0001050441☐00010504412025-01-222025-01-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 22, 2025

EAGLE BANCORP, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Maryland | 0-25923 | 52-2061461 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

7830 Old Georgetown Road, Third Floor

Bethesda, Maryland 20814

(Address of Principal Executive Offices) (Zip Code)

(301) 986-1800

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

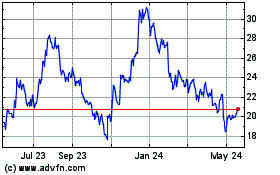

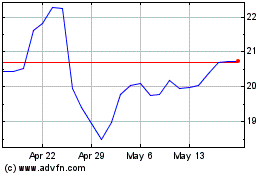

| Common Stock, $0.01 par value | EGBN | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company,indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On January 22, 2025, Eagle Bancorp, Inc. (the "Company") issued a press release, a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(b) On January 21, 2025, Kathy A. Raffa notified the Board of Directors (the “Board”) of Eagle Bancorp, Inc. (the “Company”) that she will not stand for re-election as a director of the Company at the end of her term, which expires at the Company’s 2025 Annual Meeting of Shareholders (the “Annual Meeting”). The decision of Ms. Raffa not to stand for re-election was not the result of any disagreement with the Company on any matter relating to the Company’s operations, policies, or practices. Susan Riel, President and Chief Executive Officer of the Company, thanked Ms. Raffa for her years of dedication and loyal service to the Bank and wished her well in her new board experience with a larger public company.

Item 7.01. Regulation FD Disclosure.

Attached as Exhibit 99.2 to this report is the presentation for the Company's earnings conference call on January 23, 2025, which also may be used in connection with potential meetings with investors and/or analysts. The Company does not undertake to update the information contained in the attached presentation materials.

The information contained in this Current Report on Form 8-K that is furnished under Items 2.02 and 7.01, including the accompanying Exhibits 99.1 and 99.2, is being furnished pursuant to Items 2.02 and 7.01 of Form 8-K and shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liability of that section. The information contained in this Current Report on Form 8-K that is furnished under Items 2.02 and 7.01, including the accompanying Exhibits 99.1 and 99.2, shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit Number | | Description |

| | | |

| | Press Release dated January 22, 2025 |

| | Earnings Presentation |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | EAGLE BANCORP, INC. |

| | | |

| | | |

| Date: January 22, 2025 | By: | /s/ Eric R. Newell |

| | | Eric R. Newell |

| | | Executive Vice President, Chief Financial Officer |

| | | | | | | | |

PRESS RELEASE FOR | | EAGLE BANCORP, INC. |

| IMMEDIATE RELEASE | | CONTACT: |

| | Eric R. Newell |

| January 22, 2025 | | 240.497.1796 |

EAGLE BANCORP, INC. ANNOUNCES FOURTH QUARTER 2024 RESULTS AND CASH DIVIDEND

BETHESDA, MD, Eagle Bancorp, Inc. ("Eagle", the "Company") (NASDAQ: EGBN), the Bethesda-based holding company for EagleBank, one of the largest community banks in the Washington D.C. area, reported its unaudited results for the fourth quarter ended December 31, 2024.

Eagle reported net income of $15.3 million or $0.50 per diluted share for the fourth quarter 2024, compared to net income of $21.8 million or $0.72 per diluted share during the third quarter. Pre-provision net revenue ("PPNR")1 in the fourth quarter was $30.3 million compared to $35.2 million for the prior quarter.

The $6.5 million decrease in net income from the prior quarter is attributed to a decline in noninterest income of $2.9 million associated with higher swap fees collected in the third quarter that did not reoccur in the fourth quarter; $2.0 million increase in provision expense; $1.0 million decrease in net interest income, and a $0.9 million increase in noninterest expenses.

Additionally, the Company is announcing today a cash dividend in the amount of $0.165 per share. The cash dividend will be payable on February 21, 2025 to shareholders of record on February 7, 2025.

"Last year was a transformative one for our Company, marked by significant changes and progress. We welcomed new members to senior management and strengthened our C&I team. We took steps to reduce uncertainties by replacing maturing subordinated debt, recalibrated our common stock dividend, and enhanced transparency around our commercial real estate portfolio," said Susan G. Riel, President and Chief Executive Officer of the Company. "Despite these foundational efforts, challenges remain. Asset quality fell short of expectations and valuation risk in our office portfolio continues to be a key concern. While we are proud of the groundwork laid last year, we are eager to build on these efforts and drive meaningful improvements in our profitability," added Ms. Riel.

Eric R. Newell, Chief Financial Officer of the Company said, "We successfully utilized excess liquidity and deposit growth to fully repay the $1 billion of Bank Term Funding Program debt that was outstanding at September 30. By prioritizing more effective use of wholesale funding and passing through short-term rate reductions to non-maturity deposits, we expect further benefits to funding costs in the first half of 2025. While non-accruals increased due to a $74.9 million commercial real estate office loan that was previously special mention and subsequently moved to non-accrual following a new appraisal, total classified and criticized loans declined last quarter for the first time since we began seeing migration tied to elevated office portfolio risk. The reserve for credit losses, with coverage as a percentage of total loans

1 A reconciliation of non-GAAP financial measures and the nearest GAAP measures is provided in the GAAP Reconciliation to Non-GAAP Financial Measure that accompany this document.

at 1.44%, increased 4 basis points from last quarter due in large part to the migration to nonaccrual of the previously special mention performing office loan. Our capital position remains strong, with common equity tier one capital increasing to 14.6% and our tangible common equity1 ratio exceeding 10%."

Ms. Riel added, "I thank all of our employees for their hard work and their commitment to a culture of respect, diversity and inclusion in both the workplace and the communities we serve."

Fourth Quarter 2024 Highlights

•The Company announces today a common stock dividend of $0.165 per share.

•The ACL as a percentage of total loans was 1.44% at quarter-end; up from 1.40% at the prior quarter-end. Performing office coverage2 was 3.81% at quarter-end; as compared to 4.55% at the prior quarter-end.

•Nonperforming assets increased $74.3 million to $211.5 million as of December 31, 2024 and were 1.90% of total assets compared to 1.22% as of September 30, 2024. Inflows to non-performing loans in the quarter totaled $75.3 million offset by $1.0 million of outflows. The inflows were predominantly associated with the $74.9 million commercial real estate office loan mentioned earlier.

•Substandard loans increased $34.7 million to $426.0 million and special mention loans decreased $120.2 million to $244.8 million at December 31, 2024.

•Annualized quarterly net charge-offs for the fourth quarter were 0.48% compared to 0.26% for the third quarter 2024.

•The net interest margin ("NIM") decreased to 2.29% for the fourth quarter 2024, compared to 2.37% for the prior quarter, primarily due to an increase in the average mix of interest-bearing deposits at the Federal Reserve Bank in the fourth quarter versus the third quarter.

•At quarter-end, the common equity ratio, tangible common equity ratio1, and common equity tier 1 capital (to risk-weighted assets) ratio were 11.02%, 11.02%, and 14.63%, respectively.

•Total estimated insured deposits at quarter-end were $7.0 billion, or 76.4% of deposits, an increase from the third quarter total of 74.5% of deposits.

•Total on-balance sheet liquidity and available capacity was $4.6 billion at quarter-end consistent with September 30, 2024.

Income Statement

•Net interest income was $70.8 million for the fourth quarter 2024, compared to $71.8 million for the prior quarter. The decrease in net interest income was primarily driven by $965 thousand interest income not recognized on a loan that migrated to nonaccrual during the quarter. While interest income declined due to lower rates on loans, there was a similar decline in interest expense from a reduction in rates on non-maturity deposits and a reduction in borrowings.

1 A reconciliation of non-GAAP financial measures and the nearest GAAP measures is provided in the GAAP Reconciliation to Non-GAAP Financial Measure that accompany this document.

2 Calculated as the ACL attributable to loans collateralized by performing office properties as a percentage of total loans.

•Provision for credit losses was $12.1 million for the fourth quarter 2024, compared to $10.1 million for the prior quarter. The increase in the provision for the quarter is attributed predominately to a specific reserve established for the $74.9 million commercial real estate office loan mentioned earlier. Reserve for unfunded commitments was a reversal of $1.6 million due primarily to lower unfunded commitments in our construction portfolio. This compared to a reversal for unfunded commitments in the prior quarter of $1.6 million.

•Noninterest income was $4.1 million for the fourth quarter 2024, compared to $7.0 million for the prior quarter. The primary driver for the decrease was lower swap fee income.

•Noninterest expense was $44.5 million for the fourth quarter 2024, compared to $43.6 million for the prior quarter. The increase over the comparative quarters was primarily due to increased FDIC insurance expense.

Loans and Funding

•Total loans were $7.9 billion at December 31, 2024, down 0.4% from the prior quarter-end. The decrease in total loans was driven by a reduction in income producing commercial real estate loans from the prior quarter-end, partially offset by an increase in commercial and industrial loans and increased fundings of ongoing construction projects for commercial and residential properties.

At December 31, 2024, income-producing commercial real estate loans secured by office properties other than owner-occupied properties were 10.9% of the total loan portfolio, up from 10.8% at the prior quarter-end.

•Total deposits at quarter-end were $9.1 billion, up $590.2 million, or 6.9%, from the prior quarter-end. The increase was primarily attributable to an increase in interest-bearing transaction and savings and money market accounts. Period end deposits have increased $323.0 million when compared to prior year comparable period end of December 31, 2023.

•Other short-term borrowings were $0.5 billion at December 31, 2024, down 60.5% from the prior quarter-end as BTFP borrowings were paid off with increased cash from deposits.

Asset Quality

•Allowance for credit losses was 1.44% of total loans held for investment at December 31, 2024, compared to 1.40% at the prior quarter-end. Performing office coverage was 3.81% at quarter-end; as compared to 4.55% at the prior quarter-end.

•Net charge-offs were $9.5 million for the quarter compared to $5.3 million in the third quarter of 2024.

•Nonperforming assets were $211.5 million at December 31, 2024.

◦NPAs as a percentage of assets were 1.90% at December 31, 2024, compared to 1.22% at the prior quarter-end. At December 31, 2024, other real estate owned consisted of four properties with an aggregate carrying value of $2.7 million. The increase in NPAs was predominantly associated with the previously mentioned $74.9 million commercial real estate office loan moving to non-accrual.

◦Loans 30-89 days past due were $26.8 million at December 31, 2024, compared to $56.3 million at the prior quarter-end.

Capital

•Total shareholders' equity was $1.2 billion at December 31, 2024, up 0.1% from the prior quarter-end. The increase in shareholders' equity of $0.6 million was due to an increase in retained earnings offset by decreased valuations of available-for-sale securities.

•Book value per share and Tangible book value per share3 was $40.60 and $40.59, down 0.02% from the prior quarter-end.

Additional financial information: The financial information that follows provides more detail on the Company's financial performance for the three months ended December 31, 2024 as compared to the three months ended September 30, 2024 and December 31, 2023, as well as eight quarters of trend data. Persons wishing additional information should refer to the Company's Annual Report on Form 10-K for the year ended December 31, 2023, and other reports filed with the SEC.

About Eagle Bancorp: The Company is the holding company for EagleBank, which commenced operations in 1998. The Bank is headquartered in Bethesda, Maryland, and operates through twelve banking offices and four lending offices located in Suburban Maryland, Washington, D.C. and Northern Virginia. The Company focuses on building relationships with businesses, professionals and individuals in its marketplace, and is committed to a culture of respect, diversity, equity and inclusion in both its workplace and the communities in which it operates.

Conference call: Eagle Bancorp will host a conference call to discuss its fourth quarter 2024 financial results on Thursday, January 23, 2025 at 10:00 a.m. Eastern Time.

The listen-only webcast can be accessed at:

•https://edge.media-server.com/mmc/p/28kkw3ht/

•For analysts who wish to participate in the conference call, please register at the following URL:

https://register.vevent.com/register/BIa3ebdd33983543bebaf25330a2ac7c31

•A replay of the conference call will be available on the Company's website through Thursday, February 6, 2025: https://www.eaglebankcorp.com/

Forward-looking statements: This press release contains forward-looking statements within the meaning of the Securities Exchange Act of 1934, as amended, including statements of goals, intentions, and expectations as to future trends, plans, events or results of Company operations and policies and regarding general economic conditions. In some cases, forward-looking statements can be identified by use of words such as "may," "will," "can," "anticipates," "believes," "expects," "plans," "estimates," "potential," "continue," "should," "could," "strive," "feel" and similar words or phrases. These statements are based upon current and anticipated economic conditions, nationally and in the Company's market (including volatility in interest rates and interest rate policy; inflation levels; competitive factors) and other conditions (such as the impact of bank failures or adverse developments at other banks and related negative press about the banking industry in general on investor and depositor sentiment regarding the stability and liquidity of banks), which by their nature are not susceptible to accurate forecast and are subject to significant uncertainty. Because of these uncertainties and the assumptions on which this discussion and the forward-looking statements are based, actual future operations and results in the future may differ materially from those indicated herein. For details on factors that could affect these expectations, see the risk factors and other cautionary language included in the Company's Annual Report

3 A reconciliation of non-GAAP financial measures and the nearest GAAP measures is provided in the GAAP Reconciliation to Non-GAAP Financial Measure that accompany this document.

on Form 10-K for the year ended December 31, 2023 and in other periodic and current reports filed with the SEC. Readers are cautioned against placing undue reliance on any such forward-looking statements. The Company's past results are not necessarily indicative of future performance, and nothing contained herein is meant to or should be considered and treated as earnings guidance of future quarters' performance projections. All information is as of the date of this press release. Any forward-looking statements made by or on behalf of the Company speak only as to the date they are made. Except to the extent required by applicable law or regulation, the Company undertakes no obligation to revise or update publicly any forward-looking statement for any reason.

| | | | | | | | | | | | | | | | | | | | | |

Eagle Bancorp, Inc. |

Consolidated Statements of Operations (Unaudited) |

| (Dollars in thousands, except per share data) |

| | | | | | | | | |

| Three Months Ended | | |

| December 31, | | September 30, | | December 31, | | | | |

| 2024 | | 2024 | | 2023 | | | | |

| Interest Income | | | | | | | | | |

| Interest and fees on loans | $ | 132,943 | | | $ | 139,836 | | | $ | 135,964 | | | | | |

| Interest and dividends on investment securities | $ | 12,307 | | | $ | 12,578 | | | 13,142 | | | | | |

| Interest on balances with other banks and short-term investments | $ | 23,045 | | | $ | 21,296 | | | 18,230 | | | | | |

| Interest on federal funds sold | 122 | | | 103 | | | 85 | | | | | |

| Total interest income | $ | 168,417 | | | 173,813 | | | 167,421 | | | | | |

| Interest Expense | | | | | | | | | |

| Interest on deposits | $ | 83,002 | | | $ | 81,190 | | | 78,239 | | | | | |

| Interest on customer repurchase agreements | $ | 294 | | | $ | 332 | | | 272 | | | | | |

| Interest on other short-term borrowings | $ | 9,530 | | | $ | 20,448 | | | 15,918 | | | | | |

| Interest on long-term borrowings | $ | 4,797 | | | $ | — | | | — | | | | | |

| Total interest expense | $ | 97,623 | | | $ | 101,970 | | | 94,429 | | | | | |

| Net Interest Income | 70,794 | | | 71,843 | | | 72,992 | | | | | |

| Provision for Credit Losses | $ | 12,132 | | | $ | 10,094 | | | 14,490 | | | | | |

| Provision (Reversal) for Credit Losses for Unfunded Commitments | (1,598) | | | (1,593) | | | (594) | | | | | |

Net Interest Income After Provision for Credit Losses | 60,260 | | | 63,342 | | | 59,096 | | | | | |

| | | | | | | | | |

| Noninterest Income | | | | | | | | | |

| Service charges on deposits | $ | 1,744 | | | $ | 1,747 | | | 1,688 | | | | | |

Gain on sale of loans | $ | — | | | $ | 20 | | | 23 | | | | | |

Net gain on sale of investment securities | $ | 4 | | | $ | 3 | | | 3 | | | | | |

| Increase in cash surrender value of bank-owned life insurance | $ | 742 | | | $ | 731 | | | 687 | | | | | |

| Other income | $ | 1,577 | | | 4,450 | | | 493 | | | | | |

| Total noninterest income | 4,067 | | | 6,951 | | | 2,894 | | | | | |

| Noninterest Expense | | | | | | | | | |

| Salaries and employee benefits | $ | 22,597 | | | $ | 21,675 | | | 18,416 | | | | | |

| Premises and equipment expenses | $ | 2,635 | | | $ | 2,794 | | | 2,967 | | | | | |

| Marketing and advertising | $ | 1,340 | | | $ | 1,588 | | | 1,071 | | | | | |

| Data processing | $ | 3,870 | | | $ | 3,435 | | | 3,436 | | | | | |

| Legal, accounting and professional fees | $ | 641 | | | $ | 3,433 | | | 2,722 | | | | | |

| FDIC insurance | $ | 9,281 | | | $ | 7,399 | | | 4,444 | | | | | |

| Other expenses | $ | 4,168 | | | 3,290 | | | 4,042 | | | | | |

| Total noninterest expense | 44,532 | | | 43,614 | | | 37,098 | | | | | |

(Loss) Income Before Income Tax Expense | 19,795 | | | 26,679 | | | 24,892 | | | | | |

| Income Tax Expense | $ | 4,505 | | | $ | 4,864 | | | 4,667 | | | | | |

Net (Loss) Income | $ | 15,290 | | | $ | 21,815 | | | $ | 20,225 | | | | | |

| | | | | | | | | |

(Loss) Earnings Per Common Share | | | | | | | | | |

| Basic | $ | 0.51 | | | $ | 0.72 | | | $ | 0.68 | | | | | |

| Diluted | $ | 0.50 | | | $ | 0.72 | | | $ | 0.67 | | | | | |

| | | | | | | | | | | | | | | | | |

| Eagle Bancorp, Inc. |

| Consolidated Balance Sheets (Unaudited) |

| (Dollars in thousands, except per share data) |

| December 31, | | September 30, | | December 31, |

| 2024 | | 2024 | | 2023 |

Assets | | | | | |

| Cash and due from banks | $ | 11,882 | | | $ | 16,383 | | | $ | 9,047 | |

| Federal funds sold | 2,581 | | | 9,610 | | | 3,740 | |

| Interest-bearing deposits with banks and other short-term investments | 619,017 | | | 584,491 | | | 709,897 | |

Investment securities available-for-sale at fair value (amortized cost of $1,408,935, $1,550,038, and $1,668,316 respectively, and allowance for credit losses of $22, $17, and $17, respectively) | 1,267,404 | | | 1,433,006 | | | 1,506,388 | |

Investment securities held-to-maturity at amortized cost, net of allowance for credit losses of $1,306, $1,237, and $1,956 respectively (fair value of $820,381, $868,425, and $901,582 respectively) | 938,647 | | | 961,925 | | | 1,015,737 | |

| Federal Reserve and Federal Home Loan Bank stock | 51,763 | | | 37,728 | | | 25,748 | |

| | | | | |

| Loans | 7,934,888 | | | 7,970,269 | | | 7,968,695 | |

Less: allowance for credit losses | (114,390) | | | (111,867) | | | (85,940) | |

| Loans, net | 7,820,498 | | | 7,858,402 | | | 7,882,755 | |

| Premises and equipment, net | 7,694 | | | 8,291 | | | 10,189 | |

| Operating lease right-of-use assets | 18,494 | | | 15,167 | | | 19,129 | |

| Deferred income taxes | 91,472 | | | 74,381 | | | 86,620 | |

| Bank-owned life insurance | 115,806 | | | 115,064 | | | 112,921 | |

| Goodwill and intangible assets, net | 16 | | | 21 | | | 104,925 | |

| Other real estate owned | 2,743 | | | 2,743 | | | 1,108 | |

| Other assets | 181,491 | | | 167,840 | | | 176,334 | |

Total Assets | $ | 11,129,508 | | | $ | 11,285,052 | | | $ | 11,664,538 | |

| Liabilities and Shareholders' Equity | | | | | |

Liabilities | | | | | |

| Deposits: | | | | | |

Noninterest-bearing demand | $ | 1,544,403 | | | $ | 1,609,823 | | | $ | 2,279,081 | |

Interest-bearing transaction | 1,211,791 | | | 903,300 | | | 997,448 | |

| Savings and money market | 3,599,221 | | | 3,316,819 | | | 3,314,043 | |

| Time deposits | 2,775,663 | | | 2,710,908 | | | 2,217,467 | |

| Total deposits | 9,131,078 | | | 8,540,850 | | | 8,808,039 | |

| Customer repurchase agreements | 33,157 | | | 32,040 | | | 30,587 | |

| Other short-term borrowings | 490,000 | | | 1,240,000 | | | 1,369,918 | |

| Long-term borrowings | 76,108 | | | 75,812 | | | — | |

| Operating lease liabilities | 23,815 | | | 18,755 | | | 23,238 | |

| Reserve for unfunded commitments | 3,463 | | | 5,060 | | | 5,590 | |

| Other liabilities | 145,826 | | | 147,111 | | | 152,883 | |

Total Liabilities | 9,903,447 | | | 10,059,628 | | | 10,390,255 | |

| Shareholders' Equity | | | | | |

Common stock, par value $0.01 per share; shares authorized 100,000,000, shares issued and outstanding 30,202,003, 30,173,200, and 29,925,612 respectively | 298 | | | 298 | | | 296 | |

Additional paid-in capital | 384,932 | | | 382,284 | | | 374,888 | |

| Retained earnings | 982,304 | | | 967,019 | | | 1,061,456 | |

| Accumulated other comprehensive loss | (141,473) | | | (124,177) | | | (162,357) | |

| Total Shareholders' Equity | 1,226,061 | | | 1,225,424 | | | 1,274,283 | |

| Total Liabilities and Shareholders' Equity | $ | 11,129,508 | | | $ | 11,285,052 | | | $ | 11,664,538 | |

Loan Mix and Asset Quality

(Dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| December 31, | | September 30, | | December 31, |

| 2024 | | 2024 | | 2023 |

| Amount | % | | Amount | % | | Amount | % |

| Loan Balances - Period End: | | | | | | | | |

Commercial | $ | 1,183,341 | | 15 | % | | $ | 1,154,349 | | 14 | % | | $ | 1,473,766 | | 18 | % |

| PPP loans | 287 | | — | % | | 348 | | — | % | | 528 | | — | % |

Income producing - commercial real estate | 4,064,846 | | 51 | % | | 4,155,120 | | 52 | % | | 4,094,614 | | 51 | % |

Owner occupied - commercial real estate | 1,269,669 | | 16 | % | | 1,276,240 | | 16 | % | | 1,172,239 | | 15 | % |

Real estate mortgage - residential | 50,535 | | 1 | % | | 57,223 | | 1 | % | | 73,396 | | 1 | % |

| Construction - commercial and residential | 1,210,763 | | 15 | % | | 1,174,591 | | 15 | % | | 969,766 | | 12 | % |

| Construction - C&I (owner occupied) | 103,259 | | 1 | % | | 100,662 | | 1 | % | | 132,021 | | 2 | % |

| Home equity | 51,130 | | 1 | % | | 51,567 | | 1 | % | | 51,964 | | 1 | % |

| Other consumer | 1,058 | | — | % | | 169 | | — | % | | 401 | | — | % |

| Total loans | $ | 7,934,888 | | 100 | % | | $ | 7,970,269 | | 100 | % | | $ | 7,968,695 | | 100 | % |

| | | | | | | | | | | | | | | | | |

| Three Months Ended or As Of |

| December 31, | September 30, | December 31, |

| 2024 | 2024 | 2023 |

| Asset Quality: | | | | | |

| Nonperforming loans | $ | 208,707 | | | $ | 134,387 | | | $ | 65,524 | |

| Other real estate owned | 2,743 | | | 2,743 | | | 1,108 | |

| Nonperforming assets | $ | 211,450 | | | $ | 137,130 | | | $ | 66,632 | |

Net charge-offs | $ | 9,535 | | | $ | 5,303 | | | $ | 11,936 | |

| Special mention | $ | 244,807 | | | $ | 364,983 | | | $ | 204,971 | |

| Substandard | $ | 426,032 | | | $ | 391,301 | | | $ | 335,325 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Eagle Bancorp, Inc. |

| Consolidated Average Balances, Interest Yields And Rates vs. Prior Quarter (Unaudited) |

| (Dollars in thousands) |

| | | | | | | | | | | |

| Three Months Ended |

| December 31, 2024 | | September 30, 2024 |

| Average Balance | | Interest | | Average

Yield/Rate | | Average Balance | | Interest | | Average

Yield/Rate |

| ASSETS | | | | | | | | | | | |

| Interest earning assets: | | | | | | | | | | | |

Interest-bearing deposits with other banks and other short-term investments | $ | 1,948,436 | | | $ | 23,045 | | | 4.71 | % | | $ | 1,577,464 | | | $ | 21,296 | | | 5.37 | % |

Loans held for sale (1) | — | | | — | | | — | % | | 4,936 | | | 1 | | | 0.08 | % |

Loans (1) (2) | 7,971,907 | | | 132,943 | | | 6.63 | % | | 8,026,524 | | | 139,835 | | | 6.93 | % |

Investment securities available-for-sale (2) | 1,417,958 | | | 7,142 | | | 2.00 | % | | 1,479,598 | | | 7,336 | | | 1.97 | % |

Investment securities held-to-maturity (2) | 952,800 | | | 5,165 | | | 2.16 | % | | 974,366 | | | 5,242 | | | 2.14 | % |

| Federal funds sold | 12,839 | | | 122 | | | 3.78 | % | | 10,003 | | | 103 | | | 4.10 | % |

| Total interest earning assets | 12,303,940 | | | 168,417 | | | 5.45 | % | | 12,072,891 | | | 173,813 | | | 5.73 | % |

| Total noninterest earning assets | 386,014 | | | | | | | 397,006 | | | | | |

| Less: allowance for credit losses | (114,232) | | | | | | | (108,998) | | | | | |

| Total noninterest earning assets | 271,782 | | | | | | | 288,008 | | | | | |

| TOTAL ASSETS | $ | 12,575,722 | | | | | | | $ | 12,360,899 | | | | | |

| | | | | | | | | | | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | | | | | | |

| Interest bearing liabilities: | | | | | | | | | | | |

Interest-bearing transaction | $ | 1,674,997 | | | $ | 13,048 | | | 3.10 | % | | $ | 1,656,676 | | | $ | 14,596 | | | 3.51 | % |

| Savings and money market | 3,648,502 | | | 35,262 | | | 3.84 | % | | 3,254,128 | | | 34,896 | | | 4.27 | % |

| Time deposits | 2,804,870 | | | 34,692 | | | 4.92 | % | | 2,517,944 | | | 31,698 | | | 5.01 | % |

| Total interest bearing deposits | 8,128,369 | | | 83,002 | | | 4.06 | % | | 7,428,748 | | | 81,190 | | | 4.35 | % |

| Customer repurchase agreements | 38,750 | | | 294 | | | 3.02 | % | | 38,045 | | | 332 | | | 3.47 | % |

| Other short-term borrowings | 1,003,587 | | | 12,296 | | | 4.87 | % | | 1,615,867 | | | 20,448 | | | 5.03 | % |

| Long-term borrowings | 75,939 | | | 2,031 | | | 10.64 | % | | 824 | | | — | | | — | % |

| Total interest bearing liabilities | 9,246,645 | | | 97,623 | | | 4.20 | % | | 9,083,484 | | | 101,970 | | | 4.47 | % |

| Noninterest bearing liabilities: | | | | | | | | | | | |

| Noninterest bearing demand | 1,928,094 | | | | | | | 1,915,666 | | | | | |

| Other liabilities | 170,411 | | | | | | | 160,272 | | | | | |

| Total noninterest bearing liabilities | 2,098,505 | | | | | | | 2,075,938 | | | | | |

Shareholders' equity | 1,230,573 | | | | | | | 1,201,477 | | | | | |

| TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | $ | 12,575,723 | | | | | | | $ | 12,360,899 | | | | | |

| Net interest income | | | $ | 70,794 | | | | | | | $ | 71,843 | | | |

| Net interest spread | | | | | 1.25 | % | | | | | | 1.26 | % |

| Net interest margin | | | | | 2.29 | % | | | | | | 2.37 | % |

Cost of funds | | | | | 3.48 | % | | | | | | 3.69 | % |

(1)Loans placed on nonaccrual status are included in average balances. Net loan fees and late charges included in interest income on loans totaled $4.3 million and $3.9 million for the three months ended December 31, 2024 and September 30, 2024, respectively.

(2)Interest and fees on loans and investments exclude tax equivalent adjustments.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Eagle Bancorp, Inc. |

| Consolidated Average Balances, Interest Yields And Rates vs. Year Ago Quarter (Unaudited) |

| (Dollars in thousands) |

| | | | | | | | | | | |

| Three Months Ended December 31, |

| 2024 | | 2023 |

| Average Balance | | Interest | | Average

Yield/Rate | | Average Balance | | Interest | | Average

Yield/Rate |

| ASSETS | | | | | | | | | | | |

| Interest earning assets: | | | | | | | | | | | |

| Interest-bearing deposits with other banks and other short-term investments | $ | 1,948,436 | | | $ | 23,045 | | | 4.71 | % | | $ | 1,340,972 | | | $ | 18,230 | | | 5.39 | % |

| | | | | | | | | | | |

Loans (1) (2) | 7,971,907 | | | 132,943 | | | 6.63 | % | | 7,963,074 | | | 135,964 | | | 6.77 | % |

Investment securities available-for-sale (2) | 1,417,958 | | | 7,142 | | | 2.00 | % | | 1,498,132 | | | 7,611 | | | 2.02 | % |

Investment securities held-to-maturity (2) | 952,800 | | | 5,165 | | | 2.16 | % | | 1,027,230 | | | 5,531 | | | 2.14 | % |

| Federal funds sold | 12,839 | | | 122 | | | 3.78 | % | | 8,314 | | | 85 | | | 4.06 | % |

| Total interest earning assets | 12,303,940 | | | 168,417 | | | 5.45 | % | | 11,837,722 | | | 167,421 | | | 5.61 | % |

| Total noninterest earning assets | 386,014 | | | | | | | 530,364 | | | | | |

| Less: allowance for credit losses | (114,232) | | | | | | | (84,783) | | | | | |

| Total noninterest earning assets | 271,782 | | | | | | | 445,581 | | | | | |

| TOTAL ASSETS | $ | 12,575,722 | | | | | | | $ | 12,283,303 | | | | | |

| | | | | | | | | | | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | | | | | | |

| Interest bearing liabilities: | | | | | | | | | | | |

| Interest-bearing transaction | $ | 1,674,997 | | | $ | 13,048 | | | 3.10 | % | | $ | 1,843,617 | | | $ | 16,607 | | | 3.57 | % |

| Savings and money market | 3,648,502 | | | 35,262 | | | 3.84 | % | | 3,297,581 | | | 35,384 | | | 4.26 | % |

| Time deposits | 2,804,870 | | | 34,692 | | | 4.92 | % | | 2,164,038 | | | 26,248 | | | 4.81 | % |

| Total interest bearing deposits | 8,128,369 | | | 83,002 | | | 4.06 | % | | 7,305,236 | | | 78,239 | | | 4.25 | % |

| Customer repurchase agreements | 38,750 | | | 294 | | | 3.02 | % | | 31,290 | | | 272 | | | 3.45 | % |

| Other short-term borrowings | 1,003,587 | | | 12,296 | | | 4.87 | % | | 1,370,627 | | | 15,918 | | | 4.61 | % |

| Long-term borrowings | 75,939 | | | 2,031 | | | 10.64 | % | | — | | | — | | | — | % |

| Total interest bearing liabilities | 9,246,645 | | | 97,623 | | | 4.20 | % | | 8,707,153 | | | 94,429 | | | 4.30 | % |

| Noninterest bearing liabilities: | | | | | | | | | | | |

| Noninterest bearing demand | 1,928,094 | | | | | | | 2,166,133 | | | | | |

| Other liabilities | 170,411 | | | | | | | 171,254 | | | | | |

| Total noninterest bearing liabilities | 2,098,505 | | | | | | | 2,337,387 | | | | | |

| Shareholders' equity | 1,230,573 | | | | | | | 1,238,763 | | | | | |

| TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | $ | 12,575,723 | | | | | | | $ | 12,283,303 | | | | | |

| Net interest income | | | $ | 70,794 | | | | | | | $ | 72,992 | | | |

| Net interest spread | | | | | 1.25 | % | | | | | | 1.31 | % |

| Net interest margin | | | | | 2.29 | % | | | | | | 2.45 | % |

| Cost of funds | | | | | 3.48 | % | | | | | | 3.45 | % |

(1)Loans placed on nonaccrual status are included in average balances. Net loan fees and late charges included in interest income on loans totaled $4.3 million and $4.7 million for the three months ended December 31, 2024 and 2023, respectively.

(2)Interest and fees on loans and investments exclude tax equivalent adjustments.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Eagle Bancorp, Inc. |

Statements of Operations and Highlights Quarterly Trends (Unaudited) |

| (Dollars in thousands, except per share data) |

| | | | | | | | | | | | | | | |

| Three Months Ended |

| December 31, | | September 30, | | June 30, | | March 31, | | December 31, | | September 30, | | June 30, | | March 31, |

| Income Statements: | 2024 | | 2024 | | 2024 | | 2024 | | 2023 | | 2023 | | 2023 | | 2023 |

| Total interest income | $ | 168,417 | | | $ | 173,813 | | | $ | 169,731 | | | $ | 175,602 | | | $ | 167,421 | | | $ | 161,149 | | | $ | 156,510 | | | $ | 140,247 | |

| Total interest expense | 97,623 | | | 101,970 | | | 98,378 | | | 100,904 | | | 94,429 | | | 90,430 | | | 84,699 | | | 65,223 | |

| Net interest income | 70,794 | | | 71,843 | | | 71,353 | | | 74,698 | | | 72,992 | | | 70,719 | | | 71,811 | | | 75,024 | |

| Provision (reversal) for credit losses | 12,132 | | | 10,094 | | | 8,959 | | | 35,175 | | | 14,490 | | | 5,644 | | | 5,238 | | | 6,164 | |

| Provision (reversal) for credit losses for unfunded commitments | (1,598) | | | (1,593) | | | 608 | | | 456 | | | (594) | | | (839) | | | 318 | | | 848 | |

Net interest income after provision for (reversal of) credit losses | 60,260 | | | 63,342 | | | 61,786 | | | 39,067 | | | 59,096 | | | 65,914 | | | 66,255 | | | 68,012 | |

| Noninterest income before investment gain | 4,063 | | | 6,948 | | | 5,329 | | | 3,585 | | | 2,891 | | | 6,342 | | | 8,593 | | | 3,721 | |

| Net gain (loss) on sale of investment securities | 4 | | | 3 | | | 3 | | | 4 | | | 3 | | | 5 | | | 2 | | | (21) | |

| Total noninterest income | 4,067 | | | 6,951 | | | 5,332 | | | 3,589 | | | 2,894 | | | 6,347 | | | 8,595 | | | 3,700 | |

| Salaries and employee benefits | 22,597 | | | 21,675 | | | 21,770 | | | 21,726 | | | 18,416 | | | 21,549 | | | 21,957 | | | 24,174 | |

Premises and equipment expenses | 2,635 | | | 2,794 | | | 2,894 | | | 3,059 | | | 2,967 | | | 3,095 | | | 3,227 | | | 3,317 | |

| Marketing and advertising | 1,340 | | | 1,588 | | | 1,662 | | | 859 | | | 1,071 | | | 768 | | | 884 | | | 636 | |

Goodwill impairment | — | | | — | | | 104,168 | | | — | | | — | | | — | | | — | | | — | |

| Other expenses | 17,960 | | | 17,557 | | | 15,997 | | | 14,353 | | | 14,644 | | | 12,221 | | | 11,910 | | | 12,457 | |

| Total noninterest expense | 44,532 | | | 43,614 | | | 146,491 | | | 39,997 | | | 37,098 | | | 37,633 | | | 37,978 | | | 40,584 | |

(Loss) income before income tax expense | 19,795 | | | 26,679 | | | (79,373) | | | 2,659 | | | 24,892 | | | 34,628 | | | 36,872 | | | 31,128 | |

| Income tax expense | 4,505 | | | 4,864 | | | 4,429 | | | 2,997 | | | 4,667 | | | 7,245 | | | 8,180 | | | 6,894 | |

Net (loss) income | $ | 15,290 | | | $ | 21,815 | | | $ | (83,802) | | | $ | (338) | | | $ | 20,225 | | | $ | 27,383 | | | $ | 28,692 | | | $ | 24,234 | |

| Per Share Data: | | | | | | | | | | | | | | | |

(Loss) earnings per weighted average common share, basic | $ | 0.51 | | | $ | 0.72 | | | $ | (2.78) | | | $ | (0.01) | | | $ | 0.68 | | | $ | 0.91 | | | $ | 0.94 | | | $ | 0.78 | |

(Loss) earnings per weighted average common share, diluted | $ | 0.50 | | | $ | 0.72 | | | $ | (2.78) | | | $ | (0.01) | | | $ | 0.67 | | | $ | 0.91 | | | $ | 0.94 | | | $ | 0.78 | |

| Weighted average common shares outstanding, basic | 30,199,433 | | | 30,173,852 | | | 30,185,609 | | | 30,068,173 | | | 29,925,557 | | | 29,910,218 | | | 30,454,766 | | | 31,109,267 | |

| Weighted average common shares outstanding, diluted | 30,321,644 | | | 30,241,699 | | | 30,185,609 | | | 30,068,173 | | | 29,966,962 | | | 29,944,692 | | | 30,505,468 | | | 31,180,346 | |

| Actual shares outstanding at period end | 30,202,003 | | | 30,173,200 | | | 30,180,482 | | | 30,185,732 | | | 29,925,612 | | | 29,917,982 | | | 29,912,082 | | | 31,111,647 | |

| Book value per common share at period end | $ | 40.60 | | | $ | 40.61 | | | $ | 38.75 | | | $ | 41.72 | | | $ | 42.58 | | | $ | 40.64 | | | $ | 40.78 | | | $ | 39.92 | |

Tangible book value per common share at period end (1) | $ | 40.59 | | | $ | 40.61 | | | $ | 38.74 | | | $ | 38.26 | | | $ | 39.08 | | | $ | 37.12 | | | $ | 37.29 | | | $ | 36.57 | |

Dividend per common share(2) | $ | — | | | $ | 0.17 | | | $ | 0.45 | | | $ | 0.45 | | | $ | 0.45 | | | $ | 0.45 | | | $ | 0.45 | | | $ | 0.45 | |

| Performance Ratios (annualized): | | | | | | | | | | | | | | | |

| Return on average assets | 0.48 | % | | 0.70 | % | | (2.73) | % | | (0.01) | % | | 0.65 | % | | 0.91 | % | | 0.96 | % | | 0.86 | % |

| Return on average common equity | 4.94 | % | | 7.22 | % | | (26.67) | % | | (0.11) | % | | 6.48 | % | | 8.80 | % | | 9.24 | % | | 7.92 | % |

Return on average tangible common equity (1) | 4.94 | % | | 7.22 | % | | (28.96) | % | | (0.11) | % | | 7.08 | % | | 9.61 | % | | 10.08 | % | | 8.65 | % |

| Net interest margin | 2.29 | % | | 2.37 | % | | 2.40 | % | | 2.43 | % | | 2.45 | % | | 2.43 | % | | 2.49 | % | | 2.77 | % |

Efficiency ratio (1)(3) | 59.50 | % | | 55.40 | % | | 191.00 | % | | 51.10 | % | | 48.90 | % | | 48.83 | % | | 47.20 | % | | 51.60 | % |

| Other Ratios: | | | | | | | | | | | | | | | |

Allowance for credit losses to total loans (4) | 1.44 | % | | 1.40 | % | | 1.33 | % | | 1.25 | % | | 1.08 | % | | 1.05 | % | | 1.00 | % | | 1.01 | % |

| Allowance for credit losses to total nonperforming loans | 54.81 | % | | 83.25 | % | | 110.06 | % | | 108.76 | % | | 131.16 | % | | 118.78 | % | | 267.50 | % | | 1,160.00 | % |

| | | | | | | | | | | | | | | |

Nonperforming assets to total assets | 1.90 | % | | 1.22 | % | | 0.88 | % | | 0.79 | % | | 0.57 | % | | 0.64 | % | | 0.28 | % | | 0.08 | % |

Net charge-offs (recoveries) (annualized) to average total loans (4) | 0.48 | % | | 0.26 | % | | 0.11 | % | | 1.07 | % | | 0.60 | % | | 0.02 | % | | 0.29 | % | | 0.05 | % |

| Tier 1 capital (to average assets) | 10.74 | % | | 10.77 | % | | 10.58 | % | | 10.26 | % | | 10.73 | % | | 10.96 | % | | 10.84 | % | | 11.42 | % |

| Total capital (to risk weighted assets) | 15.86 | % | | 15.51 | % | | 15.07 | % | | 14.87 | % | | 14.79 | % | | 14.54 | % | | 14.51 | % | | 14.74 | % |

| Common equity tier 1 capital (to risk weighted assets) | 14.63 | % | | 14.30 | % | | 13.92 | % | | 13.80 | % | | 13.90 | % | | 13.68 | % | | 13.55 | % | | 13.75 | % |

Tangible common equity ratio (1) | 11.02 | % | | 10.86 | % | | 10.35 | % | | 10.03 | % | | 10.12 | % | | 10.04 | % | | 10.21 | % | | 10.36 | % |

| Average Balances (in thousands): | | | | | | | | | | | | | | | |

| Total assets | $ | 12,575,722 | | $ | 12,360,899 | | $ | 12,361,500 | | $ | 12,784,470 | | $ | 12,283,303 | | $ | 11,942,905 | | $ | 11,960,111 | | $ | 11,426,056 |

| Total earning assets | $ | 12,303,940 | | $ | 12,072,891 | | $ | 11,953,446 | | $ | 12,365,497 | | $ | 11,837,722 | | $ | 11,532,186 | | $ | 11,546,050 | | $ | 11,004,817 |

Total loans (3) | $ | 7,971,907 | | $ | 8,026,524 | | $ | 8,003,206 | | $ | 7,988,941 | | $ | 7,963,074 | | $ | 7,795,144 | | $ | 7,790,555 | | $ | 7,712,023 |

| Total deposits | $ | 10,056,463 | | $ | 9,344,414 | | $ | 9,225,266 | | $ | 9,501,661 | | $ | 9,471,369 | | $ | 8,946,641 | | $ | 8,514,938 | | $ | 8,734,125 |

| Total borrowings | $ | 1,118,276 | | $ | 1,654,736 | | $ | 1,721,283 | | $ | 1,832,947 | | $ | 1,401,917 | | $ | 1,646,179 | | $ | 2,102,507 | | $ | 1,359,463 |

Total shareholders' equity | $ | 1,230,573 | | $ | 1,201,477 | | $ | 1,263,627 | | $ | 1,289,656 | | $ | 1,238,763 | | $ | 1,235,162 | | $ | 1,245,647 | | $ | 1,240,978 |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

(1)A reconciliation of non-GAAP financial measures to the nearest GAAP measure is provided in the tables that accompany this document.

(2)As previously announced, the Company altered the timing of quarterly dividend announcement to better align with its earnings releases. Therefore, no dividends were accrued for Q4 2024 as the announcement date is January 22, 2025.

(3)Computed by dividing noninterest expense by the sum of net interest income and noninterest income.

(4)Excludes loans held for sale.

| | | | | | | | | | | | | | | | | |

GAAP Reconciliation to Non-GAAP Financial Measures (unaudited) |

| (dollars in thousands, except per share data) |

| | | | | |

| December 31, | September 30, | December 31, |

| 2024 | 2024 | 2023 |

| Tangible common equity | | | | | |

Common shareholders' equity | $ | 1,226,061 | | | $ | 1,225,424 | | | $ | 1,274,283 | |

Less: Intangible assets | (16) | | | (21) | | | (104,925) | |

Tangible common equity | $ | 1,226,045 | | | $ | 1,225,403 | | | $ | 1,169,358 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Tangible common equity ratio | | | | | |

Total assets | $ | 11,129,508 | | | $ | 11,285,052 | | | $ | 11,664,538 | |

Less: Intangible assets | (16) | | | (21) | | | (104,925) | |

Tangible assets | $ | 11,129,492 | | | $ | 11,285,031 | | | $ | 11,559,613 | |

| | | | | |

Tangible common equity ratio | 11.02 | % | | 10.86 | % | | 10.12 | % |

| | | | | |

| Per share calculations | | | | | |

Book value per common share | 40.60 | | 40.61 | | 42.58 |

Less: Intangible book value per common share | $ | (0.01) | | | $ | — | | | $ | (3.50) | |

Tangible book value per common share | $ | 40.59 | | | $ | 40.61 | | | $ | 39.08 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Shares outstanding at period end | 30,202,003 | | | 30,173,200 | | | 29,925,612 | |

| | | | | | | | | | | | | | | | | | | | |

|

|

| | | | | | |

| | Three Months Ended |

| | December 31, | September 30, | December 31, |

| | 2024 | 2024 | 2023 |

| Average tangible common equity | | | | | | |

Average common shareholders' equity | | $ | 1,230,573 | | $ | 1,201,477 | | $ | 1,238,763 |

Less: Average intangible assets | | (19) | | (24) | | (105,032) |

Average tangible common equity | | $ | 1,230,554 | | | $ | 1,201,453 | | | $ | 1,133,731 | |

| | | | | | |

Return on average tangible common equity | | | | | | |

Net (loss) income | | $ | 15,290 | | $ | 21,815 | | $ | 20,225 |

Return on average tangible common equity | | 4.94% | | 7.22% | | 7.08% |

| | | | | | |

Efficiency ratio | | | | | | |

Net interest income | | $ | 70,794 | | $ | 71,843 | | $ | 72,992 |

Noninterest income | | 4,067 | | 6,951 | | 2,894 |

Operating revenue | | $ | 74,861 | | | $ | 78,794 | | | $ | 75,886 | |

Noninterest expense | | $ | 44,532 | | $ | 43,614 | | $ | 37,098 |

| | | | | | |

Efficiency ratio | | 59.49 | % | | 55.35 | % | | 48.89 | % |

| | | | | | |

Pre-provision net revenue | | | | | | |

Net interest income | | $ | 70,794 | | | $ | 71,843 | | | $ | 72,992 | |

Noninterest income | | 4,067 | | | 6,951 | | | 2,894 | |

Less: Noninterest expense | | (44,532) | | | (43,614) | | | (37,098) | |

| Pre-provision net revenue | | $ | 30,329 | | | $ | 35,180 | | | $ | 38,788 | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Tangible common equity, tangible common equity to tangible assets (the "tangible common equity ratio"), tangible book value per common share, average tangible common equity, annualized return on average tangible common equity are non-GAAP financial measures derived from GAAP based amounts. The Company calculates the tangible common equity ratio by excluding the balance of intangible assets from common shareholders' equity, or tangible common equity, and dividing by tangible assets. The Company calculates tangible book value per common share by dividing tangible common equity by common shares outstanding, as compared to book value per common share, which the Company calculates by dividing common shareholders' equity by common shares outstanding. The Company calculates the annualized return on average tangible common equity ratio by dividing net income available to common shareholders by average tangible common equity, which is calculated by excluding the average balance of intangible assets from the average common shareholders' equity. Further related to other measures, tangible equity is a measure that is consistent with the calculation of capital for bank regulatory purposes, which excludes intangible assets from the calculation of risk based ratios, and as such is useful for investors, regulators, management and others to evaluate capital adequacy and to compare against other financial institutions.

The efficiency ratio is a non-GAAP measure calculated by dividing GAAP noninterest expense by the sum of GAAP net interest income and GAAP noninterest income. The efficiency ratio measures a bank's overhead as a percentage of its revenue. The Company believes that reporting the non-GAAP efficiency ratio more closely measures its effectiveness of controlling operational activities.

Pre-provision net revenue is a non-GAAP financial measure calculated by subtracting noninterest expenses from the sum of net interest income and noninterest income. The Company considers this information important to shareholders because it illustrates revenue excluding the impact of provisions and reversals to the allowance for credit losses on loans.

4th Quarter 2024 Earnings Presentation EagleBankCorp.com January 22, 2025 Scan for digital version

Forward Looking Statements 2 This presentation contains forward looking statements within the meaning of the Securities and Exchange Act of 1934, as amended, including statements of goals, intentions, and expectations as to future trends, plans, events or results of Company operations and policies and regarding general economic conditions. In some cases, forward-looking statements can be identified by use of words such as “may,” “will,” “anticipates,” “believes,” “expects,” “plans,” “estimates,” “potential,” “continue,” “should,” and similar words or phrases. These statements are based upon current and anticipated economic conditions, nationally and in the Company’s market, interest rates and interest rate policy, competitive factors and other conditions which by their nature, are not susceptible to accurate forecast and are subject to significant uncertainty. For details on factors that could affect these expectations, see the risk factors and other cautionary language included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, and other periodic and current reports filed with the SEC. Because of these uncertainties and the assumptions on which this discussion and the forward-looking statements are based, actual future operations and results in the future may differ materially from those indicated herein. Readers are cautioned against placing undue reliance on any such forward-looking statements. The Company’s past results are not necessarily indicative of future performance. The Company does not undertake to publicly revise or update forward-looking statements in this presentation to reflect events or circumstances that arise after the date of this presentation, except as may be required under applicable law. This presentation was delivered digitally. The Company makes no representation that subsequent to delivery of the presentation it was not altered. For more information about the Company, please refer to www.eaglebankcorp.com and go to the Investor Relations tab. For further information on the Company please contact: Eric Newell P 240-497-1796 E enewell@eaglebankcorp.com

Attractive Washington DC Footprint 3 One-of-a-kind Market The Washington DC area represents a strong and stable economy bolstered by Federal government spending and related jobs insulating the region from the severity of potential economic downturns. Our market includes world-class centers of education, a robust private sector, including increasing technology innovation, and tourism. Attractive Demographics Eagle’s footprint represents some of the best demographics in the country. Household income in our markets is well above the national average and all Mid-Atlantic states. Advantageous Competitive Landscape Eagle is one of the largest banks headquartered in the Washington DC metro area and ranked 3rd by deposits in the DC MSA for banks with less than $100 billion in assets. 1 - Source: FDIC Deposit Market Share Reports - Summary of Deposits

Eagle at a Glance 4 Total Assets $11.1 billion Total Loans $7.9 billion Total Deposits $9.1 billion Tangible Common Equity $1. 2 billion Shares Outstanding (at close December 31, 2024) 30,202,003 Market Capitalization (at close January 21, 2024) $758 million Tangible Book Value per Common Share $40.59 Institutional Ownership 75% Member of Russell 2000 yes Member of S&P SmallCap 600 yes Note: Financial data as of December 31, 2024 unless otherwise noted. 1 - Equity was $1.2 billion and book value was $40.60 per share. Please refer to the Non-GAAP reconciliation in the appendix. 2 - Based on January 21, 2024 closing price of $25.10 per share and December 31, 2024 shares outstanding. 1 1 2

5 NOTE: Data at or for the quarter ended December 31, 2024 1 - Please refer to the Non-GAAP reconciliation in the appendix. 2 - Includes cash and cash equivalents. • Best-in-Class Capital Levels o CET1 Ratio = 14.63% Top quartile of all bank holding companies with $10 billion in assets or more o TCE / TA¹ = 11.02% o ACL / Gross Loans = 1.44% and ACL / Performing Office Loans = 3.81% • Long-term Strategy to Improve Operating Pre-Provision, Net Revenue (“PPNR”) Across All Interest Rate Environments o Continue the growth and diversification of deposits designed to improve funding profile • Strong Operating Efficiency o Our cost structure is designed to minimize inefficiencies, while allowing us to invest in growth and important control functions such as risk management and compliance. o Branch-light, efficient operator. o Top quartile Efficiency Ratio. Operating Efficiency Ratio¹ = 59.5% o Operating Noninterest Expense / Average Assets¹ = 1.41% • Strong Liquidity and Funding Position o Liquidity risk management is central to our strategy. • At 6.9%, Eagle has one of the highest liquid assets to total deposits ratio relative to peers², and total on-balance sheet liquidity and available borrowing capacity was $4.6 billion at quarter-end. o Uninsured deposits only represent 24% of total deposits, having a weighted average relationship with EagleBank of over 8 years. • Capitalizing on Our Desirable Geography o Proximity to the federal government and prime contractors offers a stable and financially strong customer base. o The DMV has a robust and diverse economy including education, healthcare, technology, and defense sectors. o Access to a population with high household incomes, leading to more significant deposit base. Eagle is an Attractive Investment Opportunity

1.29% 1.28% 1.24% 1.24% 1.22% 1.07% 0.96% 0.94% 0.89% 0.77% 0.75% 0.70% 0.70% 0.48% 0.46% 0.45% 0.39% 0.39% Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 Peer 12 Peer 13 EGBN Peer 14 Peer 15 Peer 16 Peer 17 ROAA Improving Return on Average Assets • Grow and deepen relationship deposits with a focus on franchise enhancement; allowing for reduction of high-cost wholesale and non-core funding • Maintain pricing discipline on loan originations to promote revenue growth • Continue operating efficiency focus and seek out opportunities for positive operating leverage Strategies to Improve Profitability 6 Peers are those used in the proxy for the May 2024 annual meeting. Proxy Peers are AUB, BHLB, BRKL, BUSE, CNOB, CVBF, DCOM, FFIC, IBTX, INDB, OCFC, PFS, SASR, TMP, UBSI, VBTX, WSFS and data is as of September 30, 2024. EGBN is as of December 31, 2024. Source: S&P Capital IQ Pro and company filings. Grow & Diversify C&I team expansion creating platform to accelerate acquisition and deepening of profitable relationships and expand deposit base Ongoing evaluation of strategies to reduce CRE concentration Increasing fee income through cross selling and higher penetration of deposit products Market positioning and resource investment focus that evolve community and customer perceptions of EagleBank towards being a full- service commercial bank Deposits & Funding Building sales behaviors with Treasury sales to deepen deposit relationships to grow fee income Utilize current and past successes to seek out deposit rich sectors and enhance and/or communicate value propositions Leverage existing branch network to drive customer acquisition Operational Excellence Continue investments that enhance operational capabilities and human talent as we strengthen the efficiency and scalability of our platform; all with an eye for maintaining an exceptional client and employee experience Driving effective expense management contributing to the overall strategy of achieving positive operating leverage

Eagle – Capital Levels vs. Peers 7 1-Please refer to the Non-GAAP reconciliation and footnotes in the appendices. Peers are those used in the proxy for the May 2024 annual meeting. Proxy Peers are AUB, BHLB, BRKL, BUSE, CNOB, CVBF, DCOM, FFIC, IBTX, INDB, OCFC, PFS, SASR, TMP, UBSI, VBTX, WSFS and data is as of September 30, 2024 (if available). EGBN is as of December 31, 2024. Source: S&P Capital IQ Pro and company filings. Strong Capital • Capital ratios are high relative to peers • Excess CET1 (over 9%) plus reserves provides a superior level of coverage when measured against our peers 15.8% 14.6% 14.6% 13.8% 13.8% 13.6% 12.2% 11.9% 11.3% 11.3% 11.1% 10.9% 10.4% 10.2% 10.2% 10.0% 9.8% 9.8% Peer 1 EGBN Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 Peer 12 Peer 13 Peer 14 Peer 15 Peer 16 Peer 17 CET1 Ratio 11.0% 11.0% 10.9% 10.7% 9.7% 9.3% 9.1% 9.1% 8.9% 8.8% 8.5% 8.4% 8.1% 8.0% 7.9% 7.9% 7.7% 7.0% EGBN Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 Peer 12 Peer 13 Peer 14 Peer 15 Peer 16 Peer 17 Tangible Common Equity / Tangible Assets1 9.5% 8.1% 7.1% 6.7% 6.5% 6.5% 4.3% 4.2% 3.5% 3.4% 3.2% 3.0% 2.7% 2.2% 1.9% 1.9% 1.7% 1.7% Peer 1 EGBN Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 Peer 12 Peer 13 Peer 14 Peer 15 Peer 16 Peer 17 Excess CET1 + ACL / Total Loans

31.9% 28.8% 24.9% 21.6% 17.2% 16.2% 16.2% 15.4% 12.9% 11.9% 10.0% 8.4% 5.6% 5.5% 4.7% 2.7% 2.1% 2.0% Peer 1 Peer 2 Peer 3 Peer EGBN Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 Peer 12 Peer 13 Peer 14 Peer 15 Peer 16 Peer 17 Cash Equivalents + AFS Securities / Total Deposits 10.0% 8.4% 8.0% 6.9% 6.4% 6.0% 6.0% 5.6% 5.5% 4.7% 4.0% 3.5% 3.3% 2.7% 2.6% 2.1% 2.0% 1.3% Peer 1 Peer 2 Peer 3 EGBN Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 Peer 12 Peer 13 Peer 14 Peer 15 Peer 16 Peer 17 Cash Equivalents / Total Deposits Eagle – Liquidity Position vs. Peers 8 Peers are those used in the proxy for the May 2024 annual meeting. Proxy Peers are AUB, BHLB, BRKL, BUSE, CNOB, CVBF, DCOM, FFIC, IBTX, INDB, OCFC, PFS, SASR, TMP, UBSI, VBTX, WSFS and data is as of September 30, 2024 (if available). EGBN is as of 12/.31/2024. Source: S&P Capital IQ Pro and company filings. Available Liquidity Cash and cash equivalents are high relative to peers. Cash equivalents combined with AFS securities provides a high level of coverage when measured against our peers. 72% 74% 76% 28% 26% 24% $8,267 $8,541 $9,131 6/30/2024 9/30/2024 12/31/2024 ($ in m ill io n s) Insured Deposit Exposure Trend Insured Uninsured

0.65% -0.01% 0.66% 0.70% 0.48% 2023Q4 2024Q1 2024Q2 2024Q3 2024Q4 Operating Return on Average Assets1 48.9% 51.1% 55.2% 55.4% 59.5% 2023Q4 2024Q1 2024Q2 2024Q3 2024Q4 Operating Efficiency Ratio1 Performance Measures 9 1-Please refer to the Non-GAAP reconciliation and footnotes in the appendices. Operating Return on Average Assets are annualized. For the periods above, return on average common equity 6.48% (2023Q4) , (0.11)% (2024Q1), (26.60)% (2024Q2), 7.22% (2024Q3), and 4.94% (2024Q4); return on average assets was 0.65% (2023Q4), -0.01% (2024Q1), -2.73% (2024Q2), 0.70% (2024Q3), and 0.48% (2024Q4), common equity to assets was 10.92% (2023Q4) 10.85% (2024Q1) 10.35% (2024Q2), 10.86% (2024Q3), and 11.02% (2024Q4); and efficiency ratio was 48.8% (2023Q3), 48.9% (2023Q4), 51.1% (2024Q1), 191.0% (2024Q2), 55.4% (2024Q3), and 59.5% (2024Q4). 10.12% 10.03% 10.35% 10.86% 11.02% 2023Q4 2024Q1 2024Q2 2024Q3 2024Q4 Tangible Common Equity/Tangible Assets1 7.08% -0.11% 7.04% 7.22% 4.94% 2023Q4 2024Q1 2024Q2 2024Q3 2024Q4 Operating Return on Average Tangible Common Equity1

Net Interest Income 10 NII Decrease and NIM Decline Net Interest Income • Interest income decreased $5.4 million quarter over quarter due to lower yields from lower short- term interest rates. • Interest expense decreased $4.3 million due to lower costs from lower short-term interest rates and a reduction in borrowings. • Net interest income decreased $1 million quarter over quarter. Margin • The net interest margin ("NIM") decreased to 2.29% for the fourth quarter 2024, compared to 2.37% for the prior quarter, primarily due to an increase in the average mix of interest-bearing deposits at the Federal Reserve Bank in the fourth quarter versus the third quarter. • Management expects cash flows from the investment portfolio of $386 million in 2025 to be reinvested at higher yields. $73.0 $74.7 $71.4 $71.8 $70.8 2.45% 2.43% 2.40% 2.37% 2.29% -1.00% 1.00% 3.00% 5.00% 7.00% 9.00% $- $20.0 $40.0 $60.0 $80.0 $100.0 2023Q4 2024Q1 2024Q2 2024Q3 2024Q4 (i n m ill io n s ) Net Interest Income & Margin Net Interest Income NIM

Net Income – Summary 11 Net Income Drivers Net interest income Net interest income down $1 million, primarily driven by $965 thousand interest income not recognized on a loan that migrated to nonaccrual during the quarter. While interest income declined due to lower rates on loans, there was a similar decline in interest expense from a reduction in rates on non-maturity deposits and a reduction in borrowings. Provision for Credit Losses (“PCL”) The increased provision for the quarter is primarily due to a specific reserve established for a $74.9 million commercial real estate office loan. Previously classified as special mention, the loan was moved to non-accrual status following a new appraisal. Reserve for unfunded commitments was a reversal of $1.6 million due primarily to lower unfunded commitments in our construction portfolio. This compared to a reversal for unfunded commitments in the prior quarter of $1.6 million. Noninterest income Noninterest income down $2.9 million primarily due to lower swap fee income. Noninterest expense Noninterest expense increased $0.9 million associated with increased FDIC insurance expense.

2025 Outlook 12 1 – The forecasted increase is based off 2024 figures for the same measure Other Notes: 2025 Outlook represents forward-looking statements and are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Please see “Forward Looking Statements” on page 2. Current 2025 Outlook1Prior 2025 Outlook4Q 2024 ActualKey Drivers Balance Sheet 1-4% increase1-4% increase$10,056 millionAverage deposits 2-5% increase1-4% increase$7,972 millionAverage loans FlatFlat$12,304 millionAverage earning assets Income Statement 2.50% - 2.75%2.40% - 2.60%2.29%Net interest margin Flat3-6% growth$4.1 millionNoninterest income 3-5% growth2-4% growth$44.5 millionNoninterest expense 21-23%21-23%22.8%Period effective tax rate

Outlook Variables & Risks 13 Notes: Outlook 2025Y represents forward-looking statements and are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Please see “Forward Looking Statements” on page 2. Variables & RisksComponent • Business activity highly correlated to current and anticipated forward ratesEconomy & Rates • Credit quality and need for credit coupled with a potential recessionClients • Ability to obtain deposit funding in a cost-effective manner • High funding costs directly impacts the competitiveness of our loan offerings Funding • Competition for loans in the market remains high with competition from non- bank lenders • Pricing (rate) and overall cost of acquiring deposits Competition • Growth in loans and deposits must remain flexibleOpportunities • Dynamic political environment and potential for new policies could impact banks Regulation/Politics To reach our 2025 outlook, we made many assumptions of variables and risks, including:

3.28% 3.36% 3.35% 3.40% 3.28% 4.61% 4.75% 5.07% 5.03% 5.28% 4.30% 4.37% 4.45% 4.47% 4.20% 2023Q4 2024Q1 2024Q2 2024Q3 2024Q4 Cost Analysis Total Deposit Cost Borrowings Total IBL Cost Deposit Mix and Trend 14 Total Period End Deposits increased $323 million Year-over-Year CDs Savings & money market Interest bearing transaction Noninterest bearing

Funding & Liquidity 15 Funding & Liquidity Summary Deposits Period end deposits were up $590 million for the quarter, attributable to an increase in interest- bearing transaction and savings and money market accounts. The long-term strategy for deposits is to increase core deposits and reduce reliance on wholesale funding. Borrowings Other short-term borrowings were $0.5 billion at December 31, 2024, down 60.5% from the prior quarter-end as BTFP borrowings were paid off with increased cash from deposits. Ample Access to Liquidity Available liquidity from the FHLB, FRB Discount Window, cash and unencumbered securities is over $4.6 billion. 1 - Includes interest-bearing deposits with banks, cash and due from, and federal funds sold 86.3% 83.3% 83.0% 86.4% 93.8% 13.7% 16.7% 17.0% 13.6% 6.2% $10,209 $10,208 $9,967 $9,889 $9,730 2023Q4 2024Q1 2024Q2 2024Q3 2024Q4 in m ill io n s Deposits & Borrowings Deposits Borrowings (includes customer repos)

5,393 4,133 2023Q4 2024Q1 2024Q2 2024Q3 2024Q4 141% 127% 105% 90% 86% 74% 63% 61% 58% 53% 51% 37% 30% 28% Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 EGBN Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 Peer 12 Peer 13 Excess CET1+ACL/ Non-Owner Occupied Office Loans 16 As of December 31, 2024 Note: Proxy Peers are AUB, BHLB, BRKL, BUSE, CNOB, CVBF, DCOM, FFIC, IBTX, INDB, OCFC, PFS, SASR, TMP, UBSI, VBTX, WSFS and data is as of September 30, 2024 (if available). Peer data only shown if CRE Income Producing Office was disclosed. EGBN is as of December 31, 2024. Source: S&P Capital IQ Pro and company filings. 1 - Class Type is determined based on the latest appraisal designation. Higher Risk Rating (9000) Lower Risk Rating (1000) Office (% of Total Inc Prod CRE) 21% Non-Office 79% Office (Weighted Risk Rating) Non-Office (Weighted Risk Rating) Mix and Risk Rating Trend of Total Income Producing CRE The vast majority of our Inc Prod CRE is Non-Office and with risk ratings that have largely remained unchanged. Office Loan Portfolio Detail Inc Producing Office Holdings Declined $85 million Year-over-Year

17 1 - DSCR is calculated based on contractual principal and interest payments and only considers cash flow from primary sources of repayment. 2 – Includes one $56.2M Pass-rated office loan with a tenant (international law firm) commenced lease payments in January 2025. Commentary • Performing Office ACL coverage = 3.81% • Non-office CRE exhibiting limited internal risk rating migration • 74% of office portfolio maturities are beyond year-end 2025 • Limited exposure to Class B central business district office Office Loan Portfolio: Income Producing Detail

18 1 - DSCR is calculated based on contractual principal and interest payments and only considers cash flow from primary sources of repayment. Multifamily Loan Portfolio: Income Producing Detail

Loan Mix and Trend 19 Commercial Owner-Occupied CRE Construction – comm& residential. Home Equity Other Consumer Construction C&I (owner-occupied) Office Income producing CRE (excluding office if applicable)

$336 $362 $408 $391 $426 $207 $265 $308 $365 $245 $543 $627 $716 $756 $671 2023Q4 2024Q1 2024Q2 2024Q3 2024Q4 (i n m ill io n s) Substandard Special mention % of loans 20 Loan Type and Classification 1-Includes land. Quarter-over-Quarter Change Special Mention • C&I +$19.4 million • CRE -$139.5 million • 100% of special mention loans were current as 12/31/24 Substandard • C&I -$21.9 million • CRE +$56.9 million • 46% of substandard loans were current at 12/31/24 Classified and Criticized Loans 82%86%85%88% 69% % performing 6.81% 7.86% 8.95% 9.49% 8.46%

0.60% 1.07% 0.11% 0.26% 0.48% 2023Q4 2024Q1 2024Q2 2024Q3 2024Q4 NCO / Average Loans1 1.08% 1.25% 1.33% 1.40% 1.44% 2023Q4 2024Q1 2024Q2 2024Q3 2024Q4 Allowance for Credit Losses/ Loans HFI $14,490 $35,175 $8,959 $10,094 $12,132 2023Q4 2024Q1 2024Q2 2024Q3 2024Q4 (i n t h o u s a n d s ) Provision for Credit Losses Asset Quality Metrics 21 1-Excludes loans held for sale. 2-Non-performing assets (“NPAs”) include loans 90 days past due and still accruing. Charts for Allowance for Credit Losses and NPAs are as of period end. Net Charge Offs (“NCO”) are annualized for periods of less than a year. 0.57% 0.79% 0.88% 1.22% 1.90% 2023Q4 2024Q1 2024Q2 2024Q3 2024Q4 NPAs2 / Assets

Appendices 22

23 Nonaccrual Loans • How do loans end up on nonaccrual status? o Appraisal: For collateral dependent loans, new appraisals received as the loan approaches maturity below loan amount. Loans charged-down to 100% of new appraisal less estimated selling costs. Such loans could be receiving full P&I payments. o Payment default. • Loans 1, 2, 4, 5 were placed on nonaccrual status based on current appraisal received, not from payment default, marked at 90% of the current appraised value. Note: Data as of December 31, 2024

24 Summary of Classified and Criticized Loans 1 – When cash collateral is considered, latest LTV is 90% 2 – Loan collateral is a project that is either recently completed and in lease up, not yet stabilized, under development, or in process of conversion

25 Top 25 Loans 1 – Mixed collateral commercial real estate 2 – Construction in process 3 – When cash collateral is considered, latest LTV is 90% Note: Data as of December 31, 2024

Total CRE Office Loan Portfolio (Excludes OOCRE & OO Construction) 26 4 Office Loans with Substandard Risk Ratings are on Nonaccrual for a total balance of $139.7 million out of Total NPAs of $211.5 million. 1 – Loan risk grade categories: 1000 – Prime, 2000 – Excellent (“Excel.”), 3000 – Good, 4000 – Acceptable (“Accept.”), 5000 – Acceptable with Risk (“AwR”), 6000 – Watch, 7000 – Other Assets Especially Mentioned (O.A.E.M.), 8000 – Substandard, 9000 – Doubtful, 9999 - Loss

Washington DC Office (Income Producing CRE & Construction) 27 • $224.2 Million Total Outstanding Balance o 11 Income Producing CRE = $220.6 million o 1 Income Producing Construction CRE loan = $3.6 million o 12 Total Washington DC Office Loans Median size = $12.6 million Average size = $18.7 million • 10 Loans Risk Rated Pass = $157.1 Million • 2 Loans with Adverse Risk Ratings o Risk Rated Special Mention = $39.9 million (Special mention loan #2 as discussed on page 24) o Risk Rated Substandard = $27.3 million (Nonaccrual loan #2 as discussed on page 23) o Both Income Producing CRE • 4 Loans in the Central Business District with $130.8 Million in Total Outstanding Balances o $56.2 million Risk Rated = Pass (Top 25 loan #16 as discussed on page 25) International law firm HQ’d in NYC signed long-term lease for >50% of square footage o $34.1 million Risk Rated = Pass o $27.3 million Risk Rated = Substandard (Nonaccrual loan #2 as above and on page 23) o $13.2 million Risk Rated = Pass

Multifamily Loan Portfolio 28 • Zero Multifamily Loans on Nonaccrual Status • 93 Total Multifamily Loans • $1.8 Billion in Outstanding Balances with Multifamily as Collateral o Median size = $7.5 million o Average size = $19.8 million • 87 Loans with $1.7 Billion in Balances with Average Risk Rating = Pass • 3 Substandard Loans with $29.6 Million in Total Outstanding Balances o $13.8 million (Apt Building in DC with Retail/Commercial space) (Substandard Loan #11 as discussed on page 24) o $8.4 million (Apt Building in DC – Bridge Loan) o $7.4 million (Apt Building in DC with appraisal on January 2, 2024 and 55% LTV) • 3 Special Mention Loan with $52.3 Million Outstanding o $26.8 million (139-unit Apt building in DC completed in 2017) (Special Mention Loan #3 as discussed on page 24) o $20.6 million (Apt Building in DC – Bridge Loan) (Special Mention Loan #4 as discussed on page 24) o $4.9 million (New construction of 20 condo unit building in Washington DC) Note: These amounts are inclusive of Income Producing ($818.7mm), Construction ($597.8mm), Mixed Use ($418.1mm), and Commercial ($2.2mm) Multi-Family loans

Underwriting, Credit Management and Risk Mitigation 29 • History of Resiliency through Credit Cycles • Strong Underwriting and Portfolio Management Functions • Internal Annual Review on a Loan-by-Loan Basis • Quarterly Portfolio Stress Testing and Covenant Monitoring • Quarterly Independent 3rd Party Loan Reviews • Deposit Account Monitoring – Real Time Assessment of Operations • Office Task Force: o Cover maturing loans 18 months in advance of maturity o Early identification/intervention of potential problems • Solutions Based Approach in Working with Customers on Challenging Credits to Allow Borrower Opportunity to Retain Property and to Minimize Risk/Loss to the Bank o Cashflow Sweep to Eagle Controlled Escrows Through Maturity o Principal Paydowns in Return for Extension Opportunities on Maturing Loans • Stable Local Economy: o Federal Government, Major Universities, Biotech (NIH, Ft Dietrick- 270 Corridor), Amazon HQ2, Government Contracting, and Highly Educated, Affluent Population o Washington Metropolitan Area historically experiences an economic boost in presidential election years

Credit Quality Since 1998 30

CRE Construction Portfolio 31 • $1.13 Billion Total Outstanding Balance: o 75 CRE Ground Up Construction $1,012.2 million o 18 CRE Renovation $116.8 million o 7 Consumer Construction $ 6.3 million o 100 Total Construction Loans Median size = $2.1 million Average size = $10.1 million • 97 Loans Risk Rated Pass • 3 Loans with Adverse Risk Ratings o Substandard = $5.7 million (New construction of 24 condo unit building in Washington DC) o Special Mention = $4.9 million (New construction of 20 condo unit building in Washington DC) o Substandard = $4.9 million (New construction of 24 condo unit building in Washington DC) Note: Loan metrics not inclusive of deferrals, fees and other adjustments.

Hotel Loan Portfolio 32 • Zero Hotel Loans on Nonaccrual Status • $416.3 Million in Outstanding Balances with Hotels as Collateral (Includes Construction CRE) o Median size = $11.0 million o Average size = $18.9 million • 22 Loans with Average Risk Rating = Pass • 0 Criticized Loans

Investment Portfolio 33 Investment Portfolio Strategy • Portfolio positioned to manage liquidity and pledging needs • Cash flow projected principal only (rates unchanged): o 2025 - $386 million • Total securities down $164 million from 9/30/2024 from principal paydowns, maturities received. • Unencumbered securities of $1.28 billion available for pledging. Note: Chart is as of period end on an amortized cost basis. AFS / HTM as of December 31, 2024

Tangible Book Value Per Share 34 Per share data is as of period end. Please refer to Non-GAAP reconciliation and footnotes in the appendices

Loan Portfolio - Details 35 Note: Loan metrics not inclusive of deferrals, fees and other adjustments. Data as of September 30, 2024.

Loan Portfolio – Income Producing CRE 36 Note: Loan metrics not inclusive of deferrals, fees and other adjustments. Data as of December 31, 2024.

Loan Portfolio – CRE Construction 37 Note: Loan metrics not inclusive of deferrals, fees and other adjustments. Data as of December 31, 2024

38 Non-GAAP Reconciliation (unaudited)

39 Non-GAAP Reconciliation (unaudited)

40 Non-GAAP Reconciliation (unaudited)