false

0001415404

0001001082

false

8-K

2024-01-12

false

false

false

false

false

0001042642

false

8-K

2024-01-12

false

false

false

false

false

0001415404

2024-01-12

2024-01-12

0001415404

SATS:DISHNETWORKCORPORATIONMember

2024-01-12

2024-01-12

0001415404

SATS:DISHDBSCORPORATIONMember

2024-01-12

2024-01-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 16, 2024 (January 12, 2024)

ECHOSTAR CORPORATION

(Exact name of registrant as specified in its charter)

001-33807

(Commission File Number)

| Nevada |

26-1232727 |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| 100 Inverness Terrace East |

|

| Englewood, Colorado |

80112 |

| (Address of principal executive offices) |

(Zip code) |

(303) 706-4000

(Registrant’s telephone number, including

area code)

Securities registered pursuant to Section 12(b)

of the Act:

|

Title

of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Class A common stock, $0.01 par value |

|

SATS |

|

The Nasdaq Stock Market L.L.C. |

DISH NETWORK CORPORATION

(Exact name of registrant as specified in its charter)

001-39144

(Commission File Number)

| Nevada |

88-0336997 |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| 9601 South Meridian Boulevard |

|

| Englewood, Colorado |

80112 |

| (Address of principal executive offices) |

(Zip code) |

(303) 723-1000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b)

of the Act: None

DISH DBS CORPORATION

(Exact name of registrant as specified in its charter)

333-31929

(Commission File Number)

| Colorado |

84-1328967 |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| 9601 South Meridian Boulevard |

|

| Englewood, Colorado |

80112 |

| (Address of principal executive offices) |

(Zip code) |

(303) 723-1000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b)

of the Act: None

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

|

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

| Co-Registrant CIK |

0001001082 |

| Co-Registrant Amendment Flag |

false |

| Co-Registrant Form Type |

8-K |

| Co-Registrant DocumentPeriodEndDate |

2024-01-12 |

| Co-Registrant Written Communications |

false |

| Co-Registrant Solicitating Materials |

false |

| Co-Registrant PreCommencement Tender Offer |

false |

| Co-Registrant PreCommencement Issuer Tender Offer |

false |

| Co-Registrant Emerging growth company |

false |

| Co-Registrant CIK |

0001042642 |

| Co-Registrant Amendment Flag |

false |

| Co-Registrant Form Type |

8-K |

| Co-Registrant DocumentPeriodEndDate |

2024-01-12 |

| Co-Registrant Written Communications |

false |

| Co-Registrant Solicitating Materials |

false |

| Co-Registrant PreCommencement Tender Offer |

false |

| Co-Registrant PreCommencement Issuer Tender Offer |

false |

| Co-Registrant Emerging growth company |

false |

Item 8.01 Other.

On January 12, 2024, EchoStar Corporation (“EchoStar”)

issued a press release, announcing that it commenced exchange offers and consent solicitations with respect to the

0% Convertible Notes due 2025 and the 3.375% Convertible Notes due 2026 issued by its subsidiary DISH Network Corporation (“DISH”),

furnished herewith as Exhibit 99.1.

On January 16, 2024, EchoStar issued a press release, announcing that,

DISH DBS Issuer LLC, an indirect subsidiary of both EchoStar and DISH DBS Corporation, EchoStar’s indirect subsidiary (“DBS”),

had commenced exchange offers and consent solicitations with respect to the 5.875% Senior Notes

due 2024, the 7.75% Senior Notes due 2026, the 7.375% Senior Notes due 2028 and the 5.125% Senior Notes due 2029 issued by DBS, furnished

herewith as Exhibit 99.2.

Item 9.01. Financial Statements and Exhibits.

Forward-looking Statements

Certain

statements in this Current Report on Form 8-K may constitute “forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995, Section 27A of the Securities Act, and Section 21E of the Exchange Act, including, in particular,

statements about plans, objectives and strategies, growth opportunities in our industries and businesses, our expectations regarding future

results, financial condition, liquidity and capital requirements, estimates regarding the impact of regulatory developments and legal

proceedings, and other trends and projections. Forward-looking statements are not historical facts and may be identified by words such

as “future,” “anticipate,” “intend,” “plan,” “goal,” “seek,” “believe,”

“estimate,” “expect,” “predict,” “will,” “would,” “could,” “can,”

“may,” and similar terms. These forward-looking statements are based on information available to us as of the date hereof

and represent management’s current views and assumptions. Forward-looking statements are not guarantees of future performance, events

or results and involve known and unknown risks, uncertainties and other factors, which may be beyond our control. Accordingly, actual

performance, events or results could differ materially from those expressed or implied in the forward-looking statements due to a number

of factors. Additional information concerning these risk factors is contained in each of

EchoStar’s, DISH’s and DBS’s most recently filed Annual Report on Form 10-K and subsequent Quarterly Reports on Form

10-Q, and in EchoStar’s, DISH’s and DBS’s subsequent Current Reports on Form 8-K, and other SEC filings. All cautionary

statements made or referred to herein should be read as being applicable to all forward-looking statements wherever they appear. You should

consider the risks and uncertainties described or referred to herein and should not place undue reliance on any forward-looking statements.

The forward-looking statements speak only as of the date made. We do not undertake, and specifically disclaim, any obligation to publicly

release the results of any revisions that may be made to any forward-looking statements, whether as a result of new information, future

events or otherwise, except as required by law. Should one or more of the risks or uncertainties described herein or in any documents

we file with the SEC occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from

those expressed in any forward-looking statements.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the undersigned hereunto

duly authorized.

| |

|

ECHOSTAR CORPORATION

DISH NETWORK CORPORATION

DISH DBS CORPORATION |

| |

|

| Date: January 16, 2024 |

By: |

/s/ Dean A. Manson |

| |

|

Dean A. Manson

Chief Legal Officer and Secretary, EchoStar Corporation |

Exhibit 99.1

EchoStar Corporation

Announces Exchange Offers and Consent Solicitations

for

0% Convertible Senior Notes due 2025 and

3.375% Convertible Senior Notes due 2026

Issued by DISH Network Corporation

Exchange Offers Intended to Reduce Aggregate

Indebtedness and Materially Extend Debt Maturity Profile Providing Significant Runway for Continued Strategic Investment and Opportunity

to Combine DISH Network’s satellite technology, streaming services and nationwide 5G network

with EchoStar's premier satellite communications solutions, creating a global leader in terrestrial and non-terrestrial wireless connectivity

Englewood, Colo., Jan. 12, 2024 —EchoStar Corporation (Nasdaq:

SATS) (“EchoStar”), a global, fully integrated communication and content delivery leader and provider of technology,

spectrum, engineering, manufacturing, networking services, television entertainment and connectivity bolstered by its merger with DISH

Network Corporation (“DISH”), today announced that it has commenced offers to exchange (i) any and all of the

0% Convertible Notes due 2025 (the “DISH Network 2025 Notes”) issued by its subsidiary DISH and (ii) any and all

of the 3.375% Convertible Notes due 2026 issued by DISH (the “DISH Network 2026 Notes,” and together with the DISH

Network 2025 Notes, the “Existing DISH Notes”), each for 10.00% Senior Secured Notes due 2030 to be issued by EchoStar

Corporation (the “EchoStar Notes”), in each case, pursuant to the terms described in a preliminary prospectus and consent

solicitation statement, dated January 12, 2024 (the “Preliminary Exchange Offer Prospectus”).

Today’s announcement further advances EchoStar’s objective

of realizing on the synergistic opportunities of the combined business to utilize its valuable portfolio of spectrum and other assets

to optimize its capital structure to position the business to execute on its strategic goal of becoming

the premier provider of terrestrial mobile, satellite connectivity, and content services.

The following table describes certain terms of the exchange offers:

| Title of Existing DISH Notes | |

CUSIP/ISIN Number(1) | |

Principal Amount

Outstanding(2) | | |

Exchange Consideration(3) | |

| 0% Convertible Notes due 2025 | |

25470MAF6/US2547MAF68 | |

$ | 1,957,197,000 | | |

$ | 610 | |

| 3.375% Convertible Notes due 2026 | |

25470MAB5/US2547MAB54 | |

$ | 2,908,801,000 | | |

$ | 510 | |

| (1) | No representation is made as to the correctness or accuracy of the CUSIP or ISIN numbers listed in this press release or printed on

the Existing DISH Notes. They are provided solely for convenience. |

| (2) | Net of $42,803,000 and $91,199,000 of 0% Convertible Notes due 2025 and 3.375% Convertible Notes due 2026, respectively, that are

held by DISH and not deemed outstanding. |

| (3) | Consideration in the form of principal amount of EchoStar Notes per $1,000 principal amount of Existing DISH Notes that are validly

tendered and accepted for exchange, subject to any rounding as described herein. Excludes accrued interest, which will be paid in cash

in addition to the Exchange Consideration, as applicable. |

The EchoStar Notes will be guaranteed on a senior secured basis by

EchoStar’s indirect subsidiary, DBSD Corporation (“DBSD”), and secured by first priority liens on the 20 MHz

of AWS-4 spectrum (consisting of 10 MHz of N70 and 10 MHz of N66) held by DBSD (the “Spectrum Collateral”), and EchoStar’s

indirect subsidiary, DBSD Services Limited, which will provide a security interest consisting of a first priority pledge of the equity

interests of DBSD (in each case as described in the Preliminary Exchange Offer Prospectus). EchoStar currently estimates the fair market

value of the Spectrum Collateral that will secure the EchoStar Notes to be approximately $9 billion. The EchoStar Notes will not have

recourse to any assets of any other subsidiary of EchoStar other than as set forth above.

Concurrently with the exchange offers, EchoStar is soliciting consents

from holders of each series of the Existing DISH Notes to amend the terms of the applicable series of Existing DISH Notes and the indentures

governing such Existing DISH Notes to, among other things, eliminate certain events of default (including any cross-defaults related to

any payment, bankruptcy or other defaults of any DISH subsidiary) and substantially all of the restrictive covenants in each such indenture

and the Existing DISH Notes of the applicable series, including, but not limited to, the merger covenant, the reporting covenant and to

make certain conforming changes to each such indenture and the Existing DISH Notes of the applicable series to reflect the proposed amendments

(the “Proposed Amendments”). Holders may not consent to the Proposed Amendments without tendering the applicable Existing

DISH Notes in the relevant exchange offer, and holders may not tender Existing DISH Notes of any series for exchange without consenting

to the Proposed Amendments for such series.

Each exchange offer and consent solicitation is a separate offer and/or

solicitation, and each may be individually amended, extended, terminated or withdrawn, subject to certain conditions and applicable law,

at any time in the EchoStar’s sole discretion, and without amending, extending, terminating or withdrawing any other exchange offer

or consent solicitation. Additionally, notwithstanding any other provision of the exchange offers, EchoStar’s obligations to accept

and exchange any of the Existing DISH Notes validly tendered pursuant to an exchange offer is subject to the satisfaction or waiver of

certain conditions, as described in the Registration Statement, and EchoStar expressly reserves its right, subject to applicable law,

to terminate any exchange offer and/or consent solicitation at any time.

The exchange offers and consent solicitations will expire at 11:59

p.m., New York City time, on February 9, 2024, or any other date and time to which EchoStar extends such period for such exchange

offer or consent solicitation in its sole discretion (such date and time for such exchange offer or consent solicitation, as it may be

extended, the “Expiration Date”). To be eligible to receive the applicable exchange consideration in the applicable

exchange offer and consent solicitation, holders must validly tender and not validly withdraw their Existing DISH Notes and validly deliver

and not revoke their consents at or prior to the Expiration Date. Holders may withdraw tendered Existing DISH Notes at any time prior

to the Expiration Date. Any Existing DISH Notes withdrawn pursuant to the terms of the applicable exchange offer and consent solicitation

shall not thereafter be considered tendered for any purpose unless and until such notes are again tendered pursuant to the applicable

exchange offer and consent solicitation. Existing DISH Notes not exchanged in the exchange offers and consent solicitations will be returned

to the tendering holder at EchoStar’s expense promptly after the expiration or termination of the exchange offers and consent solicitations.

A registration statement on Form S-4 relating to the EchoStar

Notes (the “Registration Statement”) has been filed with the Securities and Exchange Commission (the “SEC”)

but has not yet become effective. The consummation of each exchange offer and consent solicitation is subject to, and conditional upon,

the satisfaction or, where permitted, waiver of certain conditions including, among other things, the effectiveness of the Registration

Statement, and at least a majority of the outstanding principal amount of the applicable series of Existing DISH Notes being validly tendered

and not properly withdrawn prior to the Expiration Date (the “Minimum Tender Condition”). All conditions to each exchange

offer and consent solicitation must be satisfied or, where permitted, waived, on or prior to the Expiration Date. For the avoidance of

doubt, EchoStar reserves the right to waive in its sole and absolute discretion the Minimum Tender Condition and accept any and all Existing

DISH Notes validly tendered and not validly withdrawn at or prior to the expiration date.

EchoStar is conducting the exchange offers and consent solicitations

in order to, among other things, reduce its consolidated indebtedness, address certain of its nearer term debt maturities and resultantly

materially extend its debt maturity profile, which will provide significant runway for continued strategic investment in its business

and further enhance EchoStar’s unique opportunity to combine DISH Network’s satellite technology, streaming services and nationwide

5G network with EchoStar's premier satellite communications solutions, creating a global leader in terrestrial and non-terrestrial wireless

connectivity.

White & Case LLP is acting as legal advisor to EchoStar and

D.F. King & Co., Inc. is acting as exchange agent and information agent for the exchange offers and consent solicitations.

This press release does not constitute an offer to sell or exchange

or the solicitation of an offer to buy or exchange any securities, nor shall there be any exchange of the EchoStar Notes for Existing

DISH Notes pursuant to the exchange offers and consent solicitations in any jurisdiction in which such exchanges would be unlawful prior

to registration or qualification under the laws of such jurisdiction.

About EchoStar Corporation

EchoStar Corporation (Nasdaq: SATS) is a premier provider of technology,

networking services, television entertainment and connectivity, offering consumer, enterprise, operator and government solutions worldwide

under its EchoStar®, Boost Mobile®, Boost Infinite, Sling TV, DISH TV, Hughes®, HughesNet®, HughesON™, and JUPITER™

brands. In Europe, EchoStar operates under its EchoStar Mobile Limited subsidiary and in Australia, the company operates as EchoStar Global

Australia. For more information, visit www.echostar.com and follow EchoStar on X (Twitter) and LinkedIn.

Where You Can Find Additional Information

As noted above, further details regarding the terms and conditions

of the exchange offers and consent solicitations, including descriptions of the EchoStar Notes and the material differences between the

EchoStar Notes and the Existing DISH Notes, can be found in the registration statement that has been filed with the SEC but has not yet

become effective, and in a tender offer statement on Schedule TO that has been filed with the SEC. The securities subject to the registration

statement may not be issued and sold prior to the time the registration statement becomes effective. ANY INVESTOR HOLDING EXISTING DISH

NOTES IS URGED TO READ THE REGISTRATION STATEMENT, THE TENDER OFFER STATEMENT AND OTHER DOCUMENTS ECHOSTAR HAS FILED OR WILL FILE WITH

THE SEC BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE ISSUER AND THE OFFERING.

The registration statement, the tender offer statement and other related

documents, when filed, can be obtained for free from the SEC’s website at www.sec.gov. Documents are also available for

free upon oral request made to EchoStar at (303) 706-4000 or written request made to EchoStar Corporation, Attention: Investor Relations,

100 Inverness Terrace East, Englewood, Colorado 80112 and from EchoStar’s website at www.echostar.com.

Holders can also request copies of the offering materials by contacting

D.F. King & Co., Inc. by sending an email to DISH@dfking.com or by calling (800) 967-5084 (U.S. toll-free) or (212)

269-5550 (banks and brokers).

Forward-looking Statements

This document contains "forward-looking

statements" within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act, and

Section 21E of the Exchange Act, including, in particular, statements about plans, objectives and strategies, growth opportunities

in our industries and businesses, our expectations regarding future results, financial condition, liquidity and capital requirements,

estimates regarding the impact of regulatory developments and legal proceedings, and other trends and projections. Forward-looking statements

are not historical facts and may be identified by words such as "future," "anticipate," "intend," "plan,"

"goal," "seek," "believe," "estimate," "expect," "predict," "will,"

"would," "could," "can," "may," and similar terms. These forward-looking statements are based

on information available to us as of the date hereof and represent management's current views and assumptions. Forward-looking statements

are not guarantees of future performance, events or results and involve known and unknown risks, uncertainties and other factors, which

may be beyond our control. Accordingly, actual performance, events or results could differ materially from those expressed or implied

in the forward-looking statements due to a number of factors. Additional information concerning

these risk factors is contained in each of EchoStar's and DISH Network's most recently filed Annual Report on Form 10-K and subsequent

Quarterly Reports on Form 10-Q, and in EchoStar's subsequent Current Reports on Form 8-K, and other SEC filings. All cautionary

statements made or referred to herein should be read as being applicable to all forward-looking statements wherever they appear. You should

consider the risks and uncertainties described or referred to herein and should not place undue reliance on any forward-looking statements.

The forward-looking statements speak only as of the date made. We do not undertake, and specifically disclaim, any obligation to publicly

release the results of any revisions that may be made to any forward-looking statements, whether as a result of new information, future

events or otherwise, except as required by law. Should one or more of the risks or uncertainties described herein or in any documents

we file with the SEC occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from

those expressed in any forward-looking statements.

Exhibit 99.2

EchoStar Corporation

Announces Exchange Offers and Consent Solicitations

by

DISH DBS Issuer LLC for

Certain Existing Senior Notes

Issued by DISH DBS Corporation

Englewood,

Colo., Jan. 16, 2024 —EchoStar Corporation (Nasdaq: SATS) (“EchoStar”) today announced that its newly formed

subsidiary DISH DBS Issuer LLC (“DBS Issuer”) (also known as DBS Subscriber Subsidiary) has commenced offers (the “Exchange

Offers”) to Eligible Holders (as defined below) to exchange (x) up to $1,000,000,000 aggregate principal amount

of the 5.875% Senior Notes due 2024 (the “DBS 2024 Notes”) issued by DISH DBS Corporation (“DBS”),

a subsidiary of EchoStar, for Series 2024-1 Class A-1 10.00% Senior Secured Notes due 2030 (the “DBS Issuer Class A-1

Notes”) and (y) up to an aggregate principal amount described below of (i) the 7.75% Senior Notes due 2026 issued

by DBS (the “DBS 2026 Notes”), (ii) the 7.375% Senior Notes due 2028 (the “DBS 2028 Notes”)

and (iii) the 5.125% Senior Notes due 2029 (the “DBS 2029 Notes,” and together with the DBS 2024 Notes, the DBS

2026 Notes and the DBS 2028 Notes, the “Existing DBS Notes”), each for 2024-1 Class A-2 10.00% Senior Secured

Notes due 2034 (the “DBS Issuer Class A-2 Notes” and, together with DBS Issuer Class A-1 Notes, the “DBS

Issuer Notes”). The DBS Issuer Notes are to be issued by DBS Issuer, in each case, pursuant to the terms described in an exchange

offer memorandum and consent solicitation statement, dated January 16, 2024 (the “Exchange Offer Memorandum”).

The DBS Issuer Notes will be secured by the assets of DBS Issuer, which include approximately

3.0 million DISH TV subscribers.

The maximum aggregate principal amount of DBS

Issuer Notes that will be issued to eligible holders of Existing DBS Notes pursuant to the Exchange Offers is $3,000,000,000, subject

to adjustment as described below:

| (1) | no more than $1,000,000,000 aggregate principal amount of the DBS 2024 Notes (the “2024 Notes

Tender Cap”); and |

| (2) | the maximum aggregate principal amount of (i) DBS Issuer Class A-1 Notes that will be issued

is $1,000,000,000 (the “Maximum Offered Class A-1 Notes Amount”) and (ii) DBS Issuer Class A-2 Notes

that will be issued is $3,000,000,000 less the aggregate principal amount of any DBS Issuer Class A-1 Notes issued (the “Maximum

Offered Class A-2 Notes Amount”). |

DBS

Issuer reserves the right, in its sole discretion, subject to applicable law, to increase or decrease the 2024 Notes Tender Cap, the Maximum

Offered Class A-1 Notes Amount, the Maximum Offered Class A-2 Notes Amount and/or the Maximum Offered Notes Amount, but there

can be no assurance that DBS Issuer will do so. This could result in DBS Issuer purchasing a greater or lesser aggregate principal

amount of Existing DBS Notes in the Offers and issuing a greater or lesser aggregate principal amount of DBS Issuer Notes.

Existing DBS Notes accepted for exchange into

DBS Issuer Class A-2 Notes on any settlement date will be accepted in accordance with the priority levels (the “Acceptance

Priority Levels”) set forth below (with “1” being the highest Acceptance Priority Level and “3” being

the lowest Acceptance Priority Level). Only the Existing DBS Notes being exchanged for DBS Issuer Class A-2 Notes will be subject

to the Acceptance Priority Levels.

The following table describes certain terms of the exchange offers:

Title

of Existing

DBS Notes | |

CUSIP

Number(1) (Rule 144A/Reg

S) | |

ISIN(1) (Rule 144A/Reg

S) | |

Tender

Cap | | |

Principal

Amount

Outstanding | | |

Acceptance

Priority

Level | | |

DBS

Issuer

Notes | |

Exchange

Consideration(4) | | |

Early

Exchange

Premium(4)(5) | | |

Total

Consideration(4)(6) | |

| 5.875% Senior Notes

due 2024 | |

25470XAW5 / U25486AL2 | |

US25470XAW56 /

USU25486AL24 | |

$ | 1,000,000,000 | (2) | |

$ | 1,982,544,000 | (3) | |

N/A | | |

Class A-1 Notes | |

$ | 950.00 | | |

$ | 50.00 | | |

$ | 1,000.00 | |

| 7.75% Senior Notes due 2026 | |

25470XAY1 / U25486AM0 | |

US25470XAY13 / USU25486AM07 | |

| N/A | | |

$ | 2,000,000,000 | | |

1 | | |

Class A-2 Notes | |

$ | 610.00 | | |

$ | 50.00 | | |

$ | 660.00 | |

| 7.375% Senior Notes due 2028 | |

25470XBB0 / U25486AN8 | |

US25470XBB01 / USU25486AN89 | |

| N/A | | |

$ | 1,000,000,000 | | |

2 | | |

Class A-2 Notes | |

$ | 450.00 | | |

$ | 50.00 | | |

$ | 500.00 | |

| 5.125% Senior Notes due 2029 | |

25470XBD6 / U25486AP3 | |

US25470XBD66 / USU25486AP38 | |

| N/A | | |

$ | 1,500,000,000 | | |

3 | | |

Class A-2 Notes | |

$ | 380.00 | | |

$ | 50.00 | | |

$ | 430.00 | |

| (1) | No

representation is made as to the correctness or accuracy of the CUSIP numbers or ISINs listed

in this press release or printed on the Existing DBS Notes. They are provided solely for

convenience. |

| (2) | No

more than the 2024 Notes Tender Cap of 5.875% Senior Notes due 2024 (as it may be increased

or decreased by DBS Issuer in its sole discretion) will be purchased in the Exchange Offers. |

| (3) | Net

of $17,456,000 of 5.875% Senior Notes due 2024 that are held by DISH Network Corporation

and not deemed outstanding. |

| (4) | Consideration

in the form of principal amount of DBS Issuer Notes per $1,000 principal amount of Existing

DBS Notes that are validly tendered and accepted for exchange, subject to any rounding as

described in the Exchange Offer Memorandum. Excludes accrued interest, which will be paid

in cash in addition to the Exchange Consideration or the Total Consideration, as applicable. |

| (5) | The

Early Exchange Premium will be payable to Eligible Holders who validly tender Existing DBS

Notes at or prior to the Early Tender Time. |

| (6) | Includes

the Early Exchange Premium for Existing DBS Notes validly tendered at or prior to the Early

Tender Time. |

The DBS Issuer Notes will be secured by all of

DBS Issuer’s interests in its subscription and equipment agreements (as described in the Exchange Offer Memorandum). The DBS Issuer

Notes will not have recourse to any assets of EchoStar or any of its other subsidiaries.

Concurrently with the Exchange Offers, DBS Issuer

is soliciting consents (the “Consent Solicitations” and together with the Exchange Offers, the “Offers”)

from holders of each series of the Existing DBS Notes to amend the terms of the applicable series of Existing DBS Notes and the indentures

governing such Existing DBS Notes (the “Existing Indentures”) to, among other things, eliminate certain events of default

(including any defaults related to any payment default or acceleration of certain indebtedness and defaults related to the bankruptcy

of DBS) and substantially all of the covenants in each such indenture and the Existing DBS Notes of the applicable series, including,

but not limited to, limitations on restricted payments, dividend restrictions, indebtedness, liens, asset sales, affiliate transactions,

reporting and mergers, and to make certain conforming changes to each such indenture and the Existing DBS Notes of the applicable series

to reflect the proposed amendments (the “Proposed Amendments”). Holders may not consent to the Proposed Amendments

without tendering the applicable Existing DBS Notes in the relevant Exchange Offer, and holders may not tender Existing DBS Notes of any

series for exchange without consenting to the Proposed Amendments for such series.

Each Exchange Offer and Consent Solicitation will

expire immediately after 11:59 p.m., New York City time, on February 12, 2024, or any other date and time to which DBS Issuer extends

such period for such Exchange Offer and Consent Solicitation in its sole discretion (such date and time, as it may be extended, the “Expiration

Time”), unless earlier terminated.

To be eligible to receive the applicable total

consideration (the “Total Consideration”) in the applicable Offer, Eligible Holders must validly tender and not validly

withdraw their Existing DBS Notes and validly deliver and not revoke their consents at or prior to 5:00 p.m., New York City time, on January 29,

2024, or any other date and time to which DBS Issuer extends such period in its sole discretion (such date and time for such Offer, as

it may be extended, the “Early Tender Time”). Eligible Holders validly tendering their Existing DBS Notes after the

applicable Early Tender Time for an Offer and at or prior to the Expiration Time for such Offer will only be eligible to receive the applicable

exchange consideration set forth in the table above (the “Exchange Consideration”), which equals the applicable Total

Consideration less the applicable Early Exchange Premium set forth in the table above.

Validly tendered Existing DBS Notes may be withdrawn

and related consents revoked, with respect to an Exchange Offer and Consent Solicitation for any series of Existing DBS Notes at or prior

to, and not thereafter (subject to applicable law), in the case of any series of Existing DBS Notes, the earliest of (i) the time

of execution of the Supplemental Indenture (as defined below) relating to such series of Existing DBS Notes (which is expected to occur

promptly after receipt of the Requisite Consents (as defined below) for such series), (ii) 5:00 p.m., New York City time, on January 29,

2024, unless extended by DBS Issuer in its sole discretion and (iii) the termination of the Consent Solicitation with respect to

such series of Existing DBS Notes. The occurrence of such event with respect to a series of Existing DBS Notes is referred to as the “Withdrawal

Deadline” for such series of Existing DBS Notes.

The 2024 Notes Tender Cap limits the maximum aggregate

principal amount of the DBS 2024 Notes that may be exchanged in the applicable Offer to $1,000,000,000. Accordingly, acceptance for tenders

of DBS 2024 Notes may be subject to proration if the aggregate principal amount DBS 2024 Notes validly tendered would result in the aggregate

principal amount of DBS 2024 Notes exchanged exceeding the 2024 Notes Tender Cap.

DBS Issuer will exchange any Existing DBS Notes

that have been validly tendered at or prior to the Expiration Time and that it chooses to accept for exchange, subject to all conditions

to such Exchange Offer and Consent Solicitation having been either satisfied or waived by DBS Issuer, within three business days following

the Expiration Time or as promptly as practicable thereafter (the settlement date of such exchange with respect to an Exchange Offer and

Consent Solicitation being referred to as the “Settlement Date”), subject to the 2024 Notes Tender Cap, the Maximum

Offered Class A-1 Notes Amount, the Maximum Offered Class A-2 Notes Amount, the Acceptance Priority Level and proration.

Subject to the Maximum Offered Class A-2

Notes Amount, the Acceptance Priority Level and proration, all Existing DBS Notes subject to the Acceptance Priority Levels (the “Acceptance

Priority Notes”) of a series validly tendered at or before the Expiration Time having a higher Acceptance Priority Level will

be accepted before any Acceptance Priority Notes of another series tendered at or before the Expiration Time having a lower Acceptance

Priority Level are accepted, even if the Acceptance Priority Notes having a lower Acceptance Priority Level were tendered prior to the

applicable Early Tender Time and the Existing DBS Notes having a higher Acceptance Priority Level were tendered after the Early Tender

Time but on or prior to the Expiration Time. Accordingly, even if the Offers are fully subscribed such that the aggregate Exchange Consideration

issuable in respect of Acceptance Priority Notes validly tendered equals at least the Maximum Offered Class A-2 Notes Amount as of

the applicable Early Tender Time, Acceptance Priority Notes validly tendered at or before the applicable Early Tender Time may be subject

to proration if DBS Issuer accepts Acceptance Priority Notes tendered after the applicable Early Tender Time but on or prior to the Expiration

Time that have a higher Acceptance Priority Level than such Existing DBS Notes. In such a scenario, DBS Issuer will (assuming satisfaction

or waiver of the conditions set forth in the Exchange Offer Memorandum with respect to the Offers) accept all validly tendered Existing

DBS Notes and related consents on or prior to the Expiration Time on a prorated basis based on the Acceptance Priority Level such that

the aggregate Exchange Consideration for the Acceptance Priority Notes equals the Maximum Offered Class A-2 Amount (subject to rounding

down to the nearest $1,000). A Consent Solicitation with respect to a series of Existing DBS Notes will be terminated if the consents

of holders of a majority in aggregate principal amount of such series of Existing DBS Notes outstanding, or in the case of certain amendments,

66 2/3%, (excluding any DBS Senior Notes held by the Company or its affiliates) (with respect to each series of Existing DBS Notes, the

“Requisite Consents”) for such series are not obtained and, in such case, the applicable Proposed Amendments for such

series of Existing DBS Notes will not become effective.

All

Existing DBS Notes not accepted as a result of proration will be rejected from the applicable Offer and will be promptly returned to the

tendering Eligible Holder.

Existing DBS Notes may be tendered and accepted

for exchange only in principal amounts equal to minimum denominations of $2,000 and integral multiples of $1,000 in excess thereof, provided

that the DBS Issuer Notes will be issued with minimum denominations of $1,000 and integral multiples of $1,000 in excess thereof. If proration

causes DBS to return less than the minimum denomination of a series of Existing DBS Notes to an Eligible Holder, then DBS Issuer will

either accept all or reject all of the Existing DBS Notes of such series tendered by such Eligible Holder. The amount of DBS Issuer Notes

to be issued to any Eligible Holder will be rounded down to the nearest $1,000. Any fractional portion of DBS Issuer Notes not received

as a result of rounding down will be paid in cash.

If the Requisite Consents to the applicable Proposed

Amendments are received and not revoked with respect to a series of Existing DBS Notes, DBS and the trustee under the Existing Indenture

governing such series of Existing DBS Notes are expected to execute a supplemental indenture to such Existing Indenture providing for

the Proposed Amendments (with respect to any such series of Existing DBS Notes, a “Supplemental Indenture”), promptly

after receipt of such Requisite Consents. The Supplemental Indenture will effect the Proposed Amendments only with respect to such series

of Existing DBS Notes for which the applicable Requisite Consents were received and not revoked. The adoption of the Proposed Amendments

with respect to any series of Existing DBS Notes is not conditioned upon the consummation of any other Consent Solicitation or adoption

of the Proposed Amendments in respect of any other series of Existing DBS Notes or obtaining any Requisite Consent with respect to any

other series of Existing DBS Notes. The failure to obtain the Requisite Consents with respect to any series of Existing DBS Notes will

not affect the ability of DBS to enter into the Supplemental Indenture and cause the Proposed Amendments to become effective for any other

series of Existing DBS Notes. If an Exchange Offer or the related Consent Solicitation with respect to a series of Existing DBS Notes

is terminated or withdrawn, the Existing Indenture governing such series of Existing DBS Notes will remain in effect in its present form

with respect to such series of Existing DBS Notes. However, if the Proposed Amendments for a series of Existing DBS Notes become operative,

holders of such series of Existing DBS Notes who do not tender Existing DBS Notes will be bound by the applicable Proposed Amendments,

meaning that their Existing DBS Notes will be governed by an Existing Indenture as amended by the applicable Supplemental Indenture.

Each

Exchange Offer and Consent Solicitation is a separate offer and/or solicitation, and each may be individually amended, extended, terminated

or withdrawn, subject to certain conditions and applicable law, at any time in DBS Issuer’s sole discretion, and without amending,

extending, terminating or withdrawing any other Exchange Offer or Consent Solicitation. No Offer is conditioned upon any minimum principal

amount of Existing DBS Notes of any series being tendered nor the consummation of any other Offer or Consent Solicitation. Additionally,

notwithstanding any other provision of the Offers, DBS Issuer’s obligations to accept and exchange any of the Existing DBS Notes

validly tendered pursuant to an Offer is subject to the satisfaction or waiver of certain conditions, as described in the Exchange Offer

Memorandum, and DBS Issuer expressly reserves its right, subject to applicable law, to terminate any Offer and/or Consent Solicitation

at any time.

The

Offers are being made, and the applicable series of DBS Issuer Notes are being offered, only to holders of the Existing DBS Notes who

are either (a) persons who are reasonably believed to be “qualified institutional buyers” as defined in Rule 144A

under the Securities Act to whom the DBS Issuer Notes are offered in the United States in a transaction not involving a public offering,

pursuant to Section 4(a)(2) of the Securities Act or (b) persons other than “U.S. persons” as defined in Regulation

S under the U.S. Securities Act of 1933, as amended (the “Securities Act”), who agree to purchase the DBS Issuer Notes

outside of the United States and who are otherwise in compliance with the requirements of Regulation S. The holders of Existing DBS Notes

who have certified to DBS Issuer that they are eligible to participate in the Offers and Consent Solicitations pursuant to at least one

of the foregoing conditions are referred to as “Eligible Holders.” Eligible Holders may go to www.dfking.com/dish

to confirm their eligibility.

Full details of the terms and conditions of the

Exchange Offers and the Consent Solicitations are described in the Exchange Offer Memorandum. The Exchange Offers and the Consent Solicitations

are only being made pursuant to, and the information in this press release is qualified in its entirety by reference to, the Exchange

Offer Memorandum, which is being sent by DBS Issuer to Eligible Holders of the Existing DBS Notes. Eligible Holders of the Existing DBS

Notes are encouraged to read these documents, as they contain important information regarding the Exchange Offers and the Consent Solicitations.

None of EchoStar, DBS, DBS Issuer, any of their

respective subsidiaries or affiliates, or any of their respective officers, boards of directors or directors, the dealer manager and solicitation

agent, the exchange agent and information agent or any trustee is making any recommendation as to whether Eligible Holders should tender

any Existing DBS Notes in response to the Exchange Offers or deliver any consents pursuant to the Consent Solicitations and no one has

been authorized by any of them to make such a recommendation. Eligible Holders must make their own decision as to whether to tender their

Existing DBS Notes and deliver consents, and, if so, the principal amount of Existing DBS Notes as to which action is to be taken.

The Exchange Offers and the Consent Solicitations

are not being made to Eligible Holders of Existing DBS Notes in any jurisdiction in which the making or acceptance thereof would not be

in compliance with the securities, blue sky or other laws of such jurisdiction. In any jurisdiction in which the Exchange Offers and the

Consent Solicitations are required to be made by a licensed broker or dealer, the Exchange Offers and the Consent Solicitations will be

deemed to be made on behalf of DBS and DBS Issuer, as applicable, by the dealer manager and solicitation agent, or one or more registered

brokers or dealers that are licensed under the laws of such jurisdiction.

The DBS Issuer Notes have not been and will not

be registered under the Securities Act or any state securities laws and may not be offered or sold in the United States, except pursuant

to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and applicable state securities

laws. The DBS Issuer Notes have not been and will not be qualified for sale to the public by prospectus under applicable Canadian securities

laws and, accordingly, any issuance of DBS Issuer Notes in Canada will be made on a basis which is exempt from the prospectus requirements

of such securities laws.

This press release shall not constitute an offer

to sell or exchange or a solicitation of an offer to buy or exchange any securities, nor shall there be any sale or exchange of the DBS

Issuer Notes in any jurisdiction where such offering or sale or exchange would be unlawful. There shall not be any sale of the DBS Issuer

Notes in any jurisdiction in which such offer, solicitation, exchange or sale would be unlawful prior to registration or qualification

under the securities laws of such jurisdiction.

D.F. King & Co., Inc. is acting

as exchange agent and information agent for the exchange offers and consent solicitations.

About EchoStar Corporation

EchoStar Corporation (Nasdaq: SATS) is a premier

provider of technology, networking services, television entertainment and connectivity, offering consumer, enterprise, operator and government

solutions worldwide under its EchoStar®, Boost Mobile®, Boost Infinite, Sling TV, DISH TV, Hughes®, HughesNet®, HughesON™,

and JUPITER™ brands. In Europe, EchoStar operates under its EchoStar Mobile Limited subsidiary and in Australia, the company operates

as EchoStar Global Australia. For more information, visit www.echostar.com and follow EchoStar on X (Twitter) and LinkedIn.

Where You Can Find Additional Information

As noted above, further details regarding the

terms and conditions of the Offers can be found in the Exchange Offer Memorandum. ANY INVESTOR HOLDING EXISTING DBS NOTES IS URGED TO

READ THE EXCHANGE OFFER MEMORANDUM THAT HAS BEEN MADE AVAILABLE TO THEM BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE ISSUER AND

THE OFFERING.

Requests for the Exchange Offer Memorandum and

other documents relating to the Offers may be directed to D.F. King & Co., Inc., the exchange agent and information agent

for the Offers, by sending an email to DISH@dfking.com or by calling (800) 967-5084 (U.S. toll-free) or (212) 269-5550 (banks and brokers).

Forward-looking Statements

This

document contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A

of the Securities Act, and Section 21E of the Exchange Act, including, in particular, statements about plans, objectives and strategies,

growth opportunities in our industries and businesses, our expectations regarding future results, financial condition, liquidity and capital

requirements, estimates regarding the impact of regulatory developments and legal proceedings, and other trends and projections. Forward-looking

statements are not historical facts and may be identified by words such as "future," "anticipate," "intend,"

"plan," "goal," "seek," "believe," "estimate," "expect," "predict,"

"will," "would," "could," "can," "may," and similar terms. These forward-looking statements

are based on information available to us as of the date hereof and represent management's current views and assumptions. Forward-looking

statements are not guarantees of future performance, events or results and involve known and unknown risks, uncertainties and other factors,

which may be beyond our control. Accordingly, actual performance, events or results could differ materially from those expressed or implied

in the forward-looking statements due to a number of factors. Additional information concerning

these risk factors is contained in each of EchoStar's, DISH Network's and DBS’s most recently filed Annual Report on Form 10-K

and subsequent Quarterly Reports on Form 10-Q, and in EchoStar's and DBS’s subsequent Current Reports on Form 8-K, and

other SEC filings. All cautionary statements made or referred to herein should be read as being applicable to all forward-looking statements

wherever they appear. You should consider the risks and uncertainties described or referred to herein and should not place undue reliance

on any forward-looking statements. The forward-looking statements speak only as of the date made. We do not undertake, and specifically

disclaim, any obligation to publicly release the results of any revisions that may be made to any forward-looking statements, whether

as a result of new information, future events or otherwise, except as required by law. Should one or more of the risks or uncertainties

described herein or in any documents we file with the SEC occur, or should underlying assumptions prove incorrect, our actual results

and plans could differ materially from those expressed in any forward-looking statements.

v3.23.4

Cover

|

Jan. 12, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 12, 2024

|

| Entity File Number |

001-33807

|

| Entity Registrant Name |

ECHOSTAR CORPORATION

|

| Entity Central Index Key |

0001415404

|

| Entity Tax Identification Number |

26-1232727

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

100 Inverness Terrace East

|

| Entity Address, City or Town |

Englewood

|

| Entity Address, State or Province |

CO

|

| Entity Address, Postal Zip Code |

80112

|

| City Area Code |

303

|

| Local Phone Number |

706-4000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A common stock, $0.01 par value

|

| Trading Symbol |

SATS

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| DISH NETWORK CORPORATION [Member] |

|

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 12, 2024

|

| Entity File Number |

001-39144

|

| Entity Registrant Name |

DISH NETWORK CORPORATION

|

| Entity Central Index Key |

0001001082

|

| Entity Tax Identification Number |

88-0336997

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

9601 South Meridian Boulevard

|

| Entity Address, City or Town |

Englewood

|

| Entity Address, State or Province |

CO

|

| Entity Address, Postal Zip Code |

80112

|

| City Area Code |

303

|

| Local Phone Number |

723-1000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| DISH DBS CORPORATION [Member] |

|

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 12, 2024

|

| Entity File Number |

333-31929

|

| Entity Registrant Name |

DISH DBS CORPORATION

|

| Entity Central Index Key |

0001042642

|

| Entity Tax Identification Number |

84-1328967

|

| Entity Incorporation, State or Country Code |

CO

|

| Entity Address, Address Line One |

9601 South Meridian Boulevard

|

| Entity Address, City or Town |

Englewood

|

| Entity Address, State or Province |

CO

|

| Entity Address, Postal Zip Code |

80112

|

| City Area Code |

303

|

| Local Phone Number |

723-1000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_LegalEntityAxis=SATS_DISHNETWORKCORPORATIONMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_LegalEntityAxis=SATS_DISHDBSCORPORATIONMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

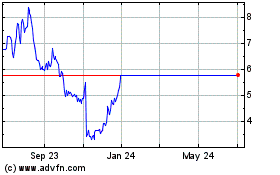

DISH Network (NASDAQ:DISH)

Historical Stock Chart

From Jan 2025 to Feb 2025

DISH Network (NASDAQ:DISH)

Historical Stock Chart

From Feb 2024 to Feb 2025