Deterioration in Receivables and Inventory

Management Masked by Significant Slowing of Payments to

Suppliers

The 1000 largest non-financial companies in the U.S.

significantly improved their ability to generate cash in 2017,

producing the strongest working capital performance since 2008. But

their ability to collect from customers and manage inventory

actually both deteriorated, masked by a significant increase in the

time companies take to pay suppliers, according to the latest

Working Capital Survey results from The Hackett Group, Inc.

(NASDAQ: HCKT).

In 2017, companies significantly extended payments to suppliers,

taking 3.4 days longer to pay than in 2016 and improving Days

Payable Outstanding (DPO) by increasing it to 56.7 days. Increasing

DPO keeps cash on the balance sheet longer and improves cash

position. The Hackett Group’s survey found evidence that for many

companies, improving DPO involves companies simply pushing the

working capital burden onto their suppliers, including much smaller

companies, by forcing them to accept longer payment terms. Supply

chain financing is also growing in popularity as a way to improve

DPO performance while limiting the impact on suppliers.

Performance of the other major elements of working capital

performance, receivables and inventory, both deteriorated slightly

in 2017. Days Sales Outstanding (DSO) rose by 4.4 percent to 39.5

days and Days Inventory On hand (DIO) rose by just 0.6 percent to

51 days.

The Hackett Group’s annual working capital survey is featured in

CFO Magazine. A complimentary analysis of the survey results is

also available from The Hackett Group, with registration, at this

link: http://go.poweredbyhackett.com/qphs

The Hackett Group’s 2018 US Working Capital Survey and scorecard

calculates working capital performance based on the latest publicly

available annual financial statements of the 1000 largest

non-financial companies in the United States, utilizing data

sourced from FactSet. Overall, the survey found the companies had a

Cash Conversion Cycle (CCC) of 33.8 days, an improvement of 1.5

days (4 percent) over last year. This is a significant improvement

over the high CCC of 37.3 days seen in 2015, and nearly matches the

lowest recent CCC of 33.4 days seen in 2008, which was driven

largely in changes made in response to the recession. CCC is a

standard metric used to quantify the ability of companies to

convert invested resources into cash, and incorporates payables,

receivables and inventory.

Top performers by industry in The Hackett Group’s survey are now

nearly three times faster than typical companies at converting

working capital into cash (16.7 days for top quartile companies

versus 47.5 days for typical). They collect from customers 2.7

weeks faster (29.1 days vs 47.7), pay suppliers three weeks slower

(66.9 days vs 45.4) and hold less than half the inventory (23.9

days vs 57.7). This translates into a $1.1 trillion improvement

opportunity for companies that are not top performers, an amount

equal to nearly 6 percent of the U.S. Gross Domestic Product (GDP).

Inventory remains the largest opportunity ($443 billion). However

for 2017 the opportunity in payables ($358 billion) grew larger

than the opportunity in receivables ($334 billion).

Despite the strong overall working capital performance of

companies in the survey, the opportunity gap between typical

companies and top performers continues to grow, indicating that top

performers are highly focused on generating improvements in this

area, while many typical companies are neglecting working capital

improvement.

Rising interest rates and extremely high M&A activity were

two major factors impacting on U.S. working capital performance in

2017. Tax reform and continued reliance on cheap debt helped drive

cash on hand up 17 percent, to its highest level ever ($1.07

trillion), while debt rose by nearly 10 percent (to $5.6 trillion).

Despite rising interest rates, companies are continuing to leverage

debt, in many cases to fund acquisitions. Debt as a percentage of

revenue has continued to climb, reaching 51 percent of revenue in

2017, steadily increasing over the last few years from closer to 33

percent revenue for the period 2008-2013.

Capital expenditures also increased by 5.5 percent, the first

increase since 2014, indicating that companies may be shifting

towards investing in themselves, rather than continuing to focus on

returning cash to shareholders, as they have since the financial

crisis.

“For the first time in years we’re finally seeing rising

interest rates, and that is driving more companies to look at

improvements to working capital,” said The Hackett Group Associate

Principal Craig Bailey. “The record level of M&A is also

starting to increase the focus on both cost and cash. So we’re

seeing a significant improvement in working capital performance.

But debt is also reaching record levels, and despite the

improvements, it appears clear that most companies are still

looking for quick fixes and avoiding doing the process improvement

and other hard work required to truly improve working capital.”

“The primary strategy many companies are using to improve

working capital performance is simply to hold back payments to

suppliers, in some cases extending payment terms up to 120 days,”

said Bailey. “Payables are often the easiest starting point for

working capital improvement, as the processes are largely in

finance’s area of control, and it has less risk of impacting on

customers. Unfortunately, when companies extend payment terms it

has significant impact on the DSO performance of their suppliers.

This year it is driving DSO to a 10-year high. It can even

destabilize a supply base, if companies are not careful.”

“Another increasingly popular way companies are improving

payables performance is through supply chain financing,” explained

Bailey. “But it’s truly not the best way to improve overall working

capital performance, as it basically enables companies to avoid

dealing with process inefficiency by using a bank to offer

suppliers financing of their receivables.”

“The focus on slowing payments to suppliers also significantly

drives the burden of working capital performance onto smaller

companies, most of which are below the radar of our survey. Many

smaller companies, and also other companies that cannot easily

improve their payables performance, such as those with consolidated

supply bases, or those with a multitude of small suppliers, are

struggling,” said Bailey.

According to The Hackett Group Director Shawn Townsend, “Even

just in terms of payables optimization, there are better ways to

make improvements than to delay supplier payments. Some companies

understand this, which is why despite improved overall working

capital performance, the opportunity gap between typical companies

and top performers continues to increase. Some organizations show

what can truly be accomplished, while many others avoid dealing

with the underlying issues.”

“There are simply much better options available. For example,

companies can focus on differentiating critical from non-critical

suppliers. They can strive to improve the procure-to-pay cycle

without impacting supply base, through process improvement,

digitization, robotic process automation, blockchain, and other

digital transformation approaches,” said Townsend.

A complimentary analysis of the results from The Hackett Group’s

2018 working capital survey is available, with registration, at

this link: http://go.poweredbyhackett.com/qphs.

About The Hackett Group

The Hackett Group (NASDAQ:HCKT) is an intellectual

property-based strategic consultancy and leading enterprise

benchmarking and best practices digital transformation firm to

global companies, offering digital transformation including robotic

process automation and enterprise cloud application implementation.

Services include business transformation, enterprise

analytics, working capital management and global

business services. The Hackett Group also provides dedicated

expertise in business strategy, operations, finance, human capital

management, strategic sourcing, procurement and information

technology, including its award-winning Oracle and SAP

practices.

The Hackett Group has completed more than 15,000 benchmarking

studies with major corporations and government agencies, including

97% of the Dow Jones Industrials, 89% of the Fortune 100, 87% of

the DAX 30 and 59% of the FTSE 100. These studies drive its Best

Practice Intelligence Center™ which includes the firm's

benchmarking metrics, best practices repository and best practice

configuration guides and process flows, which enable

The Hackett Group’s clients and partners to achieve world-class

performance.

More information on The Hackett Group is available at:

www.thehackettgroup.com, info@thehackettgroup.com, or by

calling (770) 225-3600.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180719005047/en/

The Hackett Group, Inc.Gary Baker, 917-796-2391Global

Communications Directorgbaker@thehackettgroup.com

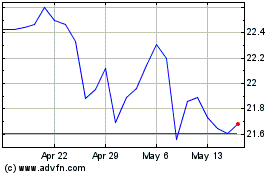

Hackett (NASDAQ:HCKT)

Historical Stock Chart

From Oct 2024 to Nov 2024

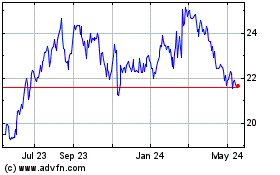

Hackett (NASDAQ:HCKT)

Historical Stock Chart

From Nov 2023 to Nov 2024