Eastern Bank Provides Financing for Capstan Atlantic’s Conversion to an Employee-Owned Company

May 14 2024 - 10:33AM

Business Wire

Eastern Bank is pleased to announce it has provided the

financing to facilitate Capstan Atlantic’s conversion to an

employee-owned company. Founded in 1956 and located in Wrentham,

MA, Capstan Atlantic is an industry leading powder metal

manufacturer producing complex gears, sprockets and structural

components for the automotive industry and a wide array of other

applications, including lawn mowers, snowblowers and all-terrain

vehicles. Eastern Bank is providing a term loan to support Capstan

Atlantic’s conversion to employee ownership through the

implementation of an Employee Stock Ownership Plan (ESOP), making

it a fully employee-owned company. Eastern Bank is also providing a

revolving line of credit to support the company’s ongoing financial

needs.

“Capstan Atlantic, which will be rebranded to Atlantic Sintered,

is pleased to begin a new banking relationship with Eastern Bank,”

said Ben Hall, President and CEO. “The creation of an employee

stock ownership plan is an exciting way to help ensure the

long-term success and growth of our company and reward our loyal

260 employees. Eastern Bank’s financing and ESOP expertise has been

instrumental as they took the time to understand our business, and

created a financing solution that enabled a smooth transition

process for our company. We look forward to continuing our

relationship with Eastern for our different banking needs.”

Greg Buscone, Executive Vice President, Chief Commercial Banking

Officer of Eastern Bank, said, “Capstan Atlantic takes pride in the

quality and craftsmanship of the gears and products it manufactures

for its customers and is committed to the dedicated employees who

deliver these results. We are pleased to assist them on their path

to employee ownership, and welcome them to Eastern Bank.”

Eastern Bank provides a range of commercial financing offerings

to help companies across many industries improve cash flow,

increase efficiencies and build for the future. Commercial lending

solutions include working capital/lines of credit, equipment/term

loans, real estate loans, acquisition financing, asset-based

lending and employee stock ownership plan-related financing.

The Commercial Banking team advising Capstan Atlantic includes:

Executive Vice President, Chief Commercial Banking Officer Greg

Buscone; Senior Vice President, Commercial Group Director Brendan

O’Neill; Senior Vice President, Commercial Team Leader Thomas King;

and Senior Vice President, Commercial Relationship Manager Youssef

Abdouh. Empire Valuation Senior Managing Director Chuck Coyne

served as an advisor to Capstan Atlantic throughout the ESOP

transaction.

About Eastern Bank

Founded in 1818, Boston-based Eastern Bank has more than 120

locations serving communities in eastern Massachusetts, southern

and coastal New Hampshire, and Rhode Island. As of March 31, 2024

Eastern Bank had approximately $21 billion in total assets. Eastern

provides a full range of banking and wealth management solutions

for consumers and businesses of all sizes, and takes pride in its

outspoken advocacy and community support that includes more than

$240 million in charitable giving since 1994. An inclusive company,

Eastern is comprised of deeply committed professionals who value

relationships with their customers, colleagues and communities.

Join us for good at www.easternbank.com and follow Eastern

on Facebook, LinkedIn, X and Instagram.

Eastern Bankshares, Inc. (Nasdaq Global Select Market: EBC) is the

stock holding company for Eastern Bank. For investor information,

visit investor.easternbank.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240514098632/en/

Media contact: Andrea Goodman Eastern Bank

a.goodman@easternbank.com 781-598-7847

Investor contact: Jill Belliveau Eastern Bankshares, Inc.

InvestorRelations@easternbank.com 781-598-7920

Eastern Bankshares (NASDAQ:EBC)

Historical Stock Chart

From Nov 2024 to Dec 2024

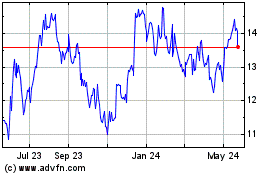

Eastern Bankshares (NASDAQ:EBC)

Historical Stock Chart

From Dec 2023 to Dec 2024