DoubleDown Interactive Co., Ltd. (NASDAQ: DDI) (“DoubleDown” or the

“Company”), a leading developer and publisher of digital games on

mobile and web-based platforms, today announced its unaudited

financial results for the fourth quarter and year ended December

31, 2023. The Company’s consolidated financial results for the

three- and twelve-month periods ended December 31, 2023 include 61

days of contributions from European iGaming operator, SuprNation,

which was acquired by the Company on October 31, 2023.

Fourth Quarter 2023 vs. Fourth Quarter

2022 Summary:

- Revenue was

$83.1 million in the fourth quarter of 2023 compared to $76.2

million in the fourth quarter of 2022. Revenue contributed by

SuprNation totaled $4.3 million for the 61 days the Company owned

and operated the business. Revenue exclusive of the contributions

from SuprNation increased 3% year over year to $78.8 million.

- Operating

expenses declined to $47.5 million in the fourth quarter of 2023

from $321.4 million in the fourth quarter of 2022, primarily

reflecting the one-time, non-cash goodwill and intangibles

impairment of $269.9 million incurred in the fourth quarter of

2022.

- Adjusted EBITDA

was $36.2 million for the fourth quarter of 2023, an increase from

$24.7 million for the fourth quarter of 2022, primarily due to

higher revenue and lower cost of revenues and sales and marketing

expenses, partially offset by higher general and administrative

expenses. Adjusted EBITDA margin increased to 43.5% in the fourth

quarter of 2023 from 32.4% in the fourth quarter of 2022.

- Net income was

$25.5 million, or earnings per fully diluted common share of $10.27

($0.51 per American Depositary Share (“ADS”)), in the fourth

quarter of 2023, compared to a loss of $(194.4) million, or a loss

of $(78.47) per fully diluted common share ($(3.92) per ADS), in

the fourth quarter of 2022. Note each ADS represents 0.05 share of

a common share.

- Average Revenue

Per Daily Active User (“ARPDAU”) for the Company’s social

casino/free-to-play games increased to $1.24 in the fourth quarter

of 2023 from $0.98 in the fourth quarter of 2022 and $1.06 in the

third quarter of 2023.

- Average monthly

revenue per payer for the social casino/free-to-play games

increased to $279 in the fourth quarter of 2023 from $227 in the

fourth quarter of 2022 and $245 in the third quarter of 2023.

“Our fourth quarter results, which include a 3%

year-over-year increase in core social casino revenue to $78.8

million and a 46% increase in Adjusted EBITDA to $36.2 million,

highlight our best-in-class ability to monetize our loyal players

combined with our disciplined approach to user acquisition and

R&D spend which drives consistent profitability and strong free

cash flow,” said In Keuk Kim, Chief Executive Officer of

DoubleDown. “We continue to deliver strong engagement metrics for

our flagship social casino game DoubleDown Casino, as ARPDAU and

average monthly revenue per payer rose 26% and 23%, respectively,

compared to the 2022 fourth quarter. As a result, cash flows from

operating activities were approximately $30 million in the fourth

quarter.

“Our acquisition of SuprNation in the fourth

quarter marked our entrance into the European iGaming market and we

are moving quickly on a range of initiatives to scale the business

which will be our initial focus before we turn to optimizing the

cash flow generated by this business. These initiatives include

increasing marketing investment and leveraging our legacy of

marketing and product expertise to grow SuprNation’s market share

in its core U.K. and Sweden markets.

“We place a primary focus on being capital

efficient as reflected in our strong Adjusted EBITDA margins and

free cash flow generation. At 2023 year-end, cash and cash

equivalents and short-term investments net of current borrowing

were approximately $235 million, which is equivalent to

approximately $4.75 per ADS. Our strong net cash position and

consistent ability to generate attractive free cash flow provides

the Company with significant flexibility to evaluate further

opportunities to deploy capital that would continue to expand our

business in gaming categories with attractive addressable markets

and where our operating discipline would ultimately deliver

additional free cash flow and create new value for our

shareholders.”

Full Year 2023 vs. Full Year 2022

Summary:

- Revenue,

inclusive of the 61-day contributions from SuprNation noted above,

decreased from $321.0 million for the year ended December 31, 2022

to $308.9 million for the year ended December 31, 2023. Revenue

exclusive of the contributions from SuprNation, declined to $304.6

million.

- Operating

expenses decreased from $634.9 million in the year ended December

31, 2022 to $190.7 million in the year ended December 31, 2023.

Full year 2022 operating expenses include a $141.8 million charge

related to the settlement of the Benson class action and associated

proceedings and the $269.9 million goodwill and intangibles

impairment charge noted above. Both of these charges were one-time

in nature and not recurring. Additionally, lower cost of revenues

and sales and marketing expenses, partially offset by higher

general and administrative expenses, contributed to the decrease in

operating expenses.

- Adjusted EBITDA

for the year ended December 31, 2023 increased to $118.9 million

from $101.6 million for the year ended December 31, 2022, resulting

in an Adjusted EBITDA margin of 38.5% in 2023, compared to an

Adjusted EBITDA margin of 31.6% in 2022. The increases in Adjusted

EBITDA and Adjusted EBITDA margin in 2023 were primarily due to

lower cost of revenues and sales and marketing expenses, partially

offset by higher general and administrative expenses.

- The Company

recorded net income of $100.4 million for the year ended December

31, 2023, or $40.53 per common share on a fully diluted basis

($2.03 per ADS), compared to a net loss of $(234.0) million for the

year ended December 31, 2022, or a loss of $(94.43) per common

share on a fully diluted basis (loss of $(4.72) per ADS) inclusive

of the Benson class action settlement and goodwill and intangibles

impairment charges noted above.

- ARPDAU for the

Company’s social casino/free-to-play games increased to $1.09 for

the year ended December 31, 2023 from $0.97 for the year ended

December 31, 2022.

- Average monthly

revenue per payer for the social casino/free-to-play games

increased to $245 for the year ended December 31, 2023 from $226

for the year ended December 31, 2022.

Summary Operating Results for DoubleDown Interactive

(Unaudited)

| |

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Revenue ($ MM) |

$83.1 |

|

|

$76.2 |

|

|

$308.9 |

|

|

$321.0 |

|

| Total operating expenses |

|

47.5 |

|

|

|

51.5 |

|

|

|

190.7 |

|

|

|

223.3 |

|

| Loss contingency |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

141.8 |

|

| Impairment of goodwill and

intangibles |

|

- |

|

|

|

269.9 |

|

|

|

- |

|

|

|

269.9 |

|

| Adjusted EBITDA ($ MM) |

|

36.2 |

|

|

|

24.7 |

|

|

|

118.9 |

|

|

|

101.6 |

|

| Net income ($ MM) |

$25.5 |

|

|

$(194.4) |

|

|

$100.4 |

|

|

$(234.0) |

|

| Net income margin |

|

30.6% |

|

|

|

(255.2)% |

|

|

|

32.5% |

|

|

|

(72.9)% |

|

| Adjusted EBITDA margin |

|

43.5% |

|

|

|

32.4% |

|

|

|

38.5% |

|

|

|

31.6% |

|

|

|

|

|

|

|

|

|

|

| Non-financial performance

metrics(1) |

|

|

|

|

|

|

|

| Average MAUs (000s) |

|

1,488 |

|

|

|

2,084 |

|

|

|

1,750 |

|

|

|

2,247 |

|

| Average DAUs (000s) |

|

703 |

|

|

|

855 |

|

|

|

772 |

|

|

|

919 |

|

| ARPDAU |

$1.24 |

|

|

$0.98 |

|

|

$1.09 |

|

|

$0.97 |

|

| Average monthly revenue per

payer |

$279 |

|

|

$227 |

|

|

$245 |

|

|

$226 |

|

| Payer conversion |

|

6.4% |

|

|

|

5.4% |

|

|

|

6.0% |

|

|

|

5.3% |

|

(1) Social casino/free-to-play games

only

Fourth Quarter 2023 Financial Results

Revenue inclusive of the contributions from

SuprNation in the fourth quarter of 2023 was $83.1 million, an

increase of 9% from the fourth quarter of 2022. Revenue exclusive

of the contributions from SuprNation increased 3% year over year to

$78.8 million. The increase was primarily driven by increased

engagement of the existing player base.

Operating expenses in the fourth quarter of 2023

were $47.5 million, an 85% decrease from the fourth quarter of

2022. The decrease in operating expenses was primarily due to lower

cost of revenue and decreases in marketing expenses in the fourth

quarter of 2023, as compared to the fourth quarter of 2022, and

reflects the $269.9 million non-cash goodwill and intangibles

impairment in the fourth quarter of 2022 noted above which did not

recur in the comparable 2023 period.

The Company recorded net income of $25.5 million

in the fourth quarter of 2023, or $10.27 per fully diluted common

share ($0.51 per ADS), as compared to a net loss of $(194.4)

million, or a loss of $(78.47) per fully diluted common share (loss

of $(3.92) per ADS) in the fourth quarter of 2022. The net loss in

the fourth quarter of 2022 included the impact of the $269.9

million non-cash impairment noted above. Net income for the fourth

quarter of 2023 reflects increased revenue and lower marketing

expenditures. Note each ADS represents 0.05 share of a common

share.

Adjusted EBITDA in the fourth quarter of 2023

was $36.2 million, an increase from $24.7 million in the fourth

quarter of 2022. The increase was primarily due to increased

revenue and lower marketing expenditures.

Net cash flows provided by operating activities

for the fourth quarter of 2023 was $29.7 million, compared to net

cash flows used in operating activities of $20.9 million in the

fourth quarter of 2022. The increase was primarily due to the

payment of $50 million toward the Benson litigation settlement in

the fourth quarter of 2022.

Full Year 2023 Financial

Results

Revenue for the year ended December 31, 2023 was

$308.9 million, down 4% from the prior year. Excluding revenue from

the 61-days of operations of SuprNation, revenue would have

declined 5% year-over-year to $304.6 million, primarily due to the

normalization of player activities after the lifting of

stay-at-home orders and other COVID-related restrictions, as well

as changes in player behaviors relating to inflation and global

economic concerns during 2023.

Operating expenses for the year ended December

31, 2023 were $190.7 million, a decrease of 70% from the prior

year. The decrease was primarily due to a charge of $141.8 million

reflecting the incremental charge associated with the agreement in

principle to settle the Benson class action and associated

proceedings and the $269.9 million impairment of goodwill and

intangibles in 2022. Both charges were one-time charges and not

re-occurring in nature.

Net income was $100.4 million, or $40.53 per

common share on a fully diluted basis ($2.03 per ADS), compared to

a net loss of $(234.0) million for 2022, or a loss of $(94.43) per

common share on a fully diluted basis (loss of $(4.72) per

ADS).

Adjusted EBITDA for 2023 increased to $118.9

million compared to $101.6 million for 2022, primarily due to lower

sales and marketing expenditures in 2023.

Net cash flows provided by operating activities

for the year ended December 31, 2023, were $20.8 million compared

to $50.8 million in the year ended December 31, 2022. The decrease

was primarily due to the payment of $95.3 million toward the Benson

litigation settlement in the second quarter of 2023. Excluding this

payment, net cash flows provided by operating activities were

$116.1 million for the year ended December 31, 2023.

Conference Call

DoubleDown will hold a conference call today

(February 13, 2024) at 5:00 p.m. Eastern Time (2:00 p.m. Pacific

Time) to discuss these results. A question-and-answer session will

follow management's presentation.

To access the call, please use the following

link: DoubleDown Fourth Quarter and Full Year 2023 Earnings Call.

After registering, an email will be sent, including dial-in details

and a unique conference call access code required to join the live

call. To ensure you are connected prior to the beginning of the

call, please register a minimum of 15 minutes before the start of

the call.

A simultaneous webcast of the conference call

will be available with the following link: DoubleDown Fourth

Quarter and Full Year 2023 Earnings Webcast, or via the Investor

Relations page of the DoubleDown website at

ir.doubledowninteractive.com. For those not planning to ask a

question on the conference call, the Company recommends listening

via the webcast.

A replay will be available on the Company's Investor Relations

website shortly after the event.

About DoubleDown Interactive

DoubleDown Interactive Co., Ltd. is a leading developer and

publisher of digital games on mobile and web-based platforms. We

are the creators of multi-format interactive entertainment

experiences for casual players, bringing authentic Vegas

entertainment to players around the world through an online social

casino experience. The Company’s flagship social casino title,

DoubleDown Casino, has been a fan-favorite game on leading social

and mobile platforms for years, entertaining millions of players

worldwide with a lineup of classic and modern games. Following its

acquisition of SuprNation in October 2023, the Company also

operates three real-money iGaming sites in Western Europe.

Safe Harbor Statement

Certain statements contained in this press

release are “forward-looking statements” about future events and

expectations for purposes of the safe harbor provisions under the

United States Private Securities Litigation Reform Act of 1995.

Forward-looking statements are based on our beliefs, assumptions,

and expectations of industry trends, our future financial and

operating performance, and our growth plans, taking into account

the information currently available to us. These statements are not

statements of historical fact. We have based these forward-looking

statements on our current expectations and assumptions about future

events. While our management considers these expectations and

assumptions to be reasonable, they are inherently subject to

significant business, economic, competitive, regulatory and other

risks, contingencies and uncertainties, most of which are difficult

to predict and many of which are beyond our control. Therefore, you

should not place undue reliance on such statements. Words such as

“anticipates,” believes,” “continues,” “estimates,” “expects,”

“goal,” “objectives,” “intends,” “may,” “opportunity,” “plans,”

potential,” “near-term,” long-term,” “projections,” “assumptions,”

“projects,” “guidance,” “forecasts,” “outlook,” “target,” “trends,”

“should,” “could,” “would,” “will,” and similar expressions are

intended to identify such forward-looking statements. We qualify

any forward-looking statements entirely by these cautionary

factors. We assume no obligation to update or revise any

forward-looking statements for any reason or to update the reasons

actual results could differ materially from those anticipated in

these forward-looking statements, even if new information becomes

available in the future.

Use and Reconciliation of Non-GAAP

Financial Measures

In addition to our results determined in

accordance with the accounting principles generally accepted in the

United States of America (“GAAP”), we believe the following

non-GAAP financial measure is useful in evaluating our operating

performance. We present “adjusted earnings before interest, taxes,

depreciation and amortization” (“Adjusted EBITDA”) because we

believe it assists investors and analysts by facilitating

comparison of period-to-period operational performance on a

consistent basis by excluding items that we do not believe are

indicative of our core operating performance. The items excluded

from the Adjusted EBITDA may have a material impact on our

financial results. Certain of those items are non-recurring, while

others are non-cash in nature. Accordingly, the Adjusted EBITDA is

presented as supplemental disclosure and should not be considered

in isolation of, as a substitute for, or superior to, the financial

information prepared in accordance with GAAP, and should be read in

conjunction with the financial statements furnished in our report

on Form 6-K filed with the SEC.

In our reconciliation from our reported GAAP

“net income before provision for taxes” to our Adjusted EBITDA, we

eliminate the impact of the following eight line items: (i)

depreciation and amortization; (ii) loss contingency related to the

Benson case; (iii) impairment of goodwill and intangibles; (iv)

interest income; (v) interest expense; (vi) foreign currency

transaction/remeasurement (gain) loss; (vii) short-term investments

(gain) loss; and (viii) other (income) expense, net. The below

table sets forth the full reconciliation of our non-GAAP

measures:

| Reconciliation of

non-GAAP measures |

Three Months EndedDecember

31, |

|

Twelve Months EndedDecember

31, |

|

(in millions, except percentages) |

|

2023 |

|

|

2022 |

|

|

|

2023 |

|

|

2022 |

|

| Net income (loss) attributable

to DoubleDown Interactive Co., Ltd. |

$25.5 |

|

$(194.4) |

|

|

$100.4 |

|

$(234.0) |

|

| Income tax (expense)

benefit |

|

(8.6) |

|

|

60.3 |

|

|

|

(30.7) |

|

|

71.2 |

|

| Income (loss) before tax |

|

34.1 |

|

|

(254.7) |

|

|

|

131.1 |

|

|

(305.2) |

|

|

|

|

|

|

|

|

| Adjustments for: |

|

|

|

|

|

|

Depreciation and amortization |

|

0.6 |

|

|

0.1 |

|

|

|

0.7 |

|

|

3.8 |

|

|

Loss contingency |

|

- |

|

|

- |

|

|

|

- |

|

|

141.8 |

|

|

Impairment of goodwill and intangibles |

|

- |

|

|

269.9 |

|

|

|

- |

|

|

269.9 |

|

|

Interest income |

|

(3.2) |

|

|

(2.3) |

|

|

|

(13.7) |

|

|

(5.0) |

|

|

Interest expense |

|

0.5 |

|

|

0.5 |

|

|

|

1.8 |

|

|

1.8 |

|

|

Foreign currency transaction/remeasurement (gain) loss |

|

4.2 |

|

|

11.2 |

|

|

|

(1.2) |

|

|

(5.8) |

|

|

Short-term investments (gain) loss |

|

0.0 |

|

|

(0.0) |

|

|

|

0.1 |

|

|

0.2 |

|

|

Other (income) expense, net |

|

0.0 |

|

|

0.0 |

|

|

|

0.0 |

|

|

0.1 |

|

| Adjusted EBITDA |

$36.2 |

|

$24.7 |

|

|

$118.9 |

|

$101.6 |

|

|

Adjusted EBITDA margin |

|

43.5% |

|

|

32.4% |

|

|

|

38.5% |

|

|

31.6% |

|

We encourage investors and others to review our

financial information in its entirety and not to rely on any single

financial measure.

Company Contact:Joe Sigristir@doubledown.com+1

(206) 773-2266Chief Financial

Officerhttps://www.doubledowninteractive.com

Investor Relations Contact:Joseph Jaffoni or

Richard LandJCIR+1 (212) 835-8500DDI@jcir.com

|

DoubleDown Interactive Co., Ltd.Condensed

Consolidated Balance Sheets(In thousands of U.S. dollars,

except share and per share amounts) |

|

|

| |

Years ended December 31, |

|

|

|

2023 |

|

2022 |

| Assets |

(unaudited) |

|

|

Current assets: |

|

|

|

Cash and cash equivalents |

$206,911 |

$217,352 |

|

Short-term investments |

|

67,756 |

|

67,891 |

|

Accounts receivable, net |

|

32,517 |

|

21,198 |

|

Prepaid expenses, and other assets |

|

8,570 |

|

6,441 |

| Total current assets |

$315,754 |

$312,882 |

|

Property and equipment, net |

|

444 |

|

436 |

|

Operating lease right-of-use assets, net |

|

6,785 |

|

3,858 |

|

Intangible assets, net |

|

51,571 |

|

35,051 |

|

Goodwill |

|

396,596 |

|

379,072 |

|

Deferred tax asset |

|

27,611 |

|

59,290 |

|

Other non-current assets |

|

2,807 |

|

1,463 |

| Total assets |

$801,568 |

$792,052 |

|

|

|

|

| Liabilities and Shareholders’

Equity |

|

|

|

Accounts payable and accrued expenses |

$13,293 |

$13,830 |

|

Short-term operating lease liabilities |

|

3,157 |

|

3,050 |

|

Income taxes payable |

|

112 |

|

- |

|

Contract liabilities |

|

2,520 |

|

2,426 |

|

Loss contingency |

|

- |

|

95,250 |

|

Current portion of borrowing with related party |

|

38,778 |

|

- |

|

Other current liabilities |

|

1,144 |

|

1,926 |

| Total current liabilities |

$59,004 |

$116,482 |

|

Long-term borrowings with related party |

|

- |

|

39,454 |

|

Long-term operating lease liabilities |

|

4,420 |

|

1,625 |

|

Other non-current liabilities |

|

10,837 |

|

8,265 |

|

Total liabilities |

$74,261 |

$165,826 |

| Shareholders’ equity |

|

|

|

Common stock, KRW 10,000 par value - 200,000,000 Shares

authorized; |

|

|

|

2,477,672 issued and outstanding |

|

21,198 |

|

21,198 |

|

Additional paid-in-capital |

|

359,280 |

|

359,280 |

|

Accumulated other comprehensive income |

|

19,986 |

|

19,360 |

|

Retained earnings |

|

326,800 |

|

226,388 |

| Total shareholders’ equity

attributable to shareowners of DDI Co. Ltd. |

$727,264 |

$626,226 |

|

Equity attributable to noncontrolling interests |

|

43 |

|

- |

| Total equity |

$727,307 |

$626,226 |

| Total liabilities and

shareholders’ equity |

$801,568 |

$792,052 |

|

DoubleDown Interactive Co., Ltd.Condensed

Consolidated Statement of Income and Comprehensive

Income(Unaudited, in thousands except share and per share

amounts) |

|

|

| |

Three months ended December 31, |

|

Twelve Months ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

|

2023 |

|

|

2022 |

|

| Revenue |

$83,098 |

|

$76,170 |

|

|

$308,864 |

|

$321,027 |

|

| Operating expenses: |

|

|

|

|

|

|

Cost of revenue(1) |

|

24,787 |

|

|

25,841 |

|

|

|

99,069 |

|

|

109,305 |

|

|

Sales and marketing(1) |

|

9,912 |

|

|

16,855 |

|

|

|

49,645 |

|

|

71,911 |

|

|

Research and development(1) |

|

4,658 |

|

|

4,478 |

|

|

|

19,131 |

|

|

18,182 |

|

|

General and administrative(1) |

|

7,573 |

|

|

4,287 |

|

|

|

22,100 |

|

|

20,058 |

|

|

Loss contingency(1) |

|

- |

|

|

- |

|

|

|

- |

|

|

141,750 |

|

|

Impairment of goodwill and intangibles(1) |

|

- |

|

|

269,893 |

|

|

|

- |

|

|

269,893 |

|

|

Depreciation and amortization |

|

571 |

|

|

50 |

|

|

|

728 |

|

|

3,801 |

|

| Total operating expenses |

|

47,501 |

|

|

321,404 |

|

|

|

190,673 |

|

|

634,900 |

|

| Operating income (loss) |

$35,597 |

|

$(245,234) |

|

|

$118,191 |

|

$(313,873) |

|

| Other income (expense): |

|

|

|

|

|

|

Interest expense |

|

(457) |

|

|

(476) |

|

|

|

(1,798) |

|

|

(1,831) |

|

|

Interest income |

|

3,166 |

|

|

2,251 |

|

|

|

13,677 |

|

|

4,993 |

|

|

Gain on foreign currency transactions |

|

889 |

|

|

6,138 |

|

|

|

4,796 |

|

|

6,994 |

|

|

Gain (loss) on foreign currency remeasurement, net |

|

(5,089) |

|

|

(17,341) |

|

|

|

(3,606) |

|

|

(1,179) |

|

|

Gain (loss) on short-term investments |

|

(6) |

|

|

3 |

|

|

|

(82) |

|

|

(152) |

|

|

Other, net |

|

(30) |

|

|

(22) |

|

|

|

(33) |

|

|

(120) |

|

| Total other income (expense),

net |

$(1,527) |

|

$(9,447) |

|

|

$12,954 |

|

$8,705 |

|

| Income (loss) before income

tax |

$34,070 |

|

$(254,681) |

|

|

$131,145 |

|

$(305,168) |

|

|

Income tax (expense) benefit |

|

(8,574) |

|

|

60,264 |

|

|

|

(30,690) |

|

|

71,190 |

|

| Net income (loss) |

$25,496 |

|

$(194,417) |

|

|

$100,455 |

|

$(233,978) |

|

|

Less: Net income attributable to noncontrolling interests |

|

43 |

|

|

- |

|

|

|

43 |

|

|

- |

|

| Net income (loss) attributable

to DoubleDown Interactive Co., Ltd. |

$25,453 |

|

$(194,417) |

|

|

$100,412 |

|

$(233,978) |

|

| Other comprehensive income

(expense): |

|

|

|

|

|

|

Pension adjustments, net of tax |

|

(441) |

|

|

32 |

|

|

|

(597) |

|

|

(154) |

|

|

Gain (loss) on foreign currency translation |

|

4,392 |

|

|

7,567 |

|

|

|

1,223 |

|

|

(3,519) |

|

| Comprehensive income

(loss) |

$29,404 |

|

$(186,818) |

|

|

$101,038 |

|

$(237,651) |

|

|

|

|

|

|

|

|

| Earnings per share: |

|

|

|

|

|

| Basic |

$10.27 |

|

$(78.47) |

|

|

$40.53 |

|

$(94.43) |

|

| Diluted |

$10.27 |

|

$(78.47) |

|

|

$40.53 |

|

$(94.43) |

|

| Weighted average shares

outstanding: |

|

|

|

|

|

| Basic |

|

2,477,672 |

|

|

2,477,672 |

|

|

|

2,477,672 |

|

|

2,477,672 |

|

| Diluted |

|

2,477,672 |

|

|

2,477,672 |

|

|

|

2,477,672 |

|

|

2,477,672 |

|

| (1) Excluding depreciation and

amortization |

|

|

|

|

|

|

DoubleDown Interactive Co., Ltd.Condensed

Consolidated Statement of Cash Flows(Unaudited, in

thousands of U.S. dollars) |

|

|

| |

Years ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

| Cash flow from (used in)

operating activities: |

|

|

| Net Income (loss) |

$100,455 |

|

$(233,978) |

|

| Adjustments to reconcile net

income to net cash from operating activities: |

|

|

|

Depreciation and amortization |

|

728 |

|

|

3,801 |

|

|

Impairment of goodwill and intangibles |

|

- |

|

|

269,893 |

|

|

Loss on foreign currency remeasurement |

|

3,605 |

|

|

1,179 |

|

|

Loss on short-term investments |

|

82 |

|

|

152 |

|

|

(Gain) on disposition of property and equipment |

|

(2) |

|

|

- |

|

|

Deferred taxes |

|

30,051 |

|

|

(84,983) |

|

| Working capital

adjustments: |

|

|

|

Accounts receivable |

|

(11,398) |

|

|

(46) |

|

|

Prepaid expenses, other current and non-current assets |

|

(3,113) |

|

|

(142) |

|

|

Accounts payable, accrued expenses and other payables |

|

(1,946) |

|

|

(239) |

|

|

Contract liabilities |

|

94 |

|

|

180 |

|

|

Income tax payable |

|

(35) |

|

|

- |

|

|

Loss contingency |

|

(95,250) |

|

|

91,750 |

|

|

Other current and non-current liabilities |

|

(2,423) |

|

|

3,224 |

|

| Net cash flows from operating

activities |

$20,848 |

|

$50,791 |

|

| Cash flow (used in) investing

activities: |

|

|

|

Acquisition, net of cash acquired, and other |

|

(26,877) |

|

|

- |

|

|

Purchases of intangible assets |

|

- |

|

|

(4) |

|

|

Purchases of property and equipment |

|

(198) |

|

|

(269) |

|

|

Disposals of property and equipment |

|

5 |

|

|

26 |

|

|

Purchases of short-term investments |

|

(146,363) |

|

|

(518,629) |

|

|

Sales of short-term investments |

|

143,164 |

|

|

451,046 |

|

| Net cash flows (used in)

investing activities |

$(30,269) |

|

$(67,830) |

|

| Cash flow from (used in)

financing activities: |

|

|

| Net cash flows from (used in)

financing activities: |

|

- |

|

|

- |

|

| Net foreign exchange

difference on cash and cash equivalents |

|

(1,020) |

|

|

(7,669) |

|

| Net (decrease) in cash and

cash equivalents |

$(10,441) |

|

$(24,708) |

|

| Cash and cash equivalents at

beginning of period |

$217,352 |

|

$242,060 |

|

| Cash and cash equivalents at

end of period |

$206,911 |

|

$217,352 |

|

| Supplemental disclosures of

cash flow information |

|

|

| Cash paid during year

for: |

|

|

| Interest |

$130 |

|

|

$- |

|

| Income taxes |

$526 |

|

$15,985 |

|

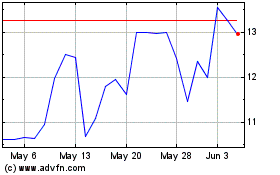

DoubleDown Interactive (NASDAQ:DDI)

Historical Stock Chart

From Dec 2024 to Jan 2025

DoubleDown Interactive (NASDAQ:DDI)

Historical Stock Chart

From Jan 2024 to Jan 2025