UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K/A

(Amendment No. 1)

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of: October 2024

Commission file number: 001-36578

ENLIVEX THERAPEUTICS LTD.

(Translation of registrant’s name into English)

14 Einstein Street, Nes Ziona, Israel 7403618

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Explanatory

Note

Enlivex

Therapeutics Ltd., a company organized under the laws of the State of Israel (the “Company”), is filing this Amendment

No. 1 on Form 6-K/A (this “Amendment”) to amend its Report on Form 6-K furnished to the U.S. Securities and Exchange

Commission on September 11, 2024 (the “Original Report”), announcing the Company’s Annual General Meeting of

Shareholders (the “Annual Meeting”) to be held on Thursday, October 31, 2024, at 7:00 p.m. (Israel time) at the offices

of the Company at 14 Einstein Street, Ness Ziona, Israel. This Amendment is being furnished solely for the purpose of furnishing a copy

of the Amended and Restated Compensation Policy for Company Office Holders (the “Policy”) as Appendix A to the Proxy

Statement for the Annual Meeting attached as Exhibit 99.1 to the Original Report, which was inadvertently not previously attached as an

appendix to such Proxy Statement. A copy of the Policy is furnished as Exhibit 99.1 to this Amendment and incorporated herein by reference.

Other

than as expressly set forth above, this Amendment does not, and does not purport to, amend, restate, or update the information contained

in the Original Report, or reflect any events that have occurred after the Original Report was filed.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Enlivex Therapeutics Ltd. |

| |

(Registrant) |

| |

|

| |

By: |

/s/ Oren Hershkovitz |

| |

Name: |

Oren Hershkovitz |

| |

Title: |

Chief Executive Officer |

Date: October 14, 2024

2

Exhibit 99.1

Enlivex Therapeutics Ltd.

(the “Company”)

Amended and Restated Compensation Policy for

Company Office Holders

| 1. |

The Objective of the Document |

The objective of this compensation policy

(the “Policy”) is to define and describe the Company’s Office Holder compensation policy as required by the Israeli

Companies Law – 1999 the “Companies Law”).

It is emphasized that this Policy does

not grant rights to the Company’s Office Holders, and the adoption of this Policy in itself does not grant the right to any Office

Holder of the Company to receive any of the compensation components described herein. It is the Company’s policy to approve the

appointment of all executives who are subject to this Policy by the Company’s Board of Directors. In addition, the compensation

amounts and components that an Office Holder will be entitled to receive will be only those that are specifically approved for the Office

Holder by the Company’s authorized bodies, and subject to the provisions of any applicable law.

If an Office Holder receives compensation

that is less than the compensation contemplated in this Policy, such compensation shall not be considered as a deviation or exception

from this Policy, and shall not require the approval of the Company’s shareholders’ meeting that would otherwise be required

for approving terms of service and employment that deviate from this Policy.

Enlivex Therapeutics Ltd. is a publicly

traded clinical stage macrophage reprogramming immunotherapy company for immune system rebalancing.

In order to remain competitive in the

international markets, the Company must be able to attract and retain Israeli and international top-level talented professionals with

the unique and necessary skills set. Therefore, and in light of the Company’s status as an Israeli company with a global footprint,

it aims to adopt compensation policies and procedures that match those of global companies of similar complexity, while complying with

applicable local laws and customs, and treating our Office Holders fairly and consistently on a global basis and providing them with competitive

compensation packages.

This Policy will apply to compensation

approved after the date of its adoption.

The masculine form is used in this policy

for convenience purposes only and it refers to both women and men equally.

Unless otherwise defined, capitalized

terms used herein shall have the meanings ascribed to them in this Paragraph 2.

“Advance Notice Period”

– the period of time following notice of termination of employment or services agreement, after which termination will become

effective.

“Equity-Based Compensation”

– options, restricted shares, restricted stock units and any other equity-based payments settled with the Company’s shares.

“Fixed Component”

– payments in respect to employment or services that are provided, that do not depend on variables that are unknown at the time

that the payment is determined. This component includes salary, pension, severance pay, annual paid vacation, loss-of-work-capacity insurance,

employer National Insurance contributions, signing bonus and tax gross-ups.

“Office Holder” –

as defined in the Companies Law, as may be amended from time to time, and as to the adoption date of this Policy, refers to – Directors

(including the Chairman of the Board1), Chief Executive Officer (the “CEO”), Deputy General Manager, Chief

Officers, any person performing such function in the Company even if under a different title and managers directly subordinate to the

CEO.

| 1 |

For the avoidance of doubt, including executive chairman, if applicable. |

“Salary Cost”

or “Management Fees” – With respect to each Office Holder, the Company’s cost of engagement with

regards to the Fixed Component, including Related Benefits, as set forth in Section 8.3, including any tax or other deductions

required of the Company in connection with the engagement, and excluding accounting provisions in respect of past commitments and

VAT (where applicable), all on a monthly basis.

“Senior Staff”

– those performing management functions directly subordinate to the CEO.

“Severance Grants” –

payment or any other benefit awarded to an Office Holder in connection with termination of his position at the Company. These payments

are on top of any severance payments required by applicable law.

“Variable Component”

– payments that depend on variables that are unknown at the time that the payment is determined. This component includes annual

bonus, special cash incentives, options and other Equity-Based Compensation that may be performance and/ or time based.

Pursuant to the Companies Law, this

Policy will be brought to the approval of our shareholders and upon approval by the shareholders of the Company, shall serve as our Compensation

Policy for the three years period commencing as of its adoption by our shareholders, unless amended earlier.

The Company’s Compensation Committee

(the “Compensation Committee”) shall periodically review this Policy and monitor its implementation, and recommend

to the Board of Directors to amend this Policy, as it may deem necessary from time to time.

| 4. |

The Objective of the Compensation Policy |

The purpose of this Policy is to serve

as an instrument in the hands of the Company’s Board of Directors and management to advance the goals and work plans of the Company,

including with a view for the long term, by:

| |

4.1 |

Creating a reasonable and appropriate set of incentives for the Company’s Office Holders while taking into consideration, inter alia, the Company’s characteristics, business activity, risk management policy and work relations. |

| |

4.2 |

Providing the tools necessary for recruiting, motivating and retaining talented and skilled Office Holders in the Company, who will be able to contribute to the Company and maximize its profits. |

| |

4.3 |

Putting an emphasis on performance-based compensation, and tying the Office Holders to the Company and its performance, by matching the Office Holders’ compensation to their contribution to the Company. |

| |

4.4 |

Creating a proper balance between the various compensation components (such as Fixed Component versus Variable Component and short-term versus long-term). |

The combination of the various compensation

components described in this document is intended to create a balance and an appropriate ratio between fixed compensation and variable

compensation so as to create a performance-based compensation system that promotes the Company’s goals and corresponds with its

risk management policy.

| 5. |

Parameters for Examining the Compensation Terms |

Presented hereunder are the parameters

that will be considered by the Company when examining the compensation terms of the Company’s Office Holders (among others):

| |

5.1 |

The Office Holder’s education, skills, expertise, professional experience and achievements. |

| |

5.2 |

The Office Holder’s position and level of responsibility and previous employment or services agreements. |

| |

5.3 |

The Office Holder’s contribution to the Company’s performance, profits and stability. |

| |

5.4 |

The level of responsibility borne by the Office Holder due to his position in the Company. |

| |

5.5 |

The need of the Company to retain the Office Holder in view of the Office Holder’s special skills, knowledge and/or expertise. |

| |

5.6 |

The ratio between the Fixed Components and the Variable Components of such compensation terms and its compatibility with this Policy. The total amount of annual bonus and Equity-Based Compensation of each of the Executive Chairman, CEO and Senior Staff shall not exceed 97% of his total compensation on an annual basis. |

| 6. |

Ratio between the Office Holders’ Compensation and Compensation of other Company Employees |

When determining the compensation terms

of the Company’s Office Holders, one of the aspects that will be examined is the ratio between the terms of service of each one

of the Company’s Office Holders and the average and median cost of employment of the Company’s employees (including contract

workers) and such ratio’s effect on work relations in the Company, all as further detailed in the Companies Law. In the course of

preparing this Policy, the Compensation Committee and Board of Directors examined the ratio between the total compensation of Office Holders

that derives from the adoption of this Policy and the average and median cost of employment of the Company’s employees. The Compensation

Committee and Board of Directors determined that these ratios are reasonable and are not expected to have a negative effect on work relations

in the Company.

| 7. |

The Compensation Terms – General |

| |

7.1 |

The compensation terms proposed to an Office Holder of the Company will be determined with reference to the existing compensation terms of other Company Office Holders and may take into consideration the compensation terms for Office Holders in similar positions in comparable companies (operating in a similar industry, with similar financial performance and market capitalization). |

| |

7.2 |

The Company will be permitted to grant the Office Holders (all or part) a compensation plan that includes a salary and related benefits, commissions (for Office Holders filling certain positions), a cash award (bonus) and/or Equity-Based Compensation. |

| |

7.3 |

Furthermore, the Company may provide arrangements for the termination of work relations, which will take into account accepted industry practice and the Company’s customary practices as further detailed in Paragraph 8 below. |

| |

7.4 |

Regarding compensation paid to Office Holders in New Israeli Shekels, the USD:ILS conversion rate would be calculated on a monthly basis. |

| |

7.5 |

For the avoidance of doubt, in the event that an Office Holder serves in more than one position overseen under this Policy, the higher compensation cap shall serve as the Office Holder maximum compensation. |

| |

8.1.1 |

The Salary Cost / Management Fees constitutes fixed compensation the purpose of which is to compensate the Office Holder for performing his position in the Company and for performing the ongoing duties required by his job. |

| |

8.1.2 |

The Salary Cost / Management Fees of the Office Holder will be determined in the negotiation regarding his engagement with the Company, according to the parameters detailed in Paragraphs 5 and 6 above, and may take into consideration the existing salary terms of other Company Office Holders, as well as reference to accepted salary terms in the market and industry for Office Holders holding similar positions in comparable companies. |

| |

8.1.3 |

The maximum Salary Costs are detailed below based on a full-time position (100%) assumption. The maximum Salary Cost of the CEO or Senior Staff who is a part time employee of the Company, will be adjusted taking into consideration such partial position and its effects. |

| |

8.2 |

Base Salary or Management Fees |

Chairman of the Board

| |

8.2.1 |

The monthly cash fee of the Chairman of the Board of Directors shall not exceed US$25,000 for a non-Executive Chairman and shall not exceed US$75,000 for an Executive Chairman of the Board (the “Executive Chairman”). |

The Company’s CEO

| |

8.2.2 |

The monthly base salary or management fee of the CEO shall not exceed US$50,000. |

Senior Staff

| |

8.2.3 |

The monthly base salary or management fee of each Senior Staff shall not exceed US$40,000. |

Changes in the salary terms of the Office

Holders mentioned above will be made pursuant to the requirements of applicable law.

Subject to applicable law, an immaterial

change, or aggregate changes, in the terms of office and engagement of Senior Staff may be approved by the CEO, provided that the amended

terms are in accordance with this Policy and such change, or such aggregate changes, do not exceed an amount equal to 10% of the annual

compensation of such Senior Staff (as compared to the terms of office and engagement approved by the Compensation Committee and Board

of Directors).

The Chairman of the Board, CEO and Senior

Staff will each be entitled to certain benefits (“Related Benefits”), including social benefits as provided under applicable

law. In addition, their salary package can include additional benefits, such as use of a car (including grossing up the related tax),

an annual paid vacation that is longer than that prescribed in applicable law, phone and communication devices and/or costs, health insurance,

holiday and special occasion gifts, reimbursement of business and travel expenses, reimbursement of relocation and related expenses, subscriptions

to professional literature, academic and professional studies etc. These benefits will be as determined by the Company on the date of

the approval of the employment or services agreement, and may be examined from time to time and be adjusted by the Compensation Committee

subject to such applicable law.

The Chairman of the Board, CEO and Senior

Staff may each be eligible, in connection with their appointment, to receive a sign-on bonus, which shall not exceed the average of such

sign-on bonuses for comparable public companies, as documented by a compensation consultant, subject to a vesting period (i.e. working

period) of at least 3 years, as will be determined by the Company’s governing bodies, in accordance applicable law.

| 9. |

Advance Notice and Severance Terms |

| |

9.1.1 |

The Advance Notice Period for termination of employment or services of Senior Staff will be determined on an individual basis for the CEO and each Senior Staff member, with reference to the parameters detailed in Paragraph 5 above, the Advance Notice Periods prescribed in the agreements of other Office Holders and the Advance Notice Periods accepted in the market and industry for Office Holders in similar positions. |

| |

9.1.2 |

With respect to the CEO or Senior Staff who on the date of the approval of this Policy has a personal employment or services agreements already in effect, which contains a defined Advance Notice Period, there will be no change in this period as provided in their respective employment or services agreements. |

| |

9.1.3 |

In any event, the Advance Notice Period of the CEO and each Senior Staff is limited to up to 12 months. |

| |

9.2.1 |

The Company’s Board of Directors will be permitted to approve compensation terms which include award of Severance Grants as indicated hereunder, in addition to the requirements of any applicable law. |

| |

9.2.2 |

The entitlement to a Severance Grant of the Chairman of the Board, CEO and Senior Staff, shall not exceed 12 monthly salaries or fees (as applicable) plus any guaranteed bonuses (on a Salary Cost / Management Fees basis), respectively. When the Board of Directors decides on a Severance Grant, it will take into account the following considerations: period of employment, terms of employment, Company and Office Holder performance during that period, contribution by the Office Holder to the Company to achieve its goals and earn profits, and the circumstances of the end of employment. The Board of Directors may also take into account additional considerations, including (without limitation) the Office Holder’s agreement not to solicit Company employees, customer and suppliers and/or not to compete with the Company for a defined period of time post-employment or service. |

| |

9.2.3 |

The Severance Grants will be decided by the Company’s governing bodies, subject to the provisions of any applicable law. |

| 10. |

The Variable Component |

| |

10.1 |

Equity-Based Compensation |

| |

10.1.1 |

The Company reserves the right to grant Equity-Based Compensation to Office Holders, according to the equity compensation plans that were and will be adopted from time to time and subject to any applicable law. |

| |

10.1.2 |

The Company’s Office Holders who are Israeli citizens may be granted Equity-Based Compensation in accordance with the requirements of Section 102 of the Israeli Income Tax Ordinance, 1961, as may be amended from time to time. |

| |

10.1.3 |

The annual economic value of the Equity-Based Compensation will be calculated by dividing the fair value of the benefit (based on financial models used for financial reporting purposes) at the grant* date by the number of years until the vesting of the last tranche (linear division) (the “Annual Economic Value”). Determination of the Annual Economic Value of Equity-Based Compensation shall be made disregarding any equity-based compensation previously granted. |

| |

● |

Maximum Annual Economic Value of Equity-Based Compensation: |

| Chairman |

Executive Chairman |

CEO |

Senior Staff |

Directors |

| 100% of the annual Salary Cost/Management Fees and not more than 1% of the Company’s fully diluted share capital. |

200% of the annual Salary Cost/Management Fees and not more than 3% of the Company’s fully diluted share capital. |

100% of the annual Salary Cost/Management Fees and not more than 2% of the Company’s fully diluted share capital. |

75% of the annual Salary Cost/Management Fees and not more than 1% of the Company’s fully diluted share capital. |

Annual Economic Value of US$200,000 |

| * |

For the purpose of calculating the Annual Economic Value –the value will be calculated as of the date of the Board of Director’s decision to approve the grant; however, in the case of Equity-Based Compensation payable in cash – the value will be calculated as at the actual payment date. |

For the avoidance of doubt, it is clarified

that the Equity-Based Compensation ceiling is in addition to the annual bonus ceiling as set forth below.

| |

10.1.4 |

The vesting

schedule of any Equity-Based Compensation shall be determined by the Compensation Committee and Board of Directors (and the shareholders

to the extent prescribed by the Companies Law) and shall be between one (1) and four (4) years (for example: in the event of a vesting

schedule of four (4) years, at the conclusion of each year during the four year period, 25% of the Equity-Based Compensation award shall

vest. The exercise price of any award (if applicable) shall not be less than 75% of the average closing price of the Company’s

shares for 30 trading days prior to the date of the grant (i.e., the date of the Board of Director’s approval to grant the Equity-Based

Compensation). |

| |

10.1.5 |

The Company has the right to define other specific performance terms (other than service period) in relation to the Equity-Based Compensation for each Office Holder, including specific performance-based vesting conditions (without defining specific service period). |

| |

10.1.6 |

Additional terms including eligibility for accelerated vesting and/or the extension of the exercise period of Equity-Based Compensation awards, including upon termination of employment or service or pre-defined events, such as merger and acquisition (“M&A”) or change of control events, adjustments for cash dividends, stock split, etc., will be consistent with the definitions of the equity-based compensation plans that were or will be adopted by the Company, with reference to the accepted terms in the market of such plans. |

| |

10.2.1 |

Performance

Bonuses - The Chairman of the Board of Directors, CEO, Senior Staff may be eligible for performance bonuses and bonuses linked

to corporate milestones, subject to the provisions of any applicable law. |

| |

10.2.2 |

Bonuses linked to corporate milestones - The Board of Directors and the Compensation Committee are authorized to determine, at the beginning of each calendar year, the parameters on which any Office Holder’s performance bonus shall be based, from the list of parameters detailed below. In addition, the Compensation Committee and the Board of Directors is authorized to determine that part of the bonus shall be based on discretion rather than measurable parameters, as follows: (a) for the CEO – the part of the bonus based on discretion shall not exceed 3 salaries; (b) for the Chairman of the Board of Directors – if any part of the bonus is based on discretion, it shall require the approval of the shareholders; (c) for Senior Staff – all components of the bonus may be based on discretion. |

| |

10.2.3 |

With respect to Office Holders (other than directors) who are subordinate to the CEO, the Board of Directors and the Compensation Committee may delegate to the CEO the authority to determine the measurable parameters, from the list of parameters set forth in Section 10.2.4. |

| |

10.2.4 |

Subject to Section 10.2.3., the parameters and the weight of each parameter will be established and approved by the Compensation Committee and the Board of Directors at the beginning of each calendar year, and may include parameters from the following list: |

| |

● |

The submission of a regulatory filing, obtaining regulatory clearance, initiation or completion of clinical trials or completion of certain milestones within a clinical trial. |

| |

● |

The signing of a term sheet or definitive agreement for a development or commercial deal, the completion of certain milestones within such a deal or the consummation of such a deal |

| |

● |

The approval to market a new product |

| |

● |

The commencement of a revenue stream |

| |

● |

The completion of budget or cash flow targets |

| |

● |

The execution of projects or meeting business development goals or economic or strategic measures |

| |

● |

Fund raising or grant targets and M&A events |

| |

● |

The Company’s stock performance, such as price and trading volumes or number of analysts covering the stock |

| |

● |

Completion of the sale of corporate assets or achievement of certain milestones related thereto |

| |

● |

The execution of corporate governance and regulatory requirements |

The weight of each parameter should

not exceed 50% of the total grant.

In special circumstances, as determined

by the Compensation Committee and the Board of Directors (e.g., regulatory changes, significant changes in the Company’s business

environment, a significant organizational change, a significant M&A event, etc.), the Compensation Committee and Board of Directors

may modify the parameters and/or their relative weights during the fiscal year.

| |

10.2.5 |

Bonus Cap and Special Bonus: The total yearly performance cash bonus targets for the Executive Chairman of the Board of Directors, CEO and Senior Staff shall not exceed an amount equal to 100% of their respective annual salaries (before taxes)/director fees for the same year in which the bonus is paid. In addition, the CEO, Executive Chairman of the Board of Directors and Senior Staff may be eligible to receive, at the discretion of the Compensation Committee and Board (subject to shareholder approval, if required in accordance with applicable law), a special discretionary bonus during the calendar year, which shall not exceed an amount equal to 100% of their respective annual salary/fee, plus the performance cash bonus target amount for the same year in which the special discretionary bonus is paid. |

| |

10.2.6 |

Eligibility for Bonus: Eligibility for a yearly bonus shall be awarded proportionately to the term of office for that Office Holder in that year. Therefore, an Office Holder who started working for the Company during a calendar year and who is entitled to an annual bonus, shall be entitled to receive a proportionate share of such annual bonus (according to the number of months actually worked during the year for which the bonus was paid). |

| |

10.2.7 |

If the performance bonus or part thereof is paid

on the basis of data found to be incorrect that was restated in the Company’s financial statements published in a subsequent three-year

period from the date of publication of the financial report on the basis of which the bonus was paid – the Office Holder will be

required to repay the Company for any amount paid based on that same incorrect information.

Nothing in this Section 10.2.7 shall derogate

from any other “claw-back” or similar provision(s) or requirement(s) regarding the recovery of erroneously awarded incentive

compensation imposed on an Office Holder by virtue of applicable laws, listing requirements and/or any other document, including, without

limitation, the Company’s Executive Officer Clawback Policy (as may be amended from time to time), in each case, provided and to

the extent that any such provision or requirement does not conflict with Israeli law. |

The Compensation Committee and Board of Directors of the Company shall

be permitted, per its discretion, to reduce the bonus amount an Office Holder is entitled to.

| 11. |

Non-Executive Directors’ Cash Remuneration (Other than the Company’s Chairman of the Board) |

Should the Company

remunerate non-executive directors (other than the Company’s Chairman or Executive Chairman of the Board) in cash, sums will be

paid up to the “fixed amount” set forth in the Israeli Companies Regulations (Rules Concerning Remuneration and Expenses for

an External Director) – 2000 for companies in the applicable “shareholder equity” range.

| 12. |

Release, Indemnification and Insurance of Office Holders |

| |

12.1 |

Insurance of Office Holders |

Office Holders will be covered by a directors’

and officers’ liability insurance policy that will be maintained by the Company. The terms of such policy shall provide for coverage

of up to US$125,000,000 (per claim and in the aggregate). Such insurance coverage may include directors’ and officers’ liability

insurance with respect to specific events, such as public offerings, or with respect to periods of time following which the then existing

insurance coverage ceases to apply, such as, by way of example only, “run-off” coverage following a termination of service

or employment, termination of the insurance policy or in other circumstances). The authority to approve the procurement, extension or

renewal of any such insurance policies shall be held by the Compensation Committee (and, if required by law, by the Board of Directors),

which shall determine that the terms of the policy are consistent with the above, and that they are consistent with current market conditions

and will not materially affect the Company’s profits, assets or liabilities.

| |

12.2 |

Release and Indemnification Letters to Office Holders |

The Company may release and indemnify

Officer Holders to the fullest extent permitted by applicable law and the Company’s Articles of Association, according to release

and indemnification letters provided to Office Holders according to the version approved from time to time by the authorized bodies of

the Company.

*********************

9

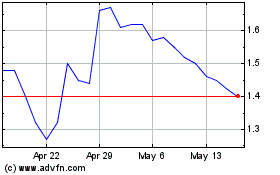

Enlivex Therapeutics (NASDAQ:ENLV)

Historical Stock Chart

From Nov 2024 to Dec 2024

Enlivex Therapeutics (NASDAQ:ENLV)

Historical Stock Chart

From Dec 2023 to Dec 2024