Exponent Increases Quarterly Dividend Payment from $0.24 to $0.26 per Share

February 02 2023 - 3:02PM

Exponent, Inc. (Nasdaq: EXPO) today announced that its Board

of Directors has raised its quarterly dividend from $0.24 to $0.26

per share of common stock. The quarterly cash dividend of $0.26 per

share of common stock is to be paid on March 24, 2023 to all common

stockholders of record as of March 10, 2023.

“Exponent is deeply committed to delivering long-term value for

our shareholders. In 2022, we returned $205.1 million to

shareholders in the form of $49.2 million in dividends and $155.9

million in common stock repurchases, and ended the year with $161.5

million in cash and cash equivalents,” commented Dr. Catherine

Corrigan, President and Chief Executive Officer. “The increase in

our regular cash dividend demonstrates the strength of our balance

sheet and our ongoing commitment to creating value for our

shareholders.”

Exponent has paid, and expects to continue to pay, quarterly

dividends each year in March, June, September and December. Future

declarations of quarterly dividends and the establishment of future

record and payment dates are subject to the final determination of

Exponent’s Board of Directors.

About ExponentExponent is an engineering and

scientific consulting firm providing solutions to complex problems.

Exponent’s interdisciplinary organization of scientists,

physicians, engineers, and business consultants draws from more

than 90 technical disciplines to solve the most pressing and

complicated challenges facing stakeholders today. The firm

leverages over 50 years of experience in analyzing accidents and

failures to advise clients as they innovate their technologically

complex products and processes, ensure the safety and health of

their users, and address the challenges of sustainability.Exponent

may be reached at (888) 656-EXPO, info@exponent.com, or

www.exponent.com.Forward Looking StatementsThis

news release contains, and incorporates by reference, certain

“forward-looking” statements (as such term is defined in the

Private Securities Litigation Reform Act of 1995, and the rules

promulgated pursuant to the Securities Act of 1933, as amended, and

the Securities Exchange Act of 1934, as amended) that are based on

the beliefs of the Company’s management, as well as assumptions

made by and information currently available to the Company’s

management. When used in this document and in the documents

incorporated herein by reference, the words “intend,” “anticipate,”

“believe,” “estimate,” “expect” and similar expressions, as they

relate to the Company or its management, identify such

forward-looking statements. Such statements reflect the current

views of the Company or its management with respect to future

events and are subject to certain risks, uncertainties and

assumptions. Should one or more of these risks or uncertainties

materialize, or should underlying assumptions prove incorrect, the

Company’s actual results, performance, or achievements could differ

materially from those expressed in, or implied by, any such

forward-looking statements. Factors that could cause or contribute

to such material differences include the COVID-19 pandemic

(including factors relating to measures implemented by governmental

authorities or by us to promote the safety of our employees,

vendors and clients; other direct and indirect impacts on our

business and the businesses of our clients, vendors and other

partners; impacts which may, among other things, adversely affect

our clients’ ability to utilize our services at the levels they

have previously; disruptions of access to our facilities or those

of our clients or third parties; and increased and potentially

significant economic uncertainty and volatility, including credit

and collectability risks and potential disruptions of capital and

credit markets), the possibility that the demand for our services

may decline as a result of changes in generally applicable and

industry-specific economic conditions, the timing of engagements

for our services, the effects of competitive services and pricing,

the absence of backlog related to our business, our ability to

attract and retain key employees, the effect of tort reform and

government regulation on our business, and liabilities resulting

from claims made against us. Additional risks and uncertainties are

discussed in our Annual Report on Form 10-K under the heading “Risk

Factors” and elsewhere in the report. The inclusion of such

forward-looking information should not be regarded as a

representation by the Company or any other person that the future

events, plans, or expectations contemplated by the Company will be

achieved. The Company undertakes no obligation to release publicly

any updates or revisions to any such forward-looking

statements.

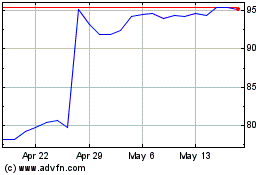

Exponent (NASDAQ:EXPO)

Historical Stock Chart

From Jan 2025 to Feb 2025

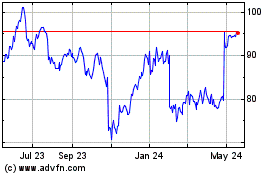

Exponent (NASDAQ:EXPO)

Historical Stock Chart

From Feb 2024 to Feb 2025