INFORMATION

Alta Fox is unaware of

any other matters to be considered at the Special Meeting. However, should other matters, which Alta Fox is not aware of at a reasonable

time before this solicitation, be brought before the Special Meeting, the persons named as proxies on the enclosed BLUE proxy card

will vote on such matters in their discretion.

Some banks, brokers and

other nominee record holders may be participating in the practice of “householding” proxy statements and annual reports. This

means that only one copy of this Proxy Statement may have been sent to multiple shareholders in your household. We will promptly deliver

a separate copy of the document to you if you write to our proxy solicitor, Okapi, at the address set forth on the back cover of this

Proxy Statement, or call toll free at (877) 629-6356.

The information concerning

the Company and the proposals in the Company Proxy Statement contained in this Proxy Statement has been taken from, or is based upon,

publicly available documents on file with the SEC and other publicly available information. Although we have no knowledge that would indicate

that statements relating to the Company contained in this Proxy Statement, in reliance upon publicly available information, are inaccurate

or incomplete, to date we have not had access to the books and records of the Company, were not involved in the preparation of such information

and statements and are not in a position to verify such information and statements. All information relating to any person other than

the Participants in this solicitation is given only to our knowledge.

This Proxy Statement is

dated [●]. You should not assume that the information contained in this Proxy Statement is accurate as of any date other than such

date, and the mailing of this Proxy Statement to shareholders shall not create any implication to the contrary.

FUTURE SHAREHOLDER PROPOSALS

Deadline

to Submit Proposals Pursuant to Rule 14a-8 for the 2025 Annual Meeting: According to the Company Proxy Statement, shareholder

proposals pursuant to Rule 14a-8 under the Exchange Act must be received at Daktronics’ principal executive office on or before

April 3, 2025, in order to be eligible to be included in the proxy statement for the 2025 annual meeting of shareholders (the “2025

Annual Meeting”).

Deadline

to Submit Nominations for the 2025 Annual Meeting for Purposes of Rule 14a-19: To

be timely for purposes of Rule 14a-19 of the Exchange Act, shareholders who intend to solicit proxies in support of Board nominees

other than the Company’s nominees must provide notice that sets forth the information required by Rule 14a-19 in addition to

satisfying the requirements of the Bylaws. Notice must be received by Daktronics’ Corporate Secretary at their principal executive

office not later than June 17, 2025 and the notice must otherwise comply with Rule 14a-4(c) under the Exchange Act.

Proposals

will only be acted upon if sent to Daktronics’ Corporate Secretary at 201 Daktronics Drive, Brookings, South Dakota 5700.

The

information set forth above regarding the procedures for submitting shareholder proposals for consideration at the 2025 Annual Meeting

is based on information contained in the Company Proxy Statement and the Bylaws. The incorporation of this information in this Proxy Statement

should not be construed as an admission by Alta Fox that such procedures are legal, valid or binding.

CERTAIN ADDITIONAL INFORMATION

WE HAVE OMITTED FROM THIS

PROXY STATEMENT CERTAIN DISCLOSURE REQUIRED BY APPLICABLE LAW THAT IS EXPECTED TO BE INCLUDED IN THE COMPANY’S PROXY STATEMENT RELATING

TO THE SPECIAL MEETING BASED ON OUR RELIANCE ON RULE 14A-5(C) UNDER THE EXCHANGE ACT. SHAREHOLDERS ARE DIRECTED TO REFER TO THE COMPANY’S

PROXY STATEMENT FOR THE FOREGOING INFORMATION. SHAREHOLDERS CAN ACCESS THE COMPANY’S PROXY STATEMENT AND OTHER RELEVANT DOCUMENTS

DISCLOSING THIS INFORMATION, WITHOUT COST, ON THE SEC’S WEBSITE AT WWW.SEC.GOV.

The information concerning

the Company and the Proposals in the Company Proxy Statement contained in this Proxy Statement has been taken from, or is based upon,

publicly available documents on file with the SEC and other publicly available information. Although we have no knowledge that would indicate

that statements relating to the Company contained in this Proxy Statement, in reliance upon publicly available information, are inaccurate

or incomplete, to date we have not had access to the books and records of the Company, were not involved in the preparation of such information

and statements and are not in a position to verify such information and statements.

ALTA FOX OPPORTUNITIES

FUND, LP

Dated: [●],

2025

SCHEDULE I

TRANSACTIONS IN SECURITIES OF THE COMPANY

DURING THE PAST TWO YEARS

| Nature of Transaction |

Amount of Securities

Purchased/(Sold) |

Date of

Transaction |

ALTA FOX OPPORTUNITIES FUND,

LP

| Sale of Common Stock |

(4,714) |

03/06/2023 |

| Sale of Common Stock |

(67,389) |

03/07/2023 |

| Purchase of Common Stock |

49,500 |

03/14/2023 |

| Purchase of Common Stock |

52,973 |

03/15/2023 |

| Sale of Common Stock |

(3,416) |

06/01/2023 |

| Sale of Common Stock |

(5,386) |

06/02/2023 |

| Sale of Common Stock |

(174,909) |

06/05/2023 |

| Sale of Common Stock |

(215,889) |

06/06/2023 |

| Sale of Common Stock |

(282,800) |

06/07/2023 |

| Sale of Common Stock |

(15,800) |

06/09/2023 |

| Purchase of Common Stock |

9,521 |

07/13/2023 |

| Purchase of Common Stock |

140,479 |

07/14/2023 |

| Sale of Common Stock |

(39,000) |

08/24/2023 |

| Sale of Common Stock |

(50,000) |

08/24/2023 |

| Sale of Common Stock |

(100,000) |

08/25/2023 |

| Sale of Common Stock |

(20,000) |

08/29/2023 |

| Sale of Common Stock |

(18,726) |

08/30/2023 |

| Sale of Common Stock |

(3,300) |

08/31/2023 |

| Sale of Common Stock |

(96,500) |

09/06/2023 |

| Sale of Common Stock |

(93,502) |

09/11/2023 |

| Sale of Common Stock |

(91,498) |

09/12/2023 |

| Sale of Common Stock |

(400) |

09/13/2023 |

| Sale of Common Stock |

(300) |

09/14/2023 |

| Sale of Common Stock |

(9,700) |

10/10/2023 |

| Sale of Common Stock |

(4,600) |

10/11/2023 |

| Sale of Common Stock |

(48,900) |

11/15/2023 |

| Sale of Common Stock |

(51,100) |

11/17/2023 |

| Sale of Common Stock |

(67,514) |

11/20/2023 |

| Sale of Common Stock |

(32,486) |

11/21/2023 |

| Sale of Common Stock |

(383,536) |

06/26/2024 |

| Sale of Common Stock |

(336,464) |

06/27/2024 |

| Purchase of Common Stock |

292,468 |

10/10/2024 |

| Purchase of Common Stock |

46,812 |

10/11/2024 |

| Purchase of Common Stock |

181,203 |

10/14/2024 |

| Purchase of Common Stock |

80,021 |

10/15/2024 |

| Purchase of Common Stock |

58,530 |

10/16/2024 |

| Purchase of Common Stock |

54,296 |

10/17/2024 |

| Purchase of Common Stock |

108,591 |

10/18/2024 |

| Purchase of Common Stock |

79,816 |

10/21/2024 |

| Purchase of Common Stock |

272,563 |

10/22/2024 |

| Purchase of Common Stock |

42,129 |

11/22/2024 |

IMPORTANT

Tell the Board what you

think! Your vote is important. No matter how many shares of Common Stock you own, please give Alta Fox your proxy “AGAINST”

the Reincorporation in accordance with Alta Fox’s recommendations on the other proposals on the agenda at the Special Meeting by

taking these three steps:

| ● | SIGNING the enclosed BLUE proxy card; |

| ● | DATING the enclosed BLUE proxy card; and |

| ● | MAILING the enclosed BLUE proxy card TODAY in the envelope provided (no postage is required if

mailed in the United States). |

If

any of your shares of Common Stock are held in the name of a brokerage firm, bank, bank nominee or other institution, only it can vote

such shares of Common Stock and only upon receipt of your specific instructions. Depending upon your broker or custodian, you may be able

to vote either by toll-free telephone or by the Internet. Please refer to the enclosed voting form for instructions on how to vote electronically.

You may also vote by signing, dating and returning the enclosed BLUE voting form.

If you have any questions

or require any additional information concerning this Proxy Statement, please contact Okapi at the address set forth below.

|

If you have any questions, require

assistance in voting your BLUE proxy card, or need additional copies of Alta Fox’s proxy materials, please contact Okapi

Partners at the phone numbers or email address listed below:

Okapi Partners LLC

1212 Avenue of the Americas, 24th Floor

New York, New York 10036

Shareholders may call toll-free: (877) 629-6356

Banks and brokers call: (212) 297-0720

E-mail: info@okapipartners.com |

BLUE PROXY CARD

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED [●], 2025

DAKTRONICS, INC.

SPECIAL MEETING OF SHAREHOLDERS

THIS PROXY IS SOLICITED ON BEHALF OF ALTA FOX OPPORTUNITIES FUND, LP AND THE OTHER PARTICIPANTS IN ITS PROXY SOLICITATION

DAKTRONICS, INC.

IS NOT SOLICITING THIS PROXY

P R O X Y

The

undersigned appoints Connor Haley, Sebastian Alsheimer, Bruce Goldfarb and Charles Garkse and each of them, as attorneys and

agents with full power of substitution to vote all shares of common stock “Common Stock”) of Daktronics, Inc., a South

Dakota corporation (the “Company”) which the undersigned would be entitled to vote if personally present at the Special

Meeting of the Company scheduled to be held at Daktronics, Inc., 201 Daktronics Drive, Brookings, South Dakota 57006 on _________, 2025

at 4:30 p.m., Central Daylight Time (including any adjournments or postponements thereof and any meeting called in lieu thereof, the

“Special Meeting Meeting”).

The undersigned hereby

revokes any other proxy or proxies heretofore given to vote or act with respect to the Common Stock held by the undersigned, and hereby

ratifies and confirms all action the herein named attorneys and proxies, their substitutes, or any of them may lawfully take by virtue

hereof. If properly executed, this Proxy will be voted as directed on the reverse and in the discretion of the herein named attorneys

and proxies or their substitutes with respect to any other matters as may properly come before the Special Meeting that are unknown to

Alta Fox Opportunities Fund, LP and the other participants in this solicitation (collectively, “Alta Fox”) a reasonable

time before this solicitation.

THIS PROXY WILL BE VOTED

AS DIRECTED. IF NO DIRECTION IS INDICATED WITH RESPECT TO THE PROPOSALS ON THE REVERSE, THIS PROXY WILL BE VOTED “AGAINST”

PROPOSAL 1 AND “AGAINST” PROPOSAL 2.

This Proxy will be valid

until the completion of the Special Meeting. This Proxy will only be valid in connection with Alta Fox’s solicitation of proxies

for the Special Meeting.

This

Proxy Statement and our BLUE proxy card are available at:

FixDaktronics.com

IMPORTANT: PLEASE SIGN, DATE AND MAIL THIS

PROXY CARD PROMPTLY!

CONTINUED AND TO BE SIGNED ON REVERSE SIDE

BLUE

PROXY CARD

[X] Please mark vote as

in this example

ALTA FOX STRONGLY RECOMMENDS

THAT SHAREHOLDERS VOTE “AGAINST” PROPOSAL 1 AND “AGAINST” PROPOSAL 2.

| 1. | The Company’s proposal to approve the reincorporation of the Company from the State of South Dakota

to the State of Delaware pursuant to a plan of conversion (the “Reincorporation Proposal”). |

| ☐

FOR |

☐

AGAINST |

☐

ABSTAIN |

| 2. | The Company’s proposal to approve an adjournment of the meeting, if necessary, to solicit additional

proxies if there are not sufficient votes of the Reincorporation Proposal. |

| ☐

FOR |

☐

AGAINST |

☐

ABSTAIN |

| |

|

| DATED: |

|

|

| |

|

| |

| (Signature) |

|

| |

|

| |

| (Signature, if held jointly) |

|

| |

|

| |

| (Title) |

|

WHEN SHARES ARE HELD JOINTLY,

JOINT OWNERS SHOULD EACH SIGN. EXECUTORS, ADMINISTRATORS, TRUSTEES, ETC., SHOULD INDICATE THE CAPACITY IN WHICH THEY ARE SIGNING. PLEASE

SIGN EXACTLY AS NAME APPEARS ON THIS PROXY.

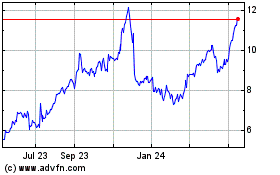

Daktronics (NASDAQ:DAKT)

Historical Stock Chart

From Feb 2025 to Mar 2025

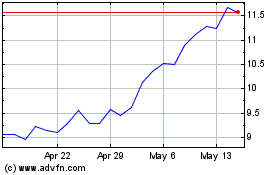

Daktronics (NASDAQ:DAKT)

Historical Stock Chart

From Mar 2024 to Mar 2025