Evelo Biosciences Announces Second Quarter Financial Results and Recent Business Highlights

August 14 2023 - 6:30AM

Evelo Biosciences, Inc. (Nasdaq: EVLO), (“Evelo” or the “Company”)

a clinical stage biotechnology company developing a novel platform

of orally delivered inflammation-resolving medicines acting on the

small intestinal axis (SINTAX), today announced its second quarter

2023 financial results and recent business highlights.

Simba Gill, Ph.D., Evelo’s Chief Executive Officer, said, “We

are on track for a top line read-out from our ongoing Phase 2 study

in moderate psoriasis with EDP2939, our first medicine based on

microbial extracellular vesicles, early in the fourth quarter.

EDP2939 is a next generation product candidate that builds on

previously reported positive Phase 2 clinical data in psoriasis

with our first-generation product, EDP1815. EDP2939 has the

potential, if approved, to be effective, safe and well tolerated,

as well as affordably priced. We believe this target product

profile is well positioned for the vast majority of the millions of

patients who suffer from moderate and milder forms of inflammatory

diseases and who are not well served by other medicines, including

antibodies and the newer immunomodulatory small molecules.”

Dr. Gill continued, “With our recent financing combined with the

restructuring and reduction of our debt, we now have the financial

resources to take us past the Phase 2 clinical readout of EDP2939

and into the first quarter of 2024.”

Recent Business Highlights and Upcoming

Milestone

- The ongoing Phase 2 study with EDP2939

in moderate psoriasis is fully enrolled and on track for top line

data readout in early Q4 2023.

- The Company completed a private

placement in July 2023, resulting in gross proceeds of

approximately $25.5 million. At the same time, the Company

restructured its debt agreement with Horizon Technology Finance

Corporation, paying down $5.0 million of its existing debt, and

converting a further $5.0 million from debt to equity.

- The Company effected a 1-for-20 reverse

stock split of its common stock effective with trading commencing

on a split-adjusted basis on June 30, 2023.

- In July 2023, the Company announced it

had entered into an agreement with its landlord to terminate the

lease on its office and laboratory space, previously scheduled to

terminate on September 30, 2025, effective as of September 15,

2023.

Second Quarter 2023 Financial Results

(Unaudited)

- Cash Position: As of

June 30, 2023, cash and cash equivalents were

$7.6 million, as compared to cash and cash equivalents of

$47.9 million as of December 31, 2022.

- Research and Development

(R&D) Expenses: R&D expenses were

$13.0 million for the three months ended June 30, 2023,

compared to $21.2 million for the three months ended

June 30, 2022. R&D expenses were $30.9 million for

the six months ended June 30, 2023, compared to

$40.5 million for the six months ended June 30,

2022.

- General and Administrative

(G&A) Expenses: G&A expenses were

$4.9 million for the three months ended June 30, 2023,

compared to $8.4 million for the three months ended

June 30, 2022. G&A expenses were $12.0 million for

the six months ended June 30, 2023, compared to

$17.8 million for the six months ended June 30,

2022.

- Net Loss: Net loss was

$21.1 million for the three months ended June 30, 2023,

compared to $30.6 million for the three months ended

June 30, 2022. Net loss was $46.4 million for the six

months ended June 30, 2023, compared to $60.4 million for

the six months ended June 30, 2022.

About the EDP2939 Trial

EDP2939-101 is a multi-center randomized, placebo-controlled,

Phase 1/2 trial evaluating the safety, tolerability and clinical

efficacy of EDP2939. Part A (Phase 1) of the trial is designed to

determine safety and tolerability in human volunteers at multiple

ascending doses. The primary endpoints of the Phase 1 are safety

endpoints: AEs, SAEs, vital signs, safety laboratory tests, and

ECGs.

Part B (Phase 2) is designed to determine the efficacy of

EDP2939 in patients with moderate plaque psoriasis at the proposed

therapeutic dose. The primary endpoint of the Phase 2 is the

proportion of patients who achieve an outcome of a 50% improvement

from baseline in Psoriasis Area and Severity Index (PASI) score (a

PASI-50 response) after 16 weeks of daily oral administration of

EDP2939 or placebo. Secondary endpoints include several physician-

and patient-reported psoriasis outcomes, as well as further safety

evaluation. The trial will comprise approximately 110 patients

randomized 1:1 to receive a single capsule of either EDP2939 or a

matching placebo.

About Evelo Biosciences

Evelo Biosciences is a clinical stage biotechnology company

developing a novel platform of orally delivered anti-inflammatory

medicines acting on the small intestinal axis, SINTAX, with

systemic therapeutic effects. The small intestine plays a central

role in governing inflammation throughout the body. The Company’s

product candidates are pharmaceutical preparations of single

strains of microbes or their extracellular vesicles (“EVs”).

Evelo’s vision is to create therapies that are effective, safe,

well-tolerated, and affordable to improve the lives of the billions

of people living with inflammatory diseases. If shown to be

effective in inflammatory disease mediated by the Th1, Th2 or Th17

inflammatory pathways, these same investigational medicines could

be effective in additional inflammatory diseases, such as psoriatic

and other forms of arthritis, asthma, allergy, and inflammatory

bowel disease. Evelo was founded by Flagship Pioneering.

For more information, please visit www.evelobio.com.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. All statements contained in this press release that do not

relate to matters of historical fact should be considered

forward-looking statements, including statements regarding the

development of EDP2939, the timing of and plans for clinical

trials, the timing and results of clinical trial readouts, the

potential benefits of the private placement and the restructuring

of our debt agreement; the impact of the reverse stock split; the

promise or potential of our product candidates and our anticipated

financial performance, financial position and cash runway.

These forward-looking statements are based on management’s

current expectations. These statements are neither promises nor

guarantees, but involve known and unknown risks, uncertainties and

other important factors that may cause Evelo’s actual results,

performance or achievements to be materially different from any

future results, performance or achievements expressed or implied by

the forward-looking statements including, but not limited to, the

following: we have incurred significant losses, are not currently

profitable and may never become profitable; our projected cash

runway; our need for additional funding; our ability to meet our

debt obligations (including restrictive and operational covenants

and terms of refinanced debt); our unproven approach to therapeutic

intervention; our ability to address regulatory questions and the

likelihood of regulatory filings and approvals; the lengthy,

expensive, and uncertain process of clinical drug development,

including potential delays in regulatory approval; our reliance on

third parties and collaborators to expand our microbial library and

conduct our clinical trials; costs and resources of operating as a

public company; and unfavorable global economic or political

conditions. These and other important factors discussed under the

caption "Risk Factors" in Evelo’s Quarterly Report on Form 10-Q

filed with the SEC for the period ended June 30, 2023 and our

other filings with the SEC could cause actual results to differ

materially from those indicated by the forward-looking statements

made in this press release. Any such forward-looking statements

represent management's estimates as of the date of this press

release. While Evelo may elect to update such forward-looking

statements at some point in the future, it disclaims any obligation

to do so, even if subsequent events cause its views to change.

Contacts

Investors:ir@evelobio.com

Media:media@evelobio.com

Evelo Biosciences,

Inc.Consolidated Balance Sheets

(Unaudited)(In thousands, except share amounts)

| |

June 30, 2023 |

|

December 31, 2022 |

| Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

7,622 |

|

|

$ |

47,940 |

|

|

Prepaid expenses and other current assets |

|

3,641 |

|

|

|

3,633 |

|

|

Total current assets |

|

11,263 |

|

|

|

51,573 |

|

| Property and equipment,

net |

|

2,369 |

|

|

|

4,842 |

|

| Right of use asset - operating

lease |

|

5,765 |

|

|

|

6,868 |

|

| Other assets |

|

1,422 |

|

|

|

1,158 |

|

| Total assets |

$ |

20,819 |

|

|

$ |

64,441 |

|

| Liabilities and stockholders’

deficit |

|

|

|

| Current liabilities: |

|

|

|

|

Debt, current portion |

$ |

43,915 |

|

|

$ |

— |

|

|

Accounts payable |

$ |

3,765 |

|

|

$ |

1,764 |

|

|

Accrued expenses |

|

5,151 |

|

|

|

7,945 |

|

|

Operating lease liability, current portion |

|

2,690 |

|

|

|

2,259 |

|

|

Other current liabilities |

|

20 |

|

|

|

427 |

|

|

Total current liabilities |

|

55,541 |

|

|

|

12,395 |

|

| Noncurrent liabilities: |

|

|

|

| Debt, net of current

portion |

|

— |

|

|

|

43,614 |

|

| Operating lease liability, net

of current portion |

|

3,876 |

|

|

|

5,265 |

|

| Deferred revenue |

|

7,500 |

|

|

|

7,500 |

|

| Other noncurrent

liabilities |

|

28 |

|

|

|

659 |

|

| Total liabilities |

|

66,945 |

|

|

|

69,433 |

|

| Stockholder’s deficit: |

|

|

|

|

Preferred stock, $0.001 par value; 10,000,000 shares authorized; no

shares issued and outstanding as of June 30, 2023 and

December 31, 2022, respectively |

|

— |

|

|

|

— |

|

|

Common stock, $0.001 par value; 200,000,000 shares

authorized; 5,599,837 and 5,542,637 shares issued

and outstanding as of June 30, 2023 and December 31,

2022, respectively |

|

6 |

|

|

|

6 |

|

| Additional paid-in

capital |

|

529,534 |

|

|

|

524,224 |

|

| Accumulated deficit |

|

(575,666 |

) |

|

|

(529,222 |

) |

| Total stockholders’

deficit |

|

(46,126 |

) |

|

|

(4,992 |

) |

| Total liabilities and

stockholders’ deficit |

$ |

20,819 |

|

|

$ |

64,441 |

|

Evelo Biosciences,

Inc.Consolidated Statements of Operations

(Unaudited)(In thousands, except per share and share

amounts)

| |

Three Months Ended June 30, |

|

Six months ended June 30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Research and development |

$ |

13,043 |

|

|

$ |

21,221 |

|

|

$ |

30,900 |

|

|

$ |

40,542 |

|

|

General and administrative |

|

4,915 |

|

|

|

8,366 |

|

|

|

11,958 |

|

|

|

17,783 |

|

|

Impairment of property and equipment |

|

1,616 |

|

|

|

— |

|

|

|

1,616 |

|

|

|

— |

|

|

Total operating expenses |

|

19,574 |

|

|

|

29,587 |

|

|

|

44,474 |

|

|

|

58,325 |

|

| Loss from operations |

|

(19,574 |

) |

|

|

(29,587 |

) |

|

|

(44,474 |

) |

|

|

(58,325 |

) |

| Other income (expense): |

|

|

|

|

|

|

|

|

Interest expense, net |

|

(1,369 |

) |

|

|

(1,020 |

) |

|

|

(2,480 |

) |

|

|

(2,047 |

) |

|

Change in fair value of warrants |

|

4 |

|

|

|

— |

|

|

|

631 |

|

|

|

— |

|

|

Other miscellaneous income, net |

|

69 |

|

|

|

209 |

|

|

|

257 |

|

|

|

229 |

|

|

Total other expenses, net |

|

(1,296 |

) |

|

|

(811 |

) |

|

|

(1,592 |

) |

|

|

(1,818 |

) |

| Loss before income taxes |

|

(20,870 |

) |

|

|

(30,398 |

) |

|

|

(46,066 |

) |

|

|

(60,143 |

) |

| Income tax expense |

|

(233 |

) |

|

|

(163 |

) |

|

|

(378 |

) |

|

|

(279 |

) |

| Net loss |

$ |

(21,103 |

) |

|

$ |

(30,561 |

) |

|

$ |

(46,444 |

) |

|

$ |

(60,422 |

) |

| |

|

|

|

|

|

|

|

| Net loss per share

attributable to common stockholders, basic and diluted |

$ |

(3.78 |

) |

|

$ |

(8.07 |

) |

|

$ |

(8.35 |

) |

|

$ |

(18.67 |

) |

| Weighted average number of

common shares outstanding, basic and diluted |

|

5,578,767 |

|

|

|

3,785,954 |

|

|

|

5,562,121 |

|

|

|

3,236,520 |

|

(1) Expenses include the following amount of

non-cash stock-based compensation expense.

| |

Three Months Ended June 30, |

|

Six months ended June 30, |

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Research and development |

$ |

1,471 |

|

|

$ |

1,701 |

|

|

$ |

2,992 |

|

|

$ |

3,737 |

|

| General and

administrative |

|

894 |

|

|

|

2,298 |

|

|

|

2,282 |

|

|

|

4,537 |

|

| Total stock-based compensation

expense |

$ |

2,365 |

|

|

$ |

3,999 |

|

|

$ |

5,274 |

|

|

$ |

8,274 |

|

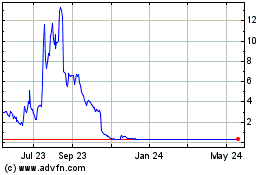

Evelo Biosciences (NASDAQ:EVLO)

Historical Stock Chart

From Oct 2024 to Nov 2024

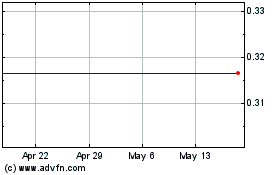

Evelo Biosciences (NASDAQ:EVLO)

Historical Stock Chart

From Nov 2023 to Nov 2024